Professional Documents

Culture Documents

Income Tax-Ias12

Uploaded by

Vincent S VincentOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax-Ias12

Uploaded by

Vincent S VincentCopyright:

Available Formats

University of London: Financial Reporting 1

TOPIC 13: ACCOUNTING FOR INCOME TAX****

Reference: International Financial Reporting and Analysis (4th Edition) by

Alexander, Britton and Jorissen, Chapter 20

Financial Accounting and Reporting (12th Edition) by Barry Elliott

and Jamie Elliott, Chapter 14

Lecture Outline: Page

A. Current Tax** 1

B. Deferred Tax*** 3

C. Measurement and Recognition of Deferred Tax**** 11

D. Presentation and Disclosure Requirement 15

E. Exercises 18

A. Current Tax**

1. The taxable profits of an enterprise essentially comprise its net profit before

dividends, adjusted for certain items where the tax treatment differs from the

accounting treatment.

The amount of tax to which a company is assessed on its profit for an

accounting period is called its tax liability for that period, In general, an

enterprise must pay its tax liability a certain amount of time after the period

end.

2. Current tax is the amount actually payable to the tax authorities in relation

to the trading activities of the enterprise during the period.

Deferred tax is an accounting measure, used to match the tax effects of

transactions with their accounting impact and thereby produce less distorted

results.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 2

3. IAS 12 as requires any unpaid tax in respect of the current or prior periods

to be recognised as a liability.

Conversely, any excess tax paid in respect of current of prior periods over

what is due should be recognised as an asset.

4. Taking this a stage further, IAS 12 also requires recognition as an asset of

the benefit relating to any tax loss that can be carried back to recover

current tax of a previous period. This is acceptable because it is probable

that the benefit will flow to the enterprise and it can be reliably measured.

5. Measurement of current tax liabilities (assets) for the current and prior

periods is very simple. They are measured at the amount expected to be

paid to (recovered from) the tax authorities. The tax rates (and tax laws)

used should be those enacted (or substantively enacted) by the balance sheet

date.

6. Normally, current tax is recognised as income or expense and included in the

net profit or loss for the period, except in two cases.

(a) Tax arising from a business combination which in an acquisition is

treated differently.

(b) Tax arising from a transaction or event which is recognised directly

in equity (in the same or a different period).

The rule in (b) is logical. If a transaction or event is charged or credited

directly to equity, rather than to the income statement, then the related tax

should be having the same treatment. An example of such a situation is

where under IAS 8, an adjustment is made to the opening balance of

retained earnings due to either a change in accounting policy that is applied

retrospectively, or to the correction of a fundamental error.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 3

B. Deferred Tax***

7. When a company recognizes an asset or liability, it expects to recover or

settle the carrying amount of that asset or liability. In other words, it

expects to sell or use up assets, and to pay off liabilities. What happens if

that recovery or settlement is likely to make future tax payments larger (or

smaller) than they would otherwise have been if the recovery or settlement

had no tax consequences? In these circumstances, IAS 12 requires

companies to recognize a deferred tax liability (or deferred tax asset).

8. Deferred tax liabilities are the amounts of income taxes payable in future

periods in respect of taxable temporary differences.

Deferred tax assets are the amounts of income taxes recoverable in future

periods in respect of:

Deductible temporary differences

The carry forward of unused tax losses

The carry forward of unused tax credits

Temporary differences are differences between the carrying amount of an

asset of liability in the balance sheet and its tax base. Temporary differences

may be either:

Taxable temporary differences, which are temporary differences

that will result in taxable amounts in determining profit (tax loss) of

future periods when the carrying amount of the asset or liability is

recovered or settled.

Deductible temporary differences, which are temporary differences

that will result in amounts that are deductible in determining taxable

profits (tax loss) of future periods when the carrying amount of the

asset or liability is recovered or settled.

The tax base of an asset or liability is the amount attributed to that asset or

liability for tax purposes.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 4

9. We can expand on the definition given above by stating that the tax base of

an asset is the amount that will be deductible for tax purposes against any

taxable economic benefits that will flow to the enterprise when it recovers

the carrying value of the asset. Where those economic benefits are not

taxable, the tax base of the asset is the same as its carrying amount.

10. In the case of a liability, the tax base will be its carrying amount, less any

amount that will be deducted for tax purpose in relation to the liability in

future periods. For revenue received in advance, the tax base of the resulting

liability is its carrying amount, less any amount of the revenue that will not

be taxable in future periods.

11. IAS 12 gives the following examples of circumstances in which the carrying

amount of an asset or liability will be equal to its tax base.

Accrued expenses have already been deducted in determining an

enterprise’s current tax liability for the current or earlier periods.

A loan payable is measured at the amount originally received and this

amount is the same as the amount repayable on final maturity of the

loan.

Accrued expenses will never be deductible for tax purposes.

Accrued income will never be taxable.

12. Accounting profits form the basis for computing taxable profits, on which

the tax liability for the year is calculated; however, accounting profits and

taxable profits are different. There are two reasons for the differences:

(a) Permanent differences. These occur when certain items of revenue

or expense are excluded from the computation of taxable profits (for

example, entertainment expenses may not be allowable for tax

purposes).

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 5

(b) Temporary differences. These occur when items of revenue or

expense are included in both accounting profits and taxable profits,

but not for the same accounting period. For example, an expense

which is allowable as a deduction in arriving at taxable profits for

20X7 might not be included in the financial accounts until 20X8 or

later. In the long run, the total taxable profits and total accounting

profits will be the same (except for permanent differences) so that

timing differences originate in one period and are capable of reversal

in one or more subsequent periods. Deferred tax is the tax attributable

to temporary differences.

13. Transactions that affect the income statement:

(a) Interest revenue received in arrears and included in accounting profit

on the basis of time apportionment. It is included in taxable profits,

however, on a cash basis.

(b) Sales of goods revenue is included in accounting profit when the

goods are delivered, but only included in taxable profit when cash is

received.

(c) Depreciation of an asset is accelerated for tax purposes. When new

assets are purchased, allowances may be available against taxable

profits which exceed the amount of depreciation chargeable on the

assets in the financial accounts for the year of purchase.

(d) Development costs which have been capitalized will be amortised in

the income statement, but they were deducted in full from taxable

profit in the period in which they were incurred.

(e) Prepaid expenses have already been deducted on a cash basis in

determining the taxable profit of the current or previous periods.

14. Transactions that affect the balance sheet:

(a) Depreciation of an asset is not deductible for tax purposes. No

deduction will be available for tax purposes when the asset is

sold/scrapped.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 6

(b) A borrower records a loan at proceeds received (amount due at

maturity) less transaction costs. The carrying amount of the loan is

subsequently increased by amortisation of the transaction costs against

accounting profit. The transaction costs were, however, deducted for

tax purposes in the period when the loan was first recognised.

15. Fair value adjustment and revaluations

(a) Financial assets or investment property are carried at fair value.

This exceeds cost, but no equivalent adjustment is made for tax

purposes.

(b) Property, plant and equipment is revalued by an enterprise, but no

equivalent adjustment is made for tax purposes (IAS 12 requires the

related deferred tax to be charged directly to equity)

16. All taxable temporary differences give rise to a deferred tax liability. There

are two circumstances given in the standards where this does not apply:

(a) The deferred tax liability arises from goodwill for which amortisation

is not deductible for tax purposes.

(b) The deferred tax liability arises from the initial recognition of an

asset or liability in a transaction which:

(i) Is not a business combination

(ii)At the time of the transaction affects neither accounting profit

nor taxable profit

The reasoning behind the recognition of deferred tax liabilities on taxable

temporary differences:

(a) When an asset is recognised, it is expected that its carrying amount

will be recovered in the form of economic benefits that flow to the

enterprise in future periods.

(b) If the carrying amount of the asset is greater than its tax base, then

taxable economic benefits will also be greater than the amount that

will be allowed as a deduction for tax purposes.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 7

(c) The difference is therefore a taxable temporary difference and the

obligation to pay the resulting income taxes in future periods is a

deferred tax liability,

(d) As the enterprise recovers the carrying amount of the asset, the

taxable temporary difference will reverse and the enterprise will have

taxable profit.

(e) It is then probable that economic benefits will flow from the

enterprise in the form of tax payments, and so the recognition of all

deferred tax liabilities (except those excluded above) is required by

IAS 12.

17. Some temporary differences are often called timing differences, when

income or expense is included in accounting profit in one period, but is

included in taxable profit in a different period. The main types of taxable

temporary differences which are timing differences and which result in

deferred tax liabilities.

Interest received which is accounted for on an accruals basis, but

which for tax purposes is included on a cash basis.

Accelerated depreciation for tax purposes.

Capitalised and amortised development costs.

18. Under IAS 16 assets may be revalued. If this affects the taxable profits for

the current period, the tax base of the asset changes and no temporary

difference arises.

If, however (as in some countries), the revaluation does not affect current

taxable profits, the tax base of the asset is not adjusted. Consequently, the

taxable flow of economic benefits to the enterprise as the carrying value of

the asset is recovered will differ from the amount that will be deductible for

tax purposes. The difference between the carrying amount of a revalued

asset and its tax base is a temporary difference and gives rise to a deferred

tax liability or asset.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 8

19. A temporary difference can arise on initial recognition of an asset or

liability, e.g. if part or all of the cost of an asset will not be deductible for tax

purposes. The nature of the transaction which led to the initial recognition

of the asset is important in determining the method of accounting for such

temporary differences.

20. If the transaction affects either accounting profit or taxable profit, an

enterprise will recognize any deferred tax liability or asset. The resulting

deferred tax expense or income will be recognised in the income statement.

21. Where a transaction affects neither accounting profit nor taxable profit it

would be normal for an enterprise to recognize a deferred tax liability or

asset and adjust the carrying amount of the asset or liability by the same

amount. However, IAS 12 does not permit this recognition of a deferred tax

asset or liability as it would make the financial statements less transparent.

This will be the case both on initial recognition and subsequently, nor should

any subsequent changes in the unrecognized deferred tax liability or asset is

depreciated be made.

22. There is a proviso, however. The deferred tax asset must also satisfy the

recognition criteria given in IAS 12. This is that a deferred tax asset should

be recognised for all deductible temporary differences to the extent that it is

probable that taxable profit will be available against which it can be

utilized. This is an application of prudence.

23. Transactions that affect the income statement:

Retirement benefit costs (pension costs) are deducted from

accounting profit as service is provided by the employee. They are not

deducted in determining taxable profit until the enterprise pays either

retirement benefits or contributions to a fund. (This may also apply to

similar expenses).

Accumulated depreciation of an asset in the financial statements is

greater than the accumulated depreciation allowed for tax purposes up

to the balance sheet date.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 9

The cost of inventories sold before the balance sheet date is deducted

from accounting profit when goods/services are delivered, but is

deducted from taxable profit when the cash is received. (Note: There

is also a taxable temporary difference associated with the related trade

receivable).

The NRV of inventory, or the recoverable amount of an item or

property, plant and equipment falls and the carrying value is therefore

reduced, but that reduction is ignored for tax purposes until the asset

is sold.

Research costs (or organization/other start-up costs) are recognised as

an expense for accounting purposes but are not deductible against

taxable profits until a later period.

Income is deferred in the balance sheet, but has already been

included in taxable profit in current/prior periods.

A government grant is included in the balance sheet as deferred

income, but it will not be taxable in future periods. (Note: A deferred

tax asset may not be recognised here according to the standard).

24. Current investments or financial instruments may be carried at fair value

which is less than cost, but no equivalent adjustment is made for tax

purposes.

Other situations discussed by the standard relate to business combinations

and consolidation.

25. The reasoning behind the recognition of deferred tax assets arising from

deductible temporary differences:

(a) When a liability is recognised, it is assumed that its carrying amount

will be settled in the form of outflows of economic benefits from the

enterprise in future periods.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 10

(b) When these resources flow from the enterprise, part or all may be

deductible in determining taxable profits of a period later than that in

which the liability is recognizes.

(c) A temporary tax difference then exists between the carrying amount

of the liability and its tax base.

(d) A deferred tax asset therefore arises, representing the income taxes

that will be recoverable in future periods when that part of the liability

is allowed as a deduction from taxable profit.

(e) Similarly, when the carrying amount of an asset is less than its tax

base, the difference gives rise to a deferred tax asset in respect of the

income taxes that will be recoverable in future periods.

26. An enterprise may have unused tax losses or credits (i.e. which it can offset

against taxable profits) at the end of a period. Should a deferred tax asset be

recognised in relation to such amounts? IAS 12 states that a deferred tax

asset may be recognised in such circumstances to the extent that it is

probable future taxable profit will be available against which the

unused tax losses/credits can be utilized.

27. For all unrecognized deferred tax assets, at each balance sheet date an

enterprise should reassess the availability of future taxable profits and

whether part or all of any unrecognized deferred tax assets should now be

recognised. This may be due to an improvement in trading conditions which

is expected to continue.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 11

C. Measurement and Recognition of Deferred Tax****

28. There are various methods of accounting for deferred tax, only one of which

is adopted by IAS 12:

Flow-through method

Full provision method (as under IAS 12)

Partial provision method (as adopted in some countries, e.g. the UK)

29. Under the flow-through method, the tax liability recognised is the expected

legal tax liability for the period (i.e. no provision is made for deferred tax).

The main advantages of the method are that it is straightforward to apply

and the tax liability recognised is closer to many people’s idea of a ‘real’

liability than that recognised under either full or partial provision.

The main disadvantages of flow-through are that it can lead to a large

fluctuation in the tax charge and that it does not allow tax relief for non-

current liabilities to be recognised until those liabilities are settled. In

addition, profits may be overstated because there is no deferred tax charge

leading to excessive dividend payments, distortion of earnings per share and

of results in the eyes of shareholders.

30. The full provision method has the advantage that it recognises that each

timing difference at the balance sheet date has an effect on future tax

payments. If a company claims an accelerated tax allowance on an item of

plant, future tax assessments will be bigger than they would have been

otherwise. Future transactions may well affect those assessments still

further, but that is not relevant in assessing the position at the balance sheet

date.

The disadvantage of full provision is that, under certain types of tax

system, it gives rise to large liabilities that may fall due only far in the

future, if at all. Furthermore, it may be said to be less realistic than the

partial provision method, if more objective.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 12

31. The partial provision method addresses this disadvantage by providing for

deferred tax only to the extent that it is expected to be paid in the foreseeable

future. This has an obvious intuitive appeal, but its effect is that deferred tax

recognised at the balance sheet date includes the tax effects of future

transactions that have not been recognised in the financial statements, and

which the reporting company has neither undertaken nor even committed to

undertake at that date. It is difficult to reconcile this with the IASC’s

Framework document, which defines assets and liabilities as arising from

past events. Where partial provision is required, the difference between the

amount provided and the maximum (i.e. under the full provision method)

should usually be disclosed.

Illustration:

Suppose that Benson Co begins trading on 1 January 20x7. In its first year it

makes profits of $5m, the depreciation charge is $1m and the tax allowance

on those assets is $1.5m. The rate of corporation tax is 30%.

Solution: Flow Through Method

The tax liability for the year is 30% x $(5 + 1 – 1.5)m = $1.35m. The

potential deferred tax liability of 30% x ($1.5m - $1m) is completely ignored

and no judgement is required on the part of the preparer.

Solution: Full Provision

The tax liability is $1.35m again, but the debit in the income statement is

increased by the deferred tax liability of 30% x $0.5m = $150,000. The total

charge to the income statement is therefore $1.5m which is an effective tax

rate of 30% on accounting profits (i.e. 30% x $5m). Again, no judgement is

involved in using this method.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 13

Solution: Partial Provision

Is a deferred tax provision necessary under partial provision? We need to

look ahead at future capital expenditure plans. Will tax allowances exceed

depreciation over the next few years? If yes, no provision for deferred tax is

required. If no, then a reversal is expected, i.e. there will be a year in which

depreciation is greater than tax allowances. The deferred tax provision is

made on the maximum reversal which will be created, and any not provided

is disclosed by note.

If we assume that the review of expected future capital expenditure under

the partial method required a deferred tax charge of $75,000 (30% x

$250,000), we can then summarise the position.

The method can be compared as follows:

Method Provision Disclosure

$ $

Flow-through -- --

Full provision 150,000 --

Partial provision 75,000 75,000

32. Where the corporate rate of income tax fluctuates from one year to

another, a problem arises in respect of the amount of deferred tax to be

credited (debited) to the income statement in later years. The amount could

be calculated using either of two methods.

(a) The deferral method assumes that the deferred tax account is an item

of ‘deferred tax relief’ which is credited to profits in the years in

which the timing differences are reversed. Therefore the tax effects of

timing differences are calculated using tax rates current when the

differences arise.

(b) The liability method assumes that the tax effects of timing

differences should be regarded as amounts of tax ultimately due by or

to the company. Therefore deferred tax provisions are calculated at

the rate at which it is estimated that tax will be paid (or recovered)

when the timing differences reverse.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 14

33. The deferral method involves extensive record keeping because the timing

differences on each individual capital asset must be held. In contrast, under

the liability method, the total originating or reversing timing difference for

the year is converted into a deferred tax amount at the current rate of tax

(and if any change in the rate of tax has occurred in the year, only a single

adjustment to the opening balance on the deferred tax account is required).

34. IAS 12 requires deferred tax assets and liabilities to be measured at the tax

rates expected to apply in the period when the asset is realized or liability

settled, based on tax rates and laws enacted (or substantively enacted) at the

balance sheet date. In other words, IAS 12 requires the liability method to

be used.

35. IAS 12 states that deferred tax assets and liabilities should not be

discounted because of the complexities and difficulties involved.

The carrying amount of deferred tax assets should be reviewed at each

balance sheet date and reduced where appropriate (insufficient future

taxable profits). Such a reduction may be reversed in future years.

36. As with current tax, deferred tax should normally be recognised as income

or an expense and included in the net profit or loss for the period in the

income statement. The exception is where the tax arises from a transaction

or event which is recognised (in the same or different period) directly in

equity.

37. The figures shown for deferred tax in the income statement will consist of

two components.

(a) Deferred tax relating to timing differences

(b) Adjustments relating to changes in the carrying amount of deferred

tax assets/liabilities (where there is no change in timing differences)

e.g. changes in tax rates/laws, reassessment of the recoverability of

deferred tax assets, or a change in the expected recovery of an asset.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 15

Items in (b) will be recognised in the income statement, unless they relate to

items previously charged/credited to equity.

38. Deferred tax (and current tax) should be charged/credited directly to

equity if the tax relates to items also charged/credited directly to equity (in

the same or a different period).

Examples of IASs which allow certain items to be credited/charged directly

to equity include:

(a) Revaluations of property, plant and equipment (IAS 16)

(b) The effect of a change in accounting policy (applied retrospectively)

or correction of a fundamental error (IAS 8).

D. Presentation and Disclosure Requirement

39. Tax assets and liabilities should be presented separately from other assets

and liabilities in the balance sheet. Deferred tax assets and liabilities should

be distinguished from current tax assets and liabilities.

In addition, deferred tax assets/liabilities should not be classified as current

assets/liabilities, where an enterprise makes such a distinction.

There are only limited circumstances where current tax assets and liabilities

may be offset. This should only occur of two things apply:

(a) The enterprise has a legally enforceable right to set off the recognised

amounts.

(b) The enterprise intends either to settle on a net basis, or to realize the

asset and settle the liability simultaneously.

Similar criteria apply to the offset of deferred tax assets and liabilities.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 16

40. The tax expense or income related to the profit or loss from ordinary

activities should be presented on the face of the income statement.

41. As you would expect, the major components of tax expense or income

should be disclosed separately. These will generally include the following:

Current tax expenses (income)

Any adjustments recognised in the period for current tax of prior

periods (i.e. for over/under statement in prior years)

Amount of deferred tax expense (income) relating to the origination

and reversal of temporary differences

Amount of the benefit arising from a previously unrecognized tax

loss, tax credit or temporary difference of a prior period that is used to

reduce current tax expense

Deferred tax expense arising from the write-down, or reversal of a

previous write-down, of a deferred tax asset

Amount of tax expense (income) relating to those changes in

accounting policies and fundamental errors which are included in

the determination of net profit or loss for the period in accordance

with the allowed alternative treatment in IAS 8.

Aggregate current and deferred tax relating to items that are charges

or credited to equity

Tax expense (income) relating to extraordinary items recognised

during the period

An explanation of the relationship between tax expenses (income)

and accounting profit in either or both of the following forms.

A numerical reconciliation between tax expense (income) and the

product of accounting profit multiplied by the applicable tax rate(s),

disclosing also the basis on which the applicable tax rate(s) is (are)

computed, or

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 17

A numerical reconciliation between the average effective tax rate and

the applicable tax rate, disclosing also the basis on which the

applicable tax rate is computed

An explanation of changes in the applicable tax rate(s) compared to

the previous accounting period

The amount (and expiry date, if any) of deductible temporary

differences, unused tax losses, and unused tax credits for which no

deferred tax is recognised in the balance sheet.

In respect of each type of temporary difference, and in respect of

each type of unused tax loss and unused tax credit:

The amount of the deferred tax assets and liabilities recognised

in the balance sheet for each period presented

The amount of the deferred tax income or expense recognised

in the income statement, if this is not apparent from the changes

in the amounts recognised in the balance sheet

In respect of discontinued operations, the tax expense relating to

The gain or loss on discontinuance

The profit or loss from the ordinary activities of the

discontinued operation for the period, together with the

corresponding amounts for each prior period presented

42. In addition to the above, an enterprise should disclose the amount of a

deferred tax asset and the nature of the evidence supporting its recognition,

when:

(a) The utilization of the deferred tax asset is dependent on future taxable

profits in excess of the profits arising from the reversal of existing

taxable temporary differences,

(b) The enterprise has suffered a loss in either the current or preceding

period in the tax jurisdiction to which the deferred tax asset relates.

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 18

E. Exercises

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 19

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 20

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

University of London: Financial Reporting 21

Copyright 2011 by James Kwan Singapore Institute of Management

All rights reserved.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Post GL U3A6Document11 pagesPost GL U3A6Jay Patel0% (1)

- Understanding Hotel Valuation TechniquesDocument0 pagesUnderstanding Hotel Valuation TechniquesJamil FakhriNo ratings yet

- Your Adv Safebalance Banking: Account SummaryDocument10 pagesYour Adv Safebalance Banking: Account SummaryAlexNo ratings yet

- PDIC Deposit Insurance CoverageDocument40 pagesPDIC Deposit Insurance CoverageAleah Jehan AbuatNo ratings yet

- Effective Interest AmortizationDocument25 pagesEffective Interest AmortizationSheila Grace BajaNo ratings yet

- Options To InvestDocument5 pagesOptions To InvestDiana Infante50% (2)

- List of Detergent Manufactures in MaharashtraDocument8 pagesList of Detergent Manufactures in MaharashtraR. Taikar100% (1)

- PDF Form PDFDocument1 pagePDF Form PDFVincent S VincentNo ratings yet

- 2014 Annual Report HighlightsThe proposed title "TITLE2014 Annual Report HighlightsDocument166 pages2014 Annual Report HighlightsThe proposed title "TITLE2014 Annual Report HighlightsVincent S VincentNo ratings yet

- Who Uses Fair Value Accounting For Non Financial Assets After Ifrs AdoptionDocument46 pagesWho Uses Fair Value Accounting For Non Financial Assets After Ifrs AdoptionVincent S Vincent0% (1)

- Structuring Hotel Deals To Achieve Strategic Goals - An Owner-S PeDocument24 pagesStructuring Hotel Deals To Achieve Strategic Goals - An Owner-S PeVincent S VincentNo ratings yet

- STOCK CONTROL Notesand Stock TakingDocument25 pagesSTOCK CONTROL Notesand Stock TakingEdwine Jeremiah ONo ratings yet

- Brand Failures: Carona Shoes: Group 2Document27 pagesBrand Failures: Carona Shoes: Group 2tushargkambliNo ratings yet

- Contract: Buyer Details Organisation DetailsDocument3 pagesContract: Buyer Details Organisation DetailsVijay JhawarNo ratings yet

- E PassDocument2 pagesE PasssaurabhNo ratings yet

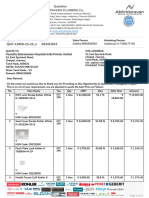

- Iho1 Robot Spare: QuotationDocument3 pagesIho1 Robot Spare: QuotationChandru ChristurajNo ratings yet

- XII Accountancy Sample PQ & MS (23-24)Document30 pagesXII Accountancy Sample PQ & MS (23-24)umangchh2306No ratings yet

- Hatten - PPT - Ch02 - Small Business Management, Entrepreneurship, and OwnershipDocument22 pagesHatten - PPT - Ch02 - Small Business Management, Entrepreneurship, and OwnershipConference paperNo ratings yet

- Accounting for investments in debt securitiesDocument6 pagesAccounting for investments in debt securitiesum ummrhNo ratings yet

- FMS2021 0743rdInternationalConferenceDocument28 pagesFMS2021 0743rdInternationalConferenceVania Dinda AzuraNo ratings yet

- Chapter 5 - Accounting EquationDocument17 pagesChapter 5 - Accounting EquationRiya AggarwalNo ratings yet

- Chapter 10 Cycle InventoryDocument32 pagesChapter 10 Cycle InventoryTeklay TesfayNo ratings yet

- House Property ChapterDocument64 pagesHouse Property ChapterManohar LalNo ratings yet

- (自练) Telco startup market expansion - Lucy - 20210731Document10 pages(自练) Telco startup market expansion - Lucy - 20210731VictoriaNo ratings yet

- Manage Your BookingsDocument2 pagesManage Your BookingsSKY HOLIDAYNo ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan SummarymerrwonNo ratings yet

- Sample test-HP3 - K45 - UpdatedDocument6 pagesSample test-HP3 - K45 - UpdatedHAN NGUYEN KIM0% (1)

- Operative Accounts Deposit Accounts Loan Accounts All AccountsDocument2 pagesOperative Accounts Deposit Accounts Loan Accounts All AccountsGamer JiNo ratings yet

- Flood repairs estimate submissionDocument4 pagesFlood repairs estimate submissionMahadev KovalliNo ratings yet

- Finals Chapter 17 - Legal AspectDocument8 pagesFinals Chapter 17 - Legal AspectAlexis EusebioNo ratings yet

- Demat and Remat: Key DifferencesDocument38 pagesDemat and Remat: Key DifferencesBhuvi100% (1)

- Plumbing Quote FeebacksDocument13 pagesPlumbing Quote Feebacksarchventure projectsNo ratings yet

- Group 1 - Ergonomics 2 Final ProjectDocument15 pagesGroup 1 - Ergonomics 2 Final Projectmj dejoseNo ratings yet

- Reorder Point (Rop) Methods in X Pharmacy, District WenangDocument6 pagesReorder Point (Rop) Methods in X Pharmacy, District WenangMiftahThariqNo ratings yet

- Income Taxation MIDTERMSDocument7 pagesIncome Taxation MIDTERMSgamit gamitNo ratings yet