Professional Documents

Culture Documents

Steinberg V Velasco

Uploaded by

apbueraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Steinberg V Velasco

Uploaded by

apbueraCopyright:

Available Formats

G.R. No.

L-30460

March 12, 1929

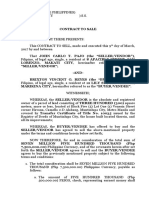

Steinberg v. Velasco

Nature: Petition for review of lower court decision to dismiss Ps complaint since it held that

the Board of Driectors could legally declare dividend of P3000

Facts:

Steinberg (P) is the receiver of Sibuguey Trading Corp. P alleges that [Velasco, as president,

Del Castillo, as vice-president, Navallo, as secretary-treasurer, and Manuel, as director of the

trading Company][R], at a meeting of the board of directors held on July 24, 1922, approved

and authorized various lawful purchases already made of a large portion of the capital stock

of the company from its various stockholders, thereby diverting its funds to the injury of the

creditors of the corp. At the time of such purchase, the corporation had debts amounting to

P13,807.50, most of which were unpaid at the time petition for the dissolution of the

corporation was financial condition, in contemplation of an insolvency and dissolution. P also

alleges that R approved a resolution for the payment of P3,000 as dividends to its

stockholders, which was done in bad faith, and to the injury and fraud of its creditors since it

had accounts less in amount than the accounts receivable. R argues that the distribution of

dividends was authorized by the board of directors and they constitute surplus profit of the

corp. The lower court found out that R authorized the purchase of, purchased and paid for,

330 shares of the capital stock of the corporation at the agreed price of P3,300, and that at

the time the purchase was made, the corporation was indebted in the sum of P13,807.50,

and that according to its books, it had accounts receivable in the sum of P19,126.02.

Issue:

Whether R can declare dividends.

Ruling:

No. The action of the board in purchasing the stock from the corporation and in declaring the

dividends on the stock was all done at the same meeting of the board of directors. The

directors were permitted to resign so that they could sell their stock to the corporation. The

authorized capital stock was P20,000 divided into 2,000 shares of the par value of P10 each,

which only P10,030 was subscribed and paid. Deducting the P3,300 paid for the purchase of

the stock, there would be left P7,000 of paid up stock, from which deduct P3,000 paid in

dividends, there would be left P4,000 only. R acted on assumption that it appeared from the

books of the corporation that it had accounts receivable of the face value of P19,126.02,

therefore it had a surplus over and above its debts and liabilities. However, there is no

stipulation as to the actual cash value of those accounts, and it does appear from the

stipulation that, P12,512.47 of those accounts had but little value. The corporation did not

then have an actual bona fide surplus from which the dividends could be paid, and that the

payment of them in full at the time would affect the financial condition of the corporation.

Because of this, the directors did not act in good faith or that they were grossly ignorant of

their duties. Creditors of a corporation have the right to assume that so long as there are

outstanding debts and liabilities, the board of directors will not use the assets of the

corporation to purchase its own stock, and that it will not declare dividends to stockholders

when the corporation is insolvent.

You might also like

- Steinberg v. Velasco, 52 Phil. 953, Digest Sec. 23Document2 pagesSteinberg v. Velasco, 52 Phil. 953, Digest Sec. 23Anonymous epsogMt100% (1)

- Steinberg Vs VelascoDocument2 pagesSteinberg Vs VelascoTeacherEli100% (1)

- Nava v. Peers MarketingDocument2 pagesNava v. Peers MarketingAnonymous 5MiN6I78I0No ratings yet

- McConnel V CADocument2 pagesMcConnel V CARaymond Cheng100% (2)

- Rural Bank of Salinas Vs CADocument1 pageRural Bank of Salinas Vs CAXing Keet LuNo ratings yet

- GAMBOA V VictorianoDocument2 pagesGAMBOA V VictorianoMiguel Castriciones50% (2)

- CAGAYAN FISHING V SANDIKODocument2 pagesCAGAYAN FISHING V SANDIKOJued Cisneros100% (1)

- De La Rama Et Al Vs Ma-Ao Sugar CentralDocument17 pagesDe La Rama Et Al Vs Ma-Ao Sugar CentralSTEPHEN M. LAYSONNo ratings yet

- General Garments Vs Director of PatentsDocument1 pageGeneral Garments Vs Director of PatentsCJNo ratings yet

- Republic of The Philippines Vs Bisaya Land TransportationDocument4 pagesRepublic of The Philippines Vs Bisaya Land TransportationAnjNo ratings yet

- 199 Uson vs. Diosomito Et Al ConsingDocument1 page199 Uson vs. Diosomito Et Al ConsingHariette Kim TiongsonNo ratings yet

- Republic Bank Vs CuadernoDocument1 pageRepublic Bank Vs CuadernoKristine Dy100% (1)

- Buenaflor vs. Camarines Sur Industry Corp.Document2 pagesBuenaflor vs. Camarines Sur Industry Corp.เจียนคาร์โล การ์เซียNo ratings yet

- Uson Vs DiosomitoDocument1 pageUson Vs DiosomitoCJNo ratings yet

- De Silva Vs AboitizDocument1 pageDe Silva Vs Aboitizgianfranco0613No ratings yet

- Claparols vs. CIRDocument1 pageClaparols vs. CIRClark Edward Runes UyticoNo ratings yet

- Tan Boon Bee & Co., Inc Vs Jarencio-DigestDocument2 pagesTan Boon Bee & Co., Inc Vs Jarencio-DigestRfs SingsonNo ratings yet

- Nava vs. Peers Marketing CorporationDocument1 pageNava vs. Peers Marketing Corporationiwamawi100% (1)

- Japanese War Notes Claimants v. SecDocument1 pageJapanese War Notes Claimants v. Secmjfernandez15No ratings yet

- Gov of The Philippines V El HogarDocument4 pagesGov of The Philippines V El HogarZoe Velasco100% (2)

- Batong Buhay v. CADocument2 pagesBatong Buhay v. CAmyc0_wheNo ratings yet

- Ramirez Vs Orientalist Co.Document2 pagesRamirez Vs Orientalist Co.Joovs Joovho67% (3)

- Mead Vs McCullough DigestDocument2 pagesMead Vs McCullough DigestCedric Enriquez100% (1)

- J.F. Ramirez v. The Orientalist CorporationDocument2 pagesJ.F. Ramirez v. The Orientalist CorporationRafaelNo ratings yet

- Baltazar v. Lingayen Gulf DIGESTDocument4 pagesBaltazar v. Lingayen Gulf DIGESTkathrynmaydevezaNo ratings yet

- Claparols Vs CIR Case DigestDocument2 pagesClaparols Vs CIR Case DigestMarie Chielo100% (2)

- Western Institute of Technology v. SalasDocument1 pageWestern Institute of Technology v. SalasJudy RiveraNo ratings yet

- Antam v. CA DigestDocument3 pagesAntam v. CA DigestkathrynmaydevezaNo ratings yet

- Commissioner vs. ManningDocument2 pagesCommissioner vs. Manningshinjha73100% (5)

- 16 Lumanlan vs. CuraDocument2 pages16 Lumanlan vs. CuraJpSocratesNo ratings yet

- Fua Cun vs. SummersDocument1 pageFua Cun vs. SummersElreen Pearl AgustinNo ratings yet

- Gokongwei v. SecDocument26 pagesGokongwei v. SecReghz De Guzman Pamatian100% (4)

- NIDC v. AquinoDocument3 pagesNIDC v. AquinoKikoy Ilagan100% (1)

- Paz v. New International Environmental UniversityDocument2 pagesPaz v. New International Environmental UniversityChic PabalanNo ratings yet

- RP Vs MarsmanDocument2 pagesRP Vs MarsmanCha100% (1)

- Pardo vs. Hercules LumberDocument2 pagesPardo vs. Hercules LumberSimon James Semilla100% (2)

- Republic Bank Vs CuadernoDocument2 pagesRepublic Bank Vs CuadernoTeacherEli100% (1)

- Alhambra Cigar vs. SECDocument2 pagesAlhambra Cigar vs. SECLilibeth Dee Gabutero67% (3)

- Edward Keller vs. Cob GroupDocument1 pageEdward Keller vs. Cob GroupAlfonso DimlaNo ratings yet

- 01 Bayla V Silang Traffic Co.Document1 page01 Bayla V Silang Traffic Co.khayis_belsNo ratings yet

- Government of Philippine Islands vs. El Hogar FilipinoDocument3 pagesGovernment of Philippine Islands vs. El Hogar FilipinoCharmila SiplonNo ratings yet

- 13 - Marvel Building Corporation Et Al Vs David Case DigestDocument2 pages13 - Marvel Building Corporation Et Al Vs David Case DigestMarjorie Porcina100% (2)

- Ponce Vs EncarnacionDocument1 pagePonce Vs EncarnacionLiaa AquinoNo ratings yet

- Cagayan Fishing v. SandikoDocument1 pageCagayan Fishing v. Sandikomkab100% (1)

- Corpo - Telephone Engineering v. WCC Case DigestDocument2 pagesCorpo - Telephone Engineering v. WCC Case DigestPerkyme100% (1)

- Pirovano V Dela RamaDocument2 pagesPirovano V Dela RamaPio Guieb AguilarNo ratings yet

- 02) Evangelista V SantosDocument2 pages02) Evangelista V SantosAlfonso Miguel Lopez100% (1)

- PADGETT vs. BABCOCKDocument1 pagePADGETT vs. BABCOCKRuth TenajerosNo ratings yet

- 210 Chua Guan v. SamahanDocument2 pages210 Chua Guan v. SamahanFranch Galanza100% (1)

- Velasco V Poizat (Gaspar)Document2 pagesVelasco V Poizat (Gaspar)Maria Angela GasparNo ratings yet

- Grace Christian High School Vs CADocument1 pageGrace Christian High School Vs CAIan Jala Calmares0% (1)

- Pirovano Et Al Vs The de La Rama SteamshipDocument3 pagesPirovano Et Al Vs The de La Rama SteamshipCJ50% (2)

- 213 de Los Santos v. McGrathDocument2 pages213 de Los Santos v. McGrathPatricia Kaye O. SevillaNo ratings yet

- 178 Lingayen Gulf Electric Power, Inc. v. Baltazar (Castro)Document2 pages178 Lingayen Gulf Electric Power, Inc. v. Baltazar (Castro)ASGarcia24100% (1)

- Halley vs. Printwell Inc.Document3 pagesHalley vs. Printwell Inc.Kadey KneyNo ratings yet

- Lions Clubs International Vs AmoresDocument7 pagesLions Clubs International Vs Amoresalbemart0% (1)

- Hall Vs PiccioDocument1 pageHall Vs PiccioLindsay MillsNo ratings yet

- CIR Vs Club Filipino DigestDocument2 pagesCIR Vs Club Filipino DigestJC100% (2)

- Daisy Lopez Realty Vs FontechaDocument1 pageDaisy Lopez Realty Vs FontechaAllenNo ratings yet

- Corpo Powers: Power To Deny Pre-Emptive Rights Datu V SecDocument9 pagesCorpo Powers: Power To Deny Pre-Emptive Rights Datu V SecGabe BedanaNo ratings yet

- 01 David Vs ArroyoDocument1 page01 David Vs ArroyoapbueraNo ratings yet

- Sample Deed of Sale House and Lot OneDocument3 pagesSample Deed of Sale House and Lot Oneapbuera72% (46)

- 03 People Vs Chua Ho SanDocument1 page03 People Vs Chua Ho SanapbueraNo ratings yet

- 02 Malaloan Vs CADocument2 pages02 Malaloan Vs CAPB AlyNo ratings yet

- Complaint Affidavit - Economic AbuseDocument3 pagesComplaint Affidavit - Economic Abuseapbuera80% (5)

- Sample Complaint For EjectmentDocument5 pagesSample Complaint For Ejectmentapbuera100% (1)

- Legmed DigestsDocument4 pagesLegmed DigestsapbueraNo ratings yet

- Petition For Review Under Rule 42Document10 pagesPetition For Review Under Rule 42apbuera100% (3)

- Data Privacy ActDocument14 pagesData Privacy ActapbueraNo ratings yet

- China Airlines v. Intermediate Appellate CourtDocument399 pagesChina Airlines v. Intermediate Appellate CourtapbueraNo ratings yet

- Sample Affidavit of LossDocument2 pagesSample Affidavit of LossapbueraNo ratings yet

- Brix Deed of SaleDocument3 pagesBrix Deed of SaleapbueraNo ratings yet

- Republic v. SB, G.R. No. 152154, July 15, 2003Document58 pagesRepublic v. SB, G.R. No. 152154, July 15, 2003Reginald Dwight FloridoNo ratings yet

- Belo v. Guevara PDFDocument13 pagesBelo v. Guevara PDFapbueraNo ratings yet

- Yu V Yu (2016)Document2 pagesYu V Yu (2016)apbuera100% (1)

- Vitangcol V PeopleDocument1 pageVitangcol V Peopleapbuera100% (1)

- Hyatt Elevators V GoldstarDocument1 pageHyatt Elevators V GoldstarapbueraNo ratings yet

- Brix Deed of SaleDocument3 pagesBrix Deed of SaleapbueraNo ratings yet

- Cosare V BroadcomDocument2 pagesCosare V BroadcomapbueraNo ratings yet

- Siochi Fishery Inc. V BPIDocument2 pagesSiochi Fishery Inc. V BPIapbuera50% (2)

- Borja-Manzano V SanchezDocument3 pagesBorja-Manzano V SanchezapbueraNo ratings yet

- Teves V CADocument5 pagesTeves V CAapbueraNo ratings yet

- Jones V HortiguelaDocument2 pagesJones V Hortiguelaapbuera100% (2)

- Cua Lai Chu Vs LaquiDocument1 pageCua Lai Chu Vs LaquiapbueraNo ratings yet

- Professional Services Inc v. AganaDocument2 pagesProfessional Services Inc v. AganaapbueraNo ratings yet

- Donato v. LunaDocument3 pagesDonato v. LunaapbueraNo ratings yet

- Villamaria v. Court of AppealsDocument2 pagesVillamaria v. Court of Appealsapbuera100% (1)

- Batangas CATV V Court of AppealsDocument2 pagesBatangas CATV V Court of Appealsapbuera67% (3)

- Anuran V BunoDocument1 pageAnuran V BunoapbueraNo ratings yet

- Velayo V ShellDocument1 pageVelayo V ShellapbueraNo ratings yet

- TCDCLPPTDocument5 pagesTCDCLPPTAbhijeet PatilNo ratings yet

- Oracle Fixed Asset RetirementsDocument31 pagesOracle Fixed Asset RetirementsPeter MakramNo ratings yet

- The Strategy of International BusinessDocument68 pagesThe Strategy of International BusinessPrachi RajanNo ratings yet

- Breakeven AnalysisDocument15 pagesBreakeven AnalysisdrajingoNo ratings yet

- Ratio Analysis of HR TextilesDocument26 pagesRatio Analysis of HR TextilesOptimistic Eye100% (1)

- Bachelor'S Graduation Thethisthesis: National Economics University Centre For Advanced Educational ProgramsDocument64 pagesBachelor'S Graduation Thethisthesis: National Economics University Centre For Advanced Educational ProgramsHà Anh NguyễnNo ratings yet

- MCQ's TreasureDocument144 pagesMCQ's TreasureAmmad HassanNo ratings yet

- College Algebra FinalsDocument5 pagesCollege Algebra FinalsLucille Gacutan AramburoNo ratings yet

- Annual Report Merk-2018Document59 pagesAnnual Report Merk-2018Lisya Kimmiko100% (2)

- Financial Market, Institutions and Services: Submitted To: Prof. Vinay DuttaDocument6 pagesFinancial Market, Institutions and Services: Submitted To: Prof. Vinay DuttaGautamNo ratings yet

- Atlas Honda Annual Report 2018Document130 pagesAtlas Honda Annual Report 2018muhammad ihtishamNo ratings yet

- SWOTDocument4 pagesSWOTKatlene HortilanoNo ratings yet

- Chapter 03 The Income Statement: Answer KeyDocument147 pagesChapter 03 The Income Statement: Answer KeymohammedNo ratings yet

- Intrinsic Valuation - Aswath Damodaran PDFDocument19 pagesIntrinsic Valuation - Aswath Damodaran PDFramsiva354No ratings yet

- NHPC Application Form DetailsTNC PDFDocument47 pagesNHPC Application Form DetailsTNC PDFHariprasad ManchiNo ratings yet

- Sbi 1Document1,104 pagesSbi 1Reedos LucknowNo ratings yet

- IB Assignment (20%)Document1 pageIB Assignment (20%)Vasundhara ChaturvediNo ratings yet

- Chapter 15, Modern Advanced Accounting-Review Q & ExrDocument16 pagesChapter 15, Modern Advanced Accounting-Review Q & Exrrlg4814100% (2)

- Measuring TheDocument20 pagesMeasuring Thedr_hsn57No ratings yet

- 36.) Carol Mathis Sworn Witness StatementDocument9 pages36.) Carol Mathis Sworn Witness StatementFailure of Royal Bank of Scotland (RBS) Risk ManagementNo ratings yet

- Public-Private Partnerships What It Is and What It Is NotDocument3 pagesPublic-Private Partnerships What It Is and What It Is Notconrad bognotNo ratings yet

- EM Final Project EntrepreneurshipDocument15 pagesEM Final Project EntrepreneurshipareebNo ratings yet

- Process Mapping Toolkit SummaryDocument2 pagesProcess Mapping Toolkit SummaryНебојша БабовићNo ratings yet

- Sadafco PartDocument6 pagesSadafco PartQusai BassamNo ratings yet

- Insurance OperationsDocument5 pagesInsurance OperationssimplyrochNo ratings yet

- Advancements in BankingDocument16 pagesAdvancements in BankingGaneshan ParamathmaNo ratings yet

- Mann V Hulme 106 CLR 136Document6 pagesMann V Hulme 106 CLR 136David LimNo ratings yet

- Q4 2011 Earnings Call Company Participants: OperatorDocument15 pagesQ4 2011 Earnings Call Company Participants: Operatorfrontier11No ratings yet

- GEDocument7 pagesGESheetal IyerNo ratings yet

- International Financial MarketsDocument13 pagesInternational Financial Marketsmanojpatel5150% (4)