Professional Documents

Culture Documents

CAFCP Income Eligibility

Uploaded by

Amanda's GardenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CAFCP Income Eligibility

Uploaded by

Amanda's GardenCopyright:

Available Formats

9

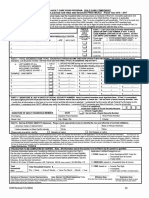

CHILD AND ADULT CARE FOOD PROGRAM: CHILD CARE COMPONENT

INCOME ELIGIBILITY APPLICATION FOR FREE AND REDUCED PRICE MEALS FY 2015 – 2016

FY2015 – FY2016 (7/1/15 – 6/30/16) INSTRUCTIONS: To apply for free and reduced-price meals, read the Household Letter and instructions on backside of

this form. Complete application and return to the center. In accordance with the NSLA, information on this application may be disclosed to other Child Nutrition

Programs or applicable enforcement agencies. Parents/guardians are not required to consent to this disclosure. Part 1 is to be completed by all households.

Part 2 is to be used only for a child living in a household receiving Food Assistance (SNAP) or Ohio Works First (OWF) benefits. Part 3 is only for children

NOT receiving Food Assistance or OWF benefits. Part 4 an adult household member must sign and date form; the last 4 digits of social security number must

be listed if Part 3 is completed. Part 5 is optional. * Asterisks indicate info that must be completed. Form must be completed annually and valid for only 12 mo.

CHECK IF PART 2 – LIST EACH CHILD’S FOOD ASSISTANCE

CENTER NAME A FOSTER (SNAP) OR OWF CASE NUMBER, IF ANY. A VALID

CHILD

(The legal

CASE NUMBER CONTAINS 10 OR 12 DIGITS. DO NOT

PART 1 – PRINT INFORMATION FOR ALL CHILDREN ENROLLED AT CENTER responsibility of LIST SWIPE CARD NUMBER. 600… numbers not valid.

a welfare agency Check type □ FOOD ASSISTANCE (SNAP) or

or court)

* NAME OF ENROLLED CHILD(REN) AGE BIRTH DATE of benefit: □ OHIO WORKS FIRST (OWF)

CASE NO. __ __ __ __ __ __ __ __ __ __ __ __

1.

2. CASE NO. __ __ __ __ __ __ __ __ __ __ __ __

3. CASE NO. __ __ __ __ __ __ __ __ __ __ __ __

4. CASE NO. __ __ __ __ __ __ __ __ __ __ __ __

PART 3 – TOTAL HOUSEHOLD SIZE, TOTAL HOUSEHOLD GROSS INCOME AND HOW OFTEN IT WAS RECEIVED: List names of all household

members. List all gross income: list how much and how often. If Part 2 is completed, skip to Part 4.

a. LIST NAMES OF ALL b. CHECK c. GROSS INCOME during the last month (amount earned before taxes & other deductions) and

HOUSEHOLD MEMBERS IF HOW OFTEN IT WAS RECEIVED: Weekly, Every 2 Weeks, Twice Per Month, Monthly, Annually

INCLUDING CHILDREN NO/ZERO

1. Earnings from work 2. Welfare payments, 3. Pensions, retirement, 4. All Other Income

INCOME

LISTED ABOVE IN PART 1 before deductions child support, alimony Social Security, SSI, VA

EXAMPLE: JANE SMITH $ 200 / weekly $ 150 / twice month $ 100 / monthly $ _________/______

1. $_________/______ $_________/_______ $_________/______ $_________/______

2. $_________/______ $_________/_______ $_________/______ $_________/______

3. $_________/______ $_________/_______ $_________/______ $_________/______

4. $_________/______ $_________/_______ $_________/______ $_________/______

5. $_________/______ $_________/_______ $_________/______ $_________/______

6. $_________/______ $_________/_______ $_________/______ $_________/______

PART 4 – SIGNATURE & LAST 4 DIGITS OF SOCIAL SECURITY NUMBER: Adult household member must sign/date form. If Part 3 is completed,

the adult signing the form must also list last 4 digits of his/her Social Security Number or check the “I do not have a Social Security Number” box.

I certify that all information on this form is true and correct and that all income is reported. I understand that the center will get Federal Funds based on the

information. I understand that CACFP officials may verify the information. I understand that if I purposely give false information, I may be prosecuted.

* If Part 3 is completed,

insert last 4 digits of Social Security Number

*_______________________________________ *_________________ (Check if applicable)

SIGNATURE OF ADULT HOUSEHOLD MEMBER DATE I do not have a Social Security Number

Print Name: Daytime Phone Number: Work Phone Number:

Street / Apt: City / State / Zip: County:

PART 5: RACIAL/ETHNIC IDENTITY (Optional): Please check appropriate boxes to identify the race and ethnicity of enrolled child(ren).

American Indian or Alaska Native Asian Black or African American

Native Hawaiian or Other Pacific Islander White Other

Please mark one ethnic identity: Hispanic or Latino Not Hispanic or Latino

Privacy Act Statement: The Richard B. Russell National School Lunch Act requires the information on this application. You do not have to give the information, but if you do not,

we cannot approve the participant for free or reduced-price meals. You must include the last four digits of the Social Security Number of the adult household member who signs the

application. The Social Security Number is not required when you apply on behalf of a foster child or you list a Supplemental Nutrition Assistance Program (SNAP), Temporary

Assistance for Needy Families (TANF) Program or Food Distribution Program on Indian Reservations (FDPIR) case number for the participant or other (FDPIR) identifier or when

you indicate that the adult household member signing the application does not have a Social Security Number. We will use your information to determine if the participant is eligible

for free or reduced-price meals, and for administration and enforcement of the Program.

State Distribution: 6/24/2015

THIS SECTION TO BE COMPLETED BY CENTER. Note: All information above this section is to be filled in by the parent or guardian.

Complete information below only if qualifying child(ren) by household income from Part 3. Application Certified/Categorized as:

Per the total household size, compare total household income to the USDA Income Eligibility

Guidelines to determine correct categorization. When income is listed in different frequencies

□ FREE, based on □ Food Assistance/OWF Case No.

□ Household Size & Income

of pay in Part 3, you must convert all income to annual income before determination. Use the

□ Foster Child

following Annual Income Conversion :

Weekly x 52, Every 2 Weeks (bi-weekly) x 26, Twice per Month (semi-monthly) x 24, Monthly x 12 □ REDUCED, based on Household Size & Income

Total Total Household Income: $____________________________ □ PAID, based on □ Income Too High

Household □ Incomplete

Size: _______ Per: □ Week □ Every 2 Weeks □ Twice Per Month □ Month □ Year □ Invalid case number or information

________________________________________ _________________________ ______________________ _____________________

Signature of Sponsor / Center Representative Date Sponsor Certified/Categorized Form Effective Date Expiration Date

Note: Effective date is determined by parent or sponsor signature date as selected on CRRS application. (From the first of month of date signed) (Valid until last day of month in which

If date of parent signature is not within month of certification or immediately preceding month, form was signed one year earlier)

effective date must be date of sponsor certification.

OCN Revised 6/24/2015 10

9

HOUSEHOLD LETTER - Dear Parent or Guardian:

Please help us comply with the requirements of the United States Department of Agriculture’s Child and Adult Care Food Program (CACFP by completing the

attached Income Eligibility Application for free and reduced-price meals. All information will be treated with strict confidentiality. The CACFP provides

reimbursement to the child care center for healthy meals and snacks served to children enrolled in child care. The completion of the Income Eligibility

Application is OPTIONAL. Complete the application on the reverse side using the instructions below for your type of household. You or your children do not

have to be U.S. citizens to qualify for meal benefits offered at the child care center. Households with incomes less than or equal to the reduced-price values

listed on the chart at the bottom of this page are eligible for free meal benefits. An application must contain complete information to be considered for free or

reduced-price meals. Households are no longer required to report changes regarding the increase or decrease of income or household size or when the

household is no longer certified eligible for Food Assistance (SNAP) or Ohio Works First (OWF). Once properly approved for free or reduced price benefits, a

household will remain eligible for these benefits for a period not to exceed 12 months. During periods of unemployment, your child(ren) is eligible for meal

reimbursement provided the loss of income during this time causes the family to be within eligibility standards for meals. In operation of the CACFP, no

person will be discriminated against because of race, color, national origin, sex, age or disability §226.23(e)(2)(iv). If you have questions regarding the

completion of this application, contact the child care center.

PART 1 – CHILD INFORMATION: ALL HOUSEHOLDS COMPLETE THIS PART ( * denotes required info)

* Print the name of the child(ren) enrolled at the child care center. All children (including foster children) can be listed on the same application.

List the enrolled child’s age and birth date.

Check box indicating if the child is a foster child. Foster children that are under the legal responsibility of the foster care agency or court are eligible

for free meals. Any foster child in the household is eligible for free meals regardless of income.

PART 2 – HOUSEHOLDS RECEIVING FOOD ASSISTANCE OR OHIO WORKS FIRST: COMPLETE THIS PART AND PART 4 – If a child is a member of

a Food Assistance (SNAP) or OWF household, they are automatically eligible to receive free CACFP meal benefits subject to application

completion.

Circle the type of benefit received: Food Assistance (SNAP) or Ohio Works First (OWF).

List a current Food Assistance or OWF case number for each child. This will be a 10 or 12-digit number. Do not list a swipe card number.

SKIP PART 3 – Do not list names of household members or income if you listed a valid Food Assistance (SNAP) or OWF case number for each child in Part 2.

PART 3 – TOTAL HOUSEHOLD SIZE, GROSS INCOME & HOW OFTEN RECEIVED: ALL OTHER HOUSEHOLDS COMPLETE THIS PART & PART 4.

a) Write the names of all household members including yourself and the child(ren) that attends the child care center, whether they receive income or not.

A household is defined as a group of related or unrelated individuals who are living as one economic unit that share housing and/or significant income

and expenses of its members. This might include grandparents, other relatives, or friends who live with you. Attach another piece of paper if you need

more space to list all household members.

b) Check the box for any person listed as a household member (including children) that has no income.

c) For each household member, list each type of income received during the last month and list how often the money was received.

1) Earnings from work before deductions: Write the amount of total gross income each household member received the last month, before

taxes/deductions or anything else is taken out (not the take-home pay) and how often it was received (weekly, every 2 weeks, twice per month,

monthly, annually). Income is any money received on a recurring basis, including gross earned income. Households are not required to include

payments received for a foster child as income. If any amount during the previous month was more or less than usual, write that person’s usual

monthly income. If you normally get overtime, include it, but not if you only get it sometimes. If you are in the military and your housing is part of

the Military Housing Privatization Initiative and you receive the Family Subsistence Supplemental Allowance, do not include these allowances as

income. Also, in regard to deployed service members, only that portion of a deployed service member’s income made available by them or on

their behalf to the household will be counted as income to the household. Combat Pay, including Deployment Extension Incentive Pay (DEIP) is

also excluded and will not be counted as income to the household. All other allowances must be included in your gross income.

2) List the amount each person got the last month from welfare, child support or alimony and list how often the money was received.

3) List the amount each person got the last month from pensions, retirement, Social Security, Supplemental Security Income (SSI), Veteran’s (VA)

benefits or disability benefits and list how often the money was received.

4) List all other income sources. Examples include: Worker’s Compensation, strike benefits, unemployment compensation, regular contributions

from people who do not live in your household, cash withdrawn from savings, interest/dividends, income from estates/trusts/investments, net

royalties/annuities or any other income. For only the self-employed, report income after expenses (net income) in column 1 under earnings from

work. For your business, farm or rental property report income in column 4. Do not include food assistance payments.

PART 4 – SIGNATURE AND LAST 4 DIGITS OF SOCIAL SECURITY NUMBER: ALL HOUSEHOLDS COMPLETE THIS PART (* denotes required info)

a) * All applications must have the signature of an adult household member.

b) * The adult signing the application must also date the form.

c) * Only an application that lists income in Part 3 must have the last 4 digits of the social security number of the adult who signs. If the adult does not

have a social security number, check the box “I do not have a Social Security Number.” If you listed a Food Assistance or OWF number for each child

or if you are applying for a foster child, the last 4 digits of the social security number are not required.

PART 5 – RACIAL/ETHNIC IDENTITY – OPTIONAL

You are not required to answer this part in order for the application to be considered complete. This information is collected to make sure that everyone is

treated fairly and will be kept confidential. No child will be discriminated against because of race, color, national origin, gender, age or disability.

NON-DISCRIMINATION STATEMENT: The U.S Department of Agriculture prohibits discrimination against its customers, employees, and applicants for

employment on the bases of race, color, national origin, age, disability, sex, gender identity, religion, reprisal, and where applicable, political beliefs, marital

status, familial or parental status, sexual orientation, or all or part of an individual’s income is derived from any public assistance program, or protected

genetic information in employment or in any program or activity conducted or funded by the Department. (Not all prohibited bases will apply to all programs

and/or employment activities.) If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint

Form, found online at http://www.ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866) 632-9992 to request the form. You may also

write a letter containing all of the information requested in the form. Send your completed complaint form or letter to us by mail at U.S. Department of

Agriculture, Director, Office of Adjudication, 1400 Independence Avenue, S.W., Washington, D.C. 20250-9410, by fax (202) 690-7442 or email at

program.intake@usda.gov. Individuals who are deaf, hard of hearing or have speech disabilities may contact USDA through the Federal Relay Service at

(800) 877-8339; or (800) 845-6136 (Spanish). USDA is an equal opportunity provider and employer.

REDUCED INCOME ELIGIBILITY GUIDELINES – 185%

Guidelines to be effective from July 1, 2015 through June 30, 2016

Households with incomes less than or equal to the reduced price values below are eligible for free or reduced-price meal benefits.

HOUSEHOLD SIZE YEAR MONTH TWICE PER MONTH EVERY TWO WEEKS WEEK

1 21,775 1,815 908 838 419

2 29,471 2,456 1,228 1,134 567

3 37,167 3,098 1,549 1,430 715

4 44,863 3,739 1,870 1,726 863

5 52,559 4,380 2,190 2,022 1,011

6 60,255 5,022 2,511 2,318 1,159

7 67,951 5,663 2,832 2,614 1,307

8 75,647 6,304 3,152 2,910 1,455

For each additional

family member, add 7,696 642 321 296 148

OCN Revised 6/24/2015 11

9

OCN Revised 6/24/2015 11

You might also like

- Photo Permission FormDocument1 pagePhoto Permission FormAmanda's GardenNo ratings yet

- Garden Gram: July 2020: From The OfficeDocument1 pageGarden Gram: July 2020: From The OfficeAmanda's GardenNo ratings yet

- SUTQ Family InfoDocument2 pagesSUTQ Family InfoAmanda's GardenNo ratings yet

- Infant MenuDocument1 pageInfant MenuAmanda's GardenNo ratings yet

- Medical Physical Care PlanDocument1 pageMedical Physical Care PlanAmanda's GardenNo ratings yet

- Fee ScheduleDocument1 pageFee ScheduleAmanda's GardenNo ratings yet

- Child MedicalDocument1 pageChild MedicalAmanda's GardenNo ratings yet

- Medical Physical Care PlanDocument1 pageMedical Physical Care PlanAmanda's GardenNo ratings yet

- Amanda's Garden Childcare & Learning Center Parent Handbook: Our Goals and PurposeDocument18 pagesAmanda's Garden Childcare & Learning Center Parent Handbook: Our Goals and PurposeAmanda's GardenNo ratings yet

- CACFP App. 2018-2019Document2 pagesCACFP App. 2018-2019Amanda's GardenNo ratings yet

- Pick Up PolicyDocument1 pagePick Up PolicyAmanda's GardenNo ratings yet

- Infant Meal PreferenceDocument1 pageInfant Meal PreferenceAmanda's GardenNo ratings yet

- Parent Handbook CurrentDocument17 pagesParent Handbook CurrentAmanda's GardenNo ratings yet

- CACFP ScheduleDocument1 pageCACFP ScheduleAmanda's GardenNo ratings yet

- Fee ScheduleDocument1 pageFee ScheduleAmanda's GardenNo ratings yet

- Sample Weekly Menu: Monday Tuesday Wednesday Thursday FridayDocument1 pageSample Weekly Menu: Monday Tuesday Wednesday Thursday FridayAmanda's GardenNo ratings yet

- Cacfp 2016 2017Document2 pagesCacfp 2016 2017Amanda's GardenNo ratings yet

- ODJFS Care PlanDocument0 pagesODJFS Care PlanAmanda's GardenNo ratings yet

- Child MedicalDocument1 pageChild MedicalAmanda's GardenNo ratings yet

- CACFP Enrollment FormDocument1 pageCACFP Enrollment FormAmanda's GardenNo ratings yet

- Basic Infant InfoDocument2 pagesBasic Infant InfoAmanda's GardenNo ratings yet

- Sample Menu: Monday Tuesday Wednesday Thursday Friday BreakfastDocument1 pageSample Menu: Monday Tuesday Wednesday Thursday Friday BreakfastAmanda's GardenNo ratings yet

- Photo Permission FormDocument1 pagePhoto Permission FormAmanda's GardenNo ratings yet

- ODJFS Medical StatementDocument1 pageODJFS Medical StatementAmanda's GardenNo ratings yet

- Ravenna School District Alternate Bus Stop FormDocument1 pageRavenna School District Alternate Bus Stop FormAmanda's GardenNo ratings yet

- SUTQ Family InfoDocument2 pagesSUTQ Family InfoAmanda's GardenNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MoRTH Road Crash Data 2019 PDFDocument213 pagesMoRTH Road Crash Data 2019 PDFDigvijayNo ratings yet

- Cloze-It's A Man's WorldDocument1 pageCloze-It's A Man's WorldMaria DialloNo ratings yet

- Davenport Syllabus Algebra 1 Spring 2021Document4 pagesDavenport Syllabus Algebra 1 Spring 2021api-232287642No ratings yet

- INF Foundation Coaching ManualDocument40 pagesINF Foundation Coaching ManualAdrian GattoNo ratings yet

- Ionut - Unit 8 - ICDocument17 pagesIonut - Unit 8 - ICComsec JonNo ratings yet

- Part I Respondent's Demographic ProfileDocument5 pagesPart I Respondent's Demographic ProfileBemBemNo ratings yet

- WELMEC Guide 6.11 Issue 2 Prepackages That Change QuantityDocument10 pagesWELMEC Guide 6.11 Issue 2 Prepackages That Change QuantityCarlos GarciaNo ratings yet

- Tqs 5 - Fmni Lesson PlanDocument2 pagesTqs 5 - Fmni Lesson Planapi-514584659No ratings yet

- Service Quality Study ReportDocument6 pagesService Quality Study ReportNIKHIL SINHANo ratings yet

- Sbi3013 Information and Communication Technology in Biology Sbi3013 Information and Communication Technology in BiologyDocument8 pagesSbi3013 Information and Communication Technology in Biology Sbi3013 Information and Communication Technology in BiologyMuhd syimir razin100% (1)

- Midterm Exam in Traffic Management and Accident Investigation Multiple ChoiceDocument5 pagesMidterm Exam in Traffic Management and Accident Investigation Multiple ChoiceRemo Octaviano63% (8)

- Test Bank Business Ethics 5th Edition WeissDocument6 pagesTest Bank Business Ethics 5th Edition WeissShiela Mae BautistaNo ratings yet

- AdvDocument5 pagesAdvMeet patelNo ratings yet

- LD Debate Format and RubricDocument3 pagesLD Debate Format and Rubricapi-275468910No ratings yet

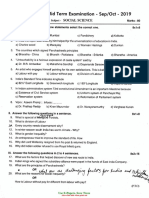

- 10th Standard Midterm Social Science ExamDocument2 pages10th Standard Midterm Social Science ExamPriya DarshiniNo ratings yet

- Ict Skills GR 3Document135 pagesIct Skills GR 3Candice Cloete100% (1)

- Strategy at Zara: © Clegg, Schweitzer, Whittle & Pitelis 2017Document2 pagesStrategy at Zara: © Clegg, Schweitzer, Whittle & Pitelis 2017Fiza Wahla342No ratings yet

- Juan Gonzalez Diaz CVDocument8 pagesJuan Gonzalez Diaz CVapi-461750328No ratings yet

- The Importance of Computer EducationDocument4 pagesThe Importance of Computer EducationPratheek Praveen Kumar100% (2)

- Management Is The Process of Reaching Organizational Goals by Working With and Through People and Other Organizational ResourcesDocument4 pagesManagement Is The Process of Reaching Organizational Goals by Working With and Through People and Other Organizational ResourcesHtetThinzarNo ratings yet

- Module1 Activity SARMIENTODocument5 pagesModule1 Activity SARMIENTOMyrene SarmientoNo ratings yet

- 15 - Chapter 8 PDFDocument30 pages15 - Chapter 8 PDFShreya ManjariNo ratings yet

- The Attorney: Law of Crimes-Ii Movie AssignmentDocument9 pagesThe Attorney: Law of Crimes-Ii Movie Assignmentsteve austinNo ratings yet

- Tues-Types of ComputerDocument3 pagesTues-Types of ComputerMichelle Anne Legaspi BawarNo ratings yet

- Kedia FIRDocument4 pagesKedia FIRCyrusNo ratings yet

- Nursing Art, Science & ProfessionDocument17 pagesNursing Art, Science & ProfessionSunil De Silva0% (1)

- Marcos Village Elementary School FunctionsDocument1 pageMarcos Village Elementary School FunctionsLeslie Joy Estardo Andrade100% (1)

- Problem Solving Using Diamond Model: Pritam DeyDocument8 pagesProblem Solving Using Diamond Model: Pritam Deymm62810No ratings yet

- Blank's Questions Guide to Developing Reading SkillsDocument2 pagesBlank's Questions Guide to Developing Reading SkillsdfNo ratings yet

- Dino: Detr With Improved Denoising Anchor Boxes For End-To-End Object DetectionDocument23 pagesDino: Detr With Improved Denoising Anchor Boxes For End-To-End Object DetectionAkhilesh YadavNo ratings yet