Professional Documents

Culture Documents

Sample Master Thesis On Economics

Uploaded by

Surendra KoiralaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Master Thesis On Economics

Uploaded by

Surendra KoiralaCopyright:

Available Formats

WikiAstha.

com

Structure of Public Debt in Nepal

A THESIS Submitted to the Central Department of Economics Faculty of Humanities and Social Sciences, Tribhuvan University In Partial Fulfillment of the Requirements For the Degree of MASTER OF ARTS (M.A.) in Economics

By

[Your name here]

Roll No.: 195/ 063-64

Central Department of Economics Tribhuvan University, Kirtipur, Kathmandu

April, 2010

Innovation, Education & Empowerment

WikiAstha.com

CONTENTS

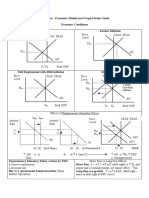

Page No. Recommendation Approval Letter Acknowledgements Contents List of Tables List of Figures Abbreviation CHAPTER ONE: Introduction 1.1 General Background 1.2 Statement of the Problem 1.3 Objective of the Study 1.4 Significance of the Study 1.5 Limitation of the Study CHAPTER TWO: Review of Literature 3.1 Introduction 3.2 Theoretical Review 3.3 International Review 3.4 Nepalese Context CHAPTER THREE: Methodology 2.1 Research Design 2.2 Sources of Data 2.3 Methods of Data Analysis 2.4 Simple Regression Equation 2.5 Working Definition of Terminology 1-4 1 2 3 3 4 5-16 5 5 10 14 17-19 17 17 18 18 19

CHAPTER FOUR: Role of Public Debt in Nepalese Context 4.1 Introduction 4.2 Public Borrowing and Deficit Financing 4.3 Public Debt and Mobilization of Resources 4.4 Fiscal Condition in Nepal 4.5 Public Borrowing and Economic Development 4.6 Problem of Borrowing in UDCs

20-30 20 22 24 26 27 29

2 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

CHAPTER FIVE: Trend and Structure of Public Debt in Nepal 5.1 Introduction 5.2 Resource gap in Nepalese Economy 5.3 Export- Import Gap 5.4 Saving-Investment Gap 5.5 Fiscal Situation in Nepal 5.6 Sources of Financing Deficit 5.7 Growth Trend of Government borrowing 5.8 Structure of Net Internal Debt in Nepal 5.9 Pattern of External Debt in Nepal 5.10 Net outstanding Public Debt in Nepal CHAPTER SIX: Burden of Public Debt 6.1 Introduction 6.2 Debt servicing Issues in Nepal 6.3 Share of Internal and External Debt Servicing in Regular Expenditure and Total Revenue 6.4 Development Expenditure, Net Outstanding of Public Debt and Debt Servicing 6.5 Percentage of Internal Debt Servicing to Annual Internal Debt 6.6 Issues of Foreign Loans 6.7 Net outstanding External Debt and GDP 6.8 Outstanding External Debt and Import 6.9 Trend of Debt Servicing and External Debt CHAPTER SEVEN: Empirical Analysis 7.1 Introduction 7.2 GDP and Internal Debt 7.3 GDP and External Debt 7.4 Effects of Internal and External Debt on GDP 7.5 Effects of Total Debt on GDP CHAPTER EIGHT: 8.1 8.2 8.3 8.4 Summary, Major Findings, Conclusion and Recommendations

31-54 31 32 36 39 41 43 45 48 49 52 55-77 55 58 62 64 67 69 71 73 75 78-84 78 78 79 81 82

Summary Major Findings Conclusion Recommendations

85-94 85 86 91 92

3 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

Annexes Bibliography

List of Tables

Table No. 5.2.1 5.3.1 5.4.1 5.5.1 5.6.1 5.7.1 5.8.1 5.9.1 5.10.1 6.2.1 6.2.2 6.3.1 Name of Tables Different Scenarios of Resource Gap Trend of Export and Import Tend of Saving and Investment Ratio of Government Expenditure and Revenue to GDP Public Debt as percentage of Fiscal Deficit Growth Trend of Government Borrowing as Percentage of GDP Ownership Pattern of Net Internal Debt Pattern of External Debt in Terms of Disbursement by Major Sources Net outstanding Public Debt to GDP Ratio Trend of Debt Servicing and GDP Trend of share of Principal and Interest Servicing to Total Debt Servicing Share of Internal and External Debt Servicing in Total Revenue, Regular Expenditure Outstanding of Public Debt, Development Expenditure and Debt Servicing Annual Internal Debt Servicing as Percentage of Annual Internal Net Outstanding External Debt and GDP Ratio of External Outstanding Debt and Imports Payments External Debt and Its Servicing Trends Page 34 37 40 42 44 46 48 50 53 59 61 63

6.4.1 6.5.1 6.7.1 6.8.1 6.9.1

65 68 72 74 76

4 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

List of Figures

Figure No. 5.2.1 5.3.1 5.7.1 5.9.1 5.10.1 6.2.1 6.4.1 Name of the Figures Different Scenario Resource Gap in Nepal Trend of Import Export Gap Growth Trend of Government Borrowing Pattern of External Debt Net Outstanding Public Debt in Nepal Pattern of Internal and External Debt Servicing Patten of Development Expenditure, Debt Servicing and Total Outstanding Public Debt Page 36 38 47 52 54 60 66

5 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

6 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

ACKNOWLEDGEMENTs

I wish to express my cordial gratitude and sincere respect to my teacher esteemed supervisor Prof. Bijaya Shrestha, Central Department of Economics for her inspiring help and valuable guidance during the course of writing this research work as well as other teachers of CEDECON for their encouragement and suggestions. I would like to express my gratefulness to Prof. Dr. Sohan Kumar Karna, Acting Head of the Central Department of Economics, who provided me the opportunity to write this thesis. My veneration goes to all my respected teachers and personnel of CEDECON who conveyed their timely and significant suggestions for this thesis both at formal and informal meetings. I would also like to appreciate to different organizations, institutions and individuals who helped me in this matter. I would like to express my gratitude and appreciate to my husband Mr. Basanta Lamichhane, other family members and my friends Mr. Binod Khadka, Mr. Shyam Pant and Umesh Khatiwada for helping their genuine support to complete this thesis. Despite my almost care and efforts, I bear the full responsibility for any errors and discrepancies that might have occurred in this study report.

[Your

Name Here]

7 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

ABBREVIATION

ADB CBS EDO EP FY GDP IMF IP LDCs MOF NRB UDCs UN UNDP WB Asian Development Bank Central Bureau of Statistics External Outstanding Debt Export Payment Fiscal Year Gross Domestic Product International Monetary fund Import Payment Least Developed Countries Ministry of Finance Nepal Rastra Bank Under Developed Countries United Nations United Nations Development Program World Bank

8 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

CHAPTER-ONE

Introduction

1. 1. General Background

Public debt is an important source of government financing. It is widely used as a means of financing development activities in underdeveloped country. The government of the country gets its income from two sources namely, public revenue and public debt. Public revenue therefore consists of the money that the government is not obliged to return to the every individual from whom it is obtained. But public debt/ borrowing taken by government is an obligation of repayment of principal sum borrowed plus a stipulated rate of interest after its maturity period to persons institutions and foreign countries. Public debt comprises of both internal and external sources of government. Internal sources include borrowing from individuals and from banking sector. External sources includes foreign loans, grants and from bilateral and multilateral agencies.

Public debt is the major source of fund for development activities basically in developing countries. Nepal is facing a serious and growing resources gap problem on the one hand and increasing inflation and population growth on the other. As internal revenue generation such as tax revenue, surplus of public undertaking are inadequate in comparison to resource requirements, government takes public debt from both internally and externally. Therefore, the need of public debt as a source of resource mobilization for development financing and to strengthen the economy is a comparatively modern phenomenon and has come into existence with the development of a democratic form of government.

9 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

Taxation is no doubt, the most important source of government financing to build up socio economic infrastructure such as health education, transportation, communication etc. for economic development. But it is quite impossible to raise adequate fund through taxation in underdeveloped countries because of poor tax payable capacity of the people. The only way to collect the needed fund is public debt. Debt can be taken from citizens as well as foreigners. Hence, public debt is taken as balancing items of increasing trends of fiscal deficit.

Nepal is heavily dependent on internal as well as external public debt for development. Since developing countries like Nepal always needs foreign currencies to import many capital goods required for development. The trend of borrowing through external source is very high in Nepal as compared to internal source. Hence in both developed as well as developing countries are making public debt as a main source of resource mobilization to meet budgetary deficit.

1. 2. Statement of the problem

Developing countries like Nepal are always facing the problem of fund needed for developmental projects. Government collects such fund from internal and external borrowing. The external borrowing is increasing more rapidly than internal debt due to wide gap between saving and investment, revenue and expenditure and exports and imports.

In Nepal, every year budgetary deficit is growing in which effective management of available resources are needed. The proposition of government borrowing and debt servicing obligation are increasing rapidly. To maintain the resource gap, debt is only

10 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

one solution, which helps to increase the amount of debt. In the context of Nepal the increasing size of public debt to maintain fiscal deficit is challenging proposition. So, public debt in Nepal is a matter of concern.

In the underdeveloped countries like Nepal, domestic resources are inadequate to meet the financial requirement for the economic development due to low income, low saving and low capital formation. So it creates the low internal debt in Nepal. Thus, Nepal is more dependent on external debt than internal one. This ever increasing trend of debt servicing of the country creates a great problem for debt management and becoming a major challenging issue for the country. Foreign assistance has become major source of financing development expenditure.

The burden of public debt is very controversial issue because government has taken loan for peace and securities which are unproductive sectors. The total outstanding debt is around 55 percent of GDP and more than 50 percent of development budget is shared by foreign loan in each periodic plan. So Nepal is heavily dependent on foreign aid. To break the vicious circle of poverty and to improve social condition of people, there is greater demand of debt. So the current situation of public debt in our country makes us to think seriously about it.

1. 3. Objectives of the study

a) To analyze the role of public debt in Nepalese context. b) To analyze trend and structure of public debt. c) To analyze the burden of public debt. d) To identify the debt servicing problem in Nepal. e) To recommend suitable policy measure for optimum utilization of debt.

11 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

1. 4. Signification of the study

The government needs a huge amount of resources for reconstruction, rehabilitation and relief to make modern and prosperous society. In this regard, public debt can be a major source of revenue mostly in developing countries like Nepal due to low level of tax payable capacity of the people.

For economic development of Nepal government must invest on various sectors such as education, health, transport, communication etc. To build up such overhead capital there is need of heavy fund, which is possible only through government borrowing due to low tax payable capacity of the people. Similarly, to break the vicious circle of poverty and to improve social condition of the people, there is greater need of public debt.

As the revenue surplus has not been adequate to meet the development expenditure, the deficit budget has remained the prime feature of Nepalese fiscal policy. been mobilized. Due to this reason, the value of total loan has been rising and the burden of debt servicing has been increasing year by year. This situation leads the government to become more indebted from external as well as internal borrowing.

The study of public debt is concerned to maintain high level of employment, a reasonable degree of price level stability, balance in foreign accounts and an acceptable rate of economic growth. This study will also be concentrated on the mobilization of financial resource through appropriate utilization of public debt. It is also applicable for the people and institution to purchase government securities. It is also written hoping that it will be a little reference for the budgetary system.

12 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

1. 5. Limitation of the study

This study is fully based on secondary data. No attempt is made to check the reliability of the secondary data. This study is covered only the period of 23 years (1985/86 2007/08) because of time and resource constraints. This study is not related to examine the effects of public debt on macro economic variables such as national income employment, price level, money supply etc

13 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

CHAPTER TWO Literature Review

2. 1. Introduction: Public debt as an important source of deficit financing refers to the obligation of government to pay back to the person, institution or countries from whom it has been obtained. Generally, public debt refers to loan raised by a government within the country or outside the country. Every government like individuals has to borrow when its expenditure exceeds its revenue. Encyclopedia Britannica (1959), defines that public debt is obligation of government, particularly those evidenced by securities, to pay certain sums to the holders at some future date.

In the literature of public debt different economists have different views regarding the public debt. Generally, Classical, Keynesian and Post Keynesian economists have different aspect towards public debt.

2. 2. Theoretical Review Review of Classical Thinking:

The classical economists were generally against the public borrowing and favored the minimum role of government. They assumed that individual, consumer and business firm employ resources more efficiently. According to them, economic activities are best in private sector because they have the greed of profit, through which allocation of resources would be more efficient. On the other hand, government does not have such greed. Due to this, they are in favor of limit/slim size of public sector and reduce the function of government to the minimum possible extent. They further believed that any

14 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

government intervention into the economic activities results into rigidity and disrupt the smooth functioning. This would help to bring about the optimum allocation of resources and the achievement of full employment and maximum output. Under a fully employed economy, therefore government can acquire resources by borrowing only at the cost of private sector where they are more fruitfully engaged. The classicists were not against any form of government expenditure. What they favored was minimum public expenditure. In between taxation and borrowing, classicists favored taxation for the following reasons: a. Deficit financing means an increase in public debt. Since it is an easy method to obtain income, government is likely to be extravagant and irresponsible. Consequently, public debt will definitely become a burden to the economy. b. Payment of interest on public debt and refunding of the principle will require additional taxation. It might prove to be difficult since governments power to tax is not unlimited. c. Deficit financing might produce currency deterioration and price inflation However the classical economists were not against all type of public debt. They favored public debt for self liquidating projects. In the words of R.A. Musgrave, Self liquidating projects may be define narrowly investment in public enterprises that provide the fee or sales income sufficient to service that debt incurred in their financing, or they may be defined broadly as expenditure projects that increase future income and the tax base. Such projects permit servicing (interest and amortization) of the debt incurred in their financing without requiring an increase in the future level of tax rates. ( Musgrave, 1959)

15 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

Review of Keynesian Thinking

Unlike the classical economists, Keynes did not accept the notion of free enterprises economy, which is self-equilibrium at full employment level. He advanced the concept of underemployment equilibrium. He argued that resources in the private sector might remain unemployed for relatively longer time period if the government becomes unconscious. In such situation when resources are unemployed on large scale, government employment of these resources does not necessarily deprives the private sector of anything. On the contrary, increasing government spending by using idle men and materials is likely to raise the level of aggregate demand and thereby aggregate output and income. Hence public borrowing/ debt need not necessarily be unproductive, and burdensome. Due to this, Keynesian strongly prescribed to increase the public expenditure even by undertaking deficit financing or borrowing.

For Keynesian, if debts are internally held, there is nothing to worry about their size. It is because such debt involves merely a series of transfer payments and they cancel out for the economy as a whole. Hence the only concern was on high level of income and employment. This has emerged the concept of double budget. But Keynesian view is that deficit budget even by undertaking public debt, would be a powerful tool during the time period of stagnation/ depression.

Review of Post Keynesian Thinking

During the Second World War II and post world war period, the size of public debt and servicing increased enormously. This has made the economist to make revision on the aspect of public debt. The post Keynesian development was that it emphasizes the transfer and management aspect as well as interrelationship between public debt and money supply.

16 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

The Post Keynesian economist like Learner also shares the view that internal debt inflicts no burden simply because it is a transfer of fund from one pocket in the other from the left hand to the right hand. He further maintains, An inter-personal of international loan yields the borrower a real benefit, it enables him to consume or invest more than he is earning or producing. And when he pays interest or repays the loan he must tighten his belt, reducing his consumption or his investment. In the case of national debt were have neither the benefit nor the burden, the belt cannot be let out when borrowing need not be tightened when repaying. (Poudel, 2005).

It cannot be denied that internally held public debt involves a series of transfer payments in the form of taxes and debt service payment and for the economy as a whole, they cancel out. But the volume of public debt cannot be dismissed as of no consequences. This is because heavy debt constitutes of burden for future generation. The post Keynesian did not reject the entirely classical notion regarding to public debt rather put it in a better perspectives:

a. According to them, public borrowing does not always deprive the private sector from the use of resources. As for example during the time period of widespread unemployment, it may be productive b. Besides, it is not accepted now that borrowing in the period of full employment must be inflationary. If the borrowing taps the funds otherwise used of consumption, it is not more inflationary c. A large public debt if internally held poses many problems for the economy. It complicates the monetary policy and creates difficulties of management and so on.

17 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

d. In resorting to borrowing, government should be guided by macro economic considerations- its effects on macro economic variables.

Recent Thinking

Recent thinkers opined that heavy growth of the borrowing is dangerous for the economy for two reasons: Firstly ,growth of debt ratio may lead crowding out of private investment; Secondly, government spending out of borrowed funds might be unproductive. (Ponser;1992) They observed that, that part of public debt is burdensome whose servicing falls entirely or mostly on tax revenue. If its servicing does not fall entirely on tax revenue, it is not burdensome rather it is productive. Because it itself generates resources for its debt service besides income, employment and output. Therefore all debts are not burdensome.

According to modern economist Raja J. Chelliah observes that. If revenue will meet subsides, other transfers, interest payments and the greater the part of current expenditure; debt finance will be used for meeting the governments non-remunerative capital formation; and the total domestic borrowing will be determined in such a way that, given the rate of domestic saving, the non-government sector will be able to obtain a due share of saving and that there will be no need to borrow form the central bank more than the correct amount of saving and the there will be no need to borrow from the central bank more than the correct amount of seignior age, it is the ideal situation for borrowing. It can be presented in another ways also:

18 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

The level of government borrowing is the function of ability and willingness of person and business to lend and the governments power and intention to tax. Maximum level of debt can be expressed in terms of the following equation: (Singh, 2004)

D=

Yt E r

Where, D= maximum sustainable national debt O= Constant expenditure of ordinary government operation t = maximum ratio of tax receipts to national income (Y) and r = contractual interest rate of government debt. However, the burden of debt depends upon the nature of investments, productive or unproductive. If it is productive, there will not be a burden because of creation of real asset in the economy which further generates income of the people thereby increasing national income. If it is unproductive, the situation will naturally be burdensome on the government.

2. 3. International Review

Bhargava viewed that the government borrowing is also useful to combat against inflation because in this situation effective demand is more than the available supply of goods and services and here the government transfers extra purchasing power from the hands of the people. Thus, a sensible debt policy can be used to check a depression or a boom. ( Bhargava, 1956: 191)

Taylor Philip E. (1968), in his book entitled The Economics of Public Finance has analyzed the nature and the burden of public debt upon the economy on of the upon which fiscal policy must stand, without it the financing of public emergencies would be impossible. Public debt is desirable, no matter what its burden when incurred for the

19 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

purpose of securing benefits which outweigh the burden. In this sense debt is a necessary evil, like cost of production; if the benefits could be secured with fewer burdens the alternative would be preferable.

The burden of public debt is represented by the economic hardship which it imposes. This hardship may take the form of waste of productive efficiency for the economy as a whole or undesirable economic burdens imposed upon particular classes. The possibility of inflation resulting from the form of borrowing constitutes another elements of burden. The urge given by Taylor to reduce debt principle may involve three kinds of burden. The raising of taxes for debt retirement by a regressive tax system will take funds for those less able to pay and transfer these funds to bond holders who gain relatively little benefit from their receipt Reduction of expenditure on expenditure on useful government function will impose bur den upon prior beneficiaries of those function. Taxes to repay debt held by the bank may result in net destruct ion of a part of the circulating medium. Certainly the most important single determinant of debt burden is the level of national income. The existing high level of public debt makes this the overriding consideration in minimizing debt burden. Sensible approach to the analysis of debt burdens requires that the size of debt principle be de-emphasized. For as we have seen, not only are the transfers of income which constitute debt burden principally those which relate to interest and not principle payments, but the size of principle is inaccurate measures of the magnitude of these transfers. The principle determinants of debt burden pointed by Taylor are:

20 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

The magnitude of annual transfers for debt service . The pattern of debt ownership within the economy. The type of tax system. The level of national income. Post Keynesian economists Richard Goode views that borrowed money when used to finance public investment causes no such reduction. All that will happen is the change in the consumption of capital formation. The inference is that failure to restrict borrowing to the investment will retard economic growth. A weakness of the argument is that not all outlays classified as investment actually contribute to growth, while some expenditure usually as government consumption promote growth ( Goode, 1984: 198)

According to new Palgrave dictionary of economics 1988, Public debt is a legal obligation on the part of government to make interest or amortization of payment to holder of designated claims in accordance with a defined temporal schedule. It is created through the government borrowing from individual, corporations, institutions and other government. It refers to loan raise by government within the country or outside the country. Every government like individual has to borrow when its expenditure exceeds revenue. The receipts from the sale of financial instruments by government to individual or firms, in the private sector to induced the private sector, to release manpower and real resource and to finance the purchase of those resources or to make welfare payments or subsidies.

Trippen (1990), in his article pointed out that debt of the banks in 1980s prevented the international financial system form collapsing, still there was not financial situation of debt problem in sight yet. He observed capital flight from Latin American countries was

21 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

a symptom of seriously economic, social and capital problems in consequence of the debt crisis. The valued currencies and negative real interest rates.

Nadim(1992), in his article entitled External debt policy has analyzed the origin of debt problems. The debt crisis had its origin in the substantial rise in the external liabilities of the developing countries during the second half of the 1970s and early 1980s, in an environment of large scale recycling of the oil exporters surpluses rising world inflation and negative real interest rate. At the time many viewed this recycling of funds as a positive development; creditors were able to identify now investment out less and debtors could acquire funds needs for development purposes. He again explained that an external debt crisis was due to: A drastic deterioration in external economic environment in the form of higher interest rates, lower commodity price and severe recession in the industrialized economies; Economic mismanagement and policy errors in debtor countries and Excessive lending by commercial banks to some countries, with little regard to country risk limits.

According to Gurley and Shaw, it is applied for the maintenance of balance between the expenditure and revenue for financing economic development, since developed or developing and revenue for financing economic development, since developed or developing countries always face the problem of fund, which is reflected in a large extent and as ever increasing financial resource gap in government budgetary. Therefore the selection of appropriate method for financing development is very important for the success of a development plan. Various methods to be adopted mobilizing financial resources and their implication for the economy are among the leading issues in economic development. Finance aspects are as important as the other

22 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

aspect of economic development and their study should be received proper attention (Gurley and Shaw, 1995: 575)

Buiter (2001), observes, The government borrows only to finance public sector formation can not be easily rationalized in terms of generally accepted economic principles. At worst it could become a straight jacket on the fiscal and financial strategy. It also risks inducing a misplaced sense of complacency about the accumulation of public investment related to public debt. Debt must be serviced through future higher current revenues or lower public spending regardless of what motivated its issuance.

2. 4. Nepalese Context Dissertation Review

Purushottam Achary a in his M.A. these entitled A case study of public Debt in Nepal states public debt is most popular in these days because of payment of debt on maturity can be adjusted through the issues of fresh public debt instruments. But the fact is that habit of purchasing bond issued by the government should be developed among the people so that no difficulty may be faced in getting the bond purchased by the people. (Acharya, 1968).

The dissertations entitled Structure of Public Debt in Nepal (1982) by Mahesh Raj Joshi in his M.A. dissertations has analyzed the structure of public debt in Nepal and the importance of public debt and financial development. Birju Prashad Sharma, in his dissertation Paper entitled Public Debt in Nepal in 19 87, has tried to show the relationship between public borrowing development expenditure and budgetary deficit.

23 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

An article on The role of foreign aid and Economic development and Poverty alleviation by Kishor Kumar Gurugharana in 1996 analyzed the burden of public debt as debt servicing cost in Nepal and has come to the conclusion that the long term upward trend of increasing debt burden inflict greater burden. He finally said that through the loan component of foreign aid, Nepal is softer than other countries like India and China, yet the very low rate of return and rapidly increasing volume of debt is slowly bring in Nepalese economy towards crises of debt trap.( Gurugharana, 1996)

Urmila Adhikari (1996) in her article entitled, Foreign Debt Servicing, A Case Study analyzed the foreign debt- servicing problem in Nepal. She found that substantial increasing in foreign between the periods of 1974/75 to 1993/ 94. She prescribed effective implementation of liberalization policy in area of investment. This can bring a great relief to the country by creating capacity for foreign exchange earning which can reduce burden of debt servicing substantially in the years to come.

An article on debt Management by Annathakrishan (1998), opines, IF a country borrows from abroad, it has repay the principle and interest the capacity to pay the debt service cost should be realized by investing the borrowed funds into increased production activity. The increase production consumption but would also increase exports. Only then can a country find funds to pay the debt service cost. He emphasized mostly on productively used of available public debt then only it helps to raised national income and GDP. Hence borrowing can increase economic welfare in both lending and borrowing countries. Laxmi Bilas Koirala (2002), in his article entitled Effective Public Debt Management in Nepalese Perspective. States that debt is a useful resource for economic development, several inverse consequences were found by its over use. The debt crisis of nineties eighties is widely known as the result of over use. The World Bank has

24 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

established multilateral insurance Guarantee Agency (MIGA) and the international monetary fund has minted special drawing right (SDRs) to cubs the crisis in the third world. He further opines that we have only two options; either mobilize more foreign debt to invest for economic development or put the hand on hand doing nothing. In a not shell, we should have a debt management plan for its better use and regularly servicing. The government debt has a simple relationship whit the government deficit, the increase in the government debt over a given year is equal to the budget deficit, the increase in the government debt over a given year os equal to the budget deficit of a higher economic growth requires a higher level of investment that is not possible simply from taxation so that government seeks public borrowing (Koirala, 2001)

Tirtha Raj Poudyal (2003) has submitted a dissertation paper titled Trend and structure of public debt in Nepal has analyzed borrowed fund from external resources produce expectable items and there should be constituted a committee to supervise and narrator and to control unnecessary foreign borrowing. The role of government in dominating private sector in all sectors of the economy in Nepal. Thus t he government should adopt appropriate economic policy. The government should give attention in all sectors of the economy with high economic growth rate by reducing excessive external dependency and internal resource mobilization for the development purpose and the economy will be capable to move in a self sustaining growth path.

Subedi, Rewat (2004), in his thesis A case study of Public Debt in Nepal has tried to study the debt situation with following objectives. To analyze the trend and structure of Debt in Nepal. To identify the debt servicing problem. To measure the burden of debt in Nepal.

25 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

He found that Nepal is going on indebted and it will fall on debt crisis of the strong obligation and commitments are not made. The burden of interest payment is higher than the burden of principle payment in Nepal. Growth rate of external debt in Nepal is faster than the growth rate of export earnings. Finally he has concluded that due to the depreciation of Nepalese currency vis-a vis the convertible foreign currency, the burden of debt servicing has been increasing year by year.

Thapa(2005), observes that, Although Nepals debt burden and its servicing should not be called as excessive, on the basis of its level of development, it is quite burdensome. Debt burden has reached this level even to achieve such meager development. Nepal has not taken high growth path so far and once it takes it will re quire enormous of investment and that investment will have to be made through borrowing from both domestic as well as the external sources. At that time Nepal will have to borrow an unlimited amount of financial resources form both the source. Therefore, until growth rate takes momentum, we should be extremely judicious while borrowing to finance the budget deficits.

26 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

CHAPTER - THREE Methodology

3. 1. Research Design

To meet the earlier mentioned objectives, the study has used both qualitative analysis. The nature of the study is descriptive and the study is based on secondary data. This research will have tried to show the trend and structure, role and burden of debt. Historical data form of last 23 years from FY 1985/86 to 2007/08 have been taken into account.

3. 2. Sources of data

This study is based on secondary sources of data and information, which have been issued and published in books, magazines and reports, journals etc. Most of the data are taken from the publication of: Publications of Nepal Rastra Bank. Publications of Ministry of Finance. Publications of Central Bureau of Statistics, C.G.O Newspaper, published articles on different journals and magazines. Publications of International Monetary Fund. Dissertation available at the central library of T.U. Publications of world Development Report and Publications of world Bank etc. Internet, e-mail

27 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

3. 3. Method of Data Analysis

The collect data from various relevant sources is processed according to the need of the chapter. The available data from various documents are collected, classified and tabulated to meet the needs of the study. Some statistical tools such as percentage distribution, average annual growth rate and trend analysis are used for analyzing the data when they are necessary.

3. 4. Simple Regression Equation

It establishes the relationship between dependent and independent variable. It is used to show the degree and direction of the relationship between variable and it also provide a mechanism for prediction or forecasting. Here, to explain the role of public debt on economic growth, a simple ordinary least square linear regression model has been used. The theoretical statement of this model is that Gross Domestic Product (GDP) depends upon the Internal Debt and External Debt. This shows the relationship between GDP and public debt.

1. 2. 3. 4 Where,

GDP = a0 + a1TD GDP = a0 + a1 ED GDP = a0 + a1 ID GDP = a0 + a1 ED + b2ID

GDP = Gross Domestic Product ID = Internal Debt ED = External Debt TD = Total Debt

a0, a1 and a2 are the parameters.

28 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

3. 5. Working Definition of Terminology

Public Debt :- total public debt includes an external obligation of a public debtor and national government. Internal Debt :- Internal debt is the governments borrowing from domestic banking sector and individual External Debt :- External debt is the governments borrowing from external source through bilateral and multilateral source. Gross Domestics Product (GDP) :- GDP is the measure of the total domestic output at factor price. Debt Servicing :- Debt Servicing refers to the principle payment and interest payment on loan after maturity. Burden of Debt :- Burden of Debt is the sacrifice of the community through a rise in taxation at the time of repayment and for paying the annual interests on the government loans. Debt Trap :- Debt Trap is the situation when new fresh loans are taken to redeem the previously taken loan. Export of goods and services (XGS) :- XGS are the total value of goods and all service ( Including workers remittance) sold to the rest of the world. Import of goods and services (MGS) :- MGS are total value of goods and services purchased from the rest of the world. Gross National Product (GNP) :- GNP is the measure of the total domestic and foreign output claimed by resident of the economy, less the domestic output

29 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

CHAPTER -FOUR

ROLE OF PUBLIC DEBT IN NEPALESE CONTEXT

4. 1. Introduction

Public borrowing plays a vital role in underdeveloped countries like Nepal. It also helps in the financing of economic development through the mobilization of resources. In Nepal, sources of revenue are inadequate and insufficient for the economic development due to low level of income and saving capacity of people. Inspite of these problem expenditure of the government is going on rapidly in order to achieve rapid economic development, mobilize unutilized resources. Government receive revenue through internal sources is not enough in maximization of resources available to the government. Since internal borrowing is very low because of poor tax payable capacity of external borrowing remains alternative sources for development economics.

Underdeveloped countries like Nepal is suffering from vicious circle of poverty. To escape out of such circle, capital formation regarded as a prime mover of development is necessary. But in Nepal, the available stock of capital goods in not sufficient to employ the available labour force on the basis of modern techniques of production. This because it has low rate of saving, investment, income, low living standard due to the low per capita income and poverty, dualistic economy, unutilized natural resources, lower health and education condition of people, deficiency of capital etc, in comparison to developed countries in which development is financed by the automatic forces of capital formation under free market economy. But Nepal has market imperfection. In such market resources are not mobilized properly due to lake of capital. So that public debt is only one solution to fulfill the lack of capital deficiency.

30 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

Fiscal policy must be designed to maintain or achieve the goals of high employment, a reasonable degree of price level stability, balance in the foreign accounts and an acceptable rate of economic growth. Public borrowing is needed for stabilization since full employment and price stability do not come about automatically in a market economy but require public policy guidance. Without it the economy tends to be subjects to unemployment or inflation (Musgrave and Musgrave;1981)

Underdeveloped countries like Nepal have low income whereby it is very difficult for mobilization of resources. Nepal has so vague areas where resources are abundant but those are not monetized. These sectors make the mobilization of financial resources more complex. People have no incentives to save. The government policy to promote development is less effective. Thus the rigorous fiscal policy must be adopted to maximize domestic saving for required investment. The availability of capital funds can be increased through compulsory saving by the help of various fiscal instruments like borrowing, deficit financing and import restriction. There is no doubt public debt is one of the major sources for development financing in developing countries.

Public borrowing is regarded as a prime mover for economic development. Along with this reasonable abundance of natural resources, a spirit of enterprise, a technically trained labour force and dedicated civil servants are the essential requirement for achieving rapid economic development. For this increased capital is needed which seems the fundamental problem of economic development in underdeveloped countries like Nepal due to low label of income and saving capacity of people. In such condition a government can take loan from internal as well as external sources. The scope of domestic borrowing is very limited because of scarce of internal resources. At the same

31 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

time, most of the underdeveloped countries face the shortage of foreign exchange so only external borrowing remains alternative. Thus, there is no doubt that public debt is a useful instrument for economic development of Nepal. Government is bounds to borrow for financing economic development due low level of capital formation, which leads to low level of income and widespread poverty. So to fulfill the lack of capital deficiency public debt plays a prominent role in underdeveloped countries like Nepal either internal or external sources.

4. 2. Public Borrowing and Deficit Financing

Deficit financing is used to mean any public expenditure that is in excess of current public revenue. It has been used for acquiring resources for economic development. When the government cannot raise the enough revenue through taxation and other sources, expenditure meet through public borrowing known is deficit financing. To fulfill such deficit, government can adopt the following solution: Loan from Central Bank Loan from people Issuing paper money External loan , Grants Deficit financing cannot create real resources, which do not exist in the economy. It is only a device that helps to transfer resources to government. The real resources require for economic development must exist in the form of material equipment, labour and skill. Printing money or issuing bank credit cannot create these things. Deficit financing only can put the funds at the disposal of government which can be used for acquiring the real resources provided they are available in the economy.

32 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

Deficit financing is the most useful method of promoting economic development of underdeveloped countries and may be used for the development of economic and social overhead capitals such as construction of roads, railways, power projects, school hospitals etc. By providing socially useful capital, deficit financing is able to break bottlenecks such as lack of capital, technical skill & monetary stability etc. of development and there by increases productivity. Deficit financing as an instrument of economic development, has been given and important place in Nepals development plans. It has been regarded as a means to cover the gap in financial resources for want of adequate internal and external monetary sources in order to fulfill the physical targets in the plans.

Deficit financing is restored mainly to enable the government to obtain necessary resources for plan. The level of outlay local down by government cannot meet only by taxation and other resources. The gap in resources some extent is made up partly by external assistance but when external assistance is not enough to fill the gap, deficit financing has to be undertaken when the targets of production and employment cannot be achieved by the level of expenditure with resources obtained taxation and other sources, additional resources have to found. How much deficit financing must be done is decided by lacking into consideration a number of other important factors and careful limits. A policy of deficit financing is an important and most fruitful instrument for capital formation in UDCs like Nepal. However, deficit financing always s doesnt provide a viable long term solution. The Nepalese experience has clearly established the fact that heavy dose of deficit financing are advisable. Because heavy dose of money infected economy and also creates the problem of monetary stability which make the fruits of development meaningless. It may also lead to inflationary pressure and loss of

33 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

confidence in the currency. Thus, the effects of deficit financing may be distrastrous to economy if its limits are exceeded So, greater stress needs to be placed on the mobilization of domestic resources for financing of development programs in Nepal. In this context, public borrowing can be taken as effective instruments for mobilization of economic resources for development in Nepal.

4. 3. Public Debt and Mobilization of Resources

For economic development of UDCs public borrowing is a means of mobilizing financial resources du e to revenue constraints. No doubt to uplift the economic development public borrowing has significant role. In terms of he orthodox theory of public finance, the current expenditure of government developed to producing capital expenditure the fruits of which subsequently be sold to purchase for fees, should be financed by loan. Mobilization of resources for financing ever increasing development outlay is an extremely difficult problem in development economy. It is in the extent that the role of taxation is emphasized. But there is limit to taxation. If this limit is crossed, taxation poses a serious problem in economic incentives. This leads to the use of public borrowing as a method of resource mobilization. ( Singh;1991)

Domestic saving is the only the reliable source of financing economic development but unfortunately the rate of domestic saving is very low in Nepal because of low income, poverty and most part of income have to pay on tax. In such circumstances, public borrowing should be adopted by government for productive purpose. Public borrowing consists of internal borrowing and external borrowing. Moreover, external borrowing/sources of debt are supplementary in nature as internal saving mobilization is stagnant. The foreign source is the only option to finance development activities as

34 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

internal borrowing capacity of an economy is determined by rate and faith of people upon government etc. therefore, public borrowing seems to be safe and effective measure for mobilizing resources for development. In modern era, in the context of Nepal, public borrowing is applied in the development process of underdeveloped countries is a wider perspective. It is used nit only far meeting the huge wasteful expenditure or for recovering the deficiency of effective demand but is used as an instrument of fiscal policy for mobilizing saving for development purpose and also as an effective instrument of monetary policy for combating inflation created in the process of growth, the ensuring growth with stability.

The objectives of public debt in developing country like Nepal is that the public debt should be used as an instrument to mobilize saving of the people, which would otherwise have gone to ideal or wastefully consumption. public debt should be advocated creating additional capacity and producing capital equipments. Generally government borrows for the creation of infrastructure in the economy. Since it requires huge investment initially which cannot be meet only through revenue collection. The aim of public debt policy should be to help in strengthening the money and capital market which in turn accelerate development and price stability. In most of underdeveloped countries, there is match between revenue and expenditure in one hand and in another investment on infrastructure development is needed. Due to this reason abundant resources are not available through the revenue. In such condition public debt can play major role of raising resource for developing funding. (Basnet2004)

Public borrowing plays a significant role in development process not only by supplying required funds but also establishes regular and acceptable channel for private investment in government securities which not only provides liquidity to invest but also profit by the investment. Public borrowing plays an important role in the development

35 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

of money and capital markets. Government Treasury bills and bonds are the main instruments of financial market which are raised for the purpose of mobilizing resources in right place. So, public borrowing is an affective instruments for mobilization of resources since increase in tax rate is against of public willingness.

4. 4. Fiscal Policy

Nepal being a least developed country has been facing the problems of fund, where level of government revenue is very low because of low tax payable capacity of people. But level of government expenditure in the form of regular and development expenditure is increasing rapidly because of growing concept of globalization, liberalization and privatization. Such concept demands heavy investment for infrastructure development and socio- economic development. Since government revenue is increasing slowly and government expenditure is increasing rapidly, public borrowing becomes important to bridge the fiscal deficit of a country.

Nepal has been incurring fiscal deficit with the evolution of budgetary development; in the first budget of the country in 2008 B.S. revenue was Rs. 30.5 million and total expenditure at Rs. 52.5 million incurring thus the fiscal deficit of Rs. 22 million (Thapa: 2005). This trend has continued uninterruptedly until now. Such condition really forced government for borrowing. Public debt is the result of mismatch between revenue and expenditure over a time frame. A widening saving investment gap, persisting demand for public expenditure accompanied by a sticky revenue ratio have pushing the size of debt in Nepal.

36 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

Nepal has been implementing periodic plan from 1956. Various objectives of economic development are determined in each periodic plan. To fulfill such objectives of economic development there is need of heavy investment to build up socio- economic infrastructure. Since government finance is very low, public debt plays important role to meet such investment.

Hence, it should be noted that dependency on public borrowing is only the temporary solution to bridge the gap between revenue and expenditure. The basic rationale of public debt is to promote domestic growth and long term economic development in the country. Public debt, if prudently and skillfully operated and managed ,can become an important instrument of economic development.

4. 5. Public Borrowing and Economic Development

Underdeveloped countries are suffering from poverty, unemployment, low level of income, low tax payable capacity, economic instability etc. To get rid of this above mentioned problem, economic development is necessary to accelerate economy. Economic development helps to transform the traditional society into modern society. So economic development is the main goal of developing countries but there are resource constraints to achieve such goal. Since other sources of revenue are limited public borrowing becomes useful resource for development.

Most of the underdeveloped countries are conformed to rapid population growth low human capital development, inadequate infrastructural problems and repressive regions. More importantly the inappropriate domestic policies; fiscal policy, monetary policy, liberalization, investment policy and taxation policy pursued by the country have

37 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

contributed to this weak and disappointing overall growth performance. (Regmi; 2004). In such situation, public debt can play vital role for economic development.

Nepal being a least developed country has the potential for development. There is low rate of saving, investment income and low living standard due to the low per capita income and poverty, dualistic economy, unutilized natural resource lower health and education condition of the people, deficiency of capital in underdeveloped countries. Resources gap is a burning problem of such underdeveloped economy due to

deficiency of capital. So that public debt is only one solution to cross the resource constraint. Nepal is facing the deficiency of capital in relation to their production and natural resources due low tax payable capacity of the people causes low income which creates low saving. Nepal is also suffering from vicious circle of poverty. To break vicious circle and uplift a country with a self sustaining growth, a large amount of initial investment is necessary. Thus, the government of such underdeveloped country should emphasize to stimulate and accelerate capital formation.

There is need of heavy investment to fulfill the objectives of economics development. Since it is not possible through the persons, there is need of government finance, such finance is not possible through government also because of poor tax pay able capacity of the people in UDCs like Nepal. At this critical juncture, public debt becomes important source to collect formation small potentiality of saving and low level of tax payable capacity finally hampers economic development, which can be removed by using borrowing and nation becomes prosperous.

In conclusion, public borrowing is regarded as a basic tool for development in developing countries. Without public debt the adequate mobilization of internal

38 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

resources could not have been made in order to accelerate the rate of economic development. Public borrowing proceeds regular channel for investment and also helps in the strengthening the money and capital markets which in turn accelerate development and price stability. As a fiscal measure it is a source of revenue to the government as it channelizes saving from the public to the government. The urgent need in developing countries is not augmentation of effective demand but expansion

of the productive capacity. So borrowing as a method of financing for development is quite suit able as it has less expansionary effect on the money supply than deficit financing.

4. 6. Problem of Borrowing in UDCs

Nepal is facing several problems or constraints in effecting its borrowing programs. The main characteristics of Nepal are low saving, low investment, low level of income, dualistic economy, underdeveloped industrial sector, subsistence forming values and institutions. Illiteracy, technological constraints, unorganized money and capital markets etc. poverty is the growing phenomenon. Due to all these reasons, financial sectors are also underdeveloped. The rural sectors of such developing country appear the largest sector and a substantial volume of saving may originate in this sector. But it is not in reality, since most of the financial and banking institutions are city oriented. So there are problem of rural saving. There is also existence of barter economy in rural areas so that people have no capacity and willingness to save due to poverty and illiteracy. Financial sectors are not well organized for rural saving and investment activities. Mobilization of rural income has not any contributive impact on the economy. Due to lack of appropriate financial and banking sector in rural areas, large part of money expenses in unproductive purpose.

39 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

Values and institutions have also negative impact for the development of physical and financial sectors. Domestic resources are inadequate to meet the financial requirement for economic development. In such condition government is bound to take external loan. But Nepal has less economic and political relation with developed countries for the external borrowing and have less capacity to pay the dues on the other. This is because the most part of the expenses used for productive purpose which decreases the believeness and then further providing of borrowing is less possible. Then factors like political instability, low level of debt servicing capacity, unproductive expense, corruption etc. decrease the intention of donors for providing loan and grants. To conclude, development of finance sectors is essential to strengthen the economy. Money and capital markets are the main indicators of development which can play major role for government borrowing as a short term or long term.

40 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

CHAPTER- FIVE

Trend and Structure of Public Debt in Nepal

5.1. Introduction

Nepal being a least developed country has been facing the problems of funds where the level of government revenue is very low because of low tax payable capacity of people. But the level of government expenditure is increasing rapidly. The government needs heavy investment for infrastructure development and socio-economic development. Since government revenue is not sufficient for such development, public borrowing plays a prominent role to bridge the fiscal deficit of a country to meet such investment. The phenomenon of public debt was originated in Great Britain in 17th century where the city merchants provided grants and loans to the government. It is interrelated with the basic government fiscal flows of taxation and expenditure. If the volume of government expenditure exceeds the volume of tax revenue and other non-tax revenue then a deficit budget exists. Such a deficit budget provides the fundamental precondition for debt creation having once been created debt require interests payments to maintain the debt is to beyond the maturities of existing securities. In Nepal, first experience of foreign aid was that of the US government in 23rd January, 1951 with an agreement of Point four Program. In the first five year plan (1956/571960/61) of Nepal, the development expenditure was fulfilled by foreign loan/ grants. But from second three year plan (1962/63-1964/65), Nepal started to obtain the external debt from 19 63/64 and internal debt from FY 1962/63. For first time FY 1962/63, the government floated securities for mobilizing saving to finance the countrys economic development. Specially, After the enforcement of public debt act 1960, public debt for the first time was issued in Nepal in 1962 through treasury bills amounting to Rs. 7

41 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

million and carried one percent of regulation since 1968/69 and practice was and is still managed with this regulation. The amount of continued increase every year. The main sources of external borrowing of Nepal are bilateral sources i.e. developed countries, mainly America, Japan, Norway, China, India and others and Multilateral sources like IMF, WB and ADB. There are mainly three reasons for raising the public debt or borrowing. To recover the deficit budget. To tackle the emergency period of crisis. To sustain the economic and monetary stability. Nepal has been borrowing heavily from external source mainly to balance her budgetary. It is applied for temporary solutions to bridge the gap between revenue and expenditure. Nepal has been implementing periodic plan from 1956. It is also applied for financing economic development since under developed countries always face the problem of funds which is reflected in a large extent as ever increasing financial resource gap in the government budgetary.

5. 2. Resource gap in Nepalese economy

Resource gap in economy has always been a common phenomenon since the starting of the systematic budgeting system in Nepal. Every individual as well as government needs fund to maintain their expenditure but importance of fund is much essential for government due to the concept of national development. To finance for the development works government must be collect funds through the taxation and other sources of revenue. However government revenue is inadequate to meet the expenditure because of limited sources of revenue generation. To collect needy funds government must be increased in the tax and fees, which is unjustifiable for the point of view of social welfare. On the other side the tax and custom administration is not fair,

42 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

transparent and agile to somewhat extent so that government cannot collect the revenue as it predicts. That is why the annual growth rate of total expenditure and the collected revenue are not increasing in the same pace. Thus, revenue expenditure gap is growing in every fiscal year. The table 5.1 shows the different scenarios of financial resource gap in Nepalese budgetary system.

43 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

Table 5.2.1 Different scenarios of resource gap Fiscal year Total revenue Annua l growt h rate of TR% Total expenditure (TE) Annual growth rate of TE % Scenario Revenue deficit (TRTE) Foreign Grants Fiscal deficit Rs. In Million GDP Reve nue defici t at % of GDP Fis cal defi cit at % of GD P 7.5 6.9 6.4 6.4 8.4 9.2 7.9 7.2 6.1 5.0 5.8 5.3 6.1 5.5 4.8 6.1 5.7 3.8 3.3 3.4 3.9 4.3 4.1 5.7

1985/86 4644.5 9797.1 1986/87 5974.1 28.6 11513.2 1987/88 7350.4 23.0 14105.0 1988/89 7776.9 5.8 18005.0 1989/90 9287.5 19.4 19669.3 1990/91 10729.7 15.5 23549.8 1991/92 13512.7 26.0 26418.2 1992/93 15148.4 12.1 30897.7 1993/94 19580.8 29.3 33597.4 1994/95 24575.2 25.5 39060.0 1995/96 27893.1 13.5 46542.4 1996/97 30373.5 8.9 50723.7 1997/98 32937.9 8.4 56118.3 1998/99 37251.0 13.1 59579.0 1999/00 42893.8 15.1 66272.5 2000/01 48893.6 14.0 79835.1 2001/02 50445.5 3.2 80072.2 2002/03 56229.8 11.5 84006.1 2003/04 62331.0 10.9 89442.6 2004/05 70122.7 12.5 102560.4 2005/06 72282.1 3.1 110889.2 2006/07 87712.1 21.3 133604.6 2007/08 107622.5 2.26 161349.9 Average 14.68 annual growth rate Source: Economic Survey of various years.

17.5 22.5 27.6 9.2 19.7 12.1 17.0 8.7 16.3 19.2 9.0 10.6 6.2 11.2 20.5 0.3 4.9 6.5 14.7 8.1 20.5 20.7 13.7

5152.6 5538.1 6754.6 10228.1 10381.8 12879.9 12905.5 15749.3 14016.6 14484.8 18649.3 20350.2 23180.4 22328.0 23378.7 30941.5 29626.7 27776.3 27111.6 32437.7 38607.1 45892.5 53727.4

1172.9 1285.5 2076.8 1780.6 1975.4 2164.8 1643.8 3793.3 2393.6 3937.1 4825.1 5988.3 5402.6 4336.6 5711.7 6753.4 6686.2 11339.1 11283.4 14391.2 13827.5 15800.8 20320.7

3979.7 4253 4677.8 8447.5 8406.4 10655.1 11261.7 11956.0 11623 10547.7 13824.2 14361.9 17777.8 17991.1 17667.1 24187.8 22940.2 16437.3 15828.2 18046.5 24779.6 30091.7 33406.7

53215.0 61140.0 73170.0 85831.0 99702.0 116127.0 144933 165350.0 191596 209976 239388 269570 289798 330018.0 366251 394052 425454 444052 473545 517993 630300.5 696989 820814

9.7 9.1 9.2 11.9 10.4 11 8.9 9.5 7.3 6.9 7.8 7.5 8.0 6.8 6.4 7.9 7.0 6.3 5.7 6.3 6.1 6.6 6.5 7.9

44 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

In the table, the first scenario shows the revenue deficit, which is difference between revenue and expenditure of government in which we can see the increasing tendency mainly because of increasing volume of total expenditure than revenue. The amount of total expenditure was Rs. 9797.1 million in FY 1985/86,which has gone up to Rs. 161349.9 million in FY 2007/08, whereas total revenue has increased from Rs. 4644.5 million in FY 1985/86 to Rs. 107622.5 in FY 2007/08. This shows public expenditure has dominated to government revenue. Thus the revenue expenditure gap is Rs. 5152.6 million. The expenditure gap is continuously increasing each year and reached up to Rs. 53727.4 million in FY 2007/08. This indicates that the resource gap is serious problem in Nepal. The average annual growth rate of total expenditure during the review period has been 14.68 where as the average annual growth rate of total revenue has been 13.7% . it shows the growth rate of revenue is greater than expenditure but in absolute terms. This indicates the horrible situation of increasing trend of resource gap is coming future. The second scenario shows the fiscal deficit [TE-(TR+Foreign Grants)]. Which is increased from Rs. 3979.7 million in starting year of review period FY 1985/86 to Rs 33406.7 million in last year of review period FY 2007/08. The fiscal deficit is fulfilled by three elements; grants is the most potential sources of foreign currency, which is solid instrument for government to import the capital goods and to pay the interest and principle of external debt. Moreover it can be used on capitalization itself. It does not give burden to the economy. The table also shows the resource gap as percentage of GDP. GDP has been increasing continuously from FY 1985/86 to 2007/08. GDP is the main indicator of the economic development that is why analysis of resource gap as percentage of GDP is more important. We can see the revenue expenditure gap has been decreased initially than after it seems increased for some time and again start decreasing. Clearly, we can say

45 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Innovation, Education & Empowerment

WikiAstha.com

that there is fluctuating trend in revenue-expenditure gap. Similarly we can see the fluctuating trend in fiscal deficit and during the review period, it has been 4.1 percent FY 2007/08. Average annual growth rate of revenue expenditure gap as percentage of GDP is 7.9 where as the average annual growth rate of fiscal deficit as percentage of GDP is 5.7. we show the different scenario of Resource Gap in Nepal in the following figure. Figure 5.2.1 Different scenario of Resource Gap in Nepal

Scenario of resource Gap

180000 160000 140000 120000 100000 80000 60000 40000 20000 0 1985/86 1986/87 1987/88 1988/89 1989/90 1990/91 1991/92 1992/93 1993/94 1994/95 1995/96 1996/97 1997/98 1998/99 1999/00 2000/01 2001/02 2002/03 2003/04 2004/05 2005/06 2006/07 2007/08 Fiscal Year Govt. revenue total exp. TR-TE

Source: Economic Survey of Various years Figure 5.2 shows different scenario of resource gap. It shows that both revenue and expenditure are increasing year by year but the increasing rare of expenditure is highere than revenue. So, the gap between revenue and expenditure is very high in every fiscal year.

5. 3. Export Import Gap

Export import gap is one of the main economic problems of Nepalese economy. Nepal being a least developed country exports limited and low quality goods such as garments, low materials, carpets etc. Major exportable goods are raw materials and food

46 WikiAstha.com is the largest online database system offering free educational contents, notes and materials in Nepal. For other free downloads log on to: www.WikiAstha.com

Rs.in Millon

Innovation, Education & Empowerment

WikiAstha.com