Professional Documents

Culture Documents

FINAL BOCC Accomplishments 09 12 2012 - 201209121111531266

Uploaded by

Valerie Dale0 ratings0% found this document useful (0 votes)

73 views4 pagesThis public document can be found on the Frederick County Government website at www.frederickcountymd.gov/documents/13/FINAL%20BOCC%20Accomplishments%20%2009%2012%202012_201209121111531266.pdf

Original Title

FINAL BOCC Accomplishments 09 12 2012_201209121111531266

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis public document can be found on the Frederick County Government website at www.frederickcountymd.gov/documents/13/FINAL%20BOCC%20Accomplishments%20%2009%2012%202012_201209121111531266.pdf

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

73 views4 pagesFINAL BOCC Accomplishments 09 12 2012 - 201209121111531266

Uploaded by

Valerie DaleThis public document can be found on the Frederick County Government website at www.frederickcountymd.gov/documents/13/FINAL%20BOCC%20Accomplishments%20%2009%2012%202012_201209121111531266.pdf

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Revised: September 12, 2012

Board of County Commissioners

Frederick County, Maryland

2010 - 2014

Major Accomplishments

Sworn into office December 1, 2010

Budget Impacts:

Eliminated the Pension Program Plan for the Board of County Commissioners.

Reduced BOCC Expense Accounts by 90%, from $2500.00/ year to $250.00/year for each

commissioner.

Made significant changes to the Frederick County Defined Benefit Pension Plan. The Plan is

now funded at 83%. Based on these changes it should be at 90% by the end of our term.

As of 6/30/2011 the States ietiiement plans actuaiial funueu status was at 64.7%.

Increased the contributions to the Pension Plan from the County Employees, 2% for non-

uniformed employees (from 4% to 6%) and 1% for uniformed employees (from 8% to 9%)

Established a Defined Contribution Retirement Plan for all new eligible Grant funded

employees and employees at the County Nursing Home (Citizens Care and Rehabilitation

Center and Montevue Assisted Living) effective July 1, 2012, relieving the taxpayers of

the long term unfunded liabilities.

Fully funded the ARC (annual required contribution) for OPEB (retiree health benefits)

and reduced the unfunded liability. The current market value of assets held in OPEB trust

is $51 million.

Continue to reduce and restructure the size of County Government regarding the

budget and full time employees FTEs. Frederick County at its peak had 2,646 budgeted

FTEs now at 2,281 in FY2013. Currently we are at 2,130 positions filled, with the goal to

continue to reduce the size of government. We have 8% less full-time/benefitted

employees since Fiscal Year 2011 and 15% less during Fiscal Year 2009.

Moderately Priced Dwelling Unit (MPDU) Program Payment in Lieu Option; an applicant

may now choose to make a payment to the Frederick County Housing Initiative Fund of

$17,500 per required MPDU.

Reduced the Building Excise Tax Rate

Residential

- 700 square feet up to 1,400 square feet /from $0.10 to $0.00

- 1,400 square feet+/from $0.25 to $0.00

Non-Residential

-From $0.75 to $0.00

Reduced the Trailer Park Tax Rate from 15% of Rental Receipts to $0.00

Implemented a Senior Tax Credit for Senior Citizens of Frederick County

-As of July 30, 2012, 477 Senior Citizens have taken advantage of the credit

Implemented a new Pay Scale for Fire and Rescue Services uniformed employees

Restored the Pay Scale for Frederick County Deputies

Revised: September 12, 2012

Implemented a Merit Step and COLA for Frederick County Government Employees for

FY2013 ; first time in 4 years.

Moved up School Construction Projects :

-Oakdale Elementary School Addition-moved up 1 year from 2013 to 2012.

-North Frederick Elementary Addition/Modernization-moved up 1 year from 2015 to

2014.

-Frederick High School Modernization-moved up 1 year from 2017 to 2016.

A $100.00 Frederick County Real Property Tax Credit was returned to all home owner

occupied properties/$6.7 million dollars; equivalent to a 3 cent tax cut.

Created an APFO School Mitigation Fee Ordinance to raise money for school

construction and to give developers/builders an option to pay more for schools and create

jobs.

Bond Rating: Immediate changes by this board resulted in a bond rating upgrade by Fitch.

Fitchs AAA bond rating outlook changed from negative to stable with our July 2011 bond

issue. The last two bond refundings have produced the following results:

February 2012: 1.7258% = True Interest Cost (TIC) $6,194,021 = Debt Service Savings (FY2012 FY2025)

August 2012: 1.336% = True Interest Cost (TIC) $3,072,981 = Debt Service Savings (FY2012 FY2021)

Taking Care of Business:

Frederick County is Upen for Business

o Business Friendly Improvement Areas Action Items: Initiated January 1, 2011.

Identified over 260 Rules/Regulations/Fees/Taxes to be eliminated/reduced or

modified. To date over 170 have been completed (close to 65% of total)

o Created a Community Development Authority, a funding mechanism for the new

Jefferson Technology Park. It will bring an estimated 7,100 jobs and $185 million in

income tax revenue to the County.

o Eliminated the $65.00 permit fee for Dishwasher, Hot Water Heater and Garbage

Disposal permits.

o Eliminated the $100.00 annual notification fee for Home Security Systems.

o Extended Permitting Service Hours for Homeowners; now open until 6:00 PM on

Wednesdays.

o New Outreach Program to visit Frederick County Businesses every week. Part of the

business friendly Strategic Plan. Businesses feel that they are being heard.

o Extended payment plans for water and sewer capacity fees, sometimes called

connection fees, paid by small businesses, reducing the burdensome upfront expenses

that often prohibit the start of new business. Financing is now available for terms up to

10 years, at the option of the applicant.

Back to Basics - Cooperation with our Municipalities: Brunswick, Burkittsville,

Emmitsburg, Frederick City, Middletown, Mount Airy, Myersville, New Market,

Rosemont, Thurmont, Walkersville and Woodsboro:

Ended the long contentious judicial review with the Countys Towns and

Municipalities of imposed APFO on New Annexations.

Eliminated charging municipalities $1.00 per parcel on tax bills to their residents.

Revised: September 12, 2012

Re-established the Tax Equity Program with the Municipalities, ending another

contentious issue; a 55% increase in revenue to towns from $7.4 million to $11.5 million.

Established the Tax Differential Program:

The City of Frederick tax rate was reduced 12.3 cents to $ .8130 for a total

of $7.6 Million.

Town of Myersville reduced 11.72 cents to $ .8188 for a total of $174,000.

Public/Private Partnerships:

Privatization and Other Service Delivery Models: As we reduce the size of government

we will continue to utilize private companies, contractors, and part-time non-benefitted

employees to deliver services while not assuming the long term liabilities, such as

pensions and benefits to the taxpayers.

Head Start Services transfer to the YMCA. Saved over $2 million dollars in salaries and

benefits to the taxpayers of Frederick County while providing the same service.

Outsourced Sewer Televising Inspection Services will save approximately $190,000.00.

Currently Dining Services at the County Nursing Home oui helpuesk foi technology

service and inventory management, and some Internal Audit Services have been

transferred to private companies. Pilot Programs have begun for Public Improvement

Agreements for developer funded streets and storm drains.

Identified synergies with the Frederick County Board of Education. Frederick County

Public Schools now assumes total iesponsibility of Fieueiick County uoveinments

warehouse and mail room operations. The warehouse merger alone is projected to yield a

savings of $80,000 in the first year of operation, and approximately $124,000 per year

thereafter. Pilot Programs approved by the Board and in progress:

May 2012

L-3 Services for the outsourcing of the IIT helpdesk functions and inventory

management.

Parks and Recreation Division to start a pilot program for Rose Hill maintenance

including:

Chimney inspection and cleaning

Carpet cleaning

Tree trimming or removal

Exterior painting

Garage door repair

Alarm systems maintenance and monitoring (expanded)

Other areas being considered for contracting in the future include:

Subsurface drain inspection and flushing

Wood floor refinishing

Leaf removal

Exterior window cleaning

Snow removal (at Rose Hill and other County facilities where

appropriate)

Revised: September 12, 2012

June 2012

The Frederick County Internal Audit function was outsourced. The contract

awarded to Cotton and Company and SC&H on June 28, 2012.

The Division of Public Works to start the following pilot programs:

o Pilot program for Public Improvement Agreements for developer funded

streets and storm drains

o Pilot program for automated time keeping

o Solicit proposals foi Bighway 0peiations Chip Seal and Crack Maintenance,

Weed Control (spraying) and Carcass removal

o minor vehicle maintenance

o Use of retired law enforcement vehicles for non-emergency service

o Pilot program for build/operate HVAC system at 520 North Market Street

Synergies success:

This BOCC convened a Synergies Committee to seek and obtain valuable efficiencies

and tax savings on various projects and endeavors in which Frederick County

Government participated with one or more other governmental entities in the County

Frederick County Public Schools (FCPS), Frederick Community College, The City of

Frederick and other municipalities. These efforts resulted in over $6 million in

savings in 2011 with projected savings of over $3 million per year in future years. In

2011, the savings were primarily due to new, cooperative purchasing with FCPS

($1.479 million), joint participation in a CIGNA health insurance program ($2.7 million),

and joint participation with FCPS in parks and recreation programs ($1.0 million).

Also:

Moved our Interagency Information Technologies Division to Winchester Hall. The

county building that housed this division (located at 117 East Church Street) is for sale,

which will put the facility back on the tax rolls. A Task Force has been formed to look at

the feasibility of relocating county employees at 188 North Market Street to another

county facility. Assisted in securing funds of $1 million for a loan from Woodsboro Bank

to Brunswick Volunteer Fire Company for their new Fire Hall.

Large Business Tax Credit Legislation adopted by the 2011 Maryland General

Assembly

Small Business Tax Credit Legislation adopted by the 2012 Maryland General

Assembly

Instituted an Invocation/Prayer to open the BOCC meetings

Established English as the Official Language of Frederick County

Establishing:

Land Trust: Creates Affordable Housing forever.

Foreclosure Clean Up Act: Eliminates NPB0s Noueiately Piiceu Bwelling 0nits anu

uses those funds to help cleanup up foreclosures in neighborhoods throughout Frederick

County.

You might also like

- CMA Part I Question Bank WILEY PDFDocument535 pagesCMA Part I Question Bank WILEY PDFsamallymn89% (28)

- JFK Killed Just Days After Shutting Down RothschildDocument12 pagesJFK Killed Just Days After Shutting Down RothschildDomenico Bevilacqua100% (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Oman Business GuideDocument17 pagesOman Business GuideZadok Adeleye50% (2)

- Forms of Business EntityDocument20 pagesForms of Business EntityMain Daiictian HuNo ratings yet

- Narra Nickel Mining Vs Redmont PDFDocument35 pagesNarra Nickel Mining Vs Redmont PDFLemuel Angelo M. EleccionNo ratings yet

- Loan Application LetterDocument2 pagesLoan Application LetteranomikaNo ratings yet

- Cocofed vs. Republic: LegisDocument4 pagesCocofed vs. Republic: LegisJoshua ManaloNo ratings yet

- MasDocument13 pagesMasHiroshi Wakato50% (2)

- Asahi Glass OcrDocument29 pagesAsahi Glass OcrHernâni Rodrigues VazNo ratings yet

- Heidrick & Struggles International Case Analysis PDFDocument9 pagesHeidrick & Struggles International Case Analysis PDFthomasnbaileyNo ratings yet

- FY 2011-2012 ADOPTED Budget 20110614Document829 pagesFY 2011-2012 ADOPTED Budget 20110614City of GriffinNo ratings yet

- Franklin Budget Message 2011 2012Document2 pagesFranklin Budget Message 2011 2012Bobby CogginsNo ratings yet

- TRC News and Notes 2-16-12Document1 pageTRC News and Notes 2-16-12James Van BruggenNo ratings yet

- Cbac Presentation: Citizens Budget Advisory Committee Recommendations For Fiscal Year 2011Document20 pagesCbac Presentation: Citizens Budget Advisory Committee Recommendations For Fiscal Year 2011jeanettecriscione762No ratings yet

- To: From: CC: Date: ReDocument11 pagesTo: From: CC: Date: ReBrad TabkeNo ratings yet

- 2012Document3 pages2012maustermuhleNo ratings yet

- West Hartford Proposed Budget 2024-2025Document472 pagesWest Hartford Proposed Budget 2024-2025Helen BennettNo ratings yet

- Kitsap Budget MemoDocument18 pagesKitsap Budget MemopaulbalcerakNo ratings yet

- 2014-2018 Jackson County Capital Improvement ProgramDocument59 pages2014-2018 Jackson County Capital Improvement ProgramLivewire Printing CompanyNo ratings yet

- Ithaca Budget NarrativeDocument42 pagesIthaca Budget NarrativeTime Warner Cable NewsNo ratings yet

- Lakeport City Council - Final BudgetDocument119 pagesLakeport City Council - Final BudgetLakeCoNewsNo ratings yet

- 2012 Women, Equity and The Municipal BudgetDocument22 pages2012 Women, Equity and The Municipal Budgetinfo2267No ratings yet

- Fiscal Year 2012-13 Adopted Budget: 260 North San Antonio Road, Suite A Santa Barbara, CA 93110 805-961-8800Document31 pagesFiscal Year 2012-13 Adopted Budget: 260 North San Antonio Road, Suite A Santa Barbara, CA 93110 805-961-8800Besir AsaniNo ratings yet

- Sioux City 2013 Operating BudgetDocument378 pagesSioux City 2013 Operating BudgetSioux City JournalNo ratings yet

- NA Testimony On FY 2011 Gap Closing Plan (11 30 10)Document5 pagesNA Testimony On FY 2011 Gap Closing Plan (11 30 10)Susie CambriaNo ratings yet

- Coronado Unified Bond Measure PublicDocument13 pagesCoronado Unified Bond Measure Publicapi-214709308No ratings yet

- CM Fimbres Fiscal Year 2013 Recommended BudgetDocument2 pagesCM Fimbres Fiscal Year 2013 Recommended BudgetRichard G. FimbresNo ratings yet

- Worcester City Manager Michael V. O'Brien Self-Evaluation.Document24 pagesWorcester City Manager Michael V. O'Brien Self-Evaluation.MassLive.comNo ratings yet

- Budget Message: To: From: Date: Subject: Proposed Budget For The Fiscal Year Ending December 31, 2013Document40 pagesBudget Message: To: From: Date: Subject: Proposed Budget For The Fiscal Year Ending December 31, 2013heneghanNo ratings yet

- BudgetMessage2008 09Document8 pagesBudgetMessage2008 09Thunder PigNo ratings yet

- Lee County Bonita Springs Utilities 21-Feb-2014 Credit ReportDocument6 pagesLee County Bonita Springs Utilities 21-Feb-2014 Credit ReportroysgtiNo ratings yet

- Recommended Budget 2011Document375 pagesRecommended Budget 2011clilly8037No ratings yet

- CMS Report 1 PDFDocument25 pagesCMS Report 1 PDFRecordTrac - City of OaklandNo ratings yet

- Resident's Guide: Volume 1 FY2013Document15 pagesResident's Guide: Volume 1 FY2013ChicagoistNo ratings yet

- LMUDA 2012 Annual Report To The City of OaklandDocument7 pagesLMUDA 2012 Annual Report To The City of OaklandOaklandCBDsNo ratings yet

- Semi AnnualDocument24 pagesSemi AnnualM-NCPPCNo ratings yet

- IBA Review of The Fiscal Year 2013 Proposed BudgetDocument30 pagesIBA Review of The Fiscal Year 2013 Proposed Budgetapi-63385278No ratings yet

- Understanding The Budget Proposal 2019Document6 pagesUnderstanding The Budget Proposal 2019Rainwalker Tatterheart100% (1)

- June EDAB eDocument4 pagesJune EDAB elrbrennanNo ratings yet

- Subcommittees Chairs Report On Budget ExcerciseDocument21 pagesSubcommittees Chairs Report On Budget ExcercisePhil AmmannNo ratings yet

- Cook County Efficiency Report FY2017, Chicago Federation of LaborDocument18 pagesCook County Efficiency Report FY2017, Chicago Federation of LaborThe Daily LineNo ratings yet

- MNGOP 2011 Points BudgetDocument4 pagesMNGOP 2011 Points BudgetCory MerrifieldNo ratings yet

- FY14 Overview MemoDocument3 pagesFY14 Overview MemokeithmontpvtNo ratings yet

- PRR 8729 Service Group 2 Part 3 PDFDocument18 pagesPRR 8729 Service Group 2 Part 3 PDFRecordTrac - City of OaklandNo ratings yet

- Final Report of The Gray AdministrationDocument72 pagesFinal Report of The Gray AdministrationSusie CambriaNo ratings yet

- Web Pearland 2016 Annualreport CalendarDocument32 pagesWeb Pearland 2016 Annualreport Calendarapi-306549584No ratings yet

- Delegate Meeting ReportDocument2 pagesDelegate Meeting ReportLatisha WalkerNo ratings yet

- State Comptroller's Audit of The The Hendrick Hudson School District's Financial ConditionDocument11 pagesState Comptroller's Audit of The The Hendrick Hudson School District's Financial ConditionCara MatthewsNo ratings yet

- CLLR Thornber Budget OverviewDocument4 pagesCLLR Thornber Budget Overviewdan_kerinsNo ratings yet

- Scott Walker Finance Reform FINAL3.24.09 - Employee Pay and Benefits ReformDocument7 pagesScott Walker Finance Reform FINAL3.24.09 - Employee Pay and Benefits ReformSarah LittleRedfeather KalmansonNo ratings yet

- 2022 Florida Legislative Priorities For The City of Naples - Sept 9 2021Document7 pages2022 Florida Legislative Priorities For The City of Naples - Sept 9 2021Omar Rodriguez OrtizNo ratings yet

- Bond Recommendation PresentationDocument24 pagesBond Recommendation PresentationJim ParkerNo ratings yet

- Mobile Mayor Sam Jones Proposed Budget For 2012Document25 pagesMobile Mayor Sam Jones Proposed Budget For 2012jamieburch75No ratings yet

- State and Local Green Building IncentivesDocument11 pagesState and Local Green Building IncentiveslaurenjiaNo ratings yet

- City of Wooster: Message From The MayorDocument8 pagesCity of Wooster: Message From The MayorCityofWoosterNo ratings yet

- DOA 2012 Annual Report To The City OaklandDocument7 pagesDOA 2012 Annual Report To The City OaklandOaklandCBDsNo ratings yet

- 2009 Budget AmendmentDocument2 pages2009 Budget AmendmentCOASTNo ratings yet

- Home Energy Loan Program (HELP) Guide and FAQ, City of Penticton, XXXXDocument4 pagesHome Energy Loan Program (HELP) Guide and FAQ, City of Penticton, XXXXIvanJNo ratings yet

- 2012 Proposed Budget by The NumbersDocument8 pages2012 Proposed Budget by The NumbersChs BlogNo ratings yet

- FY 2018 - 2022 CIP Work Session 2 1 17Document17 pagesFY 2018 - 2022 CIP Work Session 2 1 17Fauquier NowNo ratings yet

- Appendix E Funding SourcesDocument12 pagesAppendix E Funding SourcesFred WilderNo ratings yet

- 2012 Preliminary Budget & Levy PresentationDocument14 pages2012 Preliminary Budget & Levy PresentationCity of HopkinsNo ratings yet

- LePage Administration: Medicaid+Consumes+General+FundDocument7 pagesLePage Administration: Medicaid+Consumes+General+FundAndi ParkinsonNo ratings yet

- FY23 REC BudgetinBrief FinalDocument34 pagesFY23 REC BudgetinBrief FinalSteve BohnelNo ratings yet

- FY 13 Budget Meeting 3-6-12 FINALDocument30 pagesFY 13 Budget Meeting 3-6-12 FINALGerrie SchipskeNo ratings yet

- 2013 State of The City ReportDocument6 pages2013 State of The City ReportScott FranzNo ratings yet

- Report Highlights Nearly 1.3 Million Homeowner Assistance Actions Taken Through Making Home AffordableDocument18 pagesReport Highlights Nearly 1.3 Million Homeowner Assistance Actions Taken Through Making Home AffordableForeclosure FraudNo ratings yet

- Getting Work with the Federal Government: A Guide to Figuring out the Procurement PuzzleFrom EverandGetting Work with the Federal Government: A Guide to Figuring out the Procurement PuzzleNo ratings yet

- Councilwoman FitzwaterDocument3 pagesCouncilwoman FitzwaterValerie DaleNo ratings yet

- Frederick County Ethics Task Force Final ReportDocument29 pagesFrederick County Ethics Task Force Final ReportValerie DaleNo ratings yet

- Frederick High School Incident - County Executive Gardner StatementDocument2 pagesFrederick High School Incident - County Executive Gardner StatementValerie DaleNo ratings yet

- Creating A Vision For Education!Document2 pagesCreating A Vision For Education!Valerie DaleNo ratings yet

- Vote For YOUR New County Slogan!Document1 pageVote For YOUR New County Slogan!Valerie DaleNo ratings yet

- State Police Report Malicious DestructionDocument6 pagesState Police Report Malicious DestructionValerie DaleNo ratings yet

- RAMP IT UP! Social Media WorkshopDocument1 pageRAMP IT UP! Social Media WorkshopValerie DaleNo ratings yet

- Dr. Gerald GordonDocument1 pageDr. Gerald GordonValerie DaleNo ratings yet

- Bickel Campaign Fact Checks Sheriff's Campaign DebateDocument2 pagesBickel Campaign Fact Checks Sheriff's Campaign DebateValerie DaleNo ratings yet

- Code of CivilityDocument4 pagesCode of CivilityValerie DaleNo ratings yet

- Join Together Rally!Document1 pageJoin Together Rally!Valerie DaleNo ratings yet

- Score Sheet For Voters To Track The Civility of Political Candidates-3Document1 pageScore Sheet For Voters To Track The Civility of Political Candidates-3Valerie DaleNo ratings yet

- Let's Get Cookin' With Breiling!Document1 pageLet's Get Cookin' With Breiling!Valerie DaleNo ratings yet

- BPW Letter To BOCCDocument2 pagesBPW Letter To BOCCValerie DaleNo ratings yet

- LWV Forum On Citizens/Montevue!Document1 pageLWV Forum On Citizens/Montevue!Valerie DaleNo ratings yet

- Young MailingDocument4 pagesYoung MailingValerie DaleNo ratings yet

- 2013 Fairfax County Economic Development InfoDocument4 pages2013 Fairfax County Economic Development InfoValerie DaleNo ratings yet

- Save Frederick!Document1 pageSave Frederick!Valerie DaleNo ratings yet

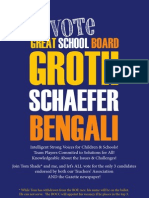

- Great School BoardDocument1 pageGreat School BoardValerie DaleNo ratings yet

- Dale BioDocument1 pageDale BioValerie DaleNo ratings yet

- Invest in Frederick, Invest in Education!Document1 pageInvest in Frederick, Invest in Education!Valerie DaleNo ratings yet

- Montevue & Citizens... FOR SALE??Document1 pageMontevue & Citizens... FOR SALE??Valerie DaleNo ratings yet

- Golf T OrnamentDocument1 pageGolf T OrnamentValerie DaleNo ratings yet

- Apply To GEPFP PDF PDF: Download Brochure: Download Program DescriptionDocument1 pageApply To GEPFP PDF PDF: Download Brochure: Download Program DescriptionValerie DaleNo ratings yet

- BOE ForumDocument1 pageBOE ForumValerie DaleNo ratings yet

- One More VoteDocument1 pageOne More VoteValerie DaleNo ratings yet

- Giving Expo Non-Profits!Document1 pageGiving Expo Non-Profits!Valerie DaleNo ratings yet

- Did You Know?!2Document1 pageDid You Know?!2Valerie DaleNo ratings yet

- History of The Company ActDocument13 pagesHistory of The Company ActJyoti SharmaNo ratings yet

- Malegam Committee Report 20-01-11Document2 pagesMalegam Committee Report 20-01-11Mayank AgrawalNo ratings yet

- CA Final Financial Reporting Self Study Notes by Ashwani JMLK3HFFDocument46 pagesCA Final Financial Reporting Self Study Notes by Ashwani JMLK3HFFJashwanthNo ratings yet

- IAS - 23 - Borrowing - Costs For EditedDocument23 pagesIAS - 23 - Borrowing - Costs For Editednati100% (1)

- Solutions To End-Of-Chapter ProblemsDocument22 pagesSolutions To End-Of-Chapter ProblemsKalyani GogoiNo ratings yet

- Opinin Denying Motion To DismissDocument29 pagesOpinin Denying Motion To DismissForeclosure FraudNo ratings yet

- FM (Astro Annual Report)Document28 pagesFM (Astro Annual Report)Muhammad Badi Nurhakim33% (3)

- Motion of Appeal by Aurelius CapitalDocument329 pagesMotion of Appeal by Aurelius CapitalDealBook100% (1)

- Hero CycleDocument11 pagesHero CycleRaj KumarNo ratings yet

- Alchian and Klein - 1973 - On A Correct Measure of InflationDocument20 pagesAlchian and Klein - 1973 - On A Correct Measure of Inflationjpkoning100% (1)

- WMI - Plan (With Signed Order)Document807 pagesWMI - Plan (With Signed Order)kevinipNo ratings yet

- Unit I - Working Capital PolicyDocument16 pagesUnit I - Working Capital Policyjaskahlon92No ratings yet

- Myles Bassell 505SGS1Document2 pagesMyles Bassell 505SGS1Prakhar CmNo ratings yet

- Smart FinancialsDocument49 pagesSmart FinancialsDebasmita NandyNo ratings yet

- A Study On Investment Planning and Fund RaisingDocument16 pagesA Study On Investment Planning and Fund RaisingAnonymous XP1PwdXNo ratings yet

- Investment LawDocument11 pagesInvestment LawHarmanSinghNo ratings yet

- UntitledDocument18 pagesUntitledapi-123420162No ratings yet

- Pinto 03Document19 pagesPinto 03jahanzebNo ratings yet

- Corporate Finance (Ross) ChaptersDocument1 pageCorporate Finance (Ross) ChaptersJayedNo ratings yet

- FIN 420 EXPERT Expect Success Fin420expertdotcomDocument20 pagesFIN 420 EXPERT Expect Success Fin420expertdotcomisabella45No ratings yet

- Handout in Financial Assets 2Document2 pagesHandout in Financial Assets 2Micaella GrandeNo ratings yet