Professional Documents

Culture Documents

Proposal Letter

Uploaded by

mail2deepak04Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proposal Letter

Uploaded by

mail2deepak04Copyright:

Available Formats

Way2Wealth today has established itself as one of Indias Premier Investments Consultancy Firms, known for making investing

simpler, more understandable and profitable for the investors. We offer a wide range of products & services viz: Equity, Derivatives, Currency Futures, Commodities Trading, IPO's, Insurance (Life/NonLife), Mutual Funds, Portfolio Management Services & Depository Services all under one roof, for the convenience and benefit of our customers. We service our customer relationships through a team of over 1000 wealth managers spread across 100 easily accessible 'Investment Outlets' in almost all major towns and cities in India.

Our Mission "To be the pre-eminent destination for personalized financial solutions helping individuals create wealth".

Our Philosophy We believe that "our knowledge combined with our investors trust and involvement will lead to the growth of wealth and make it an exciting experience Trading Products

We are members with all major national Exchanges in the country i.e. NSE, BSE, MCX as well as NCDX, in their respective segments, enabling us to offer trading in:

Equity Equity Derivatives Commodity Derivatives, and Currency Derivatives

At Way2Wealth trading goes one step beyond plain execution being backed by sound Research, specialized desks for Arbitrage and Premium Broking solutions for customer to choose from.

Trade execution is supported by in-house Depository Services to ensure smooth and speedy settlement of post-trade activities.

Account Features

Anytime, Anywhere Access! W2W Online provides you the power and convenience to trade in Equities & Derivatives anytime, anywhere. We are soon adding Commodities, Mutual Funds and IPO online. With your W2W Online account you have the flexibility to transact through the following channels: 1. 24X7 access to your online trading account at our website 2. Calling our Call n Trade desk on Toll Free No. or calling your nearest designated branch to place orders. 3. Walking in your designated branch.

PREPAID BROKRAGE

MEMBERSHIP SCHEME

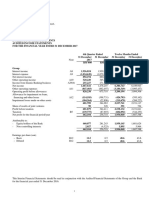

SCHEME SCHEME TYPE MEMBERSHIP COST SERVICE TAX CHEQUE AMT. A/C OPENING CHARGE DEMAT A/C AMC CHARG W2W BROSER BASE TRADING APP. BASE SOFT. DELIVERY TRADE (%) INTRA DAY (%) F&O TRADE (%) OPTION BROKERAGE PER SCRIP RUBY 6month 1500 154.5 1654.5 FREE FREE FREE 750 RS. EMERALD 6month 5000 515 5515 FREE FREE FREE FREE DIMOND 6month 15000 1545 16545 FREE FREE FREE FREE SILVER ANNUAL 2500 257.5 2757.5 FREE FREE FREE 750 RS GOLD ANNUAL 10000 1030 11030 FREE FREE FREE FREE PLATINUM ANNUAL 50000 5015 55015 FREE FREE FREE FREE T LITE ANNUAL 25000 2507.50 27507.5 FREE FREE FREE FREE T ELITE ANNUAL 100000 10030 110030 FREE FREE FREE FREE

BROKRAGE

0.4 0.04 0.04 FLAT 50 RS. 5 PAISE 0.25 0.025 0.025 FLAT 45 RS 3PAISE 0.15 0.015 0.015 FLAT 30 RS. 2PAISE 0.3 0.03 0.03 FLAT 50 RS. 3PAISE 0.2 0.02 0.02 FLAT 40 RS. 2PAISE 0.1 0.01 0.01 FLAT 25 RS 1 PAISE 0.15 0.015 0.015 FLAT 30 RS. 2PAISE 0.08 0.005 0.005 FLAT 20 RS. 1 PAISE

Superior Customer Service

W2W Online customer care gives you complete assistance in account opening related to your trading, DP as well as banking accounts. Get our valued research and technical calls on your screen through the trading day. Customer Support Center accessible on Toll Free Nos. to answer your queries. Call n Trade Desk to provide additional access channel. Dedicated Relationships Managers for W2W Pro Customers.

Corporate Advisory

Way2Wealth today services over 200 SMEs and Corporates for their Treasury Management, Hedging Programs, ESOP Structuring and Employee Tax Planning. Specifically we offer following services: Treasury Management W2W advises Institutional and Wholesale investors for their investments in various asset classes to help manage their Treasuries and optimize the portfolio yields. A structured methodology is employed for assessment, portfolio modeling, performance measurement and periodic review.

Hedging in Commodities and Currencies W2W has a specialized team, with vast experience in domestic and global markets, advising corporates and SMEs in their hedging programs. We help clients roll out their hedging policies, define optimum hedge scenarios with due scenario analysis and risk controls. Our capabilities in technical analysis help in further optimizing the entry and exit points for successful implementing of hedging strategies. ESOP Planning and Advisory ESOP planning, structuring and plan execution are important tasks for corporates planning to issue ESOPs to their employees. We extend comprehensive assistance in

the entire process. Further, we also assist corporate employees in sourcing ESOP loans through our tie-ups. Tax Filing and Financial Planning to Employees Essentially an employee welfare initiative by corporate, we assist this initiative by rolling out temporary kiosks at work sites during the tax filing season. Corporate employees get spot advice and assistance in filing and submission of their Income Tax Returns through qualified chartered accounts.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Session No. 3 / Week 3: Rizal Technological UniversityDocument14 pagesSession No. 3 / Week 3: Rizal Technological UniversityShermaine CachoNo ratings yet

- Population: This Is The Required or Expected Rate of Return On XYZDocument3 pagesPopulation: This Is The Required or Expected Rate of Return On XYZArshad KhanNo ratings yet

- Ratio AnalysisDocument11 pagesRatio Analysisbhatriyan606No ratings yet

- PROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)Document2 pagesPROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)zsaw zsawNo ratings yet

- 12 Podar International School QPDocument2 pages12 Podar International School QPAkshat KhetanNo ratings yet

- LIC's Jeevan Dhara IIDocument21 pagesLIC's Jeevan Dhara IIpratikwagh112002No ratings yet

- OrderForm Pipeline-Forecaster VNDocument1 pageOrderForm Pipeline-Forecaster VNshengchanNo ratings yet

- Saktipada Kayal All SoaDocument10 pagesSaktipada Kayal All Soabmfkolkata56No ratings yet

- Transaction Monitoring Course Syllabus: AudienceDocument7 pagesTransaction Monitoring Course Syllabus: Audiencejawed travelNo ratings yet

- Retail Banking Sample Questions by Murugan-June 19 ExamsDocument193 pagesRetail Banking Sample Questions by Murugan-June 19 ExamsN Mahesh0% (1)

- Banking Corporate Global Industry PrimerDocument8 pagesBanking Corporate Global Industry PrimerJorge Daniel Aguirre PeraltaNo ratings yet

- Pay Ikeja Electric Bill Online or Via Bank in LagosDocument2 pagesPay Ikeja Electric Bill Online or Via Bank in LagosDele OlatunjiNo ratings yet

- Granzo DLL Genmathmath11 Week1Document14 pagesGranzo DLL Genmathmath11 Week1KIMBERLYN GRANZONo ratings yet

- Abm Investama TBK - Bilingual - 31 - Des - 2019 - ReleasedDocument186 pagesAbm Investama TBK - Bilingual - 31 - Des - 2019 - ReleasedJefri Formen PangaribuanNo ratings yet

- Company Analysis MarutiDocument55 pagesCompany Analysis Marutidhingaraj20051858No ratings yet

- TutorialDocument9 pagesTutorialNaailah نائلة MaudarunNo ratings yet

- RHB Bank Berhad 2017 Audited Financial StatementsDocument75 pagesRHB Bank Berhad 2017 Audited Financial StatementssulizaNo ratings yet

- INTACCDocument3 pagesINTACCRojun Kristufer MedenillaNo ratings yet

- ID CardDocument2 pagesID CardJBuck Investments67% (3)

- Introduction of Insurance of LICDocument7 pagesIntroduction of Insurance of LICKanishk Gupta100% (1)

- Reconcile bank balancesDocument7 pagesReconcile bank balancesLEEN hashemNo ratings yet

- BPI US Equity Feeder Fund Latest DisclosureDocument3 pagesBPI US Equity Feeder Fund Latest DisclosureJelor GallegoNo ratings yet

- Fundamentals of Accountancy 1Document2 pagesFundamentals of Accountancy 1Glaiza Dalayoan FloresNo ratings yet

- Problem Set ZeroBonds SOLDocument4 pagesProblem Set ZeroBonds SOLChung Chee YuenNo ratings yet

- Regulation of Payment Aggregator - Cross BorderDocument6 pagesRegulation of Payment Aggregator - Cross BorderBharath HariharanNo ratings yet

- Akun Strawberry Salon & SpaDocument2 pagesAkun Strawberry Salon & SpaAn Nisa Sakinatul AhliyahNo ratings yet

- Fees & Charges of American Express Credit CardsDocument3 pagesFees & Charges of American Express Credit CardsZakaria HaiderNo ratings yet

- Pension expense and liability calculationsDocument1 pagePension expense and liability calculationsCassyNo ratings yet

- Chapter 4: Income Statement and Related Information: Intermediate Accounting, 11th Ed. Kieso, Weygandt, and WarfieldDocument22 pagesChapter 4: Income Statement and Related Information: Intermediate Accounting, 11th Ed. Kieso, Weygandt, and WarfieldReza MaulanaNo ratings yet

- Mobile Bill DetailsDocument8 pagesMobile Bill Detailskashyap_hiraniNo ratings yet