Professional Documents

Culture Documents

Income Tax Rates For Financial Year 2010-11

Uploaded by

tekley0 ratings0% found this document useful (0 votes)

11 views2 pagesIncome tax rates for financial year 2010-11. Individual Male (Below the age of 65 Years) Up to 1,60,000 NIL From 1,60,001 to 5,00,000 10% From 5,00,001 to 8,00,000 20% Above Than 8,00,00,000 30% Senior Citizen (Above 65 years of age) Up to 2,40,000 NIL 2,40,001 to 4,00,000. In case of individual being a woman resident in India and below the age of 65 years at any time during the previous year:

Original Description:

Original Title

Income tax rates for financial year 2010-11

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIncome tax rates for financial year 2010-11. Individual Male (Below the age of 65 Years) Up to 1,60,000 NIL From 1,60,001 to 5,00,000 10% From 5,00,001 to 8,00,000 20% Above Than 8,00,00,000 30% Senior Citizen (Above 65 years of age) Up to 2,40,000 NIL 2,40,001 to 4,00,000. In case of individual being a woman resident in India and below the age of 65 years at any time during the previous year:

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesIncome Tax Rates For Financial Year 2010-11

Uploaded by

tekleyIncome tax rates for financial year 2010-11. Individual Male (Below the age of 65 Years) Up to 1,60,000 NIL From 1,60,001 to 5,00,000 10% From 5,00,001 to 8,00,000 20% Above Than 8,00,00,000 30% Senior Citizen (Above 65 years of age) Up to 2,40,000 NIL 2,40,001 to 4,00,000. In case of individual being a woman resident in India and below the age of 65 years at any time during the previous year:

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

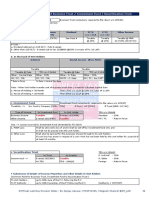

Income tax rates for financial year 2010-11.

Individual Male (Below the Age 65 Years)

Up to 1,60,000 NIL

From 1,60,001 to 5,00,000 10%

From 5,00,001 to 8,00,000 20%

Above Than 8,00,000 30%

Individual Female (Below the Age of 65 Years)

Up to 1,90,000 NIL

From 1,90,001 to 5,00,000 10%

From 5,00,001 to 8,00,000 20%

Above Than 8,00,000 30%

Senior Citizen (Above than 65 years of age)

Up to 2,40,000 NIL

2,40,001 to 5,00,000 10%

5,00,001 to 8,00,000 20%

Above Than 8,00,000 30%

In case of individual

Income Level Income Tax Rate

Where the total income does not exceed

i. NIL

Rs.1,60,000/-.

Where the total income exceeds

10% of amount by which the total income

ii. Rs.1,60,000/- but does not exceed

exceeds Rs. 1,60,000/-

Rs.5,00,000/-.

Where the total income exceeds

Rs. 34,000/- + 20% of the amount by which

iii. Rs.5,00,000/- but does not exceed

the total income exceeds Rs.5,00,000/-.

Rs.8,00,000/-.

Where the total income exceeds Rs. 94,000/- + 30% of the amount by which

iv.

Rs.8,00,000/-. the total income exceeds Rs.8,00,000/-.

II. In case of individual being a woman resident in India and below the age of 65 years at

any time during the previous year:-

Income Level Income Tax Rate

Where the total income does not exceed

i. NIL

Rs.1,90,000/-.

Where total income exceeds Rs.1,90,000/- 10% of the amount by which the total

ii.

but does not exceed Rs.5,00,000/-. income exceeds Rs.1,90,000/-.

Where the total income exceeds

Rs. 31,000- + 20% of the amount by which

iii. Rs.5,00,000/- but does not exceed

the total income exceeds Rs.5,00,000/-.

Rs.8,00,000/-.

Where the total income exceeds Rs.91,000/- + 30% of the amount by which

iv.

Rs.8,00,000/- the total income exceeds Rs.8,00,000/-.

III. In case of an individual resident who is of the age of 65 years or more at any time

during the previous year:-

Income Level Income Tax Rate

Where the total income does not exceed

i. NIL

Rs.2,40,000/-.

Where the total income exceeds

10% of the amount by which the total

ii. Rs.2,40,000/- but does not exceed

income exceeds Rs.2,40,000/-.

Rs.5,00,000/-

Where the total income exceeds

Rs.26,000/- + 20% of the amount by which

iii. Rs.5,00,000/- but does not exceed

the total income exceeds Rs.5,00,000/-.

Rs.8,00,000/-

Where the total income exceeds Rs.86,000/- + 30% of the amount by which

iv.

Rs.8,00,000/- the total income exceeds Rs.8,00,000/-.

Education Cess: 3% of the Income-tax.

You might also like

- F2848 - Power of Attorney and Declaration of Representative - InstructionsDocument6 pagesF2848 - Power of Attorney and Declaration of Representative - InstructionsAutochthon Gazette100% (3)

- Acknowledgement ReceiptDocument1 pageAcknowledgement ReceiptbLackSnow01No ratings yet

- American Express Gold CardDocument6 pagesAmerican Express Gold CardashwaracingNo ratings yet

- Quizzer TAX-Percentage-TAX Quizzer TAX - Percentage-TAXDocument15 pagesQuizzer TAX-Percentage-TAX Quizzer TAX - Percentage-TAX?????100% (4)

- Income Tax Calculator Calculate Income Tax For FY 2022-23Document1 pageIncome Tax Calculator Calculate Income Tax For FY 2022-23Vivek LakkakulaNo ratings yet

- Tax Saving GuideDocument36 pagesTax Saving GuideSamantha JNo ratings yet

- Invoice: PT Supplier Sukses SejatiDocument1 pageInvoice: PT Supplier Sukses SejatiAris SetiawanNo ratings yet

- Form 0605 PDFDocument2 pagesForm 0605 PDFeugene badereNo ratings yet

- Bustax Final ExamDocument13 pagesBustax Final Examshudaye100% (3)

- Tax Rates AS2024-25Document9 pagesTax Rates AS2024-25DRK FrOsTeRNo ratings yet

- Income Tax SlabsDocument2 pagesIncome Tax SlabsDalbir SinghNo ratings yet

- Chidambaram Pranab Mukherjee: Arya Baride. Amruta Bage. Tejas Aptikar. Shital Girigosavi. Pradnya ChaudhariDocument10 pagesChidambaram Pranab Mukherjee: Arya Baride. Amruta Bage. Tejas Aptikar. Shital Girigosavi. Pradnya ChaudhariAnkit JainNo ratings yet

- Direct Tax Code BillDocument4 pagesDirect Tax Code BillKeyur ShahNo ratings yet

- $value PDFDocument3 pages$value PDFRajesh GulveNo ratings yet

- Individuals and Hufs: Income Tax Rates / Income Tax Slabs For Ay 2012-13 (Fy 2011-12)Document4 pagesIndividuals and Hufs: Income Tax Rates / Income Tax Slabs For Ay 2012-13 (Fy 2011-12)Saurabh AkareNo ratings yet

- India income tax rates 2012-13Document2 pagesIndia income tax rates 2012-13hr14No ratings yet

- Income Tax Slab RatesDocument5 pagesIncome Tax Slab RatesBaibhav JauhariNo ratings yet

- 80.1cm (32) HD Flat TV FH4003 Series 4Document6 pages80.1cm (32) HD Flat TV FH4003 Series 4Jose JohnNo ratings yet

- Income Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)Document2 pagesIncome Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)pankaj goyalNo ratings yet

- S. No Taxable Income Rate of TaxDocument2 pagesS. No Taxable Income Rate of Taxmuhammad shoaib khalidNo ratings yet

- Income Tax Slabs For FY 2019Document2 pagesIncome Tax Slabs For FY 2019Kamran KhanNo ratings yet

- Amendment Finance Act 2009Document66 pagesAmendment Finance Act 2009Sanjay GuptaNo ratings yet

- Rates of Income TaxDocument9 pagesRates of Income TaxAiza KhanNo ratings yet

- Tax Slabs For Salaried Person For Tax Year 20202021Document2 pagesTax Slabs For Salaried Person For Tax Year 20202021Abid BashirNo ratings yet

- Income TaxDocument1 pageIncome TaxManoj KNo ratings yet

- Tax Slabs For Salaried Person For Tax Year 2020/2021Document2 pagesTax Slabs For Salaried Person For Tax Year 2020/2021Usama AlmasNo ratings yet

- Slab RatesDocument1 pageSlab RatesjayNo ratings yet

- New Microsoft PowerPoint Presentation TAXDocument10 pagesNew Microsoft PowerPoint Presentation TAXramesh BNo ratings yet

- ChecklistDocument8 pagesChecklistumeshburman7026No ratings yet

- Direct Tax BlogDocument3 pagesDirect Tax BlogArpit GuptaNo ratings yet

- Relief measures and reduced tax ratesDocument3 pagesRelief measures and reduced tax ratesAhmed RazaNo ratings yet

- Income Tax Slabs Rates AY 2014-15Document4 pagesIncome Tax Slabs Rates AY 2014-15ptk_guly3871No ratings yet

- Ajit Kumar SatapathyDocument32 pagesAjit Kumar Satapathyajitkumarsatapathy3No ratings yet

- Test 5 (QP)Document4 pagesTest 5 (QP)iamneonkingNo ratings yet

- A. Individuals and Hufs I. Individual (Other Than Ii and Iii Below) and HufDocument4 pagesA. Individuals and Hufs I. Individual (Other Than Ii and Iii Below) and HufNaveen JatianNo ratings yet

- Mega Marathon Direct Tax. YtDocument257 pagesMega Marathon Direct Tax. Ytsubroshakar gamerNo ratings yet

- Income Tax Slab FY 2014-15Document3 pagesIncome Tax Slab FY 2014-15zveeraNo ratings yet

- Indian income tax slabs for individuals over 7 yearsDocument4 pagesIndian income tax slabs for individuals over 7 yearsManoj ThuthijaNo ratings yet

- RATES OF INCOME-TAX After Budget 2013 Date 28.02.2013 A. Normal Rates of TaxDocument3 pagesRATES OF INCOME-TAX After Budget 2013 Date 28.02.2013 A. Normal Rates of TaxIla YagnikNo ratings yet

- By Shradul Sir - If StatementDocument12 pagesBy Shradul Sir - If StatementMandeep Kaur KhalsaNo ratings yet

- Tax RatesDocument4 pagesTax RatesOnkar BandichhodeNo ratings yet

- AY 20-21 Tax RatesDocument4 pagesAY 20-21 Tax Ratesashim1No ratings yet

- Slab Rates IncometaxDocument8 pagesSlab Rates IncometaxPPEARL09No ratings yet

- Tax Audit Limit & Tax RatesDocument6 pagesTax Audit Limit & Tax RatesPhani SankaraNo ratings yet

- HNW TaxationDocument4 pagesHNW Taxationshireen.mangoNo ratings yet

- Tax RatesDocument9 pagesTax RatesSai SwarupNo ratings yet

- Individual Resident Aged Below 60 Years (I.e. Born On or After 1st April 1955) or Any Nri/ Huf/ Aop/ Boi/ AjpDocument2 pagesIndividual Resident Aged Below 60 Years (I.e. Born On or After 1st April 1955) or Any Nri/ Huf/ Aop/ Boi/ AjpAndrew BrownNo ratings yet

- Power Pack Revision Material Nov 2019 PDFDocument429 pagesPower Pack Revision Material Nov 2019 PDFvarchasvini malhotraNo ratings yet

- Sekhar (Tax)Document42 pagesSekhar (Tax)sekhar_majiNo ratings yet

- Rates of Income Tax for AY 2017-18Document70 pagesRates of Income Tax for AY 2017-18dbp9050No ratings yet

- Analysis of key Finance Bill 2011 proposalsDocument30 pagesAnalysis of key Finance Bill 2011 proposalsVandana SharmaNo ratings yet

- Section:C-1/B-1 Subject: CAF-06 Teacher: Mr. Sir Adnan Rauf Total Marks: 33 Time Allowed: 55 Mints. Assessment-1 Date: 28oct, 2019Document5 pagesSection:C-1/B-1 Subject: CAF-06 Teacher: Mr. Sir Adnan Rauf Total Marks: 33 Time Allowed: 55 Mints. Assessment-1 Date: 28oct, 2019Shaheer MalikNo ratings yet

- Direct Taxes CIA 1Document5 pagesDirect Taxes CIA 1Swathy AjayNo ratings yet

- Chapter-1 Basic Concepts PDFDocument11 pagesChapter-1 Basic Concepts PDFBrinda RNo ratings yet

- Taxable - Income - Formula - Excel - TemplateDocument8 pagesTaxable - Income - Formula - Excel - TemplateFaizan AhmadNo ratings yet

- IncomeTax Calculator 2010-11Document2 pagesIncomeTax Calculator 2010-11Vimal PatelNo ratings yet

- Test 6 (QP)Document4 pagesTest 6 (QP)iamneonkingNo ratings yet

- India Income Tax Slab Rate 2017 18Document1 pageIndia Income Tax Slab Rate 2017 18minushastri33No ratings yet

- Tax Rates Salaried Individuals 2022 2023Document2 pagesTax Rates Salaried Individuals 2022 2023by kirmaniNo ratings yet

- ASSESSMENT YEAR 2009-2010 Tax Rates For Assessment Year 2009-10 For Resident Woman (Who Is Below 65 Years)Document4 pagesASSESSMENT YEAR 2009-2010 Tax Rates For Assessment Year 2009-10 For Resident Woman (Who Is Below 65 Years)sayyedasif56No ratings yet

- Income Tax HandbookDocument26 pagesIncome Tax HandbooknisarNo ratings yet

- Tds Rate Chart 10 11Document6 pagesTds Rate Chart 10 11harry_mewadaNo ratings yet

- Tax rates for individuals, HUF, AOP and moreDocument6 pagesTax rates for individuals, HUF, AOP and moreKishan PatelNo ratings yet

- Types of Taxes ExplainedDocument15 pagesTypes of Taxes ExplainedNischal KumarNo ratings yet

- Budget Highlights & Comments 2018-19-Deloittepk-NoexpDocument2 pagesBudget Highlights & Comments 2018-19-Deloittepk-NoexpAhmed RazaNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- Microsoft PowerPoint - BasicsDocument7 pagesMicrosoft PowerPoint - BasicstekleyNo ratings yet

- Accounting and BookkeepingDocument37 pagesAccounting and BookkeepingtekleyNo ratings yet

- Consumer ProtectionDocument3 pagesConsumer ProtectiontekleyNo ratings yet

- Accounting Equation (A L + SE) Accounting Cycle Accounting ConceptsDocument23 pagesAccounting Equation (A L + SE) Accounting Cycle Accounting ConceptstekleyNo ratings yet

- Accounting Equation (A L + SE) Accounting Cycle Accounting ConceptsDocument23 pagesAccounting Equation (A L + SE) Accounting Cycle Accounting ConceptstekleyNo ratings yet

- Accounting StandardsDocument31 pagesAccounting StandardstekleyNo ratings yet

- Accounting Equation (A L + SE) Accounting Cycle Accounting ConceptsDocument23 pagesAccounting Equation (A L + SE) Accounting Cycle Accounting ConceptstekleyNo ratings yet

- Slide Transitions: Set A Transition For An Individual or Group of SlidesDocument2 pagesSlide Transitions: Set A Transition For An Individual or Group of SlidestekleyNo ratings yet

- Priority Sector Lending by BanksDocument4 pagesPriority Sector Lending by BankstekleyNo ratings yet

- BiodiversityDocument4 pagesBiodiversitytekleyNo ratings yet

- The Customs Tariff Act 1975Document38 pagesThe Customs Tariff Act 1975tekleyNo ratings yet

- Profitability PressuresDocument6 pagesProfitability PressurestekleyNo ratings yet

- Business EntitiesDocument5 pagesBusiness EntitiestekleyNo ratings yet

- Bio DiversityDocument65 pagesBio DiversitytekleyNo ratings yet

- Sources of Finance for BusinessesDocument16 pagesSources of Finance for BusinessestekleyNo ratings yet

- Microsoft Access - QueryDocument10 pagesMicrosoft Access - Querytekley100% (1)

- Sources of Finance for BusinessesDocument16 pagesSources of Finance for BusinessestekleyNo ratings yet

- Access Service - An OverviewDocument174 pagesAccess Service - An OverviewtekleyNo ratings yet

- Database OverviewDocument12 pagesDatabase OverviewtekleyNo ratings yet

- Trends at A Glance: A. Access Service (Wireline + Wireless)Document4 pagesTrends at A Glance: A. Access Service (Wireline + Wireless)tekleyNo ratings yet

- Report On Mobile TelephoneDocument9 pagesReport On Mobile TelephonetekleyNo ratings yet

- Filter AccessDocument2 pagesFilter AccesstekleyNo ratings yet

- Definition of Branding: Key Elements and StrategiesDocument7 pagesDefinition of Branding: Key Elements and StrategiestekleyNo ratings yet

- Filter AccessDocument2 pagesFilter AccesstekleyNo ratings yet

- MSAccess Database Management SystemDocument13 pagesMSAccess Database Management SystemtekleyNo ratings yet

- Charging Section of CSTDocument13 pagesCharging Section of CSTtekleyNo ratings yet

- Product Life CycleDocument10 pagesProduct Life CycletekleyNo ratings yet

- Edit Data: Access 2007 Databases Hold The Actual Data Records Inside Tables. You Can Add, Edit, and DeleteDocument10 pagesEdit Data: Access 2007 Databases Hold The Actual Data Records Inside Tables. You Can Add, Edit, and DeletetekleyNo ratings yet

- Access Part IDocument40 pagesAccess Part ItekleyNo ratings yet

- Database OverviewDocument12 pagesDatabase OverviewtekleyNo ratings yet

- Factor Affecting Digital Payment Kiran GajjarDocument12 pagesFactor Affecting Digital Payment Kiran GajjarKRIANNo ratings yet

- Acknowledment ReceiptDocument2 pagesAcknowledment ReceiptKimberly TrocioNo ratings yet

- My File NameDocument1 pageMy File NameDimple QueenNo ratings yet

- Hindustan Petroleum Corporation Limited: Price ListDocument10 pagesHindustan Petroleum Corporation Limited: Price ListVizag Roads33% (3)

- Entrance Counseling Guide For Direct Loan Borrowers: WWW - Dl.ed - GovDocument5 pagesEntrance Counseling Guide For Direct Loan Borrowers: WWW - Dl.ed - Govanon-417085No ratings yet

- Direct Tax NotesDocument65 pagesDirect Tax NotesJeevan T RNo ratings yet

- DT - One Page Summary - Business Trust, Inv Fund, Sec. TrustDocument1 pageDT - One Page Summary - Business Trust, Inv Fund, Sec. TrustAruna RajappaNo ratings yet

- ACT invoice for January 2020Document2 pagesACT invoice for January 2020RajatHaldarNo ratings yet

- KRITI KUMARI-1742015-Fee ReceiptDocument1 pageKRITI KUMARI-1742015-Fee ReceiptKriti KumariNo ratings yet

- Gem A Examination Info Form January 2024Document1 pageGem A Examination Info Form January 2024dhanish20060613No ratings yet

- Chapter 1: Introduction To Consumption TaxesDocument11 pagesChapter 1: Introduction To Consumption TaxesJoody CatacutanNo ratings yet

- BSNLDocument1 pageBSNLRamki KvlNo ratings yet

- Dokumen - Tips Caxton 10pdf French Adosphere 3 Cahier Dactivites CD Rom 557131 New 1Document2 pagesDokumen - Tips Caxton 10pdf French Adosphere 3 Cahier Dactivites CD Rom 557131 New 1Ezz Civ EngNo ratings yet

- Monthly VAT ReturnDocument34 pagesMonthly VAT ReturnEdris MatovuNo ratings yet

- Newsletter 336Document8 pagesNewsletter 336Henry CitizenNo ratings yet

- CIR Vs PNBDocument9 pagesCIR Vs PNBDenise Michaela YapNo ratings yet

- 1690194141070Document7 pages1690194141070samarth.neotericNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsKuladeep Naidu PatibandlaNo ratings yet

- Microtek Microtek Line Interactive UPS Legend 650 Ups Legend 650 UpsDocument1 pageMicrotek Microtek Line Interactive UPS Legend 650 Ups Legend 650 UpsAriNo ratings yet

- DTC Agreement Between Poland and SwitzerlandDocument13 pagesDTC Agreement Between Poland and SwitzerlandOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Chandra Jayasir I P A Domestic Gampaha 05-09-083 GMA1037 071 537 Gonigahalanda Watta, Ranweli Place, GampahaDocument1 pageChandra Jayasir I P A Domestic Gampaha 05-09-083 GMA1037 071 537 Gonigahalanda Watta, Ranweli Place, Gampahasasanka123asiri123No ratings yet

- Offer: It Part No. Quty PU Price/unit Total Price Description Extra Deduction or Surchar EUR EURDocument3 pagesOffer: It Part No. Quty PU Price/unit Total Price Description Extra Deduction or Surchar EUR EURMichelNo ratings yet