Professional Documents

Culture Documents

Form 16a - TDS - Blank 16a

Uploaded by

JayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16a - TDS - Blank 16a

Uploaded by

JayCopyright:

Available Formats

Original Certificate No.

:___

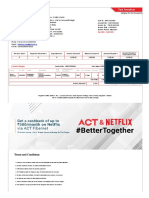

FORM NO. 16A

[See rule 31(1)(b)]

Certificate of deduction of tax at source under Section 203 of the Income-tax Act, 1961

For interest on securities; dividends; interest other than 'interest on securities'; winnings from lottery or crossword

puzzle; winnings from horse race; payments to contractors and sub-contractors; insurance commission; payments to

non-resident sportsmen/sports associations; payments in respect of deposits under National Savings Scheme'

payments on account of repurchase of units by Mutual Fund or Unit Trust of India; commission, remuneration or prize

on sale of lottery tickets; rent; fees for professional or technical services; income in respect of units; payment of

compensation on acquisition of certain immovable property; other sums under section 195; income of foreign

companies referred to in section 196A(2); income from units referred to in section 196B; income from foreign currency

bonds or shares of an Indian company referred to in section 196C; income of Foreign Institutional Investors from

securities referred to in section 196D.

Name and address of the person Acknowledgment Nos. of all Quarterly Name and address of the person to

deducting tax Statements of TDS under sub-section whom payment made or in whose

(3) of section 200 as provided by TIN account it is credited

Facilitation Centre or NSDL web-site

Quarter Acknowledgment No.

Q1

Q2

Q3

Q4

Tax deduction account No. of the Nature of Payment PAN/GIR No. of the payee

deductor

PAN/GIR No. of the deductor For the period

DETAILS OF PAYMENT, TAX DEDUCTION AND DEPOSIT OF TAX INTO CENTRAL GOVERNMENT ACCOUNT

S. No. Amount Date of TDS Surcharge Education Total Tax Cheque/DD BSR Date on Transfer

paid/credited payment/credit Cess Deposited No. Code of which tax voucher/Challan

Bank deposited Identification

Branch No.

1

2

3

4

5

6

7

8

9

10

11

12

Total

Certified that a sum of ___________(in words) Rupees ______________________________________Only. has

been deducted at source and paid to the credit of the Central Government as per details given above

Place : Signature of the person responsible for deducting tax

Date : Name :

Designation:

Note : [Not available as the last quarterly statement is yet to be furnished]

Jay74raj@gmail.comt

You might also like

- Form 16 WORD FORMATEDocument2 pagesForm 16 WORD FORMATEJay83% (46)

- BNPP Presentation TemplateDocument8 pagesBNPP Presentation TemplateGaurav AggarwalNo ratings yet

- List of Registered Independent Sales OrganizationsDocument53 pagesList of Registered Independent Sales Organizationscdill70100% (1)

- Utility Bill Template 12Document3 pagesUtility Bill Template 12Zakaria EL MAMOUNNo ratings yet

- Karen Henney 1120 Grove ST Apt 2 Downers Grove, Il 60515Document1 pageKaren Henney 1120 Grove ST Apt 2 Downers Grove, Il 60515Sharon JonesNo ratings yet

- Philippines The Manila Electric Company Electricity CompanyDocument1 pagePhilippines The Manila Electric Company Electricity CompanyPiyushNo ratings yet

- Monthly Internet Invoice for 1,198 BDTDocument1 pageMonthly Internet Invoice for 1,198 BDTRabbi RabbiNo ratings yet

- All Cheques Must Be Drawn Only in Favour of Lanka Bell LTD: InvoiceDocument2 pagesAll Cheques Must Be Drawn Only in Favour of Lanka Bell LTD: Invoiceubaid latheefNo ratings yet

- Customer Agreement H1935-108804Document3 pagesCustomer Agreement H1935-108804Angel RamírezNo ratings yet

- Best Gass BillDocument1 pageBest Gass Billmashti khanhaNo ratings yet

- Sri Lanka President Rajapaksa DynastyDocument1 pageSri Lanka President Rajapaksa DynastySriLanka GuardianNo ratings yet

- US SantanderDocument2 pagesUS Santanderfxckdabrain100% (1)

- WOS-Paychex Direct Deposit Form 2014Document1 pageWOS-Paychex Direct Deposit Form 2014Anonymous 4aUlLdHl2No ratings yet

- As 4916-2002 (Reference Use Only) Construction Management - General ConditionsDocument7 pagesAs 4916-2002 (Reference Use Only) Construction Management - General ConditionsSAI Global - APACNo ratings yet

- Pay Your Meralco Bill of ₱2 by Feb 14Document1 pagePay Your Meralco Bill of ₱2 by Feb 14البرنس اليمنيNo ratings yet

- MCG Mall Power Plant Electricity BillDocument2 pagesMCG Mall Power Plant Electricity Billlino fornollesNo ratings yet

- Kwan BillDocument2 pagesKwan Billdylanmore1223No ratings yet

- Contract of Lease-SalindaDocument2 pagesContract of Lease-Salindagabriella shintaine dominique dilayNo ratings yet

- Globe at Home E-Bill - 884810304-2020-10-06 PDFDocument2 pagesGlobe at Home E-Bill - 884810304-2020-10-06 PDFParciNo ratings yet

- Declaration Page Sample Homeowners 12Document1 pageDeclaration Page Sample Homeowners 12Keller Brown JnrNo ratings yet

- Your Koodo Bill: Account SummaryDocument6 pagesYour Koodo Bill: Account SummaryMark SloanNo ratings yet

- Payment Received by HMRC - Pay Your Self Assessment - GOV - UKDocument2 pagesPayment Received by HMRC - Pay Your Self Assessment - GOV - UKRayan KhanNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument28 pagesMobile Services: Your Account Summary This Month'S ChargesLalitNo ratings yet

- Statement May 21 XXXXXXXX1414Document2 pagesStatement May 21 XXXXXXXX1414Adithya MalnadNo ratings yet

- Chicago Il2Document2 pagesChicago Il2dylanmore1223No ratings yet

- Factory April BillDocument3 pagesFactory April BillSumit AgarwalNo ratings yet

- Washington Gas MD - 2Document2 pagesWashington Gas MD - 2Djibzlae0% (1)

- Меріленд водаDocument1 pageМеріленд водаRAMIRESNo ratings yet

- The Billing Mechanism Has Been Revised So That The Benefit of One Previous / Preceeding Slab Is Available To Domestic Consumers (Residential User)Document1 pageThe Billing Mechanism Has Been Revised So That The Benefit of One Previous / Preceeding Slab Is Available To Domestic Consumers (Residential User)babarali3991No ratings yet

- Electricity Bill of November 27, 2020: Account SummaryDocument2 pagesElectricity Bill of November 27, 2020: Account Summaryrev rev100% (1)

- Your Account Summary: F-240 Telephone Number: MultipleDocument4 pagesYour Account Summary: F-240 Telephone Number: MultipleAaron CruzNo ratings yet

- Indraprastha Gas Limited bill details and customer care numbersDocument1 pageIndraprastha Gas Limited bill details and customer care numbersashishNo ratings yet

- Customer Electric Bill DetailsDocument1 pageCustomer Electric Bill DetailsElias Andrikopoulos100% (1)

- ملفDocument1 pageملفmmieshal986No ratings yet

- PSEG Bill Residential Sample Community Solar FINAL 1Document6 pagesPSEG Bill Residential Sample Community Solar FINAL 1Oluwafemi PeterNo ratings yet

- Maharashtra electricity bill detailsDocument2 pagesMaharashtra electricity bill detailshitekshuNo ratings yet

- DSL Bill 041121193885 TN 652502989Document4 pagesDSL Bill 041121193885 TN 652502989yoghavelNo ratings yet

- Your E-Bill For March.2020 Customer 507140 1441.08.12.12.44.5444 PDFDocument2 pagesYour E-Bill For March.2020 Customer 507140 1441.08.12.12.44.5444 PDFSanu PhilipNo ratings yet

- 澳洲383797123 Gas bill PDFDocument2 pages澳洲383797123 Gas bill PDFZheng YangNo ratings yet

- Chelsea Coya BillDocument3 pagesChelsea Coya BillCandy CookiesNo ratings yet

- Billing Summary: Your Energy BillDocument4 pagesBilling Summary: Your Energy BillEgaaPutra007 PutraNo ratings yet

- DFTPDF 1-252805466203 1-252805466203 20220901Document2 pagesDFTPDF 1-252805466203 1-252805466203 20220901Silas Wafula100% (1)

- Philippines The Manila Electric Company Electricity Company 1 95851Document1 pagePhilippines The Manila Electric Company Electricity Company 1 95851البرنس اليمنيNo ratings yet

- NBR Tin Certificate 499536876199 PDFDocument1 pageNBR Tin Certificate 499536876199 PDFhasan raisNo ratings yet

- Bell MOBILEDocument7 pagesBell MOBILExyrnh2gxj6No ratings yet

- Susan Card StatmentDocument1 pageSusan Card StatmentAhsan ShabirNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument7 pagesMobile Services: Your Account Summary This Month'S ChargessooriroyNo ratings yet

- APC Electricity Bill (UK)Document1 pageAPC Electricity Bill (UK)hiltonn.shoesNo ratings yet

- Wauwatosa Water Utility: Hours CustomerDocument1 pageWauwatosa Water Utility: Hours Customer衡治洲No ratings yet

- Aircel Nov BillDocument14 pagesAircel Nov BillPavnesh SharmaaNo ratings yet

- 246 Units Rs. 6,561.47: Muzaffar Ali MinhasDocument3 pages246 Units Rs. 6,561.47: Muzaffar Ali MinhasMuhammad Khalid MinhasNo ratings yet

- ST CloudDocument1 pageST CloudSherry SherdNo ratings yet

- Toronto BillDocument3 pagesToronto BillmassinissamassinissamassinissaNo ratings yet

- Document PDFDocument2 pagesDocument PDFAndres Agapito BagumbayanNo ratings yet

- 03KBH19z-51JH053EH6999 B43a99a8 PDFDocument4 pages03KBH19z-51JH053EH6999 B43a99a8 PDFPeter ChanNo ratings yet

- Understanding Your Water Bill - SampleDocument3 pagesUnderstanding Your Water Bill - SampleBenny BerniceNo ratings yet

- View Your CARRYTEL Account Bill and Cash RewardsDocument3 pagesView Your CARRYTEL Account Bill and Cash RewardsEzzeddineNo ratings yet

- Bangalore Electricity Supply Company Limited: Thank You!Document1 pageBangalore Electricity Supply Company Limited: Thank You!vishwasNo ratings yet

- Terms and Conditions: Helpdesk - Cbe@actcorp - inDocument2 pagesTerms and Conditions: Helpdesk - Cbe@actcorp - inshibu lijackNo ratings yet

- Russia Electricity Sector Equipment DemandDocument27 pagesRussia Electricity Sector Equipment DemandAmit JoshiNo ratings yet

- First Page: Metered Bill - EnglandDocument8 pagesFirst Page: Metered Bill - Englandagnes LopesNo ratings yet

- Internet Banking Application Form: Dutch-Bangla Bank LimitedDocument6 pagesInternet Banking Application Form: Dutch-Bangla Bank LimitedTofael TohinNo ratings yet

- Form No. 16A (See Rule31 (L) (B) )Document4 pagesForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNo ratings yet

- Form No 16aaDocument4 pagesForm No 16aaJayNo ratings yet

- New PAN Application Form W.E.F. 1.11.2011Document2 pagesNew PAN Application Form W.E.F. 1.11.2011JayNo ratings yet

- Gazzated Officer Certificate FormateDocument1 pageGazzated Officer Certificate FormateJayNo ratings yet

- Instructions NEW Pan Application - 1.11.2011Document14 pagesInstructions NEW Pan Application - 1.11.2011JayNo ratings yet

- Tds Rate Chart Asst Yr 12-13Document1 pageTds Rate Chart Asst Yr 12-13JayNo ratings yet

- Business Women 2010Document1 pageBusiness Women 2010JayNo ratings yet

- SWRC DocumentDocument1 pageSWRC DocumentJayNo ratings yet

- Learning Licence FormDocument4 pagesLearning Licence FormJayNo ratings yet

- Tandurasti Tamara HathmaDocument43 pagesTandurasti Tamara HathmaJayNo ratings yet

- New TDS ProvisionDocument1 pageNew TDS ProvisionJayNo ratings yet

- Budget Highlights 2011-12Document2 pagesBudget Highlights 2011-12JayNo ratings yet

- Form 16a New FormatDocument2 pagesForm 16a New FormatJayNo ratings yet

- VARIOUS MOBILE BrandDocument1 pageVARIOUS MOBILE BrandJayNo ratings yet

- BIOMATRIC Ration Card InstructionDocument4 pagesBIOMATRIC Ration Card InstructionJayNo ratings yet

- Bankers List in IndiaDocument2 pagesBankers List in IndiaJayNo ratings yet

- Authority For PAN RegistrationDocument1 pageAuthority For PAN RegistrationJayNo ratings yet

- Income Tax JurisdictionDocument3 pagesIncome Tax JurisdictionJay0% (1)

- Obtain Tpin NumberDocument1 pageObtain Tpin NumberJayNo ratings yet

- Health ChartDocument1 pageHealth ChartJayNo ratings yet

- Spirit GUJARATIDocument4 pagesSpirit GUJARATIJayNo ratings yet

- Obtain Tpin NumberDocument1 pageObtain Tpin NumberJayNo ratings yet

- Income Tax Jurisdiction - 1Document2 pagesIncome Tax Jurisdiction - 1JayNo ratings yet

- Jai HanumanDocument1 pageJai HanumanJayNo ratings yet

- Time Pass - FunnyDocument3 pagesTime Pass - FunnyJayNo ratings yet

- Income Tax Jurisdiction - 2Document4 pagesIncome Tax Jurisdiction - 2Jay0% (1)

- Key Features of Budget 2010-2011Document14 pagesKey Features of Budget 2010-2011api-25886395No ratings yet

- TDS Limites - Union Budget 2010Document1 pageTDS Limites - Union Budget 2010JayNo ratings yet

- Kankaria Maninagar Sahakarti BankDocument2 pagesKankaria Maninagar Sahakarti BankJayNo ratings yet

- Purchase Agreement TTDocument1 pagePurchase Agreement TTLarita WootenNo ratings yet

- Checklist Distribution Agreement SPLDocument3 pagesChecklist Distribution Agreement SPLLitaNo ratings yet

- Forbes Global 2000 List 2019 Someka V1Document25 pagesForbes Global 2000 List 2019 Someka V1SayyidRamiAlRifaiNo ratings yet

- Santhosh Melvin Resume Updated (KM)Document4 pagesSanthosh Melvin Resume Updated (KM)api-281880273No ratings yet

- AICPA Released Questions AUD 2015 DifficultDocument26 pagesAICPA Released Questions AUD 2015 DifficultTavan ShethNo ratings yet

- Performance Appraisal System of AB Bank LTDDocument67 pagesPerformance Appraisal System of AB Bank LTDMahmud Abdullah100% (1)

- SPPTChap 007Document22 pagesSPPTChap 007imran_chaudhryNo ratings yet

- Form of Tender & Conditions of Contract: Nobel House ProjectDocument11 pagesForm of Tender & Conditions of Contract: Nobel House Projecthashem darwishNo ratings yet

- Fi Annual 16Document198 pagesFi Annual 16sanchita sharmaNo ratings yet

- F 1099 ADocument6 pagesF 1099 AIRS100% (1)

- Afu 07202 Accounting For InventoryDocument61 pagesAfu 07202 Accounting For InventoryPatric CletusNo ratings yet

- Streamline Unlimited Account: Closing Balance $3,265.34 CR Enquiries 13 2221Document4 pagesStreamline Unlimited Account: Closing Balance $3,265.34 CR Enquiries 13 2221jo220171No ratings yet

- Draft Policy On Special Freight Train Operator (SFTO) 1.0 GeneralDocument9 pagesDraft Policy On Special Freight Train Operator (SFTO) 1.0 GeneralcpadhiNo ratings yet

- MAS16Document12 pagesMAS16Kyaw Htin Win50% (2)

- 1558035837508gtwf3RUDP4SoBRDQ PDFDocument1 page1558035837508gtwf3RUDP4SoBRDQ PDFEmba MadrasNo ratings yet

- BillDocument11 pagesBillRahul SharmaNo ratings yet

- Claim Statement Form for Credit Life PolicyDocument1 pageClaim Statement Form for Credit Life PolicyShivNo ratings yet

- Intermediate Accounting 3 PDFDocument86 pagesIntermediate Accounting 3 PDFChelsy SantosNo ratings yet

- HDFC Bank Summer Internship Report on Segmentation and Penetration StrategiesDocument66 pagesHDFC Bank Summer Internship Report on Segmentation and Penetration StrategiesrupaliNo ratings yet

- BSP Circular 1107Document7 pagesBSP Circular 1107Maya Julieta Catacutan-EstabilloNo ratings yet

- Constitutions Heeb Farmers AssociationDocument20 pagesConstitutions Heeb Farmers AssociationSamoon Khan Ahmadzai100% (2)

- Admission Processing Fee Challan PDFDocument1 pageAdmission Processing Fee Challan PDFsundasNo ratings yet

- Visa & Mastercard: The Pain of Paying The Psychology of MoneyDocument16 pagesVisa & Mastercard: The Pain of Paying The Psychology of Moneyferoz_bilalNo ratings yet

- Community Care Policy SummaryDocument1 pageCommunity Care Policy SummaryspdscdNo ratings yet

- DEALER DownloadDocument4 pagesDEALER DownloadNivedha DeviNo ratings yet

- E-Bulletin Foundation Sept 2019Document45 pagesE-Bulletin Foundation Sept 2019Vijay SharmaNo ratings yet

- Other STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksDocument4 pagesOther STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksAman SinghNo ratings yet