Professional Documents

Culture Documents

CONSOLIDATED STATEMENT FORMULAS INTERCOMPANY TRANSACTIONS

Uploaded by

konyatanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CONSOLIDATED STATEMENT FORMULAS INTERCOMPANY TRANSACTIONS

Uploaded by

konyatanCopyright:

Available Formats

CONSOLIDATED STATEMENT

FORMULAS

INTERCOMPANY TRANSACTIONS

1.) Consolidated net income

Year of sale (plant asset) - First year (Inventory)

Parent net income from own operation, exclusive of dividends received from subsidairy

Impairment loss

Unrealized profit in ending inventory

Net unrealized gain/loss on sale (depreciable asset)

Unrealized gain/loss on sale (non-depreciable assets)

Parent adjusted net income

Add: Subsidiary adjusted net income

Subsidiary reported net income

+/- Amortization

Impairment loss

Unrealized profit in ending inventory

Net unrealized gain/loss on sale (depreciable asset)

Unrealized gain/loss on sale (non-depreciable assets)

Consolidated net income

Second Year (plant asset) - Second year (inventory)

Parent net income from own operation

Impairment loss

Realized profit in begining inventory

Unrealized profit in ending inventory

Realized gain/loss on sale (annual depreciation)

Parent adjusted net income

Add: Subsidiary adjusted net income

Subsidiary reported net income

+/- Amortization

Realized profit in begining inventory

xxx

(xxx)

(xxx)

(xxx)

(xxx)

xxx

xxx

(xxx)

(xxx)

(xxx)

(xxx)

(xxx)

Upstream sales

xxx

xxx

xxx

(xxx)

xxx

(xxx)

xxx

xxx

xxx

(xxx)

xxx

Downstream sales

Unrealized profit in ending inventory

Realized gain/loss on sale (annual depreciation - excess)

Consolidated net income

(xxx)

xxx

xxx

xxx

2.) Income from subsidiary

Year of sale (plant asset) - First year (Inventory)

Subsidiary reported net income

+/- Amortization

Impairment loss

Unrealized profit in ending inventory

Net unrealized gain/loss on sale (depreciable asset)

Unrealized gain/loss on sale (non-depreciable assets)

Subsidiary adjusted net income

Multiply by: Controlling interest

Income from subsidiary

xxx

(xxx)

(xxx)

(xxx)

(xxx)

(xxx)

xxx

x%

xxx

Second Year (plant asset) - Second year (inventory

Subsidiary reported net income

+/- Amortization

Realized profit in begining inventory

Unrealized profit in ending inventory

Realized gain/loss on sale (annual depreciation)

Subsidiary adjusted net income

Multiply by: Controlling interest

Income from subsidiary

xxx

(xxx)

xxx

(xxx)

xxx

xxx

x%

xxx

Upstream sales only

Upstream sales only

3.) Consolidated net income attributable to parent

Year of sale (plant asset) - First year (Inventory)

Parent net income from own operation, exclusive of dividends received from subsidairy

Impairment loss

Unrealized profit in ending inventory

Net unrealized gain/loss on sale (depreciable asset)

Unrealized gain/loss on sale (non-depreciable assets)

xxx

(xxx)

(xxx)

(xxx)

(xxx)

Downstream sales

Parent adjusted net income

Add: Income from subsidiary

Consolidated net income attributable to parent

Second Year (plant asset) - Second year (inventory)

Parent net income from own operation

Impairment loss

Realized profit in begining inventory

Unrealized profit in ending inventory

Realized gain/loss on sale (annual depreciation)

Parent adjusted net income

Add: Income from subsidiary

Consolidated net income attributable to parent

xxx

xxx

xxx

xxx

(xxx)

xxx

(xxx)

xxx

xxx

xxx

xxx

Downstream sales

4.) NCI in the net income of Subsidairy

Year of sale (plant asset) - First year (Inventory)

Subsidiary reported net income

+/- Amortization

Impairment loss

Unrealized profit in ending inventory

Net unrealized gain/loss on sale (depreciable asset)

Unrealized gain/loss on sale (non-depreciable assets)

Subsidiary adjusted net income

Multiply by: Noncontrolling interest

Minority interest in net income

xxx

(xxx)

(xxx)

(xxx)

(xxx)

(xxx)

xxx

%

xxx

Upstream sales only

Second Year (plant asset) - Second year (inventory

Subsidiary reported net income

+/- Amortization

Realized profit in begining inventory

Unrealized profit in ending inventory

Realized gain/loss on sale (annual depreciation)

Subsidiary adjusted net income

Multiply by: Noncontrolling interest

xxx

(xxx)

xxx

(xxx)

xxx

xxx

%

Upstream sales only

Minority interest in net income

xxx

5.) Consolidated Retained Earnings

Year of sale of plant assets

No adjustment in Retained earnings on intercompany sales of plant assets, they are adjustment in

consolidated net income in the year of sales.

Second year or More than one previous year passed:

Consolidated retained earnings formula if involves more the one previous year passed

Parent Reported Retained Earnings - beginning / January 1

Gain on acquisition - on the date of acquisition

Impairment loss - previous years (cumulative)

Unrealized profit in ending inventory - recent previous year

Net unrealized gain/loss on sale (depreciable asset) - before adjustment of current year

Unrealized gain/loss on sale (non-depreciable assets)

Parent Adjusted Retained Earnings - beginning / January 1

Add: Undistributed Subsidiary adjusted net income

Subsidiary Retained Earnings - beginning of current year

Less: Subsidiary Retained Earnings - date of acquisition

Undistributed Subsidiary unadjusted net income

Amortization ( cumulative amortization )

Impairment loss - previous years (cumulative)

Unrealized profit in ending inventory - recent previous year

Net unrealized (gain)/loss on sale (depreciable asset) - before adjustment of current year

Unrealized (gain)/loss on sale (non-depreciable assets)

Total

Less: NCI share in the income undistributed adjusted cumulative earnings

Consolidated Retained Earnings - beginning/January 1

Add: Consolidated net income attributable to parent- current year

Total

Less: Dividends declared - parent only current year

Consolidated Retained Earnings - ending

xxx

xxx

(xxx)

xxx

(xxx)

(xxx)

xxx

xxx

xxx

xxx

(xxx)

(xxx)

(xxx)

(xxx)

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

6.) Noncontrolling interest

Year of sale of plant assets

No adjustment in Retained earnings on intercompany sales of plant assets, they are adjustment in

consolidated net income in the year of sales.

Computation of Noncontrolling interest more then one previous year passed

Noncontrolling interest - at the date of acquisition ( initial )

Add: NCI share in the income undistributed adjusted cumulative earnings

Subsidiary Retained Earnings - beginning of current year

Less: Subsidiary Retained Earnings - date of acquisition

Undistributed Subsidiary unadjusted net income

Amortization ( cumulative amortization )

Impairment loss - previous years (cumulative)

Unrealized profit in ending inventory - recent previous year

Net unrealized (gain)/loss on sale (depreciable asset) - before adjustment of current year

Unrealized (gain)/loss on sale (non-depreciable assets)

Total

Multiply by: Noncontrolling interest %

Noncontrolling interest - January 1, current year

Add: NCI in net income of Subsidiary/Consolidated net income attributable to NCI

Total

Less: Dividends declared x Noncontrolling interest

Noncontrolling interest - December 31 current year

xxx

xxx

xxx

xxx

xxx

(xxx)

(xxx)

(xxx)

(xxx)

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

7.) Plant and equipment on consolidated - Old cost or Cost prior to intercompany sales

8.) Accumulated Depreciation

Accumulated Depreciation - amount prior to intercompany sales (original or old value) - January 1, current

Add: Depreciation for year - computed in original depreciation (OLD)

Total

9.) Total gain on sale of plant assets when asset sold intercompany is sold to outsider.

xxx

xxx

xxx

Actual gain in selling it to outsider

Add: Remainining unrealized gain on sale of assets

Total gain

Note: Please observe the sign if it is unrealized loss, deduct.

xxx

xxx

xxx

You might also like

- Formulas For Business Combination PDFDocument28 pagesFormulas For Business Combination PDFJulious CaalimNo ratings yet

- Formula For Intercompany TransactionsDocument6 pagesFormula For Intercompany Transactionskonyatan100% (1)

- Formulas For Business CombinationDocument26 pagesFormulas For Business CombinationJonathan Vidar0% (1)

- (Solved) Galaxy Corporation Acquired 80% of The Outstanding Shares of United... - Course HeroDocument6 pages(Solved) Galaxy Corporation Acquired 80% of The Outstanding Shares of United... - Course Heroadulusman501No ratings yet

- AainvtyDocument4 pagesAainvtyRodolfo SayangNo ratings yet

- Audit Equity AccountsDocument8 pagesAudit Equity AccountsEmerlyn Charlotte FonteNo ratings yet

- PDF 6Document349 pagesPDF 6Aexisse OrchessaNo ratings yet

- Mid PS3Document8 pagesMid PS3heyNo ratings yet

- Audit ReviewDocument9 pagesAudit ReviewephraimNo ratings yet

- Book 9Document2 pagesBook 9Actg SolmanNo ratings yet

- Accounting controls for special transactionsDocument12 pagesAccounting controls for special transactionsRNo ratings yet

- ACCY 303 Midterm Exam ReviewDocument12 pagesACCY 303 Midterm Exam ReviewCORNADO, MERIJOY G.No ratings yet

- Home-Office Branch Accounting ProceduresDocument5 pagesHome-Office Branch Accounting ProceduresPam CayabyabNo ratings yet

- Home Office Branch Accounting at CostDocument23 pagesHome Office Branch Accounting at CostJaylord ReyesNo ratings yet

- ACTExamsDocument36 pagesACTExamsKaguraNo ratings yet

- Buscom Quiz 2 MidtermDocument2 pagesBuscom Quiz 2 MidtermRafael Capunpon VallejosNo ratings yet

- Revenue Recognition for Franchise AgreementsDocument15 pagesRevenue Recognition for Franchise AgreementsBobslaneLlenos0% (2)

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- Consolidation at Acquisition DateDocument29 pagesConsolidation at Acquisition DateLee DokyeomNo ratings yet

- Consolidated Net IncomeDocument1 pageConsolidated Net IncomePJ PoliranNo ratings yet

- Closing Entries - Branchbooks: (Branch Books) Home OfficeDocument2 pagesClosing Entries - Branchbooks: (Branch Books) Home OfficeUnknown 01No ratings yet

- Intercompany Profit Transactions - Inventories: Transactions Within The Affiliated GroupDocument60 pagesIntercompany Profit Transactions - Inventories: Transactions Within The Affiliated GroupPhil MO JoeNo ratings yet

- Ira Shalini M. YbañezDocument5 pagesIra Shalini M. YbañezIra YbanezNo ratings yet

- Seatwork-Hedging of A Net Investment in Foreign OperationDocument1 pageSeatwork-Hedging of A Net Investment in Foreign OperationAnthony Tunying MantuhacNo ratings yet

- Afar 02 P'ship Operation QuizDocument4 pagesAfar 02 P'ship Operation QuizJohn Laurence LoplopNo ratings yet

- HB Quiz 2020Document4 pagesHB Quiz 2020Allyssa Kassandra LucesNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 4 (2022)Document68 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 4 (2022)Mazikeen DeckerNo ratings yet

- Chaptersin BUSINESS COMBDocument29 pagesChaptersin BUSINESS COMBalmira garcia100% (1)

- Ac8dccd2 1613019594275Document7 pagesAc8dccd2 1613019594275Emey CalbayNo ratings yet

- Chapter 18 Cost Accounting.Document19 pagesChapter 18 Cost Accounting.Kheng BinuyaNo ratings yet

- Rmbe Afar For PrintingDocument18 pagesRmbe Afar For PrintingjxnNo ratings yet

- Advanced Accounting Part II Quiz 13 Intercompany Profits Long QuizDocument14 pagesAdvanced Accounting Part II Quiz 13 Intercompany Profits Long QuizRarajNo ratings yet

- Shenista Inc. Product Profit AnalysisDocument3 pagesShenista Inc. Product Profit Analysismohitgaba19No ratings yet

- 4 Franchise Ifrs 15 2020Document15 pages4 Franchise Ifrs 15 2020natalie clyde matesNo ratings yet

- Translation of Foreign Currency StatementDocument5 pagesTranslation of Foreign Currency StatementPea Del Monte AñanaNo ratings yet

- Partnership Accounting QuestionsDocument15 pagesPartnership Accounting QuestionsNhel AlvaroNo ratings yet

- Auditing Practice Problem 6Document2 pagesAuditing Practice Problem 6Jessa Gay Cartagena TorresNo ratings yet

- Notes in Auditing Problems - Correction of ErrorsDocument3 pagesNotes in Auditing Problems - Correction of ErrorsNiño Jemerald TriaNo ratings yet

- 03 Quiz 1Document9 pages03 Quiz 1Camille MadlangbayanNo ratings yet

- HB Quiz 2018-2021Document3 pagesHB Quiz 2018-2021Allyssa Kassandra LucesNo ratings yet

- 06 Activity 1-InterAcct2Document2 pages06 Activity 1-InterAcct2Jomari EscarillaNo ratings yet

- Home Office, Agency and Branch AccountingDocument17 pagesHome Office, Agency and Branch AccountingPaupauNo ratings yet

- Accounting Review 2 Quiz SolutionsDocument11 pagesAccounting Review 2 Quiz SolutionsExequielCamisaCrusperoNo ratings yet

- Acquisition Method ConsolidationDocument2 pagesAcquisition Method ConsolidationJonathan KwanNo ratings yet

- Proforma Statement of Cash Flow 3Document1 pageProforma Statement of Cash Flow 3Praveena RavishankerNo ratings yet

- Intercompany Sale of Inventory - Upstream Sale TheoryDocument1 pageIntercompany Sale of Inventory - Upstream Sale TheoryMaxineNo ratings yet

- Solution Chapter 17Document87 pagesSolution Chapter 17Sy Him88% (8)

- 3 - Income Statement-Without Correction of ExercisesDocument58 pages3 - Income Statement-Without Correction of ExercisesClaire YINo ratings yet

- Intercompany Inventory ConsolidationDocument31 pagesIntercompany Inventory ConsolidationIm In Trouble100% (2)

- Cashflow FormatDocument2 pagesCashflow FormatShubham BawkarNo ratings yet

- Chapter 17 consolidation problemsDocument68 pagesChapter 17 consolidation problemsxxxxxxxxx100% (6)

- Value of Production Income StatementsDocument12 pagesValue of Production Income StatementsnootsheiNo ratings yet

- Cash Flows Statement Indirect MethodDocument2 pagesCash Flows Statement Indirect MethodMary100% (1)

- Conto Economico Annuale 150312 enDocument2 pagesConto Economico Annuale 150312 enToobbar FraankooNo ratings yet

- Intercompany (Inventories)Document6 pagesIntercompany (Inventories)Ma Hadassa O. FolienteNo ratings yet

- CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOMEDocument55 pagesCONSOLIDATED STATEMENT OF COMPREHENSIVE INCOMEAEberthConzaNo ratings yet

- CONSOLIDATED FINANCIAL STATEMENTS FORMULASDocument30 pagesCONSOLIDATED FINANCIAL STATEMENTS FORMULASCharmae BrutasNo ratings yet

- Final Exam Cheat-SheetDocument1 pageFinal Exam Cheat-SheetPaolo TipoNo ratings yet

- AFAR 2 - SUMMATIVE TEST (CONSOLIDATED) THEORIESDocument23 pagesAFAR 2 - SUMMATIVE TEST (CONSOLIDATED) THEORIESVon Andrei Medina100% (1)

- Accounting formulas guideDocument6 pagesAccounting formulas guideGabriel100% (2)

- Bir FormsDocument17 pagesBir FormskonyatanNo ratings yet

- Accounting Information SystemDocument70 pagesAccounting Information SystemkonyatanNo ratings yet

- AdjustmentsDocument15 pagesAdjustmentskonyatanNo ratings yet

- Additional Lecture Notes - DM DL OHDocument3 pagesAdditional Lecture Notes - DM DL OHkonyatanNo ratings yet

- For BIR Use Only Annual Income Tax ReturnDocument7 pagesFor BIR Use Only Annual Income Tax ReturndignaNo ratings yet

- Internal Control and CashDocument44 pagesInternal Control and CashkonyatanNo ratings yet

- Wey AP 8e Ch04 RevisedDocument48 pagesWey AP 8e Ch04 Revisedyan haryoNo ratings yet

- IFRS 10 SummaryDocument8 pagesIFRS 10 SummarykonyatanNo ratings yet

- The Promise: (Ang Pangako)Document26 pagesThe Promise: (Ang Pangako)konyatanNo ratings yet

- 16 - Guide QuestionsDocument3 pages16 - Guide QuestionskonyatanNo ratings yet

- Republic of The PhilippinesDocument1 pageRepublic of The PhilippineskonyatanNo ratings yet

- Job-order costing spoilage entriesDocument2 pagesJob-order costing spoilage entrieskonyatan50% (2)

- Zenaida Solutions To Exercises Chap 14 15 IncompleteDocument8 pagesZenaida Solutions To Exercises Chap 14 15 IncompletekonyatanNo ratings yet

- ch22Document29 pagesch22konyatanNo ratings yet

- Standard CostingDocument1 pageStandard CostingkonyatanNo ratings yet

- 74827448-Ch17 Investment TestbankDocument44 pages74827448-Ch17 Investment TestbankkonyatanNo ratings yet

- Nego Law-Reviewer-Aquino and AgbayaniDocument74 pagesNego Law-Reviewer-Aquino and AgbayaniCha Galang100% (6)

- Auditing TheoryDocument9 pagesAuditing TheoryYenelyn Apistar CambarijanNo ratings yet

- CONSOLIDATED STATEMENT FORMULAS INTERCOMPANY TRANSACTIONSDocument6 pagesCONSOLIDATED STATEMENT FORMULAS INTERCOMPANY TRANSACTIONSkonyatanNo ratings yet

- Chapter 01 - Business CombinationsDocument17 pagesChapter 01 - Business CombinationsTina LundstromNo ratings yet

- Answers To Exercises Chap 17-18 GuerrerroDocument14 pagesAnswers To Exercises Chap 17-18 GuerrerrokonyatanNo ratings yet

- Financial Statement Analysis 20101Document117 pagesFinancial Statement Analysis 20101konyatanNo ratings yet

- CONSOLIDATED STATEMENT FORMULAS INTERCOMPANY TRANSACTIONSDocument6 pagesCONSOLIDATED STATEMENT FORMULAS INTERCOMPANY TRANSACTIONSkonyatanNo ratings yet

- Auditing TheoryDocument9 pagesAuditing TheoryYenelyn Apistar CambarijanNo ratings yet

- 16 - Guide QuestionsDocument3 pages16 - Guide QuestionskonyatanNo ratings yet

- Release 2013-005 ARMDocument294 pagesRelease 2013-005 ARMMarketsWikiNo ratings yet

- Table of ContentsDocument1 pageTable of ContentskonyatanNo ratings yet

- Sd14 Employee Stock Options and ValuationDocument7 pagesSd14 Employee Stock Options and ValuationJorreyGarciaOplasNo ratings yet

- Following Describes The Credit Sales Procedures For Clothing Wholesaler ThatDocument1 pageFollowing Describes The Credit Sales Procedures For Clothing Wholesaler ThatAmit PandeyNo ratings yet

- Ar2021 - Financial-Statement MalaysiaDocument186 pagesAr2021 - Financial-Statement MalaysiaDian MaulanaNo ratings yet

- Cash Flow Problem Solver - Depreciation, Taxes, NPV, IRRDocument45 pagesCash Flow Problem Solver - Depreciation, Taxes, NPV, IRRHannah Fuller100% (1)

- Unit I - Audit of Investment Property - Final - t31314Document11 pagesUnit I - Audit of Investment Property - Final - t31314Jake Bundok50% (2)

- GAAS GAADocument13 pagesGAAS GAAshudayeNo ratings yet

- Qualifying Exam Tos - 3rd Year - 2021Document5 pagesQualifying Exam Tos - 3rd Year - 2021Ryan Abonales BagatuaNo ratings yet

- SLA Part 9 - Create Subledger Accounting Method PDFDocument3 pagesSLA Part 9 - Create Subledger Accounting Method PDFsoireeNo ratings yet

- Audit MCQDocument20 pagesAudit MCQNitin BadganchiNo ratings yet

- The Accounting EquationDocument4 pagesThe Accounting EquationMargo Williams100% (1)

- BS Accountancy Subjects CourseDocument6 pagesBS Accountancy Subjects CourseMhel DemabogteNo ratings yet

- us-controllership-POVDocument8 pagesus-controllership-POVmasterjugasan6974No ratings yet

- Week 1 - Lesson 1 Managerial Accounting Basic FrameworkDocument6 pagesWeek 1 - Lesson 1 Managerial Accounting Basic FrameworkReynold Raquiño AdonisNo ratings yet

- (Final) Quiz Statement of Changes in Equity and Cash Flows Word FileDocument3 pages(Final) Quiz Statement of Changes in Equity and Cash Flows Word FileAyanna CameroNo ratings yet

- Oracle Financial Tables DescriptionDocument15 pagesOracle Financial Tables Descriptionrv90470No ratings yet

- July 22 Far620Document8 pagesJuly 22 Far620FARAH ZAFIRAH ISHAMNo ratings yet

- Mother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Document3 pagesMother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Jayash Kaushal0% (2)

- Primitive Accounting Middle Ages Industrial Revolution & Corporate Organization Information AgeDocument28 pagesPrimitive Accounting Middle Ages Industrial Revolution & Corporate Organization Information AgePhil Cahilig-GariginovichNo ratings yet

- IFRS Implementation in India: Opportunities, Challenges and SolutionsDocument20 pagesIFRS Implementation in India: Opportunities, Challenges and SolutionsMohdRAnsari0% (1)

- Kunal Kumar ResumeDocument3 pagesKunal Kumar Resumekunal kumarNo ratings yet

- Engagement Letter BOC SubicDocument3 pagesEngagement Letter BOC SubicMaria MalangNo ratings yet

- Quiz On Audit Engagement and PlanningDocument7 pagesQuiz On Audit Engagement and PlanningAdam SmithNo ratings yet

- Index MCQ Booklet: Audit MCQ Compiler by Shubham Keswani Shubham KeswaniDocument108 pagesIndex MCQ Booklet: Audit MCQ Compiler by Shubham Keswani Shubham Keswaniasd100% (2)

- Aite Matrix Evaluation Investment and Fund Accounting Systems ReportDocument25 pagesAite Matrix Evaluation Investment and Fund Accounting Systems ReportVijayavelu AdiyapathamNo ratings yet

- Template - 40-Audit-Committee-CharterDocument18 pagesTemplate - 40-Audit-Committee-CharterDENIS GICHURUNo ratings yet

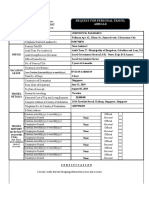

- Request For Personal Travel Abroad: Commonwealth Avenue, Quezon CityDocument5 pagesRequest For Personal Travel Abroad: Commonwealth Avenue, Quezon CityJonson PalmaresNo ratings yet

- Eob Train High CostDocument310 pagesEob Train High Costdemisca_alina4179No ratings yet

- Adobe Scan Aug 29, 2022Document12 pagesAdobe Scan Aug 29, 2022Piyush GoyalNo ratings yet

- Hico&Hico Company ProfileDocument1 pageHico&Hico Company ProfileAnonymous 7HGskNNo ratings yet

- Citi 2007: Analyzing financial reporting and regulatory capitalDocument6 pagesCiti 2007: Analyzing financial reporting and regulatory capitalKostia RiabkovNo ratings yet

- Financial Accounting Case StudiesDocument2 pagesFinancial Accounting Case StudiesRodlyn LajonNo ratings yet