Professional Documents

Culture Documents

Practice Problems

Uploaded by

jkll890 ratings0% found this document useful (0 votes)

12 views3 pagesThese problems are for practice only. You need not turn in the solutions. Use the data in Table 2 to answer questions 2 through 5. Explain two situations where current P / E ratios may not be useful for relative valuation.

Original Description:

Original Title

practiceProblems

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThese problems are for practice only. You need not turn in the solutions. Use the data in Table 2 to answer questions 2 through 5. Explain two situations where current P / E ratios may not be useful for relative valuation.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views3 pagesPractice Problems

Uploaded by

jkll89These problems are for practice only. You need not turn in the solutions. Use the data in Table 2 to answer questions 2 through 5. Explain two situations where current P / E ratios may not be useful for relative valuation.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

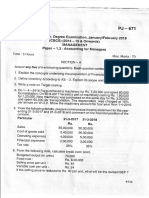

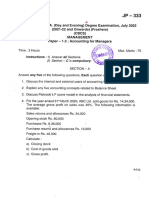

Practice Problems

These problems are for practice only. You need not turn in the solutions.

1. The following information is

available for ABC.

Table 1 Year 1 Year 2

Revenues 150 200

COGS and SG&A 50 75

Depreciation 30 40

Change in Working capital 75 55

CAPEX 20 20

Dividends 10 10

Tax rate 35% 35%

ABC has no debt.

a. Compute ABC’s earnings after taxes (Net Income) for Years 1 and 2

b. Compute ABC’s NOPLAT and free cash flow for Years 1 and 2

Use the data in Table 2 to answer questions 2 through 5. Table 2 presents selected

financial data for XYZ. Assume that XYZ has no preferred stock or excess cash.

Table 2

Year 1 Year 2

Sales 90,000 80,000

Inventory 600 300

Accounts Receivables 1,400 900

EBITDA 3,500 3,000

Depreciation and Amortization 300 320

Interest expense 200 180

Tax Expense 1050 875

Change in Working Capital 500 350

CAPEX 250 250

Dividends 100 100

Debt 1,500 1,000

Equity – Book Value 700 1,000

Equity – Market Value 2,000 2,500

Number of Shares outstanding 100 100

Total Assets 15,000 16,000

2. Compute XYZ’s Net Income for

Year 1 and Year 2.

3. Compute XYZ’s NOPLAT and

enterprise free cash flow for Year 1 and Year 2.

4. Compute XYZ’s ROA and ROIC.

5. Suppose the risk-free rate = 6%,

equity premium=5%, XYZ’s cost of debt=8% and beta= 1.2. Compute XYZ’s WACC

in Year 1 and Year 2.

6. Discuss two situations in which

current P/E ratios may not be useful for relative valuation. How would you handle

these situations?

Answer: See L11-Slide 6

7. Give a reason why P/B ratio may

not be useful for comps analysis.

Answer: See L11-Slide 7

You might also like

- Parliamentary Note - Raghuram RajanDocument17 pagesParliamentary Note - Raghuram RajanThe Wire100% (22)

- Capstone Rehearsal Guide to TacticsDocument10 pagesCapstone Rehearsal Guide to TacticsAbhishek Singh ChauhanNo ratings yet

- Cash Flow Estimation Brigham Case SolutionDocument8 pagesCash Flow Estimation Brigham Case SolutionShahid MehmoodNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Visual MerchandisingDocument40 pagesVisual MerchandisingDhandapani Surendhar100% (1)

- Scope & Objectives of Engg. Management PDFDocument7 pagesScope & Objectives of Engg. Management PDFCrystal PorterNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- SPiCE - White Paper v2.1Document35 pagesSPiCE - White Paper v2.1Vincent LuiNo ratings yet

- Income Payee's Sworn Declaration of Gross Receipts - BIR Annex B-2Document1 pageIncome Payee's Sworn Declaration of Gross Receipts - BIR Annex B-2Records Section50% (2)

- f1 Cima Workbook Q & A PDFDocument276 pagesf1 Cima Workbook Q & A PDFYounus KhanNo ratings yet

- Hola Kola Solution Base AbhinavDocument17 pagesHola Kola Solution Base Abhinavnisha0% (2)

- Credit Suisse Structured Retail ImpactDocument18 pagesCredit Suisse Structured Retail Impacthc87100% (1)

- Practical Accounting TwoDocument48 pagesPractical Accounting TwoFerdinand FernandoNo ratings yet

- Bond and Stock Problem SolutionsDocument3 pagesBond and Stock Problem SolutionsLucas AbudNo ratings yet

- 02 Task Performance 1Document3 pages02 Task Performance 1Ralph Louise PoncianoNo ratings yet

- GRA Strategic Plan Vers 2.0 06.12.11 PDFDocument36 pagesGRA Strategic Plan Vers 2.0 06.12.11 PDFRichard Addo100% (3)

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- CBCS Accounting For Managers (2019)Document4 pagesCBCS Accounting For Managers (2019)ROYAL COLLEGENo ratings yet

- Accounting for managers document analysisDocument4 pagesAccounting for managers document analysisKavithri ponnappaNo ratings yet

- National Law Institute University: BhopalDocument3 pagesNational Law Institute University: BhopalMranal MeshramNo ratings yet

- 02 Task Performance 1Document3 pages02 Task Performance 1Khris Espinili AlgaraNo ratings yet

- Analysis and Interpretation of Financial Statements PDFDocument11 pagesAnalysis and Interpretation of Financial Statements PDFKudakwashe MujungwaNo ratings yet

- AFA Tutorial 11: Analyzing Financial Statements and RatiosDocument9 pagesAFA Tutorial 11: Analyzing Financial Statements and RatiosJIA HUI LIMNo ratings yet

- ms4 2017 IIDocument4 pagesms4 2017 IIsachin gehlawatNo ratings yet

- District Resource Centre Mahbubnagar:, Pre-Final Examinations - Jan / Feb - 2011 Management AccountingDocument5 pagesDistrict Resource Centre Mahbubnagar:, Pre-Final Examinations - Jan / Feb - 2011 Management Accountingtadepalli patanjaliNo ratings yet

- BA 2802 - Principles of Finance Problems For Recitation #1Document3 pagesBA 2802 - Principles of Finance Problems For Recitation #1Eda Nur EvginNo ratings yet

- MANAGEMENT ACCOUNTING & CONTROL 306 Ele Paper IIIDocument5 pagesMANAGEMENT ACCOUNTING & CONTROL 306 Ele Paper IIItadepalli patanjaliNo ratings yet

- Afm 2810001 May 2018Document4 pagesAfm 2810001 May 2018PILLO PATELNo ratings yet

- Çağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamDocument4 pagesÇağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamKinNo ratings yet

- Assets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Document4 pagesAssets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Harsh GuptaNo ratings yet

- LEVERAGESDocument4 pagesLEVERAGESdonadisamanta9No ratings yet

- 134 Accounting Managers FreshersDocument4 pages134 Accounting Managers Freshersdchandru271No ratings yet

- Managerial Accounting Financial Statements AnalysisDocument5 pagesManagerial Accounting Financial Statements AnalysisPinaki Kumar ChakrabortyNo ratings yet

- Management AccountingDocument2 pagesManagement AccountingMateen PathanNo ratings yet

- Financial and Management AccountingDocument2 pagesFinancial and Management AccountingHarshithNo ratings yet

- 3.1 Class Revision - Upload With AnswersDocument10 pages3.1 Class Revision - Upload With AnswersAnne AnnaNo ratings yet

- Financial Performance Evaluation of Smithson PlcDocument5 pagesFinancial Performance Evaluation of Smithson PlcAyesha SheheryarNo ratings yet

- Unit - II - Analysis of Financial StatementsDocument54 pagesUnit - II - Analysis of Financial StatementsPRERNA PANDEY100% (1)

- Unit - II - Analysis of Financial StatementsDocument54 pagesUnit - II - Analysis of Financial StatementsPRERNA PANDEYNo ratings yet

- Accounting (IAS) Level 3/series 2 2008 (Code 3901)Document20 pagesAccounting (IAS) Level 3/series 2 2008 (Code 3901)Hein Linn Kyaw100% (3)

- Suggestion CorrectedDocument2 pagesSuggestion CorrectedMd Chamok ShuvoNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Common Size Statement AnalysisDocument2 pagesCommon Size Statement AnalysisRevati ShindeNo ratings yet

- MBA AFM Probs on FS Analysis, Ratio Analysis and Com SizeDocument6 pagesMBA AFM Probs on FS Analysis, Ratio Analysis and Com SizeAngelsony AmmuNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- CE On Operating SegmentsDocument3 pagesCE On Operating SegmentsalyssaNo ratings yet

- Group 1 - Chapter 20 - Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeDocument18 pagesGroup 1 - Chapter 20 - Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeRhad Lester C. MaestradoNo ratings yet

- CAC1101200910 Financial Accounting IADocument5 pagesCAC1101200910 Financial Accounting IAGift MoyoNo ratings yet

- Assignment Ficd113Document4 pagesAssignment Ficd113Eiril DanielNo ratings yet

- Ratio Analysis QuestionDocument3 pagesRatio Analysis QuestionPraween BimsaraNo ratings yet

- 6int 2007 Dec QDocument7 pages6int 2007 Dec Qapi-19836745No ratings yet

- Financial Statement Analysis and Ratio CalculationsDocument7 pagesFinancial Statement Analysis and Ratio CalculationsprinceNo ratings yet

- BF405 May 2015 PDFDocument4 pagesBF405 May 2015 PDFhuku memeNo ratings yet

- common size nd trendDocument2 pagescommon size nd trendSimran TyagiNo ratings yet

- Group 6 05 Quiz 1Document4 pagesGroup 6 05 Quiz 1Angela Fye LlagasNo ratings yet

- Comparative Financial Statement AnalysisDocument3 pagesComparative Financial Statement Analysispriya100% (1)

- BFN202 Seminar Questions SET1Document3 pagesBFN202 Seminar Questions SET1baba cacaNo ratings yet

- Chapter 17Document7 pagesChapter 17Khalil AbdoNo ratings yet

- Accounting for Managers: Financial Analysis ToolsDocument2 pagesAccounting for Managers: Financial Analysis ToolsN . pavanNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- OUba001 Advanced Financial Reporting ExamDocument6 pagesOUba001 Advanced Financial Reporting ExamRobin G'koolNo ratings yet

- Finance 745Document5 pagesFinance 745Sara KarenNo ratings yet

- Berk/Demarzo, Corporate Finance Chapter 8 Tables and ExamplesDocument4 pagesBerk/Demarzo, Corporate Finance Chapter 8 Tables and ExamplesThu Thủy ĐỗNo ratings yet

- Managerial Accounting PPDocument42 pagesManagerial Accounting PPSaurav KumarNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- Paper 8 FM ECODocument361 pagesPaper 8 FM ECOmhdsameem123No ratings yet

- 12th cbse accounts paper 10 06 2017Document2 pages12th cbse accounts paper 10 06 2017Harpreet Singh SainiNo ratings yet

- Exam Dec 2006Document10 pagesExam Dec 2006kalowekamoNo ratings yet

- Total Assets Net Income Total Debt Interest Expense Income Tax Expense Total Owners EquityDocument29 pagesTotal Assets Net Income Total Debt Interest Expense Income Tax Expense Total Owners EquityshabNo ratings yet

- Managerial Accounting The Cornerstone of Business Decision Making 7th Edition Mowen Test BankDocument140 pagesManagerial Accounting The Cornerstone of Business Decision Making 7th Edition Mowen Test BankLauraLittlebesmp100% (16)

- Chapter: 3 Theory Base of AccountingDocument2 pagesChapter: 3 Theory Base of AccountingJedhbf DndnrnNo ratings yet

- Gr08 History Term2 Pack01 Practice PaperDocument10 pagesGr08 History Term2 Pack01 Practice PaperPhenny BopapeNo ratings yet

- Work Sheet-Ii: Dollar ($) Project A Project B Project CDocument5 pagesWork Sheet-Ii: Dollar ($) Project A Project B Project Crobel popNo ratings yet

- Entrepreneurship Business Plan DR John ProductDocument11 pagesEntrepreneurship Business Plan DR John ProductsuccessseakerNo ratings yet

- Analyst PresentationDocument59 pagesAnalyst Presentationsoreng.anupNo ratings yet

- Who Should Tata Tea Target?: Arnab Mukherjee Charu ChopraDocument7 pagesWho Should Tata Tea Target?: Arnab Mukherjee Charu Chopracharu.chopra3237No ratings yet

- ACF103 2014 – Week 2 Quiz Chapter 5 and 8Document6 pagesACF103 2014 – Week 2 Quiz Chapter 5 and 8Riri FahraniNo ratings yet

- TDS Story - CA Amit MahajanDocument6 pagesTDS Story - CA Amit MahajanUday tomarNo ratings yet

- Allied Bank ProjectDocument47 pagesAllied Bank ProjectChaudry RazaNo ratings yet

- Finding and Correcting Errors on a Work SheetDocument10 pagesFinding and Correcting Errors on a Work SheetCPANo ratings yet

- ZAP BI For AXDocument4 pagesZAP BI For AXShivshankar IyerNo ratings yet

- A House Built On Sand? The ECB and The Hidden Cost of Saving The EuroDocument20 pagesA House Built On Sand? The ECB and The Hidden Cost of Saving The EuroAzhar HeetunNo ratings yet

- Guest Name: Cash MemoDocument1 pageGuest Name: Cash MemoAlpesh BhesaniyaNo ratings yet

- The Definitive Guide To A New Demand Planning Process PDFDocument11 pagesThe Definitive Guide To A New Demand Planning Process PDFmichelNo ratings yet

- ACS CASE STUDY by Prof. Avadhesh YadavDocument10 pagesACS CASE STUDY by Prof. Avadhesh YadavMUKESH PRABHUNo ratings yet

- Demand in EconomicsDocument20 pagesDemand in EconomicsmjkhumaloNo ratings yet

- Interest-The Islamic PerspectiveDocument4 pagesInterest-The Islamic PerspectiveShahinsha HcuNo ratings yet

- G9 AP Q3 Week 3 Pambansang KitaDocument29 pagesG9 AP Q3 Week 3 Pambansang KitaRitchelle BenitezNo ratings yet

- RAP Report For The Power Supply Component of The Mombasa SEZ Dev Project - Main Report Xvol Ax 0Document180 pagesRAP Report For The Power Supply Component of The Mombasa SEZ Dev Project - Main Report Xvol Ax 0Mohammed BashriNo ratings yet