Professional Documents

Culture Documents

Hedge Fund Gurus

Uploaded by

sreen2rOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hedge Fund Gurus

Uploaded by

sreen2rCopyright:

Available Formats

Hedge Fund Gurus

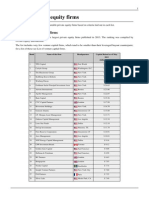

Guru David Tepper Kyle Bass Daniel Loeb Joel Greenblatt Julian Robertson T Boone Pickens Louis Moore Bacon Leon Cooperman Zeke Ashton Andreas Halvorsen David Nierenberg Tom Russo Jim Simons Mohnish Pabrai Steven Cohen Wilbur Ross Glenn Greenberg Michael Price

Firm Appaloosa Management LP Hayman Advisors Third Point, LLC Gotham Capital Tiger Management BP Capital

Portfolio Size Buy Impact Sell Impact Net Buy ($M) (%) (%) (%) 4052 143 4061 1150 353 174 80.13 67.42 63.116 37.6149 32.9 31.08 41.8679 26.509 25.25 45.4279 9.06 2.7341 30.6755 41.6 41.4252 0.47 14.87 16.306 -16.89 -5.18 -39.432 -22.1567 -18.25 -18.22 -34.3813 -19.1053 -20.16 -41.21 -6.26 -0.7639 -29.5189 -40.54 -41.1278 -0.71 -16.39 -18.007 63.24 62.24 23.684 15.4582 14.65 12.86 7.4866 7.4037 5.09 4.2179 2.8 1.9702 1.1566 1.06 0.2974 -0.24 -1.52 -1.701

Moore Capital Management, 6327 LP Omega Advisors Centaur Capital Partners Viking Global Investors LP D3 Family of Funds Gardner Russo & Gardner Renaissance Technologies LLC Pabrai Mohnish SAC Capital Advisors Invesco Private Capital Brave Warrior Capital MFP Investors LLC 5008 78 12250 267 6186 28474 325 22243 1624 1362 703

Steve Mandel Whitney Tilson Ray Dalio John Paulson Irving Kahn Private Capital John Griffin Manning & Napier Advisors, Inc Richard Pzena Larry Robbins Richard Perry Paul Tudor Jones Bill Ackman

Lone Pine Capital

16447

21.91 15.3302 11.0543 9.78 1.94 4.948 15.9 11.5987

-25.39 -19.09 -14.969 -13.8296 -7.178 -10.808 -22.424 -18.2406

-3.48 -3.7598 -3.9147 -4.0496 -5.238 -5.86 -6.524 -6.6419

T2 Partners Management, LP 345 Bridgewater Associates Paulson & Co. Kahn Brothers 6429 14961 551

Private Capital Management 1428 Blue Ridge Capital Manning & Napier Advisors Pzena Investment Management LLC Glenview Capital Perry Capital The Tudor Group Pershing Square Capital Management, L.P. Eton Park Capital Management, L.P. Blum Capital Partners Joho Capital Greenlight Capital 6043 19442

9681 5538 2079 2943 8074

5.3439 17.934 32.968 31.9403 0.21

-12.24 -24.84 -39.96 -39.2387 -8.66

-6.8961 -6.906 -6.992 -7.2984 -8.45

Eric Mindich Richard Blum Robert Karr David Einhorn George Soros Lee Ainslie Seth Klarman

7964 1388 472 5535

10.941 0.91 11.39 2.75 21.8072 32.9 1.68

-20.91 -11.62 -23.06 -14.876 -34.428 -45.6973 -14.74

-9.969 -10.71 -11.67 -12.126 -12.6208 -12.7973 -13.06

Soros Fund Management LLC 6837 Maverick Capital The Baupost Group 6953 2957

Chase Coleman Bruce Kovner Carl Icahn

Tiger Global Management LLC Caxton Associates Icahn Capital Management LP

5940 1546 9775

13.328 68.245 8.42

-27.699 -88.4577 -33.23

-14.371 -20.2127 -24.81

We can see David Tepper and Kyle Bass were the heaviest buyers in the first quarter. David Tepper has been very good at catching market bottoms. He has usually bought into the market when investors are scared. It is interesting to see him buying heavily as the market reached multi-year highs. David Tepper bought heavily into technology stocks including QQQ, Apple ( AAPL ), Google ( GOOG ), etc. You can see his trades here. Kyle Bass has been bearish for a while. But he also bought heavily in the first quarter. Interestingly, he is also heavily into technology stocks. He bought telecom companies such as Alcatel ( ALU ), Tellabs ( TLAB ), etc. You can see the details of Bass' trades here. Hedge fund managers like David Einhorn, Seth Klarman and George Soros are evidently more bearish, as they have sold a lot more stocks than they bought. To see the consensus buys and sells, please go to the aggregated holdings of Gurus, or try our new Allin-One Screener. Guru Sector Trend will tell you which industry they are buying into.

Read more: http://community.nasdaq.com/News/2012-05/hedge-fund-gurus-who-is-buying-who-isselling.aspx?storyid=143218#ixzz1vuDEyxoh

You might also like

- List of Private Equity FirmsDocument10 pagesList of Private Equity FirmsJimmy Carlos Riojas MarquezNo ratings yet

- George Soros, S SecretsDocument21 pagesGeorge Soros, S Secretscorneliusflavius7132No ratings yet

- Scribd Salesforce ConnectionsDocument2,010 pagesScribd Salesforce ConnectionsLaurelButtaroNo ratings yet

- Top Business Books of All TimeDocument5 pagesTop Business Books of All Timechandel08No ratings yet

- The Little Book of Investing Like the Pros: Five Steps for Picking StocksFrom EverandThe Little Book of Investing Like the Pros: Five Steps for Picking StocksNo ratings yet

- SUperinvestors CIKDocument2 pagesSUperinvestors CIKAnonymous O5asZmNo ratings yet

- Resume of Msnetty42Document2 pagesResume of Msnetty42api-25122959No ratings yet

- Bear Proof InvestingDocument289 pagesBear Proof Investingbigjlk100% (1)

- File Your 2020 Federal Taxes ElectronicallyDocument6 pagesFile Your 2020 Federal Taxes ElectronicallyJordan 23100% (3)

- Hays Information Technology Abby McKibbenDocument38 pagesHays Information Technology Abby McKibbenAllen Mae WilliamsNo ratings yet

- BLN Growth Forum 5th July 2011 Delegate ListDocument4 pagesBLN Growth Forum 5th July 2011 Delegate ListMarius RusNo ratings yet

- Too Big To Fail SummaryDocument1 pageToo Big To Fail SummarychepskateNo ratings yet

- Aerospace & Defense, Mergers and Acquisitions Environment, and Company ValuationDocument21 pagesAerospace & Defense, Mergers and Acquisitions Environment, and Company ValuationAlex HongNo ratings yet

- David Tepper Says Be Long Equities Market FollyDocument4 pagesDavid Tepper Says Be Long Equities Market FollynabsNo ratings yet

- CeoDocument70 pagesCeoUdit MukhijaNo ratings yet

- The Employer Brand: Bringing the Best of Brand Management to People at WorkFrom EverandThe Employer Brand: Bringing the Best of Brand Management to People at WorkNo ratings yet

- Pei 300 - Top 50 Pe FundsDocument3 pagesPei 300 - Top 50 Pe FundsDonZ1063No ratings yet

- Niosh 0500Document3 pagesNiosh 0500sreen2r100% (1)

- Why People Buy Things They Dont NeedDocument272 pagesWhy People Buy Things They Dont NeedArun DineshNo ratings yet

- 952BDocument276 pages952BMohd. Osama100% (1)

- An End to the Bull: Cut Through the Noise to Develop a Sustainable Trading CareerFrom EverandAn End to the Bull: Cut Through the Noise to Develop a Sustainable Trading CareerRating: 5 out of 5 stars5/5 (4)

- Barron 100 HedgefundsDocument2 pagesBarron 100 Hedgefundskcchan7No ratings yet

- 03 If FunctionDocument147 pages03 If Functionshahim akramNo ratings yet

- Top 100 Hedge Funds 2013 Ranking by Assets and ReturnsDocument9 pagesTop 100 Hedge Funds 2013 Ranking by Assets and ReturnsShreyas LakshminarayanNo ratings yet

- Hedge Fund Ranking 1yr 2012Document53 pagesHedge Fund Ranking 1yr 2012Finser GroupNo ratings yet

- CDP Report3Document154 pagesCDP Report3Gaurav VermaNo ratings yet

- Company Analysis - Overview: Linkedin CorpDocument8 pagesCompany Analysis - Overview: Linkedin CorpQ.M.S Advisors LLCNo ratings yet

- DeutscheBank EquityIPO v1.1Document9 pagesDeutscheBank EquityIPO v1.1Abinash BeheraNo ratings yet

- C4K ConferenceDocument1 pageC4K Conferencemarketfolly.comNo ratings yet

- FIRE314, Notes 1: Chapter 3: Overview of Security TypesDocument17 pagesFIRE314, Notes 1: Chapter 3: Overview of Security TypesYolanda GloverNo ratings yet

- 2011 Pei 300Document23 pages2011 Pei 300mtrizzle06No ratings yet

- CPC ReportDocument10 pagesCPC ReportMD ABUL KHAYERNo ratings yet

- Company Analysis - Overview: Boeing Co/TheDocument8 pagesCompany Analysis - Overview: Boeing Co/TheQ.M.S Advisors LLCNo ratings yet

- Bata DataDocument13 pagesBata Dataaltaf_catsNo ratings yet

- Manila Standard Today - Business Weekly Stocks Review (March 1, 2015)Document1 pageManila Standard Today - Business Weekly Stocks Review (March 1, 2015)Manila Standard TodayNo ratings yet

- 656 - Hong Kong Stock Quote - Fosun International LTD - BloombergDocument3 pages656 - Hong Kong Stock Quote - Fosun International LTD - BloombergBaikaniNo ratings yet

- Dividend Weekly 26 - 2013Document33 pagesDividend Weekly 26 - 2013Tom RobertsNo ratings yet

- Charter Communications Inc NasdaqGS CHTR Public Ownership DetailedDocument45 pagesCharter Communications Inc NasdaqGS CHTR Public Ownership DetailedredchillpillNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 3, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 3, 2014)Manila Standard TodayNo ratings yet

- Adviser Rank (Market Share) Market Share (%)Document3 pagesAdviser Rank (Market Share) Market Share (%)iemif2013No ratings yet

- DELL Annual Cash Flow Statement - Dell IncDocument3 pagesDELL Annual Cash Flow Statement - Dell IncmrkuroiNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 18, 2014)Manila Standard TodayNo ratings yet

- Fund Assets 7-Day Yield 30-Day YieldDocument2 pagesFund Assets 7-Day Yield 30-Day Yieldmadhumitha_vaniNo ratings yet

- Regional Yield Above 3%-140102Document22 pagesRegional Yield Above 3%-140102Invest StockNo ratings yet

- 10 Year Financials of AAPL - Apple Inc. - GuruFocusDocument2 pages10 Year Financials of AAPL - Apple Inc. - GuruFocusEchuOkan1No ratings yet

- VCComp 2006 SurveyDocument17 pagesVCComp 2006 SurveyMark Robert MitchellNo ratings yet

- Crox 20110728Document2 pagesCrox 20110728andrewbloggerNo ratings yet

- COL Calculator TemplateDocument145 pagesCOL Calculator TemplateGerardBalosbalosNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 25, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (July 25, 2013)Manila Standard TodayNo ratings yet

- Winners Edge Short Track Time Trial April 13th 2014Document3 pagesWinners Edge Short Track Time Trial April 13th 2014BernewsAdminNo ratings yet

- DLF Company AnalysisDocument41 pagesDLF Company AnalysisboobraviNo ratings yet

- Cliches About Jeff Brown Near Future You Should AvoidDocument1 pageCliches About Jeff Brown Near Future You Should Avoids1yksdc700No ratings yet

- Training Tracker: Input DataDocument25 pagesTraining Tracker: Input DataDragos MunteanNo ratings yet

- Businessweek Rank Share Price ($) Earnings Per Share ($)Document1 pageBusinessweek Rank Share Price ($) Earnings Per Share ($)Christian Josué RecinosNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 11, 2014)Manila Standard TodayNo ratings yet

- Simuate - Case Study: Team GreenDocument14 pagesSimuate - Case Study: Team GreengetkhosaNo ratings yet

- Equity Market Report and Analysis - Equity Tips For 9 MayDocument7 pagesEquity Market Report and Analysis - Equity Tips For 9 MayTheequicom AdvisoryNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayNo ratings yet

- Weird Hobbies That'll Make You Better at Jeff Brown YoutubeDocument1 pageWeird Hobbies That'll Make You Better at Jeff Brown Youtubew9dnydl554No ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 17, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 17, 2014)Manila Standard TodayNo ratings yet

- Training Tracker: Input DataDocument16 pagesTraining Tracker: Input DatavictorNo ratings yet

- Best PracticesDocument22 pagesBest PracticesAhmad MostafaNo ratings yet

- Company Analysis - Overview: Barclays PLCDocument8 pagesCompany Analysis - Overview: Barclays PLCQ.M.S Advisors LLCNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 4, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 4, 2013)Manila Standard TodayNo ratings yet

- ThreeHorizons 1Document2 pagesThreeHorizons 1sreen2rNo ratings yet

- Coal Safety Fact SheetDocument1 pageCoal Safety Fact Sheetsreen2rNo ratings yet

- Case Write Up-JetBlueDocument13 pagesCase Write Up-JetBluesreen2r100% (1)

- Addl Notes - FCFF Model PDFDocument17 pagesAddl Notes - FCFF Model PDFRoyLadiasanNo ratings yet

- AirbusDocument2 pagesAirbussreen2rNo ratings yet

- CT National Report 2Q10Document16 pagesCT National Report 2Q10amy_schenkNo ratings yet

- Boxplot y Cuartiles, Asimetria, CurtosisDocument21 pagesBoxplot y Cuartiles, Asimetria, Curtosishernan salgueroNo ratings yet

- 33333Document267 pages33333Claudia RamosNo ratings yet

- Social Security, Medicare and Medicaid Work For South Carolina 2012Document22 pagesSocial Security, Medicare and Medicaid Work For South Carolina 2012SocialSecurityWorksNo ratings yet

- (Circular E), Employer's Tax Guide: Future DevelopmentsDocument48 pages(Circular E), Employer's Tax Guide: Future DevelopmentsradhakrishnaNo ratings yet

- Appendix 24 - QUARTERLY REPORT OF REVENUE AND OTHER RECEIPTSDocument1 pageAppendix 24 - QUARTERLY REPORT OF REVENUE AND OTHER RECEIPTSPau PerezNo ratings yet

- Can I Claim Them As A Dependent?: Your Income TaxesDocument1 pageCan I Claim Them As A Dependent?: Your Income TaxesAly SmallwoodNo ratings yet

- An American Century-A Strategy To Secure America's Enduring Interests and IdealsDocument44 pagesAn American Century-A Strategy To Secure America's Enduring Interests and IdealsMitt RomneyNo ratings yet

- US Internal Revenue Service: I1040 - 2004Document128 pagesUS Internal Revenue Service: I1040 - 2004IRS100% (1)

- THE IMPACT OF GLOBAL RECESSION ON INFORMATION TECHNOLOGY SECTOR IN INDIA PPT by Sumeet DolheDocument40 pagesTHE IMPACT OF GLOBAL RECESSION ON INFORMATION TECHNOLOGY SECTOR IN INDIA PPT by Sumeet DolheSumeet DolheNo ratings yet

- Tax 4001 Exam Practice SolutionsDocument10 pagesTax 4001 Exam Practice SolutionsggjjyyNo ratings yet

- Customer Inquiry ReportDocument3 pagesCustomer Inquiry ReportFitriNo ratings yet

- Non Food RetailersDocument691 pagesNon Food RetailersLoser NeetNo ratings yet

- Importance of 'Retail Function" For RetailersDocument3 pagesImportance of 'Retail Function" For RetailersSaumya PandeyNo ratings yet

- 1-Jay Chaudhry: Jeff BezosDocument3 pages1-Jay Chaudhry: Jeff BezosRaj SharmaNo ratings yet

- Report PDFDocument10 pagesReport PDFextel2009100% (2)

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrank LamNo ratings yet

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument1 pageW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceMegan AndreaNo ratings yet

- Revisited - The Real Reasons For The Upcoming War in Iraq by William Clark, Updated - Jan 2004Document59 pagesRevisited - The Real Reasons For The Upcoming War in Iraq by William Clark, Updated - Jan 2004سید ہارون حیدر گیلانیNo ratings yet

- United States TIN PDFDocument2 pagesUnited States TIN PDFAldo Rodrigo AlgandonaNo ratings yet

- Tuition Statement Provides Tax InfoDocument2 pagesTuition Statement Provides Tax InfoJonathan EllisNo ratings yet

- BIBM101 Class ExerciseDocument4 pagesBIBM101 Class ExercisePauu HMNo ratings yet

- PricelistDocument162 pagesPricelistNIT TEKSTILNo ratings yet

- 07 BpqyDocument1 page07 BpqyMichael Van EssenNo ratings yet

- BFB Season 4 InfoDocument14 pagesBFB Season 4 InfoLoliest HuhytreNo ratings yet

- IRS Publication Form 8867Document4 pagesIRS Publication Form 8867Francis Wolfgang UrbanNo ratings yet