Professional Documents

Culture Documents

AUG-10 Mizuho Technical Analysis GBP USD

Uploaded by

Miir ViirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AUG-10 Mizuho Technical Analysis GBP USD

Uploaded by

Miir ViirCopyright:

Available Formats

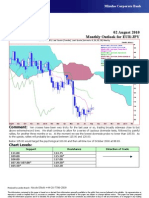

Mizuho Corporate Bank

Technical Analysis 10 August 2010

GBP

GBP=D3, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

15Apr10 - 15Sep10

Pr

1.6

1.59

61.8

1.58

1.57

1.56

50.0

1.55

1.54

1.53

38.2

1.52

1.51

1.5

1.49

1.48

GBP=D3 , Last Quote, Candle

1.47

10Aug10 1.5904 1.5905 1.5773 1.5793

GBP=D3 , Last Quote, Tenkan Sen 9

10Aug10 1.5776 1.46

GBP=D3 , Last Quote, Kijun Sen 26

10Aug10 1.5474 1.45

GBP=D3 , Last Quote, Senkou Span(a) 52

14Sep10 1.5625

1.44

GBP=D3 , Last Quote, Senkou Span(b) 52

14Sep10 1.5173

GBP=D3 , Last Quote, Chikou Span 26 1.43

06Jul10 1.5793

16Apr10 23Apr 30Apr 07May 14May 21May 28May 04Jun 11Jun 18Jun 25Jun 02Jul 09Jul 16Jul 23Jul 30Jul 06Aug 13Aug 20Aug 27Aug 03Sep 10Sep

Comment: Retreating from 61% Fibonacci retracement resistance. Let’s see whether the 9-day moving

average provides support as the 26-day average is a long way down. It is probably best if we were to drift sideways

for a week or two so that we get back to trendline support. Cable is no longer overbought and bullish momentum

remains strong.

Strategy: Attempt small longs at 1.5800; stop below 1.5660. First target 1.5900, then 1.6000.

Chart Levels:

Support Resistance Direction of Trade

1.5770 1.5907

1.5695 1.5970

1.5665 1.6000*

1.5545* 1.6125

1.5460* 1.6275

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Gbp-Usd-04 January 2010 DailyDocument1 pageGbp-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Eur-Usd-04 January 2010 DailyDocument1 pageEur-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- 65Document1 page65Ahmed MohamedNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Duplex09 PADocument1 pageDuplex09 PADenice LópezNo ratings yet

- Dúplex Pa - Repre IiiDocument1 pageDúplex Pa - Repre IiiMajo ReyesNo ratings yet

- Chart P H R134a PDFDocument1 pageChart P H R134a PDFDianNo ratings yet

- AUG-05 Mizuho Technical Analysis EUR USDDocument1 pageAUG-05 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- SebastianDocument1 pageSebastianDj Mike Iasi djNo ratings yet

- Pekerjaan Tahap 2: Denah Instalasi P.ABK. P.AK. P.VT. Dan P.Ah Lantai 1Document1 pagePekerjaan Tahap 2: Denah Instalasi P.ABK. P.AK. P.VT. Dan P.Ah Lantai 1Hasby ReyhanNo ratings yet

- EUR USDUPDATEApril23Document2 pagesEUR USDUPDATEApril23api-26441337No ratings yet

- Plan Trotuare Denis v2Document1 pagePlan Trotuare Denis v2Mihai TataruNo ratings yet

- 7Document1 page7Mohamed Khaled Elsayed GadNo ratings yet

- A B C D: Front Elevation Right Side ElevationDocument1 pageA B C D: Front Elevation Right Side Elevationkerenjoy santiagoNo ratings yet

- D220-Ew-Cljv-Shd-410016-C Earthworks - Shp.causeway 1 Cross Sections-Sheet 6 of 27Document1 pageD220-Ew-Cljv-Shd-410016-C Earthworks - Shp.causeway 1 Cross Sections-Sheet 6 of 27eddieNo ratings yet

- LEZAME - 05.06.2023-CORRECTO-ModelDocument1 pageLEZAME - 05.06.2023-CORRECTO-ModelTANIA ACARO CHININININNo ratings yet

- Nursery LayoutDocument1 pageNursery LayoutShadik BashaNo ratings yet

- Casing Cover: Av, BV, CV, DV Control Unit Assembly CustomerDocument1 pageCasing Cover: Av, BV, CV, DV Control Unit Assembly CustomerIR MA Al AzharNo ratings yet

- Final DRWG Factory Survey 2-9-2017Document1 pageFinal DRWG Factory Survey 2-9-2017ssdprojects RexNo ratings yet

- Architectural school floor plan analysisDocument1 pageArchitectural school floor plan analysisWalter Jesús IpialesNo ratings yet

- Final ProjectDocument1 pageFinal ProjectRahma SaefNo ratings yet

- Detaliul A-A Scara 1:20: Produced by An Autodesk Student VersionDocument1 pageDetaliul A-A Scara 1:20: Produced by An Autodesk Student VersionSHaZaMNo ratings yet

- Model de Parter Și SuprafețeDocument1 pageModel de Parter Și SuprafețeI am DavidNo ratings yet

- DG Nivel 1 PDFDocument1 pageDG Nivel 1 PDFKevin VillegasNo ratings yet

- 8Document1 page8Mohamed Khaled Elsayed GadNo ratings yet

- MEC321P Thermal Engineering Practice Expt-4: Vapour Compression Refrigeration SystemDocument5 pagesMEC321P Thermal Engineering Practice Expt-4: Vapour Compression Refrigeration Systemm sriNo ratings yet

- 6Document1 page6Mohamed Khaled Elsayed GadNo ratings yet

- AUDITORIO CASA DE LA CULTURA HUANCAYO-ModelDocument1 pageAUDITORIO CASA DE LA CULTURA HUANCAYO-ModelBrandon RiveraNo ratings yet

- Lantai 2Document1 pageLantai 2rizky dwi anandaNo ratings yet

- Universidad Nacional Federico Villarreal: Mercado Vecinal MódulosDocument1 pageUniversidad Nacional Federico Villarreal: Mercado Vecinal MóduloscesarNo ratings yet

- Platinum 9 - Second FloorDocument1 pagePlatinum 9 - Second FloorChetan PatilNo ratings yet

- MyFXForecastsforTHURSDAY July29thDocument2 pagesMyFXForecastsforTHURSDAY July29thapi-26441337No ratings yet

- 11Document1 page11Mohamed Khaled Elsayed GadNo ratings yet

- Analyzing the floor plan layout and measurementsDocument1 pageAnalyzing the floor plan layout and measurementsDavid LucasNo ratings yet

- Planos Estructurales Plazoleta 3 Palmas-Est-101Document1 pagePlanos Estructurales Plazoleta 3 Palmas-Est-101cesar avilaNo ratings yet

- UntitledDocument1 pageUntitledValeria TurizoNo ratings yet

- Plano Arquitectónico Casa 1 PlantaDocument1 pagePlano Arquitectónico Casa 1 PlantaKaren BustosNo ratings yet

- Des H3 05042012-ModelDocument1 pageDes H3 05042012-Modelmarco baptistaNo ratings yet

- Rampa Pendiente10%Document1 pageRampa Pendiente10%Rómulo Yucra RodasNo ratings yet

- My LATESTFXForecastsfor MAY13Document2 pagesMy LATESTFXForecastsfor MAY13api-26441337No ratings yet

- Casa Castillo Project Materials ListDocument1 pageCasa Castillo Project Materials Listcopy centerNo ratings yet

- Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Comparativa Superposicion S703Document1 pageComparativa Superposicion S703RICARDO HERNANDEZ AMAYANo ratings yet

- Cuarto TV Asc Byl Despensa Cocina: Nivel 1Document1 pageCuarto TV Asc Byl Despensa Cocina: Nivel 1DAPAMINo ratings yet

- Autodesk educational product plan of semi-basementDocument1 pageAutodesk educational product plan of semi-basementAlicia Apreciado RiveraNo ratings yet

- Casa NieciDocument1 pageCasa NieciIng. Lemuel Sanchez PaucarNo ratings yet

- Planta Arquitectonica Apt - 1001Document1 pagePlanta Arquitectonica Apt - 1001Maria Alejandra VivancoNo ratings yet

- Casa-moderna-en-forma-de-L-ModeloDocument1 pageCasa-moderna-en-forma-de-L-Modeloeduardotek5506kNo ratings yet

- 01 Avandaro Trazo IDocument1 page01 Avandaro Trazo IRodrigo MezaNo ratings yet

- Plan Parter Scara 1:100: Apartament 4Document1 pagePlan Parter Scara 1:100: Apartament 4Victor RîndunicaNo ratings yet

- Loja 10 Centermega-Layout1Document1 pageLoja 10 Centermega-Layout1Diego NunesNo ratings yet

- DG Nivel 2 y 3 PDFDocument1 pageDG Nivel 2 y 3 PDFKevin VillegasNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- What Is AccountingDocument12 pagesWhat Is AccountingallahabadNo ratings yet

- STE ProposalDocument3 pagesSTE ProposalShreyash KarmoreNo ratings yet

- Quiz 1 - Intacc 2Document9 pagesQuiz 1 - Intacc 2Eleina SwiftNo ratings yet

- Kotak Final Project Car FinancesDocument72 pagesKotak Final Project Car FinancesPrithviraj KumarNo ratings yet

- Darden Resumes BookDocument48 pagesDarden Resumes BookSaurabh KhatriNo ratings yet

- A Comprehensive Risk Appetite Framework For Banks enDocument12 pagesA Comprehensive Risk Appetite Framework For Banks enRachael Misan-Ruppee100% (2)

- Contact HBL for installment plans or visit websiteDocument4 pagesContact HBL for installment plans or visit websiteKhizar HayatNo ratings yet

- SLM-19616-B Com-Financial Markets and ServicesDocument99 pagesSLM-19616-B Com-Financial Markets and ServicesDeva T NNo ratings yet

- Audit Program Liabilities Against AssetsDocument11 pagesAudit Program Liabilities Against AssetsRoemi Rivera Robedizo100% (3)

- CPBM Gen AnsDocument118 pagesCPBM Gen Ansmadhu pNo ratings yet

- Nike CorruptionDocument41 pagesNike CorruptionLas Vegas Review-JournalNo ratings yet

- Sol. Man. - Chapter 19 - Borrowing Costs - Ia Part 1B 1Document7 pagesSol. Man. - Chapter 19 - Borrowing Costs - Ia Part 1B 1Rezzan Joy Camara Mejia100% (2)

- Intercontinental Bank Debunks Akingbola's Claims - 101010Document2 pagesIntercontinental Bank Debunks Akingbola's Claims - 101010ProshareNo ratings yet

- A Study On MFS in India FinalDocument83 pagesA Study On MFS in India Finalanas khanNo ratings yet

- Citigroup Sued For Fraud Over $1 Billion of CDOs - Loreley Financing v. Citigroup ComplaintDocument82 pagesCitigroup Sued For Fraud Over $1 Billion of CDOs - Loreley Financing v. Citigroup Complaint83jjmackNo ratings yet

- Internship Sindh BankDocument34 pagesInternship Sindh BankKR Burki100% (1)

- Vouching of The Payment Side of CashbookDocument28 pagesVouching of The Payment Side of CashbookSaba Akrem100% (1)

- Subject Verb AgreementDocument5 pagesSubject Verb AgreementHarish Yadav100% (1)

- The Goldman Sachs Group - Financial Analysis AssignmentDocument4 pagesThe Goldman Sachs Group - Financial Analysis AssignmentJeremy RichuNo ratings yet

- Section BDocument56 pagesSection BForeclosure Fraud100% (1)

- Settlement of deceased's assets without legal representationDocument18 pagesSettlement of deceased's assets without legal representationAjay GargNo ratings yet

- Loans and Deposits ExplainedDocument8 pagesLoans and Deposits ExplainedVsgg NniaNo ratings yet

- English Form For DB Account Opening Form For StudentsDocument7 pagesEnglish Form For DB Account Opening Form For StudentsFelly M. LogioNo ratings yet

- Assistant Accountant JD - Colly MpofuDocument2 pagesAssistant Accountant JD - Colly Mpofupeter mulilaNo ratings yet

- Asset Liability ManagementDocument71 pagesAsset Liability ManagementRohit SharmaNo ratings yet

- 2018 List of CasesDocument111 pages2018 List of CasescjadapNo ratings yet

- Banking Cases on Redemption Periods, Public Interest, and DiligenceDocument18 pagesBanking Cases on Redemption Periods, Public Interest, and DiligenceJerald-Edz Tam AbonNo ratings yet

- UCT Handbook 12 2019 StudentFees PDFDocument132 pagesUCT Handbook 12 2019 StudentFees PDFNjabulo DlaminiNo ratings yet

- HSBC BankDocument40 pagesHSBC BankPrasanjeet PoddarNo ratings yet

- Financial Development, Financial Inclusion, and Informality: New International EvidenceDocument36 pagesFinancial Development, Financial Inclusion, and Informality: New International EvidencececaNo ratings yet