Professional Documents

Culture Documents

INDIAN INCOME TAX RETURN FOR SALARY AND HOUSE PROPERTY INCOME

Uploaded by

Kuldeep HoodaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INDIAN INCOME TAX RETURN FOR SALARY AND HOUSE PROPERTY INCOME

Uploaded by

Kuldeep HoodaCopyright:

Available Formats

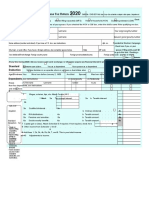

SAHAJ

FORM

INDIAN INCOME TAX RETURN

[For Individuals having Income from Salary / Pension / Income from One House Property (excluding loss brought forward from previous years) / Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses)] (Please see rule 12 of the Income-tax Rules,1962) (Also see attached instructions)

ITR-1

Assessment Year

2012-13

First Name Kuldeep Flat / Door / Building HOUSE NO. 70 Road / Street Type-IV Town/City/District Panipat Email Address kuldeephooda.20@gmail.com Income Tax Ward / Circle 1 Whether original or revised return? If revised, enter Original Ack no / Date If u/s 139(9)-defective return , enter Original Ack No If u/s 139(9)-defective return , enter Notice No Residential Status RES - Resident Area / Locallity Thermal Colony State 12-HARYANA Pin Code 132105 Middle Name Singh Last Name Hooda Status I - Individual Date of birth (DD/MM/YYYY) 08/04/1973 Sex (Select) M-Male PAN AATPH4531L

PERSONAL INFORMATION

FILING STATUS

Mobile no (Std code) Phone No Employer Category (if in 9355084855 employment) GOV Return filed under section [Pl see Form Instruction] 11-BeforeDueDt O-Original Date

If u/s 139(9)defective return , enter Notice Date Tax Refundable Tax Status 1 2 3 4 100,000 0 0 0 20,000 0 0 0 0 0 0 0 0 0 120,000 6 7 8 9 10 0 0 13 14 15 525 1,004,915 System Calculated 100,000 0 0 0 20,000 0 0 0 0 0 0 0 0 0 120,000 884,915 117,474 3,524 120,998 1,004,390

1 Income from Salary / Pension (Ensure to fill Sch TDS1) Income from one House Property 2 3 INCOME & DEDUCTIONS Income from Other Sources (Ensure to fill Sch TDS2)

4 Gross Total Income (1+2+3) 5 Deductions under Chapter VI A (Section) 5a a 80 C 5b b 80 CCC 5c(i) c(i) 80 CCD (Employers Contribution) 80 CCD (Employees / Self Employed 5c(ii) c(ii) Contribution) 5d d 80 CCF 5e e 80 D 5f f 80 DD 5g g 80 DDB 5h h 80 E 5i i 80 G 5j j 80 GG 5k k 80 GGA 5l l 80 GGC 5m m 80 U 6 6 Deductions (Total of 5a to 5m) 7 Total Income (4 - 6) 8 Tax payable on Total Income 9 Education Cess, including secondary and higher secondary cess on 8 10 Total Tax, Surcharge and Education Cess (Payable) (8 + 9) 11 11 Relief under Section 89 12 12 Relief under Section 90/91 Balance Tax Payable (10 - 11 - 12) 13 14 Total Interest u/s 234A 234B 234C 15 Total Tax and Interest Payable (13 + 14)

TAX COMPUTATION

120,998 0 120,998

23

Details of Tax Deducted at Source from SALARY [As per FORM 16 issued by Employer(s)] Tax Deduction Name of the Account Number SI.No Employer (TAN) of the Employer (3) (1) (2) RTKH01496F HPGCL 1 2 3 4

Income charg eable under the head Salaries (4) 1,004,915

Total tax Deducted (5) 120,999

(Click + to add more rows to 23) TDS on Salary above. Do not delete blank rows. ) 24 Details of Tax Deducted at Source on Income OTHER THAN SALARY [As per FORM 16 A issued by Deductor(s)] Tax Deduction Account Number (TAN) of the Deductor (2) Amount out of (6) claimed for this year (7)

SI.No

Name of the Deductor

Unique TDS Certificate No.

Deducted Year

Total tax Deducted

(1) 1 2 3 4

(3)

(4)

(5)

(6)

(Click + to add more rows ) TDS other than Salary above. Do not delete blank rows. )

25 Sl No 1 2 3 4 5 6 7 8 9 10 11

Details of Advance Tax and Self Assessment Tax Payments Date of Credit into Govt Account (DD/MM/YYYY) Serial Number of Challan

BSR Code

Amount (Rs)

12 (Click '+' to add more rows ) Tax Payments. Do not delete blank rows. )

TAXES PAID

16 Taxes Paid PLEASE NOTE THAT CALCULATED FIELDS (IN WHITE) ARE PICKED UP FROM OTHER SCHEDULES AND ARE NOT TO BE ENTERED. For ex : The taxes paid figures below will get filled up when the Schedules linked to them are filled. a Advance Tax (from item 25) b TDS (Total from item 23 + item 24) 16a 16b 0 120,999 17 18 19 120,999 0 1

REFUND

17 18 19 20

0 c Self Assessment Tax (item 25) 16c Total Taxes Paid (16a+16b+16c) Tax Payable (15-17) (if 15 is greater than 17) Refund (17-15) if 17 is greater than 15 55001529149 Enter your Bank Account number

21 Select Yes if you want your refund by direct deposit into your bank account, Select No if you want refund by Cheque 22 In case of direct deposit to your bank account give additional details 132007250 MICR Code Type of Account(As applicable) 26 Exempt income for reporting purposes only VERIFICATION KULDEEP SINGH son/daughter of HOODA I,

No

Savings

RAM TIRATH HOODA

solemnly declare that to the best of my knowledge and belief, the information given in the return thereto is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to Income-tax for the previous year relevant to the Assessment Year 2012-13 Place Date 27/07/2012 Sign here -> PANIPAT AATPH4531L PAN 27 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below: Identification No of TRP Name of TRP

28

If TRP is entitled for any reimbursement from the Government, amount thereof (to be filled by TRP)

Details of donations entitled for deduction under section 80G (PLEASE READ NOTE BELOW) Schedule 80G Donations entitled for 100% deduction without qualifying limit A Name of donee 1 2 3 4 Total 80GA 0 Adress City or Town or District State Code PinCode PAN of Donee Amount of Eligible donation Amount of Donation 0 0 0 0 0

Donations entitled for 50% deduction without qualifying limit Name of Address City or Town or State Code donee District 1 2 3 4 Total 80GB :

PinCode

PAN of Donee Amount of Eligible donation Amount of Donation 0 0 0 0 0 0

Donations entitled for 100% deduction subject to qualifying limit Name of Address City Or Town Or State Code donee District 1 2 3 4 Total 80GC :

PinCode

PAN of Donee Amount of Eligible donation Amount of Donation 0 0 0 0 0 0

Donations entitled for 50% deduction subject to qualifying limit Name of Address City Or Town Or State Code donee District 1 2 3 4 Total 80GD

PinCode

PAN of Donee Amount of Eligible donation Amount of Donation 0 0 0 0 0 0

Donations (A + B + C + D)

NOTE : (IN CASE OF DONEE FUNDS SETUP BY GOVERNMENT AS DESCRIBED IN SECTION 80G(2), PLEASE USE PAN AS "GGGGG0000G".

You might also like

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Vasanth Kumar AllaNo ratings yet

- Certificate of Title and Registration: Application ForDocument2 pagesCertificate of Title and Registration: Application ForGlendaNo ratings yet

- Exemption Certificate - SalesDocument2 pagesExemption Certificate - SalesExecutive F&ADADUNo ratings yet

- Voucher 6Document1 pageVoucher 6John Matthew SilvanoNo ratings yet

- Pran Application PDFDocument5 pagesPran Application PDFChandra Sekhar BasamNo ratings yet

- 2017 NoVo 990Document216 pages2017 NoVo 990Noam BlumNo ratings yet

- Profit or Loss From Farming: Schedule FDocument2 pagesProfit or Loss From Farming: Schedule FJacen BondsNo ratings yet

- Gene Locke Tax Return, 2006Document25 pagesGene Locke Tax Return, 2006Lee Ann O'NealNo ratings yet

- MLFA Form 990 - 2016Document25 pagesMLFA Form 990 - 2016MLFANo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyNo ratings yet

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocument2 pagesEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNo ratings yet

- 2013 AgriSafe 990Document28 pages2013 AgriSafe 990AgriSafeNo ratings yet

- 2010 Income Tax ReturnDocument2 pages2010 Income Tax ReturnCkey ArNo ratings yet

- City of Fort St. John - 2022 Annual Tax Sale ReportDocument5 pagesCity of Fort St. John - 2022 Annual Tax Sale ReportAlaskaHighwayNewsNo ratings yet

- Application for Authorization to Debit AccountDocument1 pageApplication for Authorization to Debit AccountPatrick PoculanNo ratings yet

- 8850 Wotc Tax FormDocument2 pages8850 Wotc Tax Formapi-127186411No ratings yet

- Encrypt Signedfinal-Unlocked PDFDocument2 pagesEncrypt Signedfinal-Unlocked PDFRishabh PathaniaNo ratings yet

- Foreign Status Certificate Individual Tax FormDocument1 pageForeign Status Certificate Individual Tax FormAndrew Christopher CaseNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusfelix angomasNo ratings yet

- Purchase Order 754087Document1 pagePurchase Order 754087Elmer HarrisNo ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

- Estimated Tax for IndividualsDocument12 pagesEstimated Tax for IndividualsJob SchwartzNo ratings yet

- Kashana Hafiz Mir Colony Near Petrol PUMP LILYANI 0492450277 Khalil Ahmad ShakirDocument4 pagesKashana Hafiz Mir Colony Near Petrol PUMP LILYANI 0492450277 Khalil Ahmad ShakirKhalil ShakirNo ratings yet

- 2011 Income Tax ReturnDocument4 pages2011 Income Tax Returnsalazar17No ratings yet

- 2013 Tax Return (Shep-Ty DBA Embrace)Document24 pages2013 Tax Return (Shep-Ty DBA Embrace)Game ChangerNo ratings yet

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- NCJC 561348186 - 200712 - 990Document28 pagesNCJC 561348186 - 200712 - 990A.P. DillonNo ratings yet

- Two Wheeler Insurance CertificateDocument1 pageTwo Wheeler Insurance CertificatesareenckNo ratings yet

- Lucky Tiger Casino Card Authentication: XX XXXXDocument1 pageLucky Tiger Casino Card Authentication: XX XXXXบ่จัก ดอกNo ratings yet

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDocument3 pagesTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNo ratings yet

- Wmcustomer 17188897 HU7 CustomerInvoiceDocument1 pageWmcustomer 17188897 HU7 CustomerInvoicePabitra Kumar PrustyNo ratings yet

- Individual Tax CalculationDocument11 pagesIndividual Tax CalculationSunil ChelladuraiNo ratings yet

- 0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Document1 page0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Osvaldo CalderonUACJNo ratings yet

- U.S. Departing Alien Income Tax Return: Print or TypeDocument4 pagesU.S. Departing Alien Income Tax Return: Print or TypeDavid WebbNo ratings yet

- US Internal Revenue Service: f1040nr - 2005Document5 pagesUS Internal Revenue Service: f1040nr - 2005IRSNo ratings yet

- PA Individual Income Tax Declaration for Electronic FilingDocument4 pagesPA Individual Income Tax Declaration for Electronic FilingDiana JuanNo ratings yet

- Claim Ticket Voucher: NUMBER 003306156Document1 pageClaim Ticket Voucher: NUMBER 003306156Monch SalazarNo ratings yet

- Joint Astronomy Centre - Birthday Stars - FinalDocument2 pagesJoint Astronomy Centre - Birthday Stars - Finalhail2pigdumNo ratings yet

- Neft Rtgs FormDocument1 pageNeft Rtgs FormMohit Jalan100% (1)

- January 5, 2022 Mumtaz Makda 1000 Buckshot CT Murphy, TX 75094-3616Document8 pagesJanuary 5, 2022 Mumtaz Makda 1000 Buckshot CT Murphy, TX 75094-3616Mumtaz MakdaNo ratings yet

- Customer Application FormDocument2 pagesCustomer Application FormBoopathi KalaiNo ratings yet

- Tax ReturnDocument4 pagesTax ReturncykablyatNo ratings yet

- Calculate Federal and Provincial TaxesDocument36 pagesCalculate Federal and Provincial TaxesRyan YangNo ratings yet

- Payroll taxes and deductionsDocument4 pagesPayroll taxes and deductionsJose OcandoNo ratings yet

- BPI Autodebit Arrangement FormDocument1 pageBPI Autodebit Arrangement FormKane Arvin ChingNo ratings yet

- Enroll in Auto-Debit Arrangement for Bills PaymentDocument1 pageEnroll in Auto-Debit Arrangement for Bills PaymentDiana Sia VillamorNo ratings yet

- Brooklyn Museum 2019 IRS Form 990Document64 pagesBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlNo ratings yet

- Challan PDFDocument1 pageChallan PDFashrafazmiNo ratings yet

- Default AshxDocument17 pagesDefault Ashxanon-3445500% (1)

- 2009 Income Tax ReturnDocument5 pages2009 Income Tax Returngrantj820No ratings yet

- Contract Account No: Account Name Service Address 46 13Th ST Villamor Air Base Subd Airmens Vill PasayDocument1 pageContract Account No: Account Name Service Address 46 13Th ST Villamor Air Base Subd Airmens Vill PasayAnnamae Therese MartinezNo ratings yet

- Advanced Scenario 6: Samantha Rollins (2017)Document9 pagesAdvanced Scenario 6: Samantha Rollins (2017)Center for Economic Progress0% (1)

- (Debit Mandate Form NACH/ ECS/ Direct Debit) : Request ForDocument2 pages(Debit Mandate Form NACH/ ECS/ Direct Debit) : Request Forssgentis100% (1)

- Request For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429Document2 pagesRequest For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429DrmookieNo ratings yet

- Electronic Record and Signature DisclosureDocument4 pagesElectronic Record and Signature DisclosureVhince BaltoresNo ratings yet

- Personal Details: Application No: TFS/PB/BE/ / ..Document4 pagesPersonal Details: Application No: TFS/PB/BE/ / ..Shishir SaxenaNo ratings yet

- Hillside Children's Center, New York 2014 IRS ReportDocument76 pagesHillside Children's Center, New York 2014 IRS ReportBeverly TranNo ratings yet

- Request for Taxpayer ID FormDocument4 pagesRequest for Taxpayer ID FormMichael RamirezNo ratings yet

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123No ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- Module 3 Cherry 110309Document17 pagesModule 3 Cherry 110309Krislyn Dulay LagartoNo ratings yet

- Managing Remuneration MCQDocument5 pagesManaging Remuneration MCQlol100% (1)

- JSP - How To Edit Table of Data Displayed Using JSP When Clicked On Edit ButtonDocument8 pagesJSP - How To Edit Table of Data Displayed Using JSP When Clicked On Edit Buttonrithuik1598No ratings yet

- Pharmacology of GingerDocument24 pagesPharmacology of GingerArkene LevyNo ratings yet

- Financial Management-Capital BudgetingDocument39 pagesFinancial Management-Capital BudgetingParamjit Sharma100% (53)

- Spain Usa ExtraditionDocument2 pagesSpain Usa ExtraditionAdrian BirdeaNo ratings yet

- Diagram Illustrating The Globalization Concept and ProcessDocument1 pageDiagram Illustrating The Globalization Concept and ProcessAnonymous hWHYwX6No ratings yet

- Arraignment PleaDocument4 pagesArraignment PleaJoh SuhNo ratings yet

- KAMAGONGDocument2 pagesKAMAGONGjeric plumosNo ratings yet

- Sosai Masutatsu Oyama - Founder of Kyokushin KarateDocument9 pagesSosai Masutatsu Oyama - Founder of Kyokushin KarateAdriano HernandezNo ratings yet

- Eric Bennett - Workshops of Empire - Stegner, Engle, and American Creative Writing During The Cold War (2015, University of Iowa Press) - Libgen - LiDocument231 pagesEric Bennett - Workshops of Empire - Stegner, Engle, and American Creative Writing During The Cold War (2015, University of Iowa Press) - Libgen - LiÖzge FındıkNo ratings yet

- Master ListDocument26 pagesMaster ListNikhil BansalNo ratings yet

- Grammar Level 1 2013-2014 Part 2Document54 pagesGrammar Level 1 2013-2014 Part 2Temur SaidkhodjaevNo ratings yet

- Magnetic Suspension System With Electricity Generation Ijariie5381Document11 pagesMagnetic Suspension System With Electricity Generation Ijariie5381Jahnavi ChinnuNo ratings yet

- Recommender Systems Research GuideDocument28 pagesRecommender Systems Research GuideSube Singh InsanNo ratings yet

- Ethanox 330 Antioxidant: Safety Data SheetDocument7 pagesEthanox 330 Antioxidant: Safety Data Sheetafryan azhar kurniawanNo ratings yet

- Euro Tuner 1 2008 PDFDocument2 pagesEuro Tuner 1 2008 PDFDarwinNo ratings yet

- Revision and Second Term TestDocument15 pagesRevision and Second Term TestThu HươngNo ratings yet

- Good Paper On Time SerisDocument15 pagesGood Paper On Time SerisNamdev UpadhyayNo ratings yet

- Legal Aspect of Business Course Outline (2017)Document6 pagesLegal Aspect of Business Course Outline (2017)Sulekha BhattacherjeeNo ratings yet

- Midnight HotelDocument7 pagesMidnight HotelAkpevweOghene PeaceNo ratings yet

- Rebekah Hoeger ResumeDocument1 pageRebekah Hoeger ResumerebekahhoegerNo ratings yet

- Extra Grammar Exercises (Unit 6, Page 64) : Top Notch 3, Third EditionDocument4 pagesExtra Grammar Exercises (Unit 6, Page 64) : Top Notch 3, Third EditionA2020No ratings yet

- Fitting A Logistic Curve To DataDocument12 pagesFitting A Logistic Curve To DataXiaoyan ZouNo ratings yet

- The Man of Sorrows Wednesday of Holy Week Divine IntimacyDocument5 pagesThe Man of Sorrows Wednesday of Holy Week Divine IntimacyTerri ThomasNo ratings yet

- The Ethics of Sexual Reorientation What Should Clinicians and Researchers DoDocument8 pagesThe Ethics of Sexual Reorientation What Should Clinicians and Researchers DoLanny Dwi ChandraNo ratings yet

- Postmodern Dystopian Fiction: An Analysis of Bradbury's Fahrenheit 451' Maria AnwarDocument4 pagesPostmodern Dystopian Fiction: An Analysis of Bradbury's Fahrenheit 451' Maria AnwarAbdennour MaafaNo ratings yet

- 52 Codes For Conscious Self EvolutionDocument35 pages52 Codes For Conscious Self EvolutionSorina LutasNo ratings yet

- MCQ CH 5-Electricity and Magnetism SL Level: (30 Marks)Document11 pagesMCQ CH 5-Electricity and Magnetism SL Level: (30 Marks)Hiya ShahNo ratings yet

- The Principle of Subsidiarity and Catholic Ecclesiology - ImplicatDocument218 pagesThe Principle of Subsidiarity and Catholic Ecclesiology - ImplicatJonathanKiehlNo ratings yet