Professional Documents

Culture Documents

Employee Benefits and Services HRM

Uploaded by

Sadaqat KhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employee Benefits and Services HRM

Uploaded by

Sadaqat KhanCopyright:

Available Formats

Assignment: Benefits and Services

Subject: Human Resource Management

Submitted To: Mr. Mohammad

Submitted By: Sadaqat Khan (2547)

Class: BBA (H.O.N.S)

th

5 Semester, section-A

Student ID: 2547

Date: Feb/20/2010

Qurtuba University

Of Science & Information Technology

Peshawar Campus

Prepared By Sadaqat Khan

Employee Benefits and Services

Compensation

“The purpose of compensation is to attract, motivate & maintain employees.”

Total compensation consists of direct and indirect compensation & the components of

total compensation are following:-

Indirect Security, safety & health (Legally mandated Benefits)

Compensation Benefits & Services (“Fringe” Benefits)

------------------------------------------------------------------

Direct Incentives & Gain Sharing (Pay for Performance)

Compensation Compensation Management (Base wages & salaries)

Benefits and Services are called indirect compensation & are also known as ( Fringe

benefits and Perks).Perks is something in addition to the payment like car fuel &

clothing. Whereas fringe means marginal or at the edge of pay because they were

neglected in the past but now they are simply known as “benefits and services” as it has

gained a lot of importance.

Example:-

Indirect Compensation accounts for nearly 40% of the average firms

compensation costs in the USA & even more in other European countries.

Benefits and services are used to persuade or motivate employees and are not linked with

the employee’s performance. It includes any benefits that the employee receives in

addition to their total direct remuneration which increase their wealth or well-being at

some cost of the employer.

The Role of Indirect Compensation

Societal Objectives:-

To help & provide security & benefits to lower the burden on society when ill

health, retirement or death occurs.

Organizational Objectives:-

The main objective is to recruit & retain workers.

Reduce fatigue.

Aid recruitment.

Minimize overtime cost

Reduce Turnover

Boosting Employee morale etc….

Employee Objectives:-

The main objective of employee is that these benefits & services are provided at

lower cost & its availability.

The objectives of society, organization & employees have encouraged rapid growth of

benefits & services.

Prepared By Sadaqat Khan

Major Types of Benefits

Following are the major types of Benefits:-

1) Insurance Benefits.

2) Security Benefits.

3) Time-off Benefits.

4) Work Scheduling Benefits.

1. Insurance Benefits:-

The financial risks encountered by employees & their families

can be spread by insurance. These risks are shared when funds are pooled in the form

of insurance premiums. Then when insured risk occurs, the covered employees or

there families are compensated.

It may be defined as a contract or agreement between two parties by which one of

them (called insurer) agrees to indemnify the other (called insured) against a loss

which may occur to other (insured) on the happening of some event. The agreement

or contract is put in writing & is known as “Insurance Policy.”

Following are the main types of insurance

1) Health-Related Insurance:-

2) Life Insurance:-

3) Disability Insurance:-

1. Health-Related Insurance:-

In which employers provide payments for health insurance.

a) Medical Insurance:-

Medical insurance pays for sickness accident & hospitalization expenses up to

the dollar limits (not less than or high up to) or “policy ceiling” of the policy.

Most policies contain a schedule of benefits. This schedule sets forth which sickness,

accident or hospitalization cost are covered & how much of the expenses will be paid.

Medical insurance may contain:-

• Deductible Clause:-

Deductible clause requires the covered employee to pay a specified amount

(usually 200$ to 300$ or more) before insurer is obligated to pay.

• A coinsurance clause:-

A coinsurance clause requires the employee to pay a percentage of the

medical expenses.(typically 20% of the expenses)

b) Managed Care:-

It is a health maintenance act of 1973 in which firms with more than 25 or

more employee’s health maintenance organization.

1. Health maintenance Organization (HMOs):-

Provide their own doctors & facilities where members receive services from those

employed by HMO.

2. Preferred Provider Organizations (PPOs):-

Allows subscribers to select doctors & hospitals from an approved list.

c) Vision Insurance:-

Prepared By Sadaqat Khan

Vision insurance provides vision care or vision correction

which includes examination and eye glasses.

d) Dental Insurance:-

As the name amplifies insurance policies which deal with dental problems.

e) Mental Health Insurance:-

Mental health insurance pays for psychiatric care & counseling (guiding).

2. Life Insurance:-

Firstly “burial policies” were introduced to help to cover funeral expenses but

life insurance means to protect the family from the loss of the worker’s income. Life

insurance is designed to cover the death & offers financial protection to the

dependents (family) incase of death of the insured.

Life insurance is defined as “a contract where by the insurer in consideration of a

premium paid in lump sum or in periodic installments undertakes to pay a specified

sum either on the death of the insured or on the expiry of specified number of years in

the policy.”

3. Disability Insurance:-

Disability insurances are meant to compensate employees if they become

disable or they are unable to work.

Disability insurances may be either for short term or long term disabilities:-

1) Short Term Disability (STD):

Providing a partial replacement of wages & salaries for up to six months or year.

I.e. For accident & sickness or payment for pregnant women.

2) Long-Term Disability (LTD):

When a worker is unable to work for a prolonged period (more than 1 year),

most companies provide some form of LTD insurances. In which they pay only (50%

to 60%) of his/her wages or salary.

3. Security Benefits:-

Following are some ways to provide security benefits to the employees:-

1) Employment Income security:-

The loss of a job holds potentially severe economic consequences for an

employee which can be solved by employer provided benefits, like

Severance Pay:-

These benefits entitle the worker to pay a lump-sum payment at the time of

separation from the company.

Golden Parachutes:-

It is an agreement by a company to compensate executives with bonuses &

benefits, if they are displaced by merger or acquisition.

2) Retirement Security:-

Retirement plans are designed to reward long-service employees.

Developing a Retirement plan:

For the purpose of developing a retirement plan some

important questions must answered:-

Q: Who develops retirement plan? Answer is HR Department.

Q: Who will pay for it? Answer is that it depends on HR Plans followed:-

Prepared By Sadaqat Khan

1. Non-Contributory Plan:-

The employer pays the entire amount.

2. Contributory plan:-

Contributory plan requires both employee and employer to contribute.

Q: When the pension rights will vest (when employee becomes eligible)?

Ans: Pension rights usually vest after several years of service.

Q: How will firm meet its financial obligations?

Ans: Most companies pay pension out of current income when employees retire.

Other Retirement Benefits

a) Early Retirement:-

It allows worker to retire before the traditional retirement age of 65.

Benefits are normally reduced due to his less contribution towards organization.

b) Retirement counseling:-

The primary purpose of pre-retirement counseling is to encourage an employee to

plan for retirement emotionally & financially.

3. Time-Off Benefits:-

These benefits provide rest from the physical and mental effort of a job to

increase employee productivity.

Time-Off benefits include:-

1) On the Job Breaks:-

The most common form of time-off benefits are breaks during the working hours.

I.e. Rest breaks, Meal breaks, Tea Beaks & wash up time etc……

2) Sick days and Well Pay:-

Some absences from the work are unavoidable. Today most companies pay

workers when they are absent for medical reasons by granting a limited no.

Of sick days per year.

Payment for unused sick leave is sometimes called “Well Pay” which may

serve as an incentive for attendance.

3) Holidays and Vacation:-

Holidays: Time-benefits can be offered to employees inform of holidays who

meet productivity or other goal.

Vacations: Vacations are usually based on the employee’s length of service.

I.e. 1 week = 1 year of service & 2 weeks = 2 years of service.

4) Leaves of Absence:-

Leaves of absence are often granted for pregnancy, extended illness, funeral

service and accidents and other reasons in a company HR Policies.

Extended Leaves…………Given without pay.

Shorter Leaves…………...Granted with pay.

5) Family and Medical leave Act 1993:-

Prepared By Sadaqat Khan

Firms with more than 50 employees are legally bound in which

workers are entitled to 12 weeks (2.7months) of unpaid leave during any 12

months of the year.

Example:-

• Employees are entitled to a leave to take care of baby including birth, adoption &

placement of child in foster care. <Or>

• Employees in serious health condition & are unable to work or when there is a

need for the employee to take care of spouse, parent or children with a serious

health condition.

4. Work scheduling Benefits:-

Scheduling means to create time table & Work scheduling means to create time

table where u can allocate exact amount of work to employees.

Following are different types of work scheduling benefits offered to employees:-

1) Shorter work times:-

2) Flex time:-

3) Job Sharing:-

1) Shorter Work Times:-

Shorter workdays & work weeks are new ways to increase employee productivity.

A shorter work week compresses forty hours of work less than 5 full days

(8hurs/day) and some may plan even shorten the work week less than 40 hours

i.e.37.5 or even 35 hours per 5 day week.

One version has been 40 hours of work compressed into 4 days. (10hours/day).

2) Flextime:- (Flex = Flexibility)

Flextime eliminates rigid starting & ending times for the workday, Instead

employees are allowed to report to work at any time during a range of hours

called “Core Hours”

For example:-

Starting time may be from 7:00 AM to 9:00 AM with all employees expected to

work the core hours of 9:00 AM to 3:00 PM.

3) Job Sharing:-

“Job sharing involves one or more employees doing the same job but working

different hours, days or even weeks.”

Mostly two people handle the duties of one full-time job.

Example: - General example of Doctors / Nurses Shifting Duties etc…….

Major Types of Services:-

Some companies go beyond pay and traditional benefits & provide services to

their employees. The most common ones are Educational, Financial & Social services:-

1) Educational Assistance:-

These programs are especially designed for employees for furthering their

education but may be limited to courses that are related to an employees job.

Prepared By Sadaqat Khan

2) Financial Services:-

Financial services can be offered to employees in the form of “Discount Plan”

which allow workers to buy products from the company at a discount.

Example:-

Discount plans are common among retailer Stores & consumer goods Manufacturers.

3) Social Services:-

A wide range of services are provided by employers as they adapt to a

changing & diverse work force.

At one Extreme are simple interest groups such as Cricket Teams, Bowling Leagues etc.

At the other extreme are comprehensive employee assistance programs (EAPs) designed

to help employees with personal problem ranging from drug & alcohol issues to other

family problems dealing with employees. Such as given below……..

a) Child Care:-

Programs are offered to working mothers to look after and or to take

care of children.

b) Elder Care:-

Elderly (old) presents a special problem because of limited day care options

available to their working children.

c) Relocation Programs:-

It includes payment for moving expenses to new location, To reduce stress of

the employees.

d) Social Service Leave Program:-

Social service leave provides fully paid leaves to employees who wish to work

full-time in a community program.

References:-

• Adopted from.” Human Resources and Personnel Management” Keith Davis 5th Edition.

• http://encyclopedia.farlex.com/Fringe+benefits

• http://www.scribd.com/search?cat=redesign&q=fringe+benefits

• http://search.babylon.com/web/fringe%20benefits?babsrc=client

• http://en.wikipedia.org/wiki/Employee_benefit

Prepared By Sadaqat Khan

Prepared By Sadaqat Khan

You might also like

- Employee Benefits and ServicesDocument9 pagesEmployee Benefits and ServicesAMIT K SINGHNo ratings yet

- Job Analysis and Competency ModelDocument21 pagesJob Analysis and Competency ModelJenefer DianoNo ratings yet

- Leave Policies of Different CompaniesDocument75 pagesLeave Policies of Different CompaniesArun Kumar ShakarNo ratings yet

- Recruitment and Selection in Digital AgeDocument8 pagesRecruitment and Selection in Digital AgerafiNo ratings yet

- HR GeneralistDocument3 pagesHR Generalistkurnia agungNo ratings yet

- TransferDocument6 pagesTransferDeepa AlwaniNo ratings yet

- DA Wiki Explains Indian Salary SupplementDocument2 pagesDA Wiki Explains Indian Salary SupplementMathew JcNo ratings yet

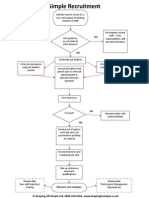

- Simple Recruitment Process FlowchartDocument1 pageSimple Recruitment Process FlowchartJyothi Raghu ReddyNo ratings yet

- Retention Strategies in ITESDocument12 pagesRetention Strategies in ITESmunmun4No ratings yet

- Retention BpoDocument22 pagesRetention BpoJomarie Emiliano100% (1)

- Compensation ManagementDocument10 pagesCompensation Managementapi-3721037100% (2)

- Case Study-Employee Relation ManagementDocument10 pagesCase Study-Employee Relation ManagementMilanisa PunutNo ratings yet

- HR Challenges in RecruitmentDocument3 pagesHR Challenges in Recruitmentlovish0595No ratings yet

- HR PolicyDocument13 pagesHR PolicyVeera Mani S0% (2)

- Study On HR Planning and RecruitmentDocument66 pagesStudy On HR Planning and Recruitmentsmart techno100% (4)

- Training and Development MBA HRDocument69 pagesTraining and Development MBA HRAmardeep Upadhyay100% (3)

- The Recruitment and Selection Process of UniliverDocument14 pagesThe Recruitment and Selection Process of Uniliveroliur rahmanNo ratings yet

- Synopsis of CompensationDocument15 pagesSynopsis of CompensationShipra Jain0% (2)

- The Nestle HR Policy PDF 2012 PDFDocument8 pagesThe Nestle HR Policy PDF 2012 PDFKelvinNo ratings yet

- HR Manager Job Description and SpecificationDocument2 pagesHR Manager Job Description and SpecificationJethro Bondoc67% (3)

- Employee Retention Harshi.Document12 pagesEmployee Retention Harshi.Vinayaka McNo ratings yet

- Job Description For An HR ExecutiveDocument9 pagesJob Description For An HR Executivesakib_k2008100% (3)

- Compensation and Benefits 16mbahr303Document95 pagesCompensation and Benefits 16mbahr303jyothibs100% (1)

- What Are HR Policies in InfosysDocument13 pagesWhat Are HR Policies in InfosysPallavi KuvvamNo ratings yet

- A Study On Employee Morale in Administrative Level at Metropolitan Transport Corporation Limited, ChennaiDocument34 pagesA Study On Employee Morale in Administrative Level at Metropolitan Transport Corporation Limited, ChennaiSoni Singh67% (3)

- HR in 21st CenturyDocument18 pagesHR in 21st Centurycg1983No ratings yet

- HR Diversity in The WorkplaceDocument15 pagesHR Diversity in The WorkplaceDrSuyog UpasaniNo ratings yet

- Rewards N RecognitionsDocument69 pagesRewards N RecognitionsRahul Dawar100% (1)

- Compensation ManagementDocument19 pagesCompensation ManagementRanjith PrakashNo ratings yet

- Role of HR Practices On Profitability of OrganizationDocument9 pagesRole of HR Practices On Profitability of Organizationmasadi1980No ratings yet

- Retention of Talent & Employee MotivationDocument4 pagesRetention of Talent & Employee MotivationHarshal TakNo ratings yet

- HRM in InfosysDocument11 pagesHRM in Infosysguptarahul27550% (4)

- Impact On Retention Strategies On Employee TurnoverDocument10 pagesImpact On Retention Strategies On Employee TurnoverlampujogjaNo ratings yet

- MyBenefits@Philips LeafletDocument2 pagesMyBenefits@Philips Leafletsubodhtaneja100% (1)

- Statutory ComplianceDocument37 pagesStatutory ComplianceNitin SaxenaNo ratings yet

- Employee Retention at ACC's Gagal Cement WorksDocument50 pagesEmployee Retention at ACC's Gagal Cement WorksAnkur ChopraNo ratings yet

- RecruitmentDocument16 pagesRecruitmentRuchi AgrawalNo ratings yet

- Caselet Zappos - Facing Competitive Challenges: BY T.CharlesDocument5 pagesCaselet Zappos - Facing Competitive Challenges: BY T.CharlesJob AsirNo ratings yet

- Recruitment in BpoDocument14 pagesRecruitment in BpoMalvika PrajapatiNo ratings yet

- A Study in The Typical Functions of A Typical HR Department in An Typically Advanced OrganizationDocument30 pagesA Study in The Typical Functions of A Typical HR Department in An Typically Advanced OrganizationansmanstudiesgmailcoNo ratings yet

- RecruitmentDocument33 pagesRecruitmentvarun19aug67% (3)

- Recruitment and Selection AssignmentDocument15 pagesRecruitment and Selection AssignmentChristian Hope MubairaNo ratings yet

- Recruitment SelectionDocument73 pagesRecruitment SelectionRomit GargNo ratings yet

- Best Practice On Google's HRDocument7 pagesBest Practice On Google's HRRio AlbaricoNo ratings yet

- Recruitment and SelectionDocument55 pagesRecruitment and SelectionAngelNo ratings yet

- Intercon Group HR Policy FrameworkDocument10 pagesIntercon Group HR Policy FrameworkSantosh Kumar SinghNo ratings yet

- Project Report On Compensation Management Case Study Have Tobe IncludedDocument33 pagesProject Report On Compensation Management Case Study Have Tobe IncludedmohitNo ratings yet

- Final Internship Report On Employee EngagementDocument75 pagesFinal Internship Report On Employee EngagementLatesh Cool86% (7)

- BRIEF GUIDE TO E-RECRUITMENT STUDYDocument40 pagesBRIEF GUIDE TO E-RECRUITMENT STUDYekta rawatNo ratings yet

- Recruitment and SelectionDocument64 pagesRecruitment and SelectionPuja Kumari50% (2)

- Reward and Recognition Strategies in The Retail SectorDocument33 pagesReward and Recognition Strategies in The Retail SectorSirsanath Banerjee75% (4)

- Employee Benefits FinalDocument33 pagesEmployee Benefits FinalKunal TejwaniNo ratings yet

- HR Induction GuideDocument21 pagesHR Induction GuideChidhuro OwenNo ratings yet

- Microsoft India's HR Strategies for SuccessDocument21 pagesMicrosoft India's HR Strategies for SuccessPradeep Kumar Singh0% (3)

- Compensation ManagementDocument67 pagesCompensation Managementsodesai100% (1)

- Employee RetentionDocument75 pagesEmployee RetentionkartikNo ratings yet

- Submitted To: Amita Sharma Submitted By: Aditya Kumar Section-A Enrollment No. - 16flicddno1006Document14 pagesSubmitted To: Amita Sharma Submitted By: Aditya Kumar Section-A Enrollment No. - 16flicddno1006Aditya PandeyNo ratings yet

- Determining Optimal Fringe BenDocument17 pagesDetermining Optimal Fringe BenYogesh PujariNo ratings yet

- Employee BenefitsDocument27 pagesEmployee BenefitsS- Ajmeri100% (1)

- Incentives and BenefitsDocument14 pagesIncentives and BenefitsAditya PandeyNo ratings yet

- Reformed Compulsory Third Party Liability Insurance: Rily I, IcDocument3 pagesReformed Compulsory Third Party Liability Insurance: Rily I, IcGlenn MontalesNo ratings yet

- Insurance Coverage of International TransportDocument4 pagesInsurance Coverage of International TransportyenleNo ratings yet

- Toyota Motor Vehicle Insurance PolicyDocument40 pagesToyota Motor Vehicle Insurance PolicydbedadaNo ratings yet

- Merrill Edge Advisory Center Business Investor Account (BIA Account) - Limited Liability Company ApplicationDocument16 pagesMerrill Edge Advisory Center Business Investor Account (BIA Account) - Limited Liability Company ApplicationMichael DavisNo ratings yet

- Comparision Between Birla Sunlife and LICDocument84 pagesComparision Between Birla Sunlife and LICPrathmesh KadamNo ratings yet

- MDR 030508841058Document1 pageMDR 030508841058Jarro Dela TorreNo ratings yet

- Register of Members Interests Dáil TDs 2007Document101 pagesRegister of Members Interests Dáil TDs 2007lostexpectationNo ratings yet

- PeopleSoft Manage Base Benefits Business ProcessDocument4 pagesPeopleSoft Manage Base Benefits Business Processpradeepv2sNo ratings yet

- Adamjee Life Parvaaz Education and Marriage PlanDocument1 pageAdamjee Life Parvaaz Education and Marriage PlanAbdul WaheedNo ratings yet

- How To Access and Understand Your PayslipDocument9 pagesHow To Access and Understand Your PayslipbucalaeteclaudialoredanaNo ratings yet

- Enq-2333 - Tender Resume - Rev.0 - Lamprell - Crpo 125 & 126 Offshore FacilitiesDocument23 pagesEnq-2333 - Tender Resume - Rev.0 - Lamprell - Crpo 125 & 126 Offshore FacilitiesNIRBHAY TIWARYNo ratings yet

- Temporary Auto Identification CardDocument1 pageTemporary Auto Identification Cardsan shir50% (2)

- Happy Family Floater Policy-2021 Policy Schedule: UIN: OICHLIP22010V042223Document5 pagesHappy Family Floater Policy-2021 Policy Schedule: UIN: OICHLIP22010V042223Bharath DixithNo ratings yet

- Soni Resources Group Contractor Agreement - 2526249 Ontario Inc - SignedDocument6 pagesSoni Resources Group Contractor Agreement - 2526249 Ontario Inc - SignedSunil BatraNo ratings yet

- IandF CT6 201704 ExamDocument6 pagesIandF CT6 201704 ExamUrvi purohitNo ratings yet

- Account Opening Form: Part-I: Branch To Affix Rubber Stamp of Name and Code NoDocument1 pageAccount Opening Form: Part-I: Branch To Affix Rubber Stamp of Name and Code NoDr. Gollapalli NareshNo ratings yet

- ICICI Project FINALDocument34 pagesICICI Project FINALRathi RajanNo ratings yet

- Guaranteed Income GoalDocument6 pagesGuaranteed Income GoalNeelamani SamalNo ratings yet

- White CollarDocument28 pagesWhite CollarPradhuymn MishraNo ratings yet

- Vibgyor Advicorp Private Limited Profile (38Document7 pagesVibgyor Advicorp Private Limited Profile (38Abhay Singh ParmarNo ratings yet

- ICICI Health Insurance Policy DetailsDocument3 pagesICICI Health Insurance Policy DetailsarjunNo ratings yet

- The Co-Operators 26-05-2023Document20 pagesThe Co-Operators 26-05-2023Liz DumoulinNo ratings yet

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEDocument1 pageMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEIshan BakshiNo ratings yet

- Infrastructure: Delhi-Mumbai Expressway To Spur NMPDocument5 pagesInfrastructure: Delhi-Mumbai Expressway To Spur NMPSuman DubeyNo ratings yet

- Lecture 6 - TrustsDocument15 pagesLecture 6 - TrustsSteve KennedyNo ratings yet

- We Exceed Expectations: Annual Report 2021Document120 pagesWe Exceed Expectations: Annual Report 2021Jayesh KaleNo ratings yet

- A Study on Agri Loan Products of IDBI Bank in TezpurDocument78 pagesA Study on Agri Loan Products of IDBI Bank in TezpurS SubhamNo ratings yet

- Lecture 2: General cash flows: Lecturer: Phạm Thị Hồng ThắmDocument35 pagesLecture 2: General cash flows: Lecturer: Phạm Thị Hồng ThắmQuynh Trang DinhNo ratings yet

- Online/Vc स हेतु ेिनंग कलडर (Training Calendar For Online/Vc Sessions) - October-2020Document2 pagesOnline/Vc स हेतु ेिनंग कलडर (Training Calendar For Online/Vc Sessions) - October-2020Naygarp IhtapirtNo ratings yet

- Auckland Council NZS 3910 Conditions of Contract - (Revised October 2023 Retenions Legisation)Document73 pagesAuckland Council NZS 3910 Conditions of Contract - (Revised October 2023 Retenions Legisation)April AryalNo ratings yet