Professional Documents

Culture Documents

2.8 Substantive Tests - AR and Sales

Uploaded by

Brian Jeric MorilloOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2.8 Substantive Tests - AR and Sales

Uploaded by

Brian Jeric MorilloCopyright:

Available Formats

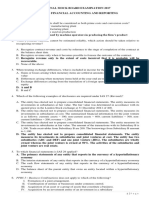

Substantive Tests: Accounts Receivable and Sales Assertions Valuation Procedures 1. Verify mathematical accuracy of A/R. a.

Obtain an A/R aged trial balance from A/R department personnel. b. Foot and cross-foot the trial balance. c. Compare total A/R per the trial balance to A/R in the general ledger. 2. Confirm year-end A/R and N/R balances with debtors. a. b. c. 3 cases when failing to confirm is justifiable: A/R is immaterial. Confirmations would likely be ineffective. Audit risk is acceptably low Usu. done at balance sheet date Can be done at interim when internal control is deemed effective and when the balances in A/R and sales accounts can be reconciled from the interim confirmation date. Positive confirmation account balance is listed in the confirmation and the customer will respond directly to the auditor about whether the balance is correct or not. Balances are relatively large Substantial numbers of inaccuracies or frauds expected. Mail more confirmations to non-respondents to maximize response rates. To customers who failed to respond, the auditor should perform alternative audit procedures such as examining: a. Subsequent cash collections to determine whether the customer paid b. Shipping documents to determine whether goods were whipped to the customer c. Sales invoices to determine whether the customers was billed. Negative confirmation debtor respond to the auditor only if the balances in an attached statement is incorrect. Internal control is adequate Balances are small Auditor has no reason to believe that debtors will not return the confirmation request. Should be mailed using the auditors envelope Negative N/R confirmation not usu. used in practice. Test cut-off to determine whether sales and receivables are recorded in the proper accounting period. Whether sales are recorded in the same period that title to the goods passed to the customer. Examine a sample of sales transactions recorded at or near the B/S date. Timing of revenue recognition and offers evidence of earnings manipulation. Review the collectability of receivables, and determine the adequacy of ADA. Determining the adequacy of an entitys ADA. Examining A/R aged trial balance Discussions with Credit Department personnel Reviewing post-B/S date collections

Existence/Rights/ Valuation

Existence/Occurrence/ Completeness

3. 4.

Valuation/Rights

Existence/Occurrence/ Completeness/Valuation

Reviewing available correspondence with delinquent debtors Examining credit ratings. 5. Perform analytical procedures to determine whether recorded sales and A/R balances appear reasonable. To direct the auditors attention to accounts that appear unusual or unreasonable, hence, additional substantive test of details. 6. Review F/S to determine whether: a. A/R, N/R and sales are properly classified and described. b. Disclosures are adequate.

Presentation and Disclosure

You might also like

- Audit 2 - TheoriesDocument2 pagesAudit 2 - TheoriesJoy ConsigeneNo ratings yet

- Cash ReviewerDocument35 pagesCash ReviewerAprile AnonuevoNo ratings yet

- T03 - Home Office & BranchDocument3 pagesT03 - Home Office & BranchChristian YuNo ratings yet

- ch11 Doc PDF - 2 PDFDocument39 pagesch11 Doc PDF - 2 PDFRenzo RamosNo ratings yet

- 14 - Audit Other Related ServicesDocument38 pages14 - Audit Other Related ServicesSyafiq AhmadNo ratings yet

- Audit of LiabsDocument2 pagesAudit of LiabsRommel Royce CadapanNo ratings yet

- Module I. Business Combination - Date of Acquisition (NA)Document13 pagesModule I. Business Combination - Date of Acquisition (NA)Melanie SamsonaNo ratings yet

- TBCH09Document6 pagesTBCH09Samit TandukarNo ratings yet

- Lesson 6 Philippine Standards On Quality Control PDFDocument17 pagesLesson 6 Philippine Standards On Quality Control PDFMarinel FelipeNo ratings yet

- Auditing Theory ReviewerDocument6 pagesAuditing Theory ReviewerHans Even Dela CruzNo ratings yet

- ACCOUNTING 12-07 - Audit-Assurance-Ethics-and-GovernanceDocument11 pagesACCOUNTING 12-07 - Audit-Assurance-Ethics-and-GovernanceNico evansNo ratings yet

- Finals Reviewer AudtheoDocument36 pagesFinals Reviewer AudtheoMae VillarNo ratings yet

- Sales QuizDocument4 pagesSales QuizJamilah Changat TuazonNo ratings yet

- Audit Theory PSADocument87 pagesAudit Theory PSAlongixNo ratings yet

- Module QuizsDocument24 pagesModule QuizswsviviNo ratings yet

- Threats To Compliance With The Fundamental PrinciplesDocument5 pagesThreats To Compliance With The Fundamental PrinciplesAbigail SubaNo ratings yet

- tAX FINALSDocument8 pagestAX FINALSAmie Jane MirandaNo ratings yet

- Department of Accountancy: Page - 1Document17 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- Far 102 - Cash and Cash EquivalentsDocument4 pagesFar 102 - Cash and Cash EquivalentsKeanna Denise GonzalesNo ratings yet

- AP Quiz No. 1 Auditing and The Audit ProcessDocument12 pagesAP Quiz No. 1 Auditing and The Audit ProcessJeremiah MadlangsakayNo ratings yet

- Hall 5e TB Ch04Document12 pagesHall 5e TB Ch04Raraj100% (1)

- Unit 7 QuizDocument2 pagesUnit 7 QuizKimberly A AlanizNo ratings yet

- SYNTHESISDocument8 pagesSYNTHESISMark Stanley PangoniloNo ratings yet

- Asset - Inventory - For Posting PDFDocument8 pagesAsset - Inventory - For Posting PDFNhicoleChoiNo ratings yet

- Nfjpia Nmbe Far 2017 Ans-1Document10 pagesNfjpia Nmbe Far 2017 Ans-1Stephen ChuaNo ratings yet

- CMPC312 QuizDocument19 pagesCMPC312 QuizNicole ViernesNo ratings yet

- Ch07 Audit Planning Assessment of Control Risk1Document26 pagesCh07 Audit Planning Assessment of Control Risk1Mary GarciaNo ratings yet

- Chapter 28 AnsDocument9 pagesChapter 28 AnsDave ManaloNo ratings yet

- Stock Edited PDFDocument29 pagesStock Edited PDFCzarina PanganibanNo ratings yet

- Auditing Theory - Solution ManualDocument21 pagesAuditing Theory - Solution ManualAj de CastroNo ratings yet

- Chap 006Document68 pagesChap 006Koki KatoNo ratings yet

- Operation AuditingDocument3 pagesOperation AuditingRosette RevilalaNo ratings yet

- ISA 265 Summary: Communicating Deficiencies in Internal Control To Those Charged With Governance and ManagementDocument2 pagesISA 265 Summary: Communicating Deficiencies in Internal Control To Those Charged With Governance and ManagementtruthNo ratings yet

- Relevant Costing by A BobadillaDocument99 pagesRelevant Costing by A BobadillaShailene DavidNo ratings yet

- ACCTGDocument13 pagesACCTGCabardo Maria RegilynNo ratings yet

- Advanced AuditingDocument358 pagesAdvanced AuditingAnuj MauryaNo ratings yet

- Fundamentals of Assurance ServicesDocument22 pagesFundamentals of Assurance ServicesxxpinkywitchxxNo ratings yet

- Top 5 Accounting Firms in The PhilippinesDocument8 pagesTop 5 Accounting Firms in The PhilippinesRoselle Hernandez100% (3)

- Q - Process Further Scarce ResourceDocument2 pagesQ - Process Further Scarce ResourceIrahq Yarte TorrejosNo ratings yet

- ACC460Document6 pagesACC460Samantha SchumacherNo ratings yet

- An SME Prepared The Following Post Closing Trial Balance at YearDocument1 pageAn SME Prepared The Following Post Closing Trial Balance at YearRaca DesuNo ratings yet

- ADocument89 pagesAJohn Carlo O. BallaresNo ratings yet

- Notes From Sir Red Sirug Handouts On Auditing TheoryDocument104 pagesNotes From Sir Red Sirug Handouts On Auditing TheoryAmithy GuevarraNo ratings yet

- Session 3 AUDITING AND ASSURANCE PRINCIPLESDocument29 pagesSession 3 AUDITING AND ASSURANCE PRINCIPLESagent2100No ratings yet

- Psa 610 Using The Work of Internal Auditors: RequirementsDocument2 pagesPsa 610 Using The Work of Internal Auditors: RequirementsJJ LongnoNo ratings yet

- AE231Document6 pagesAE231Mae-shane SagayoNo ratings yet

- Naqdown FinalsDocument6 pagesNaqdown FinalsMJ YaconNo ratings yet

- AT-02 Q Assurance and Non-Assurance ServicesDocument43 pagesAT-02 Q Assurance and Non-Assurance ServicesNicale JeenNo ratings yet

- AGS CUP 6 Auditing Elimination RoundDocument17 pagesAGS CUP 6 Auditing Elimination RoundKenneth RobledoNo ratings yet

- Mikong Due MARCH 30 Hospital and HmosDocument6 pagesMikong Due MARCH 30 Hospital and HmosCoke Aidenry SaludoNo ratings yet

- Which of The Following Will Be Most Likely Classified As Equity InstrumentDocument1 pageWhich of The Following Will Be Most Likely Classified As Equity InstrumentJAHNHANNALEI MARTICIONo ratings yet

- Psa 510Document9 pagesPsa 510Rico Jon Hilario GarciaNo ratings yet

- Auditing Theory-100 Questions - 2015Document20 pagesAuditing Theory-100 Questions - 2015yukiro rinevaNo ratings yet

- Far Eastern University: ACT 1109 HO-01Document2 pagesFar Eastern University: ACT 1109 HO-01Maryrose Sumulong100% (1)

- Auditing ProblemsDocument2 pagesAuditing ProblemsYenelyn Apistar CambarijanNo ratings yet

- Multiple Choic1Document4 pagesMultiple Choic1stillwinmsNo ratings yet

- Chapter 7 Audit Planning: Assessment of Control RiskDocument21 pagesChapter 7 Audit Planning: Assessment of Control RiskLalaine JadeNo ratings yet

- ReceivablesDocument9 pagesReceivablesThinagari JevataranNo ratings yet

- Audit Procedure ReceivablesDocument3 pagesAudit Procedure ReceivablesayyazmNo ratings yet

- Notes On Error CorrectionDocument1 pageNotes On Error CorrectionBrian Jeric MorilloNo ratings yet

- S Company Jay Co. General BorrowingDocument10 pagesS Company Jay Co. General BorrowingBrian Jeric MorilloNo ratings yet

- Assign - InvestmentsDocument2 pagesAssign - InvestmentsBrian Jeric MorilloNo ratings yet

- Revenue CycleDocument2 pagesRevenue CycleBrian Jeric MorilloNo ratings yet

- Dozer Limited: Capital Budgeting ModelDocument61 pagesDozer Limited: Capital Budgeting ModelBrian Jeric MorilloNo ratings yet

- 13 Testing Controls - Purchases and PayablesDocument2 pages13 Testing Controls - Purchases and PayablesBrian Jeric MorilloNo ratings yet

- Social MediaDocument3 pagesSocial MediaBrian Jeric MorilloNo ratings yet

- 13 Testing Controls - Purchases and PayablesDocument2 pages13 Testing Controls - Purchases and PayablesBrian Jeric MorilloNo ratings yet

- Virtue EthicsDocument1 pageVirtue EthicsBrian Jeric MorilloNo ratings yet

- Certified Trade Finance SpecialistDocument4 pagesCertified Trade Finance SpecialistKeith Parker100% (2)

- Rtgs Form Dena Bank PDFDocument1 pageRtgs Form Dena Bank PDFSuresh TatedNo ratings yet

- SBL Revision Notes PDFDocument175 pagesSBL Revision Notes PDFAliRazaSattar100% (3)

- Exhibit 1 Unitary Sec. Cert. - Domestic CorporationDocument2 pagesExhibit 1 Unitary Sec. Cert. - Domestic Corporationthesupersecretsecret40% (5)

- Wael Ali: IT Project Manager Senior Business Analyst Product OwnerDocument3 pagesWael Ali: IT Project Manager Senior Business Analyst Product OwnerWael NabhaniNo ratings yet

- Subcontractor Default InsuranceDocument18 pagesSubcontractor Default InsurancebdiitNo ratings yet

- Tarea 2 Capítulo 2Document14 pagesTarea 2 Capítulo 2Eber VelázquezNo ratings yet

- Compensation of General Partners of Private Equity FundsDocument6 pagesCompensation of General Partners of Private Equity FundsManu Midha100% (1)

- RMIT International University Vietnam: BP181 Bachelor of Commerce ProgramDocument7 pagesRMIT International University Vietnam: BP181 Bachelor of Commerce ProgramHoa AuNo ratings yet

- Unit 2 Paper 2 QuestionsDocument5 pagesUnit 2 Paper 2 QuestionsStacy Ben50% (2)

- International Issues in Managerial AccountingDocument35 pagesInternational Issues in Managerial AccountingSafira UlfaNo ratings yet

- History and Background of The Steel IndustryDocument12 pagesHistory and Background of The Steel IndustryMario R. Ramírez BasoraNo ratings yet

- Wall Street Self Defense Manual PreviewDocument18 pagesWall Street Self Defense Manual PreviewCharlene Dabon100% (1)

- Chapter 02 Evans BermanDocument19 pagesChapter 02 Evans BermanthesimpleNo ratings yet

- Haier Case StudyDocument28 pagesHaier Case StudyMagesh Kaarthick S100% (2)

- TWTR Final-Selected-Metrics-and-FinancialsDocument3 pagesTWTR Final-Selected-Metrics-and-FinancialsBonnie DebbarmaNo ratings yet

- Customer Buying Behavior: Retailing Management 8E © The Mcgraw-Hill Companies, All Rights ReservedDocument30 pagesCustomer Buying Behavior: Retailing Management 8E © The Mcgraw-Hill Companies, All Rights ReservedDavid Lumaban GatdulaNo ratings yet

- Alexander G. S., Comparing The Two Legal Realisms American and Scandinavian, 2002Document45 pagesAlexander G. S., Comparing The Two Legal Realisms American and Scandinavian, 2002andresabelr100% (1)

- Bank Fund Assignment 2Document19 pagesBank Fund Assignment 2Habiba EshaNo ratings yet

- A Study On Financial Statement Analysis of HDFC BankDocument11 pagesA Study On Financial Statement Analysis of HDFC BankOne's JourneyNo ratings yet

- Tech P: From Business Intelligence To Predictive AnalyticsDocument2 pagesTech P: From Business Intelligence To Predictive AnalyticsAdam LimbumbaNo ratings yet

- Types of Bank AccountsDocument20 pagesTypes of Bank AccountsNisarg Khamar73% (11)

- TISS Sample Paper - MA in Development Studies Part 2 Set 1Document12 pagesTISS Sample Paper - MA in Development Studies Part 2 Set 1bhustlero0oNo ratings yet

- Strategic Plan - BSBMGT517 - Manage Operational PlanDocument21 pagesStrategic Plan - BSBMGT517 - Manage Operational PlanprayashNo ratings yet

- 18bba63c U4Document11 pages18bba63c U4Thangamani.R ManiNo ratings yet

- ,types of StrategiesDocument32 pages,types of StrategiesmrunmaikrishnaNo ratings yet

- Application For Export Bills For CollectionDocument2 pagesApplication For Export Bills For CollectionsrinivasNo ratings yet

- 003 12 Business Studies Chapter 2 Short Answers 1Document3 pages003 12 Business Studies Chapter 2 Short Answers 1reereeNo ratings yet

- Corporate Income Tax - 2023Document56 pagesCorporate Income Tax - 2023afafrs02No ratings yet

- The Effects of Business Ethics and Corporate Social Responsibility On Intellectual Capital Voluntary DisclosureDocument23 pagesThe Effects of Business Ethics and Corporate Social Responsibility On Intellectual Capital Voluntary DisclosureCase HandphoneNo ratings yet