Professional Documents

Culture Documents

14

Uploaded by

JDOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

14

Uploaded by

JDCopyright:

Available Formats

0 r-

1.

Define equity valuation models and

explain the information required to

value equity securities. (p. 14-4)

2.

Describe and apply the residual

operating income model to value

equity securities. (p. 14-5)

mm

c.. )>

m l7

o .z

-4 -

-Z

<

m"

U>

3.

Explain how equity valuation models can

aid managerial decisions. (p . 14-1 0)

D U L E

perating-lncomeased Valuation

the three years prior to 2008, corporate earnings were steady and climbing , stock prices grew continuously, and growth

peared limitless. Then , the recession of 2008-2009 hit. Almost all companies saw revenues and profits decline. Healthcare

companies, however, weathered the storm reasonably well. Compared to

other sectors, healthcare tends to be less sensitive to econom ic changes

for three reasons. First, demand for healthcare products persists as the

U.S. population ages regardless of current events. Second, healthcare

products are fairly immune to depressions in the economic cycle as consumers and patients need products and devices regardless of economic

alth. Third, government spending in healthcare is a large portion of overall healthcare spending, approaching $13 trillion

2011. Government healthcare spending does not closely mirror economic changes as highlighted in the following graph.

c:

..

$1 ,500

i:i5

VI

$1 ,000

Cl>

....

..

$500

::c

$0

co

.::::.

(,)

cuCl>

14,000

13,000

12,000

11 ,000

10,000

<(

::;

9,000

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

8,000

..... oow-Jones

Healthcare cost

Johnson & Johnson (J&J) is a dominant company in the healthcare industry. The company engages in the research

d development, manufacture, and sale of various healthcare products. Among healthcare firms, Johnson & Johnson often is

favorite for those who seek so-called ruler stocks. A ruler stock is one that has an earnings plot with an upward sloping line,

if drawn with a ruler. By this definition, Johnson & Johnson is a classic ruler stock, as the gr~ph below shows.

Cl>

(,)

;:

a.

Johnson & Johnson's Price and EPS

80

70

60

-,---------------------------~6 . 00

50

-+--.!:::========-------------..a.11-_I"~J___---::;-.;'-'.:.._l~--r

Price 1 - - - - - - - - - --

EPS

- - - -- .---=--.,...,.t--- "TI

5.00

~

40 -+-----------------F--'-------,,,,,.~-----+-- 3.00

30 -+----- - - - - - - - - --.11r-- - ---2'""'-- -- - - - - - t

fli

20100 ~

~~~~=====t 0.00

1981 to Present

(continued on next page)

14-2

(continued from previous page)

Sales by

Segment

U.S. and

International Sales

for 10 Years

70

60

(in billions of dollars)

Module 14 I Operating-Income-Based Valuation

50

(in billions of dollars)

Consumer

u.s.

30

Medical Devices

and Diagnostics

50

40

40

Pharmaceutical

70

60

30

20

10

10

2008

2009

L. L.

L. L.

'02 '03 '04 '05 '06 '07 '08 '09 '10

'00 '01

2010

Ruler stocks are arguably attractive because their steady earnings growth hints at more of the same .for th~ future.

Investors often have more confidence in continued earnings growth for a ruler stock than for a company with a history of

erratic earnings.

How has Johnson & Johnson managed to create and sustain such steady earnings growth? Much of the answer rests

in its diversified portfolio of products, which includes consumer, pharmaceutical and medical devices.' The company is a~so

diversified geographically. The two charts above show Johnson & Johnson's balanced product portfolio and strong, growing

international sales.

.

Johnson & Johnson's steady earnings are matched with solid dividend payments. In times of market turr~o il, as during

2011, blue chip stocks with dependable dividends are perceived as providing go_od value _to investors. Some might argue that

Johnson & Johnson might not be the most "exciting" stock, but it is a solid bet in a volatile market.

Supported by its more diversified operations and fueled by a

steady increase in operating profits, Johnson & Johnson's stock

price has nearly completely rebounded from the decline of late

2007 and early 2008, as shown in the graph to the right.

This raises several questions. What factors drive the Johnson

& Johnson stock price? Why do analysts expect its price to continue to rise? How do accounting measures of performance and

financial condition impact stock price? This module provides

insights and answers to these questions. It explains how we can

use forecasts of operating profits and cash flows to price equity

securities such as Johnson & Johnson's stock.

Sources: Johnson & Johnson 10-K and Annual Reports; Yahoo Finance,

www.usgovernmentspending.com.

2007

2008

2009

2010

2011

0 3:

:a 0

e>c

,. c:

,.

Module 7 explains thl\t the value of a debt security is the present value of the interest and principal payments that the investor expects to receive in the future . The valuation of equity securities

is similar in that it is also based on expectations. The difference lies in the increased uncertainty

surrounding the timing and amount of payments from equity securities.

There are many equity valuation models in use today. Each of them defines the value of an

equity security in terms of the present value of forecasted amounts. They differ primarily in terms

of what is forecasted.

The basis of equity valuation is the premise that the value of an equity security is determined

by the payments that the investor can expect to receive. Equity investments involve two types

of payoffs: ( I) dividends received during the holding period and (2) proceeds received when the

security is so ld. The value of an equity security is, then, based on the present value of expected

dividends plus the present value of the security at the end of the forecasted holding period . This

dividend discount model is appealing in its simplicity and its intuitive focus on dividend distribution. As a practical matter, however, the model is not always useful because many companies

that have a positive stock price have never paid a dividend, and are not expected to pay a dividend

in the foreseeable future.

A more practical approach to valuing equity securities focuses on the company's operatino

and investing activities; that is , on the generation of cash by the company rather than the distribu~

tion of cash to the shareholders. This approach is called the discounted cash flow (DCF) model.

The focus of the forecasting process for the DCF model is the company's expected.free cash flows

to the firm, which are defined as operating cash flows net of the expected new investments in net

operating assets that are required to support the business .

Another approach to equity valuation also focuses on operating and investing activities. It

is ~own as the residual operating income (ROPI) model. This model uses both net operating

profits after tax (NOPAT) and the net operating assets (NOA) to determine equity value; see

Mo~ul e 3 for complete descriptions of the NO PAT and NOA measures. This approach highlights

the importance of return on net operating assets (RNOA), and the disaggregation of RNOA into

net operating profit margin and NOA turnover.

When the DOM was introduced in Module 12, it was based on the following relation:

!Vo

Nm

-f

EQUITY VALUATION MODELS

Operating-Income-Based Valuation

r-

stand the determinants of equity value to make informed decisions . Employees at all levels of

understand the factors that create shareholder

value so that they can work effectively toward that objective. For many senior managers, stock

value serves as a scorecard. Successful managers are those who better understand the factors

affecting that scorecard.

an organization, whether public or private, should

International

20

I +re

Both the DCF and ROPI models derive from this basic starting point and are, therefore, mathematically equivalent. Any differences between the estimated valuations of equity using these models arise due to implementaStep 1-Understandlng the BusiMSS Environment

tion issues rather than the frameworks themselves. Assumpand Accounting lnfonnatlon

Modules 1 and 2

tions such as forecast horizon length or terminal growth rate

(discussed later in the module) can be easier to determine

Step 2-Adfustlng and Aa-.lng Flnanclal lnfonnatlon

with less uncertainty for a particular company using a particuand Accounting Information

Profitabilily

Analysis-Module 3

Investing- Modules 6, 9. and 10

lar valuation model , which can lead to a more reliable value

Credit Analysis-Module 4

Financing-Modules 7 and 8

Operations - Module 5

estimate. Following our 4-step process from Module 1, the

quality of our value estimate (Step 4) is based on the quality of our forecasts of future payoffs (Step 3). Further, those

Step 3-FOfeCasting Financial Information

Module 11

forecasts are only as good as the adjustments/assessment of

]"

financi al information made (Step 2) and our understanding of

Step 4-Uslng Information for Valuation

the company's business environment (Step I). If the forecasts

Cost of Capital and Valuation Basics-Module 12

Cash-Flow-Based Valuation-Module 13

made are identical across the different payoffs , the resulting

Operating-Income-Based Va1uat1on-Module 14

Market-Based

Valuation-Module 15

value estimates from the models will also be identical.

Dividend Discount Model

Discounted Cash Flow Model

Steps for Application

Residual Operating Income

Model

Illustrating the Model

Extending the Model

This module focuses on valuino equity securities (we explain the valuation of debt securities in

Module 7). Specifically, we de;cribe and illustrate the residual o~erat!ng _income mod~l (ROP;~

in this module. We then concl ude by discussing the management imphcat1ons from an increas

understanding of the factors that impact values of equity securities. It is important that we under-

L01 Define equity

valuation models and

explain the information

required to value

equity securities.

+ IV

1

1

= ---'----=-

14-3

14-4

14-5

Module 14 I Operating-Income-Based Val uation

Module 14 I Operating-Income-Based Valuation

hurdle oper~ting pr~fit (N OABeg ~ r) is greater than NOPAT. IN either case, we must understand

the economic meaning of a negative ROPI and the valuation implications .

Speci~i cally, ~ecall that .the NOPAT we use in the ROPl model represents future ex pected

net operatrng profits to the firm. Thus, the first step in the ROPI model is to develop reasonable

forecasts of NOPAT. As explained in Module 11 , good fo recasts begi n with sound assumptions.

forecasted NO PAT can sometimes be negative for a certain period such as with new firms or with

firms experiencing an economic downturn. But over the long run , firms cannot sustain continuous

n~g~tive N?PAT as such .fi rms would run short of cash and be closed or forced into bankruptcy.

S1rrular logic leads us to mfer that firms cannot generate such low NOPAT that they do not earn

at least the average investor 's hurdle rate. (Recall that the hurdle rate is the weio-hted averaoe

cost of capital.) Firms that earn profits below the hurdle rate are destroying shareh~lder value.If

a firm consistantly earns less than the hurdl e rate, its shareholders would be better off if the firm

liquidated because they could invest their funds elsewhere and at least expect to earn the hurdle

rate. Thus, it is not economically reasonable to model ROPI that is consistentl y negative for a

viable firm . A ?1.odel that includes negative ROPI in each forecasted period , would suggest that

we need .to ~ev1s1t our forecast assumptions. If ROPI is still negati ve after more careful scrutiny,

the firm is likely not viable and the ROPI model valuation is inappropriate. The value of such a

firm is likely equal to the fair value of its individual assets less the value to settle its liabilities.

Understanding the ROPl model helps us reap the benefits from the di saggregation of return

on net operating assets (RNOA) in Module 3. In addition, the ROPI model is the foundation for

many internal an.d external performance evaluation and compensation systems marketed by management consulting and accounting services firms. 2

RESIDUAL OPERATING INCOME (ROPI) MODEL

LO 2 Describe and

apply the residual

operating income

model to value

equity securities.

The residual operating income (ROPl) model focuses on net operating profit a~er tax (NOPAT)

and net operating assets (NOA). This means it uses key measures from both the income statement

and balance sheet in determining firm value.

The rationale for usi ng the ROPI model is that book value provides an anchor to our valuation

that is then augmented based on earnings. Accounting earnings are a mea~ure of wealth creation,

which measure economic resources generated (revenues) less econorruc resource~ consumed

(ex penses) regardless of whether a cash flow has concurrently occurred. T?e accountin.g earnings

attempt to match accrual recognition to the timing of chang~s in economic value. This measure

of wealth creation provides an alternative approach to valuation w?en compared to the measures

of wealth distribution (dividends) and di stributable wealth generation (free. ~ash flo ws). We hold

an equity security, or any asset, in the expecta.tion that it will create ~dd1t10n~l wealth for our

future consumption. Thi s focus on wealth creation for future consumption has increased the use

of earnings-based valuation in recent years.

ROPI Model Structure

The ROPI model defines firm value as the sum of two components:

Firm Value= NOA+ Present Value of Expected ROPI

where

NOA= Net operating assets

Steps in Applying the ROPI Model

ROPI = Residual operating income

Net operating assets (NOA) are the foundation of fir?1 value under the ROPI ?1o~el. T~is is

potentiall y problematic because we measure NOA u~ing. th~ balance sheet, wh1c.h 1~ unlikely

to fully and contemporaneously capture the true (or mtnns1c) value of all of a firm s ope~at

ing assets.1 However, the ROPI model adds an adjustment that corrects for the ~ndervaluat~on

or overvaluation of NOA . Thi s adjustment is the present value of expected residual operatrng

income, and is defined as follows:

Application of the ROPI model to equity valuation in volves five steps:

1. Forecast and discount ROPI for the horizon period. 3

2. Forecast and di scount ROPI for the terminal period. 4

3. Sum the present values from both the horizon and terminal periods; then add thi s sum to current NOA to get firm (enterprise) value.

ROPI = NOPAT - (NOA 8 eg x r w)

4. Subtract net nonoperating obligations (NNO), along with any noncontrolling interest, from

firm value to yield firm equity value.

Expected NOPAT

5. Divide firm equity va lue by the number of shares outstanding to yield stock value per share .

where

NOA Beg = Net operating assets at beginning (B eg) of period

BUSINESS INSIGHT

r w =Weighted average cost of capital (WACC)

Residual operating income (ROPI) is the net operating profit a firm earns over and above the return

that the operating assets are expected to earn given the firm 's WACC. Shareholde.rs expect the

company to use NOA to generate, at least, a " hurdle" profit to cover the cost of capital C~A_CC) .

Companies that earn profits over and above that hurdle , create value for. s~areholders. This is the

concept of residual income: that is , income earned over and above the mm1?1um amount of return

required by investors. Typically, ROPI is positiv~ but there are ~wo algebr~1c way~ that ROP! c:

be negative: (I) if a company reports a net operating loss- that 1s, NO PAT 1s negative , or (2) if t

If the assets earn more than ex pected , it could be because NOA does not capture all of the firms ' assets. For examt~

R&D and advertisin o are not fully and contemporaneously reflected on the balance sheet as assets though they II e Y

Produce future earni~os. Likewise internall y generated goodwill is not fully refl ected on the balance sheet as an asset.

"'

S imi 1arl y, assets are generall

y not 'written up to reflect unrealized

gains._

Conversely,_somelimes

the ba Iance s hee t overtate

states the true value of NOA. For example, companies can delay the wnte-down of impaired assets and, thus , overs ue

their book values. These examples, and a host of others, can yield reported values of NOA that differ from the fa ir val

of operating assets.

1

ings: Nominal (Risk-Adjusted) vs Real

Module 12 explained that the value of the payoffs (earnings) is unaffected by whether nominal (riskadjusted) or real inputs are used in valuation provided that nominal earnings are discounted using

nominal discount rates (and real earnings are discounted using real discount rates). This means

that in practice, nominal earnings and nominal discount rates are used; analysts do not forecast

real payoffs (earnings).

Ex~mples are economic value added (EVA T") from Stern Stewart & Company, the economic profit model from

McKinsey & Co ., the cash flow return on investment (CFROJ ni) from Holt Value Associates, the economic value management from KPMG , and the value builder from PricewalerhouseCoopers (PwC).

2

When discounting RO_PI , the appropri ate di scount rate (r J is the weighted average cost of capital (WACC), where

the wei ghts are the relative percentages of debt (d) and equity (e) in the capital st ructure applied to the expected returns

on debt (r) and equity (r. ), respecti vely: WACC = r w = (rd X % of debt) + (r, X % of equity); see Module 12 .

4

For an assumed growth , g, the present value of the perpewity of ROPl beyond the horizon period is given by ~0~';.

where ROPlT is the res idual operallng income for the term inal penod , r., is WACC for the firm, and g is the assumed

growth rate of ROPlT fo llow in g the hori zon period . The res ultin g amount is then di scounted back to the prese nt using

the WACC , computed over lhe length of the horizon period .

14-6

14-7

Module 14 I Operating-Income-Based Valuation

Module 14 I Operating-Income-Based Valuation

Illustrating the ROPI Model

is $9,069 milli on , computed as $9,795 m illi on X 0 .92593 (the present value o ne year hence

8

discoun ted at 8%). S imil arl y, the present va lue of201 2 ROPI (two years he nce) is $8,6 14

mi ll ion , computed as $ 10,047 m illi o n X 0 .85734 , a nd so o n th ro ug h 20 15. T he su m of

these present va lues (cumu lative present value) is $33,966 milli o n .

Compute present value of terminal period ROPI. The present va lue of the terminal period

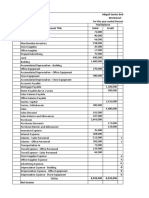

. o f the ROPI model , we use Johnson & Johnson . .Forecasted

To .illustrate app11cat1on

. . financials

for J&J (forecast hori zon of 20 lJ -20 14 and terminal period of 20 I 5) are 111 ~x h 1b1t ~4. l .5 The

fo recasts (in bo ld) are fo r sales, NOPAT, and NOA (the same fo recasts fro m 1ll ustrat1on of the

DCF model in Module 13) . These fo recasts assume an annual ~% sa l ~s growth for the horizon

1 d a term inal period sales O'rowth of 1%, net o perating profit margin (NOPM) of 21 %, and a

net operating asset

(NOAT) of 1.30 (which is

20 10 turnover rate based on

yyear-end NOA, year-end amounts are used because we are forecast mg year-end account balances,

not average ba lances).6 ' 7

p:: ~e~d

I

I

EXHIBIT 14.1

tu~nover

C I0,847 mill ion)

t~e

ROPI is $ 11 3,898 milli on , computed as

Sales (unrounded) . ... . .........

$ 61,587

$64,050.48

(61,587

61 ,587

13,065

45,694

Sales (rounded) ............. .

NOPAT* ..... . ...

NOA** . . . . .......... .:

ROP I (NO PAT - [NOA 809 X rw])

Discount facto r (1 /(1 + rwl~ * ....... .... .

Present value of horizo n ROPI ........ .

Cum present value of horizo n ROPI .... .

Present value of te rminal ROPI . . . ... . .

NOA ............. . .

Total fi rm value ....... . ........

Less NNOt . .....

1.04)

$66,612.49

(64,050.48

1.04)

$69,277.00

(66,612.49

1.04)

$72,048.08

x 1.04)

(69,277.00

$72,768.56

(72,048.08

x 1.01)

64,050

13,451

49,269

66,612

13,989

51 ,240

69,277

14,548

53,290

72,048

15,130

55,422

72,769

15,281

55,976

9,795

0.92593

9,069

10,047

0.85734

8 ,614

10,449

0.79383

8,295

10,867

0.73503

7,988

10,847

..

$ 33,966

113,898

45 ,694

193,558

(10,885)

Firm equ ity value ........... . . . ..

$204,443

S hares outstanding ... . ............

Stock value per share ............

~~O J

or ($ 10,847/0 .07) X 0 .73503 .

2014

2013

2012

2011

1.08

($33,966 milli on) and termina l peri od ($ 11 3,898 m illion), plus NO A ($45,694 milli o n), to

get firm (enterprise) va lue of $ 193,558 m illi o n . We then subtract the value of net no no perating obli gati o ns of $ 10,885 milli o n to get fir m equity va lue of $204,443. Di viding fir m

equity va lue by the 2,738 .1 milli o n shares outstand ing y ie lds the es tim ated per share valuati o n of $74 .67 .

Horizon Period

Reported

2010

~8

Compute fi r m eq uity value. We mu st sum the present va lues from the hori zon period

Application of Residual Operating Income Model

(In millions, except per share

values and discount factors)

2,738.1

74.67

We perfo rm th is valuation as of February 25, 20 11 , which is the SEC fi ling date for J&J's 10-K.

J&J's stock closed at $59 . 13 o n February 25, 20 11. Our valuation estimate of $74 .67 indicates

that the company 's stock is underva lued as of that date . J&J's stock price c limbed steadi ly thro ugh

the spring of 20 11 and was trading fo r $65 by July. Our estimated price is hi gher than analysts'

target pri ce but J&J was still recommended as a strong BUY stock.

The ROPI model estimate fo r J&J is equal to that computed using the DCF model illustrated

earlier in Module 13. Thi s is the case so long as the fi rm is in a steady state, that is, NOPAT and NOA

are growing at the same rate (for example, when RNOA is constant). When the steady-state condition

is not met, fo r example, when a company has variable growth rates over time or when profit margins are changing from year to year, the two models yield diffe rent valuations. (The terminal period

estimate of ROPLr+i is normally computed as ROPLr + 1 = [NOPATT X (l + g)] - (NOAy X r,).

A common mi stake is to compute it as ROPLr+i = [ROPIT X (l + g)]. The diffe rence is that the

latter computatio n requires that NOA grow at rate g from period T to T + I , which may or may not

be an intended assumption.) Analysts typically compute va lues fro m several models and use qualitative analys is to determine a fin al price estimate.

o

re rted in the tax footnote to its 201O 10-K, NOPAT for 2010 is computed as follows ($ .

_ $

_ $

]}) = $ ,

. A note on rounding: To forecast sales, we multiply pnor

'Given J&J 's combined federal and state statutory t~ rate of ~.O l'o ~ x ~

13 065

768

107

13

35

millions): ($61 ,587 - $18,792 - $19,424 - $6,844)

($3,6

{o.

[

.

Th n we round each year's forecasted sales to whole units and use

1

00

year's unrounded sales by (1 + Grow1h rate); this is done for the horizon an~ ~en111~a :n ~- sucec~ssive step we round the number to whole units before proceeding

rounded sales to compute NOPAT and NOA, where both are rounded to w o e urn s.

eac

55

Discounted cash fl ow (DC F) and resi dual operating income (ROPI) models yield identical esti mates

when the expected payoffs are forecasted for an infinite horizon. For practical reasons, we must use

horizon period forecasts and a terminal period forecast. This truncation of the forecast horizon is

a main cause of any difference in value estimates for these models. Importantly, if we can forecast

(GAAP-based} NOPAT and NOA more accurately than forecasts of cash inflows and outflows, we

will obtain more accurate estimates of firm value given a finite horizon .

to the next step.

$ 694

. .

. $ 2 908 - $19 355 - $8 303) - ($46 329 - $7 ,617 - $9 ,156) = 45,

.

.. NOA computations for 2010 follow($ m1Jhons). ( 10 ,

'

.

.'

'

. .

_

_

= ${10 ,885). J&J 's NNO is negative

56 579

tN NO is the difference between NOA and total shareholders' equity; 1n this case NNO ($ m1l11ons) - 45, 69 4

because it carries substantial cash and securities that exceed its debt.

.

:j:For simplification , present value computations use discount factors rounded to 5 decimal places.

T he bottom line of Ex hibit 14 .1 is the estimated J&J equi ty value of $204,443 m i ll i~n , orn~

per share stock value of $74.67. T he present v.alue computat.ions use an 8% WACC as the d1scou

rate. Specifically, we obtain thi s stock valuat10n as fo ll ows.

m ute resent value of horizon period ROPI. The fo recasted 2011 ROPI of $9 ,7_95

1.

The weighted average cost of capital (WACC) for J&J is computed using the fo ll ow in g three-step process:

I.

The cost of eq ui ty capital is given by the capital asset prici ng model (CA PM): re = r + ~ (r,,, - r ), where ~ is the

1

1

beta of the stock (an esti mate of stock pri ce vari abili ty that is reported by several services such as Yahoo!

and Standard

and Poors), r1 is the ri sk-free rate (commonly assumed as the I0-year treasury bond rate), and r,,, is the expected return

to the entire market. The expression (r,,, - r1) is the "spread" of eq uities over the risk-free rale , often assumed to be

about 5% to 7%. For J&J, given a beta of 1.00 and a 10-year treasury bond rate of 3.58% (r ) as of February 28 , 20 11 ,

1

r, is estimated as 9.58%, computed as 3.58% + ( 1.00 x 6%).

2.

Two alternative computations for pretax cost of debt capital are: ( I) Interest expense/Average inte rest-bearing debt,

and (2) Weighted-average effective interest rate on debt . For the latter, J&J reports its 5.25% rate in footnote 7 to its

10- K, whi ch we use. To obtain J&J's after-tax cost of debt capital, we multi ply 5.25% by I - 0.360, where 36.0%

is the federal and state statutory tax rate from its tax foo tnote, yiel ding 3.36% (J&J's after-tax cost of debt).

3.

WACC is the weighted average of the cost of eq ui ty capital and the cost of debt capital. J&J capital structure is 77%

equity and 23 % debt. Thus, J&J's weighted average cost of capital is (77% X 9 .58%) + (23 % X 3.36%) = 8. 15%,

rounded to 8% . (The capital structure of J&J depends on its stock price. To achi eve an internall y consistent va lue

estimate, an iterative process can be used where the esti mated val ue !in thi s case $74 .67 1 is used to recompute its

capital struct ure and get an updated WACC esti mate. After several iterations, the valuation estimate and the weights

used to compute WACC converge.)

;~lli~n is ~omputed from the forecasted 2011 NO PAT ($ 13,45 1) less th~ product of begin~

ning peri od NOA ($45,694) and WACC (0 .08). The present value of thi s ROPI as of 201

s We use a four-period horizon in the tex t and

assignmen~s simp:if~ the :~~o~~1i~~ t~:de~ou~~~~~utr~ ~y~~~:~;~::~

to

burden. In practice, analysts use spreadshe_ets to forecas t uture cas i

ows

have a forecast horizon of seven to ten pen ods.

1

d d . . trative

h

cost of ooods sold selhn 0 enera , an a m1111 s

NOPAT eq uals revenues less operati ng expenses sue as .

"'

, d

"'~"' s or losses from financial

d

NO PAT excludes any interest reven ue and mterest expense an any ,,am

.

d

reflects the operati ng si de of the firm as opposed to nonoperating activities such as borrowmg an

securi ty in vestment act ivi ti es. NOA eq uals operati ng assets less operall ~g habil 1t1es. (See Modul e 3 .~ d I 11 I this

7 NOPAT and NOA are typicall y forecasted using the detail ed .forecastmg procedures ~1 scussed 111

o ut~e v~l:ation

module we use the parsimonious method to multiyear forecas t111 g (see Modu le 11 ) to ocus attention on

process .

~::~~!~~; N~~~T

14-8

14-9

Module 14 I Operating- Income-Based Valuation

Module 14 I Operating-Income-Based Valuation

(1 + [r j2]). The Oppenheimer report in ~ppendix 138 applies a mid-year adjustment factor. For

of 8% would yield an adJustment factor of 1.04 , whi.ch increases

J&J, our

estimate

t" WACC

.

$

the

val ua ion estimate to 212,626 ($204,448 X 1.04), or $77.65 per share.

Extending the ROPI Model

The Johnson & Johnson illustration makes several assumptions that can be refined to derive more

precise stock values. We describe some of these refinements here.

Reverse Eng~~eerin~. One alte~ative to s~nsitivity analysis is to use reverse engineering in

an ~ttempt to unlock the m.arket s a~sumpt1ons in determining price. The process of reverse

engm~enng uses observed pn.c e combined with valuation assumptions to solve for one of the

valuat10n parameters such as discount rate or terminal growth rate. If the observed market price of

Johnson & Johnson of $59 .13 a~ February 25, 2011, is used with the other assumptions in Exhibit

14.1 , we can s?lve fvr the .tcrmmal. gro":~'th rate (often implemented using reiterative estimation).

In our case, this process yields an implied terminal growth rate for ROPI of -3 2 m A

l t

Id h d .

. -10 . n investor

or ~a ys cou . t. en ec1de whether he or she believes this rate to be too high or too low as a

basis for determmmg a buy or sell decision.

Horizon Period. The illustration uses a relatively short horizon period. It might be more reasonable to anticipate growth for longer than four years before the company achieves a long-term

growth of I%, as in our example. The downside to much longer horizon periods is that it is more

difficult to accurately project growth as the time horizon extends. Thus, the shorter horizon period

might provide a more conservative stock value.

Growth Rate. The illustration assumes a constant growth rate , NOPM and NOAT during the

horizon period. As an alternative, we can alter these, even having different rates for each year. For

example, we might assume that the recent economic downturn will depress J&J's sales for 20 11

and 2012 and, thus, we might forecast a growth rate less than 4% for those two years followed by

4% growth in 2013 and 2014. Similarly, we could change NOPM and/or NOAT for each year to

better match our expectations of future profitability and/or asset efficiency.

MANAGERIAL INSIGHTS FROM THE ROPI MODEL

Financial Statement Forecasts. The illustration uses a parsimonious method to multiyear forecasting to focus attention on the valuation process. As an alternative, we can prepare detailed yearby-year forecasts of the income statement and balance sheet to derive NOPAT and NOA , respectively. Year-by-year forecasts allow us to more precisely model relations on the income statement, and

between the income statement and the balance sheet. For example, the parsimonious model assumes

a constant NOPM of 21 % for the J&J illustration. This implies that all expenses vary in exactly the

same way with revenue growth. We can refine that assumption by including different growth rates

for different expenses. As another example, the parsimonious model assumes one turnover rate for

all net operating assets. In the J&J example, we apply a NOAT of 1.3 , which is the average historic

turnover rate across accounts receivable , inventory, PPE, accounts payable, and so forth. A year-byyear forecast would allow the turnover rates to vary across different operating assets and liabilities

and yield potentially more precise estimates for future expected NOA.

Terminal Growth Rate. A crucial assumption in valuation is the choice of a terminal growth

rate. This rate reflects all future ROPI beyond the forecast horizon, which is captured in terminal

value. Many valuations are sensitive to variations in terminal growth rate. The choice of a forecast

horizon is influenced by whether the company has achieved a long-run steady state where a pattern of future ROPI is expected to persist for the long-run of the company. Ideally, the forecast

horizon is sufficiently long to allow steady state to be achieved within the horizon. The terminal

growth rate can be a positive percentage (but not exceeding the discount rate), or zero, or negative (but not less than -100%). An increase in the terminal growth rate in ROPI for Johnson &

Johnson from 1% to 2% would increase the present value of the terminal ROPI from $11 3 ,898

to $132,881 [$10,847/(0.08 - 0.02)/1.08 4], yielding an increase in estimated value per share of

$6.93 [($132,881 - $113,898)/2,738 .1]. This shows the sensitivity of a valuation to a terminal

growth rate. The quality of our forecasts within the horizon period directly impacts the quality of

our terminal growth rate estimate.

Sensitivity Analysis of Stock Price. The illustration uses only one set of assumptions and derives

only one stock price. To refine our valuation we can perform sensitivity analyses. For example, the

J&J illustration uses 8% for WACC, which is our best estimate of the company's weighted average

cost of capital. We might derive stock value using a larger and smaller WACC to gauge how sensitive the stock price is to changes in the discount rate. Extending this idea, we commonly derive a

"worst case" stock value by simultaneously applying the lowest reasonable assumptions for growth,

NOPM , and NOAT, and the highest reasonable assumption for WACC. We also commonly derive

the "best case" scenario by applying the highest reasonable assumptions for growth, NOPM , and

NOAT, and the lowest reasonable assumption for WACC. This provides a range of reasonable stock

values and gives us more information and confidence about potential outcomes.

Mid-Year Adjustment. Payoffs in our valuation model are assumed to occur at year-end and are

discounted for the entire year. An alternative is to assume that payoffs occur evenly during the

year. A common adjustment in this case is to multiply the estimated value by a mid-year adjustment factor defined as (1 + r ) 05 . Another common approximation of the adjustment factor is

14-10

The R?PI.model defines firm value as the sum of NOA and the present value of expected residual

operating income as follows:

Firm Value = NOA + Present Value of Future [NOPAT - (NOA

Beg

x r )]

w

ROPI

Increasing ROPI , therefore, increases firm value . Managers can increase ROPI in two ways:

1. Decrease the NOA required to generate a given level of NOPAT (improve efficiency)

2. Increase NO PAT with the same level of NOA investment (improve profitability)

Thes~ are two very important observations. It means that achieving better performance requires

effecti ve management o.f bot~ th~ balance sheet and the income statement. Most operating managers

are accustomed to wor.kin.g with ~ncome statements. Further, they are often evaluated on profitability

~easures , such as ach1evmg desired levels of sales and gross profit or efficiently managino operating expenses. The ROPI model focuses management attention on the balance sheet as well.

Manage~ent Focus on Improved Efficiency

The ~wo points above highlight two paths to increase ROPI and, accordingly, firm value. First, let's

consider how mana~eme~t can reduce the level of NOA while maintaining a given ]eve] of NOPAT.

Many managers begm by implementing procedures that reduce net operating working capital, such as:

Reducing receivables through:

0 Better assessment of customers ' credit quality

0 Better controls to identify delinquencies and automated payment notices

0 More accurate and timely invoicing

Reducing inventories through:

0

0

0

0

Use of less costly components (of equal quality) and production with lower wage rates

Elimination of product features not valued by customers

Outsourcing to reduce product cost

Just-in-time deliveries of raw materials

0 Elimination of manufacturing bottlenecks to reduce work-in-process inventories

0 Producing to order rather than to estimated demand

Increasing payables through:

0 Extending the payment of low or no-cost payables (so long as the supplier relationships are

unharmed)

L03 Explain how

equity valuation

models can aid

managerial decisions.

14-11

Module 14 I Operating-Income-Based Valuation

Module 14 I Operating-Income-Based Valuation

Management must also look at its long-term operating assets for opportunjties to reduce unnecessary operating assets, such as the:

Sale of unnecessary property, plant or equipment

Acquisition of production and administrative assets m partnership with other entities for

greater throughput

Acquisition of finished or semifinished goods from suppliers to reduce manufacturing assets

Advantages and Disadvantages of DCF and ROPI Valuation Models

~~~~~~--~~~~~~~~

Advantages

Disadvantages

Performs Best

Popular and widely

accepted model

Cash investments in plant assets are treated as cash

outflows, even though they create shareholder value

When the firm reports positive

FCFF

Value not recognized unless evidenced by cash flows

When FCFF grows at a

relatively constant rate

Cash flows are unaffected

by accrual accounting

DCF

FCFF is intuitive

Management Focus on Improved Profitability

When a long-run steady-state

pattern of FCFF emerges in a

short horizon

- Securitization, which GAAP treats as an operating cash

flow when many view it as a financing activity

Increasing gross profit dollars through:

0 Better pricing and mix of products sold

0 Reduction of raw material and labor cost without sacrificing product quality , perhaps by

outsourcing, better design , or more efficient manufacturing

0 Increase of throughput to minimize overhead costs per unit (provided inventory does not

build up)

Computing FCFF can be difficult as operating cash flows

are affected by

- Cutbacks on investments (receivables, inventories, plant

assets); can yield short-run benefits at long-run cost

The second path to increase ROPI and, accordingly, firm value is to increase NOPAT with the same

level of NOA investment. Management would look to strategies that maximize NO PAT, such as:

ROPI

Focuses on value drivers

such as profit margins and

asset turnovers

Financial statements do not reflect all company assets,

especially for knowledge-based industries (for example,

R&D assets and goodwill)

Uses both balance sheet

and income statement,

including accrual

accounting information

Requires some knowledge of accrual accounting

Reduces weight placed on

terminal period value

When financial statements

reflect more of the assets

and liabilities; including

those items often reported

off-balance-sheet

When a long-run steady-state

pattern of ROPI emerges in a

short horizon

Reducing selling , general, and administrative expenses through:

0

0

0

0

Better management of personnel

Reduction of overhead

Use of derivatives to hedge commodity and interest costs

Minimization of tax expense

Before undertaking any of these actions , managers must consider both short- and long-run implications for the company. The ROPI model helps managers assess company performance (i ncome

statement) relative to the net operating assets committed (balance sheet).

ANALYSIS DECISION

You Are the Chief Financial Officer

The residual operating income (ROPI) model highlights the importance of increasing NOPAT and

reducing net operating assets, which are the two major components of the return on net operating

assets (RNOA). What specific steps can you take to improve RNOA through improvement of its

components: net operating profit margin and net operating asset turnover? [Answer, p. 14-15]

ASSESSMENT OF VALUATION MODELS

Exhibit 14.2 provides a brief summary of the advantages and disadvantages of the DCF and ROPI

models. Neither model dominates the other in all cases, and both are theoretically equivalent.

Instead, professionals must choose the model that performs best under practical circumstances.

There are numerous other equity valuation models in practice. Many require forecasting, but

several others do not. A quick review of selected models follows:

The method of comparables (often called multiples) model predicts equity valuation or

stock value using price multiples. Price multiples are defined as stock price divided by some key

financial statement number. That financial number varies across investors but is usually one of

the following: net income, net sales, book value of equity, total assets, or cash flow. The method

then compares companies' multiples to those of their competitors to assign value.

The net asset valuation model draws on the financial reporting system to assign value. That

is, equity is valued as reported assets less reported liabilities. Some investors adjust reported

assets and liabilities for several perceived shortcomings in GAAP prior to computing net asset

value. This method is commonly applied when valuing privately held companies.

14-12

The dividend discount model predicts that equity valuation or stock values equal the present value of expected cash dividends . This model is founded on the dividend discount formula

and depends on the reliability of forecasted cash dividends .

There are additional models applied in practice that involve dividends, cash flows, research

and development outlays, accounting rates of return, cash recovery rates, and real option models. Further, some practitioners, called chartists and technicians , chart price behavior over time

and use it to predict equity value .

RESEARCH INSIGHT Using Models to Identify Mispriced Stocks

Implementation of the ROPI model can include parameters to capture differences in growth opportunities, persistence of ROPI, and the conservatism in accounting measures. Research finds differences in how such factors, across firms and over time, affect ROPI and changes in NOA. This

research also hints that investors do not entirely understand the properties underlying these factors

and, consequently, individual stocks can be mispriced for short periods of time. Other research

contends that the apparent mispricing is due to an omitted valuation variable related to riskiness

of the firm.

ANALYZING GLOBAL REPORTS

~here _are no differences in the method or technique of valuing equity securities using IFRS

frnancial statements. We can use the ROPI method with IFRS data as inputs and determine intrinsic values. The extent to which NOA overstates or understates market value is corrected by the

present value of future expected ROPJ; this continues to hold when using different accounting

standards such as IFRS. The key is accurate forecasts, which is driven by an understanding of

accou~tin~, the comp~ny, and its environment. The four steps for financial statement analysis and

valuat10n introduced m Module 1, and reproduced at the beginning of this module, are the same

regardless of the accounting standards followed.

14-13

Module 14 I Operating-Income-Based Valuation

Module 14 I Operating-Income-Based Valuation

MODULE-END REVIEW

areholders' equity

ferred stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Common stock-par value $1 .00 per share

(authorized 4,320,000,000 shares; issued 3,119,843,000 shares) .... . .... .. ..... . . .. .

Accumulated other comprehensive income . . ... .. . . .... . .. ..... ... .... ...... . . . .. .

Retained earnings ... .. .... ... . ............ ..... ..... . ... ... .. ... ... .. . .... . .

Less: common stock held in treasury, at cost (381,746,000 shares and 365,522,000 shares) . . .

Following are forecasts of Procter & Gamble 's sales, net operating profit after tax (NOPAT), and n

operating assets (NOA). These are taken from our forecasting process in Module 11 and now include a

terminal period forecast that reflects a long-term growth rate of 1% .

Horizon Period

Reported

Sales growth ...... . ....

Net sales (unrounded) ...

$ 82 ,559

Net sales (rounded) ... . .

NOPAT ......... . .....

NOA ...... . ........ ..

$ 82 ,559

12, 193

97,247

2014

2013

2012

2011

(In mllllons)

4.6%

$86,356.71

($82,559 x 1.046)

$ 86,357

12,781

101,596

4.6%

$90,329.12

($86,356. 71 x 1.046)

$ 90,329

13,369

106,269

4.6%

$94,484.26

($90,329.12 x 1.046)

$ 94,484

13,984

111,158

2015

4.6%

$98,830.54

($94,484.26 x 1.046)

$ 98,831

14,627

116,272

1%

$99,818.84

($98,830.54 x 1.01)

$ 99,819

14,773

117,434

3,120

(3,531)

77,773

20,783

3,120

(3,058)

70,306

19,780

Total shareholders' equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

56,579

50,588

Total liabilities ar:id shar<tholdern' equity ... .. . ... . . ... . . ...... . : .... . .. . .. . ...... . .

$102,908

$94,682

2010

2009

2008

$61 ,587

18,792

$61,897

18,447

$63,747

18,511

Gross profit. ....................... .. ..................... .. . .. .

Selling, marketing and administrative expenses .. ... . .. . ........ ... ... .

Research and development expense ... ... .... ..... ................. .

Purchased in-process research and development. . . . ... . .... . ...... . .. .

Interest income . .... . . . .. ... . . . .......... .... . . .. . .......... ....

Interest expense, net of portion capitalized . . ........ . .. .. . . .. .. . . ....

Other (income) expense1 . . . . . . . . . . . . . . . . . . . . . . . . . .

Restructuring .. . ..... ...... ....... . ... .. .......... . ........... . .

42,795

19,424

6,844

43,450

19,801

6,986

(107)

455

(768)

(90)

451

(526)

1,073

. 45,236

21,490

7,577

181

(361)

435

(1,015)

Earnings before provision for taxes on income ... . . ...... . . . ...... .... .

Provision for taxes on income ............... . .................. ... .

16,947

3,613

Net earnings ................ . ..... . . ........ . . . . . .. ... . ........ .

$13 ,334

Income Statement

The solution is on page 14-28.

JOHNSON & JOHNSON FINANC IAL

STATEMENTS

-.,

JOHNSON & JOHNSON

JOHNSON & JOHNSON

Drawing on these forecasts, compute P&G's residual operating income (ROPI) and an estimate of

its stock value using the ROPI model. Assume the following: discount rate (WACC) o~ ~ %, shares

outstanding of 2,765 .7 million , and net nonoperating obligations (NNO) of $29,607 m1lhon (which

includes $36 1 million in noncontrolling interest).

APPENDIX 1 4 A:

15,755

3,489

16,929

3,980

$12,266

$12,949

---

Balance Sheet

-1

2010

2009

Assets

Cash and cash equivalents . ..... .. ..... . ... ....... . .. .. .... ... ....... . . .. .. .

Marketable securities . .. . .. . ...... . ...... . .. . . . ... .. .. . .. .... . .... ..

Accounts receivable trade, net of allowances for doubtful accounts $340 (2009, $333) . . ..

Inventories . .... . . . ... . .... .. .......... . .. ..

Deferred taxes on income .... ... . . .. .... .... . . . .. .... . .. . . .. .... ... . . . .. . . . . .

Prepaid expenses and other receivables ... ....... ............... .. . . . . . . . . . .. .

$ 19,355

8,303

9,774

5,378

2,224

2,273

$15,810

3,61 5

9,646

5,1 80

2,793

2,497

Total current assets .... .... .. ........ ... ... .... . ... .......... . . ... .. . . ... .

47,307

39,541

Property, plant and equipment, net . .......... ... .. . ........ . . . ........ .... . . . . .

Intangible assets, net . .. .. ... .... . .......... . . .. ... .. .................. . ... .. .

Goodwill ... . .............. ... .. . ..... ... ............... . ....... .... ....... .

Deferred taxes on income .. . ....... . . .. ...... . .... ................. .. .

Other assets . .... . ... .... . ... .... .... .. ..... . . . . .. . .. . ........... . .. ....

$ 14,553

16,716

15,294

5,096

3,942

$14,759

16,323

14,862

5,507

3,690

Total assets ...... . ....... . ..... .... ... ........ .... . ...

$102,908

At Fiscal Year End ($ millions, except shares and per share)

1 We classify Other (Income) Expense as nonoperating because it includes, among other items: royalty income; gains and losses related to

the sale and write-down of investments in equity securities; currency gains and losses; non-controlling interests; and hedge ineffectiveness.

"""-

Liabilities and Shareholders' Equity

Loans and notes payable . ........ . .. .... . ...... ... .. ..... .. . .... . .. . ...

Accounts payable ..... . ....... . ...... . . .... .. .. . .. .. . ..... .. .... . . . .. .. ..

Accrued liabilities .. .. .. . . . .... . ...... ........ .. . .... . .. . . .. . ... .. . . . .. . . ..

Accrued rebates, returns and promotions .. ..... . ... .. ..... ........ . ...... ....

Accrued compensation ... . ......... . .... . . .. ..... . ...... . ... .. ... . .... .. ..

Accrued taxes on income .. ...... . .... .. ... . . . . ............ .. .. ... ... .. . . . .

7,617

5,623

4,100

2,512

2,642

578

$94,682

--$ 6,31 8

5,541

4,625

2,028

2,777

442

$21 ,731

Total current liabilities .. ......... . . . .. .... ... . . . . . .. . .. .... . .. . .... .. . ..

$ 23,072

Long-term debt . ... . . . ..... . .... . ... . . . ... ... ..... .. ..

Deferred taxes on income ..... ... ............ .. . . . ...... . . . .. .... . . . .

Employee related obligations . . . . . ... ........ .... . . . . .... .. .... . .. . . . .. .... . ... .

Other liabilities . ..... . ... ...... .... . . . . .. . . ...... ... .

9,156

1,447

6,087

6,567

8,223

1,424

6,769

5,947

Total liabilities . ....... .. ...... .. .... . .... ... ........ . .... ... .. . ... . . ... .... .

$ 46,329

$44,094

continued

JOHNSON & JOHNSON

Statement of Cash Flows

~ Fiscal Year Ended ($ mlllons)

Cash flows from operating activities

Net earnings . ....... ..... ... .. . ... .. . .. ... ... .................. .

Adjustments to reconcile net earnings to cash flows:

Depreciation and amortization of property and intangibles .. .. . . . ...... .

Stock based compensation . .... . ... ....... ..... ... .............

Purchased in-process research and development .. ..... ...... ... ....

Deferred tax provision ... ........ .... ... ... . .... . ..... . . ..... . . .

Accounts receivable allowances ..... .. ....... . .. . . . . . ........... . .

Changes in assets and liabilities, net of effects from acquisitions:

(lncrease)/decrease in accounts receivable .... ..... . ..... .... . . .... .

(lncrease)/decrease in inventories . . ... . . ...... . ... . .... ...... .. . . .

lncrease/(decrease) in accounts payable and accrued liabilities .. ... .. .. .

(lncrease)/decrease in other current and noncurrent assets .. . .. .... . .. .

Increase in other current and noncurrent liabilities .. .. . . . . ............ .

2010

2009

2008

$13,334

$12,266

$12,949

2,939

614

2,774

628

356

12

(436)

58

2,832

627

181

22

86

(207)

(196)

20

(574)

87

453

95

(507)

1,209

31

(736)

(101)

(272)

(1 ,600)

984

Net cash flows from operating activities ... . . .. .... . ........ .... . . ... .

16,385

16,571

14,972

Cash flows from investing activities

Addition to property, plant and equipment. . . ...... ..... .. ...... ... ... .

Proceeds from the disposal of assets ...... .. .... . ....... ..... ...... .

Acquisitions, net of cash acquired . .... .... .. . . .. . . . .... . .... .. ..... .

Purchases of investments .. . ..... .. ....... . . . ... ...... . ... . .. .... .

Sales of investments .... ..................... .... ... . . ......... . .

Other (primarily intangibles) .... .. . .... . ...... . .. .. .... ........ .... .

(2,384)

524

(1,269)

(15,788)

11 ,101

(38)

(2 ,365)

154

(2,470)

(10,040)

7,232

(109)

(3,066)

785

(1,214)

(3,668)

3,059

(83)

Net cash used by investing activities ................... . . . ...... ... . .

(7,854)

(7,598)

(4,187)

continued

14-14

14-15

Module 14 I Operating-Income-Based Valuation

Module 14 I Operating-Income-Based Valuation

continued from prior page

Cash flows from financing activities

Dividends to shareholders . .. .. . . .... . . ...... . ... .. ... . . .. . . . . . . .. .

Repurchase of common stock . . .. . ..... . . . . . ... . ...... . ..... . .. . . . .

Proceeds from short-term debt ..... . . .. .. . . .. . ... . . . . . . . . .... . .. . . .

Retirement of short-term debt . .. ... .... . . .. ...... . . .... . . .. .. . .. .. .

Proceeds from long-term debt .. .. ... . . . ... . .. . . . . . ... .. . .. . . . . .. .. .

Retirement of long-term debt .. . . . . . ..... . . ..... . . .... . . .. . ... . . . .. .

Proceeds from the exercise of stock options/excess tax benefits .. ... ... . .

Net cash used by financing activities . . . . . . ... ... . . . ..... . . . . . . . .. ... .

1\114-9.

(5,804)

(2,797)

7,874

(6,565)

1,118

(32)

1,226

(5,327)

(2 ,130)

9,484

(6,791 )

9

(219)

882

(4,980)

(4,092)

---

Effect of exchange rate changes on cash and cash equivalents ... . . . . .. . . .

(6)

161

Increase in cash and cash equivalents .. ... . . . . . . . ... . . . . ..... . .. . .. . .

Cash and cash equivalents, beginning of year . . . . . .. . . . . . . . . .. . . . ... . .

3,545

15,810

5,042

10,768

Cash and cash equivalents, end of year . . . .. ... . . ... . . . . . . . ... . . . . . . .

- - -

- --

$19,355

$15,810

(5,024)

(6,651)

8,430

(7,319)

1,638

(24)

1,486

--

(7,464)

Co.m puting, Ana lyzing a nd Interpreting R esid ual O p erating Incom e (ROPI) (L02)

In its 20 IO fis cal year annual report , CVS reports net operating income after tax (NOPAT) of $3 ,777mil hon. As of the beginning of fisca l year 20 I 0 it reports net operatin g assets of $45 ,889 millio n.

a.

b.

1\114-10. Estima ting S ha r e Value Using the ROPI Mod el (L02)

Fo llowing are fo recasts of Target Corporation 's sales, net operatin g profit after tax (NOPAT) , and net

operating ilssr.ts (NOA) as of Jan uary 29 , 20 I I .

Sales .. . ....... . . .

NOPAT .. . .. . . ... .

NOA . .. . . . ... . ...

Q 14-2.

Define the weighted average cost of capital (WACC).

Q 14-3 .

Define net o perating profit after tax (NOPAT) .

Q14-4.

Define net o perating assets (NOA ).

Q14-S.

Define the concept of residual operating income . How is residual operatin g income used in pricing

equity securities?

Q14-6.

What insight does disaggregation of RNOA into net operatin g profit margin and net operati ng asset

turnover prov ide for manag ing a company?

Assignmen ts with the ~ logo in the m argin are available in an online homework system.

See the P r eface of the book for details.

M14-7 .

STARBUCKS

(SBUX)

M14-8.

HALLIBURTllN

COMPANY

(HAL)

Inter preting Earnings Annou ncement Effects on Stock Prices (L01, 2)

In a recent quarterl y earnings announcement , Starbucks announced th at its earnings had markedly

increased (up 7 cents per share over the prior year) and were I cent higher th an analysts ' ex pectations.

Starbucks' stock "edged higher," according to The Wall Street Journal, but did not markedl y increase.

Why do you believe that Starbucks ' stock price did not markedly increase given the good news?

Com p u ting R esidual Operating Income (ROPI) {L02)

Halliburton Company reports net operating profit after tax (NO PAT) of $2 ,0 32 million in 2010 . Its net

operatin g assets at the beginning of 2010 are $9 ,937 million . Assumin g a 10% weighted average cost of

capital (WACC), w hat is Halliburton's residual operating income for 2010 ? Show computations.

TARGET

CllllPUllA TIUN

Horizon Period

Reported

(In mllllons)

$10,768

In general, what role do expectati ons play in pricing equity securities? What is the relati on between

security prices and ex pected return s (the di scount rate , or WACC , in this case)?

(CVS)

(TGT)

2,998

7,770

margin and net operating asset turnover. Net operating profit margin can be increased by im proving gross profit

margins (better product pricing , lower-cost manufacturing , etc.) and closely monitoring and controlling operating

expenses. Net operating asset turnover can be increased by reducing net operating working capital (better monitoring of receivables, better management of inventories, carefully extending payables, etc.) and making more effective use of plant assets (disposing of unused assets, form ing corporate alliances to increase plant asset capacity,

selling productive assets to contract producers and purchasing the output, etc.). The ROPI model effectively

focuses managers on the balance sheet and income statement.

1:vs l:AllEMAllK

Did. CVS earn p~s iti ve residual operatin g income (ROPI) in 2010 if its weighted average cost of

capital (WACC) 1s 7%? Explain .

At what level of WACC would CVS not report positive residual operating income fo r 2010? Explain .

You Are the Chief Financial Officer RNOA can be disaggregated into its two key drivers: net operating profit

14- 16

2011

2012

2013

2014

2015

Terminal

Period

$67,390

$70,086

$72,889

$75,805

$78,837

$79,625

3,397

29,501

3,504

30,472

3,644

31 ,691

3,790

32,959

3,942

34,277

3,981

34,620

Answer the fo llowing requirements assumin g a terminal period growth rate of I%, discount rate (WACC)

of 7%, shares outstanding of 704 million, and net nonoperating obligations (NNO) of $ 14,014 million.

a.

b.

Estimate the value of a share of Target common stock using the residual operatin g income (ROPI)

model as of January 29 , 2011 .

Target Corporation (TGT) stock closed at $49.99 on March 18, 2011. How does your valuation estimate compare w ith this closing price? What do you believe are some reasons fo r the di fference?

El4-11. Estima ting Sha r e Value Using t he ROPI M odel (L02)

Following are forecasts of Abercrombie & Fitch 's sales, net operatin g profit after tax (NOPAT), and net

operating assets (NOA) as of January 29 , 2011 (Current-year NOPAT is lower due to transitory items;

we use a longer term estimate for NOPM of 8% .).

~

AREHCllUMBIE &

FITCH

(ANF)

Horizon Period

Reported

(In mHlions)

Sales .. .. . . .. .. ..

NOPAT .. . ... .. . .

NOA . . . . ... .. ...

2011

2012

2013

2014

2015

$3,469

152

1,032

$3,989

319

1,173

$4,587

367

1,349

$5,275

422

1,551

$6,066

485

1,784

'nlnnlnel

Period

$6,187

495

1,820

Answer the fo llowing requirements assuming a discount rate (WACC) of 10%, a terminal period growth

rate of 2%, common shares outstanding of 87 .2 million , and net nonoperating obligations (NNO) of $(858)

mi llion (negative NNO reflects net nonoperating assets such as investments rather than net obligations).

a.

b.

Estimate the value of a share of Abercrombie & Fitch common stock using the residual operating

income (ROPJ ) mode l as of January 29 , 2011 .

Abercrombie & Fitch stock closed at $56.71 on M arch 29 , 2011 . How does your valuation estimate

compare with this closing price? What do you believe are some reasons fo r the differen ce?

E14-12. Estima ting S ha r e Value Using the ROPI Mod el (L02)

Following are fo recasts of sales, net operating profit after tax (NOPAT) , and net operatin g assets (NOA)

as of February 26 , 2011 , for Best Buy, Inc.

~

BEST BUY

(BBY)

Horizon Period

Reported

(In mllUona)

Sales . . . ....... ..

NOPAT . . . .. . .. . .

NOA . . . . .. . .... .

2011

2012

2013

2014

2015

Terminal

Period

$50,272

1,389

7,876

$52,786

1,584

8,248

$55,425

1,663

8,660

$58,196

1,746

9,093

$61,106

1,833

9,548

$61,717

1,852

9,643

14-17

Module 14 I Operating-Income-Based Valuation

Module 14 I Operating-Income-Based Valuation

Answer the following requirements assuming a discount rate (WACC) of 11 % , a terminal period growth

rate of I %, common shares outstanding of 392.6 million , and net nonoperating obligati ons (NNO) of

Identifying and Computing Net Operating Profit after Tax (NOPAT) and Net Nonoperating

Expense (NNE) (LO 1, 2)

Following i s the income statement for Halliburton Company.

$1 ,274 mjllion.

a.

Estimate the value of a share of Best Buy common stock using the residual operating income

b.

(ROPI) model as of February 26 , 20 11 .

Best Buy (BBY ) stock closed at $30 .20 on April 25 , 2011. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference?

(HAL}

:1

2010

2009

$ 1,398

3,924

653

257

714

$ 2,082

2,964

1,598

1,312

210

472

Total current assets .. . . . .. . . . . ... . . .. .. . .. . . .. . . . . . . . .... .

Property, plant and equipment-net . . . .. . . .. . .. . . . . ... .. . .. . .

Goodwill . . .. .. ... . . . .. ... . . . . ..... . . . . . . . ...... . . . .. .. . .

Other assets . . . . .... . ..... . .. . . .. . ... .. ..... . .. . .. .. ... . .

8,886

6,842

1,315

1,254

8,638

5,759

1,100

1,041

Total assets ......... ... .. . .. . . ... . . . .... . .... . . . ... . .. . . .

$18,297

$16,538

$ 1,139

At December 31 (Miiiions of dollars and shares)

Assets

Cash and equivalents. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Receivables, net .. . ... . ... . . ... .. . . . . .. . .... .. .. .. ... . . .. .

Inventories ...... . .. .. .. . . . . . . . .. . .. .. . . ..... . .. . . . ..

Investments in markeatable securities . . . . . . . .. . .. . .... .... . . . .

Current deferred income taxes ... . . . . ... . ... . ... . ... . . . ... . . .

Other current assets . . ... .. . . . . ... . ....... .. .. . . . . . . . . . . . . .

Liabilities and Stockholders' Equity

Accounts payable .. . . . .. . .. . . . . .. . . . . . . . . .... . .. . .. . . ..

Current maturities of long-term debt . . ....... . . . . ... .. ... ... . .

Accrued employee compensation and benefits . .. . . .. . .... . ... . .

Deferred revenue . . . .. . .. . .... . . . . . ... . .... . . . . .... . .. . . . .

Other current liabilities . . .. . . . . . . .. . . .. . .. .. .. . . . ... . . . . . .. .

Total current liabilities . . .......................... . . ... .... .

Long-term debt ... .. . ... . ... .. .. .. .. .. .. . ... . . ... .. ..... .

Employee compensation and benefits . . . . . . .. . . . . ......... . .. .

Other liabilities .... . . . . . . . .. .. . ... . . .. .. .. .. . .... . ...... . .

1,940

716

266

636

2,757

3,824

487

842

2,889

3,824

462

606

Total liabilities .... . . .. . ... . .. .. . . .... .. .... .. . ..... . .. . .. .

7,910

7,781

Shareholders' equity

Common shares, par value $2.50 per share-authorized 2,000 shares,

issued 1 ,069 shares and 1,067 shares .. .. . . .... . . .. .. .. . ... .

2,674

2,669

Paid-in capital in excess of par value . .. . . . . ........ . .. . ...... .

Accumulated other comprehensive loss ... ... . ... . . . . . . . . . ... .

b.

2008

$13,779

4,194

$ 10,832

3,843

$13,391

4,888

Total revenue . . . . ...... . . .. . .. . . .. . . . . . .. .. . . . . .. .

Operating costs and expenses

17,973

14,675

18,279

Cost of services ....... . .. . .. . .. .... .. .... .. ...... .

Cost of sales ...... . . . .... . . .. . . .............. . ... .

General and administrative... . ... ... . .... . .... . . .. .. .

11,237

9,224

3,255

207

(5)

10,079

3,970

282

(62)

of operating assets, net . . .......... ... . . . .

3,508

229

(10)

Total operating costs and expenses . .. . . . . . . . . .... .... .

14,964

12,681

14,269

Operating income . . .. . .... ..... .. . . . . . ... . .... . ... .

Interest expense, net of interest income

of $11 , $12, and $39 . . ...... . ... . ... . .. . .. . .. .. . . .

Other nonoperating expenses, net .. . . . . ... . . . . .... . .. .

3,009

1,994

4,010

(297)

(57)

(285)

(27)

(128)

(33)

Income from continuing operations before

income taxes .... . ... . . ... . . . .... .. ....... . .... .

Provision for income taxes .. . .. .. ..... .... . . .. . . . . . . .

2,655

(853)

1,682

(518)

3,849

(1,211)

Income from continuing operations .. . .. . ... . . . . . . . .. . .

1,802

1,164

2,638

Income (loss) from discontinued operations,

net of income tax . ... .. ... . .... . .. . .. . . . .... . .. . .

40

(9)

(423)

Net income ... . . . .. ... . ... . .. .. . . . ... .. . ....... . . .

1,842

1,1 55

2,215

Noncontrolling interest in net income of subsidiaries . ... . .

(7)

Net income attributable to company .... . . . ...... . .. . . .

$1,835

(10)

$ 1,145

$ 2,224

Compute net operating profit after tax (NO PAT) for 20 JO , assuming a federal and state statutory tax

rate of 35 %.

E14-15. Estimating Share Value Using the ROPI Model

(L02)

Following are forecasts of Halliburton Company's sal es, net operating profit after tax (NOPAT) , and

net operating assets (NOA) as of D ecember 31, 2010.

HALLIBUllTIJN

COMPANY

(HAL)

411

339

(240)

(213)

Retained earnings ..... . . .. . .... .. . .. ... ... .. . ... .. . . . . .. .

12,371

10,863

Treasury stock, at cost-159 and 165 shares . .. . . . . .. .. . . .. . .. .

(4,771)

(5,002)

Company shareholders' equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10,373

8,728

Noncontrolling interest in consolidated subsidiaries. . . . . . . . . . . . . .

14

29

Total shareholders' equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10,387

8,757

Total liabilities and shareholders' equity. . . . . . . . . . . . . . . . . . . . . . . .

$18,297

$16,538

Compute net operating assets (NOA) and net nonoperating obligations (NNO ) for 2010 .

For 2010 , show that: NOA= NNO +Stockholders' equity.

Horizon Period

Reported

(In mlllons)

Sales .. . . . . . . . . ..

NOPAT .. .. . . ... .

NOA . .. .. .... . . .

Tennlnal

2010

2011

2012

2013

2014

Period

$17,973

2,032

12, 160

$21,028

2,376

14,208

$24,603

2,780

16,624

$28,786

3,253

19,450

$33,680

$35,027

3,958

23,667

3,806

22,757

Answer the fo llowing requirements assuming a discount rate (WACC) of I 0 %, a terminal period growth

rate of 4 %, common shares outstanding of 910 million , and net nonoperating obligations (NNO) of

$1 ,787 million .

a.

a.

2009

Services . .. .... .. . .. . . . .. .. . . . ......... . . . .... . . . .

Product sales . .... . .. .. ..... . .. .. .. . .. .. . . . . . . . . . .

Gain on sale

---

787

750

514

215

623

(HAL)

Revenue

Following is the balance sheet for Halliburton Company .

HALLIBURTON COMPANY

Consolidated Balance Sheets

HALLIBUllTIJN

COMPANY

HALLIBURTON COMPANY

Conaolldated Statements of Operations

At December 31 (mlHlons of dollars}

2010

E14-13. Identifying and Computing Net Operating Assets (NOA) and Net Nonoperating Obligations

(NNO) (L01, 2)

HALLIBURTIJN

COMPANY

14-18

b.

Estimate the value of a share of Halliburton Company common stock using the residual operating

income (ROPI) model as of February 17 , 2011.

H alliburton Company stock closed at $48.43 on February 17 , 2011. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference?

14-19

Module 14 I Operating- Income-Based Valuation

Module 14 I Operating-Income-Based Valuation

E14-16. Explaining the Equivalence of Valuation Models and the Relevance of Earnings (L02, 3)

M odules 13 and 14 focused on two different valuation models: the discounted cash flow (DCF) model

INTEL CORPORATION

Consolidated Balance Sheets

and the residual operati ng income (ROPI ) model . T he models focus on free cash fl ows to the firm and on

residual operating income, respectively. We stressed th at these two models are theoreti cally equivalent.

a.

b.

Wh at i s the intuition for w hy these models are equi valent?

Some analysts focus on cash flow s as they believe that companies manage earnin gs, w hich presumably mak es earnings less relevant. A re earnin gs relevant? Ex plain .

E14-17. Applying and Interpreting Value Driver Components of RNOA (L03)

The net operatin g profit m argin and the net operatin g asset turnover components of return on net operating assets are often termed value drivers, w hich refers to their pos iti ve infl uence on stock value by virtue

of their role as components of return on net operatin g assets (RNO A) .

a.

b.

December 25,

December 26,

2010

2009

Assets

Current assets

Cash and cash equivalents ....... . . . . . ...... . . . ..... .

Short-term investments . ........ . ...... . . . ......... .

Trading assets .. . ...... . .... . .. .. . ....... .. ....... .

Accou nts r.'\Ceivable, r.ot . . . ..... . .. .. ....... ... .. . . .

Inventories . . . ... .. ..... ..... ... .. ........ .. . .... .

Deferred tax assets ...... .. .. . . .. ... . . .. . . ...... . .. .

Other current assets ........ . ....... . .. . ..... . . ... . .

$ 5,498

11 ,294

5,093

2,867

3,757

1,488

1,614

$ 3,987

5,285

4,648

2,273

2,935

1,216

813

Total current assets . . . . .... . .......... . . . ...... . ... .

Property, plant and equipment, net ... ........ . . .. ...... .

Marketable equity securities . ... . ... . . . ... . ... . . ... .. . .

Other long-term investments1 . . ... . . . .... .. . .. .. . ..... .

Goodwill ........ . .. . .... . . ...... .. .. . . .... . .... . .. .

Other long-term assets ... . ... . .... .. ..... . . .. . .. . ... .

31 ,611

17,899

1,008

3,026

4,531

5,111

21,157

17,225

773

4,179

4,421

5,340

Total assets ....... . ... . .. . .. . . ... .. . ... . .... . . . . . . . .

$63, 186

$53,095

As of Year-Ended (In mlDlons, except par value)

H ow do profi t margins and asset turnover rati os influence stock values?

A ssuming that profit margins and asset turnover ratios are value drivers, w hat insight does this give

us about managing companies if the goal is to create shareholder value?

P14-18. Forecasting and Estimating Share Value Using the ROPI Model

(L02, 3)

Liabilities

Current liabilities

Short-term debt . . . ... . ... . ..... . ...... . ... . .. . . . . .

Accounts payable .. ... . . . ... . .. ....... . .. ... . ... . . .

Accrued compensation and benefits . . .............. . . .

Accrued advertising . . ... . .. . ... . . . . ......... . ..... .

Deferred income on shipments to distributors .. .. .. .. ... .

Other accrued liabilities . . . .. . .... . . ... ...... . .. . ... .

Following are the income statement and balance sheet for Intel Corporation .

INTEL

l:llllPlll\A TlllN

INTEL CORPORATION

(INTC)

Consolldatecl Statements of Income

Year Ended (In mlRlons)

Net revenue ... . . . . . . . .. . . . .... .. .. . ............ .

Cost of sales . . .. ............. . . . ..... . . . . . ..... . .

Gross margin . .. ... . .. . ........... . .. . ....... . ..

Research and development . . ..... .. ...............