Professional Documents

Culture Documents

Collaboration Planning

Uploaded by

Ahmed Sameh El-LakaniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Collaboration Planning

Uploaded by

Ahmed Sameh El-LakaniCopyright:

Available Formats

Supply Chain Management: An International Journal

Emerald Article: Collaboration planning in a supply chain Luc Cassivi

Article information:

To cite this document: Luc Cassivi, (2006),"Collaboration planning in a supply chain", Supply Chain Management: An International Journal, Vol. 11 Iss: 3 pp. 249 - 258 Permanent link to this document: http://dx.doi.org/10.1108/13598540610662158 Downloaded on: 20-09-2012 References: This document contains references to 38 other documents Citations: This document has been cited by 22 other documents To copy this document: permissions@emeraldinsight.com This document has been downloaded 5840 times since 2006. *

Users who downloaded this Article also downloaded: *

Rick Hoole, (2005),"Five ways to simplify your supply chain", Supply Chain Management: An International Journal, Vol. 10 Iss: 1 pp. 3 - 6 http://dx.doi.org/10.1108/13598540510578306 Mark Barratt, (2004),"Understanding the meaning of collaboration in the supply chain", Supply Chain Management: An International Journal, Vol. 9 Iss: 1 pp. 30 - 42 http://dx.doi.org/10.1108/13598540410517566 Andrew Cox, (1999),"Power, value and supply chain management", Supply Chain Management: An International Journal, Vol. 4 Iss: 4 pp. 167 - 175 http://dx.doi.org/10.1108/13598549910284480

Access to this document was granted through an Emerald subscription provided by NATIONAL DEFENCE COLLEGE IN KENYA For Authors: If you would like to write for this, or any other Emerald publication, then please use our Emerald for Authors service. Information about how to choose which publication to write for and submission guidelines are available for all. Please visit www.emeraldinsight.com/authors for more information. About Emerald www.emeraldinsight.com With over forty years' experience, Emerald Group Publishing is a leading independent publisher of global research with impact in business, society, public policy and education. In total, Emerald publishes over 275 journals and more than 130 book series, as well as an extensive range of online products and services. Emerald is both COUNTER 3 and TRANSFER compliant. The organization is a partner of the Committee on Publication Ethics (COPE) and also works with Portico and the LOCKSS initiative for digital archive preservation.

*Related content and download information correct at time of download.

Research paper

Collaboration planning in a supply chain

Luc Cassivi

` Department of Management and Technology, Ecole des Sciences de la Gestion, Universite du Quebec a Montreal, Montreal, Canada

Abstract Purpose To analyze how e-collaboration tools affect different partners along the supply chain, and to categorize rms according to their level of collaboration planning within a supply chain environment. Design/methodology/approach First, a eld study, which focuses on one large telecommunications equipment manufacturer and a few strategic rst-tier suppliers, provides the basis to fully understand the e-collaboration methods and the various issues and concerns of the different members of the supply chain. It is followed by an electronic survey conducted with 53 rms worldwide acting in the same supply chain, which constitutes the second phase of the study. Findings Different roles may be attributed to collaboration tools such as facilitating access to information, which affects knowledge creation capabilities, and assisting in the design of exible supply chains. Furthermore, three separate groups with different levels and types of collaboration planning were identied. These groups appropriately represent the telecommunications equipment supply chain, where rms are either deeply involved in supply chain collaboration or very minimally concerned by it. Research limitations/implications By focusing on the initial stage of CPFR, we might overlook some important links with the other two stages of CPFR. However, with a more focused approach, we were able to obtain detailed information on the collaborative planning stage. A second limitation is the selection of one specic supply chain, which makes the generalization to other supply chains difcult. Practical implications Understanding the role of CPFR in their supply chain and, more importantly, the role of collaboration planning in developing a network of partners. Originality/value This paper looks at how collaboration is planned, through CPFR actions, between members of a supply chain. Keywords Supply chain management, Innovation, Team performance Paper type Research paper

1. Introduction

More and more rms are making use of supply chain management and electronic collaboration tools to improve their performance. This performance is often closely linked to the level of integration within the supply chain (Armistead and Mapes, 1993; Kwan, 1999). The environment in which rms operate has changed drastically with the advent of integrated supply chains, the potential for outsourcing and the growth of collaboration between business partners and even competitors. Collaboration between participants in the supply chain undoubtedly shapes and inuences the type and volume of information being shared. Collaboration must be planned and sustained in order to be effective. With the use of new electronic methods and tools, activities such as planning, forecasting and replenishment are now very tightly managed, thereby facilitating the sharing and distribution of information throughout the supply chain. However, each member of a supply chain is forced to rethink the way it handles

The current issue and full text archive of this journal is available at www.emeraldinsight.com/1359-8546.htm

relationships with business partners, especially customers and suppliers. Consequently, rms must innovate in terms of processes, products and relationships in order to stay competitive in their respective networks (supply chains). These supply chain environments continuously evolve and now use electronic collaboration tools to manage and execute complex supply chain activities. With sophisticated e-commerce and collaboration tools, rms share information and collaborate with partners to support supply chain activities; this collaboration requires important levels of planning in order to be efcient as it may transform the way business is conducted between partners. Hence, the objectives pursued in this paper are as follows: . In a specic industry, identify the electronic collaboration tools used in a supply chain and analyze how they affect different partners along the supply chain. . Categorize rms in this industry according to their level of supply chain collaboration planning with upstream and downstream partners; and observe how processes, relationships and performance may vary from one conguration to another. The paper begins with a discussion of e-collaboration issues relating to a manufacturing supply chain environment, followed by the methodology and the main results. It concludes with a discussion of the implications and limitations of this research. 249

Supply Chain Management: An International Journal 11/3 (2006) 249 258 q Emerald Group Publishing Limited [ISSN 1359-8546] [DOI 10.1108/13598540610662158]

Collaboration planning in a supply chain Luc Cassivi

Supply Chain Management: An International Journal Volume 11 Number 3 2006 249 258

2. Managing a supply chain

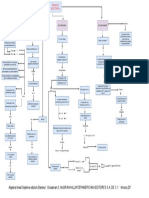

Firms adopting e-commerce in a supply chain environment need to invest time and money to adapt their internal processes and systems and develop the competencies needed to handle new e-commerce challenges. The effort and infrastructure that suppliers need if they are to adopt new methods of communication tend to favor close, long-term partnerships with a small number of partners. Collaborating electronically becomes a key element for rms in a supply chain to support more efcient business processes. The use of e-collaboration tools in a manufacturing environment translates into two major process innovations: processes that improve visibility among partners of the supply chain and processes that support the implementation of supply chain strategies. Visibility in the supply chain is achieved by making accurate information, such as forecasts, schedules and production capacity, accessible to all members of the chain. 2.1. Collaboration planning in a supply chain Supplier-buyer relationships have been the subject of many research studies in the past. Success and failure factors in these specic types of relationships are described in numerous papers (Ellram, 1995; Landeros and Monczka, 1989). However, very few research initiatives have focused on the process of partnering (Boddy et al., 2000). The conception and development of partnerships begin with excellent communications between potential supply chain partners. Some studies have identied critical steps to attain supply chain collaboration (Lummus et al., 1998; Corbett et al., 1999; Boddy et al., 2000). These frameworks or roadmaps raise some important points about planning collaboration in a supply chain. However, the level of detail of the actions to be taken by supply chain partners is still broad. These authors identify critical phases that supply chain partners experience in their collaborative creation process but concrete practical actions are not well dened. A more detailed method, known as collaborative planning, forecasting and replenishment (CPFR), introduces a sequential approach that denes key actions to be undertaken during the formulation of collaboration initiatives. CPFR, which is an initiative of the Voluntary Interindustry Commerce Standards Association (VICS), denes the operational activities that enable partners to design collaboration initiatives in supply chains (VICS, 1998). CPFR has its origins in a series of programs implemented in the 1980s and 1990s to optimize inventory and replenishment activities. These programs, particularly VMI and CRP, were designed to bring supply chain partners closer together, however none of them really focus on information sharing between partners. Collaborative planning, forecasting and replenishment captures the operational advantages of all these programs and adds collaborative mechanisms to facilitate information exchange in a multi-tiered supply chain. CPFR is segmented into stages (see Figure 1). The rst stage, planning, involves two critical steps: front-end agreement and joint business plan. The next stage includes two forecast-oriented steps: sales-forecast collaboration and order-forecast collaboration. The nal stage, replenishment, comprises one major step: order generation. In the CPFR process, the planning phase is critical as partners develop collaboration initiatives and terms. The other two phases are 250

Figure 1 CPFR process model

mostly operational and must fall back on the principles set out in the rst phase when difculties arise. When planning supply chain relationships, the rst two steps in the CPFR methodology are essential. In developing a front-end agreement (rst step), all partners requirements and objectives in the collaboration are claried. Participating companies formulate and agree on a collaborative program that identies key supply chain metrics. This agreement guarantees an adequate commitment to collaboration by all supply chain partners and aligns all parties involved around common objectives. The second step (creation of a joint business plan) enables partners to drill down through the collaboration process to the product/item information being exchanged. It involves the exchange of strategies and business plans between partners with the purpose of collaborating on the development of a joint business plan. Organizations share information about periodic business strategies and then input the details of the joint business plan into their own planning systems. Different methods have been used to assess the benets of deploying the CPFR process throughout a supply chain (Aviv, 2001; Holmstrom et al., 2002; Rubiano Ovalle and Crespo Marquez, 2003; Esper and Williams, 2003). The advantages of CPFR are signicant. Among the advantages identied, CPFR partners have experienced sales increases, inventory reductions and improved customer service. They have also strengthened their relationships by improving and fostering trust in their exchanges. However, studies are carried out on the entire CPFR method and none, according to our knowledge, have been accomplished on the collaborative planning stage of CPFR. 2.2. Supply chain-related innovations Partners collaborating on supply chain strategies and the development of e-commerce tools in a supply chain environment are often forced to innovate in order to compete in their sector (Mason-Jones and Towill, 1999). Such innovations, which are often driven by one major customer or supplier, may take different forms and may also be evaluated according to the environment in which they are used. This study recognizes the fact that dening innovation is not an easy task. The Oslo Manual (OECD/Eurostat, 1997,

Collaboration planning in a supply chain Luc Cassivi

Supply Chain Management: An International Journal Volume 11 Number 3 2006 249 258

p. 9) characterizes innovation as changes, which require a signicant degree of novelty for the rm. Innovations may relate to products, processes and organizational dynamics. Three distinct types of innovations are often mentioned in the literature: process, product and relational innovations. The following section presents an overview of the characteristics of each type of innovation in a manufacturing environment. Process innovations The following denition, which is also from the Oslo Manual, outlines the nature and role of technological process innovation: adoption of technologically new or signicantly improved production methods, including methods of product delivery. These methods may involve changes in equipment or production organization, or a combination of these changes, and may be derived from the use of new knowledge (OECD/ Eurostat, 1997, p. 32). In this study, innovative processes not only inuence functional areas within a company but also greatly affect the business partners involvement in a supply chain. Process innovation is concerned with the way products and services are designed and produced. A process is dened by Lambert and Cooper (2000, p. 76) as:

. . . a structure of activities designed for action with a focus on end customers and on the dynamic management of ows involving products, information, cash, knowledge, and ideas.

Product innovations Product innovation has been and will undoubtedly continue to be a popular research topic. The very high number of denitions of the types of product innovation makes the use of this term ambiguous in the new product development literature (Garcia and Calantone, 2002). Categorizations such as radical, routine, incremental, discontinuous, and commercially successful are employed in many product innovativeness research initiatives (Utterback and Abernathy, 1975; Nord and Tucker, 1987; von Hippel, 1988). Although some studies have tried to clarify the meaning of product innovativeness (Danneels and Kleinschmidt, 2001), the various product innovation-related disciplines (marketing, engineering, and new product development) all have different perceptions of the term (Garcia and Calantone, 2002). Product innovations may take different forms, such as upgrades, variations and extensions of existing products (Li and Atuahene-Gima, 2001). Relational innovations Relational innovations in a supply chain are dened as new (or improved) methods for governing buyer-seller interactions (e.g. assembler-supplier in a manufacturing environment). Numerous aspects such as trust, loyalty and market segmentation determine the existence of relational innovations in a supply chain. Previous studies have identied trust and commitment as critical elements in buyer-supplier relationships and in alliances (Ring and Van de Ven, 1994; Handy, 1995; Moore, 1998; Zaheer et al., 1998). Collaborative tools also transform how supply chain partners interact with each other. Communication channels such as the Internet have changed the way information is exchanged, but without a structured approach to collaboration, it may not have the same impact on relationships as would be the case if collaborative methods were used to plan supply chain activities. 251

2.3. Supply chain performance Several research elds focus on quantifying the operational performance of individual rms, of specic departments within a company, of entire industries and of key suppliers. The competitive environments of several industries now call for the performance evaluation of complete supply chains (from the suppliers suppliers to the customers customers). Authors such as Van Hoek (1998) have remarked on how difcult it is to measure and improve performance in a supply chain. Hence, some researchers have developed conceptual frameworks for analyzing the performance of SCM systems (Chen and Paulraj, 2004). In order to identify operational performance measures for a supply chain, a good understanding of the most important research initiatives in logistics, manufacturing and operations activities is necessary. The cross-boundary management required for an efcient supply chain demands that companys management team work across traditional internal functional areas and manage external interactions with both suppliers and customers. Hence, in order to monitor progress and adjust the development of a supply chain, performance indicators should primarily be based on process performance, not on nancial performance (Lummus et al., 1998; Chan and Qi, 2003). Several research initiatives have divided the performance of a supply chain into different categories or measures (Davis, 1993; Lummus et al., 1998; Spekman et al., 1998; Maloni and Benton, 2000). However, after scrutinizing the most important studies on operational performance measures, we found the most complete set of operational performance measures in Beamons (1999) study, which incorporates all of the critical performance measures (resource, output and exibility measures) identied by the previously mentioned authors. The theoretical foundation introduced in this section lead to the following research questions: RQ1. To what extent do rms plan e-collaboration initiatives in a supply chain? RQ2. Can these initiatives be linked to improved innovativeness and performance in supply chain related activities?

3. Research methodology

Research on supply chain collaboration initiatives in an electronic environment is still in its infancy. In order to fully understand the role of e-collaboration in a supply chain, a qualitative-quantitative sequential approach (Creswell, 1994; Tashakkori and Teddlie, 1998), namely a multiple-case study and an electronic survey, was carried out to gather empirical evidence from a supply chain in the telecommunications equipment industry. This single supply chain in the telecommunications equipment industry was chosen because of the widespread use of electronic tools and the growing percentage of outsourcing activities in the sector. 3.1. The telecommunications equipment industry The telecommunications equipment industry includes all companies involved in the manufacturing of equipment and software that execute the functions of information processing and communication, including transmission and display. Figure 2 illustrates the four layers of the telecommunications equipment industry supply chain, beginning at the upper end

Collaboration planning in a supply chain Luc Cassivi

Supply Chain Management: An International Journal Volume 11 Number 3 2006 249 258

Figure 2 Telecommunication equipment industry supply chain

with the network operators (i.e. the nal users of the optical products) and ending with the sub-assemblers (i.e. the manufacturers of parts and components). Three of the four layers include several key players that collaborate electronically to manufacture, assemble, or integrate some type of telecommunications device (or equipment). Therefore, the network operators, which operate different types of communication networks, are not directly involved in any e-collaboration activities present in this manufacturingoriented supply chain and will be intentionally put aside during this study. However, it is worth mentioning that they use web-based technologies to sell products and services to individual (mobile or traditional) telecommunication users. 3.2. Data collection strategy The data collection strategy involved two consecutive phases: (1) A eld study, which was conducted in the context of an international study of e-commerce initiatives sponsored by the OECD in eight countries. In one of the countries, this particular undertaking focused on one large telecommunications equipment manufacturer (system integrator) and three strategic suppliers. This phase provided the basis for fully understanding the collaboration methods and the various issues and concerns of the different members of the supply chain (ex: how the partners in the telecommunications equipment supply chain collaborate (e.g. technologies, processes, etc.) and why they use e-commerce tools). During this rst phase, the ability to explore several supply chain circumstances in depth and the capability to analyze different aspects of these situations were critical. Therefore, the multiple case studies approach was used to analyze the concepts in a realistic environment, with the objective to improve the understanding of complex collaborative supply chain issues (Yin, 1994). The exploratory nature of supply chain issues leads us to carefully follow the guidelines proposed by Stake (1995, pp. 52-53). The main data collection methods for this eld research study consisted of semi-structured face-to-face interviews. The OECD provided the interview guide, to which we added questions. Sixteen executives and supply chain professionals from four rms in the eastern part of Canada and the USA were interviewed. The interviewees 252

were chosen based on their specialized knowledge of and experience with collaborative e-commerce tools exploited in a supply chain environment, and their roles in the procurement or sales activities carried out in the supply chain. A strict protocol was established for the transcription of the respondents answers and observations. The interviews were complemented by on-site observations and documentation (press releases, reports, media articles, Web sites). The use of several data collection methods guarantees validity and reliability through the process of triangulation across the diverse sources of information (Stake, 1995; Denzin, 1989). (2) An electronic survey soliciting the participation of individual rms acting in the same supply chain for the same large telecommunications equipment manufacturer. Based on the results of the eld study, an electronic questionnaire was developed to facilitate the input of information by both the managers involved in the upstream activities of the supply chain (supplierrelated functions such as procurement and design) and those executives involved in the downstream activities (customer-related functions, for instance, sales and marketing). The questionnaire was made available on the internet, where respondents could save and set aside the electronic survey in order to come back to it at any time. Questions were displayed in one of the ve separate parts of the questionnaire, which were entitled (1) Company characteristics. (2) Degree of collaboration and product information. (3) Collaboration planning. (4) Innovativeness. (5) Supply chain performance. Several groups analyzed the questionnaire before it was made available to the potential respondents. Several of the OEMs internal supply management groups and strategic suppliers tested the questionnaire and some adjustments were made based on their remarks and suggestions. A total of 130 companies were asked to answer the electronic questionnaire, all of which belong to the OEMs supplier base. The sample of companies, identied by the system integrator (OEM), included its supply chain partners in the telecommunications equipment sector. All companies may be characterized as assemblers or sub-assemblers. Just over 76 per cent of the companies asked to answer the questionnaire are based in the USA, 12 per cent in Canada and the remaining 12 per cent in the rest of the world. They also represent a wide range of sizes, with large, medium and small enterprises targeted for the electronic survey.

4. Results and discussion

4.1 Results of the eld study We worked with one major player from the telecommunication equipment industry and its main suppliers, for a total of ve organizational entities (see Table I). The level of internal integration and of electronic collaboration within the supply chain was high. The ve units selected are key players in the supply chain and all used e-collaboration tools with different supply chain partners. Consequently, their technological posture, as characterized by

Collaboration planning in a supply chain Luc Cassivi

Supply Chain Management: An International Journal Volume 11 Number 3 2006 249 258

Table I Background information on the four members of the supply chain

OEM-ICT (SI1 and AS1) Main line of business Product demand/ customization Number of employees Revenues Number of suppliers Number of customers Optical transmission solutions and products Highly customized and integrated into customers needs Complex and costly, very short life cycle 5,500 in the optical division (87,000 total) $8.4 billion (optical division) $17.5 billion 350-400 (85 per cent are large enterprises and 15 per cent SMEs) 150 to 200 (all of which are very large enterprises) Assembler AS2 Printed circuit assembly (PCA) Product must be close to the customer Inventory in co-location 29,000 $9.8 B 800 to 900 75 to 100 (all of which are very large enterprises) Sub-assembler SA3 Electromechanical components Wide product range Custom-built 700 $500 M 1,100 (50 per cent are very large enterprises) 50 to 75 (50 per cent are very large enterprises) Sub-assembler SA4 Metal sheet transformation Customized to customers needs Short life cycles 360 $65 M 250 (95 per cent are SMEs) 100 (85 per cent are SMEs)

their e-commerce initiatives, represented a great opportunity for this research. The central player (OEM-ICT) was founded over 100 years ago and has a major role in the competitive dynamic of the telecommunications sector. In the late 1990s, a major acquisition enabled OEM-ICT to strategically position itself as an integrated network solutions provider. During the last few years, in order to respond efciently to the critical timeto-market imperative, OEM-ICT implemented collaborative supply chain initiatives to support outsourcing activities in a demand-driven strategy. This study is centered on OEM-ICTs optical unit, which controlled a large part of the US $1.5-billion annual worldwide market. OEM-ICTs optical units supplier base is composed of 350 to 400 sub-assemblers and component manufacturers and a limited number of large assemblers. Some 85 per cent of these suppliers are very large enterprises (500 employees) while small rms (10 to 250 employees) make up the remaining 15 per cent. The rst phase of this study required the participation of OEM-ICTs optical unit and a selected group of suppliers that collaborate intensively with the system integrator. As mentioned previously, a total of four companies (including two business units of OEM-ICT) were approached in order to collect data on the telecommunications equipment industry. The proles of these four companies are described in Table I. The companies participating in the eld study are quite different. From simple metal sheets to complex optical transmission solutions, the four companies offer different types of products (rst line of Table I) with specic characteristics (second line of Table I). Company size also varies drastically, with 360 to 29000 employees and with revenues ranging from $65 million to $9.8 billion. However, the numbers of suppliers and customers do not seem to be linked to size. The supplier base of sub-assembler SA3, which has $500 million in revenues, consists of 1,100 companies, while OEM-ICT has just 350 to 400 suppliers despite its $8.4 billion in revenues. The same observation can be made of the customer base; the $9.8-billion company provides PCAs to 75 to 100 customers, while the much smaller $65-million subassembler SA4 supplies metal sheets to over 100. 253

Collaboration tools The telecommunications industry supply chain uses a number of collaboration tools. The interviews with the 16 respondents allowed us to identify eight electronic tools that are used to exchange critical information among supply chain partners. These supply chain e-collaboration tools are categorized as supply chain planning or supply chain execution tools (Table II). The eld study also identied obstacles and advantages to the use of electronic collaboration tools within the telecommunication equipment industry. The main obstacles identied by each layer of the supply chain are described in the rst row of Table III. The second row lists the main advantages of carrying out electronic collaborative actions in the supply chain. The third and last row depicts the main benets, which are the tangible results of the main advantages described in the previous row.

Table II Supply chain e-collaboration tools

Supply chain execution Direct procurement Forwards purchase orders (POs) to pre-qualied suppliers Replenishment Orders directly from the shop oor to either replenish a production line or a stockroom Shortages Scans the buyers production plan to project expected component shortages Delivery and tracking Generates a payment and a delivery request and to track components Design Enables the use of interactive engineering drawing and storage of CAD designs by all the key stakeholders Supply chain planning Forecasting Exchanges the forecast information provided by both the buyer and supplier Capacity planning Determines the amount of capacity required to produce Business strategy Collects and shares the actions that need to be taken to support the objectives and mission of the SC

Collaboration planning in a supply chain Luc Cassivi

Supply Chain Management: An International Journal Volume 11 Number 3 2006 249 258

Table III Obstacles, advantages and benets of the use of e-collaboration SC tools

OEM-ICT Main obstacles Product customization Importance of human factors for contract negotiation High level of interaction with customers Human resistance to change and training issues Difcult for small suppliers to adopt or integrate tools Reduced time to market Develop/maintain core competencies Improved visibility throughout the SC Improved negotiations with suppliers Reduction in errors Transactions processed faster Fewer information losses Simplied information access Inventory reductions Assembler AS2 Security and intellectual property issues Finding technological partners with real business experience Training and skill set availability Technological reliability and dependencies (idle times are costly) Reduction in time to market for new product introductions Earlier involvement of all business partners Sub-assembler SA3 Lack of nancial resources Cost of systems is a major obstacle Internal restructuring in order to deal with innovative tools Sub-assembler SA4 No or limited inuence on the adoption of electronic tools by large customers and suppliers Flexibility needed to adapt to the required technological changes

Main advantages

Better accessibility and visibility of information

Better accessibility of information Benets derived from the demand-pull process

Main benets

Packaging consolidation Faster and more effective communication Contract negotiations with less human interaction

Increased volume of information owing from customers Fewer interactions with customers since information is available on line

Reduction in the time spent on the phone Smaller workforce to manage the relationships with customers

As a whole, two overall ndings extracted from the eld study have profoundly affected the formulation of the electronic questionnaire, the second phase of our study: (1) Focus on collaboration planning activities. The main impacts of collaborating electronically tend to be encountered in the preparation and the support phase of the relationships. These two activities strongly depend on how supply chain partners plan to collaborate and what actions are needed to ensure the quality and efciency of the collaboration process. The assembler and the sub-assemblers had different experiences with the supply chain planning approach used with the OEMICT. In one instance, the feedback provided by subassembler SA3 inuenced the design of several collaboration tools. In this case, the collaborative planning of the supply chain processes to be deployed with the OEM-ICT greatly affected the perceived performance of the collaboration tools. The performance of each partner in the supply chain seemed to be most strongly related to the planning of the collaborative initiative rather than the execution of the process. Consequently, the electronic survey focuses on the collaboration planning activities carried out in the supply chain. (2) Strong impacts on process and relational innovations. After analyzing the impacts of supply chain e-collaboration tools on innovation, their lack of impact on product innovations led us to focus only on process and relational innovations as backbone variables in the second phase of the research. For all four rms involved in this manufacturing specic supply chain, processes and relationships were transformed but no major productrelated breakthroughs were created by electronically collaborating in the supply chain. 254

4.2. Results of the electronic survey As mentioned earlier, the questionnaire presented to the rms was divided into ve main topics. First, we will describe the characteristics of the participating rms along with their activities in supply chain (topics 1 and 2). Then, collaboration planning congurations are presented using data obtained from the third topic of the questionnaire. Finally, the fourth and fth topics, innovativeness and supply chain performance, are used to compare the different congurations. A total of 53 companies answered the web survey, for a 40.8 per cent response rate. Each responding rm completed both the supplier-related and the customer-related questions, which required the participation of multiple respondents in each company. When validating the questionnaire with a few companies, two respondents were usually required to answer the questionnaire entirely. A majority of these rms are large companies (72 per cent provide work for more than 500 employees); small (less than 100 employees) and medium-sized companies (between 100 and 500 employees) each account for 14 per cent of the responding rms. In order to understand and analyze the role of collaboration in the supply chain, it was crucial to target companies involved with a large supplier base active in different layers of the supply chain. This target was met, with 39 per cent of responding rms being involved with three or more levels of suppliers and 41 per cent dealing with two levels of suppliers. Since these companies were identied as the most important suppliers of the OEM, it is no surprise that 71 per cent consider themselves to be rst-tier suppliers in the industry, the remainder being second- and third-tier suppliers. As might be expected, 25 per cent of the 53 rms that had responded to the questionnaire did not carry out collaboration planning with its supply chain partners (answering not applicable to the questions in the third part of the questionnaire). Therefore, from the data obtained from the 40 remaining rms, a cluster analysis was executed on

Collaboration planning in a supply chain Luc Cassivi

Supply Chain Management: An International Journal Volume 11 Number 3 2006 249 258

four types of collaboration planning activities: front-end agreement and joint business plan for both upstream and downstream perspectives. The results of the cluster analysis reveal three major groups, differentiated by the level and focus of collaboration planning activities (Table IV). The results obtained are quite robust since all three groups differ signicantly (p # :0006) in terms of activities conducted to develop a front-end agreement and to create joint business plans with both suppliers and customers. The rst group, which contains 17 companies, carries out minimal collaboration planning on both sides of the supply chain. The mean scores for all four collaboration-planning variables (from 4.358 to 4.661) are lower than those in the other two clusters. The second and smallest of the three groups includes seven companies that tend to plan collaboration in a more traditional manner by concentrating mainly on their suppliers (means for front-end agreement of 6.121 and joint business plan of 5.23 for upstream activities, versus 5.448 and 4.505, respectively, for downstream activities). These companies may bring the power structure in the supply chain into play and use their strong position to deal with suppliers. Finally, the 16 companies in the third cluster aim at creating a seamless supply chain by planning collaboration on both sides of the chain. The means are relatively similar when comparing upstream activities (FEAS 5:755 and JBPS 6:043) to downstream activities (FEAC 5:787 and JBPC 5:954) as companies in this third group are aware of the importance of collaborating with all partners (for both upstream and downstream). As demonstrated in Table IV, the three groups of rms have signicantly different types of collaboration congurations. Further validation of these congurations can be obtained from discriminant analysis (see Table V). The objective of this Table IV Clusters for collaboration planning variables

procedure is to predict the probability that a particular rm will belong to a particular group based on the four collaboration-planning variables (Hair et al., 1998). In this case, the overall classication rate is high, as companies are correctly classied in their respective groups in 92.5 per cent of cases. Group 3 presents a perfect classication rate whereas group 2 has the lowest but still quite adequate classication rate, 85.7 per cent. The three groups clearly differ in the way they collaborate with supply chain partners, but is there a link between collaboration planning congurations and changes in their processes, relationships or in their performance. In order to capture process and relational innovativeness, and supply chain performance, several constructs were created. In each of the two groups of variables displayed in Table VI, the Cronbach alpha coefcients conrm that the items in the constructs have strong relationships among themselves. The reliability for each of the innovativeness constructs is satisfactory for both upstream and downstream approaches as the Cronbach alphas are all between 0.90 and 0.94 (where 1.00 represents perfect reliability). The construct reliability for supply chain performance also proved to be quite satisfactory for all three variables, with Cronbach alpha coefcients ranging from 0.69 to 0.89. Table VI also demonstrates that, for the four innovativeness variables, the companies retained in our sample experienced, on average, an increase in process and relational innovations due to the introduction of collaboration planning during both upstream and downstream supply chain activities. A slight increase, on average, is also observed for two performance variables (output measures, with an average score of 4.74, and exibility measures, with an average score of 4.94). However,

Collaboration planning Front-end agreement with supplier Joint business plan with supplier Front-end agreement with customer Joint business plan with customer Percentage of rms in each group FEAS JBPS FEAC JBPC

Group 1 Minimal collaboration planning Meana 4.495 4.479 4.661 4.358 42.5

Group 2 Traditional one-way collaboration planning Meana

Group 3 Full two-way collaboration planning Meana 5.755 6.043 5.787 5.954 40

pb

0.0000 0.0000 0.0006 0.0000

6.121 5.230 5.448 4.505 17.5

Notes: a Based on Likert scales where 1 does not execute these CPFR activities in the supply chain and 7 executes these CPFR activities fully in the supply chain; b Level of signicance of Kruskal-Wallis (one-way); Chebyshev measure, Ward method; italic values: highest value of each row

Table V Classication matrix of collaboration planning discriminant analysis

Actual group Group 1 Minimal collaboration planning Group 2 Traditional one-way collaboration planning Group 3 Full two-way collaboration planning Overall classication Predicted group 1 2 3 15 1 0 16 2 6 0 8 0 0 16 16 Actual group size 17 7 16 40 Percentage correctly classied 88.2 85.7 100 92.5

Notes: Boxs M: 21.77; p 0:6358 Direct method; Level of signicance of 1st discriminant function: p 0:0000, Wilkss lambda: 0.115; Eigenvalue: 3.654; Level of signicance of 2nd discriminant function: p 0:0001; Wilkss lambda: 0.536; Eigenvalue: 0.867

255

Collaboration planning in a supply chain Luc Cassivi

Supply Chain Management: An International Journal Volume 11 Number 3 2006 249 258

Table VI Supply chain performance constructs

Innovativenessa Process innovation, supplier Relational innovation, supplier Process innovation, customer Relational innovation, customer Supply chain performanceb Resource measures Output measures Flexibility measures PINS RINS PINC RINC RM OM FM Number of items 7 5 7 5 5 9 4 a 0.90 0.92 0.89 0.94 0.89 0.69 0.79 Average score 5.26 5.35 5.17 5.58 3.95 4.74 4.94

Notes: a Average score based on Likert scales which measure the extent to which collaboration planning allows for the improvement of innovativeness: 1 disagrees that collaboration planning has a positive impact on . . . and 7 agrees that collaboration planning has a positive impact on . . .; b average score based on Likert scales where 1 decrease in performance and 7 increase in performance due to the introduction of collaborative planning activities

the mean score for the resource measures (3.95) is slightly under the mid-point of the Likert scales (4.00). When comparing the three congurations in Table VII, the link between collaboration planning, innovativeness and supply chain performance seems to exist. For process and relational innovations, it is no surprise to observe that the level of innovativeness is directly related to the intensity of collaboration planning in each group. Hence, group 1, minimal collaboration planning, obtains the lowest means for each of the four innovativeness variables. The traditional oneway collaboration planning cluster (group 2) produces means that are slightly higher than those for the minimal collaboration planning group (< 0.40 for PINS, RINS and PINC and 0.84 for RINC) but is still quite far behind the full two-way collaboration planning group (group 3), which enjoys the strongest results for all four types of innovativeness (with differences of 0.83, 1.12, 1.33 and 0.43 in favor of the two-way collaboration planning cluster). As for the performance of the supply chain, the most noticeable result is the mean of 5.48 attributed to exibility measures for two-way collaboration planning (the only mean over the 5.0 mark). For resource measures, the results are weak in all three clusters, with mean scores of 3.55, 3.82 and 4.44. For output measures, the level of signicance of the Kruskal-Wallis test is not satisfactory as all three clusters have

similar mean scores (4.61, 4.69 and 4.87). Therefore, in terms of supply chain performance, full two-way collaboration planning seems to be the only way for a company to differentiate itself from competitors by improving exibility measures.

5. Conclusion

The impact of collaboration tools on the dynamics of supply chain relationships was clearly an issue with the companies involved in the eld study. For system integrators, different roles may be attributed to collaboration tools, given the constant changes in the telecommunications equipment supply chain: facilitating access to information, which affects knowledge creation capabilities, and assisting in the design of exible supply chains. The eld study also demonstrated that process and relational innovations are enhanced by the development of electronic collaboration activities within the telecommunications equipment supply chain. In the second phase of this study, using cluster analysis, we attempted to create collaboration congurations. Three separate groups with different levels and types of collaboration planning were identied. These groups appropriately represent the telecommunications equipment

Table VII Fit as gestalt: Collaboration congurations, innovativeness and supply chain performance

Group 1 Minimal collaboration planning Meana Group 2 Traditional one-way collaboration planning Meana 5.11 5.07 4.73 5.76 3.82 4.69 4.41 Group 3 Full two-way collaboration planning Meana 5.94 6.19 6.06 6.19 4.44 4.87 5.48

pb

0.0007 0.0009 0.0004 0.0024 0.0056 0.4921 0.0113

Innovativeness Process innovation, supplier Relational innovation, supplier Process innovation, customer Relational innovation, customer Supply chain performance Resource measures Output measures Flexibility measures

PINS RINS PINC RINC RM OM FM

4.70 4.68 4.53 4.92 3.55 4.61 4.65

Notes: a Based on Likert scales where 1 does not execute these CPFR activities in the supply chain and 7 executes these CPFR activities fully in the supply chain; b level of signicance of Kruskal-Wallis (one-way); Chebyshev measure, Ward method

256

Collaboration planning in a supply chain Luc Cassivi

Supply Chain Management: An International Journal Volume 11 Number 3 2006 249 258

supply chain, where rms are either deeply involved in supply chain collaboration or very minimally concerned by it. The results of this study should be interpreted in the light of a few limitations. First, by focusing on the initial stage of CPFR, we might overlook some important links with the other two stages of CPFR. However, with a more focused approach, we were able to obtain detailed information on the collaborative planning stage. In future research initiatives, it would be interesting to look out the later stages, which are more focused on the execution of collaboration actions. A second limitation is the selection of one specic supply chain, which makes the generalization to other supply chains difcult. However, this limitation is also offset by the quality of information obtained from a more in-depth study and by the analysis of a particularly innovative setting. In conclusion, information visibility is often seen as a critical element in maintaining an efcient supply chain, but the only way to obtain visibility is to plan and execute collaborative actions with both upstream and downstream partners. This study represents an attempt to identify and compare some of the different activities required in a two-way collaborative supply chain.

References

Armistead, C.G. and Mapes, J. (1993), The impact of supply chain integration on operating performance, Logistics Information Management, Vol. 6 No. 4, pp. 9-14. Aviv, Y. (2001), The effect of collaborative forecasting on supply chain performance, Management Science, Vol. 47 No. 10, pp. 1326-43. Beamon, B.M. (1999), Measuring supply chain performance, International Journal of Operations & Production Management, Vol. 19 No. 3, pp. 275-92. Boddy, D., MacBeth, D. and Wagner, B. (2000), Implementing collaboration between organizations: an empirical study of supply chain partnering, Journal of Management Studies, Vol. 37 No. 7, pp. 1003-27. Chan, F.T.S. and Qi, H.J. (2003), Innovative performance measurement method for supply chain management, An International Journal of Supply Chain Management, Vol. 8 No. 3, pp. 209-23. Chen, I.J. and Paulraj, A. (2004), Towards a theory of supply chain management: the constructs and measurements, Journal of Operations Management, Vol. 22 No. 2, pp. 119-50. Corbett, C.J., Blackburn, J.D. and Van Wassenhove, L.N. (1999), Partnerships to improve supply chains, Sloan Management Review, Vol. 40 No. 4, pp. 71-82. Creswell, J.W. (1994), Qualitative and Quantitative Approaches, Sage Publications, Thousand Oaks, CA. Danneels, E. and Kleinschmidt, E.J. (2001), Product innovativeness from the rms perspective: its dimensions and their relation with project selection and performance, Journal of Product Innovation Management, Vol. 18 No. 6, pp. 357-73. Davis, T. (1993), Effective supply chain management, Sloan Management Review, Vol. 34 No. 4, pp. 35-47. Denzin, N.K. (1989), The Research Act, 3rd ed., PrenticeHall, Englewood Cliffs, NJ. Ellram, L.M. (1995), Partnering pitfalls and success factors, International Journal of Purchasing and Materials Management, Vol. 31 No. 1, pp. 36-44. 257

Esper, T.L. and Williams, L.R. (2003), The value of collaborative transportation management: its relationship to CPFR and information technology, Transportation Journal, Vol. 42 No. 4, pp. 55-65. Garcia, R. and Calantone, R. (2002), A critical look at technological innovation typology and innovativeness terminology: a literature review, Journal of Product Innovation Management, Vol. 19 No. 2, pp. 110-32. Hair, J.F., Anderson, R.E., Tatham, R.L. and Black, W.C. (1998), Multivariate Data Analysis, Prentice-Hall, Upper Saddle River, NJ. Handy, C. (1995), Trust and virtual organization, Harvard Business Review, Vol. 73 No. 3, pp. 40-50. Holmstrom, J., Framling, K., Kaipia, R. and Saranen, J. (2002), Collaborative planning, forecasting and replenishment: new solutions needed for mass collaboration, An International Journal of Supply Chain Management, Vol. 7 No. 3, pp. 136-45. Kwan, A.T.W. (1999), The use of information technology to enhance supply chain management in the electronics and chemical industries, Production and Inventory Management Journal, Vol. 40 No. 3, pp. 7-15. Lambert, D.M. and Cooper, M. (2000), Issues in supply chain management, Industrial Marketing Management, Vol. 29 No. 1, pp. 65-83. Landeros, R. and Monczka, R.M. (1989), Cooperative buyer/seller relationships and a rms competitive posture, Journal of Purchasing and Material Management, Vol. 25 No. 3, pp. 9-18. Li, H. and Atuahene-Gima, K. (2001), Product innovation strategy and the performance of new technology ventures in China, Academy of Management Journal, Vol. 44 No. 6, pp. 1123-34. Lummus, R.R., Vokurka, R.J. and Alber, K.L. (1998), Strategic supply chain planning, Production and Inventory Management Journal, Vol. 39 No. 3, pp. 49-58. Maloni, M. and Benton, W.C. (2000), Power inuences in the supply chain, Journal of Business Logistics, Vol. 21 No. 1, pp. 49-74. Mason-Jones, R. and Towill, D.R. (1999), Using the information decoupling point to improve supply chain performance, The International Journal of Logistics Management, Vol. 10 No. 2, pp. 13-26. Moore, K.R. (1998), Trust and relationship commitment in logistics alliances: a buyer perspective, International Journal of Purchasing and Materials Management, Vol. 34 No. 1, pp. 24-37. Nord, W.R. and Tucker, S. (1987), Implementing Routine and Radical Innovations, Lexington Books, Lexington, MA. OECD/Eurostat (1997), The measurement of scientic and technological activities: proposed guidelines for collecting and interpreting technological innovation data, OSLO Manual, OECD/Eurostat, Paris. Ring, P. and Van de Ven, A. (1994), Development processes of cooperative interorganizational relationships, Academy of Management Review, Vol. 19 No. 1, pp. 90-118. Rubiano Ovalle, R. and Crespo Marquez, A. (2003), The effectiveness of using e-collaboration tools in the supply chain: an assessment study with system dynamics, Journal of Purchasing and Supply Management, Vol. 9 No. 4, pp. 151-63. Spekman, R.E., Kamauff, J.W. and Myhr, N. (1998), An empirical investigation into supply chain

Collaboration planning in a supply chain Luc Cassivi

Supply Chain Management: An International Journal Volume 11 Number 3 2006 249 258

management: a perspective on partnerships, An International Journal of Supply Chain Management, Vol. 3 No. 2, pp. 53-67. Stake, R. (1995), The Art of Case Study Research, Sage Publications, London. Tashakkori, A. and Teddlie, C. (1998), Mixed Methodology: Combining Qualitative and Quantitative Approaches, Sage, Thousand Oaks, CA. Utterback, J.M. and Abernathy, W.J. (1975), A dynamic model of product and process innovation, Omega, Vol. 3 No. 6, pp. 639-56. Van Hoek, R.I. (1998), Measuring the unmeasurable measuring and improving performance in the supply chain, An International Journal of Supply Chain Management, Vol. 3 No. 4, pp. 187-92.

Voluntary Interindustry Commerce Standards Association (VICS) (1998), Collaborative Planning, Forecasting and Replenishment Voluntary Guidelines, Uniform Code Council, Lawrenceville, NJ. von Hippel, E. (1988), The Sources of Innovation, Oxford University Press, New York, NY. Yin, R.K. (1994), Case Study Research: Design and Methods, 2nd ed., Sage Publication, Thousand Oaks, CA. Zaheer, A., McEvily, B. and Perrone, V. (1998), The strategic value of buyer-supplier relationships, International Journal of Purchasing and Materials Management, Vol. 34 No. 3, pp. 20-6.

Corresponding author

Luc Cassivi can be contacted at: cassivi.luc@uqam.ca

To purchase reprints of this article please e-mail: reprints@emeraldinsight.com Or visit our web site for further details: www.emeraldinsight.com/reprints

258

You might also like

- U-14 Strategic Supply Chain Management and LogisticsDocument19 pagesU-14 Strategic Supply Chain Management and LogisticsMalik Khurram Shahzad AwanNo ratings yet

- New Directions in Supply-Chain Management: Technology, Strategy, and ImplementationFrom EverandNew Directions in Supply-Chain Management: Technology, Strategy, and ImplementationNo ratings yet

- 2-Sales and Operations Planning The Supply Chain PillarDocument11 pages2-Sales and Operations Planning The Supply Chain PillarSteve DemirelNo ratings yet

- Supply Chain ManagementDocument15 pagesSupply Chain ManagementSohaib Hassan50% (2)

- Framework For Supply Chain Collaboration Agri Food IndustryDocument17 pagesFramework For Supply Chain Collaboration Agri Food IndustryCH Naveed AnjumNo ratings yet

- Fire Safety Management - Traditional Building Part#2Document194 pagesFire Safety Management - Traditional Building Part#2Yoyon Haryono100% (1)

- Collaboration Planning in A Supply Chain: Research PaperDocument10 pagesCollaboration Planning in A Supply Chain: Research PaperEsteban MurilloNo ratings yet

- Supply Chain IntegrationDocument5 pagesSupply Chain IntegrationnithiyaranjiniNo ratings yet

- The Nation State and Global Order A Historical Introduction To ContemporaryDocument195 pagesThe Nation State and Global Order A Historical Introduction To Contemporaryrizwan.mughal1997100% (1)

- Supply Chain MnagementDocument5 pagesSupply Chain MnagementDanish AhsanNo ratings yet

- Supply Chain Management Practices and Supply ChainDocument15 pagesSupply Chain Management Practices and Supply ChainEkansh SaxenaNo ratings yet

- Bagchi 2003Document27 pagesBagchi 2003shaheerahmadNo ratings yet

- A Study of Role and Impact of Cloud Computing in Supply Chain ManagementDocument5 pagesA Study of Role and Impact of Cloud Computing in Supply Chain ManagementYOGEESWAR BHARATHNo ratings yet

- Expert Systems With Applications: Usha RamanathanDocument11 pagesExpert Systems With Applications: Usha RamanathanMyself NoorNo ratings yet

- Obstacles To Process Integration Along The Supply Chain: Manufacturing Firms PerspectiveDocument9 pagesObstacles To Process Integration Along The Supply Chain: Manufacturing Firms Perspectiveksamanta23No ratings yet

- Measuring Performance at The Supply Chain Level - The Role of The Chain DirectorDocument21 pagesMeasuring Performance at The Supply Chain Level - The Role of The Chain DirectorFernando JarixNo ratings yet

- Sustainable Supply Chain Management PHD ThesisDocument6 pagesSustainable Supply Chain Management PHD Thesistsfublhld100% (1)

- Supply Chain ManagementDocument11 pagesSupply Chain ManagementJulianaNo ratings yet

- Information and Competitiveness: Case of A Logistic Information SystemDocument8 pagesInformation and Competitiveness: Case of A Logistic Information Systemway4u2subdNo ratings yet

- A Bench MarkingDocument23 pagesA Bench MarkingbrennabaeNo ratings yet

- The International Journal of Logistics Management Realities of Supply Chain CollDocument15 pagesThe International Journal of Logistics Management Realities of Supply Chain CollNadaNo ratings yet

- Information Sharing in Supply Chain ManagementDocument6 pagesInformation Sharing in Supply Chain ManagementZahra Lotfi100% (1)

- New 4Document26 pagesNew 4luvita sesiliaNo ratings yet

- The Relationship Between Supply Chain Management and E-Business - A New TechniqueDocument9 pagesThe Relationship Between Supply Chain Management and E-Business - A New TechniquejayamsecNo ratings yet

- Conceptual Framework of ModelDocument29 pagesConceptual Framework of ModelSabeeb M RazeenNo ratings yet

- Int. J. Production Economics: Usha Ramanathan, Angappa GunasekaranDocument8 pagesInt. J. Production Economics: Usha Ramanathan, Angappa GunasekaranMyself NoorNo ratings yet

- 29 McLarenDocument13 pages29 McLarenfpttmmNo ratings yet

- Libyan International Medical University Faculty of Business AdministrationDocument8 pagesLibyan International Medical University Faculty of Business AdministrationmariamNo ratings yet

- Integrating The Supply Chain... 25 Years OnDocument32 pagesIntegrating The Supply Chain... 25 Years Onmohammad kbeiliNo ratings yet

- Internet Impact On Supply Chain ManagementDocument3 pagesInternet Impact On Supply Chain ManagementmostafayakoutNo ratings yet

- A Review On Supply Chain Coordination: Coordination Mechanisms, Managing Uncertainty and Research DirectionsDocument45 pagesA Review On Supply Chain Coordination: Coordination Mechanisms, Managing Uncertainty and Research DirectionsbabekosibabeNo ratings yet

- A Review of The Importance of Collaboration in Strategy Design and Efficiency of Supply Chain PartnershipDocument6 pagesA Review of The Importance of Collaboration in Strategy Design and Efficiency of Supply Chain PartnershipInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- The Relationship Between IT and Supply Chain Performance: A Systematic Review and Future ResearchDocument17 pagesThe Relationship Between IT and Supply Chain Performance: A Systematic Review and Future ResearchplokodotNo ratings yet

- Cloud Computing Adoption Literature ReviewDocument12 pagesCloud Computing Adoption Literature Reviewafmzuomdamlbza100% (1)

- Jurnal PenelitianDocument19 pagesJurnal PenelitianYORI ILHAM ALKINDINo ratings yet

- Table of Content Articles: Pg. #Document8 pagesTable of Content Articles: Pg. #Rohail SiddiqueNo ratings yet

- Sample Research Paper On Supply Chain ManagementDocument6 pagesSample Research Paper On Supply Chain ManagementgmannevndNo ratings yet

- Impact of E-Supply Chain On Supply Chain Management of Retail Malls in Nagpur. (SYNOPSIS)Document11 pagesImpact of E-Supply Chain On Supply Chain Management of Retail Malls in Nagpur. (SYNOPSIS)Deepak Singh100% (2)

- Research Article: Supply Chain Integration in The Manufacturing Firms in Developing Country: An Ethiopian Case StudyDocument13 pagesResearch Article: Supply Chain Integration in The Manufacturing Firms in Developing Country: An Ethiopian Case StudyDame TolossaNo ratings yet

- Putting Supply Chains Into PracticeDocument14 pagesPutting Supply Chains Into PracticeHadiBiesNo ratings yet

- Collaboration Strategy ContinuumDocument33 pagesCollaboration Strategy ContinuumNurtegin RysbaevNo ratings yet

- 2005 Evaluate BPDocument15 pages2005 Evaluate BPBo UlziiNo ratings yet

- ITB AssignmentDocument11 pagesITB AssignmentRAHUL DEVNo ratings yet

- Proposal For Dissertation: Submitted To Dr. Sapna PopliDocument8 pagesProposal For Dissertation: Submitted To Dr. Sapna PopliAnkit KumarNo ratings yet

- Chapter-3 Research Methodology and Survey Instrument: 3.1 Need For The StudyDocument28 pagesChapter-3 Research Methodology and Survey Instrument: 3.1 Need For The StudyArun Kumar SatapathyNo ratings yet

- Measuring Supply Chain VisibilityDocument57 pagesMeasuring Supply Chain VisibilitySaurabhNo ratings yet

- Design For Supply Chain CollaborationDocument18 pagesDesign For Supply Chain CollaborationbeltsaNo ratings yet

- Supplier Management KenyaDocument9 pagesSupplier Management KenyaceciliawuuNo ratings yet

- The Importance of E-Integration in Supply Chain of Pakistani Firms and Its Effect On PerformanceDocument8 pagesThe Importance of E-Integration in Supply Chain of Pakistani Firms and Its Effect On Performanceieom2012No ratings yet

- Supply Chain Modeling: Past, Present and Future: Cite This PaperDocument20 pagesSupply Chain Modeling: Past, Present and Future: Cite This PaperRakshita SolankiNo ratings yet

- Modeling Supply Chain Dynamics: A Multiagent Approach: Jayashankar M. SwaminathanDocument26 pagesModeling Supply Chain Dynamics: A Multiagent Approach: Jayashankar M. SwaminathanalamataNo ratings yet

- Special Research Focus On Supply Chain LDocument16 pagesSpecial Research Focus On Supply Chain LAKSHAT GHATIANo ratings yet

- Comparison Between Upstream and Downstream Supply Chain Management and How They Are Affected by E-BusinessDocument9 pagesComparison Between Upstream and Downstream Supply Chain Management and How They Are Affected by E-Businessernest libertyNo ratings yet

- Bahir Dar University LSCMDocument34 pagesBahir Dar University LSCMAnonymous MrEL6JPNo ratings yet

- SCM Integration - Literature ReviewDocument13 pagesSCM Integration - Literature ReviewEDWIN ARMANDO DUARTE SEGURANo ratings yet

- Thesis Logistics Supply Chain ManagementDocument7 pagesThesis Logistics Supply Chain Managementafktdftdvqtiom100% (1)

- Cloud Computing Literature ReviewDocument7 pagesCloud Computing Literature Reviewea0kvft0100% (1)

- Supply Chain Modeling Past, Present and Future PDFDocument19 pagesSupply Chain Modeling Past, Present and Future PDFEyüb Rahmi Aydın0% (1)

- Logistics Collaboration in Supply Chains: Practice vs. TheoryDocument21 pagesLogistics Collaboration in Supply Chains: Practice vs. Theorylobna_qassem7176No ratings yet

- Optimal Control and Optimization of Stochastic Supply Chain SystemsFrom EverandOptimal Control and Optimization of Stochastic Supply Chain SystemsNo ratings yet

- 1-01 Business Orchestration With S&OPDocument1 page1-01 Business Orchestration With S&OPsukushNo ratings yet

- Accessories For Numismatists: Incl. Accessories For Collecting Currency, Casino Chips, and MoreDocument76 pagesAccessories For Numismatists: Incl. Accessories For Collecting Currency, Casino Chips, and MoreAhmed Sameh El-LakaniNo ratings yet

- SW Presentation1Document2 pagesSW Presentation1Ahmed Sameh El-LakaniNo ratings yet

- SW Presentation1Document2 pagesSW Presentation1Ahmed Sameh El-LakaniNo ratings yet

- SW Presentation1Document2 pagesSW Presentation1Ahmed Sameh El-LakaniNo ratings yet

- Blue Oceans and Other Big IdeasDocument33 pagesBlue Oceans and Other Big IdeaszainonayraNo ratings yet

- Quanser Active Mass Damper UserManual PDFDocument21 pagesQuanser Active Mass Damper UserManual PDFCHAVEZ MURGA ARTURO ALEJANDRONo ratings yet

- Assertiveness FinlandDocument2 pagesAssertiveness FinlandDivyanshi ThakurNo ratings yet

- Proyecto San Cristrobal C-479 Iom Manual StatusDocument18 pagesProyecto San Cristrobal C-479 Iom Manual StatusAllen Marcelo Ballesteros LópezNo ratings yet

- Feasibility Study For A Sustainability Based Clothing Start-UpDocument49 pagesFeasibility Study For A Sustainability Based Clothing Start-UpUtso DasNo ratings yet

- Ips Rev 9.8 (Arabic)Document73 pagesIps Rev 9.8 (Arabic)ahmed morsyNo ratings yet

- Degree Program Cheongju UniversityDocument10 pagesDegree Program Cheongju University심AvanNo ratings yet

- Romeuf Et Al., 1995Document18 pagesRomeuf Et Al., 1995David Montaño CoronelNo ratings yet

- SBMPTN 2016 Kode 333Document6 pagesSBMPTN 2016 Kode 333Allisa MasithaNo ratings yet

- Team 12 Moot CourtDocument19 pagesTeam 12 Moot CourtShailesh PandeyNo ratings yet

- The Relationship Between Law and MoralityDocument12 pagesThe Relationship Between Law and MoralityAnthony JosephNo ratings yet

- Cyber Ethics IssuesDocument8 pagesCyber Ethics IssuesThanmiso LongzaNo ratings yet

- Glint 360 Design GuideDocument2 pagesGlint 360 Design GuidebNo ratings yet

- Temple ManualDocument21 pagesTemple Manualapi-298785516No ratings yet

- All-India rWnMYexDocument89 pagesAll-India rWnMYexketan kanameNo ratings yet

- Machiavelli's Political Philosophy and Jamaican PoliticsDocument2 pagesMachiavelli's Political Philosophy and Jamaican PoliticsAndre RobinsonNo ratings yet

- Sjögren's SyndromeDocument18 pagesSjögren's Syndromezakaria dbanNo ratings yet

- Brief For Community Housing ProjectDocument5 pagesBrief For Community Housing ProjectPatric LimNo ratings yet

- Rapidjson Library ManualDocument79 pagesRapidjson Library ManualSai Kumar KvNo ratings yet

- 4h Thank You ProofDocument1 page4h Thank You Proofapi-362276606No ratings yet

- The Normal Distribution and Sampling Distributions: PSYC 545Document38 pagesThe Normal Distribution and Sampling Distributions: PSYC 545Bogdan TanasoiuNo ratings yet

- Algebra Lineal Septima Edicion Stanley I. Grossman S. Mcgraw-Hilliinteramericana Editores S.A. de C.V Mexico, DFDocument1 pageAlgebra Lineal Septima Edicion Stanley I. Grossman S. Mcgraw-Hilliinteramericana Editores S.A. de C.V Mexico, DFJOSE JULIAN RAMIREZ ROJASNo ratings yet

- StrategiesDocument7 pagesStrategiesEdmar PaguiriganNo ratings yet

- Simple FTP UploadDocument10 pagesSimple FTP Uploadagamem1No ratings yet

- OatDocument46 pagesOatHari BabuNo ratings yet

- Glyn Marston, Town Crier - Barry McQueen and Dept. Mayor - Tony LeeDocument1 pageGlyn Marston, Town Crier - Barry McQueen and Dept. Mayor - Tony LeeJake HoosonNo ratings yet

- Lae 3333 2 Week Lesson PlanDocument37 pagesLae 3333 2 Week Lesson Planapi-242598382No ratings yet

- WWW - Nswkendo IaidoDocument1 pageWWW - Nswkendo IaidoAshley AndersonNo ratings yet

- Albert Einstein's Riddle - With Solution Explained: October 19, 2009 - AuthorDocument6 pagesAlbert Einstein's Riddle - With Solution Explained: October 19, 2009 - Authorgt295038No ratings yet