Professional Documents

Culture Documents

Draft Letter To LG February 17, 2012

Uploaded by

Chilz Sii Hitam ManiezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Draft Letter To LG February 17, 2012

Uploaded by

Chilz Sii Hitam ManiezCopyright:

Available Formats

The Management of PT.

LG Electronic Indonesia Head Office & Factory 1 Block G, MM2100 Industrial Town Cikarang Barat, Bekasi 17520 Jawa Barat , Indonesia Attn: Mr. Byoung Uk Min

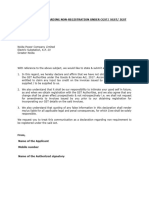

Dear Mr. Byoung Uk Min Re: Guarantee. As follow up of our yesterday email Wednesday, February 15, 2012, as well as your responded we PT. TRK director hereby thanks to your quick respond:LG does not accept the post dated Check as our guarantee but asking tangible collateral instead. We have misunderstood the purpose of said guarantees; we have the opinion that it is for the balance of repayment which we requested for installment, and not for in-transit products. Products in-transit; as far as our concern have been stipulated in our contract agreement and it should insured its mean covered by Insurance Company, the TRK liability it is maximum of US$ 10,000 (ten thousand United State dollars) per occasion liability occurred. TRK as small company does not have in up tangible assets, due to some of them are in the position of deposited in the Bank for the collateral purpose, however, TRK is willing to give a kind of Corporate Guarantee/Directors Statement or issued an Addendum to our present Contract. Hoping this proposal will be accepted by LG Management, and the operation can be started as soon as possible in accordance to our signed contract. Re: Tax penalty. To our consideration, VAT matter, which you said:fictive tax invoice, since 2009, until now and become as a problem, it was instructed and guided by LG to do so. At that time it was told and force us, otherwise our payment would not be release. In many occasion we have been argued and protested and explain that TRK is not considered/registered as VAT payer and until that time we never knew that our industry of trucking land transportation activities is subject to VAT. Also, since the year of 1999 up to 2008, we have been one of LG transporter/trucking to LG has never been required to issue VAT invoice to LG. And now we understood that our type of industry of trucking land transportation is not subject to VAT. The above clarifications we conclude that: 1. The VAT was Issuing by initiator and in the interest of LG. 2. As company it is LG as subject to VAT and not TRK. 3. The fact it is correct that some money has been paid to TRK during those times, and we have sincerely understood and mentioned since the early on this money will not be TRK moneys and some day it should be returned to LG in full amount.

4. For TRK as small company Tax penalty as such amount is a very big and heavy burden. We summarized the above four points, and we come up into conclusion that TRK is not responsible for the Tax Penalty but it is the responsibility of LG. Your kind of understanding and approval to this proposal clarification will be highly appreciated.

Sincerely yours, PT. TRK

Eddi Nerwin Hasibuan Director

You might also like

- Merry Christmas From Your Southside Team: Landlord Registration ChangesDocument6 pagesMerry Christmas From Your Southside Team: Landlord Registration ChangesatishaNo ratings yet

- TCT Title Transfer and Annotation StepsDocument8 pagesTCT Title Transfer and Annotation StepsNegros HomesNo ratings yet

- GST DeclarationksjdhwjnnDocument1 pageGST Declarationksjdhwjnnphoenix.hb.krNo ratings yet

- Soal LawyerDocument4 pagesSoal LawyerRonal ParhusipNo ratings yet

- Klarifikasi - Obras - 15-2-2024 RevDocument1 pageKlarifikasi - Obras - 15-2-2024 RevdimasamythasNo ratings yet

- 12、如何说服客户修改付款方式-淘宝店铺:稚谊 唯一微信:bb60218891Document3 pages12、如何说服客户修改付款方式-淘宝店铺:稚谊 唯一微信:bb60218891shuai liNo ratings yet

- Attachment 1 - Proposal - Thai Company Registration - V04-02-2021Document4 pagesAttachment 1 - Proposal - Thai Company Registration - V04-02-2021K. AdrianealNo ratings yet

- MTT Final Draft 2Document2 pagesMTT Final Draft 2guru mathNo ratings yet

- Transfer ProcedureDocument2 pagesTransfer ProcedureMarco palaciosNo ratings yet

- ResponseDocument4 pagesResponsestenNo ratings yet

- Soal Test Corporate Law FirmDocument4 pagesSoal Test Corporate Law FirmMerin Zuldani AlamNo ratings yet

- PreviewDocument5 pagesPreviewregineloning83No ratings yet

- ScoreDocument7 pagesScoreprevailboluwaduroNo ratings yet

- Interface Between GST and IBCDocument14 pagesInterface Between GST and IBCChandra RajanNo ratings yet

- Construction LawDocument42 pagesConstruction LawAdjei BaldanNo ratings yet

- Termination by Revstar International LTDDocument1 pageTermination by Revstar International LTDSailing VnapNo ratings yet

- Ey Indirect Uae Vat On Transfer of Business As Going ConcernDocument4 pagesEy Indirect Uae Vat On Transfer of Business As Going ConcernAdarsh V KesavanNo ratings yet

- Newsletter April 2013Document2 pagesNewsletter April 2013Nicky HanshawNo ratings yet

- AEC - Tax Advisory and Training ProposalDocument4 pagesAEC - Tax Advisory and Training ProposalsefanitNo ratings yet

- Nurjadin Sumono Mulyadi & Partners - SelectionDocument3 pagesNurjadin Sumono Mulyadi & Partners - SelectionFachry BustomiNo ratings yet

- (Jan 20 2017) - Full D - Terms For New Capital - PDF - Full Discussion - Redacted PDFDocument5 pages(Jan 20 2017) - Full D - Terms For New Capital - PDF - Full Discussion - Redacted PDFDavid HundeyinNo ratings yet

- ADOS47 CeDocument1 pageADOS47 CeDaut KadriovskiNo ratings yet

- Service Proposal: A. Customer Basic Information (客户基本资料)Document15 pagesService Proposal: A. Customer Basic Information (客户基本资料)Ust Zul hilmei Mohamad RohaniNo ratings yet

- APPLY - EmailDocument3 pagesAPPLY - EmailBubbhaNo ratings yet

- 4 - DeclarationDocument1 page4 - DeclarationSonu YadavNo ratings yet

- Soal Test Corporate Law Firm Di JakartaDocument5 pagesSoal Test Corporate Law Firm Di Jakartafahmi putra MartinNo ratings yet

- Plain Language ExamplesDocument1 pagePlain Language ExamplescitypagesNo ratings yet

- Commercial InvoiceDocument1 pageCommercial InvoiceRizky RwsNo ratings yet

- Contract Law PresentationDocument4 pagesContract Law PresentationDavid HuaNo ratings yet

- Jasa Perpajakan Dan Pembukuan 3Document3 pagesJasa Perpajakan Dan Pembukuan 3Revli Meyhendra HarbangkaraNo ratings yet

- Covering Letter For Miscellaneous Remittances - LatestDocument2 pagesCovering Letter For Miscellaneous Remittances - LatestSALE EXECUTIVESNo ratings yet

- ACL - 13150925 - Thi Xuan Quynh NguyenDocument9 pagesACL - 13150925 - Thi Xuan Quynh NguyenQuynhXuanNo ratings yet

- Disclosure of Information Concerning Affiliated TransactionsDocument6 pagesDisclosure of Information Concerning Affiliated TransactionsHilman DarojatNo ratings yet

- Banking Workshop Term 3Document55 pagesBanking Workshop Term 3Arthur AmolaNo ratings yet

- Ratio Analysis PPLDocument11 pagesRatio Analysis PPLCh Ali TariqNo ratings yet

- Country ManagerDocument3 pagesCountry Managerroshanin2017No ratings yet

- Challenges Associated With Compliance of Domestic Regulations in Bangladesh-CETSDocument10 pagesChallenges Associated With Compliance of Domestic Regulations in Bangladesh-CETSProshad RayNo ratings yet

- QUIESTIIONDocument2 pagesQUIESTIIONAlisyaNo ratings yet

- OBLICON Formative Assessment #2Document1 pageOBLICON Formative Assessment #2Mary Kris PondocNo ratings yet

- Claim Your ERC Recovery, LLC Guide & FAQsDocument19 pagesClaim Your ERC Recovery, LLC Guide & FAQsMichael OReilly100% (2)

- (15-00293 429-11) JPMC-MRS-00005335Document3 pages(15-00293 429-11) JPMC-MRS-00005335Jessie SmithNo ratings yet

- Business Communication 1Document10 pagesBusiness Communication 1Armaan HossainNo ratings yet

- Soal Test Corporate Law FirmDocument7 pagesSoal Test Corporate Law FirmAldi OutsiderNo ratings yet

- CaseDocument4 pagesCaseMaryam RohiNo ratings yet

- FAQ's Closure Of: Limited Liability PartnershipDocument6 pagesFAQ's Closure Of: Limited Liability PartnershipDivesh GoyalNo ratings yet

- Tax Payment Under GSTDocument7 pagesTax Payment Under GSTAbhay GroverNo ratings yet

- TOP Registration Form: Company InformationDocument4 pagesTOP Registration Form: Company InformationRed DevilNo ratings yet

- Reply To Letter From Minor ShareholderDocument3 pagesReply To Letter From Minor ShareholderNaeem HasanNo ratings yet

- Optima ResponseDocument3 pagesOptima ResponseLindsey BasyeNo ratings yet

- 6.1 Revenue From Contract - RecognitionDocument3 pages6.1 Revenue From Contract - RecognitionTKTGNo ratings yet

- Write Ups GROUP 3Document4 pagesWrite Ups GROUP 3MayNo ratings yet

- LUT OR BOND For GSTDocument3 pagesLUT OR BOND For GSTRohan SinhaNo ratings yet

- Equipment Rental Business PlanDocument1 pageEquipment Rental Business Plansolomon50% (2)

- TaxDocument2 pagesTaxnomercykillingNo ratings yet

- Week 11 Translation 1 Assignment-PraktikumDocument2 pagesWeek 11 Translation 1 Assignment-PraktikumBagas MartinusNo ratings yet

- Faqs Regarding SFM Offshore Company FormationDocument10 pagesFaqs Regarding SFM Offshore Company FormationInition TechnologyNo ratings yet

- Chapter 8 Debentures and ChargesDocument2 pagesChapter 8 Debentures and ChargesNahar Sabirah100% (1)

- Notre Dame University Bangladesh: Summer 2020 TrimesterDocument4 pagesNotre Dame University Bangladesh: Summer 2020 TrimesterWasif UddinNo ratings yet

- Answer For Question 1Document4 pagesAnswer For Question 1靳雪娇No ratings yet

- Study of Working Capital On Pepsico.Document31 pagesStudy of Working Capital On Pepsico.Harsh Vardhan50% (2)

- ARM 54 Look Inside The BookDocument6 pagesARM 54 Look Inside The BookJesus Kossonou0% (1)

- Metlife Final ProjectDocument66 pagesMetlife Final ProjectHasan MehandiNo ratings yet

- Khan Muttakin Siddiqui 2013Document17 pagesKhan Muttakin Siddiqui 2013Rahman AnshariNo ratings yet

- McKinsey - Greece 10 Years AheadDocument80 pagesMcKinsey - Greece 10 Years AheadzghdNo ratings yet

- PEST SingaporeDocument13 pagesPEST Singaporeliewyh75% (12)

- Project Report On DepositoryDocument68 pagesProject Report On DepositoryTarn Jeet100% (2)

- MTH302 Solved MCQs Alotof Solved MCQsof MTH302 InonefDocument26 pagesMTH302 Solved MCQs Alotof Solved MCQsof MTH302 InonefiftiniaziNo ratings yet

- Coffee Shop Business PlanDocument14 pagesCoffee Shop Business Planmeenuchoudharyoffice100% (1)

- Adnan Project FULL CompleteDocument13 pagesAdnan Project FULL CompleteSyed Nabeel AliNo ratings yet

- How To Calculate NSC InterestDocument3 pagesHow To Calculate NSC InterestSamir Navinchandra PatelNo ratings yet

- Beijing Jeep PDFDocument28 pagesBeijing Jeep PDFJuan Samuel Romero EscalanteNo ratings yet

- Bancassurance ModelsDocument2 pagesBancassurance ModelsAzade Zakeri100% (3)

- Valuation of Expropriated PropertiesDocument10 pagesValuation of Expropriated PropertiesLuningning CariosNo ratings yet

- IFRS - 12 Interests in Other EntitiesDocument6 pagesIFRS - 12 Interests in Other EntitiessaadalamNo ratings yet

- Unnati NewsletterDocument30 pagesUnnati NewsletterSiddhartha AroraNo ratings yet

- Chapter:1 Fundamentals: 1. Fixed and Fluctuating Capital AccountsDocument98 pagesChapter:1 Fundamentals: 1. Fixed and Fluctuating Capital Accountsashit_rasquinha100% (1)

- David Sm15 Case Im 25 L'OrealDocument22 pagesDavid Sm15 Case Im 25 L'OrealJa JUOINo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildMARIA ANGELINA WIBAWA (00000020978)No ratings yet

- Individual Assignment - Financial and Management AccountingDocument28 pagesIndividual Assignment - Financial and Management AccountingJonathan PohlNo ratings yet

- 2019 PDFDocument283 pages2019 PDFAmitNo ratings yet

- Project Report Union Bank PDFDocument201 pagesProject Report Union Bank PDFashwin thakurNo ratings yet

- Jun18l1fra-C02 QaDocument18 pagesJun18l1fra-C02 QajuanNo ratings yet

- Baffinland Preliminary Offering CircularDocument722 pagesBaffinland Preliminary Offering CircularNunatsiaqNews100% (1)

- Musing On MarketsDocument5 pagesMusing On MarketsM Bagus RizkyNo ratings yet

- Business CaseDocument9 pagesBusiness CasemarvinclydNo ratings yet

- LT Nifty Next 50 Index FundDocument2 pagesLT Nifty Next 50 Index FundQUALITY12No ratings yet

- Equity Valuation Report - Snap Inc.Document3 pagesEquity Valuation Report - Snap Inc.FEPFinanceClubNo ratings yet

- Case Presentation ON Jyske Bank: Submitted by - Sidhant Anand Yogesh Singla Venkat Bhanu Prakash JastiDocument19 pagesCase Presentation ON Jyske Bank: Submitted by - Sidhant Anand Yogesh Singla Venkat Bhanu Prakash JastiUtkarsh VardhanNo ratings yet

- Unit 3 Ledger Posting and Trial Balance Module - 1 M O D U L E - 1Document46 pagesUnit 3 Ledger Posting and Trial Balance Module - 1 M O D U L E - 1Ketan ThakkarNo ratings yet