Professional Documents

Culture Documents

Butler Lumber - Pro Forma - Balance and Income Statement

Uploaded by

Jack BenjaminOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Butler Lumber - Pro Forma - Balance and Income Statement

Uploaded by

Jack BenjaminCopyright:

Available Formats

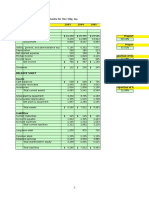

Online Bridge Program: Cash Flow Forecasting Butler Lumber Pro Formas Generate a pro forma income statement

for Butler Lumber using the percentage-of-sales method. Make projections without trade discounts (a) and with trade discounts (b). Use the following assumptions when performing your calculations:

a) Butler Lumbers 1991 sales will be $3.6 million, as estimated in the case study. b) Other historical relationships within the financial statements that prevailed in 1990 will continue in 1991. Use the percentof-forecast-sales method to calculate values unless the value is otherwise known. c) Butler Lumbers average trade discount is 2 percent of purchase price. Assume if Butler Lumber takes advantage of discounts it does so starting April 1, 1991. d) Butler Lumbers tax rate is 35 percent. average principal balance outstanding e) Remember that interest is being paid at 10.50 percent and calculated on the during the year. Normally you would need to estimate this expense. For the sake of simplicity, assume 1991 interest expense is $40,000 if no discounts are taken and $53,000 if the discounts are taken.

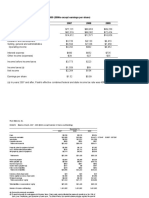

f) Assume the current portion of long-term debt stays at the same level, i.e., $7,000. g) If Butler Lumber takes advantage of trade discounts, the Accounts Payable balance at the end of 1991 will be $75,000. h) Butler plans to obtain any additional financing it needs by increasing its notes payable to the bank. After you have completed and checked your work, you will generate the pro forma balance sheet. Butler Lumber Company Income Statement For the Years Ending December 31, 1988-1990 and Pro Forma Income Statement for 1991 (in thousands of dollars) % of 1988 Net sales Cost of goods sold Beginning inventory Plus Purchases $ Less Ending inventory Total cost of goods sold Gross profit Less Operating expenses Operating income Plus: 2% discounts Less Interest expense Net income before taxes Less Provision for income taxes Net income (a) No discounts (b) With discounts $ $ 13 37 6 31 $ $ 20 41 7 34 $ $ 33 53 9 44 $ $ $ 183 1,278 1,461 239 1,222 475 425 50 $ $ $ $ 239 1,524 1,763 326 1,437 576 515 61 $ $ $ $ 326 2,042 2,368 418 1,950 744 658 86 $ 1,697 $ 1989 2,013 $ 1990 2,694 Sales Projected 1991 (a) Projected 1991 (b)

Online Bridge Program: Cash Flow Forecasting Butler Lumber Pro Formas Correct Answers: Butler Lumber Company Income Statement For the Years Ending December 31, 1988-1990 and Pro Forma Income Statement for 1991 (in thousands of dollars) % of 1988 Net sales Cost of goods sold Beginning inventory Plus Purchases $ Less Ending inventory Total cost of goods sold Gross profit Less Operating expenses Operating income Plus: 2% discounts Less Interest expense Net income before taxes Less Provision for income taxes Net income (a) No discounts (b) With discounts $ $ $ $ $ 183 1,278 1,461 239 1,222 475 425 50 13 37 6 31 $ $ $ $ $ $ 239 1,524 1,763 326 1,437 576 515 61 20 41 7 34 $ $ $ $ $ $ 326 2,042 2,368 418 1,950 744 658 86 33 53 9 44 $ $ 40 75 26 49 $ $ 24.4% $ 15.5% 72.4% $ $ $ 418 2,746 3,164 558 2,606 994 878 115 $ $ $ $ 418 2,746 3,164 558 2,606 994 878 115 41 53 103 36 67 $ 1,697 $ 1989 2,013 $ 1990 2,694 Sales $ Projected 1991 (a) 3,600 $ Projected 1991 (b) 3,600

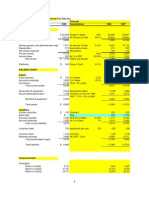

Online Bridge Program: Cash Flow Forecasting Butler Lumber Pro Formas Generate a pro forma balance sheet for Butler Lumber using the percentage-of-sales method. Make projections without trade discounts (a) and with trade discounts (b). Also calculate the size of the loan Butler Lumber will require with and without trade discounts. Use the following assumptions when performing your calculations:

a) Butler Lumbers 1991 sales will be $3.6 million, as estimated in the case study.

b) Other historical relationships within the financial statements that prevailed in 1990 will continue in 1991. Use the percent-of-foreca sales method to calculate values unless the value is otherwise known. c) Butler Lumbers average trade discount is 2 percent of purchase price. Assume if Butler Lumber takes advantage of discounts it does so starting April 1, 1991. d) Butler Lumbers tax rate is 35 percent. average principal balance outstanding during the year. e) Remember that interest is being paid at 10.50 percent and calculated on the Normally you would need to estimate this expense. For the sake of simplicity, assume 1991 interest expense is $40,000 if no discounts are taken and $53,000 if the discounts are taken.

f) Assume the current portion of long-term debt stays at the same level, i.e. $7,000. g) If Butler Lumber takes advantage of trade discounts, the Accounts Payable balance at the end of 1991 will be $75,000 h) Butler plans to obtain any additional financing it needs by increasing its notes payable to the bank. Butler Lumber Company Balance Sheet For the Years Ending December 31, 1988-1990 and Pro Forma Balance Sheet for 1991 (in thousands of dollars)

% of 1988 Cash Accounts receivable Inventory Total current assets Property (net) Total assets Notes payable, bank Notes payable, Mr. Stark Accounts payable, trade Accrued expenses Current portion of long-term debt Total current liabilities Long-term debt Total liabilities Net worth Total liabilities and shareholders' equity $ $ $ $ $ $ $ 58 171 239 468 126 594 105 124 24 7 260 64 324 270 594 $ $ $ $ $ $ $ 1989 49 222 325 596 140 736 146 192 30 7 375 57 432 304 736 $ $ $ $ $ $ $ 1990 41 317 418 776 157 933 233 256 39 7 535 50 585 348 933 Sales

Projected 1991 (a)

Projected 1991 (b)

Loan Amount Needed without discounts $ $ with discounts -

Online Bridge Program: Cash Flow Forecasting Butler Lumber Pro Formas Correct Answers: Butler Lumber Company Balance Sheet For the Years Ending December 31, 1988-1990 and Pro Forma Balance Sheet for 1991 (in thousands of dollars) % of 1988 Cash Accounts receivable Inventory Total current assets Property (net) Total assets Notes payable, bank Notes payable, Mr. Stark Accounts payable, trade Accrued expenses Current portion of long-term debt Total current liabilities Long-term debt Total liabilities Net worth Total liabilities and shareholders' equity $ $ $ $ $ $ $ 58 171 239 468 126 594 105 124 24 7 260 64 324 270 594 $ $ $ $ $ $ $ 1989 49 222 325 596 140 736 146 192 30 7 375 57 432 304 736 $ $ $ $ $ $ $ 1990 41 317 418 776 157 933 233 256 39 7 535 50 585 348 933 $ $ $ 9.5% 1.4% 5.8% $ $ Sales 1.5% 11.8% 15.5% $ $ Projected 1991 (a) 55 424 559 1,038 210 1,248 407 342 52 7 808 43 851 397 1,248 $ $ $ $ $ $ $ Projected 1991 (b) 55 424 559 1,038 210 1,248 388 342 52 7 789 43 832 416 1,248

Loan Amount Needed without discounts 407 with discounts 388

You might also like

- Butler Lumber Company Case Analysis: Assessing Financial Strategy and Expansion NeedsDocument2 pagesButler Lumber Company Case Analysis: Assessing Financial Strategy and Expansion NeedsJem JemNo ratings yet

- Butler Lumber 1Document6 pagesButler Lumber 1Bhavna Singh33% (3)

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Butler Lumber Case SolutionDocument4 pagesButler Lumber Case SolutionCharleneNo ratings yet

- Butler Lumber Company Financials 1988-1991Document7 pagesButler Lumber Company Financials 1988-1991Sam Rosenbaum100% (1)

- Butler Lumber Case SolutionDocument4 pagesButler Lumber Case SolutionPierre Heneine86% (7)

- Toy World CaseDocument9 pagesToy World Casedwchief100% (1)

- (S3) Butler Lumber - EnGDocument11 pages(S3) Butler Lumber - EnGdavidinmexicoNo ratings yet

- Flash Memory CaseDocument6 pagesFlash Memory Casechitu199233% (3)

- Estimating Funds Requirements Butler Lumber CompanyDocument18 pagesEstimating Funds Requirements Butler Lumber CompanyNabab Shirajuddoula71% (7)

- Butler Excel Sheets (Group 2)Document11 pagesButler Excel Sheets (Group 2)Nathan ClarkinNo ratings yet

- Butler Lumber CompanyDocument8 pagesButler Lumber CompanyAnmol ChopraNo ratings yet

- Income Statement and Balance Sheet Analysis 1988-1991Document1 pageIncome Statement and Balance Sheet Analysis 1988-1991arnab.for.ever9439100% (1)

- Butler Lumber CaseDocument14 pagesButler Lumber CaseSamarth Mewada83% (6)

- Hanson CaseDocument14 pagesHanson CaseSanah Bijlani40% (5)

- Tire City Spreadsheet SolutionDocument6 pagesTire City Spreadsheet Solutionalmasy99100% (1)

- Flash Memory Income Statements 2007-2009Document10 pagesFlash Memory Income Statements 2007-2009sahilkuNo ratings yet

- TN-1 TN-2 Financials Cost CapitalDocument9 pagesTN-1 TN-2 Financials Cost Capitalxcmalsk100% (1)

- Butler Lumber Operating Statements and Balance Sheets 1988-1991Document17 pagesButler Lumber Operating Statements and Balance Sheets 1988-1991karan_w3No ratings yet

- Tire City CaseDocument12 pagesTire City CaseAngela ThorntonNo ratings yet

- Butler Lumber SuggestionsDocument2 pagesButler Lumber Suggestionsmannu.abhimanyu3098No ratings yet

- Analysis Butler Lumber CompanyDocument3 pagesAnalysis Butler Lumber CompanyRoberto LlerenaNo ratings yet

- Case Analysis Toy WorldDocument11 pagesCase Analysis Toy WorldNiketa Jaiswal100% (1)

- Tire City AnalysisDocument3 pagesTire City AnalysisKailash HegdeNo ratings yet

- Butler Lumber Final First DraftDocument12 pagesButler Lumber Final First DraftAdit Swarup100% (2)

- Tire City IncDocument12 pagesTire City Incdownloadsking100% (1)

- Income Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Document25 pagesIncome Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Theicon420No ratings yet

- Tire City Spreadsheet SolutionDocument7 pagesTire City Spreadsheet SolutionSyed Ali MurtuzaNo ratings yet

- Butler Lumber CaseDocument4 pagesButler Lumber CaseLovin SeeNo ratings yet

- Harvard Case Study - Flash Inc - AllDocument40 pagesHarvard Case Study - Flash Inc - All竹本口木子100% (1)

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- Toy World - ExhibitsDocument9 pagesToy World - Exhibitsakhilkrishnan007No ratings yet

- Butler Lumber Company Funding AnalysisDocument2 pagesButler Lumber Company Funding AnalysisDucNo ratings yet

- Flash - Memory - Inc From Website 0515Document8 pagesFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Tire City - WorksheetDocument3 pagesTire City - WorksheetBach CaoNo ratings yet

- HANSSON PRIVATE LABEL Income Statement and Cash Flow AnalysisDocument34 pagesHANSSON PRIVATE LABEL Income Statement and Cash Flow Analysisincognito12312333% (3)

- PLAY TIME TOY COMPANY CASH BUDGET AND INVENTORY SCHEDULEDocument15 pagesPLAY TIME TOY COMPANY CASH BUDGET AND INVENTORY SCHEDULEjtang512100% (3)

- Flash Memory IncDocument3 pagesFlash Memory IncAhsan IqbalNo ratings yet

- Jones Electrical DistributionDocument4 pagesJones Electrical Distributioncagc333No ratings yet

- Toy World SoultionDocument27 pagesToy World SoultionAkshay Bohra100% (3)

- Tire - City AnalysisDocument17 pagesTire - City AnalysisJustin HoNo ratings yet

- Jones Electrical Line of Credit DecisionDocument6 pagesJones Electrical Line of Credit DecisionShak Uttam100% (2)

- Glaxo ItaliaDocument11 pagesGlaxo ItaliaLizeth RamirezNo ratings yet

- Play Time Toy Company Financial AnalysisFebMarAprMayJunJulAugSepOctNovDecTotal10812614512512512514514581655192520571006900070.3782.1094.4881.4581.4581.4594.48950.031,078.401,254.331,340.34Document16 pagesPlay Time Toy Company Financial AnalysisFebMarAprMayJunJulAugSepOctNovDecTotal10812614512512512514514581655192520571006900070.3782.1094.4881.4581.4581.4594.48950.031,078.401,254.331,340.34Brian Balagot100% (3)

- Proforma Cash Flow Analysis and Recommendations for Chemalite IncDocument8 pagesProforma Cash Flow Analysis and Recommendations for Chemalite IncHàMềmNo ratings yet

- Toy World, Inc - Projected Balance Sheet and Income StatementDocument4 pagesToy World, Inc - Projected Balance Sheet and Income StatementMartin Perrone0% (1)

- Case AnalysisDocument11 pagesCase AnalysisSagar Bansal50% (2)

- 93-Tire-City 22 22Document26 pages93-Tire-City 22 22Daniel InfanteNo ratings yet

- Clarkson Lumber Cash Flows and Pro FormaDocument6 pagesClarkson Lumber Cash Flows and Pro FormaArmaan ChandnaniNo ratings yet

- Exhibit No.1 Toy World, Inc.'s Pro-Forma Balance Sheet Under Level Production, 1994 (Thousands of Dollars)Document5 pagesExhibit No.1 Toy World, Inc.'s Pro-Forma Balance Sheet Under Level Production, 1994 (Thousands of Dollars)Rohit Jhawar100% (2)

- Flash Memory IncDocument7 pagesFlash Memory IncAbhinandan SinghNo ratings yet

- Toy World Inc. Financial AnalysisDocument10 pagesToy World Inc. Financial AnalysisHàMềm100% (1)

- Mercuryathleticfootwera Case AnalysisDocument8 pagesMercuryathleticfootwera Case AnalysisNATOEENo ratings yet

- Douglas KinghornDocument24 pagesDouglas KinghornAnonymous 3DG7N5No ratings yet

- CH 4Document20 pagesCH 4Waheed Zafar100% (1)

- CMA Accelerated Program Test 2Document26 pagesCMA Accelerated Program Test 2bbry1No ratings yet

- CH 26Document9 pagesCH 26MohitNo ratings yet

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsAhmed Rawy100% (1)

- UW Cover Page: AFM 291 1 of 20Document26 pagesUW Cover Page: AFM 291 1 of 20Jacob WinterNo ratings yet

- Accounting-2009 Resit ExamDocument18 pagesAccounting-2009 Resit ExammasterURNo ratings yet

- Hospitals Patient Care Units and Ward ManagementDocument22 pagesHospitals Patient Care Units and Ward Managementsaritatelma78% (41)

- Lembar Jawab Buku BesarDocument16 pagesLembar Jawab Buku BesarArii BelenNo ratings yet

- FTPartnersResearch InsuranceTechnologyTrendsDocument248 pagesFTPartnersResearch InsuranceTechnologyTrendsmeNo ratings yet

- Ziqitza HealthCare LTD Launches 108 ServiceDocument2 pagesZiqitza HealthCare LTD Launches 108 ServiceZiqitza Health CareNo ratings yet

- Challenges at Time Warner: Case StudyDocument31 pagesChallenges at Time Warner: Case StudyHoney HonNo ratings yet

- Sustainability of MFI's in India After Y.H.Malegam CommitteeDocument18 pagesSustainability of MFI's in India After Y.H.Malegam CommitteeAnup BmNo ratings yet

- 12th Book Keeping Board Papers PDFDocument50 pages12th Book Keeping Board Papers PDFRam IyerNo ratings yet

- White Paper c11 741490 16 35Document20 pagesWhite Paper c11 741490 16 35Mohamed Aly SowNo ratings yet

- ECGC Export Credit Guarantee Corp of India Summer TrainingDocument24 pagesECGC Export Credit Guarantee Corp of India Summer TrainingPhxx619No ratings yet

- IFRS Financial Statements Aviva PLC 2017 Annual Report and Accounts PDFDocument154 pagesIFRS Financial Statements Aviva PLC 2017 Annual Report and Accounts PDFĐặng Xuân HiểuNo ratings yet

- FTTH Interview Questions: Benefits, Components & TechnologiesDocument2 pagesFTTH Interview Questions: Benefits, Components & TechnologiesAnil KumarNo ratings yet

- Activity Working Capital ManagementDocument2 pagesActivity Working Capital ManagementJoshua BrazalNo ratings yet

- CMS Fee Payment ProcedureDocument2 pagesCMS Fee Payment ProceduresrijithspNo ratings yet

- JP Polyplast Swift SFMS-6523Document5 pagesJP Polyplast Swift SFMS-6523vasu vikramNo ratings yet

- London Itinerary: Harry Potter SitesDocument3 pagesLondon Itinerary: Harry Potter SitesGenalyn Española Gantalao Durano100% (1)

- Incoterms 1Document16 pagesIncoterms 1BalasubramanianNo ratings yet

- Estatement - 2022 09 19Document2 pagesEstatement - 2022 09 19Ishvinder SinghNo ratings yet

- Og 24 1701 1805 00008929Document5 pagesOg 24 1701 1805 00008929raj VenkateshNo ratings yet

- PDFDocument2 pagesPDFp.madhukarreddyNo ratings yet

- Chapter 3: Accounting Cycle: Accounting 1 (Aa015) Tutorial QuestionsDocument10 pagesChapter 3: Accounting Cycle: Accounting 1 (Aa015) Tutorial QuestionsIna NaaNo ratings yet

- 7Ps of Marketing Mix of ICICI BankDocument8 pages7Ps of Marketing Mix of ICICI Bankgktest4321100% (3)

- Module - 2 Auditor'S Report: Objectives of The AuditorDocument20 pagesModule - 2 Auditor'S Report: Objectives of The AuditorVijay KumarNo ratings yet

- Riska Amelia Xii Akl B (Ud Saloka)Document60 pagesRiska Amelia Xii Akl B (Ud Saloka)Riska AmeliaNo ratings yet

- Travel RecieptDocument1 pageTravel RecieptCa-AnAk LogisticsNo ratings yet

- ICICI Bank case study explores personalized loan appsDocument8 pagesICICI Bank case study explores personalized loan appsNiharika JainNo ratings yet

- Role of information systems in tourismDocument18 pagesRole of information systems in tourismMir AqibNo ratings yet

- 13use Bank Reconciliation ToolsDocument9 pages13use Bank Reconciliation ToolsJinky BulahanNo ratings yet

- Fundamental of RetailingDocument1 pageFundamental of RetailingDeepak Singh NegiNo ratings yet

- New American ExpressDocument27 pagesNew American Expressamitliarliar100% (2)

- Tools for monitoring bank accounts and sending checks from hacked loginsDocument3 pagesTools for monitoring bank accounts and sending checks from hacked loginsRosalina Dzeve100% (4)