Professional Documents

Culture Documents

Philippines: No. Procedure Time To Complete Associated Costs

Uploaded by

profmlocampoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Philippines: No. Procedure Time To Complete Associated Costs

Uploaded by

profmlocampoCopyright:

Available Formats

Starting a Business in

Philippines

Listed below is a detailed summary of the bureaucratic and legal hurdles an entrepreneur must overcome in order to incorporate and register a new firm, along with their associated time and set-up costs. It examines the procedures, time and cost involved in launching a commercial or industrial firm with up to 50 employees and start-up capital of 10 times the economy's per-capita gross national income (GNI). The information appearing on this page was collected as part of the Doing Business project, which measures and compares regulations relevant to the life cycle of a small- to medium-sized domestic business in 183 economies. The most recent round of data collection for the project was completed in June 2011.

No.

Procedure Verify and reserve the company name with the Securities and Exchange Commission (SEC) The availability of the proposed company name can be verified via the SEC's online verification system at no charge. Reservation of the name, once approved by the SEC, costs Php40/month for the first 30 days. The company name can be reserved for a maximum of 120 days for a fee of PHP 120, which is renewable upon expiration of the period. Deposit paid-up capital in the Authorized Agent Bank (AAB) and obtain bank certificate of deposit The company is required by law to deposit paid-up capital amounting to at least 6.25% of the authorized capital stock of the corporation. This paid-up capital must not be less than PHP 5,000. Some banks in Manila charge a fee up to PHP 105 for each certificate of deposit. Notarize articles of incorporation and treasurer's affidavit at the notary

Time to Complete

Associated Costs

1 day

PHP 40

1 day

no charge

According to Section 14 and 15 of the Corporation

1 day

PHP 500

No.

Procedure Code, articles of incorporation should be notarized before filing with the SEC. Register the company with the SEC and receive preregistered Taxpayer Identification Number (TIN) The company can register online through SEC iRegister but must pay on site at the SEC. The following documents are required for SEC registration: a. Company name verification slip; b. Articles of incorporation (notarized) and by-laws; c. Treasurer's affidavit (notarized); d. Statement of assets and liabilities; e. Bank certificate of deposit of the paid-in capital; f. Authority to verify the bank account; g. Registration data sheet with particulars on directors, officers, stockholders, and so forth; h. Written undertaking to comply with SEC reporting requirements (notarized); i. Written undertaking to change corporate name (notarized). The SEC Head Office issues pre-registered TINs only if the companys application for registration has been approved. The company must still register with the Bureau of Internal Revenue (BIR) in order to identify applicable tax types, pay an annual registration fee, obtain and stamp sales invoices, receipts and the books of accounts. Obtain barangay clearance This clearance is obtained from the Barangay where the business is located, and is required to obtain the business permit from the city or municipality. Barangay

Time to Complete

Associated Costs

3 days

(PHP 1,667.99 filing fee equivalent to 1/5 of 1% of the authorized capital stock or the subscription price of the subscribed capital stock, whichever is higher but not less than PHP 1,000 + PHP 16.68 legal research fee (LRF) equivalent to 1% of filing fee but not less than PHP 10 + PHP 500 By-laws + PHP 150 for registration of stock and transfer book (STB) required for new corporations + PHP 320 STB + PHP 10 registration for SEC bulletin)

1 day

PHP 500

No.

Procedure fees vary for each Barangay since they have the discretion to impose their own fees and charges for as long as these fees are reasonable and within the limits set by the Local Government Code and city ordinances. The fee charged by the Barangay depends on the company's paid-up capital and the land area it occupies - a PHP 500 minimum plus PHP 300 for the Barangay clearance plate. Pay the annual community tax and obtain the community tax certificate (CTC) from the City Treasurer's Office (CTO) To obtain a Barangay clearance, a company must obtain a community tax certificate. The company is assessed a basic and an additional community tax. The basic community tax rate depends on whether the company legal form is a corporation, partnership, or association (PHP 500 or lower). The additional community tax (not to exceed Php 10,000.00) depends on the assessed value of real property the company owns in the Philippines at the rate of Php 2.00 for every Php 5,000.00 and on its gross receipts, including dividends or earnings, derived from business activities in the Philippines during the preceding year, at the rate of Php 2.00 for every Php 5,000.00. Obtain the business permit to operate from the BPLO The fees vary depending on the LGU issuing the permit. The rate of license fee imposed in Quezon City is 25% of 1% of the authorized capital stock. Other permits, such as locational clearance, fire safety and

Time to Complete

Associated Costs

1 day

PHP 500 (PHP 2,084.98 business tax (25% of 1% of paid-up capital) + PHP 200 mayors permit + PHP 150 sanitary inspection fee + PHP 50 signboard fee + PHP 250 business plate + PHP 100 QCBRB + PHP 545 zoning clearance + PHP 1,300 garbage fee+ PHP 259.5 FSIC (10% of all regulatory fees))

6 days

No.

Procedure inspection certificate, sanitary permit, certificate of electrical inspection, mechanical permit, and other clearances or certificates required depending on the nature of business, are also imposable. The rate of these fees depends on the nature of business and land area occupied by the proposed corporation. The barangay clearance is a prerequisite for the issuance of business permit to operate.

Time to Complete

Associated Costs

Buy special books of account at bookstore Special books of accounts are required for registering with the BIR. The books of accounts are sold at bookstores nationwide. One set of journals consisting of four books (cash receipts account, disbursements account, ledger, general journal) costs about PHP 400. If the company has a computerized accounting system (CAS), it may opt to register its CAS under the procedures laid out in BIR Revenue Memorandum Order Nos. 21-2000 and 29-2002. The BIR Computerized System Evaluation Team is required to inspect and evaluate the companys CAS within 30 days from receipt of the application form (BIR Form No. 1900) and complete documentary requirements. 8 Apply for Certificate of Registration (COR) and TIN at the Bureau of Internal Revenue (BIR) After the taxpayer obtains the TIN, the company must pay the annual registration fee of PHP 500 at any duly accredited bank, using payment form BIR Form 0605). 1 day PHP 400

2 days

PHP 100 (certification fee) and PHP 15 (documentary stamp tax, in loose form to be attached to Form 2303)

No.

Procedure To register the BIR taxpayer must first accomplish BIR Form 1903 and submit the same together with the required attachments to the Revenue District Office having jurisdiction over the registered address of the business establishment. Moreover, the BIR now requires the submission of the Authority to Print Receipts (BIR Form 1906) as an additional requirement for registration. Companies may be assessed various taxes: VAT, a community tax, a local tax, and income tax. When a company registers as a taxpayer, it must indicate in the application the types of taxes it expects to be liable for, including VAT.

Time to Complete

Associated Costs

Pay the registration fee and documentary stamp taxes (DST) at the AAB The rate of documentary stamp tax on original issuance of shares of stock shall be Php 1.00 for every Php 200.00 or fractional part thereof, of the par value, of such shares of stock. The documentary stamp tax return shall be filed and the tax paid on or before the fifth (5th) day after the close of the month of approval of SEC registration. 10 Obtain the authority to print receipts and invoices from the BIR The authority to print receipts and invoices must be secured before the sales receipts and invoices may be printed. The company can ask any authorized printing company to print its official forms, or it can print its own forms (i.e., it uses its computers to print loose-leaf 1 day

(PHP 500 registration fee + PHP 4,169.97 DST on original issuance of shares of stock. DST on the lease contract is not included in the computation of the cost)

11

1 day

no charge

No.

Procedure invoice forms) after obtaining a permit from BIR for this purpose. To obtain the authority to print receipts and invoices from the BIR, the company must submit the following documents to the Revenue District Office (RDO): a. Duly completed application for authority to print receipts and invoices (BIR Form No. 1906); b. Job order; c. Final and clear sample of receipts and invoices (machine-printed); d. Application for registration (BIR Form No. 1903); and e. Proof of payment of annual registration fee (BIR Form No. 0605). Print receipts and invoices at the print shops The cost is based on the following specifications of the official receipt: 1/2 bond paper (8 x 5 cm) in duplicate, black print, carbonless. The minimum print volume is 25 booklets. Have books of accounts and Printers Certificate of Delivery (PCD) stamped by the BIR After the printing of receipts and invoices, the printer issues a Printers Certificate of Delivery of Receipts and Invoices (PCD) to the company, which must submit this to the appropriate BIR RDO (i.e., the RDO which has jurisdiction over the companys principal place of business) for registration and stamping within thirty (30) days from issuance. The company must also submit the following documents:

Time to Complete

Associated Costs

12

7 days

PHP 3,500

13

1 day

no charge

No.

Procedure a. All required books of accounts; b. VAT registration certificate; c. SEC registration; d. BIR Form W-5; e. Certified photocopy of the ATP; and f. Notarized taxpayer-users sworn statement enumerating the responsibilities and commitments of the taxpayer-user. The company must also submit a copy of the PCD to the BIR RDO having jurisdiction over the printers principal place of business. Register with the Social Security System (SSS) To register with the SSS, the company must submit the following documents: a. Employer registration form (Form R-1); b. Employment report (Form R-1A); c. List of employees, specifying their birth dates, positions, monthly salary and date of employment; and d. Articles of incorporation, by-laws and SEC registration. Upon submission of the required documents, the SSS employer and employee numbers will be released. The employees may attend an SSS training seminar after registration. SSS prefers that all members go through such training so that each member is aware of their rights and obligations.

Time to Complete

Associated Costs

14 15 Register with the Philippine Health Insurance Company (PhilHealth)

7 days 1 day

no charge no charge

No.

Procedure To register with PhilHealth, the company must submit the following documents: a. Employer data record (Form ER1); b. Report of employee-members (Form ER2); c. SEC registration; d. BIR registration; and e. Copy of business permit. Upon submission of the required documents, the company shall get the receiving copy of all the forms as proof of membership until PhilHealth releases the employer and employee numbers within three months.

Time to Complete

Associated Costs

How to Register and Start a Business in the Philippines

How to Register and Start a Business in the Philippines

Inbound foreign investment is actively encouraged in the Philippines, and incentives are available for business activities that increase the country's export capacity. The general theme of the Philippines' incentives program is to encourage foreign capital and technology that supplements local resources. As such, 100% foreign ownership is allowed in most businesses save for those specifically restricted in the Foreign Investment Negative List or FINL. The FINL lists activities where a required percentage of Philippine equity is prescribed by law or the Constitution, and where foreign participation is absolutely restricted. K&C will show you how to register or start a business or company in the Philippines quickly and efficiently.

Registering a Corporation in the Philippines

The most common form of corporate vehicle used by foreign investors is the corporation. The main advantage of the corporate form is its limited legal liability. In addition, doing business through a corporation or subsidiary allows room for Philippine equity participation in certain business activities, which would otherwise be restricted. The liability of the shareholders of a corporation to third parties is limited to the amount of their share capital except in cases of fraud. A shareholder is liable for damages arising from a breach of fiduciary duties, fraud, gross negligence and other unauthorized acts. All foreign entities other than individuals doing business in the Philippines are required to register with the Securities and Exchange Commission whether as domestic corporations/domestic subsidiaries, branches, or partnerships. Formation of corporations is governed by the Corporation Code. The Code provides for the right of succession, powers, attributes and properties of a corporation, all of which have important consequences.

Incorporators and Board of Directors in the Philippines

To establish a corporation, between 5 to 15 individuals must act as incorporators. They must each own or subscribe to at least one share, and a majority of them must be residents of the Philippines. At least 25% of the authorized capital stock must be subscribed at the time of incorporation, and at least 25% of that subscribed stock must be paid up. Where the capital stock consists of no-par value shares, the subscriptions must be paid in full. The minimum paid up capital is P5,000. The provisions of the Foreign Investments Act of 1991 are relevant where there are foreign shareholders, as it places constraints on foreign ownership in enterprises engaged in certain activities either through requirements on capital investment or Philippine equity participation. Corporations with more than 40% foreign equity are required to remit at least US$200,000 into the Philippines as initial paid-up capital unless they are classified as export enterprises. Export enterprises are those that export at least 60% of their gross sales whether in services or goods which are paid for in foreign currency. Majority of the board of directors must be resident in the Philippines, although not necessarily Filipino citizens. Every director must own at least one share of capital stock, which must stand in his name in the books of the corporation. Once incorporated the company must formally organize by election of a president, who shall be a director, a treasurer who may or may not be a director, a corporate secretary who should be a resident and citizen of the Philippines, and such other officers that are provided in the by-laws of the Corporation. It is possible for the director to hold such share as a nominee of another person, as the only requirement is legal title. Ordinarily, this arrangement is covered under a Deed of Trust and Assignment as well as an Indemnity Agreement. Once incorporation formalities are completed, the incorporators may sell their shares.

Shares

Share capital may be contributed in cash or property. In case of the latter, the property must be valuated by an independent certified public accountant registered with the SEC. Shares of stock may have par value or no-par value. In both cases, the shares should be paid in cash or in kind at a fair valuation equal to the par or issued value of the stocks. The shares of stock of "stock corporations" may be divided into classes or series of shares, or both, any of which classes or series of shares may have such rights, privileges or restrictions as may be stated in the articles of incorporation. Generally, no share may be deprived of voting rights except those classified and issued as "preferred" or "redeemable" shares. There must always be a class or series of shares that has complete voting rights. Any or all of the shares or series of shares may have a par value or have no par value as may be provided for in the articles of incorporation. Founders' shares may be classified as such in the articles of incorporation and can be issued granting certain rights and privileges; however, an exclusive right to vote and be voted for in the election of directors is limited to 5 years. Amounts received in excess of the par value of shares are treated as additional paid-in capital. There are no restrictions on how a corporation may apply its additional paid-in capital, except that it generally may not be distributed as dividends. Transfers of shares must be recorded in the books of the corporation and the relevant taxes must be paid. Shares of stock against which the corporation holds an unpaid claim are not transferable in the corporate books. Directors of a corporation have a fiduciary duty to the company and its shareholders. To third parties, the directors act as agents. Directors are liable for losses and damages resulting from gross negligence, assenting to patently unlawful acts, bad faith in directing the affairs of the corporation and acquiring personal or pecuniary interest in conflict with their duties as directors.

Regular meetings of shareholders are held annually on a date fixed in the bylaws. Special meetings of shareholders can be held whenever they are considered necessary, or as provided in the bylaws. Proxy voting is permitted, but notarization is necessary to make the proxy valid against third parties. Dividends may only be declared out of unrestricted retained earnings. Distributions from additional paid-in capital or premium on capital may be declared only as stock dividends. Stock corporations are prohibited from retaining surplus profits in excess of 100% of their paid-in capital stock, except when justified by definite corporate expansion projects approved by the board of directors; or when the corporation is prohibited under a loan agreement with any local or foreign financial institution or creditor from declaring dividends without the lender's consent; or when it can be clearly shown that retention is necessary to maintain a special reserve for probable contingencies. Stock dividends may be issued to convert surplus profits into authorized capital, and are not subject to income tax. They are, however, subject to a documentary stamp tax of 0.5% of the actual value represented by each share. The issue of stock dividends requires approval by stockholders representing at least two-thirds of the outstanding capital stock of the corporation.

BIR requirements

Corporations must maintain books of account, consisting of a journal and a ledger or their equivalent. Subsidiary books may also be kept as required by the particular business. All books must be registered with the BIR before they may be used. Corporations are also required to keep records of all business transactions, minutes of meetings of directors and shareholders, a stock and transfer book and annual financial statements at its principal place of office. These books and records shall be open to the inspection of any director or stockholder upon written request. A statutory audit is required for all corporations with authorized capital stock or paid-up capital exceeding P50,000, including branches of foreign corporations and for any corporation whose gross sales or earnings exceed P150,000 in any quarter. The audit must be conducted by an independent CPA accredited by the Philippines SEC. GIS Reporting Requirement Companies registered with the SEC must provide a General Information Sheet "GIS" on an annual basis within 30 days counted from the day of the annual stockholders. The GIS contains the ownership details, share structure, information on shareholders, and other relevant data. The GIS and audited financial statements filed by corporations are available at the SEC for public inspection. Documents to be filed with the SEC on applying for incorporation are: name reservation slip draft articles of incorporation, by-laws treasurer's affidavit indicating that the necessary capital has been subscribed and paid up and bank certification or proof of inward remittance

Failure to Register

The failure of a foreign corporation to register precludes it from filing suit in Philippine courts. The assumption is that the company will seek legal redress in local courts, though this course of action is uncommon. In addition, the corporation will be treated as a non-resident foreign corporation and will be taxed on its Philippine source income at a rate of 30%. This income is collected by

withholding by domestic payees. Finally, the failure to register can lead to administrative fines and penalties from governmental agencies such as the Bureau of Internal Revenue, Social Security System, Philippine Health, Pag-Ibig, and Local Government.

BSP Registration of Investment

It is recommended that foreign investors register their investment with the Bangko Sentral ng Pilipinas or the Philippine Central Bank to facilitate the repatriation of their investment and profits through the Philippine banking system.

Legal Personality

Corporate existence and juridical personality commences from the date the Securities and Exchange Commission (SEC) issues a certificate of incorporation. However, before a corporation may commence operations in the Philippines, it must also register with the Bureau of Internal Revenue (BIR), the Social Security System (SSS), the Home Development Mutual Fund (HDMF), the Philippine Health Insurance Corporation (PhilHealth), and the local government unit where its principal office will be located.

Time Frame

Registration with the SEC and other government agencies usually takes six to eight weeks in total to complete. Howsoever, the SEC certificate may take as little as 2 weeks if all documents are in order and there are no holidays during this time.

Total Government Fees

The total government fees are roughly $800. This price may vary depending on paid up capital and the city in which you decide to register.

Options for Incentives in the Philippines

Firms seeking to benefit from incentives offered by the government will need to register with the relevant agency. The most significant agencies are the Board of Investments (BOI), the Philippine Economic Zone Authority (PEZA), the Cagayan Economic Zone Authority, the Zamboanga City Economic Zone Authority, the Subic Bay Metropolitan Authority (SBMA), the Clark Development Corporation (CDC). Importers need to be accredited with the Bureau of Customs.

You might also like

- 12 Fruits of The Holy SpiritDocument2 pages12 Fruits of The Holy SpiritprofmlocampoNo ratings yet

- 15 Habits That Drain Your EnergyDocument5 pages15 Habits That Drain Your EnergyprofmlocampoNo ratings yet

- 3 Habits of Famously Productive PeopleDocument5 pages3 Habits of Famously Productive PeopleprofmlocampoNo ratings yet

- Economic Systems Market EconomiesDocument4 pagesEconomic Systems Market EconomiesprofmlocampoNo ratings yet

- Discerning The Will of GodDocument3 pagesDiscerning The Will of GodprofmlocampoNo ratings yet

- Let Go and Let GodDocument4 pagesLet Go and Let GodprofmlocampoNo ratings yet

- Deriving Satisfaction From Doing The Right ThingDocument4 pagesDeriving Satisfaction From Doing The Right ThingprofmlocampoNo ratings yet

- Surround YourselfDocument2 pagesSurround YourselfprofmlocampoNo ratings yet

- Ten Principles of EconomicsDocument4 pagesTen Principles of EconomicsprofmlocampoNo ratings yet

- VaingloryDocument3 pagesVaingloryprofmlocampoNo ratings yet

- Choose To ForgiveDocument1 pageChoose To ForgiveprofmlocampoNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Relationships With Micro CracksDocument2 pagesRelationships With Micro CracksprofmlocampoNo ratings yet

- Deriving Satisfaction From Doing The Right ThingDocument4 pagesDeriving Satisfaction From Doing The Right ThingprofmlocampoNo ratings yet

- Deriving Satisfaction From Doing The Right ThingDocument4 pagesDeriving Satisfaction From Doing The Right ThingprofmlocampoNo ratings yet

- Why Are Introverts UnderestimatedDocument3 pagesWhy Are Introverts UnderestimatedprofmlocampoNo ratings yet

- Respecting One's BeliefsDocument2 pagesRespecting One's BeliefsprofmlocampoNo ratings yet

- Genius Is Knowing What To OverlookDocument1 pageGenius Is Knowing What To OverlookprofmlocampoNo ratings yet

- Respect Your ParentsDocument1 pageRespect Your ParentsprofmlocampoNo ratings yet

- The 12 Fruits of The Holy SpiritDocument2 pagesThe 12 Fruits of The Holy SpiritprofmlocampoNo ratings yet

- Turn Your Work Into WorshipDocument5 pagesTurn Your Work Into WorshipprofmlocampoNo ratings yet

- I Shall Pass This Way But OnceDocument1 pageI Shall Pass This Way But OnceprofmlocampoNo ratings yet

- Quiz - GPS TechnologyDocument1 pageQuiz - GPS TechnologyprofmlocampoNo ratings yet

- I Shall Pass This Way But OnceDocument1 pageI Shall Pass This Way But OnceprofmlocampoNo ratings yet

- Proclaiming and Living The TruthDocument4 pagesProclaiming and Living The TruthprofmlocampoNo ratings yet

- Harsh JudgmentsDocument3 pagesHarsh JudgmentsprofmlocampoNo ratings yet

- The Path To Eternal LifeDocument3 pagesThe Path To Eternal LifeprofmlocampoNo ratings yet

- Wisdom vs. EmotionsDocument2 pagesWisdom vs. EmotionsprofmlocampoNo ratings yet

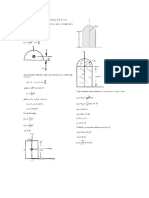

- Sample Exercise MoI PDFDocument2 pagesSample Exercise MoI PDFprofmlocampoNo ratings yet

- Wealth StrategiesDocument12 pagesWealth StrategiesprofmlocampoNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Emaan Bil Laah (Final Version)Document52 pagesEmaan Bil Laah (Final Version)Farheen KhanumNo ratings yet

- FOR IC FILING OF UNITED COCONUT PLANTERS LIFE ASSURANCE CORPORATION FINANCIAL STATEMENTSDocument101 pagesFOR IC FILING OF UNITED COCONUT PLANTERS LIFE ASSURANCE CORPORATION FINANCIAL STATEMENTSHoyo VerseNo ratings yet

- Sofia Flores - I Have A DreamDocument2 pagesSofia Flores - I Have A Dreamapi-547383692No ratings yet

- Cut Nyak Dien Biography English Language VersionDocument4 pagesCut Nyak Dien Biography English Language VersionWahyupuji Astuti100% (1)

- Audit ProceduresDocument5 pagesAudit Procedureskenoly123No ratings yet

- Gregorio Araneta Inc. v Tuason de Paterno: Piercing Corporate Veil CaseDocument3 pagesGregorio Araneta Inc. v Tuason de Paterno: Piercing Corporate Veil CaseAlecParafinaNo ratings yet

- Virtues of Seeking KnowledgeDocument7 pagesVirtues of Seeking KnowledgeNasrin AktherNo ratings yet

- ORDER Correa Petition To Resign Granted June 17 1993Document5 pagesORDER Correa Petition To Resign Granted June 17 1993Neil GillespieNo ratings yet

- RHB Auto Finance Customer Service Request FormDocument1 pageRHB Auto Finance Customer Service Request FormParang Tumpul100% (2)

- Sample Vaping Warning LetterDocument3 pagesSample Vaping Warning LetterStephen LoiaconiNo ratings yet

- GR 113213 - Wright V Court of AppealsDocument1 pageGR 113213 - Wright V Court of AppealsApple Gee Libo-on100% (1)

- FIAML Regulations 2018Document34 pagesFIAML Regulations 2018Bhoumika LucknauthNo ratings yet

- 323-1851-221 (6500 R13.0 SLAT) Issue3Document804 pages323-1851-221 (6500 R13.0 SLAT) Issue3Raimundo Moura100% (1)

- Trinsey v. PelagroDocument12 pagesTrinsey v. Pelagrojason_schneider_16100% (3)

- Cross-Compiling Arm NN For The Raspberry Pi and TensorFlowDocument16 pagesCross-Compiling Arm NN For The Raspberry Pi and TensorFlowSair Puello RuizNo ratings yet

- Foid Foia Log-Fy2020Document728 pagesFoid Foia Log-Fy2020Spit FireNo ratings yet

- MMT Bus E-Ticket - NU25147918137876 - Pune-HyderabadDocument1 pageMMT Bus E-Ticket - NU25147918137876 - Pune-HyderabadRajesh pvkNo ratings yet

- Life MemberDocument2 pagesLife MembergamenikeNo ratings yet

- Hoba TheoriesDocument9 pagesHoba TheoriesLa MarieNo ratings yet

- Intro To ISO 13485 Presentation MaterialsDocument10 pagesIntro To ISO 13485 Presentation Materialsrodcam1No ratings yet

- Democracy (Anup Shah) - Global IssuesDocument47 pagesDemocracy (Anup Shah) - Global IssuesjienlouNo ratings yet

- Constitution 8 Review Pages For Opt inDocument16 pagesConstitution 8 Review Pages For Opt inChristinaNo ratings yet

- 20465D ENU TrainerHandbook PDFDocument290 pages20465D ENU TrainerHandbook PDFbapham thuNo ratings yet

- Amezquita LetterDocument2 pagesAmezquita LetterKeegan StephanNo ratings yet

- Aguilon Members Club ConstitutionDocument2 pagesAguilon Members Club ConstitutionKeith LeonardNo ratings yet

- Workers Participation Case IDocument3 pagesWorkers Participation Case IAlka Jain100% (1)

- Hinduism's Varna System and Jāti Castes ExplainedDocument12 pagesHinduism's Varna System and Jāti Castes Explainedraju87vadhwanaNo ratings yet

- What Are Final AccountsDocument3 pagesWhat Are Final AccountsBilal SiddiqueNo ratings yet

- The Rich Cheat and Become Richer Discover How We Let The Rich Thrive and How We Can Stop Them by Fixing CapitalismDocument251 pagesThe Rich Cheat and Become Richer Discover How We Let The Rich Thrive and How We Can Stop Them by Fixing Capitalismcharles yerkesNo ratings yet

- Foreign Affairs March April 2021 Issue NowDocument236 pagesForeign Affairs March April 2021 Issue NowShoaib Ahmed0% (1)