Professional Documents

Culture Documents

What Shariah Experts Say

Uploaded by

mughalcmaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Shariah Experts Say

Uploaded by

mughalcmaCopyright:

Available Formats

International Journal of Islamic Financial Services Vol. 1 No.

What Shariah Experts Say

FUTURES, OPTIONS AND SWAPS

Should Islamic financial institutions have the freedom to dabble in derivatives, like their conventional counterparts? According to one view derivatives add value and are justifiable on efficiency grounds. At the same time, the Shariah does not perhaps explicitly forbid such contracts, as these are of recent origin. A variety of strategies are employed by conventional banks for risk reduction, hedging and speculation, involving forwards/futures. options, and swaps. In order to get a definite view on the permissibility or otherwise of such contractual mechanisms we formulated a few questions and sought the opinion of Justice Mufti Taqi Usmani. an eminent jurist of our times. Our questions and Justice Usmanis comments and answers are reproduced below. The kind cooperation of Brother Ghazanfar Adil, Director General, Institute of Islamic Banking and Insurance, London in facilitating this exchange of views with Justice Taqi Usmani is gratefully acknowledged.

1. Question: (Futures/ Forward Contracts) i) Two individuals, A and B enter into a contract on 1st January, 1996 under which A would sell a stock of company X at a price of $100 to B after an expiry of six months. B has an obligation to purchase at this price irrespective of the market price on 30th June 1996. Is this contract permissible in Shariah? ii) Can this contract or the rights and obligations of A and B be transferred by either of them to a third party C? iii) If the object of transaction is any commodity, or gold, silver or currency and not stocks, as in the case above, in what way is the validity or otherwise of the contract affected? It may be noted that the non- transferability of rights and obligations severely limits the possibility of speculation on Futures Exchanges. A commonly held belief is that Futures contracts are prohibited when they are used for speculation. Does this imply that Futures contracts are permissible when these are used for hedging? Comments by Mufti Taqi Usmani: i) This is an example of a Futures transaction. The Futures transaction as in vogue in stock and commodities markets today are not permissible for two reasons. Firstly, it is a well recognised principle of the Shariah that sale or purchase cannot be affected for a future date. Therefore, all Forward and Futures transactions are invalid in Shariah. Secondly because in most of the Futures transactions, delivery of the commodities or their possession is not intended. In most cases, the transactions end up with the settlements of difference of prices only, which is not allowed in the Shariah. ii) As Futures are not permissible, no rights or obligations can emanate therefrom. Therefore the question of transferring these rights and obligations does not arise.

International Journal of Islamic Financial Services Vol. 1 No.1

iii) Futures transactions as explained above, are totally impermissible regardless of their subject matter. Similarly, it makes no difference whether these contracts are entered into for the purpose of speculation or for the purpose of hedging. 2. Question: (Options) i) Two individuals, A and B enter into a contract on 1st January, 1996 under which A grants a right to B without any obligation on B's part. Under the contract B gets a right to purchase a stock of company X from A any time on or before 30th June, 1996 at a price of $100, irrespective of the market price on the day of purchase. B, however, does not have any obligation to purchase. A accepts a consideration of $5 from B for granting him this right without obligations. This is known as a "call" option in stocks. ii) A and B enter into a contract on 1st January, 1996 under which A grants a right to B without any obligation on B's part .Under the Contract, B gets a right to sell a stock of company X to A any time on or before 30th June 1996 at a price of $100 irrespective of the market price on the day of sale. However, B does not have any obligation to sell. A accepts a consideration of $5 from B for granting him this right without obligation. This is known as a "put" option in stocks. iii) A and B enter into a contract on 1st January 1996 by which A sells 100 stocks of company X to B at a price $100 per stock. The transaction is settled with exchange of cash for the shares. A also grants a right to B, under which B can sell back the stocks to A on the expiry of six moths, that is June 30, 1996 at a price of $120 per stock. This right, however is canceled if the price of the stocks increase beyond $120 and remains at that level for 21 consecutive days before 30th June 1996. Unlike the previous two instances of transactions in pure options, the above is a case of option as an additional feature of an equity sale and purchase. iv) If the object of transaction is any commodity, or gold, or silver, or currency and not stock as in the above three cases, in what way is the validity or otherwise of the contract affected? v) Is the validity of the above contracts affected with an added provision that B can now transfer this contract to a third party C? Comments by Mufti Taqi Usmani i), ii), iv) & v) : According to the principles of the Shariah, an option is a promise to sell or purchase a thing on a specific price within a specified period. Such a promise in itself is permissible and is normally binding on the promisor. However this promise cannot be the subject matter of a sale or purchase. Therefore, the promisor cannot charge the promisee a fee for making such a promise. Since the options transactions as in vogue in the options market are based on charging fees on these promises, they are not valid according to the Shariah. This ruling applies to all kinds to options, no matter whether they are call options or put options. Similarly, it makes no difference if the subject matter of the option sale is a commodity, gold, silver or a currency; and as the contract is invalid ab-initio, the same cannot be transferred. iii) This contract has two aspects. Firstly, if the option of selling back the stocks to A has been made a pre-condition for the original sale transaction, the whole transaction will be invalid because, according to Shariah, a sale transaction cannot accept such a condition. Secondly, if the option is an independent promise without being a precondition for the original sale, no fee can be charged for such a promise as mentioned earlier. Although a complementary promise of this kind is permissible in the Shariah, it cannot serve the purpose of the option market.

International Journal of Islamic Financial Services Vol. 1 No.1

3. Question: (Swaps) Two banks enter into an agreement to exchange deposits for a period of six month in different currencies on 1st January 1996 at the prevailing exchange rates. Bank A exchanges Rupees 30 million with Bank B for us dollars one million and the Rupee-Dollar exchange rate prevailing on the date is 30: I. During these six months, each bank utilizes the deposits it received at its own risk. At the end of six months, Bank A pays back one million dollars to Bank B and receives Rupees 30 million from it, irrespective of the Rupee-Dollar rate prevailing on June 30, 1996. For example, the Rupee- Dollar exchange rate might have become 35:1 or 25:1 on June 30, 1996. Is this contract Islamically permissible? Comments by Mufti Taqi Usmani: It is one of the principles of the Shariah that two financial transactions cannot be tied together in the sense that entering into one transaction is made a precondition to entering into the second. Keeping this principle in view, the Swap transaction referred to above is not permissible because the deposit of one million dollars has been made a precondition for accepting the deposit of 30 million rupees. Since both the parties will use the deposits for their own benefit, they are termed in Shariah as loans (Qardh) and not as trust (Wedee'ah). Therefore, advancing one loan has been made a precondition for receiving another which means that two financial transactions are tied together. This is my first hand opinion about this transaction. However it needs further study and research.

Taken From: http://islamic-finance.net/journals/journal1/art4.pdf

You might also like

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Contract in Islamic Finance and Banking. Chapter Six Condition of ContractsDocument25 pagesContract in Islamic Finance and Banking. Chapter Six Condition of Contractsotaku himeNo ratings yet

- The Islamic Bonds Market Possibilities and ChallengesDocument18 pagesThe Islamic Bonds Market Possibilities and Challengeshoch94No ratings yet

- Name Islimiyat AhadeesDocument6 pagesName Islimiyat AhadeesHaroon AfzalNo ratings yet

- Currency ExchangeDocument20 pagesCurrency ExchangeasrialiNo ratings yet

- Article 8 v10Document26 pagesArticle 8 v10sayed imadNo ratings yet

- Essentials of Islamic Finance Assignment# 2Document4 pagesEssentials of Islamic Finance Assignment# 2Idrees AkhtarNo ratings yet

- Which Court Has The Jurisdiction To Issue A Freeze Order in AMLADocument7 pagesWhich Court Has The Jurisdiction To Issue A Freeze Order in AMLAMelvin PernezNo ratings yet

- Final FD ReportDocument17 pagesFinal FD ReportKumar SunnyNo ratings yet

- Vol 4-2..anas Zarqa..Istisna Financing... DPDocument8 pagesVol 4-2..anas Zarqa..Istisna Financing... DPAdielah HassimNo ratings yet

- Week 2b ContractDocument10 pagesWeek 2b Contracthumna khanNo ratings yet

- Tender Case ResearchDocument15 pagesTender Case ResearchSakhawat AliNo ratings yet

- Contract of SaleDocument10 pagesContract of SaleKudzwai nyamuchengweNo ratings yet

- Topic 1 Lawof Contract Proposaland AcceptanceDocument19 pagesTopic 1 Lawof Contract Proposaland AcceptanceZaid Chelsea100% (1)

- Exposé Sur Les Produits DérivésDocument13 pagesExposé Sur Les Produits DérivésAnonymous mmbK7QLyhNo ratings yet

- Islamic Law of ContractDocument9 pagesIslamic Law of ContractMonju Grace100% (1)

- Uqud in Islamic Financial TransactionsDocument40 pagesUqud in Islamic Financial Transactionsmohamed saidNo ratings yet

- Norman BHAIDocument16 pagesNorman BHAIPulkitAgrawalNo ratings yet

- MD Ashiquer Rahman - Test Script - ISG501Document5 pagesMD Ashiquer Rahman - Test Script - ISG501Rahman AshiquerNo ratings yet

- Give An Example of A Contract of Sale and Discuss The Essential Elements Therein (10 Points) ConsentDocument3 pagesGive An Example of A Contract of Sale and Discuss The Essential Elements Therein (10 Points) Consentariane marsadaNo ratings yet

- Eden Hannon & Company v. Sumitomo Trust & Banking Company, Eden Hannon & Company v. Sumitomo Trust & Banking Company, 914 F.2d 556, 4th Cir. (1990)Document13 pagesEden Hannon & Company v. Sumitomo Trust & Banking Company, Eden Hannon & Company v. Sumitomo Trust & Banking Company, 914 F.2d 556, 4th Cir. (1990)Scribd Government DocsNo ratings yet

- Lecture III - ContractDocument9 pagesLecture III - ContractGoBig Tulongeni HamukotoNo ratings yet

- The Law On Negotiable Instruments (With Documents of Title) by Hector de LeonDocument18 pagesThe Law On Negotiable Instruments (With Documents of Title) by Hector de LeonEarvin James Atienza67% (3)

- Sales - Prof. Crisostomo UribeDocument36 pagesSales - Prof. Crisostomo UribeMiro100% (3)

- Introduction To ContractDocument11 pagesIntroduction To ContractPerantau Negeri Lain0% (1)

- Investmnet Analysis Unit 4Document6 pagesInvestmnet Analysis Unit 4Maitreyee jambekarNo ratings yet

- Derivative MarketsDocument143 pagesDerivative MarketsdikshitaNo ratings yet

- What Is A Forward Contract - Definition & Examples - Video & Lesson TranscriptDocument2 pagesWhat Is A Forward Contract - Definition & Examples - Video & Lesson TranscriptveronicaNo ratings yet

- PDF The Contract of Bay Al Salam and Istisna in Islamic CommercialDocument8 pagesPDF The Contract of Bay Al Salam and Istisna in Islamic CommercialLeo TayNo ratings yet

- Faqs Islamic BankingDocument10 pagesFaqs Islamic BankingFariaFaryNo ratings yet

- Principles of MuamalatDocument46 pagesPrinciples of Muamalatal-hakim100% (1)

- Mnss Eoif ReportDocument9 pagesMnss Eoif ReportM.Nabeel Shahzad SiddiquiNo ratings yet

- Arab-Malaysian Finance BHD V Taman Ihsan Jaya SDN BHD & Ors (Koperasi Seri Kota Bukit Cheraka BHD, Third Party)Document30 pagesArab-Malaysian Finance BHD V Taman Ihsan Jaya SDN BHD & Ors (Koperasi Seri Kota Bukit Cheraka BHD, Third Party)Hadhirah AzharNo ratings yet

- Void AgreementDocument18 pagesVoid AgreementAkbar LodhiNo ratings yet

- Legal Aspects of Business AssignmentDocument8 pagesLegal Aspects of Business AssignmentArk ShahiNo ratings yet

- Quiz 4 SolvedDocument10 pagesQuiz 4 SolvedAsad AliNo ratings yet

- Introduction To The Basic Concept of Derivatives: Over-The-Counter Market Mean?Document6 pagesIntroduction To The Basic Concept of Derivatives: Over-The-Counter Market Mean?Aman NegiNo ratings yet

- MurabahaDocument6 pagesMurabahaSK LashariNo ratings yet

- 2010-Derivatives in Islamic Finance-Paper 7-IsRADocument57 pages2010-Derivatives in Islamic Finance-Paper 7-IsRAirshad786@gmail.comNo ratings yet

- Introduction To Various Major Transactions in Islamic Law: Basic Operation of Interest Banking SystemDocument17 pagesIntroduction To Various Major Transactions in Islamic Law: Basic Operation of Interest Banking SystemZalikha HassimNo ratings yet

- Exga 6309: Islamic Banking & Finance (SEMESTER 2, 2010/11) : AssignmentDocument8 pagesExga 6309: Islamic Banking & Finance (SEMESTER 2, 2010/11) : AssignmentShakhrukh KurbanovNo ratings yet

- Sale of DebtDocument5 pagesSale of Debthsanak29924No ratings yet

- DeferredDocument4 pagesDeferredSarimanok Storage 6No ratings yet

- Principle of Islamic FinanceDocument6 pagesPrinciple of Islamic FinanceumbreenNo ratings yet

- Spec Com - SRC CasesDocument150 pagesSpec Com - SRC Casesjag murilloNo ratings yet

- Kuliah 3 - Islamic BankDocument42 pagesKuliah 3 - Islamic BankMusbri MohamedNo ratings yet

- FINC6013 Workshop 5 Questions & SolutionsDocument6 pagesFINC6013 Workshop 5 Questions & SolutionsJoel Christian MascariñaNo ratings yet

- ContractDocument18 pagesContractMariaNo ratings yet

- Wix Shariah and Legal Issues On Islamic Financial Products1Document30 pagesWix Shariah and Legal Issues On Islamic Financial Products1Nur IzzatiNo ratings yet

- Issues in Bay InahDocument10 pagesIssues in Bay InahShukri Omar AliNo ratings yet

- Model Q Ans For The Indian Contract Act 1872Document21 pagesModel Q Ans For The Indian Contract Act 1872api-226230529100% (1)

- AuditDocument115 pagesAuditM NattNo ratings yet

- AAOIFI - Chapter-1 - Trading in CurrenciesDocument10 pagesAAOIFI - Chapter-1 - Trading in Currencieslegendery_pppNo ratings yet

- Aaoifi Mohamed SaidDocument15 pagesAaoifi Mohamed Saidmohamed said omarNo ratings yet

- Islamic Mode of Finance IstisnaDocument15 pagesIslamic Mode of Finance IstisnaMuhammad Asif100% (2)

- NIL - Reviewer by AIcaoAnotado 2021Document24 pagesNIL - Reviewer by AIcaoAnotado 2021Alena Icao-AnotadoNo ratings yet

- And Lot Particularly Addressed at #34 Ma. Luisa Subdivision, Banilad, 6000 Cebu CityDocument7 pagesAnd Lot Particularly Addressed at #34 Ma. Luisa Subdivision, Banilad, 6000 Cebu CityKaren RefilNo ratings yet

- Cape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyFrom EverandCape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- NPTELOnline CertificationDocument66 pagesNPTELOnline CertificationAkash GuruNo ratings yet

- Relevant CostingDocument6 pagesRelevant CostingJonathan Vidar100% (1)

- Real Business Cycle TheoryDocument32 pagesReal Business Cycle Theoryrajan20202000No ratings yet

- CIE Chapter 3 Enterprise, Business Growth and SizeDocument51 pagesCIE Chapter 3 Enterprise, Business Growth and SizeKelvin Kaung Si ThuNo ratings yet

- Economics 21st Edition Mcconnell Test BankDocument35 pagesEconomics 21st Edition Mcconnell Test Banksalariedshopbook.gczx100% (18)

- 11TH Set BDocument5 pages11TH Set Bpavanlakhera000No ratings yet

- Change Management Final VersionDocument13 pagesChange Management Final VersionZheng LinNo ratings yet

- Functions of Stock ExchangeDocument7 pagesFunctions of Stock ExchangeGhulam MurtazaNo ratings yet

- Capacitated Plant Location ModelDocument12 pagesCapacitated Plant Location ModelManu Kaushik0% (1)

- The SWOT Analysis Is A Valuable Step in Your Situational AnalysisDocument5 pagesThe SWOT Analysis Is A Valuable Step in Your Situational AnalysisNisa ZlkfleeNo ratings yet

- Structural Modelling BKMDocument522 pagesStructural Modelling BKMJean Louis Brillet100% (7)

- Dividend PolicyDocument52 pagesDividend PolicyKlaus Mikaelson100% (1)

- UNDP Covid-19 and Human Development 0Document35 pagesUNDP Covid-19 and Human Development 0sofiabloemNo ratings yet

- 2010 12 Applying A Risk Budgeting Approach To Active Portfolio ConstructionDocument7 pages2010 12 Applying A Risk Budgeting Approach To Active Portfolio Constructionjeete17No ratings yet

- (CMA Fundamentals) Brian Hock, Lynn Roden - CMA Fundamentals Economics and Statistics 1 (2017)Document298 pages(CMA Fundamentals) Brian Hock, Lynn Roden - CMA Fundamentals Economics and Statistics 1 (2017)humanity firstNo ratings yet

- Management and Cost Accounting: Colin DruryDocument28 pagesManagement and Cost Accounting: Colin DruryMuhammad SohailNo ratings yet

- Chapter 5 Summary - Catharina ChrisidaputriDocument3 pagesChapter 5 Summary - Catharina ChrisidaputriCatharina CBNo ratings yet

- BD ppt19Document84 pagesBD ppt19Steven GalfordNo ratings yet

- Foreign Links Campus Course Code and TitlesDocument7 pagesForeign Links Campus Course Code and TitlesOluwaseun AwotundeNo ratings yet

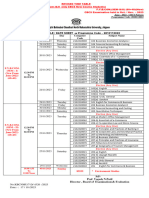

- Revised Time Table of FY-SY-TYBCom Sem I To VI New Old CBCS-CGPA Exam - To Be Held in Oct Nov-2023Document5 pagesRevised Time Table of FY-SY-TYBCom Sem I To VI New Old CBCS-CGPA Exam - To Be Held in Oct Nov-2023Viraj SharmaNo ratings yet

- Sherman Motor CompanyDocument5 pagesSherman Motor CompanyshritiNo ratings yet

- Chapter 4 MishkinDocument23 pagesChapter 4 MishkinLejla HodzicNo ratings yet

- 6 Economics of International TradeDocument29 pages6 Economics of International TradeSenthil Kumar KNo ratings yet

- EC4307 - Lecture1 - Topic 2Document42 pagesEC4307 - Lecture1 - Topic 2changmin shimNo ratings yet

- SMATH311LC InventoryPart1Document8 pagesSMATH311LC InventoryPart1Ping Ping0% (1)

- Nigerian Stock Recommendation For August 7th 2023Document4 pagesNigerian Stock Recommendation For August 7th 2023DMAN1982No ratings yet

- PPT7-Aggregate Demand and Aggregate Supply As A Model To Describe The EconomyDocument29 pagesPPT7-Aggregate Demand and Aggregate Supply As A Model To Describe The EconomyRekha Adji PratamaNo ratings yet

- Participatory NotesDocument2 pagesParticipatory NotesrathnakotariNo ratings yet

- CH 18Document129 pagesCH 18PopoChandran100% (1)

- Accounting Grade 11 Presentation ECDocument3 pagesAccounting Grade 11 Presentation ECAnonymous tWAXPAkJd50% (2)