Professional Documents

Culture Documents

General Banking Law of 2000

Uploaded by

allannicaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General Banking Law of 2000

Uploaded by

allannicaCopyright:

Available Formats

GENERAL BANKING LAW OF 2000 (R.A. No. 8791, GBL); NEW CENTRAL BANK ACT (R.A. No.

7653, NCBA); LAW ON SECRECY OF BANK DEPOSITS (R.A. No. 1405, LSB) & Related laws BANKS - refer to entities engaged in the lending of funds obtained in the form of deposits. (Sec. 3.1, GBL) CONDITIONS FOR ORGANIZATION The Monetary Board may authorize the organization of a bank or quasi-bank subject to the following conditions: 1. That the entity is a stock corporation; 2. That its funds are obtained from the public, which shall mean 20 or more persons, and; 3. That the minimum capital requirements prescribed by the Monetary Board for each category of banks are satisfied. (Sec. 8, GBL) PROHIBITED ACTS/TRANSACTIONS 1. Bank officials or employees are prohibited to disclose to any unauthorized person any information relative to the funds or properties in the custody of the bank belonging to private individuals, corporations, or any other entity, unless there is an order of a competent court of competent jurisdiction. 2. Banks are prohibited from outsourcing inherent banking functions. 3. No bank shall employ casual or non-regular personnel or too lengthy probationary personnel in the conduct of its business involving bank deposits. (Sec. 55, GBL) QUASI BANK, DEFINED - shall refer to entities engaged in the borrowing of funds through the issuance, endorsement or assignment with recourse or acceptance of deposit substitutes as defined in Sec. 95 of NCBA for purposes of re-lending or purchasing of receivables and other obligations. (Sec. 4,GBL) FOREIGN STOCKHOLDINGS Foreign individuals and non-bank corporations may own or control up to 40% of the voting stock of a domestic bank. This rule shall apply to Filipinos and domestic non-bank corporations. (Sec.11, GBL) GRANDFATHER RULE The percentage of foreign-owned voting stocks in a bank shall be determined by the citizenship of the individual stockholders in that bank. The citizenship of the corporation, which is a stockholder in a bank, shall follow the citizenship of the controlling stockholders of the corporation, irrespective of the place of incorporation. (Sec.11, GBL)

FIT AND PROPER RULE To maintain the quality of bank management and afford better protection to depositors and the public in general the Monetary Board shall prescribe, pass upon and review the qualifications and disqualifications of individuals elected or appointed bank directors or officers and disqualify those found unfit. (Sec. 16, GBL) PROHIBITION ON PUBLIC OFFICIALS GENERAL RULE No appointive or elective public official whether full-time or part-time shall at the same time serve as officer of any private bank. (Sec. 19, GBL) EXCEPTIONS 1. when the service of the public official is incident to financial assistance provided by the government or a government owned or controlled corporation to the bank; 2. when the law provides otherwise (e.g. Rural banks allow public officials, elective or appointive, to serve in a rural bank in any capacity, Sec. 5, Rural Banks Act) (Sec. 19, GBL) FOREIGN BANKS; MODES OF ENTRY 1. by acquiring or owning up to 60% of the voting stock of an existing bank; 2. by investing in up to 60% of the voting stock of a new local banking subsidiary, or; 3. by establishing branches with full banking authority. (Sec. 2, Foreign Banks Liberalization Act) NOTE: Acquisition of Voting Stock in a Domestic Bank The Monetary Board may authorize a foreign bank to acquire up to 100% of the voting stock of only 1 bank organized under the Philippines laws. However, this is allowed only within 7 years from the effectivity of GBL, which is on June 13, 2000. Further, at all times, the control of 70% of the resources or assets of the entire banking system is held by banks, which are at least majority-owned by Filipinos. (Sec. 73, GBL) Sec. 73, GBL effectively repealed the last sentence of Sec. 2, Foreign Banks Liberalization Act which provides that a foreign bank may own up to 60% of the voting stock of only 1 domestic bank or a new banking subsidiary. Nonetheless, after the lapse of the 7-year limit, the 60% limitation shall again apply. REVOCATION OF LICENSE OF A FOREIGN BANK The Monetary Board may revoke the license to transact business in the Philippines of any foreign bank under the following instances: 1. when the foreign bank is insolvent or in imminent danger thereof, or; 2. that its continuance in business will involve probable loss to those transacting business with it. (Sec. 78, GBL)

SUPERVISION AND EXAMINATION OF BANKS The operations and activities of banks shall be subject to supervision of the Bangko Sentral ng Pilipinas.

It shall also have supervision over the operations of and exercise regulatory powers over quasi-banks, trust entities and other financial institutions which under special laws are subject to Bangko Sentral supervision. (Sec. 4, GBL) PRIMARY RESPONSIBILITY OF BSP It shall provide policy direction in the areas of money, banking and credit. (Sec. 5, GBL) It shall provide policy directions in the areas of money, banking, and credit. It shall have supervision over the operations of banks and exercise such regulatory powers over the operations of finance companies and non-bank financial institutions performing quasi-banking functions, and institutions performing similar functions. (Sec. 3, NCBA) PRIMARY OBJECTIVE OF BSP To maintain price stability conducive to a balanced and sustainable growth of the economy. It shall also promote and maintain monetary stability and the convertibility of the peso. (Sec. 3, NCBA) TRO/INJUNCTIONS IN EXAMINATION OF BANKS As a rule courts cannot interfere with, or issue TRO/injunction in the investigation or examination of banks by the BSP, except only in cases where there is bad faith and arbitrary actions. (Banco Filipino vs. Central Bank. 204 SCRA 767) PRIVATE INDIVIDUALS ALLOWED TO PROSECUTE A private individual can cause the prosecution of violation of banking laws since it constitutes a public offense and the prosecution is a matter of public interest. (Perez vs. Monetary Board. 20 SCRA 592) CONSERVATORSHIP OF BANKS It is an attempt to save the bank from bankruptcy and ultimate liquidation CONSERVATOR - a person appointed, after a bank is placed under conservatorship, to take over the management of the bank and shall assume exclusive powers to oversee every aspect of the banks operation and affairs. (Central Bank vs. CA. 208 SCRA 652) LIMITATION ON CONSERVATORS POWER He may not revoke perfected and enforceable contracts. This will be an infringement of the non-impairment clause guaranteed by the Constitution. (First Bank vs. CA. 252 SCRA 259) RECEIVERSHIP AND LIQUIDATION OF BANKS Receivership is the summary closure of a bank by the BSP without prior notice and hearing after a finding that the continuance in business would involve probable loss to its depositors and creditors. (Central Bank vs. Court of Appeals. 220 SCRA 536) INSTANCES WHEN A BANK/QUASI BANK MAYBE PLACED UNDER RECEIVERSHIP

1. is unable to pay its liabilities as they become due in the ordinary course of

2. 3. 4.

5.

business: provided that this shall not include inability to pay caused by extraordinary demands induced by financial panic in the banking community; (Sec. 30, NCBA) has insufficient realizable assets, as determined by the Bangko Sentral, to meet its liabilities; (Sec. 30, NCBA) cannot continue in business without involving probable losses to its depositors or creditors; (Sec. 30, NCBA) has willfully violated a cease and desist order that has become final, involving acts or transactions which amount to fraud or a dissipation of the assets of the institution; in which cases, the Monetary Board may summarily and without need for prior hearing forbid the institution from doing business in the Philippines and designate the Philippine Deposit Insurance Corporation as receiver of the banking institution; (Sec. 30, NCBA) In case it notifies the Bangko Sentral or publicly announces a bank holiday, or in any manner suspends the payment of its deposit liabilities continuously for more than 30 days. (this pertains to the insolvency of bank) ( Sec 53, last par. GBL)

OTHER IMPORTANT DOCTRINES When a bank is placed under receivership, its officers, including its acting president, are no longer authorized to transact business in connection with the banks assets and property. (Abacus Real Estate Devt Center vs. Manila Bank. G.R. No. 162270. April 6, 2005) The appointment of a receiver does not dissolve the bank as a corporation nor does it interfere with the exercise of corporate rights. Banks under liquidation retain their corporate personality. The bank can sue and be sued but any case should be initiated and prosecuted through the liquidator. (Manalo vs. CA. October 2002) When a bank is declared insolvent and placed under receivership, the BSP through the Monetary Board, determines whether to proceed with the liquidation or reorganization of the financially distressed bank. (Sps. Larrobis, Jr. vs. Phil Veterans Bank. G.R. No. 135706. October 1, 2004) The assets of the bank shall be deemed in custodia legis in the hands of the receiver and shall, from the moment the bank was placed under receivership or liquidation, be exempt from any order of garnishment, levy, attachment, or execution. (Phil. Veterans Bank vs. NLRC. G.R. No. 13039. October 26, 1999) The BSP forbids the bank from doing business. As such the bank cannot foreclose any mortgage. (Provident Savings Bank vs. CA. 222 SCRA 125) Pendency of the case did not diminish the authority of the designated liquidator to administer and to continue the banks transactions. (Banco Pilipino Savings and Mortgage Bank vs. Ybaez. 445 SCRA 482) DEGREE OF DILIGENCE A bank should exercise its functions and treat the accounts of their clients not only with the diligence of a good father of a family but it should do so with the highest degree of care considering the fiduciary nature of its relationship with its depositors. (BPI vs. CA. 326 SCRA 641. 2000)

The banks are under obligation to treat the accounts of its depositors with meticulous care always having in mind the fiduciary nature of their relationship. (BPI vs. IAC. 206 SCRA 408.) However, the higher degree of diligence is not expected to be exerted by banks in commercial transactions that do not involve their fiduciary relationship with their depositors. (Reyes vs. CA. G.R. No. 118492. August 15, 2001) By the very nature of the work of banks, the degree of responsibility, care and trustworthiness expected of their employees and officials is far greater that those of ordinary clerks and employees. Banks are expected to exercise the highest degree of diligence in the selection and supervision of their employees. (PCI Bank vs. CA. 350 SCRA 446. 2001) SECRECY OF BANK DEPOSITS GENERAL RULE All deposits of whatever nature with banks or banking institutions in the Philippines including investments in bonds issued by the Government of the Philippines, its political subdivisions and its instrumentalities, are hereby considered as absolutely confidential in nature and may not be examined, inquired, or looked into by any person, government official, bureau or office. (Sec. 2, LSB) EXCEPTIONS 1. When there is written permission of the depositor or investor; (Sec. 2, LSB) 2. Impeachment cases; (Sec. 2, LCB) 3. Upon the order of a competent court in cases of bribery or dereliction of duty of public officials; (Sec. 2,LSB) 4. Upon the order of a competent court in cases where the money deposited or invested is the subject of litigation; (Sec. 2, LSB) 5. In case of prosecution of unexplained wealth; (BF vs. Purisima. 161 SCRA 576; R.A. No. 301) 6. In case of inquiry of the BIR of bank accounts of a decedent for estate tax purposes or in case of a tax compromise; (Sec. 6F, NIRC of 1997) 7. Upon order of a competent court in cases of violation of the AMLA; (R.A. No. 9160, as amended) 8. Incidental disclosures of unclaimed balances Unclaimed Balances Law. (R.A. No. 3696) PERSONS BANNED FROM LOOKING INTO BANK DEPOSIT Any person, government official, bureau or office. GARNISHMENT OF BANK DEPOSITS The foreign currency deposit shall be exempt from attachment, garnishment or any other order or process of any court, legislative body, government agency or any administrative body whatsoever. (Sec 8. R.A. 6426, FCDA) Except when it has been established that there is probable cause that the deposits involved are in any way related to money laundering. (Sec. 11, AMLA) The provision of R.A. No. 6426, FCDA, which prohibits garnishment of foreign currency deposits, is inapplicable to a foreign transient. Attachment of the foreign currency deposits of an American tourist is allowed who kidnapped and raped a twelve-year old Filipino child. The FCDA applies to accounts of lenders and investors. (Salvacion vs. Central Bank of the Philippines and China Bank. 278 SCRA 27. 1997)

LETTERS OF CREDIT LETTER OF CREDIT, DEFINED A letter of credit is an engagement by a bank or other persons made at the request of a customer that the issuer will honor drafts or other demands for payment upon compliance with the conditions specified in the credit. (Bank of Commerce vs. Serrano. 451 SCRA 484. February 16, 2005) PURPOSE OF THE LAW To substitute for the agreement of the buyer-importer to pay money under a contract or arrangement. NATURE OF LETTER OF CREDIT (3 distinct and independent contracts) 1. Contract of sale between the buyer and the seller; 2. Contract of the buyer with the issuing bank, and; 3. Letter of credit proper in which the bank promises to pay the seller pursuant to the terms and conditions stated therein. (Keng Hua Paper Products Co., Inc. vs. CA. 286 SCRA 257) PERFECTION - perfected from the time the correspondent bank makes payment to persons in whose favor the letter of credit has been opened. PARTIES 1. Buyer; 2. Issuing bank; 3. Seller. COMMERCIAL CREDITS AND STANDBY CREDITS DISTINGUISHED Commercial credits involve the payment of money under the contract of sale. Such credits become payable upon the presentation by the seller-beneficiary of the documents that show he has taken affirmative steps to comply with the sales agreement. In the standby type, the credit is payable upon certification of a partys nonperformance of the agreement. The documents that accompany the beneficiarys draft tend to show the applicant has not performed. The beneficiary of a commercial credit must demonstrate by documents that he has performed his contract. The beneficiary of the standby credit must certify that his obligor has not performed the contract. Transfield Philippines Inc vs. Luzon Hydro Corporation. 443 SCRA 307. November 22, 2004)

BULK SALES LAW (Act No. 3952) WHAT CONSTITUTES BULK SALES:

1. Any sale, transfer, mortgage, or assignment of a stock of goods, wares, merchandise, provisions, or materials otherwise than in the ordinary course of trade and the regular prosecution of the business of the vendor; 2. Any sale, transfer, mortgage, or assignment of all or substantially all of the business or trade conducted by the seller, mortgagor, transferor, or assignor, and; 3. Any sale, transfer, mortgage, or assignment of all or substantially all, of the fixtures and equipment used in and about the business of the seller, mortgagor, transferor, or assignor. (Sec. 2) PURPOSE OF THE LAW - To prevent secret or fraudulent sale of the business, which could lead to its closure, to the detriment of the creditors. WHEN BULK SALES LAW DOES NOT APPLY: 1. When the sale, transfer, or disposition is made in the ordinary course of business; 2. When there is a waiver of all the creditors, and; 3. When the sale, transfer, or disposition is by virtue of judicial order. FORMALITIES 1. Execution of an affidavit, listing the names and addresses of all creditors, the nature and the amount of obligation; 2. Preparation of inventory of the stocks to be sold; 3. Notification of all the creditors at least 10 days before the projected sale in bulk, and; 4. Registration of the foregoing documents with the Bureau of Domestic Trade. (Sec. 3-4) EFFECTS OF FAILURE TO OBSERVE THE FORMALITIES 1. Sale is null and void; 2. Purchaser holds the property in trust for the seller; 3. Purchaser is liable to the sellers creditors for properties he bought, and already disposed of by him, and; 4. Purchaser has the right to demand from the seller the return of the purchase price plus damages.

WAREHOUSE RECEIPTS LAW (Act No. 2137, as amended) PURPOSES OF THE LAW 1. To regulate the status, rights and liabilities of the parties in a warehousing contract; 2. To protect those who, in good faith and for value, acquire negotiable warehouse receipts by negotiation;

3. To render the title to, and right of possession of property stored in warehouses more easily convertible; 4. To place a much greater responsibility on the warehouseman. WAREHOUSE RECEIPT, DEFINED - a written acknowledgment by the warehouseman that he has received goods from the depositor and holds the same in trust for him. KINDS OF RECEIPT 1. NEGOTIABLE WAREHOUSE RECEIPT - a receipt in which it is stated that the goods received will be delivered to the bearer or to the order of any person named in such receipt. (Sec. 5) 2. NON-NEGOTIABLE WAREHOUSE RECEIPT - a receipt in which it is stated that the goods received will be delivered to the depositor or to any other person. (Sec. 4) - a non-negotiable receipt shall place upon its face by the issuing warehouseman, non-negotiable or not negotiable. - upon failure to do so, a holder who purchased it for value supposing it to be negotiable, may, at his option treat such receipt as imposing upon the warehouseman the same liabilities he would have incurred had the receipt been negotiable. (Sec. 7) INSTANCES WHERE WAREHOUSEMAN BOUND TO DELIVER A warehouseman, in the absence of some lawful excuse provided by Act No. 2137 is bound to deliver the goods upon a demand made either by the holder of a receipt for the goods or by the depositor, if such demand is accompanied with: a. offer to satisfy warehousemans lien; b. offer to surrender receipt, if negotiable, with such indorsements as would be necessary for the negotiation of the receipt, and; c. readiness and willingness to sign, an acknowledgment when the goods are delivered, of such signature is requested by the warehouseman. (Sec. 8) PERSON TO WHOM GOODS MUST BE DELIVERED 1. person lawfully entitled to the possession of the goods, or his agent; 2. person who is either himself entitled to delivery by the terms of the non-negotiable receipt issued for the goods, or who has written authority from the person so entitled either indorsed upon the receipt or written upon another paper, or; 3. person in possession of a negotiable receipt by the terms of which the goods are deliverable to him or order, or to the bearer, or which has been indorsed to him or in blank by the person to whom delivery was promised by the terms of the receipt or by his immediate indorser. (Sec. 9) INSTANCES WHEN WAREHOUSEMAN MAY LEGALLY REFUSE TO DELIVER GOODS 1. When the holder of the receipt does not satisfy the conditions prescribed in Sec. 8 of Act No. 2137, as amended. 2. When the warehouseman has legal title in himself on the goods, such title or right being derived directly or indirectly from the transfer made by the

3. 4. 5. 6. 7.

depositor at the time or subsequent to the deposit for storage, or from the warehousemans lien. (Sec. 16) If he had been requested by a person lawfully entitled to a right of property or possession in the goods not to make delivery to any person. (Sec.10) If he had information that the delivery to be made was to one not lawfully entitled to the possession of the goods. (Sec.10) Where the goods have already been lawfully sold to third persons to satisfy the warehousemans lien or disposed of because of their perishable nature. (Sec. 36) In case of adverse claimants. (Secs. 17&18) In the valid exercise of the warehousemans lien. (Sec. 31)

INSTANCES WHERE WAREHOUSEMAN LIABLE FOR CONVERSION EVEN WITH AUTHORITY The warehouseman is also liable even with indorsement or with authority, he is likewise liable, if prior to delivery he had either: 1. been requested, by or on behalf of the person lawfully entitled to a right of property or possession in the goods, not to make such delivery, or; 2. had information that the delivery about to be made was to one not lawfully entitled to the possession of the goods. (Sec. 10) DUTY OF WAREHOUSEMAN WHERE SEVERAL CLAIM THE GOODS 1. determine within reasonable time the validity of the conflicting claim; (Sec.18) 2. bring a complaint in interpleader; (Sec.1, Rule 62 of the Rules of Court) 3. require claimant to litigate among themselves (Sec.17). TRUST RECEIPTS LAW (P.D. No. 115) TRUST RECEIPT, DEFINED A trust receipt is one where the entruster, who holds an absolute title or security interests over certain goods, documents or instruments, released the same to the entrustee, who executes a trust receipt binding himself to hold the goods, documents or instruments in trust for the entruster and to sell or otherwise dispose of the goods, documents and instruments with the obligation to turn over to the entruster the proceeds thereof to the extent of the amount owing to the entruster, or a s appears in the trust receipt, or return the goods, documents or instruments themselves if they are unsold, or not otherwise disposed of, in accordance with the terms and conditions specified in the trust receipt. (Bank of Commerce vs. Serrano. 451 SCRA 484. February 16, 2005) PURPOSE OF THE LAW To punish dishonesty and abuse of confidence in the handling of money or goods to the prejudice of public order. (Ong vs. CA. G.R. No. 119858. April 29, 2003) NATURE OF TRUST RECEIPT A trust receipt partakes of the nature of a security transaction. It could never be a mere additional or side document. Otherwise, a party to a trust receipt

agreement could easily renege on its obligation thereunder, undermining the importance and defeating with impunity the purpose of such an indispensable tool in commercial transactions. (Ong vs. CA. G.R. No. 119858. April 29, 2003) ACTS AND OMISSIONS PENALIZED The law is violated whenever the entrustee fails to: 1. return the goods covered by the trust receipts, or; 2. return the proceeds of the sale of said goods. (Metropolitan Bank vs. Tonda. 338 SCRA 256. 2000) INTELLECTUAL PROPERTY CODE (R.A. NO. 8293) STATE POLICY The State recognizes that an effective intellectual and industrial property system is vital to the development of domestic and creative activity, facilitates transfer of technology, attracts foreign investments, and ensures market access for our products. It shall protect and secure the exclusive rights of scientists, inventors, artists and other gifted citizens to their intellectual property and creations, particularly when beneficial to the people, for such periods as provided in this Act. The use of intellectual property bears a social function. To this end, the State shall promote the diffusion of knowledge and information for the promotion of national development and progress and the common good. It is also the policy of the State to streamline administrative procedures of registering patents, trademarks and copyright, to liberalize the registration on the transfer of technology, and to enhance the enforcement of intellectual property rights in the Philippines. (Sec. 2) EFFECT ON INTERNATIONAL CONVENTIONS AND ON PRINCIPLE OF RECIPROCITY Any person who is a national or who is domiciled or has a real and effective industrial establishment in a country which is a party to any convention, treaty or agreement relating to intellectual property rights or the repression of unfair competition, to which the Philippines is also a party, or extends reciprocal rights to nationals of the Philippines by law, shall be entitled to benefits to the extent necessary to give effect to any provision of such convention, treaty or reciprocal law, in addition to the rights to which any owner of an intellectual property right is otherwise entitled by this Act. (Sec. 3) SIGNIFICANT FEATURES OF THE LAW 1. A shift was made from the "first-to-invent system" under R.A. No. 165 [old law] to "first-to-file system" under the new law. 2. In the case of inventions, the period of the grant was increased from 17 years from grant under the old law to 20 years from date of filing under the new law. 3. In the case of utility models, the previous grant of 5 years plus renewals of 5 years each under the old law was changed to 7 years without renewal under the new law.

4. In the case of industrial designs, the previous grant of 5 years plus renewals of 5 years each was maintained. 5. Under the old law, there was no opposition proceedings and the examination is mandatory; under the new law, the examination is made only upon request possibly with or without examination. 6. Under the old law, publication is made after the grant; under the new law, publication is effected after 18 months from filing date or priority date. 7. Under the old law, the penalties for repetition of infringement are: P10,000 and/or 5 years of imprisonment and the offense prescribes in 2 years; under the present law, the penalties range from P100,000 to P300,000 and/or 6 months to 3 years of imprisonment and the offense prescribes in 3 years. GOVERNMENT AGENCIES The agency of the government in charge of the implementation of the Intellectual Property Code is the Intellectual Property Office, which replaced the Bureau of Patents, Trademarks and Technology Transfer. It is divided into 6 Bureaus, namely: 1. Bureau of Patents; 2. Bureau of Trademarks; 3. Bureau of Legal Affairs; 4. Documentation, Information and Technology Transfer Bureau; 5. Management Information System and EDP Bureau, and; 6. Administrative, Financial and Personnel Services Bureau. (Sec.6) INTELLECTUAL PROPERY RIGHTS 1. Copyright and Related Rights 2. Trademarks and Service Marks; 3. Geographic Indications; 4. Industrial Designs; 5. Patents; 6. Layout-Designs (Topographies) of Integrated Circuits, and; 7. Protection of undisclosed information. (Sec. 4) PATENT - an exclusive right acquired over an invention, to sell, use, and make the same whether for commerce or trade. - it may relate to product, process, or an improvement of any of the foregoing.

PATENTABLE INVENTIONS Any technical solution of a problem in any field of human activity which is new, involves an inventive step and is industrially applicable shall be patentable. It may be, or may relate to, a product, or process, or an improvement of any of the foregoing. (Sec. 21) NON-PATENTABLE INVENTIONS 1. Discoveries, scientific theories and mathematical methods;

2. Schemes, rules and methods of performing mental acts, playing games or

doing business, and programs for computers;

3. Methods for treatment of the human or animal body by surgery or therapy

and diagnostic methods practiced on the human or animal body. This provision shall not apply to products and composition for use in any of these methods; 4. Plant varieties or animal breeds or essentially biological process for the production of plants or animals; 5. Aesthetic creations, and; 6. Anything which is contrary to public order or morality. (Sec.22) ELEMENTS: a) Novelty and prior art; (Sec. 23&24) The element of novelty is an essential requisite of the patentability of an invention or discovery. If a device or process has been known or used by others prior to its application or discovery by the applicant, an application for a patent therefore should be denied, and if the application has been granted, the court, in a judicial proceeding in which the validity of the patent is drawn in question, will hold it void and ineffective. It has been repeatedly held that an invention must possess the essential elements of novelty, originality and precedence, and for the patentee to be entitled to the protection the invention must be new to the world. (Manzano vs. CA. GR No.113388. September 5, 1997) b) Inventive Step An invention involves an inventive step if, having regard to prior art, it is obvious to a person skilled in the art at the time of the filing date or priority date of the application claiming the invention. (Sec 26) c) Industrial Applicability An invention that can be produced and used in any industry shall be industrially applicable. (Sec. 27) FIRST-TO-FILE RULE 1. if two or more persons have made the invention separately and independently of each other- right to patent belongs to the person who filed an application for such invention; 2. if two or more applications are filed for the same invention- to the applicant who has the earliest filing date or, the earliest filing date. (Sec. 29) GROUNDS FOR COMPULSORY LICENSING The Director of Legal Affairs may grant a license to exploit a patented invention, even without the agreement of the patent owner, in favor of any person who has shown his capability to exploit the invention, under any of the following circumstances: 1. National emergency or other circumstances of extreme urgency; 2. Where the public interest, in particular, national security, nutrition, health or the development of other vital sectors of the national economy as determined by the appropriate agency of the Government, so requires; 3. Where a judicial or administrative body has determined that the manner of exploitation by the owner of the patent or his licensee is anti-competitive; 4. In case of public non-commercial use of the patent by the patentee, without satisfactory reason;

5.

If the patented invention is not being worked in the Philippines on a commercial scale, although capable of being worked, without satisfactory reason. (Sec. 93)

RIGHT TO A PATENT 1. to the inventor, his heirs, or assigns 2. when two or more persons have jointly made an invention - to them jointly 3. if two or more persons have made the invention separately and independently of each other - to the person who filed an application for such invention 4. when two or more applications are filed for the same invention - to the applicant who has the earliest filing date or the earliest priority date. INFRINGEMENT The making, using, offering for sale, selling, or importing a patented product or a product obtained directly or indirectly from a patented process, or the use of a patented process without the authorization of the patentee. 1. Civil action for infringement a. to recover from the infringer damages as the court may award provided that it shall not exceed 3 times the amount of the actual damages sustained plus attorneys fees and other expenses of litigation; b. action for injunction; c. to receive reasonable royalty, if damages are inadequate; d. to have the infringing goods, materials, and implements used in the infringement disposed of outside the channels of commerce or destroyed; e. to hold contributory infringer jointly and severally liable with the infringer. 2. Criminal action for repetition of infringement TRADEMARKS/SERVICEMARK - any visible sign capable of distinguishing the goods (trademark) or services (service mark) of an enterprise and shall include a stamped or marked container of goods. (Sec. 121.1) TRADENAME - name or designation identifying or distinguishing an enterprise. (Sec. 121.3) HOW MARKS ACQUIRED The rights in a mark shall be acquired through registration made validly in accordance with the provisions of this law. (Sec. 122) DOCTRINE OF SECONDARY MEANING - a long time exclusive and continuous use of a mark or name which is unregistrable for being geographical , descriptive or a surname, such that the mark or name has lost its secondary meaning and it becomes associated in the public mind with particular goods. REMEDIES OF THE OWNER OF THE REGISTERED MARK 1. Civil action - damages

- impounding of sales invoices - injunction - destruction of goods found to be infringing 2. Criminal Action A certificate of registration gives rise a presumption of its validity and the right to the exclusive use of the trademarks. While an administrative cancellation of a registered trademark, on any of the grounds under Sec. 17 of R.A. No. 166, is within the ambit of the BPTTT, an action for infringement or other incidental remedy sought is within the jurisdiction of the ordinary courts. An action for infringement or unfair competition, including the available remedies of injunction and damages, in the regular courts can proceed independently or simultaneously with an action for the administrative cancellation of a registered trademark in the BPTTT. (Levi Stauss (Phils.) Inc. vs. Vogue Traders Clothing Company. 462 SCRA 52. June 29, 2005) The infringement case can and should proceed independently from the cancellation case with the Bureau so as to afford the owner of certificates of registration redress and injunctive writs. In the same light, so must the cancellation case with the BPTTT (now the Bureau of Legal Affairs, Intellectual Property Office) continue independently from the infringement case so as to determine whether a registered mark may ultimately be cancelled. (Shangri-la International Hotel Management Ltd. vs. CA. G.R. No. 111580. June 21, 2001) A certificate of registration of a mark or trade-name shall be prima facie evidence of the validity of the registration, the registrant's ownership of the mark or trade-name, and of the registrant's exclusive right to use the same in connection with the goods, business or services specified in the certificate, subject to any conditions and limitations stated therein. In determining whether colorable imitation exists, there are two kinds of tests the Dominancy Test applied in Asia Brewery, Inc. vs. Court of Appeals and other cases and the Holistic Test developed in Del Monte Corporation v. Court of Appeals and its proponent cases. The test of dominancy focuses on the similarity of the prevalent features of the competing trademarks, which might cause confusion or deception and thus constitutes infringement. The question at issue in cases of infringement of trademarks is whether the use of the marks involved would be likely to cause confusion or mistakes in the mind of the public or deceive purchasers. The holistic test mandates that the entirety of the marks in question must be considered in determining confusing similarity. Duly registered trademarks are protected by law as intellectual properties and cannot be appropriated by others without violating the due process clause. An infringement of intellectual rights is no less vicious and condemnable as theft of material property, whether personal or real. (Amigo Manufacturing, Inc. vs. Cluett Peabody Co., Inc. G.R. No. 139300. March 14, 2001)

COPYRIGHT - right over literary and artistic works which are original intellectual creations in the literary and artistic domain protected from the moment of creation. (Kho vs CA. G.R. No. 115758. March 11, 2002) When rights over copyrights are conferred - from the moment of creation (Sec. 172.1) The format of a show is not copyrightable. The copyright does not extend to the general concept or format of its dating game show. Copyright does not extend to an idea, procedure, process, system, method of operation, concept, principle, or discovery, regardless of the form in which it is described, explained, illustrated or embodied in such work. (Joaquin, Jr. vs. Drilon. January 28, 1999) Copyright infringement and unfair competition are not limited to the act of selling counterfeit goods. They cover the whole range of acts, from copying, assembling, packaging to marketing, including the mere offering for sale of the counterfeit goods. (Microsoft Corporation vs. Maxicorp., Incorporated. 438 SCRA 224) Copyright shall be presumed to subsist in the work or other subject matter to which the action relates if the defendant does not put in issue the question whether copyright subsist in the work or subject matter; and Where the subsistence of the copyright is established, the plaintiff shall be presumed to be the owner of the copyright and the defendant does not put in issue the question of his ownership. (Bayanihan Music Philippines, Inc. vs. BMG Records (Pilipinas), Et Al. G.R. No. 166337. March 7, 200)

CHATTEL MORTGAGE LAW (Act No. 1508 in relation to Arts. 1484, 1485, 2140 and 2141 of the New Civil Code) REAL ESTATE MORTGAGE (Act 3135, as amended by R.A. NO. 4118) CHATTEL MORTGAGE, DEFINED By a chattel mortgage, personal property is recorded in the Chattel Mortgage Register as a security for the performance of an obligation. If the movable instead of being recorded, is delivered to the creditor or a third person, the contract is a pledge and not a chattel mortgage. (Sec. 2140, NCC) FORMALITIES 1. Registration

It must be registered in the Chattel Mortgage Register of the Register of Deeds where the mortgagor resides or if he resides in the Philippines in the place where the property is situated. (Sec. 4, Act No. 1508) 2. Affidavit of Good Faith It is a subscribed statement in contract of chatted mortgage wherein the parties severally swear that the mortgage is made for the purpose of securing the obligation specified in conditions thereof, and for no other purpose and that the same is just and valid obligation and one not entered into for the purpose of fraud. (Sec. 5, Act No. 1508) DEFIENCY AFTER FORECLOSURE When the proceeds of the sale are insufficient to cover the debts in an extrajudicial foreclosure of chattel mortgage, the mortgagee is entitled to claim the deficiency from the debtor. (State Investment House, Inc. vs. CA. 217 SCRA 32, 1993) EQUITY OF REDEMPTION VS. RIGHT OF REDEMPTION The right of redemption in relation to a mortgage exists only in the case of the extrajudicial foreclosure of the mortgage. No such right is recognized in a judicial foreclosure except only where the mortgage is a bank or banking institution. The period to exercise the right of redemption is within one year from the registration of the sheriffs certificate of foreclosure sale. Where no right of redemption exists in case of a judicial foreclosure because the mortgagee is not a bank or a banking institution, the foreclosure sale when confirmed by an order of the court shall operate to divest the rights of all parties to the action and to vest their rights in the purchaser. There then exists only what is simply known as the equity of redemption. This is simply the right of the defendant mortgagor to extinguish the mortgage and retain ownership of the property by paying the secured debt within the 90-day period after the judgment becomes final, in accordance with Rule 68 of the Rules of Court, or even after the foreclosure sale, but prior to confirmation. (Huerta Alba Resort, Inc. vs. CA. September 1, 2000. G.R. No. 128567)

OTHER IMPORTANT DOCTRINES No mortgage on any unit or lot shall be made by the owner or developer without prior written approval of the Housing and Land Use Regulatory Board (HLURB). A mortgagees want of knowledge due to its negligence takes the place of registration it is presumed to know the rights of others over the lot and the conversion of its status as mortgageee to buyer-owner will not lessen the importance of such knowledge. Under the Art. 2085 of the Civil Code, the essential requisites of a contract of mortgage are: (a) that it be constituted to secure the fulfillment of a principal obligation; (b) that the mortgagor be the absolute owner of the thing mortgaged; and (c) that the persons constituting the mortgage have the free disposal of their property, and in the absence thereof, that they be legally authorized for the

purpose. (Home Bankers Savings & Trust Co. vs. Court of Appeals. 457 SCRA 167. April 26, 2005) Under Art. 2085 of the Civil Code, one of the essential requisites of the contract of mortgage is that the mortgagor should be the absolute owner of the property to be mortgaged; otherwise, the mortgage is considered null and void an exception to this rule is the doctrine of mortgage in good faith. (Llanto vs. Alzona. 450 SCRA 288. January 31, 2005) The right of redemption should be exercised within the specified time limit, which is one year from the date of registration of the certificate of sale. In case of disagreement over the redemption price, the redemptioner may preserve his right of redemption through judicial action which in every case must be filed within the one-year period of redemption. The general rule in redemption is that it is not sufficient that a person offering to redeem manifests his desire to do so the statement of intention must be accompanied by an actual and simultaneous tender of payment. (Banco Filipino Savings and Mortgage Bank vs. CA. 463 SCRA 64. July 28, 2005) A foreclosure sale buyer, having accepted payment from persons claiming right to redeem foreclosed property, has the obligation to account for such payment, to return the excess, if any, to allow redemption. (Rural Bank of Calinog (Iloilo), Inc. vs. CA. 463 SCRA 79. July 28, 2005) A recorded real estate mortgage is a right in rem, a lien on the property whoever its owner may be. Mortgage follows the property until discharged. Debtor in extrajudicial foreclosures under Act No. 3135 or his successor-ininterest has one year from the date of registration of the Certificate of Sale with the Registry of Deeds a right to redeem the foreclosed mortgage. The buyer in a foreclosure sale becomes the absolute owner of the property purchased if it is not redeemed during the period of one year after the registration of the sale. (Paredes vs. CA. 463 SCRA 505. July 15, 2005)

INSOLVENCY LAW (Act No. 1956) INSOLVENCY DISTINGUISHED FROM SUSPENSION OF PAYMENTS 1. In insolvency, the liabilities of the debtor are more than his assets while in suspension of payments the assets of the debtor are more than his liabilities. 2. In insolvency, the purpose is to obtain discharge from all debts and liability while in suspension of payments the purpose is to delay payment of debts which remain unaffected although a postponement of payments is declared. 3. In insolvency, the assets of the debtor are to be converted into cash for distribution among his creditors, while in suspension of payments the debtor is asking for time within which to convert his properties into cash with which to pay his creditors as the obligations fall due.

INVOLUNTARY INSOLVENCY DISTINGUISHED FROM VOLUNTARY INSOLVENCY 1. In involuntary, three or more creditors are required while in voluntary one creditor may be sufficient. 2. In involuntary, the creditors must be residents of the Philippines whose credits or demand accrued in the Philippines and none of the creditors has become a creditor by assignment within 30 days prior to the filing of the petition while no such requirements exist for voluntary insolvency. 3. In involuntary, the amount of indebtedness must be less than P1,000 while for voluntary, it must exceed P1,000. 4. In involuntary, the petition must be accompanied by a bond, while voluntary does not require a bond. TRUTH IN LENDING ACT (R.A. No. 3765, as amended by the Consumer Act of 1992) DISCLOSURE REQUIREMENT: Any creditor shall furnish to each person to whom credit is extended, prior to the consummation of the transaction, a clear statement in writing setting forth, to the extent applicable in accordance with rules and regulations prescribed by the Monetary Board of the BSP, the following information: 1. the cash price or delivered price of the property or service to be acquired; 2. the amounts, if any, to be credited as down payment and/or trade-in; 3. the difference between the amounts set forth under clauses 1 and 2; 4. the charges, individually itemized, which are paid or to be paid by such person in connection with the transaction but which are not incident to the extension of credit; 5. the total amount to be financed; 6. the finance charge expressed in terms of pesos and centavos; 7. the percentage that the finance charge bears to the total amount to be financed expressed as a simple annual rate on the outstanding unpaid balance of the obligation; 8. the effective interest rate; 9. the repayment program; 10.the default or delinquency charges on late payments. (Sec.4) Excessive interests, penalties and other charges not revealed in disclosure statements issued by banks even if stipulated in the promissory notes, cannot be given effect under Truth un Lending Act. (New Sampaguita Builders Construction, Inc. vs. Philippine National Bank. G.R. No. 148753. July 30, 2004) ANTI- MONEY LAUNDERING LAW (R.A. No. 9160, as amended by R.A. No. 9194) MONEY LAUNDERING, DEFINED - is a crime whereby the proceeds of an unlawful activity are transacted, thereby making them appear to have originated from legitimate sources. (Sec. 4)

How is the offense money laundering committed? 1. Any person knowing that any monetary instrument or property represents, involves, or relates to, the proceeds of any unlawful activity, transacts or attempts to transact said monetary instrument or property. 2. Any person knowing that any monetary instrument or property involves the proceeds of any unlawful activity performs or fails to perform any acts as a result of which he facilitates the offense of money laundering referred to in paragraph 1 above. 3. Any person knowing that any monetary instrument or property is required under this Act to be disclosed and filed with the AMLA Council fails to do so. UNLAWFUL ACTIVITIES UNDER AMLA: Any act or omission or series or combination thereof involving or having direct relation to the following: 1. Kidnapping for ransom under Art. 267 of the Revised Penal Code, as amended. 2. Secs. 4, 5, 7, 8, 9, 10, 12, 13, 14, 15 and 16 of the Comprehensive Dangerous Drugs Act of 2002. 3. Section 3, paragraphs B, C, E, G, H and I of Anti-Graft and Corrupt Practices Act. 4. Plunder under RA 7080, as amended. 5. Robbery and extortion under Arts. 294, 295, 296, 299, 300, 301 and 302 of the RPC, as amended. 6. Jueting and masiao punished as illegal gambling under PD 1602. 7. Piracy on the high seas under the RPC, as amended and PD 532. 8. Qualified theft under Art. 310 of the RPC, as amended. 9. Swindling under Art. 315 of the RPC, as amended. 10.Smuggling under RA 455 and 1937. 11.Violations under Electronic Commerce Act of 2000. 12.Hijacking and other violations under RA 6235, destructive arson and murder, as defined under the RPC, as amended, including those perpetrated by terrorists against non-combatant persons and similar targets. 13.Fraudulent practices and other violations under Securities Regulation Code of 2000. 14.Felonies or offenses of a similar nature that are punishable under the penal laws of other countries.

You might also like

- Union Bank of India (1) Account Statement PDFDocument2 pagesUnion Bank of India (1) Account Statement PDFJoshua Hannity50% (4)

- Banking Laws ReviewerDocument26 pagesBanking Laws ReviewerZtirf Nobag83% (6)

- Amla ReviewerDocument8 pagesAmla ReviewerFatMan8750% (2)

- Special Commercial Law ReviewerDocument17 pagesSpecial Commercial Law ReviewerresNo ratings yet

- List of Registered Independent Sales OrganizationsDocument53 pagesList of Registered Independent Sales Organizationscdill70100% (1)

- Questionnaire of Behavioral FinanceDocument9 pagesQuestionnaire of Behavioral Financebikash_sharma19880% (1)

- New Central Bank ActDocument20 pagesNew Central Bank Actcpl123No ratings yet

- RA 8791 General Banking LawDocument33 pagesRA 8791 General Banking LawAngelo Christian100% (1)

- General Banking Law ReviewerDocument89 pagesGeneral Banking Law ReviewerKarla Marie Tumulak67% (3)

- RA 1405 and RA 6426Document4 pagesRA 1405 and RA 6426lawkalawkaNo ratings yet

- Credit Transactions: Benefit of ExcussionDocument5 pagesCredit Transactions: Benefit of ExcussionDandan TanNo ratings yet

- DIZON - Banking Laws PDFDocument246 pagesDIZON - Banking Laws PDFBianca de Guzman100% (4)

- 1st Long Exam New Central Bank Act QnADocument5 pages1st Long Exam New Central Bank Act QnAAldrin100% (1)

- Antichresis-Ppt-Rfbt 3Document15 pagesAntichresis-Ppt-Rfbt 316 Dela Cerna, RonaldNo ratings yet

- New Central Bank Act ReviewerDocument12 pagesNew Central Bank Act ReviewerLynn N David100% (1)

- New Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDocument17 pagesNew Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDominic Romero75% (4)

- Banking ReviewerDocument81 pagesBanking ReviewerApril Gan CasabuenaNo ratings yet

- Banking LawDocument20 pagesBanking LawKenneth Rafols100% (2)

- General Banking Law of 2000 ReviewerDocument10 pagesGeneral Banking Law of 2000 ReviewerBryan AriasNo ratings yet

- 1 - New Central Bank ActDocument19 pages1 - New Central Bank Actrandyblanza2014100% (2)

- New Central Bank Act NotesDocument14 pagesNew Central Bank Act NotesAleric Mondano67% (3)

- Banking Laws SummaryDocument13 pagesBanking Laws SummaryTwentyNo ratings yet

- What is the Philippine Deposit Insurance Corporation (PDICDocument5 pagesWhat is the Philippine Deposit Insurance Corporation (PDICMarlon EspedillonNo ratings yet

- Banking NotesDocument17 pagesBanking Notescmv mendozaNo ratings yet

- FRIA Law ReviewerDocument21 pagesFRIA Law ReviewerDakila Maloy100% (7)

- Basic Queries About Money Laundering & The Anti-Money Laundering Act (Amla)Document19 pagesBasic Queries About Money Laundering & The Anti-Money Laundering Act (Amla)Agapito De Asis100% (2)

- Batas Pambansa Blg.22Document10 pagesBatas Pambansa Blg.22Mavz PelonesNo ratings yet

- Intellectual PropertyDocument3 pagesIntellectual PropertyJanelle TabuzoNo ratings yet

- General Banking Law of 2000Document25 pagesGeneral Banking Law of 2000John Rey Bantay RodriguezNo ratings yet

- New Central Bank ActDocument17 pagesNew Central Bank ActKamil Ubungen Delos ReyesNo ratings yet

- SECRECY OF BANK DEPOSITS LAWDocument12 pagesSECRECY OF BANK DEPOSITS LAWCliff Anthony Rivera Santillan100% (1)

- Financial Rehabilitation Act SummaryDocument25 pagesFinancial Rehabilitation Act SummaryNaiza Mae R. Binayao100% (2)

- Speccom - NCBA GBL ReviewerDocument10 pagesSpeccom - NCBA GBL ReviewerSarah CadioganNo ratings yet

- Cpat Reviewer - AmlaDocument3 pagesCpat Reviewer - AmlaZaaavnn Vannnnn100% (1)

- PDIC Law - Lecture NotesDocument4 pagesPDIC Law - Lecture NotesJolina Ayngan100% (1)

- Commercial Law Reviewer: Banking and Allied LawsDocument89 pagesCommercial Law Reviewer: Banking and Allied Lawsviktor samuel fontanilla100% (2)

- New PDIC maximum deposit insurance explainedDocument5 pagesNew PDIC maximum deposit insurance explainedMercy Rebua AragonNo ratings yet

- General Banking LawDocument31 pagesGeneral Banking LawAileen Mae San JoseNo ratings yet

- CPAT Reviewer - Pledge, Mortgaage and AntichresisDocument4 pagesCPAT Reviewer - Pledge, Mortgaage and AntichresisZaaavnn VannnnnNo ratings yet

- Bank Secrecy Law ExceptionsDocument5 pagesBank Secrecy Law Exceptionsjb_uy100% (1)

- AmlaDocument31 pagesAmlaNaomi Yumi - GuzmanNo ratings yet

- New Central Bank Act FINALDocument50 pagesNew Central Bank Act FINALSharmaine SurNo ratings yet

- Fria NotesDocument13 pagesFria NotesMary SmithNo ratings yet

- Simex International v. CA, G.R. No. 88013. 89 Scra 360. March 19, 1990Document1 pageSimex International v. CA, G.R. No. 88013. 89 Scra 360. March 19, 1990Pamela Camille BarredoNo ratings yet

- Secrecy in Bank DepositsDocument59 pagesSecrecy in Bank DepositsJenevieve Muya SobredillaNo ratings yet

- UST Golden Notes - Banking LawsDocument20 pagesUST Golden Notes - Banking LawsAntrex GuroNo ratings yet

- 2019 Bar Notes On Anti-Money Laundering PDFDocument10 pages2019 Bar Notes On Anti-Money Laundering PDFAnonymous kiom0L1Fqs100% (1)

- BANKING ALLIED LAWS 10 November 2019Document19 pagesBANKING ALLIED LAWS 10 November 2019David YapNo ratings yet

- Banking Laws of 2000Document11 pagesBanking Laws of 2000Joy DalesNo ratings yet

- Banking Laws Week 1Document7 pagesBanking Laws Week 1Keshlyn KellyNo ratings yet

- Banking Laws: A. The New Central Bank Act (R.A. NO. 7653)Document14 pagesBanking Laws: A. The New Central Bank Act (R.A. NO. 7653)Ahl Ja MarNo ratings yet

- Banking Law QuizDocument18 pagesBanking Law QuizJui Aquino Provido100% (1)

- Close Now Hear Later - Exercise of Police Power Over BanksDocument20 pagesClose Now Hear Later - Exercise of Police Power Over BanksJosh Migo G. MordenoNo ratings yet

- General Banking Laws of 2000 (RA 8791) : Banks Shall Be Classified IntoDocument9 pagesGeneral Banking Laws of 2000 (RA 8791) : Banks Shall Be Classified IntoJoy DalesNo ratings yet

- Atty. VLSalido - Banking Laws Phil JudDocument75 pagesAtty. VLSalido - Banking Laws Phil Judjz.montero19No ratings yet

- General Banking Law of 2000 (RA8791) Key ProvisionsDocument22 pagesGeneral Banking Law of 2000 (RA8791) Key ProvisionsMark DigaNo ratings yet

- StatCon (Agpalo)Document3 pagesStatCon (Agpalo)moonlightmidamNo ratings yet

- Banking LawsDocument31 pagesBanking LawsJanMarkMontedeRamosWongNo ratings yet

- Banking Laws PhilippinesDocument6 pagesBanking Laws PhilippinesJoel Guasis AyonNo ratings yet

- 2023 Pre-Week BankingDocument36 pages2023 Pre-Week BankingCassie GacottNo ratings yet

- Ra 8791 General Banking Law: Maria Ginalyn CalderonDocument54 pagesRa 8791 General Banking Law: Maria Ginalyn CalderonMaria Ginalyn CastilloNo ratings yet

- Commercial Law ReviewDocument27 pagesCommercial Law ReviewimianmoralesNo ratings yet

- RA 8791 - An overview of the General Banking Law of 2000Document19 pagesRA 8791 - An overview of the General Banking Law of 2000Amado Vallejo IIINo ratings yet

- LienVietPostBank Profile 2018Document16 pagesLienVietPostBank Profile 2018Hoàng Tuấn LinhNo ratings yet

- Financial institution policies that promote Bangladeshi entrepreneurshipDocument36 pagesFinancial institution policies that promote Bangladeshi entrepreneurshipmehedihsn100% (1)

- Rsbsa-8 7 2015 PDFDocument4 pagesRsbsa-8 7 2015 PDFRonalene Garbin100% (1)

- Kiosk Banking Solution KBSDocument2 pagesKiosk Banking Solution KBSMANISHNo ratings yet

- Afar 106 - Home Office and Branch Accounting PDFDocument3 pagesAfar 106 - Home Office and Branch Accounting PDFReyn Saplad PeralesNo ratings yet

- DV For MOOEDocument10 pagesDV For MOOELex AmarieNo ratings yet

- Fms Project-Microfinance in IndiaDocument25 pagesFms Project-Microfinance in Indiaashu181186No ratings yet

- CPA Board Examinations QuestionsDocument14 pagesCPA Board Examinations QuestionsJeane BongalanNo ratings yet

- EB Rainer wl11 IIS3 WM PDFDocument580 pagesEB Rainer wl11 IIS3 WM PDFran_chanNo ratings yet

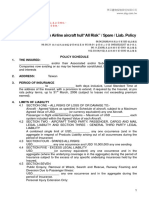

- Airline Aircraft Hull All Risk Spare Liab Policy BrochureDocument27 pagesAirline Aircraft Hull All Risk Spare Liab Policy BrochureZoran DimitrijevicNo ratings yet

- IRCTC travel insurance coverDocument3 pagesIRCTC travel insurance coverAbhinav TayadeNo ratings yet

- Issue Mechanism PDFDocument4 pagesIssue Mechanism PDFNikshitha100% (1)

- MEMORANDUM Leobrera vs. BPI PC2 JCBDocument10 pagesMEMORANDUM Leobrera vs. BPI PC2 JCBdivine_carlosNo ratings yet

- Bangayan vs. Rizal Commercial Banking CorporationDocument31 pagesBangayan vs. Rizal Commercial Banking CorporationT Cel MrmgNo ratings yet

- Jaiib Questions and Model Question PaperDocument52 pagesJaiib Questions and Model Question Paperவன்னியராஜாNo ratings yet

- Harding v. Commercial Union Assurance CompanyDocument3 pagesHarding v. Commercial Union Assurance CompanyIldefonso HernaezNo ratings yet

- Product Growth Leader with Expertise in FintechDocument4 pagesProduct Growth Leader with Expertise in FintechMohammed LangstonNo ratings yet

- This Is The Sample Illustration Issued by HDFC Life Insurance Company LimitedDocument2 pagesThis Is The Sample Illustration Issued by HDFC Life Insurance Company Limitedsaurabh sumanNo ratings yet

- PNBONE_mPassbook_134611_6-4-2024_13-4-2024_0053XXXXXXXX00 (1) (1)Document3 pagesPNBONE_mPassbook_134611_6-4-2024_13-4-2024_0053XXXXXXXX00 (1) (1)imtiyaz726492No ratings yet

- Investor Services by Mutual FundsDocument16 pagesInvestor Services by Mutual FundssidhanthaNo ratings yet

- What Is Corporate Banking PDFDocument2 pagesWhat Is Corporate Banking PDFSonakshi Behl100% (1)

- PDFDocument7 pagesPDFSoman MenonNo ratings yet

- 1 4907089629913546889 PDFDocument68 pages1 4907089629913546889 PDFGodha KiranaNo ratings yet

- For Non Resident Indians: Account Opening FormDocument16 pagesFor Non Resident Indians: Account Opening Formshalabh2381No ratings yet

- Letter of CreditDocument7 pagesLetter of CreditprasadbpotdarNo ratings yet

- Afu 07202 Accounting For InventoryDocument61 pagesAfu 07202 Accounting For InventoryPatric CletusNo ratings yet