Professional Documents

Culture Documents

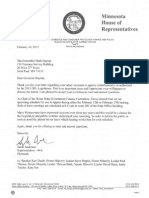

Dayton Letter To Daudt

Uploaded by

Patrick Condon0 ratings0% found this document useful (0 votes)

247 views1 pageDayton letter to Speaker Daudt.

Original Title

Dayton Letter to Daudt

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDayton letter to Speaker Daudt.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

247 views1 pageDayton Letter To Daudt

Uploaded by

Patrick CondonDayton letter to Speaker Daudt.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

STATE OF MINNESOTA

Office of Governor Mark Dayton

116 Veterans Service Building 20 West 12th Street Saint Paul, MN 55155

June 2, 2016

The Honorable Kurt Daudt

Speaker of the House

Room 463, State Office Bldg.

St. Paul, Minnesota 55155

Dear Speaker Daudt:

I take strong exception to your charge, in your June 1, 2016 letter to me, that I am

holding the Omnibus Tax bill "hostage" to an acceptable Bonding bill in a Special Session. It

is certainly not my fault that the tax bill contained an error, which would cost the state

treasury $101 million in lost revenues over the next three fiscal years.

While I appreciate your willingness to agree to correct this error, the Commissioner

of Revenue has advised me that only a correction to the statute, enacted by the full

legislature, will allow the Department to administer the provision differently than currently

written and be assured of withstanding the otherwise expected court challenge by some, who

would benefit from this error.

Additionally, if I were to sign the current tax bill and an agreement could not be

reached to call a Special Session, that provision would become law and take effect on July 1,

2016, causing the revenue loss described above.

Lt. Governor Smith and I remain available to meet with you and the other Caucus

leaders at your earliest convenience. I see no reason why we cannot quickly reach agreement

on the terms for a Special Session, hold it in the very near future, and bring proper closure to

the 2016 Legislative Session.

erely,

94/11:2071t"

Mar Dayton

Governor

Voice: (651) 201-3400 or (800) 657-3717

Website: http://mn.gov/governor/

Fax: (651) 797-1850

MN Relay (800) 627-3529

An Equal Opportunity Employer

Printed on recycled paper containing 15% post consumer material and state government printed

You might also like

- Rep. Davids Letter To Gov WalzDocument2 pagesRep. Davids Letter To Gov WalzMinnesota House RepublicansNo ratings yet

- State of Minnesota: Office of Governor Mark DaytonDocument2 pagesState of Minnesota: Office of Governor Mark DaytonRachel E. Stassen-BergerNo ratings yet

- 7.29.19 Gov. Tim Walz Letter To Majority Leader Paul GazelkaDocument2 pages7.29.19 Gov. Tim Walz Letter To Majority Leader Paul GazelkaFluenceMediaNo ratings yet

- The Minnesota House of Representatives in Support of Plaintiffs' Motion For Temporary Restraining OrderDocument34 pagesThe Minnesota House of Representatives in Support of Plaintiffs' Motion For Temporary Restraining OrderSharon AndersonNo ratings yet

- Hendricks LetterDocument3 pagesHendricks LetterTim NelsonNo ratings yet

- Senate Hearing, 114TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2016Document288 pagesSenate Hearing, 114TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2016Scribd Government DocsNo ratings yet

- Tax Reform and The Tax Treatment of Debt and EquityDocument360 pagesTax Reform and The Tax Treatment of Debt and EquityScribd Government DocsNo ratings yet

- 09 15 2014 Vanyo Darrell Chairman Fargo-Moorhead Diversion AuthorityDocument1 page09 15 2014 Vanyo Darrell Chairman Fargo-Moorhead Diversion Authorityjennifer_brooks3458No ratings yet

- Senate Hearing, 114TH Congress - The Economic Report of The PresidentDocument58 pagesSenate Hearing, 114TH Congress - The Economic Report of The PresidentScribd Government DocsNo ratings yet

- Dwnload Full South Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions Manual PDFDocument36 pagesDwnload Full South Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions Manual PDFcatholeshrineuxsl100% (12)

- Forensic Letter From FogderudeDocument3 pagesForensic Letter From FogderudeThomas HorneNo ratings yet

- Senate Hearing, 113TH Congress - Nomination of John Andrew KoskinenDocument117 pagesSenate Hearing, 113TH Congress - Nomination of John Andrew KoskinenScribd Government DocsNo ratings yet

- Senate Hearing, 113TH Congress - The Budget and Economic Outlook: Fiscal Years 2013 To 2023Document181 pagesSenate Hearing, 113TH Congress - The Budget and Economic Outlook: Fiscal Years 2013 To 2023Scribd Government DocsNo ratings yet

- South Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions ManualDocument26 pagesSouth Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions ManualKellyBurtoncbjq100% (44)

- Letter From House Speaker Steven Tilley To State Auditor Tom Schweich Regarding MamtekDocument2 pagesLetter From House Speaker Steven Tilley To State Auditor Tom Schweich Regarding MamtekColumbia Daily TribuneNo ratings yet

- April 7 East Grand Forks Property Tax Deadline RequestDocument4 pagesApril 7 East Grand Forks Property Tax Deadline RequestJoe BowenNo ratings yet

- Debt Limit Letter To Congress 20210928Document2 pagesDebt Limit Letter To Congress 20210928ZerohedgeNo ratings yet

- Senate Hearing, 110TH Congress - Examining The Administration ' S Plan For Reducing The Tax Gap: What Are The Goals, Benchmarks, and Timetables?Document175 pagesSenate Hearing, 110TH Congress - Examining The Administration ' S Plan For Reducing The Tax Gap: What Are The Goals, Benchmarks, and Timetables?Scribd Government DocsNo ratings yet

- Sattgast AttachmentDocument5 pagesSattgast AttachmentPat PowersNo ratings yet

- No SS Levy For TaxesDocument15 pagesNo SS Levy For Taxesfdartee100% (2)

- Dwnload Full South Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions Manual PDFDocument36 pagesDwnload Full South Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions Manual PDFcatholeshrineuxsl100% (13)

- House Hearing, 114TH Congress - Federal Workforce Tax AccountabilityDocument58 pagesHouse Hearing, 114TH Congress - Federal Workforce Tax AccountabilityScribd Government DocsNo ratings yet

- Dan Moul: Date: Time: LocationDocument4 pagesDan Moul: Date: Time: LocationPAHouseGOPNo ratings yet

- General Assembly Session.": Montgomery County CouncilDocument1 pageGeneral Assembly Session.": Montgomery County CouncilAaron KrautNo ratings yet

- H.196 Veto-3Document3 pagesH.196 Veto-3Ashley MooreNo ratings yet

- Mike Reese: Dear FriendsDocument4 pagesMike Reese: Dear FriendsPAHouseGOPNo ratings yet

- 2015 11 09 GMD Letter To Daudt Hann On Commissioners Managers Compensation PlanDocument2 pages2015 11 09 GMD Letter To Daudt Hann On Commissioners Managers Compensation PlanRachel E. Stassen-BergerNo ratings yet

- Senate Hearing, 111TH Congress - The Federal Housing Administration - Current Condition and Future ChallengesDocument59 pagesSenate Hearing, 111TH Congress - The Federal Housing Administration - Current Condition and Future ChallengesScribd Government DocsNo ratings yet

- House Hearing, 112TH Congress - Oversight of The Department of Housing and Urban Development (Hud)Document85 pagesHouse Hearing, 112TH Congress - Oversight of The Department of Housing and Urban Development (Hud)Scribd Government DocsNo ratings yet

- Keeping Montgomery County Whole 121615Document2 pagesKeeping Montgomery County Whole 121615Aaron KrautNo ratings yet

- Senate Hearing, 113TH Congress - Impact of A Default On Financial Stability and Economic GrowthDocument61 pagesSenate Hearing, 113TH Congress - Impact of A Default On Financial Stability and Economic GrowthScribd Government DocsNo ratings yet

- BakkThissenSpecialFinal 1Document1 pageBakkThissenSpecialFinal 1Minnesota Senate Republican CaucusNo ratings yet

- Sec. Yellen Letter To Speaker McCarthyDocument2 pagesSec. Yellen Letter To Speaker McCarthyDaily Caller News FoundationNo ratings yet

- House Hearing, 110TH Congress - Oversight of The Department of Housing and Urban DevelopmentDocument112 pagesHouse Hearing, 110TH Congress - Oversight of The Department of Housing and Urban DevelopmentScribd Government DocsNo ratings yet

- Senate Hearing, 109TH Congress - Gsa Contractors Who Cheat On Their Taxes and What Should Be Done About ItDocument120 pagesSenate Hearing, 109TH Congress - Gsa Contractors Who Cheat On Their Taxes and What Should Be Done About ItScribd Government DocsNo ratings yet

- Taxes As Part of The Federal Budget: HearingDocument168 pagesTaxes As Part of The Federal Budget: HearingScribd Government DocsNo ratings yet

- The White House 1600 Pennsylvania Avenue NW Washington, DC 20500Document5 pagesThe White House 1600 Pennsylvania Avenue NW Washington, DC 20500Rob NikolewskiNo ratings yet

- Jack Lew Letter On Debt Ceiling DateDocument2 pagesJack Lew Letter On Debt Ceiling DateGretaWireNo ratings yet

- House Hearing, 112TH Congress - Putting Americans Back To Work: The State of The Small Business EconomyDocument65 pagesHouse Hearing, 112TH Congress - Putting Americans Back To Work: The State of The Small Business EconomyScribd Government DocsNo ratings yet

- Steve Barrar: Ear NeighborDocument4 pagesSteve Barrar: Ear NeighborPAHouseGOPNo ratings yet

- State of Minnesota: Office of Governor Tim Walz Lt. Governor Peggy FlanaganDocument7 pagesState of Minnesota: Office of Governor Tim Walz Lt. Governor Peggy FlanaganjpcoolicanNo ratings yet

- State Auditor Rebecca Otto Letter To State Government Finance Committee - August 18, 2015Document2 pagesState Auditor Rebecca Otto Letter To State Government Finance Committee - August 18, 2015mbrodkorbNo ratings yet

- 2013 5 14 Week in ReviewDocument2 pages2013 5 14 Week in Reviewapi-215003736No ratings yet

- Agreement Actimarket1Document5 pagesAgreement Actimarket1vpjNo ratings yet

- Veto Letter Dayton To DaudtDocument5 pagesVeto Letter Dayton To DaudtGoMNNo ratings yet

- Pro Hac Vice) Pro Hac Vice) Attorneys For Midland Loan Services, IncDocument12 pagesPro Hac Vice) Pro Hac Vice) Attorneys For Midland Loan Services, IncChapter 11 DocketsNo ratings yet

- Senate Hearing, 111TH Congress - Hearing With Secretary Timothy GeithnerDocument83 pagesSenate Hearing, 111TH Congress - Hearing With Secretary Timothy GeithnerScribd Government DocsNo ratings yet

- Dayton Reinsurance LetterDocument1 pageDayton Reinsurance LetterdhmontgomeryNo ratings yet

- Debt Limit BoehnerDocument2 pagesDebt Limit BoehnerBrett LoGiuratoNo ratings yet

- Confronting The Looming Fiscal Crisis: Hearing Committee On Finance United States SenateDocument75 pagesConfronting The Looming Fiscal Crisis: Hearing Committee On Finance United States SenateScribd Government DocsNo ratings yet

- Floor Speech On Possible Government ShutdownDocument4 pagesFloor Speech On Possible Government Shutdownles_braswell5524No ratings yet

- House Hearing, 112TH Congress - Hearing On Transparency and Funding of State and Local Pension PlansDocument115 pagesHouse Hearing, 112TH Congress - Hearing On Transparency and Funding of State and Local Pension PlansScribd Government DocsNo ratings yet

- Brown Week in ReviewDocument3 pagesBrown Week in Reviewapi-215003736No ratings yet

- House Hearing, 114TH Congress - U.S. Department of Veterans Affairs Budget Request For Fiscal Year 2016Document209 pagesHouse Hearing, 114TH Congress - U.S. Department of Veterans Affairs Budget Request For Fiscal Year 2016Scribd Government DocsNo ratings yet

- Affidavit of Confirmation/ Notice of Non Response/ No Contest & AcceptanceDocument3 pagesAffidavit of Confirmation/ Notice of Non Response/ No Contest & AcceptanceSuzanne Cristantiello100% (14)

- Hearing On The President'S Fiscal Year 2012 Budget Proposal With U.S. Department of The Treasury Secretary Timothy F. GeithnerDocument79 pagesHearing On The President'S Fiscal Year 2012 Budget Proposal With U.S. Department of The Treasury Secretary Timothy F. GeithnerScribd Government DocsNo ratings yet

- Estate Planning and Administration: How to Maximize Assets, Minimize Taxes, and Protect Loved OnesFrom EverandEstate Planning and Administration: How to Maximize Assets, Minimize Taxes, and Protect Loved OnesNo ratings yet

- The Benefit and The Burden: Tax Reform-Why We Need It and What It Will TakeFrom EverandThe Benefit and The Burden: Tax Reform-Why We Need It and What It Will TakeRating: 3.5 out of 5 stars3.5/5 (2)

- Lawful Income Tax Avoidance for the Qualified Wages and Salaries of Natural PersonsFrom EverandLawful Income Tax Avoidance for the Qualified Wages and Salaries of Natural PersonsNo ratings yet

- Letter To Governor Dayton 6.2.16Document1 pageLetter To Governor Dayton 6.2.16Rachel E. Stassen-BergerNo ratings yet

- Will Repair or Replace 15,500 Lane Miles and 330 Bridges Without A Tax IncreaseDocument3 pagesWill Repair or Replace 15,500 Lane Miles and 330 Bridges Without A Tax IncreasePatrick CondonNo ratings yet

- BondingDocument2 pagesBondingPatrick CondonNo ratings yet

- The Rolling Stones DayDocument1 pageThe Rolling Stones DayPatrick CondonNo ratings yet

- Dayton 2Document5 pagesDayton 2Patrick CondonNo ratings yet

- Transportation Funding LetterDocument1 pageTransportation Funding Lettercrichert30No ratings yet

- Anderson LetterDocument1 pageAnderson LetterPatrick CondonNo ratings yet

- 02 9 2015 Letter Leg Leaders Cabinet Salaries PDFDocument3 pages02 9 2015 Letter Leg Leaders Cabinet Salaries PDFRachel E. Stassen-BergerNo ratings yet

- House Committee ChairsDocument1 pageHouse Committee ChairsPatrick CondonNo ratings yet