Professional Documents

Culture Documents

State Powers of Police, Eminent Domain & Taxation

Uploaded by

Carla Abapo RCrimOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State Powers of Police, Eminent Domain & Taxation

Uploaded by

Carla Abapo RCrimCopyright:

Available Formats

3 Inherent Powers of the State: 1. Police Power; 2. Power of Eminent Domain or Power of Expropriation; and 3.

Power of Taxation Purpose: 1. for public good or welfare - Police Power 2. for public use - Power of Eminent Domain 3. for revenue - Power of Taxation 1. POLICE POWER is the power of promoting the public welfare by restraining and regulating the use of both liberty and property of all the people. It is considered to be the most all-encompassing of the three powers. It may be exercised only by the government. The property taken in the exercise of this power is destroyed because it is noxious or intended for a noxious purpose. It lies primarily in the discretion of the legislature. Hence, the President, and administrative boards as well as the lawmaking bodies on all municipal levels, including the barangay may not exercise it without a valid delegation of legislative power. Municipal governments exercise this power by virtue of the general welfare clause of the Local Government Code of 1991. Even the courts cannot compel the exercise of this power through mandamus or any judicial process. Requisites of a valid police measure: (a.) Lawful Subject the activity or property sought to be regulated affects the public welfare. It requires the primacy of the welfare of the many over the interests of the few. (b.) Lawful Means the means employed must be reasonable and must conform to the safeguards guaranteed by the Bill of Rights. 2. POWER OF EMINENT DOMAIN affects only property RIGHTS. It may be exercised by some private entities. The property forcibly taken under this power, upon payment of just compensation, is needed for conversion to public use or purpose. The taking of property in law may include: - trespass without actual eviction of the owner; - material impairment of the value of the property; or - prevention of the ordinary uses for which the property was intended. The property that may be subject for appropriation shall not be limited to private property. Public property may be expropriated provided there is a SPECIFIC grant of authority to the delegate. Money and a chose in action are the only things exempt from expropriation. Although it is also lodged primarily in the national legislature, the courts have the power to inquire the legality of the right of eminent domain and to determine whether or not there is a genuine necessity therefore. 3. POWER OF TAXATION affects only property rights and may be exercised only by the government. The property taken under this power shall likewise be intended for a public use or purpose. It is used solely for the purpose of raising revenues, to protect the people and extend them benefits in the form of public projects and services (I hope so). Hence, it cannot be allowed to be confiscatory, except if it is intended for destruction as an instrument of the police power. It must conform to the requirements of due process. Therefore, taxpayers are entitled to be notified of the assessment proceedings and to be heard therein on the correct valuation to be given the property. It is also subject to the general requirements of the equal protection clause that the rule of taxation shall be uniform and equitable.

Regalian Doctrine All lands of the public domain belong to the State, which is the source of any asserted right to ownership of land. All lands not otherwise appearing to be clearly within private ownership are presumed to belong to the State.[1] All lands not otherwise clearly appearing to be privately-owned are presumed to belong to the State.[2]

TAKE NOTE THAT THE REGALIAN DOCTRINE IS ENSHRINED IN OUR PRESENT AND PAST CONSTITUTIONS THE 1987 CONSTITUTION PROVIDES UNDER NATIONAL ECONOMY AND PATRIMONY THE FOLLOWING > Section 2. All lands of the public domain, waters, minerals, coal, petroleum, and other mineral oils, all forces of potential energy, fisheries, forests or timber, wildlife, flora and fauna, and other natural resources are owned by the State. With the exception of agricultural lands, all other natural resources shall not be alienated. The exploration, development, and utilization of natural resources shall be under the full control and supervision of the State. The State may directly undertake such activities, or it may enter into co-production, joint venture, or production-sharing agreements with Filipino citizens, or corporations or associations at least sixty per centum of whose capital is owned by such citizens. Such agreements may be for a period not exceeding twenty-five years, renewable for not more than twenty-five years, and under such terms and conditions as may be provided by law. In cases of water rights for irrigation, water supply fisheries, or industrial uses other than the development of water power, beneficial use may be the measure and limit of the grant. > The abovementioned provision provides that except for agricultural lands for public domain which alone may be alienated, forest or timber, and mineral lands, as well as all other natural resources must remain with the State, the exploration, development and utilization of which shall be subject to its full control and supervision albeit allowing it to enter into coproduction, joint venture or production-sharing agreements, or into agreements with foreignowned corporations involving technical or financial assistance for large-scale exploration, development, and utilization THE 1987 PROVISION HAD ITS ROOTS IN THE 1935 CONSTITUTION WHICH PROVIDES > Section 1. All agricultural timber, and mineral lands of the public domain, waters, minerals, coal, petroleum, and other mineral oils, all forces of potential energy and other natural resources of the Philippines belong to the State, and their disposition, exploitation, development, or utilization shall be limited to citizens of the Philippines or to corporations or associations at least sixty per centum of the capital of which is owned by such citizens, subject to any existing right, grant, lease, or concession at the time of the inauguration of the Government established under this Constitution. Natural resources, with the exception of public agricultural land, shall not be alienated, and no license, concession, or lease for the exploitation, development, or utilization of any of the natural resources shall be granted for a period exceeding twentyfive years, renewable for another twenty-five years, except as to water rights for irrigation, water supply, fisheries, or industrial uses other than the development of water power, in which cases beneficial use may be the measure and limit of the grant. THE 1973 CONSTITUTION REITERATED THE REGALIAN DOCTRINE AS FOLLOWS > Section 8. All lands of public domain, waters, minerals, coal, petroleum and other mineral oils, all forces of potential energy, fisheries, wildlife, and other natural resources of the Philippines belong to the State. With the exception of agricultural, industrial or commercial, residential, or resettlement lands of the public domain, natural resources shall not be alienated, and no license, concession, or lease for the exploration, or utilization of any of the natural resources shall be granted for a period exceeding twentyfive years, except as to water rights for irrigation, water supply, fisheries, or industrial uses other than development of water power, in which cases, beneficial use may by the measure and the limit of the grant. THE REGALIAN DOCTRINE DOESN'T NEGATE NATIVE TITLE. THIS IS IN PURSUANCE TO WHAT HAS BEEN HELD IN CRUZ V. SECRETARY OF ENVIRONMENT AND NATURAL RESOURCES > Petitioners challenged the constitutionality of Indigenous Peoples Rights Act on the ground that it amounts to an unlawful deprivation of the State s ownership over lands of the public domain and all other natural resources therein, by recognizing the right of ownership of ICC or IPs to their ancestral domains and ancestral lands on the basis of native title. > As the votes were equally divided, the necessary majority wasn t obtained and petition was dismissed and the law s validity was upheld > Justice Kapunan: Regalian theory doesn t negate the native title to lands held in private ownership since time immemorial, adverting to the landmark case of CARINO V. LOCAL GOVERNMENT, where the US SC through Holmes held: xxx the land has been held by individuals under a claim of private ownership, it will be presumed to have been held in the same way from before the Spanish conquest, and never to have been public land. > Existence of native titie to land, or ownership of land by Filipinos by virtue of possession under a claim of ownership since time immemorial and independent of any grant from the Spanish crown as an exception to the theory of jure regalia > Justice Puno: Carino case firmly established a concept of private land title that existed irrespective of any royal grant from the State and was based on the strong mandate extended to the Islands via the Philippine Bill of 1902. The IPRA recognizes the existence of ICCs/IPs as a distinct sector in the society. It grants this people the ownership and possession of their ancestral domains and ancestral lands and defines the extent of these lands and domains > Justice Vitug: Carino cannot override the collective will of the people expressed in the Constitution. > Justice Panganiban: all Filipinos, whether indigenous or not, are subject to the Constitution, and that no one is exempt from its allencompassing provisions

WHAT IS THE CONCEPT OF JURE REGALIA? (REGALIAN DOCTRINE) > Generally, under this concept, private title to land must be traced to some grant, express or implied, from the Spanish Crown or its successors, the American Colonial Government, and thereafter, the Philippine Republic > In a broad sense, the term refers to royal rights, or those rights to which the King has by virtue of his prerogatives > The theory of jure regalia was therefore nothing more than a natural fruit of conquest CONNECTED TO THIS IS THE STATE S POWER OF DOMINUUM > Capacity of the state to own or acquire property foundation for the early Spanish decree embracing the feudal theory of jura regalia > This concept was first introduced through the Laws of the Indies and the Royal Cedulas > The Philippines passed to Spain by virtue of discovery and conquest. Consequently, all lands became the exclusive patrimony and dominion of the Spanish Crown. > The Law of the Indies was followed by the Ley Hipotecaria or the Mortgage Law of 1893. This law provided for the systematic registration of titles and deeds as well as possessory claims > The Maura Law: was partly an amendment and was the last Spanish land law promulgated in the Philippines, which required the adjustment or registration of all agricultural lands, otherwise the lands shall revert to the State

You might also like

- Fundamental Powers of the State: Police, Eminent Domain, TaxationDocument2 pagesFundamental Powers of the State: Police, Eminent Domain, TaxationÄnne Ü Kimberlie82% (72)

- 3 Inherent Powers of The StateDocument12 pages3 Inherent Powers of The StateMarilou Gutierrez98% (42)

- Essential Tax Characteristics: Enforced, Proportionate, PecuniaryDocument1 pageEssential Tax Characteristics: Enforced, Proportionate, PecuniaryEdward Francis Arabe100% (2)

- Police Powers ExplainedDocument4 pagesPolice Powers ExplainedAlbert Azura100% (2)

- 3 Inherent Powers of The StateDocument1 page3 Inherent Powers of The Statesharlene_17corsatNo ratings yet

- 3 Inherent Powers of The StateDocument12 pages3 Inherent Powers of The StateRusty Nomad100% (1)

- Nature and Scope of The Power of TaxationDocument4 pagesNature and Scope of The Power of Taxationwiggie2782% (17)

- 3 Inherent Powers of The StateDocument5 pages3 Inherent Powers of The StateAnonymous B0aR9GdN100% (2)

- General Principles and ConceptsDocument2 pagesGeneral Principles and ConceptsCharry Ramos67% (3)

- Theory and Basis of Taxation: Lifeblood Principle and Benefit-Received ConceptDocument4 pagesTheory and Basis of Taxation: Lifeblood Principle and Benefit-Received ConceptJiyu50% (2)

- Fundamental Powers of The StateDocument10 pagesFundamental Powers of The StateTrizha Reamico100% (2)

- The Three Inherent Powers of The StateDocument3 pagesThe Three Inherent Powers of The StateFrajonalyn Leon100% (1)

- Lifeblood TheoryDocument2 pagesLifeblood TheoryCon Pu0% (1)

- Essential Requisites of A Contract of SaleDocument10 pagesEssential Requisites of A Contract of SaleDesiree Joy UmaliNo ratings yet

- Fundamental Powers of The StateDocument15 pagesFundamental Powers of The StateJoanne Alyssa Hernandez Lascano100% (3)

- Reviewer - SEPARATION-Delegation of POWERSDocument5 pagesReviewer - SEPARATION-Delegation of POWERS8LYN LAW100% (2)

- Not All Legal Is Moral, But What Is Moral Is Worth LegalizingDocument1 pageNot All Legal Is Moral, But What Is Moral Is Worth LegalizingNarlie Jade Cadorna100% (1)

- Textbook On The Philippine Constitution (De Leon, Hector)Document9 pagesTextbook On The Philippine Constitution (De Leon, Hector)superbbloom80% (25)

- Lifeblood DoctrineDocument1 pageLifeblood DoctrineEric Roy Malik0% (1)

- SC rules on double jeopardyDocument14 pagesSC rules on double jeopardySbl IrvNo ratings yet

- Police Power - Eminent DomainDocument14 pagesPolice Power - Eminent DomainChristia Sandee Suan100% (1)

- Art. 2Document39 pagesArt. 2maria erika100% (6)

- Application of PaymentDocument13 pagesApplication of Paymentulticon0% (2)

- Checks and Balances, Blending of Powers, Doctrine of Separation of PowersDocument1 pageChecks and Balances, Blending of Powers, Doctrine of Separation of PowersLizzy Way100% (3)

- Marbury v Madison: Judicial Review EstablishedDocument30 pagesMarbury v Madison: Judicial Review EstablishedMa. Tiffany T. CabigonNo ratings yet

- Article XII Philippine ConstitutionDocument40 pagesArticle XII Philippine ConstitutionJazztine GelleraNo ratings yet

- Introduction to the Elements of Political ScienceDocument3 pagesIntroduction to the Elements of Political ScienceElle100% (1)

- A. General Concepts and Principles of TaxationDocument4 pagesA. General Concepts and Principles of TaxationAngelica EsguireroNo ratings yet

- LAW ON OBLIGATION AND CONTRACTS: WHO IS THE REAL PARTY-IN-INTERESTDocument7 pagesLAW ON OBLIGATION AND CONTRACTS: WHO IS THE REAL PARTY-IN-INTERESTCristy C. Bangayan100% (1)

- PAMANTASAN Report on Social Justice and Human RightsDocument23 pagesPAMANTASAN Report on Social Justice and Human RightsRAINBOW AVALANCHE100% (15)

- Philippine Constitution Powers Blending ExamplesDocument1 pagePhilippine Constitution Powers Blending ExamplesTokie TokiNo ratings yet

- Legislative Department ReviewerDocument9 pagesLegislative Department ReviewerMichaella Reyes100% (3)

- Land Owner's Choice to Pay for House or Require Builder to Pay for LandDocument2 pagesLand Owner's Choice to Pay for House or Require Builder to Pay for LandTricia SibalNo ratings yet

- The Fundamental Powers of The StateDocument12 pagesThe Fundamental Powers of The Statedaphnie lorraine ramosNo ratings yet

- Unpacking The Self The Material SelfDocument3 pagesUnpacking The Self The Material SelfWALLANG, Nicol B.No ratings yet

- 1156 1178Document8 pages1156 1178Trisha Cabral100% (5)

- Aspects of TaxationDocument1 pageAspects of TaxationJuvie AnNo ratings yet

- Essential Elements of A TaxDocument31 pagesEssential Elements of A TaxJosephine Berces100% (5)

- Bill of Rights Case DigestDocument33 pagesBill of Rights Case DigestMN San JoseNo ratings yet

- Scope and Limitations of TaxationDocument2 pagesScope and Limitations of TaxationBianca Viel Tombo CaligaganNo ratings yet

- When A Thing Considered LostDocument2 pagesWhen A Thing Considered LostAlyssa Mae Ogao-ogao0% (1)

- 4 Fundamental Characteristics of ContractsDocument2 pages4 Fundamental Characteristics of Contractsrai barrameda100% (5)

- Notes On Prescription Obligations and ContractsDocument165 pagesNotes On Prescription Obligations and ContractsPaul Jared Quilaneta NgNo ratings yet

- Criminal Liability CircumstancesDocument5 pagesCriminal Liability CircumstancesMieh Pacual90% (10)

- Essential Guide to the Philippines' Agrarian Reform ProgramDocument53 pagesEssential Guide to the Philippines' Agrarian Reform ProgramLovely Jane MercadoNo ratings yet

- Reaction PaperDocument2 pagesReaction PaperRoselle Casiguran100% (1)

- Your ArgumentsDocument16 pagesYour ArgumentsBurning RoseNo ratings yet

- Difference Between Act of Lasciviousness Vs RapeDocument2 pagesDifference Between Act of Lasciviousness Vs RapeCa CabaruanNo ratings yet

- Constitutional CommissionsDocument16 pagesConstitutional CommissionsPatricia BautistaNo ratings yet

- Article 1284Document1 pageArticle 1284Mitz Arzadon100% (1)

- Civilian SupremacyDocument3 pagesCivilian SupremacyJomar Teneza100% (1)

- IPS2Document6 pagesIPS2Shawn Dustin CoscolluelaNo ratings yet

- What Is The Concept of Jure Regalia? (Regalian Doctrine)Document7 pagesWhat Is The Concept of Jure Regalia? (Regalian Doctrine)Alberto NicholsNo ratings yet

- Regalian DoctrineDocument2 pagesRegalian DoctrineSi Trixie GarvidaNo ratings yet

- Concept of Jure RegaliaDocument6 pagesConcept of Jure RegaliaRonaldNo ratings yet

- Jura RegaliaDocument4 pagesJura RegaliaSig G. MiNo ratings yet

- Regalian doctrine and native titleDocument7 pagesRegalian doctrine and native titleBurn-Cindy AbadNo ratings yet

- Regalian DoctrineDocument3 pagesRegalian DoctrineMa Jean Baluyo CastanedaNo ratings yet

- Regalian DoctrineDocument9 pagesRegalian DoctrineAna Adolfo100% (2)

- Regallian DoctrineDocument1 pageRegallian DoctrineMary Joy SumapidNo ratings yet

- The Initial Police Report on the Murder of Marilyn SheppardDocument6 pagesThe Initial Police Report on the Murder of Marilyn SheppardCarla Abapo RCrimNo ratings yet

- SHEDIED by Haveyouseenthisgirl (Wattpad)Document186 pagesSHEDIED by Haveyouseenthisgirl (Wattpad)Angelica Barcelona Yumang100% (4)

- Strength of TrademarksDocument1 pageStrength of TrademarksCarla Abapo RCrimNo ratings yet

- Trademark ExampleDocument3 pagesTrademark ExampleJuliuz DitanNo ratings yet

- Contracts AlbanoDocument42 pagesContracts AlbanoCarla Abapo RCrimNo ratings yet

- Information Technology and The Law OutlineDocument1 pageInformation Technology and The Law OutlineCarla Abapo RCrimNo ratings yet

- UNCITRAL Model Law on E-Commerce GuideDocument2 pagesUNCITRAL Model Law on E-Commerce GuideCarla Abapo RCrim0% (1)

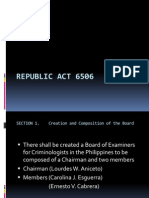

- Republic Act 6506Document19 pagesRepublic Act 6506Carla Abapo RCrim100% (3)

- RH BillDocument6 pagesRH BillCarla Abapo RCrimNo ratings yet

- College of Criminal Justice: University of Cebu Cebu CityDocument5 pagesCollege of Criminal Justice: University of Cebu Cebu CityCarla Abapo RCrim100% (4)

- Civil Law09Document11 pagesCivil Law09pipay04No ratings yet

- Criminal Aspect: Rojas, Godfred BenjaminDocument2 pagesCriminal Aspect: Rojas, Godfred BenjaminadeeNo ratings yet

- Succession Syllabus BreakdownDocument4 pagesSuccession Syllabus Breakdownleah caindoyNo ratings yet

- Coca-Cola Bottlers Phils. Inc. v. Dela Cruz, Et Al.Document6 pagesCoca-Cola Bottlers Phils. Inc. v. Dela Cruz, Et Al.charlaine_latorreNo ratings yet

- Owens v. State of Mississippi Et Al - Document No. 18Document2 pagesOwens v. State of Mississippi Et Al - Document No. 18Justia.comNo ratings yet

- Motion To Dismiss GrantedDocument6 pagesMotion To Dismiss GrantedDeepa Patil100% (1)

- MP New Reservation PolicyDocument2 pagesMP New Reservation PolicyRajeevNo ratings yet

- PROVREM Case Digest 1Document35 pagesPROVREM Case Digest 1Kaye Laurente100% (1)

- CPC Assignment 1Document7 pagesCPC Assignment 1Maryam BasheerNo ratings yet

- United States Court of Appeals Third CircuitDocument3 pagesUnited States Court of Appeals Third CircuitScribd Government DocsNo ratings yet

- 38 - Castillo v. Security BankDocument2 pages38 - Castillo v. Security BankJcNo ratings yet

- Ayer Productions Vs CapulongDocument23 pagesAyer Productions Vs CapulongattykaseyvillordonNo ratings yet

- BPI v. Suarez DigestDocument18 pagesBPI v. Suarez DigestBryce KingNo ratings yet

- Jesus Vergara v. Hammonia Maritime Sevices, Inc., G.R. No. 172933, 6 October 2008Document2 pagesJesus Vergara v. Hammonia Maritime Sevices, Inc., G.R. No. 172933, 6 October 2008Jonathan BravaNo ratings yet

- Wild Valley Shipping Vs CADocument1 pageWild Valley Shipping Vs CAmeriiNo ratings yet

- Nava Vs Peers MKTGDocument3 pagesNava Vs Peers MKTGiajoyamatNo ratings yet

- CIVPRO Batch 5 Case DigestsDocument19 pagesCIVPRO Batch 5 Case DigestsVic RabayaNo ratings yet

- Malatji Letter To Hawks - 24082016Document4 pagesMalatji Letter To Hawks - 24082016eNCA.comNo ratings yet

- Court Reviews Bigamy CaseDocument9 pagesCourt Reviews Bigamy CaseJerome ArañezNo ratings yet

- Foreclosure Procedures in TennesseeDocument6 pagesForeclosure Procedures in TennesseeLuis A del MazoNo ratings yet

- ObliConQuizzer-2 WADocument15 pagesObliConQuizzer-2 WAbobo ka100% (1)

- VIP Membership Application FormDocument3 pagesVIP Membership Application FormthinagaranNo ratings yet

- Philippine Airlines Not Liable for Bumping Off Late PassengersDocument10 pagesPhilippine Airlines Not Liable for Bumping Off Late PassengersAngelReaNo ratings yet

- Vda. de Roxas v. Roxas, G.R. L-2396, December 11, 1950, 87 Phil. 692Document14 pagesVda. de Roxas v. Roxas, G.R. L-2396, December 11, 1950, 87 Phil. 692Ritche PepitoNo ratings yet

- SPECIAL POWER OF ATTORNEY JomonDocument2 pagesSPECIAL POWER OF ATTORNEY JomonAlkaios RonquilloNo ratings yet

- Bail Reviewer - SampleDocument12 pagesBail Reviewer - SampleADNo ratings yet

- Consti 2: Case Digests - Regado: Home Building & Loan Assn. V BlaisdellDocument6 pagesConsti 2: Case Digests - Regado: Home Building & Loan Assn. V BlaisdellAleezah Gertrude RegadoNo ratings yet

- 002 - Freedman V MarylandDocument2 pages002 - Freedman V MarylandKevin Buen MarquezNo ratings yet

- Evergreen Park Arrests, Feb. 26-March 4, 2016Document7 pagesEvergreen Park Arrests, Feb. 26-March 4, 2016Anonymous dCnp13No ratings yet

- Revision Notes On Cpa 1987Document5 pagesRevision Notes On Cpa 1987nataliea rennoNo ratings yet

- Beaver Street Investments, LLC v. Summit County, No. 22-3600 (6th Cir. Apr. 21, 2023)Document11 pagesBeaver Street Investments, LLC v. Summit County, No. 22-3600 (6th Cir. Apr. 21, 2023)RHTNo ratings yet