Professional Documents

Culture Documents

SRO 586 of 1991

Uploaded by

Abdul QadirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SRO 586 of 1991

Uploaded by

Abdul QadirCopyright:

Available Formats

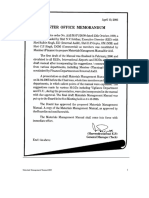

GOVERNMENT OF PAKISTAN CENTRAL BOARD OF REVENUE *** Islamabad, the 30th June, 1991 NOTIFICATION (INCOME TAX) S.R.O.

586 (I)/91. In exercise of the powers conferred by clause (ii) of the proviso to sub-section (4) of section 50 of the Income Tax Ordinance, 1979 (XXXI of 1979), hereinafter referred to as the Ordinance, and in supersession of its Notification No. S.R.O. 659(I)/81 dated the 25th June, 1981, the Central Board of Revenue is pleased to specify the following to be the recipients, or the classes of recipients, to whom the said sub-section shall not, namely:(i) (ii) (iii) a Provincial Government; a local authority; persons who are residents of the Tribal Areas or Azad Kashmir and execute contracts in Tribal Areas, or as the case may be, Azad Kashmir only and produce a certificate to this effect from the Political Agent concerned or the district authority, as the case may be, or in the case of Azad Kashmir, from the Income Tax Officer concerned; persons who produce a certificate from the Commissioner of Income Tax to the effect that their income during the income year is exempt from tax under the Second Schedule to the Income Tax Ordinance, 1979; persons receiving payments from a company exclusively for the supply of agricultural produce which has not been subjected to any process other than that which is ordinarily performed to render such produce fit to be taken to market; companies receiving payments for the supply of electricity and gas; companies receiving payments for the supply of crude oil;

(iv)

(v)

(vi) (vii)

(viii) Attock Refinary Limited, National Refinary Limited and Pakistan Refinary Limited, receiving payments for the supply of their products; (ix) Pakistan State Oil Company Limited, Pakistan Burmah Shall Limited, and Caltex Oil (Pakistan) Limited, receiving payments for the supply of petroleum products;

(x)

Hotels and restaurants receiving payments in cash for providing accommodation or food or both as the case may be; shipping companies and air carries receiving payments for the supply of passenger tickets and for the cargo charges of goods transported; persons receiving payments, for the supply of goods or execution of a contract, not exceeding rupees one thousand for a single transaction and the total of such transactions does not exceed rupees ten thousand in a financial year: Provided that where the total value of payments, on accounts of the aforesaid transactions, exceeds rupees ten thousand during a financial year, the payer shall deduct tax from the payments including the tax on payments of rupees one thousand or less made earlier without deduction of tax during the same financial year.

(xi)

(xii)

2.

notification shall have effect from the first day of July, 1991.

(SAJJAD HASSAN) MEMBER (INCOME TAX)

You might also like

- User Manual Scout 8104Document158 pagesUser Manual Scout 8104kashif Abbasi0% (1)

- Project Finance GuideDocument26 pagesProject Finance GuideÑagáşaï BøïnâNo ratings yet

- Southern Bypass - Project Information MemorandumDocument16 pagesSouthern Bypass - Project Information MemorandumAini Ali100% (1)

- 6 ComparisonMatrix USAP1122Document7 pages6 ComparisonMatrix USAP1122dmedstromNo ratings yet

- Sweetbriar II - 2009 VADocument207 pagesSweetbriar II - 2009 VADavid LayfieldNo ratings yet

- 37-Local Government Employees (Medical Attendacen) Rules, 20Document6 pages37-Local Government Employees (Medical Attendacen) Rules, 20Humayoun Ahmad FarooqiNo ratings yet

- Canada Line Agreement OverviewDocument3 pagesCanada Line Agreement OverviewJeff NagelNo ratings yet

- PTCL GisDocument13 pagesPTCL Gismajusid100% (1)

- Public Private Partnership in Road SectorDocument8 pagesPublic Private Partnership in Road SectorPriya GautamNo ratings yet

- BPDB Service Rule 1982Document115 pagesBPDB Service Rule 1982Tanzim Taj100% (1)

- Quantitative Techniques WbaDocument6 pagesQuantitative Techniques WbaDavid Mboya100% (1)

- Time Value of Money Notes Loan ArmotisationDocument12 pagesTime Value of Money Notes Loan ArmotisationVimbai ChituraNo ratings yet

- Chapters AuditDocument30 pagesChapters Auditrudy0% (2)

- Exam II Version BDocument12 pagesExam II Version B조서현No ratings yet

- Sindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFDocument64 pagesSindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFrohail51No ratings yet

- Project Management (PM)Document4 pagesProject Management (PM)N-aineel DesaiNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- Local Government Property Rules, 2003Document26 pagesLocal Government Property Rules, 2003Rizwan Shabbir100% (1)

- Proposal Chaity Composite of Gulshan BranchDocument25 pagesProposal Chaity Composite of Gulshan BranchMD Meftahul Alam50% (2)

- A Revenue Guide To Professional Services Withholding Tax (PSWT) For Accountable Persons and Specified PersonsDocument26 pagesA Revenue Guide To Professional Services Withholding Tax (PSWT) For Accountable Persons and Specified Personstere1330No ratings yet

- BRPD Circular No 05Document14 pagesBRPD Circular No 05Iftekhar Ifte100% (1)

- Appendix 17A - Some Useful Formulas of Financial Structure - (McGraw-Hill)Document1 pageAppendix 17A - Some Useful Formulas of Financial Structure - (McGraw-Hill)QuantDev-MNo ratings yet

- Fixed Income Broker Dealer - USEReady Tableau Case Study v1Document4 pagesFixed Income Broker Dealer - USEReady Tableau Case Study v1usereadyNo ratings yet

- SBD AMISP Tender 1Document438 pagesSBD AMISP Tender 1raiutkarshNo ratings yet

- Materials Management Manual 22042017Document148 pagesMaterials Management Manual 22042017shishirgupta20070% (1)

- National University of Computer & Emerging Sciences Islamabad Campus Programming Fundamentals (CS118) FALL 2019 ASSIGNMENT # 2Document6 pagesNational University of Computer & Emerging Sciences Islamabad Campus Programming Fundamentals (CS118) FALL 2019 ASSIGNMENT # 2Muhammad Ahmad0% (1)

- Chapter 2 Decesion Making Statements DK Mamonai 09CE37Document12 pagesChapter 2 Decesion Making Statements DK Mamonai 09CE37Darya MemonNo ratings yet

- Cost-Benefit Analysis of Public ProjectsDocument4 pagesCost-Benefit Analysis of Public Projectskaruna141990100% (1)

- Gilgit Baltistan System of Financial Control 2009Document55 pagesGilgit Baltistan System of Financial Control 2009Muhammad ShakirNo ratings yet

- MM ZG627 Ec-2r First Sem 2017-2018Document1 pageMM ZG627 Ec-2r First Sem 2017-2018UDAYAN BIPINKUMAR SHAHNo ratings yet

- Al Nakheel Hygienic Paper Manufacturing LLC: Mubasher Maqsood Alam Maqsood AlamDocument1 pageAl Nakheel Hygienic Paper Manufacturing LLC: Mubasher Maqsood Alam Maqsood AlamCH MUBASHER MAQSOOD ALAMNo ratings yet

- Practice Test MidtermDocument6 pagesPractice Test Midtermrjhuff41No ratings yet

- JGI's focus on human resources as key to successDocument9 pagesJGI's focus on human resources as key to successrazishadab50% (2)

- The Standards For Exchange Business in The UAE (Version 1.10) - 01.03.2018 For Issue (Clean)Document156 pagesThe Standards For Exchange Business in The UAE (Version 1.10) - 01.03.2018 For Issue (Clean)Māhmõūd ĀhmēdNo ratings yet

- Model Answers - 116342Document6 pagesModel Answers - 116342Marius BuysNo ratings yet

- Opinion - 80IA - Slump SaleDocument16 pagesOpinion - 80IA - Slump SaleShashankNo ratings yet

- Implications of Dollarization On Cambodia's Banking SystemDocument62 pagesImplications of Dollarization On Cambodia's Banking SystemMG Lim100% (3)

- 09-MWSS2013 Part2-Observations and RecommendationsDocument128 pages09-MWSS2013 Part2-Observations and RecommendationsEppie SeverinoNo ratings yet

- Crashing QuestionsDocument3 pagesCrashing QuestionsSYED ASGHAR ALI SULTANNo ratings yet

- The Sindh Government Rules of Business 1986 PDFDocument69 pagesThe Sindh Government Rules of Business 1986 PDFmuhammed younusNo ratings yet

- Reoi Cukurova 30 04 21 PublishedDocument2 pagesReoi Cukurova 30 04 21 PublishedBurak AyvaNo ratings yet

- Incentives EPZDocument1 pageIncentives EPZMOHAMMED ALI CHOWDHURYNo ratings yet

- 4 Wire Resistive Touch Screen Sensor Interfacing With AVR ATmega32 MicrocontrollerDocument9 pages4 Wire Resistive Touch Screen Sensor Interfacing With AVR ATmega32 MicrocontrollerVishal YeoleNo ratings yet

- ExercisesDocument4 pagesExercisesLuân Nguyễn Đình ThànhNo ratings yet

- Financial Accounting by DrummerDocument48 pagesFinancial Accounting by DrummershabahatanwaraliNo ratings yet

- CEWARN Communication Strategy Tender Dossier - 1 August 2019Document34 pagesCEWARN Communication Strategy Tender Dossier - 1 August 2019Anonymous WUAZ3A5tCxNo ratings yet

- Kerala State Electricity Connections - .. . . ( ) ., ,, ,, , .Document11 pagesKerala State Electricity Connections - .. . . ( ) ., ,, ,, , .James AdhikaramNo ratings yet

- Capital Budgeting - Homework-2 AnswersDocument3 pagesCapital Budgeting - Homework-2 AnswersYasmine GouyNo ratings yet

- Quality Assurance Plan: Global Infra SolutionsDocument112 pagesQuality Assurance Plan: Global Infra SolutionssujeetNo ratings yet

- IT Project ManagmentDocument9 pagesIT Project ManagmentNehal Gupta100% (1)

- Dr. Nawar Khan - Continuous Improvement in Quality & Productivity Through Integral Lean ManagementDocument25 pagesDr. Nawar Khan - Continuous Improvement in Quality & Productivity Through Integral Lean ManagementaalwajhkNo ratings yet

- Company BS FormatDocument11 pagesCompany BS FormatSurya ReddyNo ratings yet

- Acca P6 QuestionDocument8 pagesAcca P6 QuestionChuaJieLingNo ratings yet

- Goldman v. Richmond (2019) Count 2 Documents: Consolidated Questions & ResponsesDocument122 pagesGoldman v. Richmond (2019) Count 2 Documents: Consolidated Questions & ResponsesActivate VirginiaNo ratings yet

- Alpha Technology - Scrypt Analysis On FPGA Proof of ConceptDocument8 pagesAlpha Technology - Scrypt Analysis On FPGA Proof of ConceptKanber KavNo ratings yet

- Blueair Avionics Inc Company Project: Spring 2017Document17 pagesBlueair Avionics Inc Company Project: Spring 2017MOHAMMAD ALMUBARAKNo ratings yet

- RAPS QCI Document PDFDocument124 pagesRAPS QCI Document PDFSurya Teja SarmaNo ratings yet

- Full File at Http://testbankinstant - CH/Test-Bank-for-Principles-of-Cost-Accounting,-16th-EditionDocument11 pagesFull File at Http://testbankinstant - CH/Test-Bank-for-Principles-of-Cost-Accounting,-16th-EditionAnne Marieline BuenaventuraNo ratings yet

- Iris FAQsDocument74 pagesIris FAQsHammad SalahuddinNo ratings yet

- Speech of CorazonDocument3 pagesSpeech of CorazonBlesvill BaroroNo ratings yet

- Umar's Reforms and Strong AdministrationDocument2 pagesUmar's Reforms and Strong Administrationhati1100% (1)

- THEORIESDocument15 pagesTHEORIES123No ratings yet

- Oslo Faculty of Law Case on Right to Fair TrialDocument2 pagesOslo Faculty of Law Case on Right to Fair TrialShashwat Jindal100% (1)

- People Vs Jaime Jose y Gomez, Et Al.Document2 pagesPeople Vs Jaime Jose y Gomez, Et Al.Anonymous NqaBAyNo ratings yet

- Terminiello v. City of ChicagoDocument3 pagesTerminiello v. City of ChicagoMenchu MabanNo ratings yet

- The Peninsula Manila v. AlipioDocument1 pageThe Peninsula Manila v. AlipioJoanne Macabagdal100% (1)

- Pnoc Vs KeppelDocument6 pagesPnoc Vs KeppeljessapuerinNo ratings yet

- Nenita Coconut Farmers Endorse Richard Hiponia for PCA BoardDocument2 pagesNenita Coconut Farmers Endorse Richard Hiponia for PCA Boardmj cryptoNo ratings yet

- Laurel v. Abrogar G.R. No. 155076Document7 pagesLaurel v. Abrogar G.R. No. 155076Kimberly MNo ratings yet

- Berbano Vs Barcelona (2003)Document9 pagesBerbano Vs Barcelona (2003)sjbloraNo ratings yet

- SC Circular 63-97Document1 pageSC Circular 63-97cloyd vigoNo ratings yet

- Modes of Extinguishing ObligationsDocument29 pagesModes of Extinguishing Obligationsdanielzar delicanoNo ratings yet

- GR No. L-40789, February 27, 1987 Intestate Estate of Petra Rosales Vs Fortunato RosalesDocument2 pagesGR No. L-40789, February 27, 1987 Intestate Estate of Petra Rosales Vs Fortunato RosalesDiane DistritoNo ratings yet

- Notice of Special AppearanceDocument21 pagesNotice of Special AppearanceSLAVEFATHER90% (30)

- Chua Che v. Philippines Patent OfficeDocument1 pageChua Che v. Philippines Patent OfficeJoe CuraNo ratings yet

- Unit 1 - Introduction To Law PDFDocument23 pagesUnit 1 - Introduction To Law PDFFarhan AllybocusNo ratings yet

- Miranda Et Al. v. Tuliao, G.R. No. 158763, March 31, 2006 Crim Pro - JurisdictionDocument13 pagesMiranda Et Al. v. Tuliao, G.R. No. 158763, March 31, 2006 Crim Pro - JurisdictionJohn Gabriel OrtizNo ratings yet

- Roshell V. Gasing-Bs Criminology 1st Year - Cri 121-1090Document2 pagesRoshell V. Gasing-Bs Criminology 1st Year - Cri 121-1090roshell GasingNo ratings yet

- Er-Ee Rel Employer - Employee RelationshipDocument6 pagesEr-Ee Rel Employer - Employee Relationshipramos_annalyn100% (1)

- Tort ExamDocument2 pagesTort ExamOnyee FongNo ratings yet

- Bayanihan To Heal As One ActDocument8 pagesBayanihan To Heal As One ActVanityHughNo ratings yet

- Practical Petroleum Law QuestionsDocument11 pagesPractical Petroleum Law QuestionsanaghaNo ratings yet

- KWASEKO CBO ConstitutionDocument7 pagesKWASEKO CBO ConstitutionSharon Amondi50% (2)

- DAVID NIEDRIST v. Bristol Township, Bristol Township Police, Falls Township Police & Levittown-Fairless Hills Rescue SquadDocument27 pagesDAVID NIEDRIST v. Bristol Township, Bristol Township Police, Falls Township Police & Levittown-Fairless Hills Rescue SquadTom Sofield100% (1)

- Petition For NaturalizationDocument4 pagesPetition For NaturalizationbertspamintuanNo ratings yet

- Annotation Complex Crime of Kidnapping With MurderDocument10 pagesAnnotation Complex Crime of Kidnapping With MurderPia Christine BungubungNo ratings yet

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument1 pageNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNo ratings yet

- Torts-Case Digests-FinalDocument126 pagesTorts-Case Digests-FinalKatrina FregillanaNo ratings yet

- Powers and Functions of Philippine Administrative AgenciesDocument3 pagesPowers and Functions of Philippine Administrative AgenciesLuis GuerreroNo ratings yet