Professional Documents

Culture Documents

8391786

Uploaded by

Rajat AggarwalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

8391786

Uploaded by

Rajat AggarwalCopyright:

Available Formats

FORM NO.

16 A

[SEE RULE 31 (1) (B) ] Sr.No. 74629

Certificate of Deduction Of Tax at Sources Under

Section 203 of The Income Tax Act, 1961

----------------------------------------------------------------------------------------------------------------------------------

For interest on securities: dividends: interest other than interest on securities winings from lottery or crossword puzzle winnings from horse race payment to contractors

and subcontractors insurance commission payment to non-resident sportsmen/sports associations payment in respect of deposits under national savings scheme

payment on account of repurchase of units by mutual fund or unit trust of india commission,remuneration or prize on sale of lottery tickets rent fees for professional or

technical services income in respect of units payment of companies referred to in section 196A(2)income from units refered to in section 196B income from foreign

currency bonds or shares of an indian company referred to in section 196C income of foreign institutional investors from securities refered to in section 196D.

----------------------------------------------------------------------------------------------------------------------------------

Name and address of the person deduction tax Acknowlegement Nos. of all Quarterly statement of TDS Name & address of the person to whom payment made

under section 2000 as provided by TIN facilitation or in credited.

centre or NSDL web-site

Quater1 : 071110500020501

Quater2 : 071110500026226

Quater3 : 071110600023153

Quater4 : To be Filed

----------------------------------------------------------------------------------------------------------------------------------

Fashion Suitings Pvt.Ltd.,RCM World, Hamirgarh ITO TDS BHILWARA MOHAN LAL AGGARWAL DI8391786 49,

Road,RIICO Growth Centre,Bhilwara- KANGANWAL ROAD NEAR HINDUSTAN

311001,Rajasthan,INDIA TYRES LUDHIANA Ludhiana Punjab

----------------------------------------------------------------------------------------------------------------------------------

Tax Deduction A/c No. Of The Deductor JDHF00159F Nature Of Payment COMMISSION PAN/GIR of Payee PANNOTAVBL

----------------------------------------------------------------------------------------------------------------------------------

PAN/GIR No. Of The Deductor AAACF3294L For The Period Of 01/04/2008 To 31/03/2009

----------------------------------------------------------------------------------------------------------------------------------

Detail Of Payment Tax Deduction and Deposit Of Tax Into Central Government Account

----------------------------------------------------------------------------------------------------------------------------------

S. No. Amount Paid Date of TDS Surcharge Ed.Ces. Total Tax BSR Code of Date Challan

Credited Payment Deposited Bank

----------------------------------------------------------------------------------------------------------------------------------

1 3170 10-01-2009 317 0 10 327 6360218 07-02-2009 6124

2 67 10-02-2009 7 0 0 7 6360218 07-03-2009 3643

3 70 10-03-2009 7 0 0 7 6360218 30-03-2009 11138

4 43352 31-03-2009 4335 0 143 4478 6360218 30-04-2009 1378

----------------------------------------------------------------------------------------------------------------------------------

46659 4666 0 153 4819

----------------------------------------------------------------------------------------------------------------------------------

Certified That a Sum of Rupees Four Thousand Eight Hundreds Nineteen Only has been deducted at source and paid to the credit of Central

Government as per detail given above.

Place :-Bhilwara

Dated :-30-04-2009

For Fashion Suitings Pvt. Ltd.

Sd/-

(Wriddhi Chand Jain)

Authorised Signatory

Signature of Person Responsible for Deduction of Tax

You might also like

- NF22697104417913 ETicketDocument2 pagesNF22697104417913 ETicketRajat AggarwalNo ratings yet

- A Theory of Single-Viewpoint Catadioptric Image FormationDocument22 pagesA Theory of Single-Viewpoint Catadioptric Image FormationRajat AggarwalNo ratings yet

- From Sound To Music: CSC 161: The Art of Programming Prof. Henry Kautz 11/16/2009Document23 pagesFrom Sound To Music: CSC 161: The Art of Programming Prof. Henry Kautz 11/16/2009Rajat AggarwalNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Book 1Document2 pagesBook 1Rajat AggarwalNo ratings yet

- Book 1Document2 pagesBook 1Rajat AggarwalNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PayslipDocument2 pagesPayslipAbdul JabarNo ratings yet

- PwcSalesInvoiceReport DesignJCDocument2 pagesPwcSalesInvoiceReport DesignJCCHOTINo ratings yet

- CTS India Night Shift PolicyDocument4 pagesCTS India Night Shift Policynivasshaan50% (2)

- Taxation of Newly Established BusinessesDocument15 pagesTaxation of Newly Established BusinessesPrakhar KesharNo ratings yet

- 0310000100113329ffd - PSP (1) .RPTDocument4 pages0310000100113329ffd - PSP (1) .RPTrahulNo ratings yet

- Triple L Food Corp 2306 - JollibeeDocument1 pageTriple L Food Corp 2306 - JollibeeclarikaNo ratings yet

- Salary Slip: Month Employee Name: Year Designation: School Name Income Tax PANDocument2 pagesSalary Slip: Month Employee Name: Year Designation: School Name Income Tax PANMohamad SallihinNo ratings yet

- Final Updated FY 2018-19 Revenue PerformanceDocument8 pagesFinal Updated FY 2018-19 Revenue PerformanceThe Star KenyaNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceNeha RawatNo ratings yet

- OCTOBER 2021: PT. Shopee Internasional IndonesiaDocument1 pageOCTOBER 2021: PT. Shopee Internasional IndonesiaRifka FitrotuzzakiaNo ratings yet

- Inter Paper11Document553 pagesInter Paper11PANDUNo ratings yet

- MULTIPLE CHOICE QUESTIONS IN TAX REVIEW Jan 5Document1 pageMULTIPLE CHOICE QUESTIONS IN TAX REVIEW Jan 5Quasi-Delict89% (18)

- Terminal Cash FlowDocument9 pagesTerminal Cash FlowKazzandraEngallaPaduaNo ratings yet

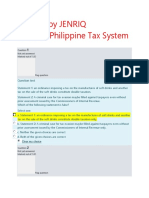

- Created by JENRIQ Quiz 1 - Philippine Tax System: Question TextDocument6 pagesCreated by JENRIQ Quiz 1 - Philippine Tax System: Question TextMarvin DeinlaNo ratings yet

- 20220407T115419 - Afq Inv Sa 2022 1586492Document4 pages20220407T115419 - Afq Inv Sa 2022 1586492Hassan ShathakNo ratings yet

- Budget 2021 Summary Mrunal Competitive ExamsDocument24 pagesBudget 2021 Summary Mrunal Competitive ExamsVarun MatlaniNo ratings yet

- GSTR 1Document70 pagesGSTR 1vassudevanrNo ratings yet

- Multilateral Instrument (Mli) ConventionDocument8 pagesMultilateral Instrument (Mli) ConventionTaxpert Professionals Private LimitedNo ratings yet

- Management Control Systems, Transfer Pricing, and Multinational ConsiderationsDocument9 pagesManagement Control Systems, Transfer Pricing, and Multinational ConsiderationsMurtaza A ZaveriNo ratings yet

- I. Doctrines in Taxation: I.1. Prospectivity of Tax Laws I. Prescriptions Found in StatutesDocument1 pageI. Doctrines in Taxation: I.1. Prospectivity of Tax Laws I. Prescriptions Found in StatutesAdam CuencaNo ratings yet

- Premier Tower: Thanks For VisitDocument7 pagesPremier Tower: Thanks For VisitVikki DadaNo ratings yet

- Notice of RegistrationDocument1 pageNotice of Registrationbra9tee9tini100% (1)

- Obillos, Jr. vs. Commissioner of Internal Revenue, No. L-68118 - Case Digest (Co-Ownership Nor Sharing in Gross Returns Not Itself Partnership)Document1 pageObillos, Jr. vs. Commissioner of Internal Revenue, No. L-68118 - Case Digest (Co-Ownership Nor Sharing in Gross Returns Not Itself Partnership)Alena Icao-AnotadoNo ratings yet

- FABM2 Summative Test # 4Document2 pagesFABM2 Summative Test # 4randy magbudhi67% (3)

- Taxation of Employment IncomeDocument7 pagesTaxation of Employment IncomeJamvy Jose FernandezNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pritish SahalotNo ratings yet

- Busi Tax 3Document2 pagesBusi Tax 3Jason MalikNo ratings yet

- Inclusion and Exclusion of Gross Income Summary Review by ValenciaDocument6 pagesInclusion and Exclusion of Gross Income Summary Review by ValenciaMichael Pelingon Severo100% (1)

- InvoiceDocument1 pageInvoiceChandrika NagarajNo ratings yet

- Guide To CGSTDocument12 pagesGuide To CGSTSunil RAYALASEEMA GRAPHICSNo ratings yet