Professional Documents

Culture Documents

FOREX

Uploaded by

manoranjanpatra100%(3)100% found this document useful (3 votes)

6K views15 pagesForeign exchange market is a market where foreign currencies are bought and sold. It helps business convert one currency to another. The foreign exchange market started forming during the 1970s.

Original Description:

Original Title

FOREX ppt

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentForeign exchange market is a market where foreign currencies are bought and sold. It helps business convert one currency to another. The foreign exchange market started forming during the 1970s.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

100%(3)100% found this document useful (3 votes)

6K views15 pagesFOREX

Uploaded by

manoranjanpatraForeign exchange market is a market where foreign currencies are bought and sold. It helps business convert one currency to another. The foreign exchange market started forming during the 1970s.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 15

FOREX

MEANING: The foreign exchange market is a market

where foreign currencies are bought and sold.

Ex:if an Indian importer imports goods from USA

and has to make payments in US dollars.

• The purpose of FOREX is to help international

trade and investment.

• A FOREX market helps business convert one

currency to another.

• In a typical foreign exchange transaction a

party purchases a quantity of one currency by

paying a quantity of another currency.

• The foreign exchange market started forming

during the 1970s.

• The FOREX is unique because of:-

- Its trading volumes

- The extremely liquidity of the market

- Its geographical dispersion

- Its long trading hours ,24hours a day

- The low margins of profit compared with

other market or fixed income. but profits can

be high due to very large trading volumes.

Trading Characteristics

• It is called as the over counter market (OTC)

• There is no single unified foreign exchange

market

• There are rather a number of interconnected

marketplaces ,where different currency

instruments are traded.

• The main trading centers are in London, New

york,Tokyo,Hongkong,Singapore,but banks

throughout the world participate.

Cont……….

• There is little or no “inside information” in the

foreign exchange market.

• Exchange rates fluctuations are usually caused

by actual monetary flows as well as by

expectations of change in monetary flows

caused by changes in GDP growth, Inflation,

interest rates, budget and trade deficits or

surpluses and other macro-economic

conditions.

Cont……

• Major news is released publicly, often on

scheduled dates , so that many people have

access to the same news at the same time.

Market size and Liquidity

• Presently, the FOREX is one of the largest and

liquid financial markets in the world.

• Traders include large banks, currency

speculators, corporations, governments and

other financial institutions.

• The average daily volume in the global foreign

exchange and related market is continuously

growing.

Cont………..

• Daily turnover was reported to be over US$

3.2 trillion in Apr.2007 by the bank for

international settlements.

• Of the daily global turnover ,trading in London

accounted for 34.1% of the total. London by

far the global center for foreign exchange.

• In second and third places respectively,

trading in Newyork 16.6% and Tokyo 6.0%

Major participants…

The participants in the foreign exchange market

are:-

• Individuals

• Firm

• Banks

• Governments

• International Agencies

Cont……

• There are two tier system in the foreign

exchange market.

• One involves the transactions between the

ultimate customer and bank.

• Other consists of the transaction between the

banks

Structure of the FOREX

• The foreign exchange market in india consists of

three tier system

• The first consists of transactions between RBI and

the Authorized Dealers(ADs)

• Second tier is the inter bank market in which the

Ads deal with each other

• Third tier consists of transactions between Ads

and their corporate customers

• The daily turnover in the Indian foreign exchange

market is currently estimated to be between USD

1.5 – 3 billion.

Cont……..

• The most important center is Mumbai.

• Other active centers are Delhi, Kolkata,

Chennai, Cochin and Bangalore

Trade currency mechanics

• The main actors in the forex market are the

primary market makers who trade on their own

account and make a two-way bid offer market.

• They deal actively and continuously with each

other and with their clients, central banks and

sometimes with currency brokers.

• The ISO has developed three letter codes for all

currencies which abbreviate the name of the

country as well as currency.

For Example:-

• USD

• GBP

• JPY

• CAD

• EUR

• CHF

• AUD

• SEK

• NLG

• BEF

• FRF

• ESP

• INR

• DEM

• ITL

• SAR

You might also like

- Chapin Columbus DayDocument15 pagesChapin Columbus Dayaspj13No ratings yet

- An Etymological Dictionary of The Scottivol 2Document737 pagesAn Etymological Dictionary of The Scottivol 2vstrohmeNo ratings yet

- Forex Trading Guide .2.0Document53 pagesForex Trading Guide .2.0Alexandro DiraNo ratings yet

- Binary Options: Boss (COMPANY NAME) (Company Address)Document11 pagesBinary Options: Boss (COMPANY NAME) (Company Address)Oscar MontielNo ratings yet

- Advanced Guide To TradingDocument32 pagesAdvanced Guide To TradingKESHAV ZONENo ratings yet

- BinaryOptionsE BookDocument9 pagesBinaryOptionsE BookKal MarshallNo ratings yet

- Atfx Presentation - en - HDocument39 pagesAtfx Presentation - en - HNurul Mutmainnah NadarNo ratings yet

- High Frequency Forex Linguistics DictionaryDocument22 pagesHigh Frequency Forex Linguistics DictionaryIM ACADEMY MILLIONAIRESNo ratings yet

- Forex Beginner's GuideDocument42 pagesForex Beginner's GuideRvnthah RvnthahNo ratings yet

- Forex TradingDocument3 pagesForex TradingAnda Visan100% (1)

- Forex PDF TrainingDocument66 pagesForex PDF TrainingFahrur RoziNo ratings yet

- Book Free Classes: Follow @glocotz On Twitter and Book Any Forex Question Call: 2774 342 1296 / 2779 679 8288 or Email Tsithole@pro91media - Co.zaDocument38 pagesBook Free Classes: Follow @glocotz On Twitter and Book Any Forex Question Call: 2774 342 1296 / 2779 679 8288 or Email Tsithole@pro91media - Co.zaTiyi TZ Sitholeni100% (1)

- Introduction To Forex - Forex Made Easy PDFDocument33 pagesIntroduction To Forex - Forex Made Easy PDFKundan Kadam100% (1)

- Forex Trading Mastering the Global Foreign Exchange Market the Ultimate Guide with the Best Secrets, Strategies and Psychological Attitudes to Become a Successful Trader in the Forex Market: WARREN MEYERS, #5From EverandForex Trading Mastering the Global Foreign Exchange Market the Ultimate Guide with the Best Secrets, Strategies and Psychological Attitudes to Become a Successful Trader in the Forex Market: WARREN MEYERS, #5No ratings yet

- Mathematics Into TypeDocument114 pagesMathematics Into TypeSimosBeikosNo ratings yet

- Motion and Time: Check Your Progress Factual QuestionsDocument27 pagesMotion and Time: Check Your Progress Factual QuestionsRahul RajNo ratings yet

- Forex IndicatorsDocument21 pagesForex IndicatorsDejidmaa Galbadrakh50% (2)

- Binary Trading Strategy That's Makes You Millionaire in 2022Document2 pagesBinary Trading Strategy That's Makes You Millionaire in 2022Tieba issouf Ouattara100% (1)

- Division of Mzone Financial Services PVT LTDDocument19 pagesDivision of Mzone Financial Services PVT LTDMzone SalesNo ratings yet

- Picking A Forex StrategyDocument7 pagesPicking A Forex StrategyMansoor SlamangNo ratings yet

- NasdaqDocument21 pagesNasdaqSaadat ShaikhNo ratings yet

- Beginners Guide On How To Use Binary Options Trading SignalsDocument9 pagesBeginners Guide On How To Use Binary Options Trading SignalsJolly JoginhoNo ratings yet

- Blessed FX BasicsDocument54 pagesBlessed FX Basicsjoshuasage160No ratings yet

- Forex For Beginners: "Rapid Quick Start Manual" by Brian CampbellDocument10 pagesForex For Beginners: "Rapid Quick Start Manual" by Brian CampbellBudi MulyonoNo ratings yet

- Forex - Trading - For - Beginners 0 PDFDocument30 pagesForex - Trading - For - Beginners 0 PDFPedro ArteagaNo ratings yet

- ForexRealProfitEA v5.11 Manual 12.21.2010Document29 pagesForexRealProfitEA v5.11 Manual 12.21.2010RODRIGO TROCONIS100% (1)

- Basic of Forex TradingDocument7 pagesBasic of Forex TradingdafxNo ratings yet

- Forex Samurai Robot: User's Guide ForDocument7 pagesForex Samurai Robot: User's Guide ForHaslucky Tinashe Makuwaza100% (1)

- m4m Mt5 ManualDocument44 pagesm4m Mt5 ManualElsaNo ratings yet

- Rules For Forex TradingDocument22 pagesRules For Forex Tradinglever70No ratings yet

- Keys To Trading Gold USDocument15 pagesKeys To Trading Gold USHaichuNo ratings yet

- Forex Ghost Scalper StrategyDocument6 pagesForex Ghost Scalper StrategyPakkiri RNo ratings yet

- Concept of HalalDocument3 pagesConcept of HalalakNo ratings yet

- 4 5863814219530505354Document31 pages4 5863814219530505354DansnipesNo ratings yet

- Binary Options TradingDocument12 pagesBinary Options TradingAlexandre SilvaNo ratings yet

- Introduction To Forex Trading by TemplefxDocument28 pagesIntroduction To Forex Trading by TemplefxkelvinNo ratings yet

- BimetallismDocument28 pagesBimetallismmanoranjanpatraNo ratings yet

- Foreign Exchange 101: Presented By: Jervin S. de Celis, CSR, CFMPDocument99 pagesForeign Exchange 101: Presented By: Jervin S. de Celis, CSR, CFMParthur the greatNo ratings yet

- ActiveTrader User GuideDocument50 pagesActiveTrader User GuideAhmed SaeedNo ratings yet

- Execution RisksDocument22 pagesExecution RisksLopang WesthuizenNo ratings yet

- List of Best Forex Trading Strategies For Beginners To FollowDocument2 pagesList of Best Forex Trading Strategies For Beginners To FollowFarva QandeelNo ratings yet

- Introduction To Forex ManagementDocument6 pagesIntroduction To Forex ManagementDivakara Reddy100% (1)

- How To Trade Synthetic Indices. Simple Invest FXDocument14 pagesHow To Trade Synthetic Indices. Simple Invest FXuuguludavid77No ratings yet

- ArbitrageDocument17 pagesArbitrageKamalakannan AnnamalaiNo ratings yet

- MultiBank Company Profile English 2022Document24 pagesMultiBank Company Profile English 2022Anonymous CQ4rbzLVENo ratings yet

- BusinessPlan BinaryTradingDocument11 pagesBusinessPlan BinaryTradinghukaNo ratings yet

- Advanced Introduction Notes PDFDocument9 pagesAdvanced Introduction Notes PDFInternet VideosNo ratings yet

- Accessing The Interbank Forex MarketDocument4 pagesAccessing The Interbank Forex Marketgeekkurosaki100% (1)

- Client Broker RelationshipDocument24 pagesClient Broker RelationshipMahbubul Islam KoushickNo ratings yet

- Tools For Hedging Foreign ExchangeDocument28 pagesTools For Hedging Foreign ExchangeUmeshNo ratings yet

- Beginner'S Guide To Forex Trading: October 2018Document8 pagesBeginner'S Guide To Forex Trading: October 2018JackzidNo ratings yet

- Presentation On " ": Devi Ahilya Vishwavidyalaya, Indore (A State Govt. Statutory University of M.P.)Document20 pagesPresentation On " ": Devi Ahilya Vishwavidyalaya, Indore (A State Govt. Statutory University of M.P.)Buddhapratap RathoreNo ratings yet

- Live Forex SignalsDocument6 pagesLive Forex SignalsTop Free Forex Signals100% (1)

- SmartFX BrochureDocument10 pagesSmartFX BrochureAkhil HussainNo ratings yet

- Boom Crash CostsDocument64 pagesBoom Crash CostsLisa MajminNo ratings yet

- NASDAQDocument10 pagesNASDAQVìkhíl VíçkyNo ratings yet

- Oisches Capital Boom and Crash Strategy - PDF - Economies - Business 2Document16 pagesOisches Capital Boom and Crash Strategy - PDF - Economies - Business 2Philippe KakudjiNo ratings yet

- Forex: Foreign ExchangeDocument15 pagesForex: Foreign ExchangeLeong Weng PhoonNo ratings yet

- How To Start A Forex Trading Business From HomeDocument6 pagesHow To Start A Forex Trading Business From Homemarshy bindaNo ratings yet

- Tweezer TopDocument5 pagesTweezer Topkarthick sudharsanNo ratings yet

- Put Option: Instrument ModelsDocument4 pagesPut Option: Instrument ModelsPutta Vinay KumarNo ratings yet

- Assignment:3: What Is Forex Market?Document3 pagesAssignment:3: What Is Forex Market?Ayesha HamidNo ratings yet

- Marketing PlanDocument8 pagesMarketing PlanBagus KridhaNo ratings yet

- Trade Plan & LogDocument13 pagesTrade Plan & LogDarwiish Academy100% (1)

- Role of An International Financial ManagerDocument13 pagesRole of An International Financial ManagermanoranjanpatraNo ratings yet

- Pret On Currency OptionsDocument6 pagesPret On Currency OptionsmanoranjanpatraNo ratings yet

- Intl. Portfolio Investment, JituDocument18 pagesIntl. Portfolio Investment, JitumanoranjanpatraNo ratings yet

- OptionDocument7 pagesOptionmanoranjanpatraNo ratings yet

- Role of An International Financial ManagerDocument13 pagesRole of An International Financial ManagermanoranjanpatraNo ratings yet

- Transfer Pricing, RajeshDocument10 pagesTransfer Pricing, RajeshmanoranjanpatraNo ratings yet

- OptionDocument7 pagesOptionmanoranjanpatraNo ratings yet

- Intl. Capital Budgeting, BanshiDocument7 pagesIntl. Capital Budgeting, BanshimanoranjanpatraNo ratings yet

- Foreign Exchange Market: by Vive Kku Ma Rsa Hay Ati D AshDocument12 pagesForeign Exchange Market: by Vive Kku Ma Rsa Hay Ati D AshmanoranjanpatraNo ratings yet

- FII, BongoDocument9 pagesFII, BongomanoranjanpatraNo ratings yet

- Intl. Portfolio Investment, JituDocument18 pagesIntl. Portfolio Investment, JitumanoranjanpatraNo ratings yet

- Foreign Institutional InvestmentDocument9 pagesForeign Institutional InvestmentmanoranjanpatraNo ratings yet

- International Bonds KrushnaDocument10 pagesInternational Bonds KrushnamanoranjanpatraNo ratings yet

- Abhilash Presents: Forgien Direct InvestmentDocument11 pagesAbhilash Presents: Forgien Direct InvestmentmanoranjanpatraNo ratings yet

- Job SitesDocument6 pagesJob SitesmanoranjanpatraNo ratings yet

- Foreign Direct Investment (FDI)Document11 pagesForeign Direct Investment (FDI)manoranjanpatraNo ratings yet

- Currncy MKT., Future, Option BanshiDocument12 pagesCurrncy MKT., Future, Option BanshimanoranjanpatraNo ratings yet

- BisDocument6 pagesBismanoranjanpatraNo ratings yet

- Brand Equity of Dettol, Savlon & SutholDocument8 pagesBrand Equity of Dettol, Savlon & SutholmanoranjanpatraNo ratings yet

- Euro Currency Market PCDDocument43 pagesEuro Currency Market PCDmanoranjanpatraNo ratings yet

- Pricing/Valuation of Merger and Aquisition: Presented by - Bikash Ranjan MeherDocument19 pagesPricing/Valuation of Merger and Aquisition: Presented by - Bikash Ranjan MehermanoranjanpatraNo ratings yet

- Balance of PaymentDocument15 pagesBalance of PaymentmanoranjanpatraNo ratings yet

- Brand Value of Reliance Fresh of BhubaneswarDocument7 pagesBrand Value of Reliance Fresh of BhubaneswarmanoranjanpatraNo ratings yet

- Int MRKTNGDocument2 pagesInt MRKTNGmanoranjanpatraNo ratings yet

- India HDFC Bank To Take Over Centurion BankDocument5 pagesIndia HDFC Bank To Take Over Centurion BankmanoranjanpatraNo ratings yet

- Introduction To H .R .M .Document4 pagesIntroduction To H .R .M .manoranjanpatraNo ratings yet

- Brand Equity of Antiseptic LotionDocument5 pagesBrand Equity of Antiseptic LotionmanoranjanpatraNo ratings yet

- Capital StructureDocument22 pagesCapital StructuremanoranjanpatraNo ratings yet

- Principles of Communication PlanDocument2 pagesPrinciples of Communication PlanRev Richmon De ChavezNo ratings yet

- Information Security Policies & Procedures: Slide 4Document33 pagesInformation Security Policies & Procedures: Slide 4jeypopNo ratings yet

- First Aid General PathologyDocument8 pagesFirst Aid General PathologyHamza AshrafNo ratings yet

- PHD Thesis - Table of ContentsDocument13 pagesPHD Thesis - Table of ContentsDr Amit Rangnekar100% (15)

- Name: Kartikeya Thadani Reg No.: 19bma0029Document4 pagesName: Kartikeya Thadani Reg No.: 19bma0029Kartikeya ThadaniNo ratings yet

- Weill Cornell Medicine International Tax QuestionaireDocument2 pagesWeill Cornell Medicine International Tax QuestionaireboxeritoNo ratings yet

- Ignorance Is The Curse of God. Knowledge Is The Wing Wherewith We Fly To Heaven."Document3 pagesIgnorance Is The Curse of God. Knowledge Is The Wing Wherewith We Fly To Heaven."Flori025No ratings yet

- ListeningDocument2 pagesListeningAndresharo23No ratings yet

- Irregular Verbs-1Document1 pageIrregular Verbs-1timas2No ratings yet

- Formal Letter Format Sample To Whom It May ConcernDocument6 pagesFormal Letter Format Sample To Whom It May Concernoyutlormd100% (1)

- ISIS Wood Product Solutions Selects Cloud-Hosting Partner Real Cloud Solutions LLCDocument2 pagesISIS Wood Product Solutions Selects Cloud-Hosting Partner Real Cloud Solutions LLCdevaprNo ratings yet

- Present Continuous WorkshopDocument5 pagesPresent Continuous WorkshopPaula Camila Castelblanco (Jenni y Paula)No ratings yet

- Alice (Alice's Adventures in Wonderland)Document11 pagesAlice (Alice's Adventures in Wonderland)Oğuz KarayemişNo ratings yet

- Diane Mediano CareerinfographicDocument1 pageDiane Mediano Careerinfographicapi-344393975No ratings yet

- Nandurbar District S.E. (CGPA) Nov 2013Document336 pagesNandurbar District S.E. (CGPA) Nov 2013Digitaladda IndiaNo ratings yet

- Reflection On Sumilao CaseDocument3 pagesReflection On Sumilao CaseGyrsyl Jaisa GuerreroNo ratings yet

- Adverbs Before AdjectivesDocument2 pagesAdverbs Before AdjectivesJuan Sanchez PrietoNo ratings yet

- What Is A Designer Norman PotterDocument27 pagesWhat Is A Designer Norman PotterJoana Sebastião0% (1)

- Lista Agentiilor de Turism Licentiate Actualizare 16.09.2022Document498 pagesLista Agentiilor de Turism Licentiate Actualizare 16.09.2022LucianNo ratings yet

- Pa Print Isang Beses LangDocument11 pagesPa Print Isang Beses LangGilbert JohnNo ratings yet

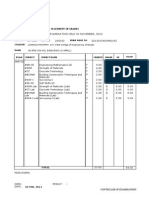

- 2024 01 31 StatementDocument4 pages2024 01 31 StatementAlex NeziNo ratings yet

- " Thou Hast Made Me, and Shall Thy Work Decay?Document2 pages" Thou Hast Made Me, and Shall Thy Work Decay?Sbgacc SojitraNo ratings yet

- Charles P. Jones, Investments: Analysis and Management, Eleventh Edition, John Wiley & SonsDocument20 pagesCharles P. Jones, Investments: Analysis and Management, Eleventh Edition, John Wiley & SonsRizki AuliaNo ratings yet

- Electronic ClockDocument50 pagesElectronic Clockwill100% (1)

- Wwe SVR 2006 07 08 09 10 11 IdsDocument10 pagesWwe SVR 2006 07 08 09 10 11 IdsAXELL ENRIQUE CLAUDIO MENDIETANo ratings yet