Professional Documents

Culture Documents

Itr-V: Income Tax Return Verification Form Indian

Uploaded by

api-25886395Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itr-V: Income Tax Return Verification Form Indian

Uploaded by

api-25886395Copyright:

Available Formats

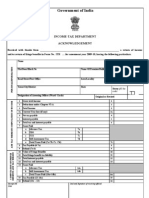

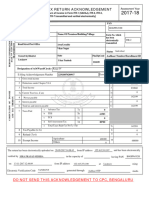

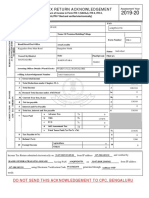

INCOME TAX RETURN VERIFICATION FORM Assessment Year

ITR- INDIAN [Where the data of the Return of Income in Form SARAL-II (ITR-1), ITR-2, ITR-3, ITR-

FORM

V 4, ITR-5, ITR-6 & ITR-8 transmitted electronically without digital signature]

(Please see rule 12 of the Income-tax Rules,1962) 2 0 1 0 - 1 1

(Also see attached instructions)

Name PAN

PERSONALINFORMATION AND THE DATE OF

Flat/Door/Block No Name Of Premises/Building/Village Form No. which

ELECTRONIC TRANSMISSION

has been

electronically

transmitted

Road/Street/Post Office Area/Locality (fill the code)

Town/City/District State

Status (fill the

code)

Designation of Assessing Officer (Ward/ Circle) Original or Revised

E-filing Acknowledgement Number Date(DD/MM/YYYY) / /

1 Gross total income 1

2 Deductions under Chapter-VI-A 2

3 Total Income 3

3a Current Year loss (if any) 3a

COMPUTATION OF INCOME

4 Net tax payable 4

AND TAX THEREON

5 Interest payable 5

6 Total tax and interest payable 6

7 Taxes Paid

a Advance Tax 7a

b TDS 7b

c TCS 7c

d Self Assessment Tax 7d

e Total Taxes Paid (7a+7b+7c +7d) 7e

8 Tax Payable (6-7e) 8

9 Refund (7e-6) 9

VERIFICATION

I, _________________________________________________(full name in block letters), son/ daughter of

____________________________________________ holding permanent account number

__________________________solemnly declare that to the best of my knowledge and belief, the information given in the

return and the schedules thereto which have been transmitted electronically by me vide acknowledgement number

mentioned above is correct and complete and that the amount of total income/ fringe benefits and other particulars shown

therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income and

fringe benefits chargeable to income-tax for the previous year relevant to the assessment year 2010-11. I further declare that

I am making this return in my capacity as ____________________________________ and I am also competent to make this

return and verify it.

Sign here Î Date Place

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter

Signature of

TRP

For Office Use Only Seal and Signature of receiving official

Receipt No

Da t e

You might also like

- Itr-V 2 0 0 9 - 1 0: Indian Income Tax Return Verification Form Assessment YearDocument10 pagesItr-V 2 0 0 9 - 1 0: Indian Income Tax Return Verification Form Assessment YearranaonlineNo ratings yet

- Form ITR-V and Acknowledgement FinalDocument4 pagesForm ITR-V and Acknowledgement FinalHarish100% (1)

- ITR Ack 2010 11Document1 pageITR Ack 2010 11Kiran Avinash Priti MhatreNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument3 pagesItr-V: Indian Income Tax Return Verification FormBalaji NaikNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument4 pagesItr-V: Indian Income Tax Return Verification FormVivekanandNo ratings yet

- Indian Government Income Tax AcknowledgementDocument1 pageIndian Government Income Tax AcknowledgementPramod Reddy RNo ratings yet

- Indian Income Tax Return Verification FormDocument28 pagesIndian Income Tax Return Verification FormPobitro DasNo ratings yet

- 2019 07 19 20 32 28 808 - 1563548548808 - XXXPS0222X - Acknowledgement PDFDocument1 page2019 07 19 20 32 28 808 - 1563548548808 - XXXPS0222X - Acknowledgement PDFsampreethpNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMaheshNo ratings yet

- Indian Income Tax Return Acknowledgement DetailsDocument1 pageIndian Income Tax Return Acknowledgement DetailsMaheshNo ratings yet

- Indian Income Tax Return Acknowledgement SummaryDocument1 pageIndian Income Tax Return Acknowledgement SummaryShankar SagarNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Anmol KhannaNo ratings yet

- Itr 2 in Excel Format With Formula For A.Y. 2010 11Document12 pagesItr 2 in Excel Format With Formula For A.Y. 2010 11Shakeel sheoranNo ratings yet

- Acknowledgement 1Document1 pageAcknowledgement 1kumar1309No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Acknowledgement FinalDocument2 pagesAcknowledgement FinalMohan NaiduNo ratings yet

- Itr-V Aaifp5094r 2007-08 2554600241007Document1 pageItr-V Aaifp5094r 2007-08 2554600241007dharmendraganatra2No ratings yet

- Indian ITR-4 Return AcknowledgementDocument1 pageIndian ITR-4 Return AcknowledgementvishalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruvishnu ksNo ratings yet

- Income Tax Return Ay 2019-20Document1 pageIncome Tax Return Ay 2019-20ramanNo ratings yet

- Deepak Bansal PDFDocument1 pageDeepak Bansal PDFPARDEEP JINDALNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurudibyan dasNo ratings yet

- Indian Income Tax Return Acknowledgement SummaryDocument1 pageIndian Income Tax Return Acknowledgement SummaryPradeep NegiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusurajit halderNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnil vaddiNo ratings yet

- PDF 776005010080819Document1 pagePDF 776005010080819Hasan KhanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikas MahorNo ratings yet

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDocument1 page2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)shalabhNo ratings yet

- Indian Income Tax Return Acknowledgement DetailsDocument1 pageIndian Income Tax Return Acknowledgement DetailsAnimesh JainNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKarthikJacobNo ratings yet

- Itr-V Axlpa8901a 2019-20 958819430290819Document1 pageItr-V Axlpa8901a 2019-20 958819430290819sduttacob114No ratings yet

- INDIAN INCOME TAX RETURN VERIFICATIONDocument1 pageINDIAN INCOME TAX RETURN VERIFICATIONSunil PeerojiNo ratings yet

- Indian Income Tax Return Acknowledgement for FY 2019-20Document1 pageIndian Income Tax Return Acknowledgement for FY 2019-20Subhendu NathNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDebabrata pahariNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPavitra Nityanand DasNo ratings yet

- 2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFDocument1 page2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFMurali KrishnaNo ratings yet

- Itr-V Bogpp6352h 2017-18 225020870280917Document1 pageItr-V Bogpp6352h 2017-18 225020870280917DEVIL RDXNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementSagar Kumar GuptaNo ratings yet

- A.Y. 2019-20 ItrvunlDocument1 pageA.Y. 2019-20 Itrvunlkishan bhalodiyaNo ratings yet

- Indian Income Tax Return Verification FormDocument1 pageIndian Income Tax Return Verification FormSumanyuu NNo ratings yet

- Itr 19-20Document1 pageItr 19-20Ashwani KumarNo ratings yet

- PDF Class NoteDocument1 pagePDF Class NoteSachin KadamNo ratings yet

- 2020 11 22 11 41 29 647 - 1606025489647 - XXXPJ7641X - Itrv 1Document1 page2020 11 22 11 41 29 647 - 1606025489647 - XXXPJ7641X - Itrv 1Ritesh MehtaNo ratings yet

- Balwinder Singh ITR 2Document1 pageBalwinder Singh ITR 2Pawan KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurugamini bhargavNo ratings yet

- 2019 08 29 08 03 51 002 - 1567046031002 - XXXPS7042X - Acknowledgement PDFDocument1 page2019 08 29 08 03 51 002 - 1567046031002 - XXXPS7042X - Acknowledgement PDFsonal aNo ratings yet

- Itr 19-20Document1 pageItr 19-20Ashwani KumarNo ratings yet

- 2019 07 31 23 05 02 491 - 1564594502491 - XXXPS2437X - Acknowledgement PDFDocument1 page2019 07 31 23 05 02 491 - 1564594502491 - XXXPS2437X - Acknowledgement PDFsosale prasannaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurusumitNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNadeemNo ratings yet

- Indian Income Tax Return Acknowledgement for Kapil Dilip WasuleDocument1 pageIndian Income Tax Return Acknowledgement for Kapil Dilip WasuleMohit JainNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruTAPAS MAHARANANo ratings yet

- Indian Income Tax Return Acknowledgement for AY 2018-19Document1 pageIndian Income Tax Return Acknowledgement for AY 2018-19Bimal Kumar MaityNo ratings yet

- Indian Income Tax Return Verification FormDocument1 pageIndian Income Tax Return Verification FormSahana SkNo ratings yet

- ACKDocument1 pageACKSAITEJA SOLVENT PURCHASENo ratings yet

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Reserve Bank of India Foreign Exchange Department Central Office Mumbai - 400 001Document2 pagesReserve Bank of India Foreign Exchange Department Central Office Mumbai - 400 001api-25886395No ratings yet

- Reserve Bank of India Foreign Exchange Department Central Office Mumbai - 400 001Document2 pagesReserve Bank of India Foreign Exchange Department Central Office Mumbai - 400 001api-25886395No ratings yet

- NullDocument13 pagesNullapi-25886395No ratings yet

- Important Notice: As Per Recent RBI GuidelinesDocument1 pageImportant Notice: As Per Recent RBI Guidelinesapi-25886395No ratings yet

- Securities and Exchange Board of India: WWW - Corpfiling.co - inDocument1 pageSecurities and Exchange Board of India: WWW - Corpfiling.co - inapi-25886395No ratings yet

- NotificationDocument7 pagesNotificationapi-25886395No ratings yet

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilNo ratings yet

- Report Highlights: India's GDP To Quadruple To INR 205 TRNDocument7 pagesReport Highlights: India's GDP To Quadruple To INR 205 TRNapi-25886395No ratings yet

- (Published in The Gazette of IndiaDocument6 pages(Published in The Gazette of Indiaapi-25886395No ratings yet

- NullDocument22 pagesNullapi-25886395No ratings yet

- Highlights of BudgetDocument3 pagesHighlights of Budgetapi-25886395No ratings yet

- NullDocument20 pagesNullapi-25886395No ratings yet

- (Published in The Gazette of IndiaDocument6 pages(Published in The Gazette of Indiaapi-25886395No ratings yet

- Important Notice: As Per Recent RBI GuidelinesDocument1 pageImportant Notice: As Per Recent RBI Guidelinesapi-25886395No ratings yet

- Highlights of BudgetDocument3 pagesHighlights of Budgetapi-25886395No ratings yet

- Legal DigestDocument1 pageLegal Digestapi-25886395No ratings yet

- Various Examples :illustration : - 1 CompanyDocument6 pagesVarious Examples :illustration : - 1 Companyapi-25886395No ratings yet

- Speech of Mamata Banerjee Introducing The RailwayDocument47 pagesSpeech of Mamata Banerjee Introducing The Railwayapi-25886395No ratings yet

- Reserve Bank of India: UBD - PCB.Cir. No. 50 /13.05.000/2007-08Document1 pageReserve Bank of India: UBD - PCB.Cir. No. 50 /13.05.000/2007-08api-25886395No ratings yet

- Views On Union BudgetDocument1 pageViews On Union Budgetapi-25886395No ratings yet

- RBI - BPLR To Base Rate ChangeDocument4 pagesRBI - BPLR To Base Rate Changeankit_gupta_92No ratings yet

- Key Features of Budget 2010-2011Document14 pagesKey Features of Budget 2010-2011api-25886395No ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- S&P CNX Nif T yDocument15 pagesS&P CNX Nif T yapi-25886395No ratings yet

- Key Features of Budget 2010-2011Document14 pagesKey Features of Budget 2010-2011api-25886395No ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Rbi/2009-10/323 Dpss - Co.chd - No. 1832 / 04.07.05 / 2009-10Document6 pagesRbi/2009-10/323 Dpss - Co.chd - No. 1832 / 04.07.05 / 2009-10api-25886395No ratings yet

- Speech of Mamata Banerjee Introducing The RailwayDocument47 pagesSpeech of Mamata Banerjee Introducing The Railwayapi-25886395No ratings yet

- RESERVE BANK of INDIA Foreign Exchange DepartmentDocument2 pagesRESERVE BANK of INDIA Foreign Exchange Departmentapi-25886395No ratings yet

- 2016 Mustang WiringDocument9 pages2016 Mustang WiringRuben TeixeiraNo ratings yet

- Cianura Pentru Un Suras de Rodica OjogDocument1 pageCianura Pentru Un Suras de Rodica OjogMaier MariaNo ratings yet

- Arduino Guide using MPU-6050 and nRF24L01Document29 pagesArduino Guide using MPU-6050 and nRF24L01usmanNo ratings yet

- 10 Slides For A Perfect Startup Pitch DeckDocument6 pages10 Slides For A Perfect Startup Pitch DeckZakky AzhariNo ratings yet

- ASTM D256-10 - Standard Test Methods For Determining The Izod Pendulum Impact Resistance of PlasticsDocument20 pagesASTM D256-10 - Standard Test Methods For Determining The Izod Pendulum Impact Resistance of PlasticsEng. Emílio DechenNo ratings yet

- Modified Release Drug ProductsDocument58 pagesModified Release Drug Productsmailtorubal2573100% (2)

- Antiquity: Middle AgesDocument6 pagesAntiquity: Middle AgesPABLO DIAZNo ratings yet

- Operation Manual: Auto Lensmeter Plm-8000Document39 pagesOperation Manual: Auto Lensmeter Plm-8000Wilson CepedaNo ratings yet

- The Learners Demonstrate An Understanding Of: The Learners Should Be Able To: The Learners Should Be Able ToDocument21 pagesThe Learners Demonstrate An Understanding Of: The Learners Should Be Able To: The Learners Should Be Able ToBik Bok50% (2)

- Ch07 Spread Footings - Geotech Ultimate Limit StatesDocument49 pagesCh07 Spread Footings - Geotech Ultimate Limit StatesVaibhav SharmaNo ratings yet

- Political Reporting:: Political Reporting in Journalism Is A Branch of Journalism, Which SpecificallyDocument6 pagesPolitical Reporting:: Political Reporting in Journalism Is A Branch of Journalism, Which SpecificallyParth MehtaNo ratings yet

- Judge Vest Printable PatternDocument24 pagesJudge Vest Printable PatternMomNo ratings yet

- Exor EPF-1032 DatasheetDocument2 pagesExor EPF-1032 DatasheetElectromateNo ratings yet

- Measuring Renilla Luciferase Luminescence in Living CellsDocument5 pagesMeasuring Renilla Luciferase Luminescence in Living CellsMoritz ListNo ratings yet

- Problems of Teaching English As A Foreign Language in YemenDocument13 pagesProblems of Teaching English As A Foreign Language in YemenSabriThabetNo ratings yet

- NPV Irr ArrDocument16 pagesNPV Irr ArrAnjaliNo ratings yet

- VEGA MX CMP12HP Data SheetDocument2 pagesVEGA MX CMP12HP Data SheetLuis Diaz ArroyoNo ratings yet

- Optimization of The Spray-Drying Process For Developing Guava Powder Using Response Surface MethodologyDocument7 pagesOptimization of The Spray-Drying Process For Developing Guava Powder Using Response Surface MethodologyDr-Paras PorwalNo ratings yet

- Give Five Examples Each of Nature Having Reflection Symmetry and Radial Symmetry Reflection Symmetry Radial Symmetry Butterfly StarfishDocument12 pagesGive Five Examples Each of Nature Having Reflection Symmetry and Radial Symmetry Reflection Symmetry Radial Symmetry Butterfly StarfishANNA MARY GINTORONo ratings yet

- IELTS Vocabulary ExpectationDocument3 pagesIELTS Vocabulary ExpectationPham Ba DatNo ratings yet

- New Brunswick CDS - 2020-2021Document31 pagesNew Brunswick CDS - 2020-2021sonukakandhe007No ratings yet

- All Associates Warning Against ChangesDocument67 pagesAll Associates Warning Against Changesramesh0% (1)

- Computer Portfolio (Aashi Singh)Document18 pagesComputer Portfolio (Aashi Singh)aashisingh9315No ratings yet

- Second Law of EntrophyDocument22 pagesSecond Law of EntrophyMia Betia BalmacedaNo ratings yet

- NOTE CHAPTER 3 The Mole Concept, Chemical Formula and EquationDocument10 pagesNOTE CHAPTER 3 The Mole Concept, Chemical Formula and EquationNur AfiqahNo ratings yet

- Report Daftar Penerima Kuota Telkomsel Dan Indosat 2021 FSEIDocument26 pagesReport Daftar Penerima Kuota Telkomsel Dan Indosat 2021 FSEIHafizh ZuhdaNo ratings yet

- Reinvestment Allowance (RA) : SCH 7ADocument39 pagesReinvestment Allowance (RA) : SCH 7AchukanchukanchukanNo ratings yet

- 2019-10 Best Practices For Ovirt Backup and Recovery PDFDocument33 pages2019-10 Best Practices For Ovirt Backup and Recovery PDFAntonius SonyNo ratings yet

- Insize Catalogue 2183,2392Document1 pageInsize Catalogue 2183,2392calidadcdokepNo ratings yet

- Covey - Moral CompassingDocument5 pagesCovey - Moral CompassingAsimNo ratings yet