Professional Documents

Culture Documents

Irs 990-Ez 2007

Uploaded by

api-18678301Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Irs 990-Ez 2007

Uploaded by

api-18678301Copyright:

Available Formats

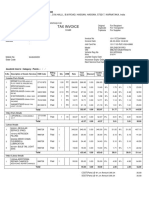

Form

990-EZ

Short Form Return of Organization Exempt From Income Tax

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation)

Sponsoring organizations, and controlling organizations as defined in section 512(b)(13) must file Form 990. All other organizations with gross receipts less than $100,000 and total assets less than $250,000 at the end of the year may use this form. The organization may have to use a copy of this return to satisfy state reporting requirements.

OMB No. 1545-1150

2007

Open to Public Inspection

, 20

Department of the Treasury Internal Revenue Service

A For the 2007 calendar year, or tax year beginning B Check if applicable: Please C Name of organization

Address change Name change Initial return Termination Amended return Application pending use IRS label or print or type. See Specific Instructions.

, 2007, and ending

D Employer identification number

ADCO Development Corporation 7190 Colorado Blvd.

City or town, state or country, and ZIP + 4

84

( 303 )

1152000 227-2079

Number and street (or P.O. box, if mail is not delivered to street address) Room/suite E Telephone number

Commerce City, CO 80022-1812

F Group Exemption Number G Accounting method: Other (specify) Cash Accrual

Section 501(c)(3) organizations and 4947(a)(1) nonexempt charitable trusts must attach a completed Schedule A (Form 990 or 990-EZ). I

Website:

501(c) ( ) (insert no.) 4947(a)(1) or 527

J Organization type (check only one)

H Check if the organization is not required to attach Schedule B (Form 990, 990-EZ, or 990-PF).

K Check if the organization is not a section 509(a)(3) supporting organization and its gross receipts are normally not more than $25,000. A return is not required, but if the organization chooses to file a return, be sure to file a complete return. L Add lines 5b, 6b, and 7b, to line 9 to determine gross receipts; if $100,000 or more, file Form 990 instead of Form 990-EZ $ 0

Part I

1 2 3 4 5a b c 6 a

Revenue, Expenses, and Changes in Net Assets or Fund Balances (See page 55 of the instructions.)

Contributions, gifts, grants, and similar amounts received Program service revenue including government fees and contracts Membership dues and assessments Investment income 5a Gross amount from sale of assets other than inventory 5b Less: cost or other basis and sales expenses Gain or (loss) from sale of assets other than inventory. Subtract line 5b from line 5a (attach schedule) Special events and activities (attach schedule). If any amount is from gaming, check here of contributions Gross revenue (not including $ 6a reported on line 1) 6b Less: direct expenses other than fundraising expenses Net income or (loss) from special events and activities. Subtract line 6b from line 6a 7a Gross sales of inventory, less returns and allowances 7b Less: cost of goods sold 1 2 3 4

0 0 0 0 0 0

Revenue

5c

b c 7a b c Gross profit or (loss) from sales of inventory. Subtract line 7b from line 7a 8 Other revenue (describe 9 Total revenue. Add lines 1, 2, 3, 4, 5c, 6c, 7c, and 8 10 11 12 13 14 15 16 17 18 19 20 21 Grants and similar amounts paid (attach schedule) Benefits paid to or for members Salaries, other compensation, and employee benefits Professional fees and other payments to independent contractors Occupancy, rent, utilities, and maintenance Printing, publications, postage, and shipping Other expenses (describe Total expenses. Add lines 10 through 16

0 0

6c

0 0

)

Part II

Excess or (deficit) for the year. Subtract line 17 from line 9 Net assets or fund balances at beginning of year (from line 27, column (A)) (must agree with 15,000 19 end-of-year figure reported on prior years return) 0 20 Other changes in net assets or fund balances (attach explanation) Net assets or fund balances at end of year. Combine lines 18 through 20 15,000 21 Balance SheetsIf Total assets on line 25, column (B) are $250,000 or more, file Form 990 instead of Form 990-EZ.

(A) Beginning of year (B) End of year

Net Assets

7c 8 9 10 11 12 13 14 15 16 17 18

0 0 0 0 0 0 0 0 0 0 0 0

Expenses

(See page 60 of the instructions.) 22 Cash, savings, and investments 23 Land and buildings 24 Other assets (describe 25 Total assets 26 Total liabilities (describe 27 Net assets or fund balances (line 27 of column (B) must agree with line 21)

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

) Cat. No. 10642I

15,000 0 0 15,000 0 15,000

22 23 24 25 26 27

Form

15,000 0 0 15,000 0 15,000

990-EZ

(2007)

Form 990-EZ (2007)

Page

Part III

Statement of Program Service Accomplishments (See page 60 of the instructions.)

What is the organizations primary exempt purpose? Low Income Housing & Supprotive Services Describe what was achieved in carrying out the organizations exempt purposes. In a clear and concise manner, describe the services provided, the number of persons benefited, or other relevant information for each program title. 28 No housing or services were provided during this year - entity was temporarily inactive. Anticipate utilizing in the future. (Grants $ 29 ) If this amount includes foreign grants, check here

Expenses (Required for 501(c)(3) and (4) organizations and 4947(a)(1) trusts; optional for others.)

28a

(Grants $ 30

) If this amount includes foreign grants, check here

29a

30a (Grants $ ) If this amount includes foreign grants, check here 31 Other program services (attach schedule) (Grants $ ) If this amount includes foreign grants, check here 31a 32 Total program service expenses. Add lines 28a through 31a 32 Part IV List of Officers, Directors, Trustees, and Key Employees (List each one even if not compensated. See page 61 of the instructions.)

(A) Name and address (B) Title and average hours per week devoted to position (C) Compensation (If not paid, enter -0-.) (D) Contributions to employee benefit plans & deferred compensation (E) Expense account and other allowances

0 0

Donald May 7190 Colorado Blvd., Commerce City, CO 80022

President - 1

Part V

33

Other Information (Note the statement requirement in General Instruction V.)

33 34

Yes No

Did the organization make a change in its activities or methods of conducting activities? If Yes, attach a detailed statement of each change 34 Were any changes made to the organizing or governing documents but not reported to the IRS? If Yes, attach a conformed copy of the changes 35 If the organization had income from business activities, such as those reported on lines 2, 6, and 7 (among others), but not reported on Form 990-T, attach a statement explaining your reason for not reporting the income on Form 990-T. a Did the organization have unrelated business gross income of $1,000 or more or 6033(e) notice, reporting, and proxy tax requirements? b If Yes, has it filed a tax return on Form 990-T for this year? 36 Was there a liquidation, dissolution, termination, or substantial contraction during the year? If Yes, attach a statement. 37a 37a Enter amount of political expenditures, direct or indirect, as described in the instructions. b Did the organization file Form 1120-POL for this year? 38a Did the organization borrow from, or make any loans to, any officer, director, trustee, or key employee or were any such loans made in a prior year and still unpaid at the start of the period covered by this return? b If Yes, attach the schedule specified in the line 38 instructions and enter the amount 38b involved 39 501(c)(7) organizations. Enter: a Initiation fees and capital contributions included on line 9 b Gross receipts, included on line 9, for public use of club facilities 39a 39b

35a 35b 36 37b 38a

Form

990-EZ

(2007)

Form 990-EZ (2007)

Page

Part V

Other Information (Note the statement requirement in General Instruction V.) (Continued)

40a 501(c)(3) organizations. Enter amount of tax imposed on the organization during the year under: section 4911 ; section 4912 ; section 4955 b 501(c)(3) and (4) organizations. Did the organization engage in any section 4958 excess benefit transaction during the year or did it become aware of an excess benefit transaction from a prior year? If Yes, attach an explanation

Yes No

40b

c Enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 d Enter amount of tax on line 40c reimbursed by the organization e All organizations. At any time during the tax year, was the organization a party to a prohibited tax shelter 40e transaction? Colorado 41 List the states with which a copy of this return is filed. Michael Belieu/Controller 227-2079 42a The books are in care of Telephone no. ( 303 ) 7190 Colorado Blvd., Commerce City, CO 80022-1812 Located at ZIP + 4 b At any time during the calendar year, did the organization have an interest in or a signature or other authority over a financial account in a foreign country (such as a bank account, securities account, or other financial account)? If Yes, enter the name of the foreign country: See the instructions for exceptions and filing requirements for Form TD F 90-22.1. c At any time during the calendar year, did the organization maintain an office outside of the U.S.? If Yes, enter the name of the foreign country: 43 Section 4947(a)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041Check here and enter the amount of tax-exempt interest received or accrued during the tax year 43

Yes No

42b

42c

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge.

Please Sign Here

Signature of officer

Date

Donald May - President

Type or print name and title. Preparers signature Firms name (or yours if self-employed), address, and ZIP + 4 Date Check if selfemployed EIN Phone no.

( )

Paid Preparers Use Only

Preparers SSN or PTIN (See Gen. Inst. X)

Form

990-EZ

(2007)

You might also like

- West Hempstead, NY Rotary Foundation IRS 990s, 2011-2013Document39 pagesWest Hempstead, NY Rotary Foundation IRS 990s, 2011-2013Peter M. HeimlichNo ratings yet

- katrinaBlairDirectsVolunteers2011 841141304 - 201112 - 990EZDocument13 pageskatrinaBlairDirectsVolunteers2011 841141304 - 201112 - 990EZuncleadolphNo ratings yet

- Justice 990 2009Document12 pagesJustice 990 2009TheSceneOfTheCrimeNo ratings yet

- FTG Irs Form 990-Ez 2008Document12 pagesFTG Irs Form 990-Ez 2008L. A. PatersonNo ratings yet

- United Council Form 990 2010Document18 pagesUnited Council Form 990 2010Signe BrewsterNo ratings yet

- Short Form - EZ Return of Organization Exempt From Income TaxDocument6 pagesShort Form - EZ Return of Organization Exempt From Income TaxTheSceneOfTheCrime100% (1)

- FTG Irs Form 990-Ez 2010Document12 pagesFTG Irs Form 990-Ez 2010L. A. PatersonNo ratings yet

- Short Form .EZ Return of Organization Exempt From Income Tax 2012Document9 pagesShort Form .EZ Return of Organization Exempt From Income Tax 2012FIXMYLOANNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionFrancis Wolfgang UrbanNo ratings yet

- DT 2007 990Document34 pagesDT 2007 990shimeralumNo ratings yet

- Institute For Liberty 202641983 2008 076b44aeDocument4 pagesInstitute For Liberty 202641983 2008 076b44aecmf8926No ratings yet

- Return of Organization Exempt From Income Tax: HE Heartland Institute) 03 (312) 377-4000Document20 pagesReturn of Organization Exempt From Income Tax: HE Heartland Institute) 03 (312) 377-4000shimeralumNo ratings yet

- Justice 990 2003Document2 pagesJustice 990 2003TheSceneOfTheCrimeNo ratings yet

- Threshold Foundation 2006 990Document29 pagesThreshold Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- NCJC 561348186 - 200712 - 990Document28 pagesNCJC 561348186 - 200712 - 990A.P. DillonNo ratings yet

- Return of Organization Exempt From Income TaxDocument11 pagesReturn of Organization Exempt From Income TaxEnvironmental Working GroupNo ratings yet

- Threshold Foundation 2007 990Document28 pagesThreshold Foundation 2007 990TheSceneOfTheCrimeNo ratings yet

- Received: Return of Organization Exempt From Income TaxDocument16 pagesReceived: Return of Organization Exempt From Income Taxcmf8926No ratings yet

- Wep 990 2006 581518182 - 200606 - 990Document34 pagesWep 990 2006 581518182 - 200606 - 990A.P. DillonNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionpittscherylNo ratings yet

- Tides Foundation 2006 990Document82 pagesTides Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public Inspectiongeoffb1No ratings yet

- NCCF 990Document235 pagesNCCF 990Anita LiNo ratings yet

- ECDC 2009 Tax ReturnDocument27 pagesECDC 2009 Tax ReturnNC Policy WatchNo ratings yet

- Return of Organization Exempt From Income TaxDocument30 pagesReturn of Organization Exempt From Income TaxshimeralumNo ratings yet

- Stanford 990Document208 pagesStanford 990coo9486No ratings yet

- Donors Capital Fund541934032 2007 048EED01SearchableDocument28 pagesDonors Capital Fund541934032 2007 048EED01Searchablecmf8926No ratings yet

- Return of Organization Exempt From Income TaxDocument19 pagesReturn of Organization Exempt From Income TaxshimeralumNo ratings yet

- FreedomWorks Foundation 521526916 2007 040FCA34SearchableDocument16 pagesFreedomWorks Foundation 521526916 2007 040FCA34Searchablecmf8926No ratings yet

- PDC - 2009 Tax ReturnDocument19 pagesPDC - 2009 Tax ReturnNC Policy WatchNo ratings yet

- Big 12 990 Report: Fiscal Year 2009Document45 pagesBig 12 990 Report: Fiscal Year 2009HuskieWireNo ratings yet

- Big 12 990 Report: Fiscal Year 2008Document35 pagesBig 12 990 Report: Fiscal Year 2008HuskieWireNo ratings yet

- 2016 OVF 990EZ With SchedulesDocument7 pages2016 OVF 990EZ With SchedulesDaniel R. Gaita, MA, LMSWNo ratings yet

- Schwab Charitable Fund 2010 990Document1,013 pagesSchwab Charitable Fund 2010 990TheSceneOfTheCrimeNo ratings yet

- Tides Foundation 2008 990Document163 pagesTides Foundation 2008 990TheSceneOfTheCrimeNo ratings yet

- 2009 561750279 05ba1360 9Document31 pages2009 561750279 05ba1360 9Fecund StenchNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921Document3 pagesShort Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921lesliebrodieNo ratings yet

- ICIRR Money and OrganizationsDocument73 pagesICIRR Money and OrganizationsOmar Jonathan Pérez MoralesNo ratings yet

- Silicon Valley Community Foundation 2008 990Document481 pagesSilicon Valley Community Foundation 2008 990TheSceneOfTheCrimeNo ratings yet

- Silicon Valley Community Foundation 2009 990Document220 pagesSilicon Valley Community Foundation 2009 990TheSceneOfTheCrime100% (1)

- FreedomWorks Foundation 521526916 2010 074FD753SearchableDocument44 pagesFreedomWorks Foundation 521526916 2010 074FD753Searchablecmf8926No ratings yet

- US Internal Revenue Service: F990sa - 1991Document5 pagesUS Internal Revenue Service: F990sa - 1991IRSNo ratings yet

- GPTMC - 2011 990Document47 pagesGPTMC - 2011 990juliabergNo ratings yet

- US Internal Revenue Service: F990sa - 1996Document6 pagesUS Internal Revenue Service: F990sa - 1996IRSNo ratings yet

- Church of Scientology, Flag Service Organization, FSO, 990-T, IRS, 2014Document9 pagesChurch of Scientology, Flag Service Organization, FSO, 990-T, IRS, 2014The Department of Official InformationNo ratings yet

- ECDC 2005 Add-OnDocument2 pagesECDC 2005 Add-OnNC Policy WatchNo ratings yet

- BLMGN 2020 Ez 01012020 - 06302020Document13 pagesBLMGN 2020 Ez 01012020 - 06302020Jim HoftNo ratings yet

- Return of Private Foundation or Section 49 A7 @) (11 Nonexempt Charitable TrustDocument15 pagesReturn of Private Foundation or Section 49 A7 @) (11 Nonexempt Charitable TrustalavifoundationNo ratings yet

- US Internal Revenue Service: F990sa - 1992Document5 pagesUS Internal Revenue Service: F990sa - 1992IRSNo ratings yet

- Harrisburg University's 2007 990 FormDocument39 pagesHarrisburg University's 2007 990 FormPennLiveNo ratings yet

- Supplemental Information To Form 990 or 990-EZDocument3 pagesSupplemental Information To Form 990 or 990-EZBilboDBagginsNo ratings yet

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- NCJC 561348186 - 200912 - 990Document36 pagesNCJC 561348186 - 200912 - 990A.P. DillonNo ratings yet

- Institute For Humane Studies 941623852 2006 03A6717CDocument15 pagesInstitute For Humane Studies 941623852 2006 03A6717Ccmf8926No ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- st3 FormDocument12 pagesst3 FormAvijit BanerjeeNo ratings yet

- Tax1a Preliminary ExamDocument7 pagesTax1a Preliminary ExamCharmaine PamintuanNo ratings yet

- Rev SKBPP Forms1 3Document3 pagesRev SKBPP Forms1 3Naka Ng TetengNo ratings yet

- Cash Flow Statement Template in ExcelDocument5 pagesCash Flow Statement Template in ExcelOyewale OyelayoNo ratings yet

- Sesi 7 - Skyview Manor CaseDocument3 pagesSesi 7 - Skyview Manor CasestevenNo ratings yet

- Asian Paints DCF ValuationDocument64 pagesAsian Paints DCF Valuationsanket patilNo ratings yet

- Tax 102Document53 pagesTax 102Dave A ValcarcelNo ratings yet

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- Shambhu Med.Document1 pageShambhu Med.Rajeev KejriwalNo ratings yet

- Introduction of Income TaxDocument47 pagesIntroduction of Income TaxVishwamittarNo ratings yet

- Invoice ToDocument1 pageInvoice ToTester Simplicity For BusinessNo ratings yet

- Taxation 123Document3 pagesTaxation 123Cantos FlorenceNo ratings yet

- Lumbera LectureDocument3 pagesLumbera LectureRyeNo ratings yet

- Fiscal Policy and Developments-FinalDocument108 pagesFiscal Policy and Developments-FinalShime HI RayaNo ratings yet

- Unit 4 - Income From Capital GainsDocument10 pagesUnit 4 - Income From Capital GainsAvin P RNo ratings yet

- FW 8 Ben 2Document1 pageFW 8 Ben 2DCOM SoftwaresNo ratings yet

- Business Taxation Solman Tabag@garcia PDFDocument42 pagesBusiness Taxation Solman Tabag@garcia PDFJoey AbrahamNo ratings yet

- Ghana Revenue Authority: Monthly Vat & Nhil ReturnDocument2 pagesGhana Revenue Authority: Monthly Vat & Nhil Returnokatakyie1990No ratings yet

- Aec10 - Business Taxation Solution Tabag CH4Document8 pagesAec10 - Business Taxation Solution Tabag CH4EdeksupligNo ratings yet

- The Maharashtra Motor Vehicles Tax ActDocument46 pagesThe Maharashtra Motor Vehicles Tax ActmilinddhandeNo ratings yet

- A 1 The Statement Is Entitled Consolidated Balance SheetsDocument1 pageA 1 The Statement Is Entitled Consolidated Balance SheetsM Bilal SaleemNo ratings yet

- Tax Planning AssignmentDocument10 pagesTax Planning AssignmentJayashree Mohandass100% (1)

- Vodafone Case SummaryDocument3 pagesVodafone Case SummaryShubham NathNo ratings yet

- Hero 10117CC24V8991Document2 pagesHero 10117CC24V8991punithupcharNo ratings yet

- IRSChange of AddressDocument2 pagesIRSChange of AddressLynette SmithNo ratings yet

- TDS Report 27-06-2023Document2 pagesTDS Report 27-06-2023AVDHESH YADAVNo ratings yet

- Agatha Is Planning To Start A New Business Venture and PDFDocument1 pageAgatha Is Planning To Start A New Business Venture and PDFDoreenNo ratings yet

- MGMT3052 Taxation & Tax Management (UWI)Document6 pagesMGMT3052 Taxation & Tax Management (UWI)payel02000100% (1)

- Employee DataDocument1 pageEmployee DataDinesh RNo ratings yet

- Flyer PERA Infographics FA PDFDocument2 pagesFlyer PERA Infographics FA PDFChristopher BrownNo ratings yet