Professional Documents

Culture Documents

Barclays DUS Primer 3-9-2011

Uploaded by

pratikmhatre123Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Barclays DUS Primer 3-9-2011

Uploaded by

pratikmhatre123Copyright:

Available Formats

SECURITISATION RESEARCH

CMBS Strategy | 9 March 2011

DUS: A Primer

DUS bonds are mostly backed by multifamily loans originated by a network of pre-approved lenders and are underwritten to Fannie Mae (FNMA) criteria. Similar to other agency issued securities, scheduled interest and principal payments on DUS bonds are guaranteed by FNMA. DUS financing has grown in popularity in the past two years as conduits withdrew from the market following the downturn. A majority of outstanding DUS pools are, therefore, from the 2009-10 vintages. Typically, lenders share the losses if a loan defaults. This encourages better credit underwriting, leading to lower default rates compared to conduits. These loans also come with strong prepay protection, usually in the form of yield maintenance requirements. Current voluntary speeds remain below 1 CPR. DUS bonds offer comparatively high coupons with low prepay risk and mildly positive convexity due to the nature of yield maintenance penalties. Trading close to S+70, they look cheap, compared to low convexity single-family 3.5s or agency debt. Since DUS pools typically consist of a single loan, they can be used to add exposure in specific geographies. Because of their small size, DUS pools sometimes face liquidity concerns. To improve liquidity, investors can aggregate DUS pools to create Megas. This also helps in diversifying risk, with the investor less exposed to single-loan defaults.

Julia Tcherkassova +1 212 412 5977 julia.tcherkassova@barcap.com Keerthi Raghavan +1 212 412 7947 keerthi.raghavan@barcap.com www.barcap.com

PLEASE SEE ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES STARTING AFTER PAGE 9

Barclays Capital | DUS: A Primer

Figure 1: Outstanding by vintage ($bn)

30 25 20 15 10 5

Figure 2: Outstanding by prefix

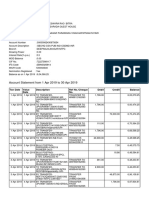

Prefix HY Type Conventional, Balloon, Actual/360, Maturity>7y Short-Term, Balloon, LevelPay; Actual/360, Maturity<7y Balloon, Level-Pay, Maturity>7y ARM, Actual/360, Maturity dates vary Subordinates, Actual/360, Maturity dates may vary. Outstanding ($bn) 47 Share 65%

HX

13%

MY HA

6 5

8% 7%

ML

3%

0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Source: FNMA, Barclays Capital

Source: FNMA, Barclays Capital

What is the DUS program?

Under the DUS (Delegated Underwriting and Servicing) Program, a network of preapproved lenders underwrites loans on multifamily properties with five plus units. There are currently 26 approved lenders (Appendix A). The loans are made according to underwriting criteria established by Fannie Mae, and are subsequently bundled into pools backed by a FNMA guaranty. While the program was initiated in 1988, securitization of DUS multifamily loans began only in 1994 and now makes up close to $70bn in outstanding balance. $45bn of this has been issued in the past few years (Figure 1). Starting in 2003, DUS issuance declined because private CMBS labels were offering better rates, and more multifamily loans made their way into CMBS conduits. With the private label conduits largely withdrawing from the market following the 2008 financial crisis, some recent multifamily originations have been diverted to the DUS channel. The rapid growth of this market during the past two years explains why this product is proving increasingly popular among various groups of investors. There is no maximum or minimum restriction on the number of loans that can be securitized into a single DUS pool. In practice, an overwhelming majority (more than 96% of 2009 vintage DUS pools) is made up of a single loan. Pool types are identified by their two letter prefix, used to identify the mortgage type. For example, HY stands for standard conventional multifamily property. As Figure 2 shows about 65% of outstanding DUS are made up of HY pools or conventional fixed rate loans with maturities greater than seven years. These pass-through pools can then be either traded independently or further aggregated into what are known as Megas. Some DUS pools are also used as collateral for structured instruments with time-tranching.

DUS collateral

A number of property categories are eligible for loans under the DUS program. These range from the conventional multifamilies found in most CMBS conduit deals, to more esoteric property types such as Rural Rental Housing (see Appendix B). That said, an overwhelming 90% of outstanding DUS loans are backed by standard multifamily collateral, with manufactured housing and seniors housing loans making up only a relatively small share of the DUS universe (Figure 3). Regarding loan terms, DUS loans can be fixed or floating, with maturities of 5, 7, or 10 years. Some fixed rate loans might have longer terms of up to 30 years (which sets them apart

9 March 2011 2

Barclays Capital | DUS: A Primer

Figure 3: Outstanding by property type

Student 1% Co-op 1% MH Senior 4% 3%

Figure 4: Conduit MF versus DUS WACs

9.0 Conduit MF 8.0 7.0 6.0 5.0 4.0 DUS 10 Yr TSY

Multifamily 91%

Source: FNMA, Barclays Capital

3.0 97 98 99 00 01 02 03 04 05 06 07 08 09 10

Source: FNMA, Intex, Barclays Capital

from the conduit loans); however, these are less common. The most popular DUS loan type is a fixed 10y balloon structure maturing in 10 years with a 9.5 year yield maintenance period (about 60% of DUS universe are composed of such loans). DUS loans are typically non-recourse and assumable. The assumption fee structure is similar to that of CMBS conduits and typically is 75-100bp. The primary difference is that while conduit multifamily loans can be modified and assumed simultaneously, DUS loans are just assumed. Some characteristics, such as property type and loan terms, might be somewhat similar; however, DUS loans can differ significantly from conduit MFs in terms of some other credit metrics. These come about primarily because of Fannie Mae underwriting guidelines, which all DUS lenders need to follow while making new loans.

Tier-based underwriting and loss sharing

The DUS program follows a three-tier credit underwriting structure, Figure 5. Tier 4 loans, for instance, with higher DSCRs and lower LTVs, will receive better interest rates than a loan that falls in Tier 2. In addition, the better (or Tier 4) underwritten loans will also typically have lower servicing and FNMA guarantee fees. In addition to the tier-based assessment, the properties are usually subjected to a number of additional tests including appraisal, environmental assessment, and a physical need assessment. Appraisals are based on USPAP standards, which may have prevented the most aggressive pro forma appraisals that were common in the conduit space. Most importantly, DUS lenders also enter into a loss-sharing arrangement with Fannie Mae on the loans they originate explaining better credit performance. Typically, one-third of the losses are borne by the lender pari passu, although some agreements could specify the lender taking the first loss piece of a defaulted loan. DUS lenders are required to maintain a certain level of capital against their Fannie Mae obligations to be able to meet the standards of loss sharing agreement, if needed. For some of the larger loans, the loss sharing provision might be waived, if the lender is considered to be too small to maintain the required reserve. In these rare instances it is our understanding that Fannie re-underwrites such loans (effectively waiving the delegated feature). As more multifamily borrowers view the possibility of refinancing their loans through the agency route, it is possible that such instances will increase in the future.

9 March 2011 3

Barclays Capital | DUS: A Primer

Figure 5: Tier-based credit underwriting

Rating Tier 2 Tier 3 Tier 4

Source: FNMA, Barclays Capital

Minimum DSCR 1.25 1.35 1.55

Maximum LTV Ratio 80 65 55

Approved DUS lenders are also entitled to service the loans they have previously originated. As such, in addition to an upfront fee at the time of origination, DUS lenders earn a running servicing strip, which is typically higher than the fees in conduit loans. Needless to say, the attractive servicing terms, along with the possibility of eventual losses, provide a strong incentive for the lenders to err on the side of caution while underwriting slightly dented collateral, and in keeping loans current. DUS originations also differ somewhat from other agency multifamily products. Loans securitized through the Freddie K series, for instance, are originated by Freddie Mac itself and do not rely on delegated lenders, as in the case of DUS. For further details on the Freddie K series, please see Agency CMBS Primer: Freddie Mac K certificates program, May 4, 2010. The tighter underwriting guidelines, coupled with the loss-sharing arrangement, has a significant effect on credit characteristics. As Figure 4 shows, DUS pass-through coupons (after deducting guarantee fees paid to FNMA) for older vintages have been lower than the net coupon for MF loans securitized in conduit trusts, signifying better collateral. This relationship broke down in the 2005-07 episode, when the conduit market grew exponentially, often under-pricing credit risk to increase volume. As Figure 1 shows, there was a concomitant decline in DUS outstanding in these vintages. Since then, however, DUS net coupons have once again dipped below what is offered through conduit execution. The conduit versus DUS divergence can also be seen in Figure 6, which shows the average loan size of outstanding loans in various vintages. As Figure 6 demonstrates, the average sizes of pre 2004-vintage MF conduit loans were roughly similar to an average DUS loan, before zooming higher in the 2005-08 episode. This was probably due to better terms (resulting from looser underwriting) offered by the conduit lenders. As conduit issuance stalled in 2009-10, larger loans have started making their way into DUS pools. Figure 6: Conduit MF versus DUS loan size ($mn)

16 14 12 10 8 6 4 2 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Source: FNMA, Intex, Barclays Capital

Figure 7: Outstanding by tier-based credit quality

90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2007

Source: FNMA, Barclays Capital

Conduit

DUS

Tier 2

Tier 3

Tier 4

2008

2009

2010

9 March 2011

Barclays Capital | DUS: A Primer

That said, there has been some tightening in credit, even for DUS pools. Figure 7 shows the relative share of different tiers in each DUS vintage; 2008 and 2009 vintages have a higher share of better loans categorized as Tier 3 and 4 (about 30-40%), compared with the 2007 vintage (20%).

Prepay protection

Most DUS loans have fairly strong prepay protection in the form of yield maintenance requirements, though defeasance provisions and lock-outs also exist to a lesser extent. The most typical multifamily pool would have a 10y loan term with a 9.5y yield maintenance period (commonly referred to as 10/9.5 pools). Under the yield maintenance provisions, a borrower who voluntarily prepays during the penalty period would need to pay an additional fee. This fee is calculated as the greater of 1% of the principal, and the present value of the future interest cash flows minus the corresponding US Treasury. For loans that prepay after the expiry of the yield maintenance period, the borrower would still need to pay a premium of 1% of the prepaid balance, up to three months prior to the maturity of the loan. A share of this prepayment fee will be kept by Fannie Mae according to a specified formula, while the rest will be passed on to the investor. However, Fannie has the right (but not the obligation) to waive this 1% prepayment penalty at their discretion. In addition to yield-maintenance provisions, defeasance and lock-outs, some loans may also have a prepayment fee option known as declining premium. Under this, the prepayment fee is based on certain percentage of unpaid balance which will decline over time. The investor will then receive a share of this premium.

The Fannie guaranty

Like other agency MBS, investors in DUS pools are guaranteed timely payments of interest and principal. This includes the monthly interest and principal and the balloon amount. On loans that have voluntarily prepaid, FNMA would pass on any prepay penalty payment collected after deducting its share of the penalty, although there is no specific guaranty on the yield maintenance payments. On loans that fall delinquent, Fannie has the option to purchase from the pool any loan that has been 120+ days in delinquency. On early pay defaults, where a loan falls delinquent within four months of the first payment date, the loan

Figure 8: Cumulative buyouts from 10/9.5 DUS pools

5.0% 4.5% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% 2005 2006 2007 2008 2009 2010 2004 2005 2006 2007 2008 2009

Figure 9: Payoffs by year from 10/9.5 DUS pools

12% 10% 8% 6% 4% 2% 0% 2003 2004 2005 2006 2007 2008 2009 2010 2003 2004 2005 2006 2007 2008 2009

Source: FNMA, Barclays Capital

Source: FNMA, Barclays Capital

9 March 2011

Barclays Capital | DUS: A Primer

could be repurchased by FNMA as soon as it is 30+ days delinquent and put back to the originator. Typically, Fannie tends to buy out loans as soon as they become eligible.

Historical performance

As we have discussed before, DUS underwriting has generally been on the conservative end of the scale, compared with conduit originations. This is borne out in the performance data released by Fannie Mae. Figure 8 looks at the cumulative balance of loans bought out of 10/9.5 multifamily pools, broken out by vintage. Expectedly, involuntary prepayments are the highest in the 2005-07 vintages, and 2007 buyouts are still trending sharply higher. It is useful to note that the higher share of buyouts comes off comparatively low issuance. Most multifamily loans in these vintages were being securitized in conduits, while some others were being held by Fannie in its portfolio. In any case, DUS buyouts are considerably lower than the 15% serious delinquency rate seen in the MF conduit space (Figure 10). Despite the uptick in delinquency buyouts, DUS loans are still performing better than their conduit counterparts by orders of magnitude.

Figure 10: Conduit MF 60+ Delinquency

18% 16% 14% 12% 10% 8% 6% 4% 2% 0% Jan-03 Oct-03 Jul-04 Apr-05 Jan-06 Oct-06 Jul-07 Apr-08 Jan-09 Oct-09 Jul-10

Source: Intex, Barclays Capital

Admittedly, this is not a strict apples-to-apples comparison. Bought-out loans would presumably include only those that are 120+days delinquent and neglect ones that are 60120 days delinquent and still in the DUS pool. This is, however, only a small factor: DUS serious delinquencies were reported at 0.6%, as of September 2010. While it is clear that DUS loans perform significantly better than MF loans in conduits, they have not been entirely immune to the downturn; note the uptick in DUS buyouts in 2009, mostly on loans from the 2006-07 vintages. Since then, however, the pace of buyouts has cooled off somewhat, analogous to the performance improvement in the conduit universe. Voluntary prepayments are very low, as we would expect, given the prepay penalty provisions embedded in DUS loans. Prepays did, however, pick up during the boom years in 2006-07, when a number of loans either refinanced into other agency pools or the private label market. Private labels, by virtue of looser underwriting, were offering comparable rates to DUS, along with the opportunity for possible cash-out refis. Since then, prepays have fallen once again to sub 1 CPR levels (Figure 9).

9 March 2011

Barclays Capital | DUS: A Primer

Multifamily Megas and ACES

As we mentioned before, DUS pools are typically made of one loan and are of rather small sizes. To increase the size of offered pools and enhance liquidity in this space, Fannie also issues Megas 1. In a DUS Mega, DUS securities with the same prefix and similar fixed rate coupon (with a 100bp range) are aggregated into larger pools. Investors can submit DUS bonds to Fannie, which will then structure the Megas in return for a transaction fee. In addition, Fannie issues multifamily DUS REMICs under the ACES program (Alternative Credit Enhancement Securities), in which principal and interest from DUS pools are structured into time-tranched sequential securities.

DUS looks cheap to comparable assets

Spreads over swaps on DUS pools have tightened to near the 70bp mark over the past month (mid 60s for the seasoned paper and low 80s for the new issue). Investors typically price these bonds to 0 CPY, owing to the 1% prepay penalty that exists even after the YM provisions have expired.

Figure 11: Spreads on comparable sectors (bp)

350 300 250 200 150 100 50 0 -50 May-07 Nov-07 May-08 Nov-08 May-09 Nov-09 May-10 Nov-10 DUS FNCL 3.5 TBA FNMA 10yr Debt

Source: FNMA, Barclays Capital

Despite the recent tightening, there are few comparable products in the market that combine the relatively high coupon the DUS provide with exceptional prepay protection. 10y agency debt trades considerably tighter, at about 10bp. Even compared with, for example, the low convexity 3.5% 30y FNMA single families, which trade at a zero volatility spread of about 40-50bp, DUS bonds look cheap. In addition, due to the nature of yield maintenance payment calculations, DUS pools are slightly positively convex. As rates dip, the present value of the excess spread between the loan coupon and the corresponding Treasury widens, increasing YM payments to the bond. DUS pools are, therefore, ideal for investors looking for stable cash flows at relatively cheap levels, compared with agency single families. CDRs on DUS pools are leveling off, and we expect to see further improvement as multifamily property financials recover. As we have pointed out in Multifamily: Bottomed in Q4, whats next?, July 26, 2010, apartment vacancies have declining since Q4 09, and asking rents have begun to climb. Also, favorable demographics, coupled with declining homeownership rates, suggest strong demand growth for apartment rentals over the next decade.

1

First MEGA pool was issued in 1996.

9 March 2011

Barclays Capital | DUS: A Primer

Apart from fundamental valuations, there are several other reasons why investors favor DUS bonds. These securities are popular with banks looking for assets that do not require excessive risk-capital. With 20% risk-weight, DUS pools are equivalent to other agency single-family products. In addition, because they usually consist of a single loan, they provide an easy method for investors to add exposure in specific geographies. This is especially useful for smaller banks that could receive tax concessions when buying local mortgage assets. The additional attractiveness of DUS certificates could be attributed to lower spread volatility (for example, at the end of 2008, conduit spreads for AAA dupers widened to S+1500 area, while DUS certificates still traded in the S+280 area) and the absence of any extension risk since Fannie guarantees the balloon payment at maturity.

Risks

The flip side is that because most DUS pools consist of only one loan, the investor takes on the risk of an idiosyncratic involuntary prepayment. This is especially important on older DUS bonds with higher WACs which trade at premium. Even if the defaulted loan resolution results in higher than par recovery, the guarantee covers only par and the trust is not entitled to get the excess proceeds. Some DUS pools may also trade wider, due to the perceived weaker collateral quality of specific originators. On more recent issuance with lower WACs, the recent sell-off in Treasuries has led to several late 2010 DUS bonds trading at a discount. Faster involuntary prepayments on these loans would be beneficial. In addition, smaller pool sizes also restrict liquidity, and a few market participants could influence pricing considerably. For instance, spreads widened in the middle of 2010 because of a few FHLBs temporarily withdrawing from the market. Since then, the investor base has widened as the market hunts for yield in a tightening environment. There is, however, very little overlap in the investor base between the conduit and the DUS universe. These risks are somewhat mitigated by investing in Megas, which are of larger size, more diversified, and less exposed to single-borrower defaults. They typically trade a few bp tighter than standard multifamily DUS pools.

9 March 2011

Barclays Capital | DUS: A Primer

Appendix A: List of DUS Lenders

DUS Lenders

Alliant Capital Finance, LLC AmeriSphere Multifamily Finance, LLC Arbor Commercial Funding, LLC Beech Street Capital, LLC Berkadia Commercial Mortgage LLC CBRE Multifamily Capital, Inc Centerline Mortgage Capital, Inc. Citibank, N.A. CWCapital LLC Deutsche Bank Berkshire Mortgage, Inc (DB Mortgage Services, LLC) Dougherty Mortgage, LLC Grandbridge Real Estate Capital, LLC

Source: FNMA

Greystone Servicing Corporation, Inc. HomeStreet Capital Corporation HSBC Bank USA, N.A. JP Morgan Chase Bank, N.A. KeyCorp Real Estate Capital Markets, Inc M&T Realty Capital Corporation Oak Grove Commercial Mortgage, LLC Pillar Multifamily, LLC PNC Multifamily Mortgage, LLC Prudential Multifamily Mortgage, Inc. Red Mortgage Capital, LLC Walker & Dunlop, LLC Wells Fargo Bank, N.A.

Appendix B: Types of multifamily mortgaged properties eligible for DUS/MBS

Property Type Description

Standard Conventional A multifamily loan secured by a residential property composed of five or more dwelling units and in which generally no Multifamily more than 20 percent of the net rentable area is rented to, or to be rented to non-residential tenants. Multifamily Affordable Housing and LowIncome Housing Tax Credit Seniors Housing A multifamily loan on a mortgaged property encumbered by a regulatory agreement or recorded restriction that limits rents, imposes income restrictions on tenants or places other restrictions on the use of the property. A multifamily loan secured by a mortgaged property that is intended to be used for elderly residents for whom the owner or operator provides special services that are typically associated with either independent living or assisted living. Some Alzheimers and skilled nursing capabilities are permitted.

A multifamily loan secured by a residential development that consists of sites for manufactured homes and includes Manufactured Housing utilities, roads and other infrastructure. In some cases, landscaping and various other amenities such as a clubhouse, Community swimming pool, and tennis and/or sports courts are also included. Cooperative Blanket Student Housing/ Dedicated Student Housing Military Housing A multifamily loan made to a cooperative housing corporation and secured by a first or subordinate lien on a cooperative multifamily housing project that contains five or more units. Multifamily loans secured by multifamily properties in which college or graduate students make up a significant portion of the tenants. A multifamily loan secured by a multifamily property in which more than 20% of the units are occupied by persons serving in or employed by the military or which is located in an area where military and military-related employment accounts for 20% or more of the local employment base. A multifamily loan secured by an affordable multifamily property located within specified rural areas designated by the Rural Rental Housing Guaranteed Loan Program of the USDA. The USDA guarantees up to 90% of any loss incurred upon liquidation of loans it has approved, provided that the loan was underwritten and serviced in accordance with the USDA requirements.

Rural Rental Housing

Source: FNMA

9 March 2011

Analyst Certification(s) We, Julia Tcherkassova and Keerthi Raghavan, hereby certify (1) that the views expressed in this research report accurately reflect our personal views about any or all of the subject securities or issuers referred to in this research report and (2) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this research report. Important Disclosures For current important disclosures regarding companies that are the subject of this research report, please send a written request to: Barclays Capital Research Compliance, 745 Seventh Avenue, 17th Floor, New York, NY 10019 or refer to https://ecommerce.barcap.com/research/cgibin/all/disclosuresSearch.pl or call 212-526-1072. Barclays Capital does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that Barclays Capital may have a conflict of interest that could affect the objectivity of this report. Any reference to Barclays Capital includes its affiliates. Barclays Capital and/or an affiliate thereof (the "firm") regularly trades, generally deals as principal and generally provides liquidity (as market maker or otherwise) in the debt securities that are the subject of this research report (and related derivatives thereof). The firm's proprietary trading accounts may have either a long and / or short position in such securities and / or derivative instruments, which may pose a conflict with the interests of investing customers. Where permitted and subject to appropriate information barrier restrictions, the firm's fixed income research analysts regularly interact with its trading desk personnel to determine current prices of fixed income securities. The firm's fixed income research analyst(s) receive compensation based on various factors including, but not limited to, the quality of their work, the overall performance of the firm (including the profitability of the investment banking department), the profitability and revenues of the Fixed Income Division and the outstanding principal amount and trading value of, the profitability of, and the potential interest of the firms investing clients in research with respect to, the asset class covered by the analyst. To the extent that any historical pricing information was obtained from Barclays Capital trading desks, the firm makes no representation that it is accurate or complete. All levels, prices and spreads are historical and do not represent current market levels, prices or spreads, some or all of which may have changed since the publication of this document. Barclays Capital produces a variety of research products including, but not limited to, fundamental analysis, equity-linked analysis, quantitative analysis, and trade ideas. Recommendations contained in one type of research product may differ from recommendations contained in other types of research products, whether as a result of differing time horizons, methodologies, or otherwise.

This publication has been prepared by Barclays Capital, the investment banking division of Barclays Bank PLC, and/or one or more of its affiliates as provided below. It is provided to our clients for information purposes only, and Barclays Capital makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included in this publication. Barclays Capital will not treat unauthorized recipients of this report as its clients. Prices shown are indicative and Barclays Capital is not offering to buy or sell or soliciting offers to buy or sell any financial instrument. Without limiting any of the foregoing and to the extent permitted by law, in no event shall Barclays Capital, nor any affiliate, nor any of their respective officers, directors, partners, or employees have any liability for (a) any special, punitive, indirect, or consequential damages; or (b) any lost profits, lost revenue, loss of anticipated savings or loss of opportunity or other financial loss, even if notified of the possibility of such damages, arising from any use of this publication or its contents. Other than disclosures relating to Barclays Capital, the information contained in this publication has been obtained from sources that Barclays Capital believes to be reliable, but Barclays Capital does not represent or warrant that it is accurate or complete. The views in this publication are those of Barclays Capital and are subject to change, and Barclays Capital has no obligation to update its opinions or the information in this publication. The analyst recommendations in this publication reflect solely and exclusively those of the author(s), and such opinions were prepared independently of any other interests, including those of Barclays Capital and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Barclays Capital recommends that investors independently evaluate each issuer, security or instrument discussed herein and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results. This communication is being made available in the UK and Europe primarily to persons who are investment professionals as that term is defined in Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion Order) 2005. It is directed at, and therefore should only be relied upon by, persons who have professional experience in matters relating to investments. The investments to which it relates are available only to such persons and will be entered into only with such persons. Barclays Capital is authorized and regulated by the Financial Services Authority ('FSA') and member of the London Stock Exchange. Barclays Capital Inc., U.S. registered broker/dealer and member of FINRA (www.finra.org), is distributing this material in the United States and, in connection therewith accepts responsibility for its contents. Any U.S. person wishing to effect a transaction in any security discussed herein should do so only by contacting a representative of Barclays Capital Inc. in the U.S. at 745 Seventh Avenue, New York, New York 10019. Non-U.S. persons should contact and execute transactions through a Barclays Bank PLC branch or affiliate in their home jurisdiction unless local regulations permit otherwise. This material is distributed in Canada by Barclays Capital Canada Inc., a registered investment dealer and member of IIROC (www.iiroc.ca). Subject to the conditions of this publication as set out above, Absa Capital, the Investment Banking Division of Absa Bank Limited, an authorised financial services provider (Registration No.: 1986/004794/06), is distributing this material in South Africa. Absa Bank Limited is regulated by the South African Reserve Bank. This publication is not, nor is it intended to be, advice as defined and/or contemplated in the (South African) Financial Advisory and Intermediary Services Act, 37 of 2002, or any other financial, investment, trading, tax, legal, accounting, retirement, actuarial or other professional advice or service whatsoever. Any South African person or entity wishing to effect a transaction in any security discussed herein should do so only by contacting a representative of Absa Capital in South Africa, 15 Alice Lane, Sandton, Johannesburg, Gauteng 2196. Absa Capital is an affiliate of Barclays Capital. In Japan, foreign exchange research reports are prepared and distributed by Barclays Bank PLC Tokyo Branch. Other research reports are distributed to institutional investors in Japan by Barclays Capital Japan Limited. Barclays Capital Japan Limited is a joint-stock company incorporated in Japan with registered office of 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131, Japan. It is a subsidiary of Barclays Bank PLC and a registered financial instruments firm regulated by the Financial Services Agency of Japan. Registered Number: Kanto Zaimukyokucho (kinsho) No. 143. Barclays Bank PLC, Hong Kong Branch is distributing this material in Hong Kong as an authorised institution regulated by the Hong Kong Monetary Authority. Registered Office: 41/F, Cheung Kong Center, 2 Queen's Road Central, Hong Kong. Barclays Bank PLC Frankfurt Branch distributes this material in Germany under the supervision of Bundesanstalt fr Finanzdienstleistungsaufsicht (BaFin). This material is distributed in Malaysia by Barclays Capital Markets Malaysia Sdn Bhd. This material is distributed in Brazil by Banco Barclays S.A. Barclays Bank PLC in the Dubai International Financial Centre (Registered No. 0060) is regulated by the Dubai Financial Services Authority (DFSA). Barclays Bank PLC-DIFC Branch, may only undertake the financial services activities that fall within the scope of its existing DFSA licence. Barclays Bank PLC in the UAE is regulated by the Central Bank of the UAE and is licensed to conduct business activities as a branch of a commercial bank incorporated outside the UAE in Dubai (Licence No.: 13/1844/2008, Registered Office: Building No. 6, Burj Dubai Business Hub, Sheikh Zayed Road, Dubai City) and Abu Dhabi (Licence No.: 13/952/2008, Registered Office: Al Jazira Towers, Hamdan Street, PO Box 2734, Abu Dhabi). Barclays Bank PLC in the Qatar Financial Centre (Registered No. 00018) is authorised by the Qatar Financial Centre Regulatory Authority (QFCRA). Barclays Bank PLC-QFC Branch may only undertake the regulated activities that fall within the scope of its existing QFCRA licence. Principal place of business in Qatar: Qatar Financial Centre, Office 1002, 10th Floor, QFC Tower, Diplomatic Area, West Bay, PO Box 15891, Doha, Qatar. This material is distributed in Dubai, the UAE and Qatar by Barclays Bank PLC. Related financial products or services are only available to Professional Clients as defined by the DFSA, and Business Customers as defined by the QFCRA. This material is distributed in Saudi Arabia by Barclays Saudi Arabia ('BSA'). It is not the intention of the Publication to be used or deemed as recommendation, option or advice for any action (s) that may take place in future. Barclays Saudi Arabia is a Closed Joint Stock Company, (CMA License No. 09141-37). Registered office Al Faisaliah Tower | Level 18 | Riyadh 11311 | Kingdom of Saudi Arabia. Authorised and regulated by the Capital Market Authority, Commercial Registration Number: 1010283024. This material is distributed in Russia by Barclays Capital, affiliated company of Barclays Bank PLC, registered and regulated in Russia by the FSFM. Broker License #177-11850-100000; Dealer License #177-11855-010000. Registered address in Russia: 125047 Moscow, 1st Tverskaya-Yamskaya str. 21. This material is distributed in India by Barclays Bank PLC, India Branch. This material is distributed in Singapore by the Singapore branch of Barclays Bank PLC, a bank licensed in Singapore by the Monetary Authority of Singapore. For matters in connection with this report, recipients in Singapore may contact the Singapore branch of Barclays Bank PLC, whose registered address is One Raffles Quay Level 28, South Tower, Singapore 048583. Barclays Bank PLC, Australia Branch (ARBN 062 449 585, AFSL 246617) is distributing this material in Australia. It is directed at 'wholesale clients' as defined by Australian Corporations Act 2001. IRS Circular 230 Prepared Materials Disclaimer: Barclays Capital and its affiliates do not provide tax advice and nothing contained herein should be construed to be tax advice. Please be advised that any discussion of U.S. tax matters contained herein (including any attachments) (i) is not intended or written to be used, and cannot be used, by you for the purpose of avoiding U.S. tax-related penalties; and (ii) was written to support the promotion or marketing of the transactions or other matters addressed herein. Accordingly, you should seek advice based on your particular circumstances from an independent tax advisor. Barclays Capital is not responsible for, and makes no warranties whatsoever as to, the content of any third-party web site accessed via a hyperlink in this publication and such information is not incorporated by reference. Copyright Barclays Bank PLC (2011). All rights reserved. No part of this publication may be reproduced in any manner without the prior written permission of Barclays Capital or any of its affiliates. Barclays Bank PLC is registered in England No. 1026167. Registered office 1 Churchill Place, London, E14 5HP. Additional information regarding this publication will be furnished upon request. US17785

You might also like

- CDOPrimerDocument40 pagesCDOPrimermerton1997XNo ratings yet

- A Deloitte & Touche LLP MBS Structuring Concepts & Techniques PrimerDocument12 pagesA Deloitte & Touche LLP MBS Structuring Concepts & Techniques PrimerPropertywizzNo ratings yet

- Vault Career Guide To Investment Management European Edition 2014 FinalDocument127 pagesVault Career Guide To Investment Management European Edition 2014 FinalJohn Chawner100% (1)

- Bank To The Future Oza549Document9 pagesBank To The Future Oza549jim borlineNo ratings yet

- CMBS AB Note ModificationsDocument24 pagesCMBS AB Note ModificationsAbhijit MannaNo ratings yet

- Cds PrimerDocument15 pagesCds PrimerJay KabNo ratings yet

- (Bank of America) Residential Mortgages - Prepayments and Prepayment ModelingDocument31 pages(Bank of America) Residential Mortgages - Prepayments and Prepayment ModelingJay KabNo ratings yet

- The Art of Credit Derivatives: Demystifying the Black SwanFrom EverandThe Art of Credit Derivatives: Demystifying the Black SwanRating: 4 out of 5 stars4/5 (1)

- CMBS Special Topic: Outlook For The CMBS Market in 2011Document26 pagesCMBS Special Topic: Outlook For The CMBS Market in 2011Yihai YuNo ratings yet

- Anatomy of Credit CPPI: Nomura Fixed Income ResearchDocument15 pagesAnatomy of Credit CPPI: Nomura Fixed Income ResearchAlviNo ratings yet

- Nomura CDS Primer 12may04Document12 pagesNomura CDS Primer 12may04Ethan Sun100% (1)

- CMS Inverse FloatersDocument8 pagesCMS Inverse FloaterszdfgbsfdzcgbvdfcNo ratings yet

- Analyzing CDS Credit Curves - A Fundamental PerspectiveDocument11 pagesAnalyzing CDS Credit Curves - A Fundamental PerspectiveMatt WallNo ratings yet

- JPM MBS Primer PDFDocument68 pagesJPM MBS Primer PDFAndy LeungNo ratings yet

- Abs Cdos - A Primer: StrategyDocument28 pagesAbs Cdos - A Primer: StrategyjigarchhatrolaNo ratings yet

- Bank of America Trust IOPO MarketDocument29 pagesBank of America Trust IOPO Marketsss1453No ratings yet

- Fixed Income Relative Value Analysis: A Practitioners Guide to the Theory, Tools, and TradesFrom EverandFixed Income Relative Value Analysis: A Practitioners Guide to the Theory, Tools, and TradesNo ratings yet

- JP Morgan Global Markets Outlook and StrategyDocument32 pagesJP Morgan Global Markets Outlook and StrategyEquity PrivateNo ratings yet

- Valuation of Inverse IOs and Other MBS DerivativesDocument12 pagesValuation of Inverse IOs and Other MBS DerivativesgoldboxNo ratings yet

- Asset Swaps: Not For Onward DistributionDocument23 pagesAsset Swaps: Not For Onward Distributionjohan oldmanNo ratings yet

- Local Volatility SurfaceDocument33 pagesLocal Volatility SurfaceNikhil AroraNo ratings yet

- AGICL AXIS BANK Statement MO NOV 2016 PDFDocument4 pagesAGICL AXIS BANK Statement MO NOV 2016 PDFJogodish BainNo ratings yet

- MBS Basics: Nomura Fixed Income ResearchDocument31 pagesMBS Basics: Nomura Fixed Income ResearchanuragNo ratings yet

- An Options Approach To Commercial Mortgage and CMBS Valuation and Risk AnalysisDocument24 pagesAn Options Approach To Commercial Mortgage and CMBS Valuation and Risk AnalysisCameronNo ratings yet

- Modern credit risk management techniquesDocument5 pagesModern credit risk management techniquesmpr176No ratings yet

- 807512Document24 pages807512Shweta SrivastavaNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in Viet NamFrom EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNo ratings yet

- (Lehman) O'Kane Turnbull (2003) Valuation of CDSDocument19 pages(Lehman) O'Kane Turnbull (2003) Valuation of CDSGabriel PangNo ratings yet

- CMBS Trading - ACES IO Strategy Overview (07!19!16 Plain)Document21 pagesCMBS Trading - ACES IO Strategy Overview (07!19!16 Plain)Darren WolbergNo ratings yet

- Agencies JPMDocument18 pagesAgencies JPMbonefish212No ratings yet

- Volatility Trading InsightsDocument5 pagesVolatility Trading Insightspyrole1100% (1)

- Interest Rate Swaps Basics 1-08 USDocument6 pagesInterest Rate Swaps Basics 1-08 USbhagyashreeskNo ratings yet

- Outlook For The RMBS Market in 2007Document45 pagesOutlook For The RMBS Market in 2007Dimitri DelisNo ratings yet

- A Guide To Commercial Mortgage-Backed SecuritiesDocument50 pagesA Guide To Commercial Mortgage-Backed SecuritiesJay Kab100% (1)

- Hedging Illiquid AssetsDocument16 pagesHedging Illiquid Assetspenfoul29No ratings yet

- Yieldbook LMM Term ModelDocument20 pagesYieldbook LMM Term Modelphilline2009100% (1)

- RMBS Trading Desk Strategy Guide to IO/PO SecuritiesDocument29 pagesRMBS Trading Desk Strategy Guide to IO/PO SecuritiesDimitri DelisNo ratings yet

- RMBS Trading Desk Strategy on Agency ARM MBS PrepaymentsDocument11 pagesRMBS Trading Desk Strategy on Agency ARM MBS PrepaymentsJay KabNo ratings yet

- Ginnie Mae 2007 Bank of America PrimerDocument37 pagesGinnie Mae 2007 Bank of America PrimerJylly Jakes100% (2)

- Constructing A Liability Hedging Portfolio PDFDocument24 pagesConstructing A Liability Hedging Portfolio PDFtachyon007_mechNo ratings yet

- Exchange Rate Determination Puzzle: Long Run Behavior and Short Run DynamicsFrom EverandExchange Rate Determination Puzzle: Long Run Behavior and Short Run DynamicsNo ratings yet

- Collateralized Mortgage Obligations: An Introduction To Sequentials, Pacs, Tacs, and VadmsDocument5 pagesCollateralized Mortgage Obligations: An Introduction To Sequentials, Pacs, Tacs, and Vadmsddelis77No ratings yet

- Life Settlements and Longevity Structures: Pricing and Risk ManagementFrom EverandLife Settlements and Longevity Structures: Pricing and Risk ManagementNo ratings yet

- Bank Guaranty Agreement Allows Direct Action Against GuarantorDocument2 pagesBank Guaranty Agreement Allows Direct Action Against GuarantorTin TinNo ratings yet

- Wells Non QM PDFDocument21 pagesWells Non QM PDFsinhaaNo ratings yet

- (Bank of America) The Agency ARM MBS SectorDocument25 pages(Bank of America) The Agency ARM MBS Sector00aaNo ratings yet

- Energy Budgets at Risk (EBaR): A Risk Management Approach to Energy Purchase and Efficiency ChoicesFrom EverandEnergy Budgets at Risk (EBaR): A Risk Management Approach to Energy Purchase and Efficiency ChoicesNo ratings yet

- (Bank of America) Hybrid ARM MBS - Valuation and Risk MeasuresDocument22 pages(Bank of America) Hybrid ARM MBS - Valuation and Risk Measures00aaNo ratings yet

- 507068Document43 pages507068ab3rdNo ratings yet

- Class 23: Fixed Income, Interest Rate SwapsDocument21 pagesClass 23: Fixed Income, Interest Rate SwapsKarya BangunanNo ratings yet

- SLM-19616-B Com-Financial Markets and ServicesDocument99 pagesSLM-19616-B Com-Financial Markets and ServicesDeva T NNo ratings yet

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketFrom EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketNo ratings yet

- Letter of Guarantee by CorporateDocument6 pagesLetter of Guarantee by CorporateTira MagdNo ratings yet

- European Fixed Income Markets: Money, Bond, and Interest Rate DerivativesFrom EverandEuropean Fixed Income Markets: Money, Bond, and Interest Rate DerivativesJonathan A. BattenNo ratings yet

- Barclays Introduction To Inverse IODocument20 pagesBarclays Introduction To Inverse IOsriramkannaNo ratings yet

- Port AgentsDocument11 pagesPort AgentstbalaNo ratings yet

- Credit Risk Frontiers: Subprime Crisis, Pricing and Hedging, CVA, MBS, Ratings, and LiquidityFrom EverandCredit Risk Frontiers: Subprime Crisis, Pricing and Hedging, CVA, MBS, Ratings, and LiquidityNo ratings yet

- Interiors New HyderabadDocument12 pagesInteriors New Hyderabadrajgreat2011No ratings yet

- Wai Lee - Regimes - Nonparametric Identification and ForecastingDocument16 pagesWai Lee - Regimes - Nonparametric Identification and ForecastingramdabomNo ratings yet

- Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsFrom EverandCredit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsNo ratings yet

- 15624702052231UoGssBO9TQOUnD5 PDFDocument5 pages15624702052231UoGssBO9TQOUnD5 PDFvenkateshbitraNo ratings yet

- Ecf 320 - Money, Banking and Financial MarketsDocument22 pagesEcf 320 - Money, Banking and Financial MarketsFredrich KztizNo ratings yet

- ICICI Bank ACQUISITION WITH BANK OF RAJASTHANDocument6 pagesICICI Bank ACQUISITION WITH BANK OF RAJASTHANPrayagraj PradhanNo ratings yet

- Securities and Exchange Commission (SEC) by Towhidul AlamDocument11 pagesSecurities and Exchange Commission (SEC) by Towhidul AlamTowhidul Alam Pavel0% (1)

- SSB Online Extension-RKUM11407230018Document1 pageSSB Online Extension-RKUM11407230018simphiwe matheNo ratings yet

- Forward Rate CalculationDocument128 pagesForward Rate CalculationalexNo ratings yet

- CASE: Financial Services in IndiaDocument8 pagesCASE: Financial Services in IndiaANCHAL SINGHNo ratings yet

- How To Set Up Intercompany Balancing Rules For Bank Account TransfersDocument9 pagesHow To Set Up Intercompany Balancing Rules For Bank Account TransfersflavioNo ratings yet

- Apply for TAN number onlineDocument1 pageApply for TAN number onlineNIKUL DARJINo ratings yet

- Fixed and Floating Exchange RatesDocument22 pagesFixed and Floating Exchange Ratesmeghasingh_09No ratings yet

- Journal and ledger entries for multiple accounting transactionsDocument5 pagesJournal and ledger entries for multiple accounting transactionsAdil Khan LodhiNo ratings yet

- EFPE 2002: Private Equity InvestmentsDocument19 pagesEFPE 2002: Private Equity InvestmentsKARTHIK145No ratings yet

- CFG Accounting and Finance Considerations PWC Winter 2014Document39 pagesCFG Accounting and Finance Considerations PWC Winter 2014timevalueNo ratings yet

- Forward RatesDocument2 pagesForward RatesTiso Blackstar GroupNo ratings yet

- Akshay Singh NagarkotiDocument105 pagesAkshay Singh NagarkotiAkshay SinghNo ratings yet

- Sol. Man. - Chapter 19 - Borrowing Costs - Ia Part 1B 1Document7 pagesSol. Man. - Chapter 19 - Borrowing Costs - Ia Part 1B 1Rezzan Joy Camara Mejia100% (2)

- SW 02Document2 pagesSW 02Deepak KrishnanNo ratings yet

- Bicycle Sharing On Rental Basis-06-06-18 PDFDocument45 pagesBicycle Sharing On Rental Basis-06-06-18 PDFRavi ShuklaNo ratings yet

- ContractDocument1 pageContractAbdulla CharyyevNo ratings yet

- Retail Banking Products and ServicesDocument8 pagesRetail Banking Products and ServicesankitasankitaNo ratings yet

- CXC It Sba 2015Document6 pagesCXC It Sba 2015Wayne WrightNo ratings yet

- Nifty Day Trader March 28, 2019Document7 pagesNifty Day Trader March 28, 2019RogerNo ratings yet