Professional Documents

Culture Documents

Request For Admissions Template

Uploaded by

barbara3721Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Request For Admissions Template

Uploaded by

barbara3721Copyright:

Available Formats

STATE OF ILLINOIS COUNTY OF DUPAGE IN THE CIRCUIT COURT FOR THE 18TH JUDICIAL CIRCUIT DUPAGE COUNTY WHEATON,

, ILLINOIS CIVIL DIVISION BankWhois suing you PLAINTIFF ) ) ) ) )CASE NO.: YourCase# ) ) ) ) )REQUEST FOR ADMISSIONS ) ) ) ) )

VS PartybeingSued DEFENDANT

DEFENDANTS REQUEST FOR ADMISSIONS Note Rule 16 is Illinois Supreme Court Law, Refer to the law to see how many days are allowed, Illinois law also required the following warning WARNING: If you fail to serve the response required by Rule 216 within 28 days after you are served with this paper, all the facts set forth in the requests will be deemed true and all the documents described in the requests will be deemed genuine. ADMISSIONS 1) The Plaintiff admits that the promissory note associated with the Mortgage on Your Address has been paid in full when the note was securitized. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment: 2) The Plaintiff admits that there is zero amount outstanding to Plaintiff. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment: 1

3) The Plaintiff admits that there was no assignment of the Mortgage as required by the law of this State relating to real property recording of items relating to items affecting real property. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

4) The Plaintiff admits that they are negligent in their duties when they failed to release the Mortgage as per the terms of paragraph 23 in the Mortgage. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

5) The Plaintiff admits that they did not assign the promissory note but in fact received a payoff for the Promissory Note. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

6) The Plaintiff admits they are in breach of contract with the terms of the Mortgage according to paragraph 23. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

7) The Plaintiff understands that in the event of ambiguous language in a contract, the ruling is against the drafter of the document. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

8) The Plaintiff admits that the Promissory Note has been securitized into a Mortgage Backed Security. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment: 2

9) The Plaintiff admits they are not a Real Party of Interest of the promissory note. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

10) The Plaintiff admits they are just a servicer of the promissory note. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

11) The Plaintiff admits that they are attempting to foreclose on the subject property loan #??? under false pretense. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

12) The Plaintiff admits to being a debt collector and not the creditor of the promissory note. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

13) The Plaintiff admits that there is no chain of title present on the original wet ink signature promissory note linking from the original lender, to any third parties through securitization, and then back to the Plaintiff. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

14) The Plaintiff admits that once a promissory note has been securitized, they forever lose their right to enforce the note under IRS accounting rules under a REMIC(Real estate mortgage investment Conduit). If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment: 3

15) The Plaintiff admits the real parties of interest are the individual share holders of the REMIC. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

16) The Plaintiff admits that under FAS 140 (Financial Account Standard), once a promissory note (that secures real property) have been sold to a REMIC, the Defendant forever loses its interest and control of the underlying security. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

17) The Plaintiff admits it never used its own funds to fund the transaction. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

18) The Plaintiff admits the loan was destined to be securitized upon closing. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

19) Therefore, the Plaintiff admits that it was only a lender in name but not in substance or actuality. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

20) The Plaintiff admits that once a promissory note has been securitized, they forever lose their right to enforce the note under IRS accounting rules under a REMIC(Real estate mortgage investment Conduit). The real parties of interest are the individual shareholders of the REMIC. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment: 4

21) The Plaintiff admits the real parties of interest are the individual shareholders of the REMIC. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

22) The Plaintiff admits it received the Defendants notice asking for validation of debt but chose to ignore the request, willfully and blatantly ignoring the Fair Debt Collections Practices Act. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

23) The Plaintiff admits it willfully and deceptively misrepresented itself as the owner of the obligation and mailed communications to the Defendant to attempt to foreclose on the subject property without any real authority to do so. If no answer provided, the answer is: "Admit". Admit:_____ Deny:_____ Comment:

CERTIFICATE OF SERVICE Case #: ??? I, YourName, certify that I mailed the foregoing document by Certified Mail #??? on this the ____day of ___, 2012 to: Attorney Name and Address Respectfully submitted: This ___ day of ___, 2012. _______________________ Your Name , Pro Se Your Address Your Phone Number

You might also like

- Unlawful Detainer Not EvictionDocument21 pagesUnlawful Detainer Not EvictionJon KlurfeldNo ratings yet

- District Court FLSA SuitDocument8 pagesDistrict Court FLSA SuitGreg Wilder100% (4)

- Plaintiffs Response To Motion To DismissDocument26 pagesPlaintiffs Response To Motion To Dismissnootkabear100% (10)

- Request For Production of Documents in DiscoveryDocument4 pagesRequest For Production of Documents in DiscoveryVivek Suri100% (3)

- Request For ProductionDocument8 pagesRequest For ProductionLoanClosingAuditors100% (3)

- Sample InterrogatoriesDocument10 pagesSample InterrogatoriesLeroy Heartsfield100% (1)

- Motion For Default JudgmentDocument4 pagesMotion For Default JudgmentWestSeattleBlog100% (3)

- Motion For Summary JudgmentDocument16 pagesMotion For Summary Judgmentpgattis7719100% (3)

- Petition for Certiorari Denied Without Opinion: Patent Case 96-1178From EverandPetition for Certiorari Denied Without Opinion: Patent Case 96-1178No ratings yet

- Sample Request For Production of DocumentsDocument9 pagesSample Request For Production of Documentsjsconrad12100% (2)

- MOTION To Amend ComplaintDocument7 pagesMOTION To Amend ComplaintMonica Regina Guillemin100% (1)

- Appeal From Eviction Case Due Process DeniedDocument25 pagesAppeal From Eviction Case Due Process Deniedmsf31538100% (4)

- Motion Stay Writ Possession Foreclosure CaseDocument2 pagesMotion Stay Writ Possession Foreclosure CaseLibio Calejo60% (10)

- Response in Opposition To Motion To Dismiss ComplaintDocument25 pagesResponse in Opposition To Motion To Dismiss ComplaintProfessor NoBull100% (7)

- Response To Motion For Summary JudgmentDocument6 pagesResponse To Motion For Summary JudgmentPamGrave50% (2)

- Plaintiff's Motion To Compel Responses To Requests For Production of Documents and Defendant's OppositionDocument22 pagesPlaintiff's Motion To Compel Responses To Requests For Production of Documents and Defendant's OppositionSteve Chan100% (2)

- Making Request For AdmissionsDocument3 pagesMaking Request For Admissionsgarutch100% (8)

- Sample Format For Evidentiary ObjectionsDocument21 pagesSample Format For Evidentiary ObjectionsElisa Getlawgirl100% (2)

- 1st Request For AdmissionsDocument5 pages1st Request For Admissionsjrod3733% (3)

- Sample Motion To Amend ComplaintDocument11 pagesSample Motion To Amend Complainttravellerkitty75% (8)

- Plaintiffs Response in Oppostion To Summary JudgmentDocument26 pagesPlaintiffs Response in Oppostion To Summary JudgmentJanet and James75% (4)

- Motion For Default JudgmentDocument3 pagesMotion For Default JudgmentMarc MkKoy100% (6)

- Answers to Interrogatories Form 6.14Document3 pagesAnswers to Interrogatories Form 6.144EqltyMom100% (2)

- How To Write Requests For AdmissionsDocument3 pagesHow To Write Requests For AdmissionsGreg Wilder100% (5)

- Residential Purchase AgreementDocument5 pagesResidential Purchase Agreementbarbara372150% (2)

- Notice of AppealDocument3 pagesNotice of Appealjoljoljo100% (1)

- DemurrerDocument19 pagesDemurrerbhawna_22b100% (4)

- Final Request For Jury InstructionsDocument29 pagesFinal Request For Jury Instructionstmccand100% (2)

- Motion To CompelDocument3 pagesMotion To CompelMichele DobbsNo ratings yet

- Sample Requests For Admission Under Rule 36Document2 pagesSample Requests For Admission Under Rule 36Stan Burman57% (7)

- Plaintiff's Motion For Default JudgmentDocument6 pagesPlaintiff's Motion For Default JudgmentColin WalshNo ratings yet

- 09.15.2010 Plaintiff's Responses To Defendant's Request For Admissions - Midland v. SheridanDocument7 pages09.15.2010 Plaintiff's Responses To Defendant's Request For Admissions - Midland v. SheridanJillian Sheridan100% (1)

- Sample Questions Level IDocument31 pagesSample Questions Level IWong Yun Feng Marco100% (1)

- Motion To Set AsideDocument2 pagesMotion To Set AsideNicholas Ryan33% (3)

- Affidavit of Defendant1Document1 pageAffidavit of Defendant1barbara3721No ratings yet

- Request For AdmissionsDocument5 pagesRequest For Admissionsclaudine uananNo ratings yet

- Requests For Production of Documents For California Eviction1Document7 pagesRequests For Production of Documents For California Eviction1Frank D'Ambrosio100% (1)

- Special InterrogatoriesDocument11 pagesSpecial Interrogatoriestmccand75% (4)

- Note InterrogatoriesDocument16 pagesNote InterrogatoriesLoanClosingAuditors50% (2)

- Reply To Opposition To Compel Discovery From FNMADocument9 pagesReply To Opposition To Compel Discovery From FNMALee PerryNo ratings yet

- Request For Judicial Notice in Support of Defendant City 02-05-15 (m130393)Document39 pagesRequest For Judicial Notice in Support of Defendant City 02-05-15 (m130393)L. A. PatersonNo ratings yet

- Request For AdmissionsDocument4 pagesRequest For Admissionstmccand60% (10)

- Chris Leben ComplaintDocument6 pagesChris Leben Complaintwolf wood100% (1)

- Request For Admissions Directed at American Express Centurion BankDocument6 pagesRequest For Admissions Directed at American Express Centurion Bankluke17No ratings yet

- 165 Reply Re Motion For Reconsideration - Local 501Document21 pages165 Reply Re Motion For Reconsideration - Local 501Benjamin CrawfordNo ratings yet

- Motion To CompelDocument27 pagesMotion To CompelABC10No ratings yet

- Civil Summons RulesDocument130 pagesCivil Summons Rulesbarbara3721100% (1)

- 99 - Motion For Default JudgmentDocument10 pages99 - Motion For Default JudgmentRipoff ReportNo ratings yet

- WWW - Ilga.gov - Ilcs4Document38 pagesWWW - Ilga.gov - Ilcs4barbara3721No ratings yet

- Opposition To Motion To DismissDocument23 pagesOpposition To Motion To Dismisscalheel75% (4)

- Request For Admission - Set No1Document2 pagesRequest For Admission - Set No1William A. Daniels50% (2)

- Vault Career Guide To Investment Management European Edition 2014 FinalDocument127 pagesVault Career Guide To Investment Management European Edition 2014 FinalJohn Chawner100% (1)

- Motion To Compel Interrogatories - ForeclosureDocument3 pagesMotion To Compel Interrogatories - Foreclosurewinstons2311100% (1)

- Demurrer To Unlawful Detainer Complaint in CaliforniaDocument3 pagesDemurrer To Unlawful Detainer Complaint in CaliforniaKimberly La Fromboise Nolen100% (1)

- FL Request For Production - Foreclosure DefenseDocument16 pagesFL Request For Production - Foreclosure Defensewinstons231180% (5)

- Requests For Production of Documents in CaliforniaDocument3 pagesRequests For Production of Documents in CaliforniaStan Burman100% (5)

- Rule 60b MotionDocument19 pagesRule 60b MotionSensa Verogna100% (1)

- Defendant's Second Request For AdmissionsDocument5 pagesDefendant's Second Request For Admissions1SantaFeanNo ratings yet

- Motion Vacate Judgment TemplateDocument2 pagesMotion Vacate Judgment Templatebarbara3721No ratings yet

- Motion to Vacate Default JudgmentDocument6 pagesMotion to Vacate Default Judgmentbarbara3721100% (3)

- Adv Interrogatories Set 1 4 7 2011Document11 pagesAdv Interrogatories Set 1 4 7 2011j mcguire100% (2)

- Defendant's Motion To Vacate Default JudgmentDocument2 pagesDefendant's Motion To Vacate Default JudgmentElder Abuse Advocate100% (1)

- In The Chancery Court For Washington County, Tennessee at JonesboroughDocument9 pagesIn The Chancery Court For Washington County, Tennessee at JonesboroughJessica FullerNo ratings yet

- 0460 Response To Motion For Summary JudgmentDocument14 pages0460 Response To Motion For Summary JudgmentRoy WardenNo ratings yet

- Simulated Document CheckDocument6 pagesSimulated Document CheckAlok Pathak100% (1)

- Prop Proposed ORDER AFTER HEARING On Motion in Limine To Preclude Admission of Trustees Deed After SaleDocument3 pagesProp Proposed ORDER AFTER HEARING On Motion in Limine To Preclude Admission of Trustees Deed After SaletmccandNo ratings yet

- Asset Liability ManagementDocument71 pagesAsset Liability ManagementRohit SharmaNo ratings yet

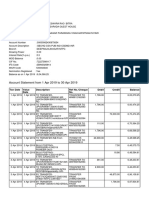

- City Union Bank account statement for Ramamoorthy KDocument1 pageCity Union Bank account statement for Ramamoorthy KRama MoorthyNo ratings yet

- Statement of Account Details and Payment OptionsDocument4 pagesStatement of Account Details and Payment OptionsJonathan CorderoNo ratings yet

- Apo Fruits Corporation v. Land Bank of The Philippines (Digest)Document2 pagesApo Fruits Corporation v. Land Bank of The Philippines (Digest)Tini Guanio100% (3)

- Answer and Affirmative Defenses in Figueroa v. SzymoniakDocument13 pagesAnswer and Affirmative Defenses in Figueroa v. SzymoniakMartin AndelmanNo ratings yet

- Blank Civil AnswerDocument7 pagesBlank Civil AnswerHugh Wood83% (6)

- EvaReeseForgeryDocument2 pagesEvaReeseForgerybarbara3721No ratings yet

- Vacate Judgment Quash ServiceDocument14 pagesVacate Judgment Quash Servicebarbara3721No ratings yet

- Step by Step Guide For CTA RegistrationDocument4 pagesStep by Step Guide For CTA Registrationbarbara3721No ratings yet

- EvaReeseForgeryDocument2 pagesEvaReeseForgerybarbara3721No ratings yet

- EvaReeseForgeryDocument2 pagesEvaReeseForgerybarbara3721No ratings yet

- EvaReeseForgeryDocument2 pagesEvaReeseForgerybarbara3721No ratings yet

- ILSOS StatementofEconomicInterest JudgeRobertGGibsonDocument2 pagesILSOS StatementofEconomicInterest JudgeRobertGGibsonbarbara3721No ratings yet

- EvaReese RightOfWay PDFDocument2 pagesEvaReese RightOfWay PDFbarbara3721No ratings yet

- EvaReeseNotary MortgageDocument9 pagesEvaReeseNotary Mortgagebarbara3721No ratings yet

- EvaReese SaleWithMortgageDocument4 pagesEvaReese SaleWithMortgagebarbara3721No ratings yet

- RAY V MOLL - Assignment 2-403Document6 pagesRAY V MOLL - Assignment 2-403barbara3721No ratings yet

- GAO 2007-03 (Standing Orders)Document2 pagesGAO 2007-03 (Standing Orders)barbara3721No ratings yet

- Roy de Shane August CalendarDocument2 pagesRoy de Shane August Calendarbarbara3721No ratings yet

- No Document NameDocument5 pagesNo Document Namebarbara3721No ratings yet

- Roy de Shane September CalendarDocument2 pagesRoy de Shane September Calendarbarbara3721No ratings yet

- Team Viewer ManualDocument89 pagesTeam Viewer ManualTobby Knight100% (1)

- Noopept Specification: 99% 25 Count - 10mg EachDocument1 pageNoopept Specification: 99% 25 Count - 10mg Eachbarbara3721No ratings yet

- Henna Labelbig - OdtDocument1 pageHenna Labelbig - Odtbarbara3721No ratings yet

- Henna Leaf Powder 100g - Natural Henna for Skin & HairDocument1 pageHenna Leaf Powder 100g - Natural Henna for Skin & Hairbarbara3721No ratings yet

- 2778 A Course DetailsDocument4 pages2778 A Course Detailsbarbara3721No ratings yet

- 2778 A Course DetailsDocument4 pages2778 A Course Detailsbarbara3721No ratings yet

- 20120705FBI Cover LetterTemplateDocument2 pages20120705FBI Cover LetterTemplatebarbara3721No ratings yet

- 2207 Mandamus SummonsDocument2 pages2207 Mandamus Summonsbarbara3721No ratings yet

- Account Opening FormDocument10 pagesAccount Opening Formsujit kcNo ratings yet

- 01-JUN-2019 - 30-JUN-2019 (1) - UnlockedDocument3 pages01-JUN-2019 - 30-JUN-2019 (1) - UnlockedSwethasri KNo ratings yet

- Charles Reed BishopDocument4 pagesCharles Reed BishopLinas KondratasNo ratings yet

- 2A COMMUNICATIVE Are You A Saver or A Spender?Document1 page2A COMMUNICATIVE Are You A Saver or A Spender?B McNo ratings yet

- What Is Debt-to-Income (DTI) Ratio?Document5 pagesWhat Is Debt-to-Income (DTI) Ratio?Niño Rey LopezNo ratings yet

- History of India's Largest Bank SBIDocument1 pageHistory of India's Largest Bank SBISNEHA MARIYAM VARGHESE SIM 16-18No ratings yet

- Ecf 320 - Money, Banking and Financial MarketsDocument22 pagesEcf 320 - Money, Banking and Financial MarketsFredrich KztizNo ratings yet

- How To Design A Plain Vanilla Interest Rate Swap: Fixed FloatingDocument3 pagesHow To Design A Plain Vanilla Interest Rate Swap: Fixed FloatingaS hausjNo ratings yet

- Olea Vs CA DigestDocument2 pagesOlea Vs CA DigestT Cel MrmgNo ratings yet

- Test 3 Review PDFDocument8 pagesTest 3 Review PDFThomas BroadyNo ratings yet

- CASE: Financial Services in IndiaDocument8 pagesCASE: Financial Services in IndiaANCHAL SINGHNo ratings yet

- 15624702052231UoGssBO9TQOUnD5 PDFDocument5 pages15624702052231UoGssBO9TQOUnD5 PDFvenkateshbitraNo ratings yet

- Pakistan-US-IMF Relations and Dutch DiseaseDocument23 pagesPakistan-US-IMF Relations and Dutch DiseaseUmair UddinNo ratings yet

- Insurance - 14. RCBC vs. CADocument1 pageInsurance - 14. RCBC vs. CAannedefrancoNo ratings yet

- CLV - CalculationDocument10 pagesCLV - CalculationUtkarsh PandeyNo ratings yet

- Legal NoticeDocument1 pageLegal NoticeMita BanerjeeNo ratings yet

- Idl Egis Handbook 2017Document68 pagesIdl Egis Handbook 2017vegaronNo ratings yet

- E-Payment in India PDFDocument6 pagesE-Payment in India PDFM GouthamNo ratings yet

- Forward RatesDocument2 pagesForward RatesTiso Blackstar GroupNo ratings yet

- Past Year Exam Paper Bank Discount & Promissory NotesDocument5 pagesPast Year Exam Paper Bank Discount & Promissory Notesatiqahcantik100% (1)

- Score 4.39.90Document4 pagesScore 4.39.90Aravindh MassNo ratings yet

- Adb Loan Disbursement Handbook PDFDocument140 pagesAdb Loan Disbursement Handbook PDFMunir AhmadNo ratings yet

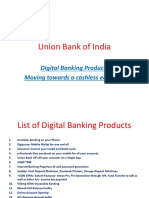

- Digital Banking Products From UBIDocument18 pagesDigital Banking Products From UBISawan NathwaniNo ratings yet