Professional Documents

Culture Documents

Maryland Corporation Name Reservation

Uploaded by

RocketLawyerCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Maryland Corporation Name Reservation

Uploaded by

RocketLawyerCopyright:

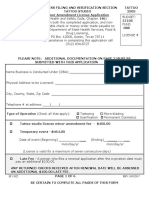

State of Maryland

Department of Assessments and Taxation

Charter Division

TRADE NAME APPLICATION

NON EXPEDITED FEE: $25.00 EXPEDITED FEE: ADDITIONAL $50.00 | TOTAL EXPEDITED SERVICE: $75.00

(Make checks payable to Department of Assessments and Taxation)

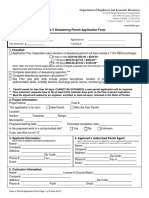

1) TRADE NAME: (Only one trade name may appear on this line) _______________________________________________________________________________________ _______________________________________________________________________________________ 2) STREET ADDRESS(ES) WHERE NAME IS USED: ______________________________________ _______________________________________________________________________________________ CITY: _________________________ STATE: ___________________________ ZIP: _______________

Post office box number is only accepted when part of the physical address.

3) FULL LEGAL NAME OF OWNER OF BUSINESS OR INDIVIDUAL USING THE TRADE NAME: _____________________________________________________________________________________

If more than one owner, attach an additional sheet listing each owner with his/her address. Be sure each owner signs this form.

4) If the owner is an individual or general partnership, do they have a personal property account (an L number)? Circle one: YES NO IF YES, WHAT IS THAT NUMBER? ____ ____ ____ ____ ____ ____ ____ ____ IF NO, see item 4 of the Trade Name Application Instructions. 5) ADDRESS OF OWNER: ____________________________________________________________________ _____________________________________________________________________________________________

CITY: _________________________ STATE: ___________________________ ZIP: _______________

Post office box number is only accepted when part of the physical address.

6) DESCRIPTION OF BUSINESS: ________________________________________________________________ _____________________________________________________________________________________________ _____________________________________________________________________________________________

I affirm and acknowledge under penalties of perjury that the foregoing is true and correct to the best of my knowledge. _________________________________________

SIGNATURE OF OWNER (AUTHORIZED TITLE)

_________________________________________

SIGNATURE OF OWNER (AUTHORIZED TITLE)

_________________________________________

SIGNATURE OF OWNER (AUTHORIZED TITLE)

_________________________________________

SIGNATURE OF OWNER (AUTHORIZED TITLE)

Room 80130l West Preston Street-Baltimore, Maryland 21201 Phone: (410) 767-1350 - Fax: (410) 333-7097 TTY Users call Maryland Relay 1-800-735-2258 Toll Free in MD: 1-888-246-5941 website: http://www.dat.state.md.us

rev. 6/11

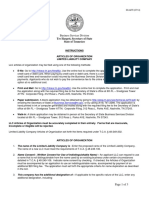

TRADE NAME APPLICATION INSTRUCTIONS

General Information

1. The fee is $25.00. Checks should be payable to: DEPARTMENT OF ASSESSMENTS AND TAXATION Filings submitted in person at the Charter Division office and processed on a while-you-wait basis, as well as filings by fax are subject to an additional $50.00 surcharge for Expedited Service. Visit our web page to view our fee schedule and a list of all service fees at http://www.dat.state.md.us/sdatweb/fees.html. Mail the completed form and check to: Charter Division Department of Assessments and Taxation 301 W. Preston Street, Room 801 Baltimore, Maryland 21201 2. Walk-in hours are 8:30 a.m. to 4:30 p.m. For same day service fees must be paid by check, cash or money order. 3. For expedited faxes, attach a separate completed cover sheet with return mailing address, telephone number, fax number, MasterCard or Visa information, cardholders signature and credit card expiration date with the application and fax to 410-333-7097. Do not put credit card information on the trade name application. 4. Trade name applications must be signed to be accepted. 5. If the name is available and all items on the form are completed, SDAT will accept the filing for record and an acknowledgement, with the filing date will be sent to the Address of Owner (unless otherwise stated), ordinarily within 6-8 weeks of acceptance. 6. This filing is effective for five years from the date of acceptance by SDAT. During the last six months of the period the filing may be renewed for an additional five years. If not renewed, the Department will forfeit the trade name and a new application must be filed. NOTICE: Acceptance of a trade name application does not confer on the owner any greater right to use the name than he otherwise already has. The Department checks the name only against other trade names filed with this Department. Federal trademarks, State service marks, records in other states and trade names are NOT meant to reserve the name for its owners, to act as a trademark filing or to confer on the owner any greater right to the name than he already possesses. For further information, contact your lawyer, accountant or financial advisor.

HOW TO COMPLETE TRADE NAME APPLICATION

All blanks on the form must be typed or printed legibly, with black ink, with an original signature (no stamps, Xerox or carbon copy).

Numbers correspond to item numbers on the trade name application: 1. TRADE NAME Only one trade name may appear on this line. To file more than one trade name, complete a separate application for each and send separate checks. NO trade name may contact a term that implies it is a type of entity that it is not (i.e., if the owner is an individual, Inc. cannot be in the trade name). Check the name on the business data search section of our web site www.dat.state.md.us. 2. STREET ADDRESS (ES) WHERE NAME IS USED List the full address, including street address, city, state and zip code. Post office box number is only accepted when part of the physical address. Out-of-state addresses are acceptable. 3. FULL NAME OF LEGAL ENTITY OR INDIVIDUAL USING THE TRADE NAME Legal entities may be owners of the trade name. If the legal entity is the owner the legal entity must be registered with MD Dept of Assessments and Taxation. If more than one owner, attach an additional sheet listing each owner with his/her address. Be sure each owner signs this form. 4. UNINCORPORATED ACCOUNT (answer YES or NO). If yes, indicate unincorporated account number. Note: All Unincorporated businesses that own or lease personal property (furniture, fixtures, tools, machinery, equipment, etc.) or anticipate owning or leasing personal property in the future, or need a business license must file an annual personal property return with this Department. Registration applications can be obtained by contacting your local Assessment office or by calling (410) 767-4991. 5. ADDRESS OF OWNER List the full address including street address, city, state and zip code. Post office box number is only accepted when a part of the physical address. Attach an additional sheet for all owners addresses, if needed. 6. DESCRIPTION OF BUSINESS State the nature of business. 7. SIGNATURE Each person listed as an owner must sign. If a legal entity is the owner of the trade name, the person who signs for the entity must list his/her title.

rev. 9/10

You might also like

- Maryland Articles of OrganizationDocument4 pagesMaryland Articles of OrganizationhowtoformanllcNo ratings yet

- Maryland Articles of IncorporationDocument3 pagesMaryland Articles of IncorporationRocketLawyerNo ratings yet

- Cra (2) DddaDocument14 pagesCra (2) DddadulmasterNo ratings yet

- Municipal and Law Enforcement Title and Registration PacketDocument10 pagesMunicipal and Law Enforcement Title and Registration PacketMusicDramaMamaNo ratings yet

- Form R-1 - VA Department of Taxation Business Registration ApplicationDocument4 pagesForm R-1 - VA Department of Taxation Business Registration ApplicationRichie DonaldsonNo ratings yet

- DB A InstructionsDocument1 pageDB A Instructionsbanala.kalyanNo ratings yet

- Husky 2015Document12 pagesHusky 2015sonicbooahxxxNo ratings yet

- 2013 SBS Business AppDocument2 pages2013 SBS Business AppJose Miguel AlegriaNo ratings yet

- Certificate of Approval License ApplicationDocument3 pagesCertificate of Approval License ApplicationMark ReinhardtNo ratings yet

- Inf FormDocument15 pagesInf Formxanixe2435No ratings yet

- Food Truck in Miami, Florida: 10 Licenses RequiredDocument95 pagesFood Truck in Miami, Florida: 10 Licenses RequiredalejandroNo ratings yet

- IA 843 Claim For Refund: Sales, Use, Excise, and Local Option TaxDocument2 pagesIA 843 Claim For Refund: Sales, Use, Excise, and Local Option TaxbolinagNo ratings yet

- BUSLIC Business Licence FormDocument10 pagesBUSLIC Business Licence Formcrew242No ratings yet

- Articles of Incorporation For A Close Corporation: FirstDocument3 pagesArticles of Incorporation For A Close Corporation: Firstdaniel besina jrNo ratings yet

- Used Dealer or Dealer Wholesale Only Application Checklist: InstructionsDocument14 pagesUsed Dealer or Dealer Wholesale Only Application Checklist: Instructionssara rudd100% (1)

- Direct Deposit FormDocument3 pagesDirect Deposit FormRabindra ShakyaNo ratings yet

- (License Is Valid For A Maximum of Seven Consecutive Days) : EF 13022 REV 11/03/2017Document6 pages(License Is Valid For A Maximum of Seven Consecutive Days) : EF 13022 REV 11/03/2017Christiam ChacNo ratings yet

- Washington Business License ApplicationDocument4 pagesWashington Business License ApplicationGreenpoint Insurance ColoradoNo ratings yet

- California excise tax permit application guideDocument8 pagesCalifornia excise tax permit application guideAnonymous UUUcrNNo ratings yet

- Articles of Incorporation For A Close CorporationDocument4 pagesArticles of Incorporation For A Close Corporationlea_pedro50% (2)

- DOF Form 91Document2 pagesDOF Form 91ARNOLD CABRALNo ratings yet

- Class-5 Permit Form For RCRCDocument6 pagesClass-5 Permit Form For RCRCayaz hasanNo ratings yet

- Idaho LLC Certificate of OrganizationDocument2 pagesIdaho LLC Certificate of OrganizationRocketLawyerNo ratings yet

- Credit Application FormDocument1 pageCredit Application FormGreg RomeroNo ratings yet

- Honda Cars, Rizal: Credit Application For Auto FinancingDocument13 pagesHonda Cars, Rizal: Credit Application For Auto FinancingalbertfrancoNo ratings yet

- Maryland Car Dealer License ApplicationDocument16 pagesMaryland Car Dealer License ApplicationBuySurety.comNo ratings yet

- 197 - Excess Contribution and Deposit Correcti..Document1 page197 - Excess Contribution and Deposit Correcti..tdrkNo ratings yet

- Visitor Permit Application FormDocument2 pagesVisitor Permit Application FormJames GiddingsNo ratings yet

- Cover Sheet: Print Form Clear FormDocument1 pageCover Sheet: Print Form Clear FormIshak AnsarNo ratings yet

- Tre Hargett, Secretary of State State of Tennessee: Business Services DivisionDocument5 pagesTre Hargett, Secretary of State State of Tennessee: Business Services DivisionnowayNo ratings yet

- Candidate Info BulletinDocument39 pagesCandidate Info BulletinMelynda Majors SDACNo ratings yet

- CSP Vendor Maintenance FormDocument4 pagesCSP Vendor Maintenance FormKurt FinkNo ratings yet

- Mailing Address ChangeDocument1 pageMailing Address ChangeDave RodriguezNo ratings yet

- Alabama Certificate of FormationDocument4 pagesAlabama Certificate of FormationFindLegalFormsNo ratings yet

- Dispute To Creditor For Charge OffDocument4 pagesDispute To Creditor For Charge Offrodney75% (20)

- Truist Ach FormDocument1 pageTruist Ach FormhugstinsNo ratings yet

- Taxi Franchise Application FormDocument9 pagesTaxi Franchise Application FormMETANOIANo ratings yet

- BusinesslicenseappDocument2 pagesBusinesslicenseappapi-253134164No ratings yet

- New Hampshire LLC Certificate of FormationDocument5 pagesNew Hampshire LLC Certificate of FormationRocketLawyerNo ratings yet

- Montana LLC Reservation of NameDocument3 pagesMontana LLC Reservation of NameRocketLawyerNo ratings yet

- Power of Attorney Authorization To Disclose Tax InformationDocument4 pagesPower of Attorney Authorization To Disclose Tax InformationaghorbanzadehNo ratings yet

- CR 2 e 047Document5 pagesCR 2 e 047jessie granilNo ratings yet

- GodaddyDocument1 pageGodaddywalterdpcNo ratings yet

- TCEQ 0724 Form InstructionsDocument7 pagesTCEQ 0724 Form InstructionsJoydev GangulyNo ratings yet

- Tax Collector Hearing / Bonded Title Application FormDocument2 pagesTax Collector Hearing / Bonded Title Application Formtfour2000No ratings yet

- Annual Business Licensing GuideDocument4 pagesAnnual Business Licensing Guidematt5starfitnessNo ratings yet

- Vendor Registration FormDocument30 pagesVendor Registration Formaqib_luqmaan@yahoo.com0% (1)

- UFMS Vendor RequestDocument2 pagesUFMS Vendor RequestHeather ValenzuelaNo ratings yet

- Montana LLC Articles of OrgranizationDocument3 pagesMontana LLC Articles of OrgranizationRocketLawyerNo ratings yet

- Collection AgencyDocument3 pagesCollection Agencyapi-299614008No ratings yet

- How To Dispute Credit Report Errors: October 2011Document6 pagesHow To Dispute Credit Report Errors: October 2011hello98023No ratings yet

- SOS Welcome LetterDocument1 pageSOS Welcome Letteradamcash200No ratings yet

- Verification of Reported IncomeDocument3 pagesVerification of Reported IncomepdizypdizyNo ratings yet

- VoguePay 2Document3 pagesVoguePay 2islamNo ratings yet

- Cos Salonshop PDFDocument3 pagesCos Salonshop PDFRahel EbottNo ratings yet

- Credit Application Form 18Document3 pagesCredit Application Form 18Patricia GonsalesNo ratings yet

- How To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditFrom EverandHow To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Wisconsin LLC Articles of OrganizationDocument2 pagesWisconsin LLC Articles of OrganizationRocketLawyer91% (11)

- Utah Articles of IncorporationDocument1 pageUtah Articles of IncorporationRocketLawyer83% (6)

- Florida Articles of IncorporationDocument4 pagesFlorida Articles of IncorporationRocketLawyer50% (2)

- Delaware Certificate of IncorporationDocument3 pagesDelaware Certificate of IncorporationRocketLawyer100% (1)

- Colorado Articles of IncorporationDocument3 pagesColorado Articles of IncorporationRocketLawyer100% (2)

- Tennessee LLC Articles of OrganizationDocument1 pageTennessee LLC Articles of OrganizationRocketLawyerNo ratings yet

- Vermont Articles of OrganizationDocument1 pageVermont Articles of OrganizationRocketLawyerNo ratings yet

- Maine Articles of IncorporationDocument3 pagesMaine Articles of IncorporationRocketLawyer100% (1)

- Delaware Certificate of IncorporationDocument3 pagesDelaware Certificate of IncorporationRocketLawyer100% (1)

- Utah LLC Articles of OrganizationDocument1 pageUtah LLC Articles of OrganizationRocketLawyer100% (1)

- Kentucky Articles of IncorporationDocument2 pagesKentucky Articles of IncorporationRocketLawyerNo ratings yet

- Colorado LLC Articles of OrganizationDocument3 pagesColorado LLC Articles of OrganizationRocketLawyer100% (1)

- Ohio Articles of IncorporationDocument6 pagesOhio Articles of IncorporationRocketLawyerNo ratings yet

- Texas LLC Certificate of FormationDocument6 pagesTexas LLC Certificate of FormationRocketLawyer100% (5)

- Arizona Articles of IncorporationDocument5 pagesArizona Articles of IncorporationRocketLawyer100% (2)

- New York Articles of IncorporationDocument2 pagesNew York Articles of IncorporationRocketLawyer100% (1)

- Alabama Certificate of FormationDocument4 pagesAlabama Certificate of FormationhowtoformanllcNo ratings yet

- West Virginia Articles of IncorporationDocument1 pageWest Virginia Articles of IncorporationRocketLawyerNo ratings yet

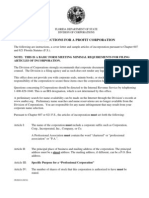

- Washington Application To Form A Profit CorporationDocument3 pagesWashington Application To Form A Profit CorporationRocketLawyer100% (2)

- New Hampshire LLC Certificate of FormationDocument5 pagesNew Hampshire LLC Certificate of FormationRocketLawyerNo ratings yet

- Minnesota Articles of IncorporationDocument3 pagesMinnesota Articles of IncorporationRocketLawyer0% (1)

- South Carolina Articles of OrganizationDocument3 pagesSouth Carolina Articles of OrganizationhowtoformanllcNo ratings yet

- Kentucky LLC Articles of OrganizationDocument2 pagesKentucky LLC Articles of OrganizationRocketLawyer100% (2)

- Michigan LLC Articles of OrganizationDocument3 pagesMichigan LLC Articles of OrganizationRocketLawyer100% (2)

- South Carolina Articles of IncorporationDocument3 pagesSouth Carolina Articles of IncorporationRocketLawyerNo ratings yet

- New Mexico LLC Articles of OrganizationDocument4 pagesNew Mexico LLC Articles of OrganizationRocketLawyer100% (1)

- South Dakota Articles of OrganizationDocument3 pagesSouth Dakota Articles of OrganizationhowtoformanllcNo ratings yet

- Massachusetts Articles of OrganizationDocument3 pagesMassachusetts Articles of OrganizationhowtoformanllcNo ratings yet

- Wyoming Articles of OrganizationDocument3 pagesWyoming Articles of OrganizationhowtoformanllcNo ratings yet

- Arkansas Articles of IncorporationDocument2 pagesArkansas Articles of IncorporationRocketLawyer100% (1)

- Restructuring Egypt's Railways - Augst 05 PDFDocument28 pagesRestructuring Egypt's Railways - Augst 05 PDFMahmoud Abo-hashemNo ratings yet

- Furnace ITV Color Camera: Series FK-CF-3712Document2 pagesFurnace ITV Color Camera: Series FK-CF-3712Italo Rodrigues100% (1)

- Unit 1 - Introduction To BankingDocument17 pagesUnit 1 - Introduction To Bankingc08No ratings yet

- Give Five Examples Each of Nature Having Reflection Symmetry and Radial Symmetry Reflection Symmetry Radial Symmetry Butterfly StarfishDocument12 pagesGive Five Examples Each of Nature Having Reflection Symmetry and Radial Symmetry Reflection Symmetry Radial Symmetry Butterfly StarfishANNA MARY GINTORONo ratings yet

- PharmacologyAnesthesiology RevalidaDocument166 pagesPharmacologyAnesthesiology RevalidaKENT DANIEL SEGUBIENSE100% (1)

- Rheology of Polymer BlendsDocument10 pagesRheology of Polymer Blendsalireza198No ratings yet

- Development of Rsto-01 For Designing The Asphalt Pavements in Usa and Compare With Aashto 1993Document14 pagesDevelopment of Rsto-01 For Designing The Asphalt Pavements in Usa and Compare With Aashto 1993pghasaeiNo ratings yet

- Micropolar Fluid Flow Near The Stagnation On A Vertical Plate With Prescribed Wall Heat Flux in Presence of Magnetic FieldDocument8 pagesMicropolar Fluid Flow Near The Stagnation On A Vertical Plate With Prescribed Wall Heat Flux in Presence of Magnetic FieldIJBSS,ISSN:2319-2968No ratings yet

- Doe v. Myspace, Inc. Et Al - Document No. 37Document2 pagesDoe v. Myspace, Inc. Et Al - Document No. 37Justia.comNo ratings yet

- Key formulas for introductory statisticsDocument8 pagesKey formulas for introductory statisticsimam awaluddinNo ratings yet

- New Brunswick CDS - 2020-2021Document31 pagesNew Brunswick CDS - 2020-2021sonukakandhe007No ratings yet

- Individual Assignment ScribdDocument4 pagesIndividual Assignment ScribdDharna KachrooNo ratings yet

- Understanding Oscilloscope BasicsDocument29 pagesUnderstanding Oscilloscope BasicsRidima AhmedNo ratings yet

- Job Description Support Worker Level 1Document4 pagesJob Description Support Worker Level 1Damilola IsahNo ratings yet

- Ijimekko To Nakimushi-Kun (The Bully and The Crybaby) MangaDocument1 pageIjimekko To Nakimushi-Kun (The Bully and The Crybaby) MangaNguyễn Thị Mai Khanh - MĐC - 11A22No ratings yet

- Liber Chao (Final - Eng)Document27 pagesLiber Chao (Final - Eng)solgrae8409100% (2)

- 27 MARCH 2020: Assignment 5 Question PaperDocument4 pages27 MARCH 2020: Assignment 5 Question PaperShadreck SandweNo ratings yet

- Positioning for competitive advantageDocument9 pagesPositioning for competitive advantageOnos Bunny BenjaminNo ratings yet

- BMS Technical ManualDocument266 pagesBMS Technical Manualiago manziNo ratings yet

- The Effect of Dodd-Frank On Divorcing Citizens 1Document5 pagesThe Effect of Dodd-Frank On Divorcing Citizens 1Noel CookmanNo ratings yet

- NetsimDocument18 pagesNetsimArpitha HsNo ratings yet

- EE290 Practice 3Document4 pagesEE290 Practice 3olgaNo ratings yet

- Machine Spindle Noses: 6 Bison - Bial S. ADocument2 pagesMachine Spindle Noses: 6 Bison - Bial S. AshanehatfieldNo ratings yet

- Drafting TechnologyDocument80 pagesDrafting Technologyong0625No ratings yet

- Post Marketing SurveillanceDocument19 pagesPost Marketing SurveillanceRamanjeet SinghNo ratings yet

- Lecture 1: Newton Forward and Backward Interpolation: M R Mishra May 9, 2022Document10 pagesLecture 1: Newton Forward and Backward Interpolation: M R Mishra May 9, 2022MANAS RANJAN MISHRANo ratings yet

- Create a seat booking form with Google Forms, Google Sheets and Google Apps Script - Yagisanatode - AppsScriptPulseDocument3 pagesCreate a seat booking form with Google Forms, Google Sheets and Google Apps Script - Yagisanatode - AppsScriptPulsebrandy57279No ratings yet

- Miami Police File The O'Nell Case - Clemen Gina D. BDocument30 pagesMiami Police File The O'Nell Case - Clemen Gina D. Barda15biceNo ratings yet

- MSDS FluorouracilDocument3 pagesMSDS FluorouracilRita NascimentoNo ratings yet

- 14 15 XII Chem Organic ChaptDocument2 pages14 15 XII Chem Organic ChaptsubiNo ratings yet