Professional Documents

Culture Documents

Calpine Calc

Uploaded by

Aniket RaneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calpine Calc

Uploaded by

Aniket RaneCopyright:

Available Formats

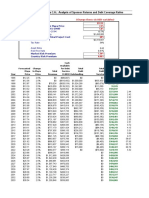

Representative Economics for a Combined-Cycle Gas Fired Power Plant

Key Assumptions Output (megawatts) Capacity Factor (availability) Electricity Price ($ per MWh) In 1999 In 2009 Fuel (Gas) Price ($ per MMBtu) Plant Heat Rate (BTU per kWh) O&M Expense ($ per MWh) Capital Costs (millions) Depreciable Life (years) Debt-to-Capitalization Ratio Debt Interest Rate Inflation Rate Tax Rate No. Of Days that plant will operate Price per Mwh of Electricity $31.00 assuming a market heat rate of 11,000 $24.00 assuming a market heat rate of 7,500 $2.20 note: 1 MMBtu = 1,000,000 Btu 7,500 note: 1000 kWh = 1 MWh $3.50 $500 note: construction period = 2 years 30 65% 7.75% 2.00% 38% 328.5 $31.0 For the Plant working in normal Conditions ($000) Capital Expenditure Production (MWh) Revenue Expense Fuel O&M Expense Depreciation Total Expense Gross Profit Interest Expense Profit before Tax Taxes @38% Net Income ROCE Net gain On production Of 1000 MW of Power 130086.00 27594.00 16666.67 174,347 70,057 25,188 44,870 17,051 27,819 6% 12,231 123581.7 24834.6 160916.3 83487.70 18,891 64597.08 24,547 40,050 11% $500,000 For the Plant Operated with aggressive methodology ($000) $375,000 7,884,000.00 244404.00 1,000 90%

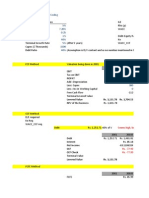

Comments & Assu

As Per aggressive strategy cost of set

7,884,000.00

244404.00

As Per aggressive strategy cost of fuel As Per aggressive strategy cost of O& 12500 Straight Line Depreciation with salvag

We assume Debt/Equity = 0.65

Comments & Assumptions

Per aggressive strategy cost of setting up plant reduce by 25%

Per aggressive strategy cost of fuel will reduce by 5% Per aggressive strategy cost of O&M will reduce by 10% aight Line Depreciation with salvage value = 0 and life = 30yr

assume Debt/Equity = 0.65

You might also like

- Pacific Spice CompanyDocument15 pagesPacific Spice CompanySubhajit MukherjeeNo ratings yet

- Kitchen & Bath Group Power Systems Interiors Group Hospitality & R. EstateDocument12 pagesKitchen & Bath Group Power Systems Interiors Group Hospitality & R. Estatemksscribd100% (2)

- Sampa Video Case ExhibitsDocument1 pageSampa Video Case ExhibitsOnal RautNo ratings yet

- Tudor Pickering Holt&CoDocument65 pagesTudor Pickering Holt&CotalentedtraderNo ratings yet

- Managing Inventories at Alko Inc: Submitted by Group 3 - ISCA - PGDM (GM)Document12 pagesManaging Inventories at Alko Inc: Submitted by Group 3 - ISCA - PGDM (GM)Akhilesh JaiswalNo ratings yet

- PZ Financial AnalysisDocument2 pagesPZ Financial AnalysisdewanibipinNo ratings yet

- Calpine Corporation: The Evolution From Project Finance To Corporate FinanceDocument20 pagesCalpine Corporation: The Evolution From Project Finance To Corporate FinanceSunil Kesarwani100% (1)

- Seagate NewDocument22 pagesSeagate NewKaran VasheeNo ratings yet

- Sampa Video IncDocument4 pagesSampa Video IncarnabpramanikNo ratings yet

- Debt Capacity ModelDocument2 pagesDebt Capacity ModelGolamMostafaNo ratings yet

- Polar SportDocument4 pagesPolar SportKinnary Kinnu0% (2)

- Group4 Calpine CaseDocument3 pagesGroup4 Calpine CaseVikas TiwariNo ratings yet

- Sampa SolnDocument13 pagesSampa SolnAnirudh KowthaNo ratings yet

- Polar SportsDocument9 pagesPolar SportsAbhishek RawatNo ratings yet

- AirThread CalcDocument15 pagesAirThread CalcSwati VermaNo ratings yet

- PPE ProblemsDocument10 pagesPPE ProblemsJhiGz Llausas de GuzmanNo ratings yet

- Msdi Alcala de Henares, Spain: Click To Edit Master Subtitle StyleDocument24 pagesMsdi Alcala de Henares, Spain: Click To Edit Master Subtitle StyleShashank Shekhar100% (1)

- Long Run and Short Run (Final)Document39 pagesLong Run and Short Run (Final)subanerjee18No ratings yet

- Corporate Valuation: Group - 2Document6 pagesCorporate Valuation: Group - 2RiturajPaulNo ratings yet

- Ocean Carriers - Case (Final)Document18 pagesOcean Carriers - Case (Final)Namit LalNo ratings yet

- Hansson PLDocument14 pagesHansson PLdenden007No ratings yet

- Petroleraa ZuataDocument9 pagesPetroleraa ZuataArka MitraNo ratings yet

- (Holy Balance Sheet) Jones Electrical DistributionDocument29 pages(Holy Balance Sheet) Jones Electrical DistributionVera Lúcia Batista SantosNo ratings yet

- California Pizza Kitchen Rev2Document7 pagesCalifornia Pizza Kitchen Rev2ahmed mahmoud100% (1)

- Power Plant Financial AnalysisDocument16 pagesPower Plant Financial AnalysisGaurav BasnyatNo ratings yet

- Sampa VideoDocument18 pagesSampa Videomilan979No ratings yet

- American Home ProductsDocument6 pagesAmerican Home Productssunitha_ratnakaram100% (1)

- Investment Analysis Polar Sports ADocument9 pagesInvestment Analysis Polar Sports AtalabreNo ratings yet

- Power Plant Economics SpreadsheetDocument2 pagesPower Plant Economics SpreadsheetCollie100% (7)

- Calpine Spreadsheet Student For DistributionDocument9 pagesCalpine Spreadsheet Student For DistributiondilipNo ratings yet

- Calpine CorporationDocument9 pagesCalpine CorporationkjhathiNo ratings yet

- Calpine Part1Document14 pagesCalpine Part1Prachi KhaitanNo ratings yet

- Calpine PDFDocument17 pagesCalpine PDFAmrita PrasadNo ratings yet

- Viden Io Calpine Corporation Detailed Case Study GR I Team 9 Calpine 2017Document9 pagesViden Io Calpine Corporation Detailed Case Study GR I Team 9 Calpine 2017rohitmahaliNo ratings yet

- Calpine Corporation: Evolution From Project To Corporate FinanceDocument2 pagesCalpine Corporation: Evolution From Project To Corporate FinanceNayana Singh0% (1)

- CALPINE CORPORATION v. ACE AMERICAN INSURANCE COMPANY DocketDocument10 pagesCALPINE CORPORATION v. ACE AMERICAN INSURANCE COMPANY DocketACELitigationWatchNo ratings yet

- Calpine Corporation: Case SummaryDocument3 pagesCalpine Corporation: Case SummaryUtkarsh TiwariNo ratings yet

- Calpine CorporationDocument18 pagesCalpine Corporationparaghpatil100% (1)

- Polar Sports X Ls StudentDocument9 pagesPolar Sports X Ls StudentBilal Ahmed Shaikh0% (1)

- Ocean - Carriers Revised 2011Document7 pagesOcean - Carriers Revised 2011Prashant MishraNo ratings yet

- MSDI Excel SheetDocument4 pagesMSDI Excel SheetSurya AduryNo ratings yet

- Riskman SectionD Group3 Case2Document8 pagesRiskman SectionD Group3 Case2subhrajyoti_mandal100% (1)

- Midland EnergyDocument9 pagesMidland EnergyPrashant MishraNo ratings yet

- Worldwide Paper Company: NWC (Ten Percent of Sales) - Change in NWC (Cash Flow)Document1 pageWorldwide Paper Company: NWC (Ten Percent of Sales) - Change in NWC (Cash Flow)KritikaPandeyNo ratings yet

- 25th June - Sampa VideoDocument6 pages25th June - Sampa VideoAmol MahajanNo ratings yet

- Student SpreadsheetDocument14 pagesStudent SpreadsheetPriyanka Agarwal0% (1)

- Answer Q 10 Pinkerton CaseDocument3 pagesAnswer Q 10 Pinkerton CaseSaswata BanerjeeNo ratings yet

- Case: Calpine Corporation: The Evolution From Project To Corporate FinanceDocument7 pagesCase: Calpine Corporation: The Evolution From Project To Corporate FinanceKshitishNo ratings yet

- OceanCarriers KenDocument24 pagesOceanCarriers KensaaaruuuNo ratings yet

- BP Amoco - A Case Study On Project FinanceDocument11 pagesBP Amoco - A Case Study On Project Financevinay5209100% (2)

- Polar SportsDocument7 pagesPolar SportsShah HussainNo ratings yet

- Sterling Student ManikDocument23 pagesSterling Student ManikManik BajajNo ratings yet

- Teuer Furniture Case AnalysisDocument3 pagesTeuer Furniture Case AnalysisPankaj Kumar0% (1)

- MegaPower Project Memo VfinalDocument5 pagesMegaPower Project Memo VfinalSandra Sayarath AndersonNo ratings yet

- Group PetrozuataDocument5 pagesGroup PetrozuataBiranchi Prasad SahooNo ratings yet

- Jet IPO ValuationDocument2 pagesJet IPO Valuationprtkshnkr50% (2)

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDocument5 pagesIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenNo ratings yet

- Bu5053 Lec3 1617Document46 pagesBu5053 Lec3 1617Enzo MichelNo ratings yet

- Test Bank For Engineering Economy 16th Edition by Sullivan Wicks Koelling ISBN 0133439275 9780133439274Document35 pagesTest Bank For Engineering Economy 16th Edition by Sullivan Wicks Koelling ISBN 0133439275 9780133439274AshleyParksegn100% (24)

- Test Bank For Engineering Economy 16Th Edition by Sullivan Wicks Koelling Isbn 0133439275 9780133439274 Full Chapter PDFDocument25 pagesTest Bank For Engineering Economy 16Th Edition by Sullivan Wicks Koelling Isbn 0133439275 9780133439274 Full Chapter PDFmindy.sorrell339100% (14)

- Summer Project Guidelines - 2012Document17 pagesSummer Project Guidelines - 2012Aniket RaneNo ratings yet

- Group 7 - SCOPE - Technology in Retail BankingDocument5 pagesGroup 7 - SCOPE - Technology in Retail BankingAniket RaneNo ratings yet

- Manipulation of Financial Statements V0.1Document17 pagesManipulation of Financial Statements V0.1Aniket RaneNo ratings yet

- Regression AnalysisDocument8 pagesRegression AnalysisAniket RaneNo ratings yet

- Pre-Delinquency Management (PDM) Solution: - Aniket Rane Neha SinghDocument16 pagesPre-Delinquency Management (PDM) Solution: - Aniket Rane Neha SinghAniket RaneNo ratings yet