Professional Documents

Culture Documents

Presentment

Uploaded by

Marj PagaduanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Presentment

Uploaded by

Marj PagaduanCopyright:

Available Formats

Sec. 70. Effect of want of demand on principal debtor.

- Presentment for payment is not necessary in order to charge the person primarily liable on the instrument; but if the instrument is, by its terms, payable at a special place, and he is able and willing to pay it there at maturity, such ability and willingness are equivalent to a tender of payment upon his part. But except as herein otherwise provided, presentment for payment is necessary in order to charge the drawer and indorsers. Sec. 71. Presentment where instrument is not payable on demand and where payable on demand. - Where the instrument is not payable on demand, presentment must be made on the day it falls due. Where it is payable on demand, presentment must be made within a reasonable time after its issue, except that in the case of a bill of exchange, presentment for payment will be sufficient if made within a reasonable time after the last negotiation thereof. Sec. 72. What constitutes a sufficient presentment. - Presentment for payment, to be sufficient, must be made: (a) By the holder, or by some person authorized to receive payment on his behalf; (b) At a reasonable hour on a business day; (c) At a proper place as herein defined; (d) To the person primarily liable on the instrument, or if he is absent or inaccessible, to any person found at the place where the presentment is made. Sec. 73. Place of presentment. - Presentment for payment is made at the proper place: (a) Where a place of payment is specified in the instrument and it is there presented; (b) Where no place of payment is specified but the address of the person to make payment is given in the instrument and it is there presented; (c) Where no place of payment is specified and no address is given and the instrument is presented at the usual place of business or residence of the person to make payment; (d) In any other case if presented to the person to make payment wherever he can be found, or if presented at his last known place of business or residence. (ORDER OF PREFERENCE)

Presentment for payment means the instrument is presented to the maker or drawee asking for payment written on the instrument. There is no need for it to charge person that is primarily liable and if there is place indicated where the instrument will be payable at its maturity as it show ability and willingness equivalent to tender of payment. There is a need of it to charge person that is secondarily liable

The instrument is payable at Coffee house in Bagong Street in Makati City, there is no need for presentment for payment.

If the instrument is payable at a fixed or determinable future time, the presentment must be made at the date of maturity. If the instrument is payable on demand, the presentment of note must be made within the reasonable time after its issue and the presentment of bill must be made within the reasonable time from the last negotiation.

Ms. Cruz received a note in exchange of her goods delivered to Sweettalk Company. Because the company is experiencing because of recession of the economy of the country, they talked to Ms. Cruz for the extension. This will be in favor of the company as the time of presentment of Ms. Cruz is already out of reasonable time.

The section shows the requisite for sufficient presentment for payment. Presentment for payment must be made by the holder of the instrument or by some person authorized to receive payment on his behalf at a reasonable hour on a business day at a proper place as indicated in the instrument.

Ms. Cruz received a note in exchange of her goods delivered to Sweettalk Company. She then indorse the instrument to Marie. Marie go to Sweettalk Company exactly 10am, Monday.

The presentment of payment should be made at proper place specified in sec. 73

Manila, Philippines September 17, 2012 I promise to pay Ms. Cruz or order the sum of One hundred thousand pesos only (P100,00.00) at #545 2nd flr. New Condominium, Shaw Boulevard, Mandaluyong City. (Sgd) Sweettalk Company #545 2nd flr. New Condominium, Shaw Boulevard, Mandaluyong City is the proper place of the presentment for payment as indicated in the instrument.

Sec. 74. Instrument must be exhibited. - The instrument must be exhibited to the person from whom payment is demanded, and when it is paid, must be delivered up to the party paying it.

The presentment for payment not only require the demand of the holder for payment of the instrument but also the instrument itself so that the acceptor will know the genuineness of the instrument and the right of the holder to receive the payment. But the exhibition is excused if the debtor doesnt demand to see the instrument or

Sweettalk Company issue a promissory note to Ms. Cruz. She then indorses the instrument to Sight Mdse. Sight Mdse should then go to Sweettalk Company and present the instrument to them for payment.

the instrument was lost or destroyed. Sec. 75. Presentment where instrument payable at bank. Where the instrument is payable at a bank, presentment for payment must be made during banking hours, unless the person to make payment has no funds there to meet it at any time during the day, in which case presentment at any hour before the bank is closed on that day is sufficient. The presentment of payment must be made during banking hours. Manila, Philippines September 17, 2012 I promise to pay Ms. Cruz or order the sum of One hundred thousand pesos only (P100,00.00) at Robinsons Bank Pioneer Branch.. (Sgd) Sweettalk Company The instrument is order to the bank to pay Ms. Cruz to be debited to the account of Sweettalk Company. Sec. 76. Presentment where principal debtor is dead. - Where the person primarily liable on the instrument is dead and no place of payment is specified, presentment for payment must be made to his personal representative, if such there be, and if, with the exercise of reasonable diligence, he can be found. Sec. 77. Presentment to persons liable as partners. - Where the persons primarily liable on the instrument are liable as partners and no place of payment is specified, presentment for payment m ay be made to any one of them, even though there has been a dissolution of the firm. Sec. 78. Presentment to joint debtors. Where there are several persons, not partners, primarily liable on the instrument and no place of payment is specified, presentment must be made to them all. Sec. 79. When presentment not required to charge the drawer. - Presentment for payment is not required in order to charge the drawer where he has no right to expect or require that the drawee or acceptor will pay the instrument. The section applies where there is no place specified. the holder of the instrument should find the representative of the dead person primarily liable on the instrument. Ms. Cruz issue a note to Sweettalk Company for the equipment they deliver for the use of her friends laboratory renovation. When Sweettalk Company wants to present the note to her, they found out that she died a week ago. The company may look for her co-debtor friend to present the instrument.

If the instrument is made by partners, the holder may present the instrument to any one of them.

Before the Sight Mdse. run by a partners/owners close, they issue a note payable to Sweettalk Company signed by the two of them. The company may then present the instrument for payment to any of the two partner/owner even the business is already close.

If the instrument is made by joint debtors, the holder must present the instrument to all of them

Ms. Cruz and Mr. Santos issue a promissory note to Sweettalk Company signed jointly. Presentment for payment must be made to both debtor.

There is no need for presentment for payment to the drawer under the following circumstances: 1. the instrument has been stopped, 2. the drawee has insufficient balance, 3. the drawer has no account to the drawee.

Ms. Cruz bought jewelry to Ana. She then issue a bill payable to Ana by her drawee, Mr. Cruz. As Ana go to Mr. Cruz and found out that he is insolvent, she may go to Ms. Cruz to demand for payment even without presenting the instrument to her.

Sec. 80. When presentment not required to charge the indorser. - Presentment is not required in order to charge an indorser where the instrument was made or accepted for his accommodation and he has no reason to expect that the instrument will be paid if presented. Sec. 81. When delay in making presentment is excused. - Delay in making presentment for payment is excused when the delay is caused by circumstances beyond the control of the holder and not imputable to his default, misconduct, or negligence. When the cause of delay ceases to operate, presentment must be made with reasonable diligence. Sec. 82. When presentment for payment is

There is no need for presentment for payment to make the indorser liable if the instrument were made or accepted for his accommodation and he has no reason to expect that the instrument will be paid if presented.

Jane go to Mr. Santos to accommodate her to the goods she receive from Sweettalk Company. If the company presented the instrument to Mr. Santos, there is no need for him to Present the instrument for payment to make Jane liable as he is just accommodating her and she has no right to expect that he will pay for her. Ms. Cruz receive a note payable on December 12, 2012. At that date, their house was damaged by the flood and some other infrastructure such as bridge was destroyed. She then have a reason for her not to be able to present the instrument for payment to the maker.

The presentment is excused because of beyond the control of the holder situation like overwhelming calamity, malignant diseases, interruption of trade negotiations by political circumstances, etc.

The presentment for payment is excused not

Ms. Cruz receive a bill payable on December 12,

excused. - Presentment for payment is excused: (a) Where, after the exercise of reasonable diligence, presentment, as required by this Act, cannot be made; (b) Where the drawee is a fictitious person; (c) By waiver of presentment, express or implied. Sec. 83. When instrument dishonored by nonpayment. - The instrument is dishonored by non-payment when: (a) It is duly presented for payment and payment is refused or cannot be obtained; or (b) Presentment is excused and the instrument is overdue and unpaid. Sec. 143. When presentment for acceptance must be made. - Presentment for acceptance must be made: (a) Where the bill is payable after sight, or in any other case, where presentment for acceptance is necessary in order to fix the maturity of the instrument; or (b) Where the bill expressly stipulates that it shall be presented for acceptance; or (c) Where the bill is drawn payable elsewhere than at the residence or place of business of the drawee. In no other case is presentment for acceptance necessary in order to render any party to the bill liable. Sec. 144. When failure to present releases drawer and indorser. - Except as herein otherwise provided, the holder of a bill which is required by the next preceding section to be presented for acceptance must either present it for acceptance or negotiate it within a reasonable time. If he fails to do so, the drawer and all indorsers are discharged. Sec. 145. Presentment; how made. Presentment for acceptance must be made by or on behalf of the holder at a reasonable hour, on a business day and before the bill is overdue, to the drawee or some person authorized to accept or refuse acceptance on his behalf; and (a) Where a bill is addressed to two or more drawees who are not partners, presentment must be made to them all unless one has authority to accept or refuse acceptance for all, in which case presentment may be made to him only; (b) Where the drawee is dead, presentment may be made to his personal representative; (c) Where the drawee has been adjudged a bankrupt or an insolvent or has made an assignment for the benefit of creditors,

because of delay but because of failure to make the presentment.

2012. When she go to the place of the drawee, she found out that theres no such person working there.

The instrument must be duly presented for payment and payment is either refused or cannot be obtained or Presentment for payment is excused and Instrument is overdue and It is unpaid

Ms. Cruz receive a bill payable on December 12, 2012. When she go to the place of the drawee, she found out that theres no such person working there. The instrument is then dishonored by non-payment as the presentment is excused and the instrument is overdue and unpaid.

The presentment for acceptance is necessary on the situation indicated in sec. 143

Ms. Cruz issues a bill to Ana for payment to the jewelry she received stating that it should be presented for acceptance. Ana then indorsed the instrument to A. A to B. B to C. C to H. H then should present the instrument for acceptance to the drawee of the instrument.

Upon the failure present the instrument for acceptance or negotiate it within a reasonable time, is discharges the drawer and indorser to their liability.

Ms. Cruz issues a bill to Ana indicating that it should be presented for acceptance. Ana forgot the instrument and become overdue. It now discharges Ms. Cruz to her liability to Ana.

The presentment should be made on the circumstances stated in Sec. 145

Ms. Cruz issues a bill to Ana indicating that it should be presented for acceptance to Andrew Palmero and Joan Masujer. In this case, Ana should present the instrument for acceptance to both Andrew Palmero and Joan Masujer.

presentment may be made to him or to his trustee or assignee. Sec. 146. On what days presentment may be made. - A bill may be presented for acceptance on any day on which negotiable instruments may be presented for payment under the provisions of Sections seventy-two and eighty-five of this Act. When Saturday is not otherwise a holiday, presentment for acceptance may be made before twelve o'clock noon on that day. Sec. 147. Presentment where time is insufficient. - Where the holder of a bill drawn payable elsewhere than at the place of business or the residence of the drawee has no time, with the exercise of reasonable diligence, to present the bill for acceptance before presenting it for payment on the day that it falls due, the delay caused by presenting the bill for acceptance before presenting it for payment is excused and does not discharge the drawers and indorsers. Sec. 148. Where presentment is excused. Presentment for acceptance is excused and a bill may be treated as dishonored by non-acceptance in either of the following cases: (a) Where the drawee is dead, or has absconded, or is a fictitious person or a person not having capacity to contract by bill. (b) Where, after the exercise of reasonable diligence, presentment can not be made. (c) Where, although presentment has been irregular, acceptance has been refused on some other ground. The presentment for acceptance may be made anyday except non-business hour or holiday. Ms. Cruz received a bill from Mr. Cruz, a manager payable by Sweettalk company indicating that it should be presented for acceptance. Ms. Cruz should go to the company within its business hour.

If the holder wont be able to present the instrument for acceptance to the drawee because of insufficiency in time to make the presentment doesnt discharge the drawer or indorser to their liability to the instrument.

Ms. Cruz issues a check to Ana using her foreign account maturing two days after to be presented for acceptance in Las Vegas, Nevada. Because the time is insufficient for Ana to do the presentment, it wont discharges Ms. Cruz for the non-presentment of the instrument.

The presentment is excused to circumstances indicated in Sec. 148.

Ms. Cruz issues a bill to Ana payable by Andrew Palmero. When

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Sobejana-Condon vs. ComelecDocument4 pagesSobejana-Condon vs. Comeleccmptmarissa0% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Finder Fee AgreementDocument3 pagesFinder Fee AgreementAKNo ratings yet

- Crime Facilitating Speech Eugene Volokh Vol 57 STANFORD LAW REVIEW 1095 To 1222Document128 pagesCrime Facilitating Speech Eugene Volokh Vol 57 STANFORD LAW REVIEW 1095 To 1222lunainisideNo ratings yet

- in Re Al C. Argosino, BM 712, 1995Document7 pagesin Re Al C. Argosino, BM 712, 1995Christia Sandee SuanNo ratings yet

- Nature of the Legal ProfessionDocument3 pagesNature of the Legal Professionisha yoga60% (5)

- MABANAG V Lopez VitoDocument4 pagesMABANAG V Lopez VitoJanila BajuyoNo ratings yet

- Corporate Veil ExplainedDocument9 pagesCorporate Veil ExplainedRaman SrivastavaNo ratings yet

- Sop Title: SOP Version No: 01 Date:: Reviewing and Obtaining Informed ConsentDocument12 pagesSop Title: SOP Version No: 01 Date:: Reviewing and Obtaining Informed ConsentMadhan MohanNo ratings yet

- People Vs ArizalaDocument3 pagesPeople Vs ArizalaNeil MayorNo ratings yet

- San Miguel Corporation Vs LayocDocument2 pagesSan Miguel Corporation Vs LayocMichelle Vale CruzNo ratings yet

- 6 Reyes vs. Sempio-DiyDocument8 pages6 Reyes vs. Sempio-DiyRaiya AngelaNo ratings yet

- People vs. Quasha, GR L-6055, June 12, 1953 DIGESTDocument1 pagePeople vs. Quasha, GR L-6055, June 12, 1953 DIGESTJacquelyn AlegriaNo ratings yet

- People V DurangoDocument6 pagesPeople V DurangoMadz BuNo ratings yet

- People V GoceDocument1 pagePeople V GoceIan AuroNo ratings yet

- John Marie Stephen P. Pinto Bs-Criminology 4B: Juvenile Delinquency and Crime PreventionDocument5 pagesJohn Marie Stephen P. Pinto Bs-Criminology 4B: Juvenile Delinquency and Crime PreventionPerdanio Nosal April JoyNo ratings yet

- Mathay Vs CADocument19 pagesMathay Vs CABory SanotsNo ratings yet

- Module 3 The ActDocument38 pagesModule 3 The ActFloieh QuindaraNo ratings yet

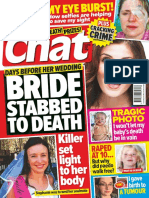

- ChatDocument68 pagesChatalexe012No ratings yet

- Civil 101Document12 pagesCivil 101QuinxNo ratings yet

- RTC Branch 5 Dismisses Estafa Case Due to Prosecution's Failure to ProsecuteDocument14 pagesRTC Branch 5 Dismisses Estafa Case Due to Prosecution's Failure to ProsecuteMp CasNo ratings yet

- Dayao v. ComelecDocument15 pagesDayao v. ComelecRichelle CartinNo ratings yet

- Hermes v. Thursday Friday DocketDocument4 pagesHermes v. Thursday Friday DocketCharles E. ColmanNo ratings yet

- Loan Agreement: Transaction Details ScheduleDocument13 pagesLoan Agreement: Transaction Details ScheduleNaren Singh TanwarNo ratings yet

- Indian Citizenship Act 1955Document17 pagesIndian Citizenship Act 1955Anupam KumarNo ratings yet

- Divorces Caused by Personality, MoneyDocument2 pagesDivorces Caused by Personality, Moneyapi-25889050No ratings yet

- Poliand Industrial Limited vs. National DevelopmentDocument53 pagesPoliand Industrial Limited vs. National DevelopmentYeu GihNo ratings yet

- Judicial Affidavit of JODocument4 pagesJudicial Affidavit of JOEd Armand VentoleroNo ratings yet

- Shri Ram Janam Bhoomi Ayodhya Verdict Part 9 of 14Document500 pagesShri Ram Janam Bhoomi Ayodhya Verdict Part 9 of 14satyabhashnamNo ratings yet

- Prudential Guarantee and Assurance Inc., vs. Trans-Asia Shipping Lines, IncDocument4 pagesPrudential Guarantee and Assurance Inc., vs. Trans-Asia Shipping Lines, Incjon_cpaNo ratings yet

- Judicial Reforms of Warren Hasting'sDocument13 pagesJudicial Reforms of Warren Hasting'sPratham Saxena75% (4)