Professional Documents

Culture Documents

Luv Final Presentation

Uploaded by

api-312977476Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Luv Final Presentation

Uploaded by

api-312977476Copyright:

Available Formats

We Dont Believe in LUV at First Sight

The University of Texas at Dallas

James, Tyler, Trevor

1

Company Overview

Industry Analysis

Executive Summary

Recommendation: HOLD

Current Price: $37.54

Target Price: $34.53 (8% Downside)

Valuation

Risk Analysis

Conclusion

$60

$50

LUV $37.54

$40

$30

LUV $34.53

$20

$10

Close Price

Current Price

Feb-16

Jan-16

Dec-15

Nov-15

Oct-15

Sep-15

Aug-15

Jul-15

Jun-15

Apr-15

$0

Mar-15

Market Profile (as of 02/04/2016)

Closing Price:

$37.54

52-Week High-Low:

$31.36 / $51.34

Diluted Shares Out. :

679.55 M

Average Volume (6M):

8.44 M

Market Cap:

$ 22.78 B

LTM Dividend Yield:

0.76%

Short Interest (%) Float:

3.77%

Beta:

1.11

EV/EBITDAR*:

5.0 x

P/E*:

12.7 x

Institutional Holders:

82.94%

Insider Holdings:

0.28%

*Multiples adjusted for Operating Leases

Feb-15

NYSE: LUV

Industry: Airlines

Sector: Transportation

Financial Analysis

Investment Themes:

Low Cost, No Frill Approach

Conservative Operating Philosophy

Declining Competitive Advantage

Strained Employee Relations

May-15

Investment Highlights

Target Price

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Historical Competitive Advantage

A

C

Cost Structure

E

D

F

D

E

G

C

Vs.

Hub and

Spoke

The Southwest Effect

Traffic Demand In New Markets

Average Fares in New Markets

Low Cost

Structure

Point to

Point

Low Fares

Employee Relations

Each route serves

a single city-pair

Hub connections

significantly

increase CASM

Higher aircraft

utilization and

turnaround times

Routes are

interdependent

for connecting

passengers

Brand Image

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Executive Council

Conclusion

* denotes company tenure

11

EVP of Corporate

Services

EVP/Chief

Commercial

Officer

28

Jeff Lamb

EVP Strategy &

Innovation

Robert E. Jordan

Thomas M. Nealon

29*

Chairman of the

Board, CEO

Gary C. Kelly

12

24

EVP/Chief

Financial Officer

Tammy Romo

15

EVP/Chief

Operating Officer

SV P Gen. Counsel,

Corporate Secr etary

Mark R. Shaw

Michael G. Van de Ven

Your people come first, and if you treat them right, theyll treat the customers right.

- Herb Kelleher, Founder of Southwest Airlines

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Major Markets, Pre-AirTran Acquisition (2011)

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Major Markets, After AirTran Acquisition (2014)

PORTLAND

GRAND

RAPIDS

FLINT

ROCHESTER

RICHMOND

WICHITA

BRANSON

CHARLOTTE

MEMPHIS

BERMUDA

ATLANTA

PENSACOLA

PARADISE ISLAND

CABO SAN LUCAS

SAN JUAN

PUNTA CANA

CANCN

MONTEGO BAY

MEXICO CITY

ARUBA

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Major Markets, After Wright Amendment Repeal (2014)

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Porters Five Forces

Power of

Suppliers

Threat of

New

Entrants

Industry

Rivalry

Threat of

Substitutes

Power of

Buyers

8

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Changing Dynamics

Deregulation

Weakened

Barriers

Laissez-faire

Pricing

Bankruptcy

Converging Interests

Average Fares

$500

$450

Legacy

Legacy

$400

$350

LCCs

ULCCs

$300

$250

Before 1978

2016

$200

1979

1986

1993

2000

2007

2014

9

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Industry Timeline

American West/US

Airways Merger

AAL/TWA MetroJet 9/11 Terror

Merger Liquidation Attacks

2001

DAL/Northwest Financial

Merger

Crisis

2008

2005

UAL/Continental LUV/AirTran AAL/US Airways

Merger

Merger

Merger

2010

2011

2013

Improving Operating Margin

Strengthening Z scores

$200 B

18%

16%

14%

$150 B

2

12%

10%

$100 B

8%

6%

$50 B

-1

4%

2%

-2

1997

1999

2001

AAL

2003

2005

DAL

2007

2009

UAL

2011

2013

LUV

2015

$0 B

0%

2007 2008 2009 2010 2011 2012 2013 2014 2015

Revenue

Operating Margin

10

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Evolving Structures

Operating Cost Structure

Streamlined Labor Costs % of Revenue

45%

40%

40%

35%

35%

30%

30%

25%

25%

20%

20%

15%

15%

10%

10%

5%

5%

0%

1998

0%

2001

2000

2002

2004

Labor

2006

2008

Other Costs

2010

2012

2014

2003

2005

Wages

2007

Fuel

2009

2011

2013

2015

Other Costs

The industry dynamics have changed substantially since the Deregulation Act

11

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Current Dynamics

Supply Imbalance vs Crude Oil

3.0 M

$120

2.5 M

$100

2.0 M

44% Jet fuel price per gallon

Oil Supply Surplus

$80

1.5 M

1.0 M

$60

0.5 M

Global energy demand

$40

0.0 M

$20

-0.5 M

-1.0 M

$0

Supply-Demand Spread (mbpd)

Alleviate debt obligations

Increase shareholder returns

WTI Spot Price

Fuel tailwinds have created ROIC levels above WACC

12

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Macroeconomic Drivers

Contracting PMI levels

Corporate Earnings vs Airline Traffic

90,000 B

6%

80,000 B

5%

70

60

4%

70,000 B

50

3%

60,000 B

Correlation = 84%

50,000 B

2%

40

1%

40,000 B

30

0%

30,000 B

-1%

20,000 B

-2%

10,000 B

-3%

0B

0B

500 B

1,000 B

1,500 B

2,000 B

2,500 B

-4%

1986

20

10

0

1991

1996

2001

PMI Index

PMI

*78%

Non-PMI

*80%

Corp. Earnings

*84%

2006

2011

2016

Real GDP YoY

Traffic

* Denotes correlation

13

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Industry Drivers

Valuation

Risk Analysis

Conclusion

Yield = Passenger Revenue/Revenue Passenger Mile

Yield

Passenger Revenue per Available Seat Mile

20%

14.0

15%

12.0

10.0

10%

8.0

5%

6.0

0%

4.0

-5%

-10%

2010

2.0

2011

2012

Legacy

2013

LCC's

ULCC's

2014

2015

0.0

03/06

10/07

PRASM

05/09

12/10

Fuel Cost pASM

07/12

02/14

09/15

Labor Cost pASM

Short-term industry yields are expected to stabilize

14

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Revenue Analysis

Historical Yield

Capacity Expansion vs Traffic

40%

20%

35%

15%

30%

10%

25%

20%

5%

15%

10%

0%

5%

-5%

0%

-10%

-5%

-10%

2006

2008

2010

ASM YoY Growth

2012

2014

2016

-15%

2002

2005

2008

2011

2014

2017

RPM YoY Growth

15

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Growth Opportunity

4%

Domestic

6%

Capacity

Expansion

2%

International

16

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Cost Efficiency Analysis

Significantly Above-average Labor Costs

Industry's CASM Ex-fuel compared to LUV

= -19%

40%

Industry

35%

= -15%

30%

= 10%

25%

ULCC's

= -8%

20%

LCC's

15%

= -11%

10%

Legacy

5%

0%

1997

2000

2003

2006

Industry Wages

2009

2012

LUV Wages

2015

2018

-60%

-40%

-20%

09/2015

0%

20%

40%

12/2009

17

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Cost Efficiency Analysis

Late Arrival Ratio

Industry's CASM Ex-fuel compared to LUV

= -19%

14%

Industry

12%

= -15%

10%

ULCC's

8%

= -8%

6%

= 34%

LCC's

4%

= -11%

2%

0%

2011

Legacy

2012

2013

Southwest*

2014

2015

-60%

-40%

-20%

09/2015

Industry*

0%

20%

40%

12/2009

Not only has the world changed, but our relative position within the industry on costs has changed.

- Gary Kelly, CEO of Southwest Airlines

18

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Labor Cost Uncertainty

Percent of Workers Unionized

17%

5Representing

Labor Costs % Operating Expenses

Union Work Groups

83%

Unionized

Current Negotiations:

Non-Unionized

57%

43%

55.8% Employees

Labor Expenses

Other Expenses

19

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Fading Competitive Advantage

Legacy

Other

LCCs

ULCCs

CostCost

Quality of Service

Quality of Service

LUV

Legacy

LUV

ULCCs

Other

LCCs

Cost

LUV no longer remains a low cost leader

This graph is illustrative purposes

20

Investment Highlights

Company Overview

Industry Analysis

Profitability Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Historical EBITDAR

FASB Operating Leases Adjustment

6,000

Add back Aircraft & Other Rentals

4,000

5,000

3,000

2,000

1,000

Before Adjustment

After Adjustment

27.4% EBITDAR

28.9% EBITDAR

24.1% ROIC

20.3% ROIC

+2.7B Debt

30%

25%

20%

15%

10%

5%

0%

-5%

ROIC

Reported ROIC

Adjusted ROIC

21

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Capital Structure Analysis

Total Debt/EBITDAR

Historical Debt to Capital

12.0 x

70 %

60 %

10.0 x

50 %

8.0 x

40 %

6.0 x

30 %

4.0 x

20 %

2.0 x

10 %

0%

FY05A

NM

FY07A

FY09A

FY11A

As reported

FY13A

FY15A

FY17E

Adjusted

Conservative Operating Philosophy

22

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Valuation Overview

DCF Analysis

Price: $38.81

Relative Valuation

Price: $30.24

(50%)

(50%)

Terminal EV/EBITDAR

Adj. for Operating Leases

EV/EBITDAR

Normalized P/E

LUV

$34.53

8% Potential Downside

23

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Revenue Assumptions

Risk Analysis

Conclusion

Revenue Projection

25 B

35%

30%

Assumption Breakdown

YoY Capacity Growth:

Load Factor:

Change in Yield:

Passenger Revenue:

Freight:

Other Revenue:

Total Operating Revenue:

YoY Growth Rate:

FY16E

5.5%

83.6%

-1.5%

19,023

180

1,257

20,460

4.1%

FY17E

4.0%

83.6%

0.5%

19,882

184

943

21,009

2.7%

FY18E

3.0%

83.6%

1.0%

20,684

180

971

21,835

3.9%

20 B

25%

20%

15 B

15%

10%

10 B

5%

0%

5B

-5%

0B

-10%

FY09A

FY10A

FY11A

FY12A

FY13A

FY14A

FY15A

FY16E

FY17E

FY18E

Historical Earnings vs Reinvesment Need

3B

2B

1B

~82%

Average Annual

Reinvestment Need

0B

-1 B

-2 B

-3 B

FY05A FY06A FY07A FY08A FY09A FY10A FY11A FY12A FY13A FY14A FY15A

Reinvestment Need

After-tax Adjusted EBIT

24

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

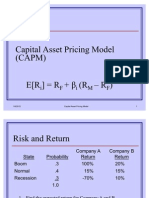

WACC Assumptions

Cost of Debt

2016-2019 Terminal

Risk-free Rate*:

2.25%

3.00%

BBB+ Default Spread:

2.00%

2.00%

Cost of Debt:

4.25%

5.00%

*Expected 10-Y U.S. Treasury

WACC:

Cost of Equity

2016-2019 Terminal

Risk-free Rate*:

2.25%

3.00%

Risk Premium:

5.00%

5.00%

Adjusted Beta:

1.32

1.16

Cost of Equity:

8.84%

8.78%

2016-2019 Terminal

7.11%

7.60%

25

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

DCF Outputs

Base

$38.54

$45 - $55 - $65

Brent

$45 - $55 - $65 Brent

+ 650 bps SPE FY 2016

+6.5% SPE

$54.70

$65

Brent

- $75

$35

- $45 - $55

Brent

Bull$55 - +5.1%

$45 - $55 - $65 Brent

SPE

Bear

+ 510 bps SPE FY 2016

+6.5% SPE

DCF

$55 - $65 - $75 Brent

Target Price

+7.6% SPE

$38.81

$23.72

$55 - $65 - $75

Brent

$45 - $55 - $65 Brent

+ 760 bps SPE FY 2016

+6.5% SPE

SPE = Salaries per Employee

26

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Average Per-employee

Expense

Sensitivity Analysis

$120,862

$123,884

$125,092

$126,301

$127,510

$128,718

$129,927

$131,136

$132,344

$133,553

2.5%

3.5%

4.5%

5.5%

6.5%

7.5%

8.5%

9.5%

10.5%

$ 25.00 $

$ 1.21 $

$ 48.75 $

47.25

45.72

44.17

42.58

40.97

39.32

37.65

35.95

30.00 $

1.30 $

47.71 $

46.21

44.68

43.13

41.54

39.93

38.29

36.61

34.91

35.00

1.39

46.68

45.18

43.65

42.09

40.51

38.89

37.25

35.58

33.88

Jet Fuel Expense

$ 40.00 $ 45.00 $

$ 1.48 $ 1.57 $

$ 45.64 $ 44.60 $

44.14

43.10

42.61

41.57

41.05

40.02

39.47

38.43

37.85

36.82

36.21

35.17

34.54

33.50

32.84

31.80

50.00 $

1.66 $

43.56 $

42.06

40.54

38.98

37.39

35.78

34.14

32.47

30.76

55.00 $

1.75 $

42.53 $

41.03

39.50

37.94

36.36

34.74

33.10

31.43

29.73

60.00 $

1.84 $

41.49 $

39.99

38.46

36.90

35.32

33.71

32.06

30.39

28.69

65.00

1.93

40.45

38.95

37.42

35.87

34.28

32.67

31.03

29.35

27.65

27

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Relative Valuation

North American

Airlines

Screening

Criteria

Comparable Valuation

Multiple

Turn

Price

2016E EBITDAR:

4.4 x $30.47

2017E EBITDAR:

4.5 x $26.64

Market Cap >1.5B

Normalized P/E Valuation

Comparable P/E:

24.7 x

Normalized EPS (LUV): $ 1.37

Implied Price (LUV):

$ 33.84

Historical LUV EV/EBITDAR

25.0 x

Revenue >1.5B

20.0 x

15.0 x

10.0 x

5.0 x

0.0 x

28

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Valuation Summary

Team Analysis

Consensus

Adjust for Operating Leases (BOTH

(Some) Adjust for Operating Leases

LUV and Peers)

Add back only Aircraft Rentals $45 - $55 - $65 Brent

+6.5% SPE

Add back full Operating Lease

Wait for new contract releases and

Expenses (Aircraft + Facility + Others)

then revise investment thesis

Integrate the impacts of labor contracts

$55 - $65

- $75 Brent normalized

Cycle-average

EV/EBITDAR,

+7.6% SPE

P/E

DCF Analysis

$38.81

Relative Valuation

$30.24

(50%)

(50%)

Target Price

$34.53

(8% Downside)

29

Investment Highlights

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

OR1

Medium

Probability

High

Risk Analysis

Company Overview

OR2

MR2

MR3

MR1

UC

Low

OR3

Low

Legend

OR1: Operational Risk

Balancing Employee Compensation

Medium

High

Impact

MR1: Market Risk Economic Uncertainty

MR2: Market Risk Commodity Price Volatility

UC: Uncertain Catastrophes

30

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Market Risk

Economic Fuel Price vs Market Price

$3.5

$3.0

$2.5

$2.0

$1.5

$1.0

$0.5

$0.0

2000

Carrier

Southwest

Delta

American

United

Alaskan

JetBlue

Virgin

Spirit

Allegiant Air

Manufacturing PMI vs Non-Manufacturing PMI

65

60

55

50

2003

2015

40%

40%

0%

22%

42%

17%

27%

35%

0%

2006

2016

20%

5%

0%

35%

33%

0%

0%

0%

0%

2009

2012

2015

45

Comments

Most heavily hedged (65% through 2017)

Owns refinary to offset flucuations

Does not hedge

Opportunity to gain philosophy

Uses call options as insurance

Opportunity to gain philosophy

Hedged 31% H1' 16

No hedging target

Does not hedge

40

35

30

NAPMPMI Index

NAPMNMI Index

31

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Uncertain Catastrophes

Thunderstorm

Cybersecurity

Frequency

Geopolitical

Tension

Tornado

Hurricane

Volcanoes

H1N1

MERS

-CoV

Zika

TB

H7N9

Ebola

War

Hezbollah

ISIS

Al-Qaeda

Regulation

Impact

32

Investment Highlights

Company Overview

Industry Analysis

Financial Analysis

Valuation

Risk Analysis

Conclusion

Investment Summary

Tenuous Pricing Power

Low-cost Structure

Strained Labor Relations

Customer Service

Conservative Operating

Philosophy

HOLD

Target Price

$34.53

(8% Downside)

Air travel

Commoditization

Cyclicality

33

You might also like

- Empower Your PenisDocument32 pagesEmpower Your Penisdakkid65% (23)

- Homemade Water PurifierDocument13 pagesHomemade Water PurifierSherazNo ratings yet

- The Loner-Staying Clean in IsolationDocument4 pagesThe Loner-Staying Clean in Isolationgemgirl6686No ratings yet

- Bloomberg Assessment TestDocument12 pagesBloomberg Assessment TestManish Gujjar100% (1)

- Investment BankingDocument64 pagesInvestment BankinganuragchogtuNo ratings yet

- Eclerx Services (Eclser) : Chugging Along..Document6 pagesEclerx Services (Eclser) : Chugging Along..shahavNo ratings yet

- CS US Multi-Industrial Analyst Presentation - July 2014 - Part 1 End Market SlidesDocument220 pagesCS US Multi-Industrial Analyst Presentation - July 2014 - Part 1 End Market SlidesVictor CheungNo ratings yet

- Opening RitualDocument17 pagesOpening RitualTracy CrockettNo ratings yet

- India Pharma Sector - Sector UpdateDocument142 pagesIndia Pharma Sector - Sector Updatekushal-sinha-680No ratings yet

- Why Moats Matter: The Morningstar Approach to Stock InvestingFrom EverandWhy Moats Matter: The Morningstar Approach to Stock InvestingRating: 4 out of 5 stars4/5 (3)

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Tanada, Et Al. Vs Angara, Et Al., 272 SCRA 18, GR 118295 (May 2, 1997)Document3 pagesTanada, Et Al. Vs Angara, Et Al., 272 SCRA 18, GR 118295 (May 2, 1997)Lu CasNo ratings yet

- Polaris CapitalDocument33 pagesPolaris CapitalBurj CapitalNo ratings yet

- Jes Staley, Investment Bank Chief Executive Officer: February 15, 2011Document20 pagesJes Staley, Investment Bank Chief Executive Officer: February 15, 2011pepecolatanNo ratings yet

- U.S. Airline Industry Pricing StrategiesDocument41 pagesU.S. Airline Industry Pricing Strategiesreddyj225543No ratings yet

- November 2008Document14 pagesNovember 2008Aldrin ThomasNo ratings yet

- Oldfield PartnersDocument13 pagesOldfield PartnersCanadianValue100% (1)

- Global Investing: A Practical Guide to the World's Best Financial OpportunitiesFrom EverandGlobal Investing: A Practical Guide to the World's Best Financial OpportunitiesNo ratings yet

- California Clothing Vs QuinonesDocument4 pagesCalifornia Clothing Vs QuinonesLily MondaragonNo ratings yet

- RC 2013 Winning Presentation Wroclaw UnivDocument31 pagesRC 2013 Winning Presentation Wroclaw UnivhonestscarryNo ratings yet

- CFA Institute Research Challenge 2013-2014 Investment Summary for Callaway Golf Company (ELYDocument25 pagesCFA Institute Research Challenge 2013-2014 Investment Summary for Callaway Golf Company (ELYarnabNo ratings yet

- Aci Reuters BuyDocument6 pagesAci Reuters BuysinnlosNo ratings yet

- Thomson Reuters Company in Context Report: Baker Hughes Incorporated (Bhi-N)Document6 pagesThomson Reuters Company in Context Report: Baker Hughes Incorporated (Bhi-N)sinnlosNo ratings yet

- Final Valuation Report GSDocument8 pagesFinal Valuation Report GSGennadiy SverzhinskiyNo ratings yet

- Overviewing Engineering Consultants ACEC Leadership Summit 2014 FRPaulZofnassDocument28 pagesOverviewing Engineering Consultants ACEC Leadership Summit 2014 FRPaulZofnassSen HuNo ratings yet

- Thomson Reuters Company in Context Report: Aflac Incorporated (Afl-N)Document6 pagesThomson Reuters Company in Context Report: Aflac Incorporated (Afl-N)sinnlosNo ratings yet

- Ciena Thompson Hold+Document6 pagesCiena Thompson Hold+sinnlosNo ratings yet

- FY 2011-12 Third Quarter Results: Investor PresentationDocument34 pagesFY 2011-12 Third Quarter Results: Investor PresentationshemalgNo ratings yet

- Thomson Reuters Company in Context Report: Bank of America Corporation (Bac-N)Document6 pagesThomson Reuters Company in Context Report: Bank of America Corporation (Bac-N)sinnlosNo ratings yet

- Illinois Tool Works Inc. Valuation and RecommendationDocument30 pagesIllinois Tool Works Inc. Valuation and Recommendationgaru1991No ratings yet

- 3m ReportDocument22 pages3m Reportapi-321324040No ratings yet

- Tutorial 5 FAT Solution (Unimelb)Document25 pagesTutorial 5 FAT Solution (Unimelb)Ahmad FarisNo ratings yet

- ValuEngine Weekly Newsletter July 27, 2012Document9 pagesValuEngine Weekly Newsletter July 27, 2012ValuEngine.comNo ratings yet

- THL Credit Stock Valuation ReportDocument2 pagesTHL Credit Stock Valuation ReportManish MahendruNo ratings yet

- Ve Weekly NewsDocument10 pagesVe Weekly NewsValuEngine.comNo ratings yet

- IR Presentation AML CommunicationsDocument35 pagesIR Presentation AML CommunicationsDrSues02No ratings yet

- Rolls-Royce SWOT and Financial AnalysisDocument5 pagesRolls-Royce SWOT and Financial AnalysisChidam CNo ratings yet

- Financial Statement Analysis and Ratio GuideDocument37 pagesFinancial Statement Analysis and Ratio Guidesiauw0283No ratings yet

- January 9, 2015: Market OverviewDocument8 pagesJanuary 9, 2015: Market OverviewValuEngine.comNo ratings yet

- Action Notes: Trican Well Service LTDDocument4 pagesAction Notes: Trican Well Service LTDkanith0No ratings yet

- ValuEngine Weekly Newsletter February 24, 2012Document12 pagesValuEngine Weekly Newsletter February 24, 2012ValuEngine.comNo ratings yet

- Stock Up - Overstock - Com UpgradedDocument5 pagesStock Up - Overstock - Com UpgradedValuEngine.comNo ratings yet

- Equity Research Analysis ShashankDocument24 pagesEquity Research Analysis ShashankVineet Pratap SinghNo ratings yet

- Capital Asset Pricing ModelDocument25 pagesCapital Asset Pricing ModelAamit KumarNo ratings yet

- Ings BHD RR 3Q FY2012Document6 pagesIngs BHD RR 3Q FY2012Lionel TanNo ratings yet

- Straco Corporation: Weak Macro Taking Its Toll On Visitor NumbersDocument10 pagesStraco Corporation: Weak Macro Taking Its Toll On Visitor NumbersKoh YSNo ratings yet

- Warren Buffett ReportDocument15 pagesWarren Buffett ReportsuleymonmonNo ratings yet

- AMANX FactSheetDocument2 pagesAMANX FactSheetMayukh RoyNo ratings yet

- Barings To Miami Pension PlanDocument25 pagesBarings To Miami Pension Planturnbj75No ratings yet

- R2S National Sustainability Screen 0211 v0.6Document59 pagesR2S National Sustainability Screen 0211 v0.6Tim BarkerNo ratings yet

- Amnd 4 Silver River Manufacturing Company ReportDocument21 pagesAmnd 4 Silver River Manufacturing Company ReportRina Nanu100% (1)

- Weekly Trends April 10, 2015Document4 pagesWeekly Trends April 10, 2015dpbasicNo ratings yet

- Bloomberg Assessment Test - BATDocument12 pagesBloomberg Assessment Test - BATathurhuntNo ratings yet

- Jetblue AirwaysDocument8 pagesJetblue AirwaysJahanzeb Hussain Qureshi50% (2)

- Mda CibcDocument12 pagesMda CibcAlexandertheviNo ratings yet

- Research Sample - IREDocument7 pagesResearch Sample - IREIndepResearchNo ratings yet

- SPCapitalIQEquityResearch ConchoResourcesInc Feb 28 2016Document11 pagesSPCapitalIQEquityResearch ConchoResourcesInc Feb 28 2016VeryclearwaterNo ratings yet

- Are There Central Problems in Credit?: Peter Cotton, Sep 2006Document28 pagesAre There Central Problems in Credit?: Peter Cotton, Sep 2006ttongNo ratings yet

- ValuEngine Weekly Newsletter September 21, 2012Document10 pagesValuEngine Weekly Newsletter September 21, 2012ValuEngine.comNo ratings yet

- Driving Performance and Executing On Strategy: Simon Moore Director, Investor RelationsDocument23 pagesDriving Performance and Executing On Strategy: Simon Moore Director, Investor RelationsChristopher TownsendNo ratings yet

- Presentation DLJDocument24 pagesPresentation DLJShaheen Rahman100% (1)

- 1.introduction To Business Environment-1Document45 pages1.introduction To Business Environment-1Swati SawantNo ratings yet

- Measuring Business Interruption Losses and Other Commercial Damages: An Economic ApproachFrom EverandMeasuring Business Interruption Losses and Other Commercial Damages: An Economic ApproachNo ratings yet

- Strategy, Value and Risk: A Guide to Advanced Financial ManagementFrom EverandStrategy, Value and Risk: A Guide to Advanced Financial ManagementNo ratings yet

- Revised HD Equity Research ReportDocument18 pagesRevised HD Equity Research Reportapi-312977476No ratings yet

- Ut Dallas Cfa Irc Report - 2016 LuvDocument47 pagesUt Dallas Cfa Irc Report - 2016 Luvapi-312977476No ratings yet

- Kors Equity Research Report FinalDocument21 pagesKors Equity Research Report Finalapi-312977476No ratings yet

- James Nguyen - Resume WodDocument1 pageJames Nguyen - Resume Wodapi-312977476No ratings yet

- The Transformation of PhysicsDocument10 pagesThe Transformation of PhysicsVíctor Manuel Hernández MárquezNo ratings yet

- Tugas BHS InggrisDocument2 pagesTugas BHS InggrisJust NestNo ratings yet

- CS3C Mover Practice 2Document4 pagesCS3C Mover Practice 2Nguyễn Lê Hà ViNo ratings yet

- Life Cycle of A BirdDocument3 pagesLife Cycle of A BirdMary Grace YañezNo ratings yet

- The Church of The Nazarene in The U.S. - Race Gender and Class in The Struggle With Pentecostalism and Aspirations Toward Respectability 1895 1985Document238 pagesThe Church of The Nazarene in The U.S. - Race Gender and Class in The Struggle With Pentecostalism and Aspirations Toward Respectability 1895 1985Luís Felipe Nunes BorduamNo ratings yet

- Climate and Urban FormDocument10 pagesClimate and Urban FormYunita RatihNo ratings yet

- Vaishali Ancient City Archaeological SiteDocument31 pagesVaishali Ancient City Archaeological SiteVipul RajputNo ratings yet

- College Resume TemplateDocument7 pagesCollege Resume Templatevofysyv1z1v3100% (1)

- The Base-Catalyzed-Hydrolysis and Condensation-Reactions of Dilute and Concentrated Teos SolutionsDocument7 pagesThe Base-Catalyzed-Hydrolysis and Condensation-Reactions of Dilute and Concentrated Teos SolutionscoloreyeNo ratings yet

- Gauge Invariance in Classical ElectrodynamicsDocument22 pagesGauge Invariance in Classical ElectrodynamicsArindam RoyNo ratings yet

- 1000arepas Maythuna Aceituna Una YogaDocument164 pages1000arepas Maythuna Aceituna Una YogaDaniel Medvedov - ELKENOS ABE100% (1)

- Meena ResumeDocument3 pagesMeena ResumeAnonymous oEzGNENo ratings yet

- Homework Solutions For Chapter 8Document6 pagesHomework Solutions For Chapter 8api-234237296No ratings yet

- TGT EnglishDocument3 pagesTGT EnglishKatta SrinivasNo ratings yet

- General Physics Mass, Weight, DensityDocument37 pagesGeneral Physics Mass, Weight, DensityMat MinNo ratings yet

- Love Against All Odds: Summary of The Wedding DanceDocument2 pagesLove Against All Odds: Summary of The Wedding DanceLYumang, Annika Joy D.No ratings yet

- 58 58 International Marketing Chapter WiseDocument126 pages58 58 International Marketing Chapter WiseNitish BhaskarNo ratings yet

- Two Sides of Effective Oral CommunicationDocument17 pagesTwo Sides of Effective Oral CommunicationSharath KumarNo ratings yet

- Peta I Think Fizik t4Document18 pagesPeta I Think Fizik t4Yk TayNo ratings yet

- Assessing The NeckDocument3 pagesAssessing The NeckAnne Joyce Lara AlbiosNo ratings yet

- What Is The Advantages and Disadvantages of Analog and Digital InstrumentDocument22 pagesWhat Is The Advantages and Disadvantages of Analog and Digital Instrumentabishek_bhardwa866645% (20)

- ML for Humans: A Journey from Ignorance to OxfordDocument27 pagesML for Humans: A Journey from Ignorance to OxfordDivyanshu Sachan50% (2)