Professional Documents

Culture Documents

AberdeenGroup - MRO Benchmark Report

Uploaded by

Levin LiuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AberdeenGroup - MRO Benchmark Report

Uploaded by

Levin LiuCopyright:

Available Formats

The Maintenance, Repair and Operating Supplies Benchmark Report

Strategies for Improved MRO Spend Management

September, 2006

The MRO Program Benchmark Report

Executive Summary

Maintenance, repair and operating supplies, while seeing some level of corporate attention in the past, has long been neglected by executives as an area of cost reduction, or as an area that can drive strategic importance to the enterprise. As the sourcing and procurement wave has been making its way throughout organizations, MRO is fast gaining attention as an area of focus. Another dynamic, the importance of asset utilization, quality and lean manufacturing programs have come into play. These initiatives are exposing some weaknesses of MRO programs, or causing MRO costs to increase in order to maintain service levels to support these initiatives This report examines the drivers, hurdles, strategies, tactical action plans, including use of technology for more than 150 companies for an MRO Category Spend Management Program and identifies best-practices for such a program.

Key Business Value Findings

Best in class companies have reduced MRO costs by 19% Reducing administrative costs provides a strong opportunity for savings, since on average, 54% of transactions are related to MRO. Online ordering and payment are top actions for reducing administrative costs

Implications & Analysis

How do they do it? 51% of Best in Class enterprises automate some or all portions of the source-topay process in support of MRO programs vs. 30% of industry average The widest gap in the use of technology from Best in Class vs. industry average is in enterprise asset management systems and spend intelligence/analysis (45% and 44% greater use of these technologies by the Best in Class) Strategic sourcing (62%) and spend analysis/intelligence (52%) are other technologies used extensively by Best in Class enterprises to achieve MRO cost reductions

Recommendations for Action

Control ad hoc MRO: Unplanned MRO purchases (spot buys) represent 18% of all MRO expenditures today. Extend electronic payment: Just 16% of all MRO transactions settle with electronic payments; this remains a large opportunity to reduce transaction costs Focus on spend analysis/intelligence: Spend analysis/intelligence which is crucial to providing visibility into MRO spend, is in use by only 38% of respondents

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup i

The MRO Category Benchmark Report

Table of Contents

Strategies for Improved MRO Spend Management....................................... 1 Executive Summary .............................................................................................. i Key Business Value Findings.......................................................................... i Implications & Analysis ................................................................................... i Recommendations for Action.......................................................................... i Chapter One: Issue at Hand.................................................................................1 Chapter Two: Key Business Value Findings ........................................................4 Best in Class Key Performance Indicators (KPIs)................................................4 Challenges and Responses .................................................................................6 Chapter Three: Implications & Analysis...............................................................7 Technology Automation Usage.............................................................................8 Technology Usage................................................................................................9 Technology Spending Plans for MRO...................................................................9 To Outsource, or Not to Outsource?.....................................................................9 Pressures, Actions, Capabilities, Enablers (PACE) ............................................ 11 Chapter Four: Recommendations for Action ...................................................... 12 Laggard Steps to Success ................................................................................. 13 Industry Average Steps to Success.................................................................... 13 Best in Class Next Steps.................................................................................... 13 Featured Underwriters ....................................................................................... 15 Appendix A: Research Methodology .................................................................. 18 Appendix B: Related Aberdeen Research & Tools ............................................. 20

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup

The MRO Category Benchmark Report

Figures

Figure 1: Top Pressures Driving an MRO Category Spend Management Program...............3 Figure 2: Technology Automation ..........................................................................................8 Figure 3: Key Performance Indicators, Competitive Framework and Enterprises who Outsource Sourcing and Procurement of MRO.................................10

Tables

Table 1: Key Performance Indicators .....................................................................................4 Table 2: Key Performance Indicators (Effect KPI's) ..............................................................5 Table 3: MRO Program Challenges and Actions....................................................................6 Table 4: Aberdeens Competitive Framework for MRO Programs........................................7 Table 5: Technologies in Use..................................................................................................9 Table 6: PACE (Pressures, Actions, Capabilities, Enablers) ................................................11 Table 7: Unplanned MRO Expenditures ..............................................................................12

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup

The MRO Category Benchmark Report

Chapter One: Issue at Hand

Key Takeaways MRO spend management represents another wave of cost savings to enterprises MRO is becoming more strategic and is crucial for maintaining operations Unlike other indirect materials such as office supplies, MRO requires supply chain-like inventory management techniques

n the past 10 years, cost savings initiatives for enterprises have been focused on direct materials (materials that are converted into sellable product) and indirect materials that include office supplies and business services. As enterprises continue to challenge themselves to reduce costs, another area of focus in cost reductions is maintenance, repair and operating supplies, or MRO. Controlling MRO spend is especially critical for discrete and process manufacturing enterprises, distribution companies and high technology companies. The category of MRO includes a large and diverse group of items and for many companies represents a large part of their purchase order transaction volume. Aberdeens recent study of 140 enterprises MRO category spend programs reveals that for these MROintensive organizations, MRO accounts for 16% of an enterprises spend, while accounting for 62% of the requisitions. The focus on MRO is more than just reducing the costs of the individual items; enterprises are looking at total delivered costs of PACE Key For more detailed descriptheir entire MRO program. Such costs intion see Appendix A clude freight, loading, unloading, packaging, Aberdeen applies a methodology to benchmark and, in some enterprise/supplier relationresearch that evaluates the business pressures, ships, additional costs such as warehousing actions, capabilities, and enablers (PACE) that costs and inventory management costs. indicate corporate behavior in specific business

processes. These terms are defined as follows: Pressures external forces that impact an organizations market position, competitiveness, or business operations Actions the strategic approaches that an organization takes in response to industry pressures Capabilities the business process competencies required to execute corporate strategy Enablers the key functionality of technology solutions required to support the organizations enabling business practices

MRO Category Program

With many cost factors and varied enterprise/supplier relationships, the MRO category is not as simple as re-negotiate the price of a hammer. It is not solely a procurement issue, a supply-chain issue or a sourcing issue; it is a combination of various disciplines that, when executed as a cohesive program, yields benefits to the enterprise. An MRO Category Program spans the areas of spend analysis, sourcing, procurement, contract management, invoice reconciliation

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup 1

The MRO Category Benchmark Report

and payment, compliance, inventory management and supplier collaboration. A large discrete manufacturer noted the depletion of MRO supplies with the following seasonal pattern: Gloves (March) Batteries (December) Office supplies (August-September) Scotch tape (December) Further investigation showed that the depletion was due to employee utilizing these items for personal reasons: Gloves for gardening season Batteries for holiday season Office supplies: back to school Scotch tape: holiday season The solution for this company is to place some MRO items (consumables, such as gloves, batteries, etc) in vending machines, causing employees to use their badges or P-Cards, thus recording the utilization. Consumption was reduced by one-third.

MRO as an Increasing Area of Spend

As noted in Figure 1, the study participants report that the MRO category has become a larger portion of their corporate spend. Does this mean that MRO prices are rising? Detailed interviews with respondents revealed that MRO items have followed standard markets in terms of price increases. One specific MRO category to note is lubricants, where costs are heavily determined by the price of oil, which has seen noted increases over the past three years. Other than exceptions such as this category, MRO items have not seen uncommon increases in costs. What we discovered is that while many categories of spend, by virtue of a source-to-pay process have seen cost reductions, the MRO category has simply not gone through the rigor of a source-to-pay process and thus MRO cost reductions remain an untapped area of opportunity for most companies.

Asset Utilization and Lean Quality Programs

Assets such as machines and other equipment need to be operating when needed, at full capacity and at peak efficiency. A recent trend, noted by a regional manager of custom engineered equipment, is an increase in the number of enterprises scheduling planned downtime to maintain equipment, resulting in the consumption of MRO supplies. In fact, to keep equipment operating at peak efficiency, the operating supplies may be replaced at faster intervals utilizing more supplies than before and driving up costs of the specific MRO items. However, by keeping equipment at peak performance levels, the enterprise is able to maintain a higher level of quality, resulting in less scrap and higher yields. Here, we see that the specific cost of the MRO items on an annual basis may increase; however, the better resulting quality has cost savings ramifications on the manufactured products (fewer defects, fewer returns). MRO category spend initiatives must take into

All print and electronic rights are the property of AberdeenGroup 2006. 2 AberdeenGroup

The MRO Category Benchmark Report

account these benefits as part of the overall strategy and resist focusing only on onedimensional MRO cost reduction.. Figure 1: Top Pressures Driving an MRO Category Spend Management Program

MRO spending has become a much larger portion of our overall spend Need to improve asset utilization Need to reduce inventory costs Lean or quality programs have made MRO management more important

0% 10% 20% 30%

44% 49% 59%

55%

40%

50%

60%

70%

% of Respondents

Source: AberdeenGroup, September, 2006

MRO Inventory Costs

Calculating the proper amount of MRO inventory to maintain or improve asset utilization is instrumental to an effective MRO program. To improve asset utilization, the MRO supplies required need to be available as soon as needed. The easy answer is to keep additional inventory thus driving up the costs of inventory. The challenge of reducing inventory costs while improving availability is why traditional indirect material purchasing and sourcing approaches are not the answer improving service levels while reducing inventory fall into the domain of advanced planning solutions or supply chain solutions. A large paper manufacturing company discovered quality issues in the latter stages of cutting paper products; the edges of the finished product were not cut properly (frayed edges), causing the quality team to discard the product, resulting in waste. The solution was to replace the cutting instruments (knives) more often, thus having assurance of sharper blades. The solution resulted in less waste, justifying the cost of additional MRO (knives) purchases. An inventory control and tracking system was installed to ensure the optimal amount of MRO inventory on-hand while keeping costs under control.

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup 3

The MRO Category Benchmark Report

Chapter Two: Key Business Value Findings

Key Takeaways Best in Class companies have reduced MRO costs by 19% Reducing administrative costs provide a strong opportunity for savings, since 54% of all enterprise purchase transactions (as measured by number of requisitions) and can be facilitated by online ordering and payment Lack of visibility with MRO spend is a top challenge, as cited by 59% of the respondents

hat differentiates successful organizations from those that have difficulty in their MRO Category Program? The distinguishing factors are a closed-loop source-to-pay process, automation of the individual steps within the source-topay process, and collaboration with suppliers. Competitive Framework Key The Aberdeen Competitive Framework defines enterprises as falling into one of the three following levels of practices and performance: Laggards (30%) practices that are significantly behind the average of the industry Industry norm (50%) practices that represent the average or norm Best in Class (20%) practices that are the best currently being employed and significantly superior to the industry norm

Best in Class Key Performance Indicators (KPIs)

Best in Class companies see hard-dollar savings with their MRO items and have experienced reductions in MRO inventory costs and reductions in administration costs -- all within the last year. Aberdeen defines Best in Class companies as those that: Saved 11% or more on their MRO spend in the last year andMRO administrative costs have been reduced by 11% or more in the last year

The results, as shown in Table 1 are very clear; Best in Class companies are realizing hard dollar savings with MRO. Table 1: Key Performance Indicators Key Performance Indicator

MRO savings % over the last year MRO administration cost % reduction MRO inventory reductions % for past 3 years MRO supply base reduction % for past 3 years

Best in Class

19% 18% 14% 17%

Industry Average

7% 7% 8% 9%

Laggards

3% 2% 2% 3%

Source: AberdeenGroup, September, 2006

All print and electronic rights are the property of AberdeenGroup 2006. 4 AberdeenGroup

The MRO Category Benchmark Report

These KPIs can be viewed as effect KPIs as part of a cause and effect equation. When reviewing other KPIs (Table 2), we notice two metrics, online ordering and electronic payments, where Best in Class enterprises are clearly ahead of average and laggard performers. Table 2: Key Performance Indicators (Effect KPI's) Key Performance Indicator

MRO orders/deliveries made online as a % of total MRO spend MRO payments made electronically as a % of total MRO payments

Best in Class

21%

Industry Average

14%

Laggards

7%

26%

19%

15%

Source: AberdeenGroup, September, 2006

The top two cause KPIs show a direct correlation to the effect KPI of administration costs. Previous Aberdeen research shows: The administration costs of ordering items is reduced by 96% when moving to online ordering Migrating from paper-based payments to electronic payments reduces payment costs by 50%.

The efficiencies from these two KPIs are easily seen in the reduction in Best in Class performers administrative costs.

A large consumer-goods company experienced the following success factors when executing an e-sourcing strategy for their MRO program: 14% cost reductions, 63% savings in time and a 60% reduction in supply-base. These successful metrics were achieved by a combination of process and technology. The process was very disciplined where the suppliers capabilities and other KPIs (on-time delivery, quality, for example) were measured. Next, suppliers were measured not only by cost, but other criteria such as disposal fees, carrying costs, delivery fees and expedite fees. These two sets of factors (costs and KPIs) were then balanced to achieve the needs of the organization. For example, one supplier may be the lowest cost, but if they are routinely late and have poor quality, does that cost the enterprise in the long run? This balancing act was performed throughout negotiations and the optimal cost and non-cost tradeoffs were achieved.

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup 5

The MRO Category Benchmark Report

Challenges and Responses

The top challenge to improving MRO spend management, as stated in Table 3, is a lack of visibility into MRO spend. This challenge is very common among other areas of corporate spend and is addressed by a spend analysis or spend intelligence program. Aberdeens recent Spend Intelligence study emphasizes that a key capability of spend intelligence technology is the ability to accept spend data in inconsistent descriptions, numerous formats, languages, currencies and turn the data into clear, concise and actionable plans. A spend analysis initiative, which provides visibility is a crucial step to achieving MRO cost-savings objectives. Buyer compliance -- the ability for the enterprises own buying organization to adhere to policies, contracts, approved vendors, pricing structures, expediting rules and many other guidelines -- is another challenge as indicated by respondents. Compliance is not just a challenge for MRO purchases, compliance is a challenge for all areas of spend. Aberdeen research states: 65% of all purchases are compliant with contracts The average cost savings of transactions compliant with contracts is 22%

Leveraging the capabilities of a contract management system that manages compliance is a mechanism that an enterprise can utilize to increase compliant purchases, and apply the 22% savings to more purchases, including MRO purchases. Table 3: MRO Program Challenges and Actions Challenges

Lack of visibility into MRO spend Managing and maintaining internal (buyer) compliance to existing agreements Difficulty in managing many locations

% Selected

59% 50%

Responses to Challenges

Create and execute a company-wide spend analysis/intelligence initiative Define and execute a procure-to-pay process Create an enterprise-wide MRO program, with executive sponsor and change management Integrate demand drivers (EAM, supply-chain, service parts planning) Create a closed-loop source-to-pay process

% Selected

49% 48%

41%

51%

Creating accurate MRO purchasing plans Gaining new year-over-year savings

39% 37%

43% 48%

Source: AberdeenGroup, September, 2006

All print and electronic rights are the property of AberdeenGroup 2006. 6 AberdeenGroup

The MRO Category Benchmark Report

Chapter Three: Implications & Analysis

Key Takeaways 51% of Best in Class enterprises automate some or all portions of the source-to-pay process in support of MRO programs vs. 30% of industry average The widest gap in the use of technology from Best in Class vs. industry average is in enterprise asset management systems and spend intelligence/analysis (45% and 44% greater use Strategic sourcing (62%) and spend analysis/intelligence (52%) are technologies that differentiate Best in Class enterprises s discussed earlier, the respondents performance in MRO savings and administration costs determined their competitive ranking Best in Class, average and laggards. Use Table 4 to identify your companys maturity level across three dimensions: MRO spend management process, knowledge, and technology.

Table 4: Aberdeens Competitive Framework for MRO Programs Laggards Process

No formal process

Industry Average

Minimal process aligned and Alignment across company

Best in Class

Standard and aligned company-wide process

Knowledge

Minimal access to MRO contract information and no detailed visibility into MRO expenditures No invoice and payment automation

Minimal access to MRO contract information and some visibility into MRO expenditures Automation in procurement and invoice and payment technologies

MRO contract information is accessible as is detailed visibility into MRO expenditures Automation in spend intelligence, sourcing, procurement, contract management, invoice and payment and buyer compliance

Technology

Source: AberdeenGroup, September 2006

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup 7

The MRO Category Benchmark Report

Technology Automation Usage

Best in Class enterprises have automated the source-to-pay process to a much higher extant than their peers (Figure 2). In fact, the two automated areas by most Best in Class organizations are procurement and invoice and payment. Recalling the cause and effect for Best in Class in Table 1 and Table 2, a common thread appears: The majority of Best in Class automate procurement and invoice and payment processes Best in Class enterprises manage more MRO orders online than average and laggard performers Best in Class enterprises make more MRO payments electronically than average and laggard performers

Automating the procurement and invoice/payment process enables on-line ordering and electronic payments; resulting in lower administrative costs. Figure 2: Technology Automation

70% 60% % of Respondents 50% 40%

31% 33% 35% 31% 53% 48% 66%

30% 20% 10% 0%

16% 18%

30% 18% 12% 15%

14%

31%

9%

12%

9%

Spend Analysis

Sourcing

Procurement

Contract Management

Invoice and Payment

Laggard

Buyer Compliance

Best-in-class

Industry Average

Source: AberdeenGroup, September 2006

A large service organization we interviewed analyzed spend patterns and discovered $15M in gasoline costs, expensed by employees. The employees, while authorized to purchase gasoline, were purchasing food and beverages, unknown to the organization. A detailed analysis of the gasoline spend revealed the additional items (food and beverages). The organization rolled out a P-card program, which limited the amount per transaction as well as the authorized items (in this case, only gasoline). Within 1 year, the gasoline spend was reduced from $15M to $12M; a very significant number, since gasoline prices increased during this time. This is an example of the use of spend analysis and procurement (using p-cards).

All print and electronic rights are the property of AberdeenGroup 2006. 8 AberdeenGroup

The MRO Category Benchmark Report

Technology Usage

Best in Class enterprises are more likely than their peers to utilize technologies to improve MRO spend management (Table 5). Two technology areas where Best in Class greatly differentiate are strategic sourcing systems and spend analysis/intelligence systems. In fact, these two technologies are in use by Best in Class organizations at rates about 45% greater than industry average organizations. Best in Class companies are also least likely to be relying on spreadsheets and phone/fax/email. Table 5: Technologies in Use Best in Class

Strategic sourcing Spend intelligence/analysis 62% 52%

Industry Average

48% 36%

Laggards

38% 25%

Source: AberdeenGroup, September 2006

Use of enterprise asset management systems is also a differentiator, as 45% more Best in Class organizations utilize these solutions vs. industry average organizations.

Technology Spending Plans for MRO

On average, enterprises will spend $468,507 on New MRO technology projects within the next year. 38% will spend $100,000 and up 27% will spend $200,000 and up Spending in 2007 with respect to investments made in 2006 are also on the rise, as 28% of the respondents indicate that they plan on spending more (in 2007 vs. 2006) on MRO category spend technology. A large diversified manufacturer of corrugate and other products invested in an eprocurement, sourcing and catalog solution in 2001. The success of this implementation has encouraged them to continue to drive out costs throughout the entire source-to-pay process and is ready to invest in an electronic payments solution.

To Outsource, or Not to Outsource?

The question of whether or not to outsource the sourcing and procurement of MRO often comes up, specifically for laggard and average performers. In our survey, those enterprises that outsource the sourcing and procurement of MRO are more likely than their industry average and laggard peers to have MRO cost reductions and administrative cost reductions but fall below Best in Class performers. Does this suggest that outsourcing will yield below Best in Class results? Not necessarily, as 30% of Best in Class organizations currently outsource.

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup 9

The MRO Category Benchmark Report

Figure 3: Key Performance Indicators, Competitive Framework and Enterprises who Outsource Sourcing and Procurement of MRO

20% 18% 16% 14% 12% % 10% 8% 6% 4% 2% 0% 3% 2% 3% 7% 12% 9% 7% 8% 8% 9% 9% 14% 19% 18% 17%

2%

MRO Savings % over the last year

MRO administration cost % Reduction

MRO inventory MRO supply base reductions % for past 3 reduction % for past 3 years years

Best in class Laggards

Industry Average Outsourcing

Source: AberdeenGroup, September 2006

Two other metrics of interest, MRO inventory reductions and supply-base reductions, show no differentiation between average performers and enterprises that outsource. Follow-up interviews with respondents reveal that while the MRO cost savings and administrative cost savings are realized when outsourced, in some cases, it is unknown if inventory reductions have occurred due to the fact that the outsourcing is managed by the integrated supply partner that also manages inventory. In some integrated supply relationships, the enterprise does not have access to detailed inventory information to be able to measure this performance metric. Outsourcing is not an all or nothing proposition. Selective outsourcing to providers that complement a companys capabilities has provided significant benefits to many companies who effectively defined a proper and manageable relationship. This has been validated through follow-up discussions with various respondents. A chemicals manufacturer engaged an outsourcing firm to help determine why an eprocurement initiative was not achieving savings targets. After a comprehensive evaluation, it was determined that the e-procurement implementation was not the problem; negotiating contracts (sourcing) was the problem. In fact, the e-procurement solution was enabling the organization to be more efficient with poorly negotiation contracts. The chemicals manufacturer outsourced the sourcing of its key categories to drive savings.

All print and electronic rights are the property of AberdeenGroup 2006. 10 AberdeenGroup

The MRO Category Benchmark Report

Pressures, Actions, Capabilities, Enablers (PACE)

Aberdeen has consistently seen a clear correlation between the pressures companies face causing them to implement an MRO category spend management program; the strategic actions they take, the capabilities (usually a business process) and finally, the enablers or technology investments. Using the data from our research, in Table 4, we have prioritized the pressures and placed the corresponding actions, capabilities and enablers. Table 6: PACE (Pressures, Actions, Capabilities, Enablers) Prioritized Pressures

MRO spending has become a much larger portion of our overall spend

Prioritized Actions

Define and execute an MRO cost management process with executive sponsorship and change management Improve availability of MRO items

Prioritized Capabilities

Electronically enabling all aspects of a source-topay process (spend analysis, sourcing, procurement, contract mgmt, invoice reconciliation and payment, compliance) MRO requirements predictive capabilities (forecasting) and ordering/fulfillment capabilities Forecast and/or demand collaboration with warehouse, or suppliers

Prioritized Enablers

Automation across all these processes, integration of data across all processes

Need to improve asset utilization

Use of enterprise asset management systems, spares management systems Use of Inventory management systems, warehouse management system

Need to improve inventory costs

Improve inventory visibility Transition to supplier-managed inventory Closely management inventory or fulfillment of key MRO items

Lean or quality programs have made MRO management more strategic Plant or other assets have been adversely affected by downtimes

Closely monitor overall equipment effectiveness to monitor demand

Use of an asset management system and/or fulfillment systems (for ordering) Use of an asset management system and/or fulfillment systems (for ordering)

Closely management inventory or fulfillment of key MRO items

Closely monitor overall equipment effectiveness to monitor demand

Source: AberdeenGroup, September 2006

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup 11

The MRO Category Benchmark Report

Chapter Four: Recommendations for Action

Key Takeaways 18% of all MRO expenditures are unplanned (spot-buys); representing an opportunity for improvement 16% of all MRO transactions settle with electronic payments; representing an opportunity to reduce transaction costs with the remaining 84% Spend analysis/intelligence is crucial to provide visibility into MRO spend, is in use by only 38% of respondents; showing opportunity for 62% of the respondents to undertake a spend analysis/intelligence initiative

rogress has been made in MRO cost reductions, as evidenced by that fact that in Aberdeens 2004 MRO survey, organizations surveyed reported MRO cost reductions of 6%. In the current survey, enterprises report MRO cost reductions of 8%. Can organizations continue to reduce cost in the MRO category? With efficiencies such as online ordering and electronics payments only in use for 14% and 16% of all MRO spend, respectively, we can deduce that 86% of MRO orders are still not online, and 84% of MRO payments are still processed by paper. Simply applying these efficiencies to more and more MRO spend is a sure way to gain processes efficiencies and as a result, savings. One key performance indicator, unplanned MRO expenditures (or spot-buys) show no differentiation across the competitive framework. Table 7: Unplanned MRO Expenditures Key Performance Indicator

MRO expenditures made via spot buy (unplanned) as a % of total MRO expenditures

Best in Class

18%

Industry Average

17%

Laggards

18%

Source: AberdeenGroup, September 2006

Spot buys increase costs by causing expediting, off-contract buys and non-negotiated purchases. All enterprises need to have a continued focus on reducing spot buys by: 1. Fully understanding past spot-buys and determine the cause-and-effect of the purchases. An analysis of spend patterns may provide predictions and enable the organization to negotiate such spend. 2. Transitioning spot-buy items to an integrated supplier that will be able to maintain appropriate on-hand inventory levels.

All print and electronic rights are the property of AberdeenGroup 2006. 12 AberdeenGroup

The MRO Category Benchmark Report

Laggard Steps to Success

1. Define an MRO process. No MRO spend program can be sustainable and repeatable without a defined process with an executive sponsor and change management. 2. Gain visibility to MRO spend. Laggard performers need to fully engage in an MRO spend analytics process. Without having knowledge of who the suppliers are, how much is spent on them, where and with what items, any MRO program is fighting in the dark against an invisible enemy. 3. Automate the steps within the source-to-pay process. For organizations that have not automated any steps, the sourcing, procurement and payment processes can provide quick savings opportunities and quick return on investment. Start with strategic sourcing, procurement and payment solutions.

Industry Average Steps to Success

1. Expand the breadth of processes. Industry average performers have begun to standardize processes, specifically in procurement; now is the time to expand and standardize the MRO program to all steps in the source-to-pay process. 2. Consider outsourcing for specific MRO items. Utilize the expertise of outside providers that understand market dynamics and can negotiate more favorable agreements. 3. Focus on more strategic cost reductions. Work with suppliers to determine shipping costs, warehousing costs and other cost drivers of MRO supplies. By collaborating with suppliers, can drivers of cost be identified and reduced? One comment from a survey respondent is: How do we jointly reduce each others costs without affecting our margins? 4. Involve more upstream demand-drivers to better forecast MRO demand. Enterprise asset management, supply chain and spares management are all business functions (with accompanying technology) that can provide forward visibility into MRO requirements, providing suppliers better lead times.

Best in Class Next Steps

1. Move to Company-wide processes. Some Best in Class organizations practice processes that are not standardized or aligned company-wide. To gain additional cost reductions, organizations need to think and act globally. 2. Expand automation. Best in Class companies have automated the procurement and the invoicing and payment processes, resulting in transactional savings. However, automation levels in spend analysis, sourcing, contract management, and compliance is still lacking at many companies. By automating and connecting all phases of this source-to-pay process, savings beyond transaction savings will result, such as lower costs of MRO supplies, lower inventory costs, and lower shipping costs.

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup 13

The MRO Category Benchmark Report

3. Explore a different cost structure or additional value adds from suppliers. While some Best in Class organizations have seen success with non-traditional cost arrangement with MRO suppliers, the following cost or value-adds from suppliers should be considered: SLA-based financial incentives Buyer compliance management Replenishment ordering Vendor managed inventory Gain sharing incentives for savings Onsite personnel (managerial) Catalogue management Consolidated payment Cost-Plus calculation plus fees

All print and electronic rights are the property of AberdeenGroup 2006. 14 AberdeenGroup

The MRO Category Benchmark Report

Featured Underwriters

This research report was made possible, in part, with the financial support of our underwriters. These individuals and organizations share Aberdeens vision of bringing fact based research to corporations worldwide at little or no cost. Underwriters have no editorial or research rights and the facts and analysis of this report remain an exclusive production and product of Aberdeen Group.

PROACTIS Group Ltd, founded in 1996, is a specialist in Spend Control software that helps mid to large size organizations take control of costs and streamline procurement. The company's flagship spend control software, PROACTIS P2P, has an impressive list of users across diverse industry sectors. These include financial services, education, hospitality, retail, Government, not-for-profit and business services.

Vinimaya Inc. offers next generation supplier enablement solutions for MRO and Indirect eProcurement. Only Vinimayas patent-pending ViniSyndicate Catalog Integration System allows buyers to order from online and stored supplier catalogs concurrently via a single user interface, directly from their eProcurement system. Vinimayas Easyorder Internet EDI Service makes delivery and management of transactions simple and efficient. The Shelby Group, LLC, a unique spend management consultancy, offers a complete range of professional services and is a Vinimaya Consulting Partner. As a trusted name in the industry, Shelby has enabled leading companies with successful eSourcing, eProcurement & Supplier Management solutions.

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup 15

The MRO Category Benchmark Report

Sponsor Directory

Proactis

Proactis Group, Ltd. Holtby Manor Stamford Bridge Road York, YO19 5LL +44 (0) 1904 481 999 www.proactis.com info@proactis.com

Vinimaya

Vinimaya 4 Armstrong Road Shelton, CT 06484 410-480-9757 www.vinimaya.com sales@vinimaya.com

The Shelby Group

The Shelby Group, LLC 330 Main Street Cornwall, NY 12518 845-689-2222 ext. 941 www.theshelbygroup.com sales@theshelbygroup.com

All print and electronic rights are the property of AberdeenGroup 2006. 16 AberdeenGroup

The MRO Category Benchmark Report

Appendix A: Research Methodology

etween August and September, 2006, AberdeenGroup examined the Maintenance repair and operating category spend program strategies, experiences, and intentions of more than 150 enterprises in retail, manufacturing, automotive, hightech, industrial products, and other industries.

Responding supply chain, procurement, sourcing finance and logistics, and operations executives completed an online survey that included questions designed to determine the following: The various challenges and strategies leading enterprises to consider and execute a MRO program The structure and effectiveness of existing MRO programs Current and planned use of automation to aid these activities Key performance indicators of enterprises involved in such programs

Aberdeen supplemented this online survey effort with telephone interviews with select survey respondents, gathering additional information on MRO strategies, experiences, and results. The study aimed to identify emerging best practices for MRO Category Spend Management and provide a framework by which readers could assess their own MRO management capabilities. Responding enterprises included the following: Job title/function: The research sample included respondents with the following job titles: procurement, supply chain, logistics executive or manager (53%); manufacturing/operations executive or manager (10%); sales/marketing (9%); CFO or other C-level officer (10%), Industry: The research sample included respondents predominantly from discrete manufacturing enterprises, comprising nearly 43% of the survey pool. Process manufacturing also played a significant role in our research study sample, with 16% of respondents from the industry. High-technology represents 13% of the respondents. Other sectors responding included distribution, education, retail, public sector, services, transportation at 26% of the respondents. Geography: Many study respondents where located in the Americas (59%) from Remaining respondents were from Europe (29%) and the Asia-Pacific region (11%).

Company size: About 35% of respondents were from large enterprises (annual revenues

above US$1 billion); 37% were from mid-size enterprises (annual revenues between $50 million and $1 billion); and 28% of respondents were from small businesses (annual revenues of $50 million or less).

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup 17

The MRO Category Benchmark Report

Appendix B: Related Aberdeen Research & Tools

Related Aberdeen research that forms a companion or reference to this report include: The Spend Intelligence Benchmark Report The E-Procurement Benchmark Report The Contract Management Benchmark: Procurement Contracts

Information on these and any other Aberdeen publications can be found at www.Aberdeen.com.

All print and electronic rights are the property of AberdeenGroup 2006. AberdeenGroup 19

The MRO Category Benchmark Report

AberdeenGroup, Inc. 260 Franklin Street, Suite 1700 Boston, Massachusetts 02110-3112 USA Telephone: 617 723 7890 Fax: 617 723 7897 www.aberdeen.com 2006 AberdeenGroup, Inc. All rights reserved September 2006

Founded in 1988, AberdeenGroup is the technologydriven research destination of choice for the global business executive. AberdeenGroup has over 100,000 research members in over 36 countries around the world that both participate in and direct the most comprehensive technology-driven value chain research in the market. Through its continued fact-based research, benchmarking, and actionable analysis, AberdeenGroup offers global business and technology executives a unique mix of actionable research, KPIs, tools, and services.

The information contained in this publication has been obtained from sources Aberdeen believes to be reliable, but is not guaranteed by Aberdeen. Aberdeen publications reflect the analysts judgment at the time and are subject to change without notice. The trademarks and registered trademarks of the corporations mentioned in this publication are the property of their respective holders.

THIS DOCUMENT IS FOR ELECTRONIC DELIVERY ONLY

The following acts are strictly prohibited: Reproduction for Sale Transmittal via the Internet

Copyright 2006 AberdeenGroup, Inc. Boston, Massachusetts

Terms and Conditions

Upon receipt of this electronic report, it is understood that the user will and must fully comply with the terms of purchase as stipulated in the Purchase Agreement signed by the user or by an authorized representative of the users organization. Aberdeen has granted this client permission to post this report on its Web site. This publication is protected by United States copyright laws and international treaties. Unless otherwise noted in the Purchase Agreement, the entire contents of this publication are copyrighted by Aberdeen Group, Inc., and may not be reproduced, stored in another retrieval system, or transmitted in any form or by any means without prior written consent of the publisher. Unauthorized reproduction or distribution of this publication, or any portion of it, may result in severe civil and criminal penalties, and will be prosecuted to the maximum extent necessary to protect the rights of the publisher. The trademarks and registered trademarks of the corporations mentioned in this publication are the property of their respective holders. All information contained in this report is current as of publication date. Information contained in this publication has been obtained from sources Aberdeen believes to be reliable, but is not warranted by the publisher. Opinions reflect judgment at the time of publication and are subject to change without notice.

Usage Tips

Report viewing in this PDF format offers several benefits: Table of Contents: A dynamic Table of Contents (TOC) helps you navigate through the report. Simply select Show Bookmarks from the Windows menu, or click on the bookmark icon (fourth icon from the left on the standard toolbar) to access this feature. The TOC is both expandable and collapsible; simply click on the plus sign to the left of the chapter titles listed in the TOC. This feature enables you to change your view of the TOC, depending on whether you would rather see an overview of the report or focus on any given chapter in greater depth. Scroll Bar: Another online navigation feature can be accessed from the scroll bar to the right of your document window. By dragging the scroll bar, you can easily navigate through the entire document page by page. If you continue to press the mouse button while dragging the scroll bar, Acrobat Reader will list each page number as you scroll. This feature is helpful if you are searching for a specific page reference. Text-Based Searching: The PDF format also offers online text-based searching capabilities. This can be a great asset if you are searching for references to a specific type of technology or any other elements within the report. Reader Guide: To further explore the benefits of the PDF file format, please consult the Reader Guide available from the Help menu.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- IBV - Women, Leadership, and Missed OpportunitiesDocument24 pagesIBV - Women, Leadership, and Missed OpportunitiesSankalp Hota100% (1)

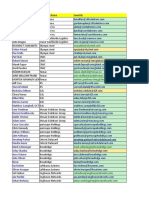

- Contacts list of IT professionals from various companiesDocument10 pagesContacts list of IT professionals from various companiesSailapathiNo ratings yet

- From School Improvement To Sustained CapacityDocument241 pagesFrom School Improvement To Sustained CapacityBiznicheNo ratings yet

- Internal Audit RFP - Start Up or OutsourcingDocument5 pagesInternal Audit RFP - Start Up or OutsourcingQuanTum ChinprasitchaiNo ratings yet

- Jesus' Leadership SecretsDocument5 pagesJesus' Leadership SecretsEmmanuel KaluriNo ratings yet

- Designing The Networked OrganizationDocument16 pagesDesigning The Networked OrganizationBusiness Expert Press0% (1)

- Vrio Framework - Apollo HospitalsDocument1 pageVrio Framework - Apollo HospitalsVarun ShakyaNo ratings yet

- Leadership Theory and Practice 8th Edition Northouse Solutions ManualDocument25 pagesLeadership Theory and Practice 8th Edition Northouse Solutions ManualErikKeithnwmp100% (57)

- Final Presentation SAP PMDocument7 pagesFinal Presentation SAP PMMangezi TaperaNo ratings yet

- The Lean Supply Chain Sample ChapterDocument30 pagesThe Lean Supply Chain Sample ChaptershreyasgbtNo ratings yet

- Staffing PlanDocument7 pagesStaffing Planlomesh1No ratings yet

- Ethical LeadershipDocument6 pagesEthical LeadershipsuryayoyoNo ratings yet

- Directory of Participants 03242015Document78 pagesDirectory of Participants 03242015bojik2100% (1)

- TECH Meets LEADERSHIP Webinar CEO Circle February 21 2023 ADocument6 pagesTECH Meets LEADERSHIP Webinar CEO Circle February 21 2023 ASteeve ShajiNo ratings yet

- Strategic Control Strategic ManagementDocument4 pagesStrategic Control Strategic ManagementJagdesh SinghNo ratings yet

- MG 8591 - Question Bank With K Level-1Document6 pagesMG 8591 - Question Bank With K Level-1MohanaramNo ratings yet

- OIG ME Strategy 2021 2023Document16 pagesOIG ME Strategy 2021 2023kiskismaniNo ratings yet

- Akshay Sutrave CH12Document1 pageAkshay Sutrave CH1212NewsNowNo ratings yet

- ARC Market Research - Process Simulation & OptDocument1 pageARC Market Research - Process Simulation & OptKokil JainNo ratings yet

- Annotated BibliographyDocument3 pagesAnnotated Bibliographyapi-278471247No ratings yet

- Community Organizing Participatory & ActionDocument49 pagesCommunity Organizing Participatory & Actionrhenier_ilado100% (3)

- Case Study: Incentive PlansDocument5 pagesCase Study: Incentive Plansms.nada.omarNo ratings yet

- Barry's (1991) Article Managing The Bossless Team On Distributed LeadershipDocument17 pagesBarry's (1991) Article Managing The Bossless Team On Distributed LeadershipKiara ZaynNo ratings yet

- Reglas Generales Del Management:: Conjunto, Destacarás Como Elemento EjecutivoDocument4 pagesReglas Generales Del Management:: Conjunto, Destacarás Como Elemento EjecutivoivanNo ratings yet

- AbstractDocument4 pagesAbstractSohaib Riaz100% (2)

- Impact Factor: 2.711: Special Issue On Leadership and EmotionsDocument2 pagesImpact Factor: 2.711: Special Issue On Leadership and EmotionsAsma ImranNo ratings yet

- HRMDocument23 pagesHRMJabasteen Jaba100% (1)

- Centennial College Business Plan 2007–2008 FutureboundDocument27 pagesCentennial College Business Plan 2007–2008 Futureboundminhazalam786No ratings yet

- An Evaluation of Learning Environment in Predicting Academic Performance of Secondary School Students in KenyaDocument8 pagesAn Evaluation of Learning Environment in Predicting Academic Performance of Secondary School Students in KenyaInternational Journal of Innovative Science and Research TechnologyNo ratings yet