Professional Documents

Culture Documents

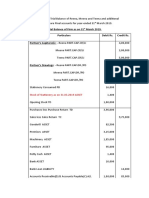

Determining Difference in Net Profit Under Cash Basis

Uploaded by

agrawalrohit_2283840 ratings0% found this document useful (0 votes)

8 views5 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views5 pagesDetermining Difference in Net Profit Under Cash Basis

Uploaded by

agrawalrohit_228384Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 5

JOURNAL ENTRIES ACCORDING TO CASH BASIS

DATE PARTICULARS L.F. DEBIT CREDIT

APR 1 Bank a/c Dr 20,000

To Capital a/c 20,000

APR 5 Rent a/c Dr 3,600

To Cash a/c 3,600

APR 7 Office supplies Dr 610

To Cash a/c 610

APR 9 Cash a/c Dr 9,200

To Revenue from services 9,200

APR 16 Salaries a/c Dr 1,600

To Cash a/c 1,600

APR 24 Telephone Expense Dr 470

To Cash a/c 470

APR 28 Cash a/c Dr 2,600

To Revenue from services 2,600

NET PROFIT UNDER CASH BASIS

REVENUES

Revenue from services 9,200

Revenue from services (Advance) 2,600

Total Revenues 11,800

EXPENSES

Rent Expense 3,600

Office Supplies Expense 610

Salaries Expense 1,600

Telephone Expense 470

Total Expenses 6,280

Net Profit 11,800 – 6,280= 5,520

JOURNAL ENTRIES ACCORDING TO ACCURAL BASIS

DATE PARTICULARS L.F. DEBIT CREDIT

APR 1 Bank a/c Dr 20,000

To Capital a/c 20,000

APR 5 Prepaid rent a/c Dr 3,600

To Cash a/c 3,600

APR 7 Office supplies Dr 610

To Cash a/c 610

APR 9 Cash a/c Dr 9,200

To Revenue from services 9,200

APR 16 Salaries a/c Dr 1,600

To Cash a/c 1,600

APR 19 Unbilled revenue (debtor) Dr 9,700

To revenue from services a/c 9,700

APR 24 Telephone Expense Dr 470

To Cash a/c 470

APR 28 Cash a/c Dr 2,600

To Revenue from services 2,600

ADJUSTMENT ENTRIES

DATE PARTICULARS L.F. DEBIT CREDIT

APR 30 Rent a/c Dr 1,200

To Prepaid Rent a/c 1,200

APR 30 Office supplies exp. a/c Dr 430

To Office supplies 430

APR 30 Electricity exp. a/c Dr 1,600

To Electricity Payable a/c 1,600

APR 30 Salary Expenses Dr 1,600

To salary payable a/c 1,600

NET PROFIT UNDER ACCRUAL BASIS

REVENUES

Revenue from services 9,200

Billed Revenue 9,700

Total Revenues 18,900

EXPENSES

Rent Expense 1200

Office Supplies Expense 610-180 =430

Salaries Expense 1,600 +1600 = 3200

Telephone Expense 470

Electricity Exp. 130

Total Expenses 5430

Net Profit 18900 –5430 = 13470

You might also like

- Kapoor Software LTD CRCTD AnswerDocument9 pagesKapoor Software LTD CRCTD AnswerMaryNo ratings yet

- Journal Entries LedgerDocument8 pagesJournal Entries LedgerpranaviNo ratings yet

- Dey's Solution Book Accountancy XII Part-A 2021-22 EditionDocument56 pagesDey's Solution Book Accountancy XII Part-A 2021-22 Editionmanoj jainNo ratings yet

- Journal Entries: Date Particular Debit CreditDocument10 pagesJournal Entries: Date Particular Debit CreditHarshit SinglaNo ratings yet

- FA Book ProblemDocument8 pagesFA Book ProblemPhuntru PhiNo ratings yet

- Accounting For Decision MakingDocument15 pagesAccounting For Decision MakingbrammaasNo ratings yet

- ADJUSTING AND CLOSING ENTRIES Assignment Nov 20 2020Document4 pagesADJUSTING AND CLOSING ENTRIES Assignment Nov 20 2020Kayle MallillinNo ratings yet

- KP ProblemDocument14 pagesKP ProblemTanveer Ali ShahNo ratings yet

- Activity 2-1 Labausa Catering (Answer)Document13 pagesActivity 2-1 Labausa Catering (Answer)Vince EspinoNo ratings yet

- Problem 2 - Poque Accounting3Document6 pagesProblem 2 - Poque Accounting3Marites AmorsoloNo ratings yet

- Btap KTTCDocument5 pagesBtap KTTChuongcute2003No ratings yet

- In The Books of Ajit Trading A/C & P/L Account For The Year Ended 31.3.16 Particulars Amount AmountDocument43 pagesIn The Books of Ajit Trading A/C & P/L Account For The Year Ended 31.3.16 Particulars Amount AmountflamerydersNo ratings yet

- Kapoor Software Lid Case StudyDocument9 pagesKapoor Software Lid Case StudyRaghav GiramNo ratings yet

- Class Work Journal EntryDocument16 pagesClass Work Journal EntryRishabh ChawlaNo ratings yet

- Activity 19. in This Activity You Will Assemble The Data in Order For You To PrepareDocument2 pagesActivity 19. in This Activity You Will Assemble The Data in Order For You To PrepareVibe VreeNo ratings yet

- Waltham Oil - SolutionDocument11 pagesWaltham Oil - SolutionAniruddha Bhatta PGP 2022-24 BatchNo ratings yet

- BSBMGT517 - Profit and Loss StatementDocument1 pageBSBMGT517 - Profit and Loss StatementSonam SharmaNo ratings yet

- PGBPDocument3 pagesPGBPJimmy ShergillNo ratings yet

- Practical 1Document31 pagesPractical 1Rohit ReddyNo ratings yet

- General Journal Ref Date Account Titles & Explanation Debit CreditDocument5 pagesGeneral Journal Ref Date Account Titles & Explanation Debit CreditG02 BANDELARIA ChristellNo ratings yet

- Cash DR. CRDocument5 pagesCash DR. CRMANALI SINGHNo ratings yet

- A To Z Cool Centre Prop: MD - Kamil Profit and Loss Account For The Year Ended 31St March 2019 Particulars Amount in Rs. Particulars Amount in RsDocument2 pagesA To Z Cool Centre Prop: MD - Kamil Profit and Loss Account For The Year Ended 31St March 2019 Particulars Amount in Rs. Particulars Amount in Rsajaya thakurNo ratings yet

- Vogue Co. Ledger - TB - FsDocument8 pagesVogue Co. Ledger - TB - FsNavneet SharmaNo ratings yet

- Act. 16-19Document4 pagesAct. 16-19ジェフ ァーソンNo ratings yet

- Accounts Solution Mock 2 12-11Document21 pagesAccounts Solution Mock 2 12-11Foundation Group tuitionNo ratings yet

- Q4 Partnership Final Accs QuestionsDocument4 pagesQ4 Partnership Final Accs QuestionsIsha KatiyarNo ratings yet

- Voucher - September 2019Document20 pagesVoucher - September 2019Kirby ReyesNo ratings yet

- Accounting Apalisoc ProblemDocument10 pagesAccounting Apalisoc ProblemJoyce CariñoNo ratings yet

- Ledger Posting 2.2 MR.Z Established Computer Care Ltd. During August She Completed The Following TransactionsDocument4 pagesLedger Posting 2.2 MR.Z Established Computer Care Ltd. During August She Completed The Following TransactionsSvijayakanthan SelvarajNo ratings yet

- ACCT 1002 Past Paper (1) SolutionsDocument9 pagesACCT 1002 Past Paper (1) SolutionsClaire CumminsNo ratings yet

- Accounts4 Sem1Document16 pagesAccounts4 Sem1api-3849048No ratings yet

- Water Bill, Connection, Fitting, Registration, Telephone, Insurance Account DetailsDocument4 pagesWater Bill, Connection, Fitting, Registration, Telephone, Insurance Account DetailsSailesh VasaNo ratings yet

- Q5 Partnership Final Accs QuestionsDocument2 pagesQ5 Partnership Final Accs QuestionsIsha KatiyarNo ratings yet

- ACC111 - Activity19&20Document2 pagesACC111 - Activity19&20Triquesha Marriette Romero RabiNo ratings yet

- Branch AccountsDocument9 pagesBranch AccountsKalpana SinghNo ratings yet

- Ans - 21.11.23 CA-foun. MTP Accounts Dec. 23Document10 pagesAns - 21.11.23 CA-foun. MTP Accounts Dec. 23RohitNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- q.3 BK Chp.1 Syjc h077Document8 pagesq.3 BK Chp.1 Syjc h077Isha KatiyarNo ratings yet

- Unadjusted Trial Balance and Financial StatementsDocument15 pagesUnadjusted Trial Balance and Financial Statementspatel avaniNo ratings yet

- Test 3-11Document2 pagesTest 3-11TIÊN NGUYỄN LÊ MỸNo ratings yet

- Q2 Partnership Final Accounts Online Questions q2Document3 pagesQ2 Partnership Final Accounts Online Questions q2Isha KatiyarNo ratings yet

- Accounts Case Study 78Document4 pagesAccounts Case Study 78Vraj AdrojaNo ratings yet

- Lala Trading's financial statements for year ended 2018Document4 pagesLala Trading's financial statements for year ended 2018GIROLYDIA EDDYNo ratings yet

- Practice Test Answers CH 12Document3 pagesPractice Test Answers CH 12Adoree RamosNo ratings yet

- Ex 2Document13 pagesEx 2Phuong Vu HongNo ratings yet

- QuestionDocument5 pagesQuestionakhileshmoney143No ratings yet

- Accounts a MTP CAF Apr 2021Document12 pagesAccounts a MTP CAF Apr 2021backuphpdv6No ratings yet

- Class Activity, Recording Transactions (With T Account, Trial)Document33 pagesClass Activity, Recording Transactions (With T Account, Trial)ANAS ABBASINo ratings yet

- Problem P2 2ADocument2 pagesProblem P2 2ASHAMSUN NAHARNo ratings yet

- Main 3 - Claveria, Jenny PDFDocument18 pagesMain 3 - Claveria, Jenny PDFSheena marie ClaveriaNo ratings yet

- Depreciation Expense A/c: Statement FormatDocument7 pagesDepreciation Expense A/c: Statement FormatAnup PandeyNo ratings yet

- Aminah Quiz Answer Done by Abdullah Narejo-The Great.Document10 pagesAminah Quiz Answer Done by Abdullah Narejo-The Great.Abdullah NarejoNo ratings yet

- Buku BesarDocument32 pagesBuku BesarAlmer Faishal WafiNo ratings yet

- AB Hospitality BusinessDocument15 pagesAB Hospitality BusinessAfrin rahman miliNo ratings yet

- Realisation Accounts and Capital AccountsDocument14 pagesRealisation Accounts and Capital AccountsIsha KatiyarNo ratings yet

- BRANCH ACCOUNTS - Assignment SolutionsDocument9 pagesBRANCH ACCOUNTS - Assignment SolutionsNaveen C GowdaNo ratings yet

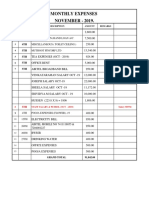

- Monthly Expenses NOVEMBER - 2019.: 1TH 1TH 4TH 5TH 5TH 5TH 5THDocument2 pagesMonthly Expenses NOVEMBER - 2019.: 1TH 1TH 4TH 5TH 5TH 5TH 5THBruno VincentNo ratings yet

- 10 Full Questions Till Closing Account BSSE (2A)Document33 pages10 Full Questions Till Closing Account BSSE (2A)Should Should100% (2)

- Financial Accounting: Master of Accounting and Auditing Course: Dr. Naser Abdel Kareem Student Name: Abdallah NamroutiDocument3 pagesFinancial Accounting: Master of Accounting and Auditing Course: Dr. Naser Abdel Kareem Student Name: Abdallah NamroutiHasan NajiNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Best Global BrandsDocument18 pagesThe Best Global Brandsagrawalrohit_228384No ratings yet

- The Great Leader - Sardar Vallabhbhai PatelDocument9 pagesThe Great Leader - Sardar Vallabhbhai Patelagrawalrohit_228384100% (1)

- The Power of Positive ThinkingDocument19 pagesThe Power of Positive Thinkingagrawalrohit_228384No ratings yet

- Parliamentary Election in IndiaDocument13 pagesParliamentary Election in Indiaagrawalrohit_228384No ratings yet

- Sardar Speech) FinalDocument3 pagesSardar Speech) Finalagrawalrohit_228384No ratings yet

- Smart GridDocument11 pagesSmart Gridagrawalrohit_228384No ratings yet

- Smart GridDocument11 pagesSmart Gridagrawalrohit_228384No ratings yet

- Sardar Vallabhbhai Patel: Builder of A Steel Strong IndiaDocument9 pagesSardar Vallabhbhai Patel: Builder of A Steel Strong Indiaagrawalrohit_228384No ratings yet

- India 2050Document19 pagesIndia 2050agrawalrohit_228384No ratings yet

- Maslow's Hierarchy TheoryDocument2 pagesMaslow's Hierarchy Theoryagrawalrohit_228384No ratings yet

- Middle East - The Obama InitiativeDocument14 pagesMiddle East - The Obama Initiativeagrawalrohit_228384No ratings yet

- Introduction To Microsoft Office03Document11 pagesIntroduction To Microsoft Office03agrawalrohit_228384No ratings yet

- If I Were The Ceo of Wal-MartDocument17 pagesIf I Were The Ceo of Wal-Martagrawalrohit_228384No ratings yet

- My Role Model - Sourav Chandidas GangulyDocument18 pagesMy Role Model - Sourav Chandidas Gangulyagrawalrohit_228384No ratings yet

- Management by Objectives: Presented By: Ashish Prajapati Seema Patil Vaibhav SinghDocument14 pagesManagement by Objectives: Presented By: Ashish Prajapati Seema Patil Vaibhav Singhagrawalrohit_228384No ratings yet

- If I Were Prime Minister of IndiaDocument20 pagesIf I Were Prime Minister of Indiaagrawalrohit_22838450% (2)

- TelanganaDocument18 pagesTelanganaagrawalrohit_228384No ratings yet

- First Year of Launch: Market ContextDocument5 pagesFirst Year of Launch: Market Contextagrawalrohit_228384No ratings yet

- Final Presentation On MisDocument22 pagesFinal Presentation On Misagrawalrohit_228384No ratings yet

- EnterprenuerDocument10 pagesEnterprenueragrawalrohit_228384No ratings yet

- Summers Report On Indian Cement Industry (Specially Ultra Tech Cement)Document78 pagesSummers Report On Indian Cement Industry (Specially Ultra Tech Cement)kapil60% (5)

- AccountDocument4 pagesAccountagrawalrohit_228384No ratings yet

- Wal MartDocument55 pagesWal Martagrawalrohit_228384100% (1)

- Group 6Document44 pagesGroup 6agrawalrohit_228384No ratings yet

- Econmics Demand and SupplyDocument11 pagesEconmics Demand and Supplyagrawalrohit_228384No ratings yet

- The Indian Telecom SectorDocument44 pagesThe Indian Telecom Sectoragrawalrohit_228384No ratings yet

- Sardar PatelDocument39 pagesSardar Patelagrawalrohit_228384No ratings yet

- SBBJDocument26 pagesSBBJagrawalrohit_228384No ratings yet

- Deployments and Deployment Attempts: Futuregrid, and The More Modern Intergrid and IntragridDocument22 pagesDeployments and Deployment Attempts: Futuregrid, and The More Modern Intergrid and Intragridagrawalrohit_228384No ratings yet

- Technology Management 1Document38 pagesTechnology Management 1Anu NileshNo ratings yet

- Republic Act No. 10667Document5 pagesRepublic Act No. 10667orionsrulerNo ratings yet

- Handbook of Value Added Tax by Farid Mohammad NasirDocument15 pagesHandbook of Value Added Tax by Farid Mohammad NasirSamia SultanaNo ratings yet

- What Informal Remedies Are Available To Firms in Financial Distress inDocument1 pageWhat Informal Remedies Are Available To Firms in Financial Distress inAmit PandeyNo ratings yet

- Csa z1600 Emergency and Continuity Management Program - Ron MeyersDocument23 pagesCsa z1600 Emergency and Continuity Management Program - Ron MeyersDidu DaduNo ratings yet

- Freddie Mac internal controlsDocument2 pagesFreddie Mac internal controlsElla Marie LopezNo ratings yet

- EFFECTS OF ECONOMIC GROWTH AND GST RISEDocument41 pagesEFFECTS OF ECONOMIC GROWTH AND GST RISESebastian ZhangNo ratings yet

- BecelDocument10 pagesBecelCorina MarinicăNo ratings yet

- OpenText Vendor Invoice Management For SAP Solutions 7.5 SP4 - Administration Guide English (VIM070500-04-AGD-En-2)Document228 pagesOpenText Vendor Invoice Management For SAP Solutions 7.5 SP4 - Administration Guide English (VIM070500-04-AGD-En-2)Goran Đurđić Đuka100% (3)

- Co OperativeSocietiesAct12of1997Document49 pagesCo OperativeSocietiesAct12of1997opulitheNo ratings yet

- CPA-HSE Best Practice Guide For Crane Hire and Contract Lifting - ExtractDocument1 pageCPA-HSE Best Practice Guide For Crane Hire and Contract Lifting - ExtractWNo ratings yet

- ResumeChaturyaKommala PDFDocument2 pagesResumeChaturyaKommala PDFbharathi yenneNo ratings yet

- Aditya Birla Capital Risk Management PolicyDocument6 pagesAditya Birla Capital Risk Management Policypratik zankeNo ratings yet

- Bank of Ceylon Annual Report 2011 PDFDocument340 pagesBank of Ceylon Annual Report 2011 PDFunknown45No ratings yet

- Practices by KFCDocument17 pagesPractices by KFCfariaNo ratings yet

- Ds Netsuite Data CenterDocument4 pagesDs Netsuite Data CenterPABLONo ratings yet

- Baby Food IndustryDocument13 pagesBaby Food IndustryPragati BhartiNo ratings yet

- Tata Chemicals Ltd profit and loss analysis for Rs in Cr from 2010-2006Document1 pageTata Chemicals Ltd profit and loss analysis for Rs in Cr from 2010-2006amadhourajNo ratings yet

- Examination Warehouse SCM Profit 2023 (1) Muhammad Hafizh Al Ahsan (22b505041182)Document5 pagesExamination Warehouse SCM Profit 2023 (1) Muhammad Hafizh Al Ahsan (22b505041182)Muhammad hafizhNo ratings yet

- Ra 7042 Foreign Investment ActDocument2 pagesRa 7042 Foreign Investment ActMark Hiro NakagawaNo ratings yet

- Diagnostic Level 3 AccountingDocument17 pagesDiagnostic Level 3 AccountingRobert CastilloNo ratings yet

- 12 Accountancy Lyp 2017 Foreign Set3Document41 pages12 Accountancy Lyp 2017 Foreign Set3Ashish GangwalNo ratings yet

- Valeura Hse Management System PDFDocument19 pagesValeura Hse Management System PDFAbdelkarimNo ratings yet

- XenArmor Software LicenseDocument4 pagesXenArmor Software LicenseAle RoqueNo ratings yet

- Infosys Sourcing & Procurement - Fact Sheet: S2C R2I I2PDocument2 pagesInfosys Sourcing & Procurement - Fact Sheet: S2C R2I I2PGautam SinghalNo ratings yet

- Capital Budgeting Techniques ExplainedDocument14 pagesCapital Budgeting Techniques ExplainedYvonne Marie DavilaNo ratings yet

- NCBA Financial Management (Financial Analysis)Document9 pagesNCBA Financial Management (Financial Analysis)Joanne Alexis BiscochoNo ratings yet

- SOP FinalDocument16 pagesSOP FinalAvinash SinghNo ratings yet

- "A Study of Financial Performance Analysis of IT Company": Project ReportDocument48 pages"A Study of Financial Performance Analysis of IT Company": Project ReportRohit MishraNo ratings yet

- Module 8-MRP and ErpDocument25 pagesModule 8-MRP and ErpDeryl GalveNo ratings yet