Professional Documents

Culture Documents

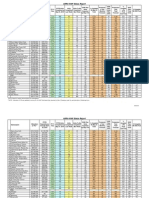

Wong Daniel O 00059421 448462 000 2009

Uploaded by

Texas Watchdog0 ratings0% found this document useful (0 votes)

0 views24 pagesPersonal Financial Statement covering calendar year 2009, filed with the Texas Ethics Commission. Posted by Texas Watchdog, http://www.texaswatchdog.org.

Original Title

Wong_Daniel_O_00059421_448462_000_2009

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPersonal Financial Statement covering calendar year 2009, filed with the Texas Ethics Commission. Posted by Texas Watchdog, http://www.texaswatchdog.org.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

0 views24 pagesWong Daniel O 00059421 448462 000 2009

Uploaded by

Texas WatchdogPersonal Financial Statement covering calendar year 2009, filed with the Texas Ethics Commission. Posted by Texas Watchdog, http://www.texaswatchdog.org.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 24

“Texas Ethics Commission P.O. Box 12070 ‘Austin, Texas 78711-2070 (612) 483-5800 __ 1-800-525-8506

PERSONAL FINANCIAL STATEMENT Form PFS

COVER SHEET

Filed in accordance with chapter §72 of the Government Code. "

For flings required in 2010, covering calendar year ending December 31, 2009. ==

Use FORM PFS-INSTRUCTION GUIDE when completing this form,

NAME: TERT

544

‘OFFICE USE ONLY

R- Dée OO. oe

iorouiud: Us FFX RECEIVED

Wong AeR 08 2010

a a ater

$506 Coron Gled CovkT

Sucse Law, 77474

TZ] ccueck ie ness Home aDoREss)

TELEPHONE | >Re cone PONE WER STEEN

NUMBER} (7B) 1d3- 7064

‘+ REASON

FORFILING | Cl canpiare Inoeare orice)

‘STATEMENT

Di etecten oFFicer evocare orricey

Soeronresomcen TEXAS Bones oF PRFEGONAL ENGIMEERE cy

Dlexecurive Heap —— orcare score

C1 FoRMER OF RETIRED JUDGE SITTING BY ASSIGNMENT

nctea par

CO sTATE PARTY CHAIR

Clotner oscars PoSON

5 Family members whose fnancistactvty you are reporting (er must report Information about the fnanelal actly ofthe filers spouse or

pendent chitren if the fer had actual Crsol over that acti):

‘SPOUSE

DEPENDENT CHILD +.

ee

3 = =

In Parts 4 through 18, you will disclose your financial activity during the preceding calendar year. In Parts 1 through 14, you are

Fequited to disclose not only your own financial activity, but also that of your spouse or a dependent child if you had actual control

over that person's financial activity

aul GOPY AND ATTACH ADDITIONAL PAGES AS NECESSARY p. ug ui-3.

‘Texas Ethics Commission

P.0.B0x12070__

__Austin, Texas 78711-2070 (612) 463-8800_ 1-800-825-8506

1 norappucaste

SOURCES OF OCCUPATIONAL INCOME

Part 1A.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

2 INFORMATION RELATES TO

DA rwer Ci seouse Ci oePeNpenr cHinD

2

EMPLOYMENT

“ONC tone Pre Hone Aaeas)

TeLunat— WONG EW SIN EES, We-

Pl eurrovensvanomer | fo7/> S. SAW thaSten PY. w,, # 700

HouSTA, TR 7703

Ceo.

Ciseur-emptoveo NATUREOF OCCUPATION

INFORMATION RELATES TO

" Cruer Ci spouse Ci vePeNvenr cH

EMPLOYMENT EY (heat ar ame Aes)

CI EMPLOYED BY ANOTHER

eye suse or oecrrion

INFORMATION RELATES TO

Orwer CO spouse (CO DEPENDENT CHILD

EMPLOYMENT

Cl ewptoven ey aNoTHER

Cl stir emptoveo

NOSE neck Fre ome Alsen)

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Texas Ethics Commission P.0..Box 12070 Austin, Texas 78711-2070 (512)463-5800__ 1-800-325-8506

RETAINERS. part 1B

B sorarrucase

This section concerns fees received as a retainer by you, your spouse, or a dependent child (or by a businessiin which you,

your spouse, or a dependent child have a "substantial interest’) fora claim on future services in case of need, rather than for

services on a matter specified at the ime of contracting for or receiving the fee. Report information here only ifthe value of

the work actually performed during the calendar year did not equal or exceed the value ofthe retainer. For more information,

‘see FORM PFS--INSTRUCTION GUIDE,

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1

FEE RECEIVED FROM

FEE RECEIVED BY

Orwer

OR FILER'S BUSINESS

O spouse

(OR SPOUSE'S BUSINESS,

CD pepenvent cio

OR CHILD'S BUSINESS

3

FEE AMOUNT Cites tHawss.000 [1 $5,000-s8,999 1] s10.000-824.000 1 $25,000-0R MORE

FEE RECEIVED FROM

FEE RECEIVED BY

Orwer

OR FILER'S BUSINESS

Cl spouse

(Or Beles pac

Ci pePenvenr cro.

(OR CHILD'S BUSINESS

FS Mount, Ces rHaN $5,000) $5,000-s9.999 1] s10.000-s24,908 1] $25,000-0R MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

- ea

‘Texas Ethics Commission P.O. Box 12070

STOCK

CO noraprucaate

Austin, Texas 78711-2070 ___(612) 463-5800_ 1-800-825-8606

PART 2.

INSTRUCTION GUIDE.

List each business entity in which you, your spouse, or a dependent child held or acquired stock during the calendar year

and indicate the category of the number of shares held or acquired. If some or all of the stock was sold, also indicate the

category of the amount of the net gain or loss realized from the sale. For more information, soe FORM PFS—

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

T BUSINESS ENTITY

VARIOUS InTERMET STOCKS

2 STOCK HELD OR ACQUIRED BY

Orwer

Cisrouse CI] bePENDENT CHILD

3 NUMBER OF SHARES

JE Less Than 100

1 5000 70 9960

Diooto«e —Chsootoes 100010 4009

1D 10,0000R MORE

4 1F SOLD Bren can | PSLess Tuan ss000 1 $5.000-89.909 1 s10.000-s24.909 1 $26,000-o8 MORE.

Cnertoss

BUSINESS ENTITY ae

"STOCK HELD OR ACQUIRED BY | CI Fier Cisrouse CI bePENDeNT CHILD

NUMBER OF SHARES Clues tHant0a Cl o0To« Clsootosse C1 1000 To 40m

C1sp00T0 9999 1) 19900 oR more

F SOLD ner can | 7) cess tran ss.000 (2 $8,000-89,989 1) s10,000-824.089 1] s25,00-0F MORE

Oneross

BUSINESS ENTITY se

STOCK HELD ORACQUIRED BY |Tirier Cisrouse CI] dePenpenr cHito

NUMBER OF SHARES Tlussstian 100 — Cliooto« — Csvotow Cliooro«oe

C1 so00 709990 C1 10900 0R MoRE :

(SOLD Chnercan | Chess Tran ssco0 C1 s5000-s0e09 Cl sto000-s2«e0 1 $25 000-0R MORE

OnerLoss

BUSINESS ENTITY 7

‘STOGKHELD OR ACQUIRED BY | Crier Ciseouse_ Dloerenpenr ono

NUMBER OF SHARES Cltesstuant00 —Cli0t049 — Cscotows 100 10 4900

| 21500070 9.960 £19000 0R MoRE

IF SOLD Ciner can | 7) tess rHanss.000 1 s5.000-s0,609 C1 s10,000-24009 7] $25,000-OR MORE

Onerioss

BUSINESS ENTITY oo

‘STOCK HELD OR ACQUIRED BY | C) rier Cisrouse ~~ Clperenpenr cop —

NUMBER OF SHARES ~ |Cuesstaav100 Clioov0499 Clsvotoae CI xan To sem

Cso00 T0909 C1 10000 oR MoRE

IF SOLD wercan | C}cess Tuan ss.000 C1 $5000-89909 C] s10.000-$24.000 ] $25,000-0R MORE.

COnervoss

[__ cy an ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0.Box12070___Austin, Texas 78711-2070 (612) 463-6800 _ 1-800-325-8506

BONDS, NOTES & OTHER COMMERCIAL PAPER PART 3.

Il notappucasie

List all bonds, notes, and other commercial paper held or acquired by you, your spouse, or a dependent child during the

calendar year. If sold, indicate the category of the amount of the net gain or loss realized from the sale. For more

information, soe FORM PFS~INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

7

DESCRIPTION

OF INSTRUMENT

2

HELD OR ACQUIRED BY

Crer Ci spouse (Ci DEPENDENT CHILD

3

IF SOLD

Onerean C1tess THaN $5,000 C1 $5.9000-s0,909 C] $10,000-$24,009 C) $25,000-OR MORE.

Onertoss

DESCRIPTION

OF INSTRUMENT

HELD OR ACQUIRED BY

Crier CO spouse C1 vePeNDENT CHILD

IF SOLD

Oneroan Dtess tHaw $5,000 C2 $5.000-s0.902 C1] $10.000-$24909 1) $25.000-0R MORE

Oinertoss

DESCRIPTION

OF INSTRUMENT

HELD OR ACQUIRED BY

Cruer CO spouse (Dl vePeNDENT CHILO |

IF SOLD

ner can tess THaw $5,000 C1 s5000-s0.999 C] s10.000-$24009 [1] $25.000-0R MORE

Onertoss

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

Texas Ethics Commission P.0..Box 12070 ‘Austin, Texas 78711-2070 (612) 468-5800 _ 1-800-325-8506

MUTUAL FUNDS PART 4

1A noraPeLcaBLe

List each mutual fund and the numberof shares in hat mutual fund that you, your spouse, or a dependent child held or

‘quired during the calendar year and indicate the category of he numberof shares ofmtual funds held or accuied, if

some allofne shares of mutual fund were sol, also ncaa the category ofthe amount of the net gan orloss realized

from the sale. For more information, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

+ MUTUALFUND wae

; -

na Don aeaanen eve Orucr Cisrouse — C]oerenoenr cio -

3 NUMBER OF SHARES CLESS THAN 100 1 100 To 429, 500 To 999 O 1.000 To 4,999

(OF MUTUAL FUND

C1 5,000 To 9,999 1 10,000 or MoRE

4

"FsoLp Oweroan 1 5 cess Tuan $6000 ]$5.000-80.900 [1] sio000-s24,000 |] $25,000-0R MORE

Dnertoss

MUTUAL FUND vee

‘SHARES OF MUTUAL FUND

ELD ORAEEURED EYE Corner Ciseouse C1 oe enpenr cH.

NUMBER OF SHARES: CILESs THAN 100 1 100 To 499° 1 500 To 999 1 1.000 To 4,999

OF MUTUAL FUND

1 5,000 To 9,999 C2 10,000 oR MORE

IF SOLD

CINETGAIN | Fy Less THaN $5,000] $5,000-$9.900 ] st0000-24900 -] $25.000-0n MORE

Cinertoss

MUTUAL FUND ae

SHARES OF MUTUAL FUND

REI ORASOURED EYE Orner Ciseouse 1] oePeNvenr cnt

NUMBER OF SHARES CliesstHan 100 © CJ 100 To4es = C500 T0999 ©) 1,000 To 4909

OF MUTUAL FUND

1 5.000 To 9,999 7 10,000 oR MORE

SOLD 7

Onercan | Less Tran ss.000 (]ss000-s0900 [1] s10000-824,509 [[] $25,000-OR MORE

Ci ner Loss

‘COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Texas Ethics Commission

P.O. Box 12070 Austin, Texas 78711-2070 (612)463-5800__ 1-800-325-8506

1 norareticaste

INCOME FROM INTEREST, DIVIDENDS, ROYALTIES &RENTS part 5

List each source of income you, your spouse, or @ dependent child received in excess of $500 that was derived from

interest, dividends, royalties, and rents during the calendar year and indicate the category of the amount ofthe income. For

more information, see FORM PFS-INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you ate reporting by

providing the number under which the child is listed on the Cover Sheet.

1

‘SOURCE OF INCOME

CHASE BAK OA) C-D.

? RECEIVED BY

‘SOURCE OF INCOME

Brier Lisrouse Di vePenoenr cHiLo

3

fesschadl TR s800-s4.990 1 s5.000-s5,900 C1 s10,000-s2.009 C1 s25.000-08 MORE

BAnk oF ARIK OW 6.0.

RECEIVED BY

FILER Ci spouse Cl oePenoent chit

_ ee |

oo Bisso0-s6909 C1 s.00-80999 C1 si000-s24000 C1] s25.000-08 MORE

SOURCE OF INCOME

RECEIVED BY

Crner Ci spouse Ci berenenr cuit

cua 1 s800-s4.998 1 s5.000-s0.900 C1 sto000-s24000 1 25,000-0n MORE

‘COPY

AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethies Commission

P.O. Box 12070 ‘Austin, Texas 78711-2070 (612)463-5800__ 1-800-525-8508

PERSONAL NOTES AND LEASE AGREEMENTS PART 6

NOTAPPLCABLE

Identify each guarantor of a loan and each person or financial institution to whom you, your spouse, or

a dependent child had a total financial liability of more than $1,000 in the form of a personal note or notes or lease

‘agreement at any time during the calendar year and indicate the category of the amount ofthe liability. For more informa-

tion, see FORM PFS-INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is isted on the Cover Sheet.

7

PERSON OR INSTITUTION

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

Orer Ci spouse (Ol vePeNpent cH —__

GUARANTOR

‘AMOUNT

Cs1000-s4900 C1) s5,000-$9.900 CL] s10,000-$24,900 1] $25,000-0R MORE

PERSON OR INSTITUTION

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

Orwer CO seouse CI DEPENDENT CHILD

GUARANTOR

AMOUNT

1 s1.000-84999 1 s5,000-$0.999 C1 s10.000-s24,909 1] $25,000-0R MORE

PERSON OR INSTITUTION

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

Oruer CO spouse CI Der eNbeNT CHILD

GUARANTOR

‘AMOUNT Cis1,000-s4.982 C1 $s,000-s9.999 C1 s10.000-s24,9e9 1 $25,000-0R MORE.

copy

AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Texas Ethics Commission ___P.0. Box 12070 Austin, Texas 78711-2070 (612)463-5800_ 1-800-325-8506

INTERESTS IN REAL PROPERTY PART 7A

noraprucaBte:

Describe all beneficial interests in real property held or acquired by you, your spouse, or a dependent child during the

calendar year. Ifthe interest was sold, also indicate the category of the amount ofthe net gain or loss realized from the sale,

For an explanation of "beneficial interest" and other specific directions for completing this section, see FORM PF:

INSTRUCTION GUIDE.

‘When reporting information about a dependent childs activity, indicate the child about whom you are reporting by

providing the number under which the child s isted on the Cover Sheet,

" HELD OR ACQUIRED BY Bruen Cisrouse Ci berenoenrcHito

2 STREETADDRESS [STREET ASORESE NGLUDNEG CF, COUNTY, AIO STATE -

Ci woranane (Ro S. Ska Holst! PREEMET WEST

Di check it FiteR's HoMe aDoREss

3 DESCRIPTION

Glio HaeeS Coun

Orcas

* NAMES OF PERSONS

RETAINING AN INTEREST

Di norapeucasie

(SEVERED MINERALINTEREST)

* IFsoLD

(Kneroan Cluesstmanssoc0 8.85.000-s8,009 C) s10.000-§24.999 1 s25000-oR MORE

Cinertoss

HELD OR ACQUIRED BY OFier Uspouse (CDEP ENDENT CHILD

STEenDRESS ‘BREET ASORESS NELUONS GT, COTY OTA

Co noravanaste

i cHeck iF FLeR's HOME ADDRESS

DESCRIPTION

Dus

CO) Acres

NAMES OF PERSONS

RETAINING AN INTEREST

Di norarpucasie

(SEVERED MINERAL INTEREST)

IF SOLD

ner can Tess Tuan $5,000] $6,000-$8,988 [1] $10,000-$24,909 1] s25,000-0R MORE

Cinertoss

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Texas Ethics Commission P.O. Box 12070 Austin, Texas 78711-2070 (612) 463-5800 _ 1-800-325-8506

INTERESTS IN BUSINESS ENTITIES Part 7B

i norappucante

Describe all beneficial interests in business entities held or acquired by you, your spouse, or a dependent child during the

calendar year. Ifthe interest was sold, also indicate the category of the amount ofthe net gain or loss realized from the sale

For an explanation of "beneficial interest" and other specific directions for completing this section, see FORM PF:

INSTRUCTION GUIDE.

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet,

7

HELD OR ACQUIRED BY Alrwer Cispouse Ci bePeNpeNT CHILD —__

2 ~~ NAME AND ADDRESS

DESCRIPTION Cea Pes ome atin

DANIEL Govnw ok

Qrel VALDEMoRILLo DRWE

Corps cHesti , B78 YY

* IF SOLD

Fa nercan Ci tess tran $5,000 £1 s5.000-s9,909 C] $10,000-s24900 C1] $26,000-0R MORE

CNet toss

HELD OR ACQUIRED BY Orer CO. spouse CA DEPENDENT CHILD

DESCRIPTION (Choe a ome sain

iF SOLD

ner enn Ces THAN $5,000 [1 s5,000-$5.909 1] $10,000-s24,909 [1] $25,000-0R MORE:

Cner Loss

-_ 1

HELD OR ACQUIRED BY Crier OC spouse (CO DEPENDENT CHILD

DESCRIPTION Ceowe Pf toe ates

IF SOLD

ner can CiLess tHan $5,000 1 $5,000-$9.909 [1] $10,000-$24,909 [1] $25,000-08 MORE

ner Loss

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

Texas Ethics Commission __P.0. 8x 12070 Austin, Texas 78711-2070 (512) 463-5800 _ 1-800-825-8506

GIFTS ParT 8

1 norarrucaace

Identify any person or organization that has given a git worth more than 825010 you, your spouse, ora dependent child, and

describe the git. The description of agit ofcash ora cash equivalent, such as @ negotiable instrument or gif certificate, must

include a statement ofthe value ofthe gift. Do not include: 1) expenditures required tobe reported by a person required to be

registered as a lobbyist under chapter 305 of the Government Code; 2) poltical contributions reported as required by law; or

3) gits given by a person related tothe recipient within the second degree by consanguinity orafnity. For more information,

‘500 FORM PFS-INSTRUCTION GUIDE

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

7 DONOR

RECIPIENT Cruer Ci spouse (i vePenpenr CHILD

DESCRIPTION OF GIFT

DONOR

RECIPIENT Orner Ci srouse (J vePenvenr cHi.o

DESCRIPTION OF GIFT

DONOR

RECIPIENT Orwer Ci srouse (1 bePeNDENT CHILD

DESCRIPTION OF GIFT

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Texas Ethics Commission P.0.Box 12070 Austin, Texas 78711-2070

(612) 463-8800 _ 1-800-325-8508

TRUST INCOME

Protec

PART 9

providing the number under which the child is listed on the Cover Sheet.

Identity each source of income received by you, your spouse, ora dependent child as beneficiary of a trust and indicate the

category of the amount of income received. Also identify each asset of the trust from which the beneficiary received more

than $500 in income, if the identity of the asset is known. For more information, soe FORM PFS—INSTRUCTION GUIDE,

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

" source

BENEFICIARY Cree CO srouse

Ci oePenoent crit

cca Cites THan $5,000 C] $5,000-$9.908

CZ s10.000-824,009 | C] $25,000-0R MORE

ASSETS FROM WHICH

OVER $500 WAS RECEIVED

unknown

SOURCE

BENEFICIARY Ciruer Ci srouse

(i vePeNDENT CHILD

oe (CD Less THAN $5,000 C1] $5,000-s9,999

1 s10,000-s24.999 [1] $25,000.08 MORE

ASSETS FROM WHICH

OVER $500 WAS RECEIVED

Cl uneown

OVER $500 WAS RECEIVED

Dunmow

SOURCE

BENEFICIARY Orner Ci seouse CpePenvenr crit

Glee Cites THaN $6,000 £1 $5,000-$9.999 J s10,000-$24,999 1] $25,000-0f MORE

ASSETS FROM WHICH

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Texas Ethies Commission P.0.B0x12070__Austin, Texas 78711-2070 (612)463-5800__ 1-800-325-8506

BLIND TRUSTS PART 10A,

Pl norarPucasie

Identity each blind trust that complies with section 572.023(c) of the Government Code. See FORM PFS~INSTRUCTION

GUIDE.

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the childis listed on the Cover Sheet,

1 NAME OF TRUST

2 TAME AND RODRESS

‘TRUSTEE,

3

BENEFICIARY Orwer Ci srouse Ol verenvenr cuito

4

FAIR MARKET VALUE

Ces Tuan $5,000 (1) $6,000-$9.909 1] s10,000-s24.s09 [] $25,000-0R MoRE

® DATECREATED

NAME OF TRUST

— Tae ome

BENEFICIARY

OFter O spouse (1 DEPENDENT CHILD

FAIR MARKET VALUE C1tess THAN $5,000) $6,000-s9,999 [1] 10,000-$24.999 [1] $25,000-OR MORE

DATE CREATED

NAME OF TRUST |

TRUSTe Ta ORS

BENEFICIARY Crner CO spouse DEPENDENT CHILD

FAIR MARKET VALUE

Ciess Tian $5,000 C1) $6,000-89.999 1] $10,000-s24,000 [1] $25,000-OR MORE

J =

DATE CREATED

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

Texas Ethics Commission P.0.Box 12070 Austin, Texas 78711-2070 (612)463-8800 _ 1-800-925-8506

TRUSTEE STATEMENT PaRT 10B

(ZLNOTAPPLICABLE

‘An individual who is required to identify a blind trust on Part 10A of the Personal Financial Statement must submit a

statement signed by the trustee of each biind trust listed on Part 10A. The portions of section 572.023 of the Government

Code that relate to blind trusts are listed below.

1 NAME OF TRUST

2 TRUSTEE NAME

3 FILER ON WHOSE cA

BEHALF STATEMENT

IS BEING FILED

4 TRUSTEE STATEMENT | affirm, under penalty of perjury, that | have not revealed any information to the beneficiary of this

trust excopt information that may be disclosed under section §72.023 (b)(8) of the Government

Code and that to the best of my knowledge, the trust complies with section 572.023 of the

Government Code,

Trustee Signature

§ 572.023. Contents of Financial Statement in General

(b) The account of financial activity consists of:

(® identification ofthe source and the category of the amount of all income received as beneficiary of trust, other

than a blind trust that complies with Subsection (c), and identification of each trust asset, i known to the beneficiary,

from which income was received by the beneficiary in excess of $500;

(14) identification of each blind trust that complies with Subsection (c), including:

(A) the category ofthe fair market value ofthe trust;

(8) the date the trust was created;

(C)the name and address of the trustee; and

(D)a statement signed by the trustee, under penalty of perjury, stating that

(the trustee has not revealed any information tothe individual, except information that may be disclosed

Under Subdivision 8); and

(i) to the best ofthe trustee's knowledge, the trust complies with this section

(©) For purposes of Subsections (b)(8) and (14), a blind trusts a trust as to which:

(4) the trustee:

(A)is a disinterested party;

(B)is not the individual;

(C)is not required to register as a lobbyist under Chapter 305;

(D)is nota public officer or public employee; and

(€)was not appointed to public ofice by the individual or by a public officer or public employee the individual

supervises; and

(2) the trustee has complete discretion to manage the trust, including the power to dispose of and acquire trust

assets without consulting or notifying the individual

(@ Ifa blind trust under Subsection c) is revoked while the individual is subject to this subchapter, the individual must fie an

‘amendment tothe individual's most recent financial statement, disclosing the date of revocation and the previously unreported

| value by category of each asset and the income derived from each asset.

“Texas Ethics Commission P.O. Box 12070 Austin, Texas 78711-2070 (612) 463-6800 _ 1-800-325-8506

ASSETS OF BUSINESS ASSOCIATIONS PaRT 11A

(Oy noraprucaate

Describe all assets of each corporation, firm, partnership, limited partnership, limited liability partnership, professional

corporation, professional association, joint venture, or other business association in which you, your spouse, or a depen-

dent child held, acquired, or sold 50 percent or more of the outstanding ownership and indicate the category of the amount

ofthe assets. For more information, see FORM PFS--INSTRUCTION GUIDE.

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the childis listed on the Cover Sheet.

* BUSINESS Co tcreck i Fees Home Across)

ae oLundt- Won EEINEERS EWC.

2 BUSINESS TYPE a4

¥ HELD, ACQUIRED,

OREOLD EY) Arner D spouse Cl berenvenr cup

* Assets eee caTECoRY

Ces ran 5.000 C1 $5,000-s9.909

Pho Fessional F (RM

Cist0.000-s24.988 ('s25,000-0R woRE

Cites THan $5,000 C1 $5,000-s9.900

O)s10,000-s24,0e8 [1] $28,000-0R MORE

Ces Tuan $5,000 1 $5,000-s0.909

Cist0.000-s2488 C] s25,000-0R MORE

tess THan $5,000 C1 $5,000-s9.990

Citess Tan $5,000 C1 s5,000-$9,900

s10,000-$24,900 C] $25,000-0R MORE

Citess tan $5,000 [1] s5,000-$8.998,

C1 s10.000-$24.090 C1 s25,000-0n MORE

Dtess THAN $5,000 T) $5,000-$9,998

Cist0.000-s24989 1 s25,000-0n WORE

Tess Than $5,000 C1 $5,000-s9.900

T

|

|

\

I

|

|

|

|

|

|

|

|

i

\

| Clstoom-sarse0 C1 s2s000-o8 wore

|

|

|

|

|

|

|

|

i

i

|

|

\

i

i

|

|

C1 810.000.624.999] $25,000-OR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Texas Ethics Commission

P.O. Box 12070 ‘Austin, Texas 78711-2070 (612)463-5800__ 1-800-325-8506

Rl norserucenie

LIABILITIES OF BUSINESS ASSOCIATIONS

part 11B

Describe all labilies of each corporation, firm, partnership, limited partnership, limited liabilty partnership, professional

corporation, professional association, joint venture, or other business association in which you, your spouse, or a depen-

dent child held, acquired, or sold 60 percent or more of the outstanding ownership and indicate the category of the amount

ofthe assets. For more information, see FORM PFS-INSTRUCTION GUIDE,

When reporting information about a dependent chilo’s activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

* BUSINESS

ASSOCIATION

Di ccneats Pers Hone Aas)

? BUSINESS TYPE

3 HELD,ACQUIRED,

OR SOLD BY

Orter Cisrouse Ci bePeNbenr CHILD

* UaBILITIES

Ces THan $5,000

D1 s10,000-s24,098

Ces THaw 88,000

D s10,000-$24,999

Ctess THaw $5,000

1 st0.000-s24,999,

Cl Less THaN $5,000

1 s10,000-24,998

(C1 Less THAN $5,000

a

'$10,000-$24,999

Hess THan $5,000

1D sto.00-s24,009

C1 ess THAN $5,000

O s10,000-¢24,999

C1LEss THAN $5,000

T

|

|

|

|

|

|

|

|

|

i

|

I

|

|

|

|

|

1

1

1

1

1

1

!

|

|

!

|

|

|

|

|

J.

Ci s10.000-s24,988

1 s5,000-33,909

01 825,000-0R MORE

Ci s5,000-3,009

1 s25,000-0R MORE

1 s5,.000-s2.009

1 s25;000-0R MORE

i s5.000-$3,908

C1 s25,000-0F MORE

1 85.00.3909

1 s25,000-oF wore

1 s5,000-39,000

1 s2s.000-0F MoRE

i s5,000-$9,009

01 825,000.08 MORE

Ti sscce-sa999 |

CIs2sn00-o8 more |

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Texas Ethics Commission P.O. Box 12070 Austin, Texas 78711-2070 (612)463-5800__ 1-800-325-8506

BOARDS AND EXECUTIVE POSITIONS PART 12

0 norappucaste

List all boards of directors of which you, your spouse, or a dependent child are a member and all executive positions you,

your spouse, or a dependent child hold in corporations, firms, partnerships, limited partnerships, limited labilty partner-

Ships, professional corporations, professional associations, joint ventures, other business associations, or proprietorships,

stating the name of the organization and the position held. For more information, see FORM PFS-INSTRUCTION GUIDE,

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the childs listed on the Cover Sheet.

* ORGANIZATION FORT Sev Economie DELP MW] Gund

* POSITION HELD TRostee

* position HELD BY Grier D srouse Cl epenent cHito

ORGANIZATION Get Bene Cee oF Guneh cE

POSITION HELD Bore weer

POSITION HELD BY rer Ci spouse (CI DEPENDENT CHILD

i

ORGANIZATION SUGAR LA HEMTAGE fMYATION

POSITION HELD Poxeo ueMBer_

- od

POSITION HELD BY rue Ci spouse Ci berenoenr cto

ORGANIZATION

POSITION HELD

POSITION HELD BY Crier CO spouse Ci vePeNDeNT cHLo

ORGANIZATION

POSITION HELD

POSITION HELD BY Cruse Ci spouse Cl verenoenr crit —__

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Texas Ethics Commission P.O. Box 12070 Austin, Texas 78711-2070 (612/463-5800 _ 1-800-325-8508,

EXPENSES ACCEPTED UNDER HONORARIUM EXCEPTION PART 13

fu NOTAPPLICABLE

Identify any person who provided you with necessary transportation, meals, or lodging, as permitted under section 36.07(b)

‘of the Penal Code, in connection with a conference or similar event in which you rendered services, such as addressing an

‘audience or participating in a seminar, that were more than perfunctory. Also provide the amount of the expenditures on

transportation, meals, orlodging. You are not required to include items you have already reported as political contributions

‘on a campaign finance report, or expenditures required to be reported by a lobbyist under the lobby law (chapter 305 of the

Government Code). For more information, see FORM PFS—INSTRUCTION GUIDE.

* PROVIDER "

? AMOUNT

PROVIDER

‘AMOUNT

PROVIDER

‘AMOUNT

PROVIDER

AMOUNT

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Texas Ethics Commission

[Brorvervcse

___P.0.80x 12070

Austin, Texas 78711-2070

INTEREST IN BUSINESS IN COMMON WITH LOBBYIST

(512) 483-5800,

1-800-325-8508

PART 14

Identify each corporation, frm, partnership, limited partnership, limited liability partnership, professional corporation, profes-

sional association, joint venture, or other business association, other than a publicly-held corporation, in which you, your

spouse, or a dependent child, and a person registered as a lobbyist under chapter 305 of the Government Code that both have

an interest, For more information, soe FORM PFS~INSTRUCTION GUIDE.

* BUSINESS ENTITY

2

INTERESTHELD BY Orter Clsrouse 1 bePenbenr cio

BUSINESS ENTITY MENON

INTERESTHELD BY Orter Disrouse ve envent cet

BUSINESS ENTITY a

INTEREST HELD BY Oruer Cispouse 1 DEPENDENT CHILD

BUSINESS ENTITY Phe

INTERESTHELD BY Orner Cisrouse Cl bePenvenr chit

BUSINESS ENTITY ne)

INTEREST HELD BY Orwer Ciseouse C1) vePennent cro _

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

‘Texas Ethics Commission P.0..Box 12070 ‘Austin, Texas 78711-2070 (612) 463-6800 _ 1-800-325-8506

FEES RECEIVED FOR SERVICES RENDERED part 15

TO ALOBBYIST OR LOBBYIST'S EMPLOYER

sLLnoraPpucas.e

Report any fee you received for providing services to or on behalf of a person required to be registered as a lobbyist under

chapter 305 of the Government Code, or for providing services to or on behalf ofa person you actually know directly compen-

sates or reimburses a person required to be registered as a lobbyist. Report the name of each person or entity for which the

services were provided, and indicate the category of the amount of each fee. For more information, see FORM PFS—

INSTRUCTION GUIDE.

* PERSON OR ENTITY

FOR WHOM SERVICES

WERE PROVIDED

2

eee Ctess Tran $5,000 1 s5,000-89.909 1] $10,000-$24.900 1] s26,000-oR MORE

PERSON OR ENTITY

FOR WHOM SERVICES

WERE PROVIDED

FEE CATEGORY Ctess THAN $5,000 1 s5,000-$9,909 7] $10,000-s24,900 1 $25,000-0R MORE

PERSON OR ENTITY

FOR WHOM SERVICES

WERE PROVIDED

pe celecory, tess THaN $5,000 C1] s5}900-s0.999 C1 $10.000-s24,909 7] $25,000-08 MORE:

PERSON OR ENTITY

FOR WHOM SERVICES

WERE PROVIDED

FEE CATEGORY tess THan 5000] s5000-so.s60 (I sto,con-s24se0 [1 $26,000-OF MORE:

PERSON OR ENTITY

FOR WHOM SERVICES

WERE PROVIDED

eee Des Tuan $5,000) $5,000-$9.999 1] s10,000-s24099 [1] $25,000-0R MORE

PERSON OR ENTITY

FOR WHOM SERVICES

WERE PROVIDED

eee Tess THaN $5,000 C1) $5.000-$0.990 C1 $10.000-824,969 [7] $25,000-0F MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.O. Box 12070 ‘Austin, Texas 78711-2070 (612) 463-5800 _ 1-800-325-8506

REPRESENTATION BY LEGISLATOR BEFORE PART 16 |

STATE AGENCY

Kiscrenucone

This section applies only to members of the Texas Legislature. Amember of the Texas Legislature who represents a person

for compensation before a state agency in the executive branch must provide the name of the agency, the

name of the person represented, and the category of the amount of the fee received for the representation. For more

information, see FORM PFS-INSTRUCTION GUIDE,

Note: Beginning September 1, 2003, legislators may not, for compensation, represent another person before a state

agency in the executive branch. The prohibition does not apply if: (1) the representation is pursuant to an attorney/client

relationship ina criminal law matter, (2) the representation involves the fling of documents that involve only ministerial acts

‘on the part of the agency; or (3) the representation is in regard to a matter for which the legislator was hired before

‘September 1, 2003,

u STATE AGENCY

2

PERSON REPRESENTED

3

oe cee Lites Tuan $5,000 (1 $5,000-$9.999 1] s10,000-$24,000 [1] $25,000-0R MORE

‘STATE AGENCY

PERSON REPRESENTED

FEE CATEGORY Tess tian $5,000 (1 $5.000-s5.999 C1] $10.000-824,900 1 $25,000-0F MORE

STATE AGENCY

PERSON REPRESENTED

ee CoteCOrny, Tess THaN $5,000 C1 $5.000-$9.999 C] $10.000-$24.069 |] $25,000-0F MORE:

STATE AGENCY

PERSON REPRESENTED

ee Ctess Tran $5,000 2 ss.000-89.999 1] s10,000-$24.000 C1 $25,000-0R MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.O. Box 12070 Austin, Texas 78711-2070 (512)463-5800_ 1-800-325-8506

BENEFITS DERIVED FROM FUNCTIONS HONORING part 17

PUBLIC SERVANT

[Alsotveeucanie

Section 36.10 of the Penal Code provides that the gift prohibitions set outin section 36.08 of the Penal Code do not apply

to benef derived from a function in honor or appreciation of a public servant required o flea statement under chapter 572

ofthe Government Code or tite 15 ofthe Election Code if the benefit and the source of any benefit over $50 in value are: 1)

reported inthe statement and 2) the benefits used solely to defray expenses that accrue inthe performance of duties or

activities in connection with the office which are nonreimbursable by the state ora political subdivision. If such a beneftis

received andi not reported by the public servant under ite 15 ofthe Election Code, the beneftis reportable here, For more

information, see FORM PFS-INSTRUCTION GUIDE.

' SOURCE OF BENEFIT

2

BENEFIT

SOURCE OF BENEFIT

BENEFIT

‘SOURCE OF BENEFIT

BENEFIT

‘SOURCE OF BENEFIT

BENEFIT

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0..Box 12070

LEGISLATIVE CONTINUANCES

Austin, Texas 78711-2070

(612) 463-5800

1-200-026-8506,

PART 18

Axvorsreucasie

Identity any legislative continuance that you have applied for or obtained under section 30,003 of the Civil Practice

‘and Remedies Code, or under another law or rule that requires or permits a court to grant continuances on the

‘grounds that an attomey for a party is a member or member-elect ofthe legislature

NAME OF PARTY

REPRESENTED

DATERETAINED

STYLE, CAUSE NUMBER,

COURT & JURISDICTION

DATE OF CONTINUANCE

APPLICATION

WAS CONTINUANCE

GRANTED? Oves

NAME OF PARTY

REPRESENTED

DATE RETAINED

STYLE, CAUSE NUMBER,

COURT, & JURISDICTION

DATE OF CONTINUANCE

APPLICATION

WAS CONTINUANCE

GRANTED? Oves

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethice Commission .0.B0x12070__

PERSONAL FINANCIAL STATEMENT AFFIDAVIT

_Austin, Texas 78711-2070 (512)483-5800_ 1-800-325-8506

‘The aw requires the personal financial statement to be verified. The verification page must have the signature of the

individual required to fle the personal financial statement, as well as the signature and stamp or seal of office of a notary

public or other person authorized by law to administer oaths and affirmations, Without proper verification, the statement

is not considered filed

| swear, or affirm, under penalty of perjury, that this financial statement

covers calendar year ending December 31, 2009, and is true and correct

{nd includes all information required to be reported by me under chapter

572 of the Government Code.

“on Broun je of 7

ry Publ, State of Texas

‘My Commission Epes

Morch 09, 2012

/AFFIX NOTARY STAMP / SEAL ABOVE

wom o and subectes tao me, ty te sna Danis! lon foe out

Agni l 20 £0 _ . to certify which, witness my i and seal of office.

Sionatre of ocr ediistng ca Pont nme of fcr aministng oat Tie of eticersdmitelog oh

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Homeland Security BudgetDocument183 pagesHomeland Security BudgetTexas Watchdog100% (1)

- Drop Settlement AnnouncmentDocument2 pagesDrop Settlement AnnouncmentTexas WatchdogNo ratings yet

- Kentucky Resources Council 990 (2009)Document12 pagesKentucky Resources Council 990 (2009)Texas WatchdogNo ratings yet

- Kentucky Senate Bill 88Document5 pagesKentucky Senate Bill 88Texas WatchdogNo ratings yet

- Senate Bill 13Document6 pagesSenate Bill 13Texas WatchdogNo ratings yet

- Senate Bill 14Document24 pagesSenate Bill 14Texas WatchdogNo ratings yet

- Kentucky Resources Council 990 (2008)Document12 pagesKentucky Resources Council 990 (2008)Texas WatchdogNo ratings yet

- Kentucky Resources Council 990 (2010)Document27 pagesKentucky Resources Council 990 (2010)Texas WatchdogNo ratings yet

- Project Connect/ Urban Rail ReportDocument22 pagesProject Connect/ Urban Rail ReportTexas WatchdogNo ratings yet

- OIG Report On Homeland Security Spending by State of TexasDocument53 pagesOIG Report On Homeland Security Spending by State of TexasTexas WatchdogNo ratings yet

- Economic Analysis of Critical Habitat Designation For Four Central Texas SalamandersDocument138 pagesEconomic Analysis of Critical Habitat Designation For Four Central Texas SalamandersTexas WatchdogNo ratings yet

- Texans For Public Justice Lawsuit ReleaseDocument2 pagesTexans For Public Justice Lawsuit ReleaseTexas WatchdogNo ratings yet

- Hog Catcher Liberty County TexasDocument1 pageHog Catcher Liberty County TexasTexas WatchdogNo ratings yet

- The Cost of The Production Tax Credit and Renewable Energy Subsidies in TexasDocument4 pagesThe Cost of The Production Tax Credit and Renewable Energy Subsidies in TexasTexas WatchdogNo ratings yet

- Road Map To RenewalDocument72 pagesRoad Map To RenewalTexas WatchdogNo ratings yet

- Texas Revenue EstimateDocument100 pagesTexas Revenue EstimateTexas WatchdogNo ratings yet

- School Finance 101 01142011Document50 pagesSchool Finance 101 01142011Texas WatchdogNo ratings yet

- Preview of "Tex. Att'y Gen. Op. No. ... G Abbott Administration"Document4 pagesPreview of "Tex. Att'y Gen. Op. No. ... G Abbott Administration"Texas WatchdogNo ratings yet

- Coburn Safety at Any PriceDocument55 pagesCoburn Safety at Any PriceAaron NobelNo ratings yet

- Cityreferenda DownballotDocument2 pagesCityreferenda DownballotTexas WatchdogNo ratings yet

- Your Money and Pension ObligationsDocument24 pagesYour Money and Pension ObligationsTexas Comptroller of Public AccountsNo ratings yet

- Weekly Weatherization ReportsDocument89 pagesWeekly Weatherization ReportsTexas WatchdogNo ratings yet

- State Employees ChangeDocument2 pagesState Employees ChangeTexas WatchdogNo ratings yet

- Travis County BallotDocument2 pagesTravis County BallotTexas WatchdogNo ratings yet

- Inspection ReportsDocument63 pagesInspection ReportsTexas Watchdog100% (1)

- Alamo ReportDocument38 pagesAlamo ReportTexas WatchdogNo ratings yet

- Travisco DownballotDocument3 pagesTravisco DownballotTexas WatchdogNo ratings yet

- Stateemployees PercentDocument1 pageStateemployees PercentTexas WatchdogNo ratings yet

- Nov 2012 Sample BallotDocument6 pagesNov 2012 Sample BallotMike MorrisNo ratings yet

- State Employees ChangeDocument2 pagesState Employees ChangeTexas WatchdogNo ratings yet