Professional Documents

Culture Documents

Paul Ryan Comparison Table

Uploaded by

Committee For a Responsible Federal BudgetOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paul Ryan Comparison Table

Uploaded by

Committee For a Responsible Federal BudgetCopyright:

Available Formats

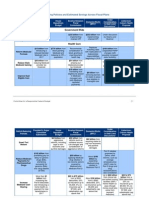

Paul Ryans Budget Proposals

Budget Category Discretionary Defense/ Security Roadmap 1 (2008) Roadmap 2 (2010) Path to Prosperity 1 (2011) Path to Prosperity 2 (2012)

Details unspecified, but Unspecified, but defense non-entitlement spending is spending appears to grow with inflation estimated to grow above inflation

Details unspecified, but

Non-Defense (NDD)/ NonSecurity (NSD) Health Care

Freezes NDD at 2009 non-entitlement spending is levels through 2019 Indexes to CPI+.7% estimated to grow above thereafter inflation

Fulfills Presidents defense Reprioritizes most security request (above BCA levels) savings from BCA and sequester to non-defense Retains sequester for 2014 and beyond. Cuts NSD to 2006 levels, Reduces NSD by ~$20 B in freezes for 5 years 2013, reallocates security savings to non-security in Indexes to inflation future years. thereafter Retains sequester for 2014 and beyond.

Medicare

Medicaid

Premium support for Premium support for Premium support for Premium support for beneficiaries who are beneficiaries who are beneficiaries who are beneficiaries who are currently under 55, indexed currently under 55, indexed currently under 55, indexed currently under 55, with to halfway between general to halfway between general to inflation per beneficiary FFS Medicare competing, and medical inflation and medical inflation indexed to GDP+0.5% per Increases Medicare beneficiary Means-tested premiums for Means-tested premiums for eligibility age to 67 by 2 higher earners higher earners month intervals each year Means-tested premiums for beginning in 2023 higher earners Phases out DSH payments Raises Medicare age from 65 to 69.5 by 2022 Assumes doc fixes are Increases Medicare offset (unspecified) eligibility age to 67 between 2023 and 2036 Assumes doc fixes are offset (unspecified) Allows states to participate Block grants long-term Block grants all Medicaid in Block grants in 2013, grows in tax credit plan or block care, indexed to halfway 2013, grows by inflation by inflation plus population grants current Medicaid between general and plus population program, grows by inflation medical inflation plus plus population population Replaces Medicaid acute care w/ subsidies for private

________________________________________________________________________________________________________________________________ Committee for a Responsible Federal Budget 1

Budget Category

Other

Roadmap 2 Path to Prosperity 1 (2010) (2011) insurance Replaces health insurance Replaces health insurance Repeals coverage tax exclusion with tax tax exclusion with tax provisions of PPACA; credits indexed to halfway credits indexed to halfway keeps most spending cuts between general and between general and Enacts tort reform medical inflation plus medical inflation plus population population Enacts tort reform Enacts tort reform Indexes retirement age to Sets up reform trigger, longevity where President and Congress are required to Implements progressive consider reforms under price indexing Creates minimum benefit at expedited process 120% of FPL Offers optional individual accounts Consolidates and reforms job training programs Repeals most unobligated funds from American Recovery & Reinvestment Act Reduces TARP authority Block grants food stamps and limits spending, increases to inflation and population growth beginning in 2015 Consolidates and reforms job training programs Eliminated in-school interest subsidies for undergraduates and graduate students Restricts FDIC too-big-tofail authority Expands spectrum auctions Reduces farm subsidies Reforms civil service retirement

Roadmap 1 (2008)

Path to Prosperity 2 (2012) Repeals coverage provisions of PPACA; keeps most spending cuts and revenue Enacts tort reform

Social Security Indexes retirement age to longevity Implements progressive price indexing Social Security Creates minimum benefit at 120% of FPL Offers optional individual accounts Other Mandatory Sets up reform trigger, where President and Congress are required to consider reforms under expedited process

Block grants food stamps and limits spending, increases to inflation and population growth beginning in 2016 Consolidates and reforms job training programs Reduces student loan subsidies Reduces farm subsidies Reforms civil service retirement Sells excess federal assets and property Privatizes Fannie and Freddie Reforms PBGC

________________________________________________________________________________________________________________________________ Committee for a Responsible Federal Budget 2

Budget Category

Roadmap 1 (2008)

Roadmap 2 (2010)

Path to Prosperity 1 (2011)

Path to Prosperity 2 (2012)

Sells excess federal assets Reforms SSI and property Reforms other meanstested entitlement programs Privatizes Fannie and Freddie Reforms PBGC Reforms SSI Reforms other meanstested entitlement programs Tax Reform Limits revenues to no more Limits revenues to no more than 18.5% of GDP than 19% of GDP Offers an alternative Offers an alternative Simplified Tax, with: Simplified Tax, with: - No AMT - No AMT - No estate tax - No estate tax - No taxes on - No taxes on investment income investment income - Few tax preferences - Few tax preferences - 2 rates of 10%, 25% - 2 rates of 10%, 25% Replaces corporate income Replaces corporate income tax with broad-based 8.5% tax with broad-based 8.5% business consumption tax business consumption tax (BCT) (BCT) Calls for revenue neutral tax reform with 25% top rate with fewer brackets Reduces tax preferences (unspecified) Calls for revenue neutral tax reform with two brackets of 10% and 25% Repeals the AMT Reduces tax preferences (unspecified)

Individual

Corporate

Reduces corporate rate to 25% Reduces tax preferences (unspecified)

Reduces corporate rate to 25% Enacts territorial system Reduces tax preferences (unspecified) 65.1% of GDP (AFS Assumes 89%) 1.0% of GDP (AFS Assumes 5.3%) 10% of GDP (AFS Assumes 334%) 3% of GDP (AFS Assumes 25.3%)

Other Details 40% of GDP (AFS Assumes 53%) 2.2% of GDP Deficit in 2020 (AFS Numbers Unspecified) 110% of GDP Debt in 2050 (AFS Assumes 292%) 5.5% of GDP Deficit in 2050 (AFS Numbers Unspecified) Debt in 2020 69.2% of GDP (AFS Assumes 87%) 3.8% of GDP (AFS Assumes 7.4%) 95.8% of GDP (AFS Assumes 321%) 2.6% of GDP (AFS Assumes 22.3%) 68.7% of GDP (AFS Assumes 97%) 1.8% of GDP (AFS Assumes 7.2%) 10% of GDP (AFS Assumes 344%) 4.3% of GDP (AFS Assumes 26%)

________________________________________________________________________________________________________________________________ Committee for a Responsible Federal Budget 3

You might also like

- Paul Ryan TableDocument3 pagesPaul Ryan TableCommittee For a Responsible Federal BudgetNo ratings yet

- November 2010Document32 pagesNovember 2010cookie1961No ratings yet

- Background and Summary of Fiscal Commission PlanDocument8 pagesBackground and Summary of Fiscal Commission PlanCommittee For a Responsible Federal BudgetNo ratings yet

- Comparing Medicare Reform ProposalsDocument1 pageComparing Medicare Reform ProposalsDonald SjoerdsmaNo ratings yet

- The Sequester: Mechanics, Impact, and OutlookDocument39 pagesThe Sequester: Mechanics, Impact, and OutlookAshley Swearingen100% (1)

- Summers 12-15-08 MemoDocument57 pagesSummers 12-15-08 MemochenjiayuhNo ratings yet

- Deficit Committee PaperDocument5 pagesDeficit Committee PaperRyan DeCaroNo ratings yet

- Year-End Tax Planning: (In Uncertain Times)Document28 pagesYear-End Tax Planning: (In Uncertain Times)Jayati BhasinNo ratings yet

- Tuesday Goss GlennDocument32 pagesTuesday Goss GlennNational Press FoundationNo ratings yet

- Trustees PaperDocument6 pagesTrustees PaperCommittee For a Responsible Federal BudgetNo ratings yet

- Union Budget 2010-2011: Presented byDocument44 pagesUnion Budget 2010-2011: Presented bynishantmeNo ratings yet

- Pension Costs: September 14, 2011 House Finance Committee Senate Finance CommitteeDocument62 pagesPension Costs: September 14, 2011 House Finance Committee Senate Finance Committeepcapineri8399No ratings yet

- Healthcare Reform ActDocument3 pagesHealthcare Reform Actpeterlouisanthony7859No ratings yet

- Connecticut General Assembly: Office of Fiscal AnalysisDocument16 pagesConnecticut General Assembly: Office of Fiscal AnalysisJordan FensterNo ratings yet

- 0 To Secure Improved Value For Money Following An Appraisal That Determined The Optimal Support Appropriate (Telecoms Policy Unit)Document10 pages0 To Secure Improved Value For Money Following An Appraisal That Determined The Optimal Support Appropriate (Telecoms Policy Unit)PrakashsogoyalNo ratings yet

- Sample Essay MacroDocument18 pagesSample Essay MacropotpalNo ratings yet

- Macroeconomic Policy Chapter 30 & 31Document37 pagesMacroeconomic Policy Chapter 30 & 31Adam BabaNo ratings yet

- 2020 Riverside County Pension Review Advisory Committee ReportDocument17 pages2020 Riverside County Pension Review Advisory Committee ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- A Bipartisan Plan To Reduce Our Nation'S Deficits Executive SummaryDocument5 pagesA Bipartisan Plan To Reduce Our Nation'S Deficits Executive SummaryMarkWarnerNo ratings yet

- Presentation On Economic Survey Final 2014-15 FinalDocument87 pagesPresentation On Economic Survey Final 2014-15 FinaltrvthecoolguyNo ratings yet

- Averting A Fiscal Crisis 0 0 0Document23 pagesAverting A Fiscal Crisis 0 0 0Committee For a Responsible Federal BudgetNo ratings yet

- 2022 Proposed Budget For Livingston CountyDocument384 pages2022 Proposed Budget For Livingston CountyWatertown Daily TimesNo ratings yet

- CalPERS LTC Recommendation and AnalysisDocument6 pagesCalPERS LTC Recommendation and Analysisjon_ortizNo ratings yet

- Resident's Guide: Volume 1 FY2013Document15 pagesResident's Guide: Volume 1 FY2013ChicagoistNo ratings yet

- MONETARY & FISCAL POLICY INSIGHTSDocument29 pagesMONETARY & FISCAL POLICY INSIGHTSKenny AdamsNo ratings yet

- Medicare Table of Reform Proposals 2 0518Document1 pageMedicare Table of Reform Proposals 2 0518mng1mng1No ratings yet

- Projected Impacts of COVID-19 On City BudgetDocument18 pagesProjected Impacts of COVID-19 On City BudgetAnonymous Pb39klJNo ratings yet

- CRFB's Long-Term Realistic Baseline June 30, 2011: HairmenDocument4 pagesCRFB's Long-Term Realistic Baseline June 30, 2011: HairmenCommittee For a Responsible Federal BudgetNo ratings yet

- Social Security and Medicare Trustees ReportDocument28 pagesSocial Security and Medicare Trustees ReportAustin DeneanNo ratings yet

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Document53 pagesAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Committee For a Responsible Federal BudgetNo ratings yet

- Fiscal Policy Is The Policy of Regulating and Contracting The Revenue and Expenditure of The Procurement To Achieve Certain Macro Economic ObjectivesDocument4 pagesFiscal Policy Is The Policy of Regulating and Contracting The Revenue and Expenditure of The Procurement To Achieve Certain Macro Economic Objectivesmnasir_virgo14No ratings yet

- Session 13 The Government BudgetDocument22 pagesSession 13 The Government BudgetSourabh AgrawalNo ratings yet

- Healthcare Reform TimelineDocument16 pagesHealthcare Reform TimelinenfibNo ratings yet

- Restoring Balance BriefDocument1 pageRestoring Balance BriefJ. Swift (The Bulwark)No ratings yet

- Pension SubA Power Point 11-9-11Document42 pagesPension SubA Power Point 11-9-11tnesi4798No ratings yet

- MNGOP 2011 Points BudgetDocument4 pagesMNGOP 2011 Points BudgetCory MerrifieldNo ratings yet

- 2019 Riverside County Pension Advisory Review Committee ReportDocument20 pages2019 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- Fiscal PolicyDocument22 pagesFiscal Policyshailendersingh74No ratings yet

- Economics For Business and Management: Week 12Document66 pagesEconomics For Business and Management: Week 12qiyunyufeiNo ratings yet

- Fiscal policy tools & deficitsDocument21 pagesFiscal policy tools & deficitsmanish9890No ratings yet

- Five DebatesDocument12 pagesFive DebatesraviNo ratings yet

- Overlapping Policies and Estimated Savings Across Fiscal PlansDocument13 pagesOverlapping Policies and Estimated Savings Across Fiscal PlansCommittee For a Responsible Federal BudgetNo ratings yet

- 07 - Fiscal Policy WSDocument9 pages07 - Fiscal Policy WSAntonio Ambrosio ToroNo ratings yet

- Economic Survey 2022Document119 pagesEconomic Survey 2022sangeerthana sanaNo ratings yet

- LEGT2751 Lecture 1Document14 pagesLEGT2751 Lecture 1reflecti0nNo ratings yet

- Fiscal Policy MeaningDocument27 pagesFiscal Policy MeaningVikash SinghNo ratings yet

- Medicaid Health Website VersionDocument6 pagesMedicaid Health Website VersionsenategopILNo ratings yet

- Fiscal FinalDocument23 pagesFiscal FinalKrishna ChaitanyaNo ratings yet

- 14. Fiscal Policy 2021Document6 pages14. Fiscal Policy 2021bodduvidhiNo ratings yet

- DeficitReduction ScreenDocument46 pagesDeficitReduction ScreenPeggy W SatterfieldNo ratings yet

- Milligan Budget 2009Document26 pagesMilligan Budget 2009lesmiserables24601No ratings yet

- Budget Balancing Exercise: 1 BackgroundDocument14 pagesBudget Balancing Exercise: 1 Backgroundzagham11No ratings yet

- IBA Review of The Fiscal Year 2013 Proposed BudgetDocument30 pagesIBA Review of The Fiscal Year 2013 Proposed Budgetapi-63385278No ratings yet

- Union Budget: Prof. M K SahooDocument30 pagesUnion Budget: Prof. M K SahoosanujeeNo ratings yet

- Federal Budget Sequestration 101: Perspectives Through The County LensDocument31 pagesFederal Budget Sequestration 101: Perspectives Through The County LenslaedcpdfsNo ratings yet

- A Message To The PublicDocument24 pagesA Message To The Publicthe kingfishNo ratings yet

- Budget and Its Implications On Fiscal Deficit and EconomyDocument29 pagesBudget and Its Implications On Fiscal Deficit and EconomyNedaabdiNo ratings yet

- WM HCR TimelinelDocument2 pagesWM HCR TimelinelnadmennymillicentNo ratings yet

- Prepplan PDFDocument12 pagesPrepplan PDFCommittee For a Responsible Federal BudgetNo ratings yet

- Averting A Fiscal Crisis 0Document26 pagesAverting A Fiscal Crisis 0Committee For a Responsible Federal BudgetNo ratings yet

- House Bills Would Add Billions To Debt Scuttle Medicare Cost Controls PDFDocument2 pagesHouse Bills Would Add Billions To Debt Scuttle Medicare Cost Controls PDFCommittee For a Responsible Federal BudgetNo ratings yet

- Fy16 Presidents Budget CRFB Slidedeck PDFDocument18 pagesFy16 Presidents Budget CRFB Slidedeck PDFCommittee For a Responsible Federal BudgetNo ratings yet

- CRFB Reacts To OMBs Report On The SequesterDocument1 pageCRFB Reacts To OMBs Report On The SequesterCommittee For a Responsible Federal BudgetNo ratings yet

- Reforming The Corporate Tax CodeDocument14 pagesReforming The Corporate Tax CodeCommittee For a Responsible Federal BudgetNo ratings yet

- CRFB JCT Response FINAL JS PDFDocument8 pagesCRFB JCT Response FINAL JS PDFCommittee For a Responsible Federal BudgetNo ratings yet

- CRFB On SGR Deal 3262014Document1 pageCRFB On SGR Deal 3262014Committee For a Responsible Federal BudgetNo ratings yet

- CRFB JCT Response FINAL JS PDFDocument8 pagesCRFB JCT Response FINAL JS PDFCommittee For a Responsible Federal BudgetNo ratings yet

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Document53 pagesAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Committee For a Responsible Federal BudgetNo ratings yet

- CRFB JCT Response FINAL JS PDFDocument8 pagesCRFB JCT Response FINAL JS PDFCommittee For a Responsible Federal BudgetNo ratings yet

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0Document59 pagesAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0Committee For a Responsible Federal BudgetNo ratings yet

- CRFB JCT Response FINAL JS PDFDocument8 pagesCRFB JCT Response FINAL JS PDFCommittee For a Responsible Federal BudgetNo ratings yet

- CRFB JCT Response FINAL JS PDFDocument8 pagesCRFB JCT Response FINAL JS PDFCommittee For a Responsible Federal BudgetNo ratings yet

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0Document60 pagesAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0Committee For a Responsible Federal Budget100% (1)

- Goldwein 09-10Document3 pagesGoldwein 09-10Committee For a Responsible Federal BudgetNo ratings yet

- Averting A Fiscal Crisis 0Document26 pagesAverting A Fiscal Crisis 0Committee For a Responsible Federal BudgetNo ratings yet

- CRFB Reacts To Six-Month Continuing Resolution 9-11-2012Document1 pageCRFB Reacts To Six-Month Continuing Resolution 9-11-2012Committee For a Responsible Federal BudgetNo ratings yet

- With Conventions Out of The Way Its Time For Leaders To LeadDocument1 pageWith Conventions Out of The Way Its Time For Leaders To LeadCommittee For a Responsible Federal BudgetNo ratings yet

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0Document59 pagesAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0Committee For a Responsible Federal BudgetNo ratings yet

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0Document59 pagesAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0Committee For a Responsible Federal BudgetNo ratings yet

- Politco Fiscal Cliff Ad FinalDocument1 pagePolitco Fiscal Cliff Ad FinalCommittee For a Responsible Federal BudgetNo ratings yet

- Averting A Fiscal Crisis 0Document25 pagesAverting A Fiscal Crisis 0Committee For a Responsible Federal BudgetNo ratings yet

- CBO August 2012 Update 0Document6 pagesCBO August 2012 Update 0René Guerieri WoodNo ratings yet

- Americans Sign Debt Petition in One WeekDocument2 pagesAmericans Sign Debt Petition in One WeekCommittee For a Responsible Federal BudgetNo ratings yet

- Press Clips For Fix The Debt 8-13-2012Document7 pagesPress Clips For Fix The Debt 8-13-2012Committee For a Responsible Federal BudgetNo ratings yet

- Dont Put The Extenders On The Nations Credit CardDocument1 pageDont Put The Extenders On The Nations Credit CardCommittee For a Responsible Federal BudgetNo ratings yet

- Davis Steele Rendell Gregg Call For Debates On Debt ReductionDocument3 pagesDavis Steele Rendell Gregg Call For Debates On Debt ReductionCommittee For a Responsible Federal BudgetNo ratings yet

- CPTDocument2 pagesCPTmmaitehmdNo ratings yet

- Aurdrea Weiman Resume1 1Document1 pageAurdrea Weiman Resume1 1api-321906932No ratings yet

- Aravind Eye Care SystemDocument5 pagesAravind Eye Care SystemArpit GuptaNo ratings yet

- Writing A Fact SheetDocument4 pagesWriting A Fact SheetJan TronNo ratings yet

- Atrium Executive Summary - NHRMC RFPDocument5 pagesAtrium Executive Summary - NHRMC RFPBen SchachtmanNo ratings yet

- APN AsiaDocument8 pagesAPN AsiaJohn Mark LingconNo ratings yet

- 837 835 Institutional CompanionDocument34 pages837 835 Institutional CompanionaforararuntejNo ratings yet

- Sensitive Medical Data: Finding the Right BalanceDocument58 pagesSensitive Medical Data: Finding the Right BalanceBerrezeg MahieddineNo ratings yet

- Benchmarking Hospital Performance in HealthDocument48 pagesBenchmarking Hospital Performance in HealthCristianCantoVillanuevaNo ratings yet

- PRC 4m Pakalat Pls MSEUFDocument2 pagesPRC 4m Pakalat Pls MSEUFjewaNo ratings yet

- APTA Approved Credentials EvaluatorsDocument2 pagesAPTA Approved Credentials EvaluatorsJörn AllenNo ratings yet

- Clinical PathwayDocument28 pagesClinical Pathwayriandhani0% (1)

- Mohammadi Group Limited MGL PDFDocument39 pagesMohammadi Group Limited MGL PDFTanvir ChowdhuryNo ratings yet

- Final Output PDFDocument43 pagesFinal Output PDFApril Anne CostalesNo ratings yet

- Nueces County Hospital District Christus SpohnDocument19 pagesNueces County Hospital District Christus SpohncallertimesNo ratings yet

- Cochlear Implants Are Miraculous and Maddening - BloombergDocument6 pagesCochlear Implants Are Miraculous and Maddening - BloombergParker KohlNo ratings yet

- Procedures for Admitting, Transferring & Discharging PatientsDocument30 pagesProcedures for Admitting, Transferring & Discharging PatientsKetheesaran Lingam100% (2)

- Communityresourceguide 1Document29 pagesCommunityresourceguide 1api-376009670No ratings yet

- Test Bank Learning and Behavior Active Learning 6th EditionDocument8 pagesTest Bank Learning and Behavior Active Learning 6th EditionRichard1LauritsenNo ratings yet

- Gilmartin Et Al-2014-International Journal of Pharmacy PracticeDocument8 pagesGilmartin Et Al-2014-International Journal of Pharmacy PracticeAnusha AndyNo ratings yet

- 1224 Visual Acuity FromDocument1 page1224 Visual Acuity Fromreza khakshouriNo ratings yet

- Java Developer ProfileDocument3 pagesJava Developer ProfileKealeboga Duece ThoboloNo ratings yet

- Dr181113h CheckDocument1 pageDr181113h ChecklimskewNo ratings yet

- FrenectomiaDocument8 pagesFrenectomiaRafa LopezNo ratings yet

- Nanny AgreementDocument3 pagesNanny AgreementRocketLawyer100% (1)

- 14-Trends and Issues in NursingDocument23 pages14-Trends and Issues in NursingFrancis Emman Santiago100% (1)

- 1 - Pharmaceutical Care Practice - An OverviewDocument76 pages1 - Pharmaceutical Care Practice - An OverviewekramNo ratings yet

- HealthReformInChina PDFDocument204 pagesHealthReformInChina PDFJason LiNo ratings yet

- Benefits of Preoperative Education For Adult Elective Surgery PatientsDocument6 pagesBenefits of Preoperative Education For Adult Elective Surgery PatientschayankkuNo ratings yet

- Concierge ServiceDocument65 pagesConcierge ServiceabbsheyNo ratings yet