Professional Documents

Culture Documents

Edmonton Property Value Assessments 2016

Uploaded by

Anonymous QRCBjQd5I7Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Edmonton Property Value Assessments 2016

Uploaded by

Anonymous QRCBjQd5I7Copyright:

Available Formats

BACKGROUNDER

Edmonton2016PropertyAssessmentNotices

HowmanypropertiesdidtheCityassess?

TheCityofEdmontonassessed376,560properties:

352,567residentialproperties

23,993nonresidentialproperties(includesapartmentbuildings)

Whydidtheassessedvaluesofsinglefamily,detachedhomesincrease?

Between2014and2015,EdmontonslabourmarketoutperformedCanadasaverageduetostronggainsin

employmentandincomes,whichledtopositivelevelsofnetinmigration.Thisgoodeconomicfoundationtogether

withlowmortgageratessupporteddemandforhousinginEdmonton,whichresultedinanincreaseinmarketvalues

acrossmostpropertytypes.

TheEdmontonRealEstateBoard(EREB)andtheCanadaMortgageandHousingCorporation(CMHC)tracklocal

realestatemarketconditions.TheEREBreportedthatthepriceofanexistingsinglefamilyhomeincreased2.4%

betweenJuly2014andJuly2015,whiletheCMHCreportedanincreaseof2.9%foranewsinglefamilyhome.

WhatisthetotalassessedvalueofallpropertiesinEdmonton?

ThevalueofalltaxableassessedpropertiesinEdmontonnowstandsat$172.3billion

$115.6billionforresidential

propertiesand$56.7billionfornonresidentialpropertiesandapartmentbuildings

anincreaseof4.2%overallwhen

comparedto2015.

Whatistheassessmentchangebypropertytype?

Singlefamilyhomes

Condos,townhouses

Apartmentbuildings

Commercial/Industrial

+1.7%

+4.8%

+9.0%

+0.7%

Whatistheassessmentchangeinthelastfiveyears?

Thefiveyearannualchangeinmedianpropertyassessmentfortypical

singlefamily,detachedhomes

inEdmonton

is+2.2%:

2016

2015

2014

2013

2012

+1.7

+7.1%

+2.5%

+1.3%

1.7%

WhichneigbourhoodswithintheCityexperiencedthelargestchangesinassessed

values?

Dependingonsalesandthephysicalstateofrealestate,notallpropertiesandneighbourhoodsreflecttheaverage

changeinassessedvaluesfromyeartoyear.However,overalongerperiodoftime(forexample,fiveyears)trends

havedemonstratedthatallneighbourhoodschangeinvaluebyapproximatelythesameamount.

Thefivecommunitiesinwhichtheaverageassessed

valueforsinglefamilyhomes

increasedthemost

Asof

Fiveyear

July1,2015

averagechange

Thefivecommunitiesinwhichtheaverageassessed

valueforsinglefamilyhomes

decreasedthemost

Asof

July1,2015

Fiveyear

averagechange

Homesteader

5.4%

2.4%

Athlone

6.8%

1.3%

Lynnwood

4.6%

2.0%

Kensington

6.4%

1.1%

McConachieArea

4.4%

3.8%

Edgemont

6.3%

N/A

TerraceHeights

4.4%

2.5%

QueenMaryPark

6.0%

2.3%

Chambery

4.2%

3.1%

Killarney

6.0%

1.0%

Thedetailedbreakdownonaverageassessmentvaluesisavailablethroughthe

AssessmentChangereports

.

Howdochangesinpropertyassessmentsaffectpropertytaxes?

TheCityusesassessedvaluesofpropertiestocalculatetheamountof

municipal

and

provincialeducation

propertytaxespropertyownerspayinproportiontothevalueoftherealestatetheyown.Achangeinassessed

valuesaffectspropertytaxesinthefollowingmanner:

BACKGROUNDER

Averageassessedvalueincrease=averagemunicipaltaxincrease

Ifthepropertysassessedvalueincreaseissimilartotheaverage,citywideassessedvalueincrease,the

propertyownerwillseeataxincreasethatissimilartotheaveragemunicipaltaxincrease.

Higherthanaverageassessedvaluechange=higherthanaveragemunicipaltax

increase

Ifthepropertysassessedvalueincreasedbymorethantheaverage

assessedvalueincrease,theproperty

ownerwillseeagreaterthantheaveragemunicipaltaxincrease.

Lowerthanaverageassessedvaluechange=lowerthanaveragemunicipaltaxincrease

Ifthepropertysassessedvalueincreasedbylessthantheaverageassessedvalueincrease,thepropertyowner

willseeataxincreasethatislessthantheaveragemunicipaltaxincrease.

Tolearnmoreaboutthepropertyassessmentprocess,watchour

videos

.

Whatwilltheimpactbeonatypicalhomeowner?

TheCitysbudget,passedinDecember2015,callsfora3.4%increase.

Thismeansthatthehomeownerofatypical$408,000homewillpayapproximately$2,339inmunicipalproperty

taxes$77moreperyearor$6.42morepermonth.

ThefinaltaxratewillbesetinMaywhenthemunicipalbudgetisconfirmedandtheGovernmentofAlberta

establishesitsbudgettofundtheprovincialeducationsystem.

Whatcanpropertyownersdoiftheydonotagreewiththe2016assessedvalueoftheir

property?

Onlineresources

Propertyspecificassessmentdetails

TheCitys

securesiteforpropertyowners

givespropertyownersaccesstoreportsonphysical

characteristicsandassessmentdetailsoftheirpropertiesandsalesinformationofpropertiessimilarto

theirs.

Maps

TheCitys

maps

helpreviewbasicassessmentinformationaboutEdmontonpropertiesandseewhat

municipalfacilitiesandservicesareavailablewithinvariousneighbourhoods.

Oneononesupport

Ifpropertyownershavecomeacrossanerrorintheirpropertiesassessments,theyshouldcontacttheCity

first.Mostassessmentrelatedconcernscanberesolvedbyspeakingwitha311agentorassessorwithno

formalcomplaintfeesrequired.

Call:

311

Email:

assessment@edmonton.ca

Formalcomplaint

Ifpropertyownersdisagreewiththeirproperty'sassessment,theycanfileaformalcomplaintwith

the

AssessmentReviewBoard

nolaterthanMarch11,2016.

Whenwillthe2016propertytaxnoticesbemailed?

TheCityofEdmontonwillmakefinalpropertytaxcalculationsinthespringof2016,aftertheGovernmentofAlberta

establishesitsbudgettofundtheprovincialeducationsystem.

TaxnoticeswillbemailedinMay2016withadeadlineforpaymentofJune30,2016.

You might also like

- RSBSA Enrollment Form SummaryDocument2 pagesRSBSA Enrollment Form Summaryanon_28428654175% (133)

- Civil Procedure Doctrines UPDATEDDocument64 pagesCivil Procedure Doctrines UPDATEDJose RocoNo ratings yet

- P290037 TAHSIN M A Osmani UWEBIC Offer Letter PDFDocument5 pagesP290037 TAHSIN M A Osmani UWEBIC Offer Letter PDFM A Osmani TahsinNo ratings yet

- Crisostomo Vs CA Transpo DigestDocument2 pagesCrisostomo Vs CA Transpo DigestAlvin ClaridadesNo ratings yet

- Edmonton Home Values, July 2015Document2 pagesEdmonton Home Values, July 2015Edmonton SunNo ratings yet

- 4th Quarter 2014Document29 pages4th Quarter 2014api-130707342No ratings yet

- Home Economic Report Oct 21Document2 pagesHome Economic Report Oct 21Adam WahedNo ratings yet

- REBGV Stats Package, August 2013Document9 pagesREBGV Stats Package, August 2013Victor SongNo ratings yet

- PropertyDocument5 pagesPropertyapi-437469743No ratings yet

- Housing Prices in First Quarter Rise in Active Local Market: News ReleaseDocument2 pagesHousing Prices in First Quarter Rise in Active Local Market: News ReleaseTed BauerNo ratings yet

- Housing Affordability in England and Wales 2018Document18 pagesHousing Affordability in England and Wales 2018JilShethNo ratings yet

- Types of Real EstateDocument26 pagesTypes of Real Estateገብረእግዚአብሔር አንተነህNo ratings yet

- Affordability ChartDocument1 pageAffordability ChartThe Vancouver SunNo ratings yet

- REBGV December 2015 Stats PackageDocument9 pagesREBGV December 2015 Stats PackageVancouver Real Estate PodcastNo ratings yet

- Macro EconomicsDocument63 pagesMacro EconomicsShimpi BeraNo ratings yet

- VREB News Release - Victoria March 2014 Real Estate UpdateDocument28 pagesVREB News Release - Victoria March 2014 Real Estate UpdateDane KingsburyNo ratings yet

- Statsmls April2012Document2 pagesStatsmls April2012Allison LampertNo ratings yet

- Victoria Real Estate Newsletter - Winter 2015Document2 pagesVictoria Real Estate Newsletter - Winter 2015Kevin WhiteNo ratings yet

- Macro GDP Le Thi Quynh AnhDocument9 pagesMacro GDP Le Thi Quynh AnhQuỳnh Anh Lê TNo ratings yet

- Housing and The Economy: AUTUMN 2013Document16 pagesHousing and The Economy: AUTUMN 2013faidras2No ratings yet

- Vietnam's Growing Economy and Housing MarketDocument23 pagesVietnam's Growing Economy and Housing Marketdainghia12a1No ratings yet

- Economic HistoryDocument19 pagesEconomic Historyapi-270419375No ratings yet

- REBGV Stats Package November 2014 Mike Stewart Vancouver RealtorDocument9 pagesREBGV Stats Package November 2014 Mike Stewart Vancouver RealtorMike StewartNo ratings yet

- REBGV Stats Package December 2014Document9 pagesREBGV Stats Package December 2014Vancouver Real Estate PodcastNo ratings yet

- RlepageDocument2 pagesRlepageSteve LadurantayeNo ratings yet

- 2016 01 January Stats PackageDocument9 pages2016 01 January Stats PackageEthan HekimNo ratings yet

- Seattle Property Tax BreakdownDocument13 pagesSeattle Property Tax BreakdownWestSeattleBlog0% (1)

- Development 170601075504Document19 pagesDevelopment 170601075504Ashish RockyNo ratings yet

- Macroeconomics: Biswa Swarup MisraDocument30 pagesMacroeconomics: Biswa Swarup MisraAbhijeet DashNo ratings yet

- UK HousingDocument19 pagesUK HousingAziza MaharNo ratings yet

- Topic 1(2)Document73 pagesTopic 1(2)75ndy5b4jsNo ratings yet

- Analysis Price of Houses in ArubaDocument21 pagesAnalysis Price of Houses in ArubaBryan SaenzNo ratings yet

- Caso 2-MACRODocument13 pagesCaso 2-MACROYudy TrianaNo ratings yet

- 2123 ch01ch02Document41 pages2123 ch01ch02Minda TinNo ratings yet

- Victoria Market Shows Modest GainsDocument2 pagesVictoria Market Shows Modest GainsKevin WhiteNo ratings yet

- Working Paper: Central Bank of IcelandDocument29 pagesWorking Paper: Central Bank of IcelandBrickaaaNo ratings yet

- 09 11 10 Final PoP ReleaseDocument2 pages09 11 10 Final PoP Releaseapi-26178658No ratings yet

- Submisssion AurumDocument5 pagesSubmisssion AurumSuper FreakNo ratings yet

- Macro-Magnitudes Inflation and Unemployment: External SectorDocument33 pagesMacro-Magnitudes Inflation and Unemployment: External SectorJuan Carlos Zarco GalindoNo ratings yet

- Homebuyer Confidence Creates Record Real Estate Results: News ReleaseDocument2 pagesHomebuyer Confidence Creates Record Real Estate Results: News Releaseapi-14890938No ratings yet

- The Macroeconomics of Open EconomiesDocument25 pagesThe Macroeconomics of Open EconomiesOmar Bani KhalefNo ratings yet

- Chapter Two: The Development Gap and The Measurement of PovertyDocument28 pagesChapter Two: The Development Gap and The Measurement of PovertyWalid Mohamed AnwarNo ratings yet

- Ch1 MacroDocument28 pagesCh1 MacroMd. Mohiuddin RownakNo ratings yet

- East Haven Apartments PresentationDocument5 pagesEast Haven Apartments PresentationDillon DavisNo ratings yet

- 2022 Cost of Living Report (Portland Business Alliance)Document4 pages2022 Cost of Living Report (Portland Business Alliance)KGW NewsNo ratings yet

- GDP Explained: What is GDP and How is it CalculatedDocument13 pagesGDP Explained: What is GDP and How is it CalculatedNine ToNo ratings yet

- Lecture 2 (ED)Document21 pagesLecture 2 (ED)Nouran EssamNo ratings yet

- Informative Real Estate Trends in Maricopa County 4-25-10Document1 pageInformative Real Estate Trends in Maricopa County 4-25-10bryanwatkinsNo ratings yet

- Australian Housing Chartbook July 2012Document13 pagesAustralian Housing Chartbook July 2012scribdooNo ratings yet

- Vancouver HousingDocument2 pagesVancouver Housingshuvo devNo ratings yet

- ECO 2: Comparative Economic Development IndicatorsDocument19 pagesECO 2: Comparative Economic Development IndicatorsMarjon DimafilisNo ratings yet

- Housing Market Outlook 3rd Q 2013Document33 pagesHousing Market Outlook 3rd Q 2013David PylypNo ratings yet

- Chapter 12 Gross Domestic Product and GrowthDocument75 pagesChapter 12 Gross Domestic Product and Growthapi-307444798No ratings yet

- By: Yuanyuan Gu Jhorland Ayala-García No. 312 July, 2022: Emigration and Tax RevenueDocument23 pagesBy: Yuanyuan Gu Jhorland Ayala-García No. 312 July, 2022: Emigration and Tax RevenueJuan ZGNo ratings yet

- OREA 2011 Election SurveyDocument11 pagesOREA 2011 Election SurveyMatthew ThorntonNo ratings yet

- Macroeconomics Canadian 5th Edition Mankiw Solutions ManualDocument25 pagesMacroeconomics Canadian 5th Edition Mankiw Solutions ManualMrJosephCruzMDfojy100% (51)

- August 2011 REBGV Statistics PackageDocument7 pagesAugust 2011 REBGV Statistics PackageMike StewartNo ratings yet

- 32a) National IncomeDocument2 pages32a) National IncomecastroxfourNo ratings yet

- Week08 Open EconomyDocument49 pagesWeek08 Open Economyinayah ulfahNo ratings yet

- Real and Nominal GDP: Macroeconomics: Lecture 2Document11 pagesReal and Nominal GDP: Macroeconomics: Lecture 2АдамNo ratings yet

- MacroEconomics GDP ConceptsDocument14 pagesMacroEconomics GDP Conceptssaif ur rehmanNo ratings yet

- Summary Of "The Economic System" By Armando Fastman: UNIVERSITY SUMMARIESFrom EverandSummary Of "The Economic System" By Armando Fastman: UNIVERSITY SUMMARIESNo ratings yet

- Alberta Health Services - Tuberculosis Fact SheetDocument1 pageAlberta Health Services - Tuberculosis Fact SheetAnonymous QRCBjQd5I7No ratings yet

- One Energy Boom, Two Approaches: Fiscal Restraint Has Left Texas in Better Shape Than AlbertaDocument34 pagesOne Energy Boom, Two Approaches: Fiscal Restraint Has Left Texas in Better Shape Than AlbertaAnonymous QRCBjQd5I7No ratings yet

- 12-12-Victim Impact Statements PDFDocument15 pages12-12-Victim Impact Statements PDFAnonymous QRCBjQd5I7No ratings yet

- Notice CPC Relocation 2018Document2 pagesNotice CPC Relocation 2018Anonymous QRCBjQd5I7No ratings yet

- BABY DAWN: Bed-Sharing With Infants in Foster CareDocument24 pagesBABY DAWN: Bed-Sharing With Infants in Foster CareAnonymous QRCBjQd5I7No ratings yet

- NorQuest Annual Report 2015-2016 Section 4Document2 pagesNorQuest Annual Report 2015-2016 Section 4Anonymous QRCBjQd5I7No ratings yet

- Alberta's Response To OCYA Report On Baby DawnDocument3 pagesAlberta's Response To OCYA Report On Baby DawnAnonymous QRCBjQd5I7No ratings yet

- Presentation - The Somali Experience in AlbertaDocument29 pagesPresentation - The Somali Experience in AlbertaAnonymous QRCBjQd5I7No ratings yet

- Appeal From The Acquittal by The Honourable Judge Savaryn On The 22nd Day of April, 2016Document7 pagesAppeal From The Acquittal by The Honourable Judge Savaryn On The 22nd Day of April, 2016Anonymous QRCBjQd5I7No ratings yet

- Winter Street Sand Recycling and Mixing Program AuditDocument2 pagesWinter Street Sand Recycling and Mixing Program AuditAnonymous QRCBjQd5I7No ratings yet

- Report - The Somali Experience in AlbertaDocument36 pagesReport - The Somali Experience in AlbertaAnonymous QRCBjQd5I7No ratings yet

- Justice Thomas' Reasons For Judgement: Travis VaderDocument66 pagesJustice Thomas' Reasons For Judgement: Travis VaderAnonymous QRCBjQd5I7No ratings yet

- Sacramental Practice in Situations of EuthanasiaDocument34 pagesSacramental Practice in Situations of EuthanasiaAnonymous QRCBjQd5I7No ratings yet

- 09 29 Sandaudit2 PDFDocument33 pages09 29 Sandaudit2 PDFAnonymous QRCBjQd5I7No ratings yet

- FAQ: Installing TELUS PureFibre To Your HomeDocument2 pagesFAQ: Installing TELUS PureFibre To Your HomeAnonymous QRCBjQd5I7No ratings yet

- Wildfire Evacuee Transitional Accommodation BenefitDocument2 pagesWildfire Evacuee Transitional Accommodation BenefitAnonymous QRCBjQd5I7No ratings yet

- 2016 Alberta Report Card Full ReportDocument114 pages2016 Alberta Report Card Full ReportAnonymous QRCBjQd5I7No ratings yet

- Letter From Minister of EducationDocument1 pageLetter From Minister of EducationAnonymous QRCBjQd5I7No ratings yet

- Minor Hockey Injuries in AlbertaDocument9 pagesMinor Hockey Injuries in AlbertaAnonymous QRCBjQd5I7No ratings yet

- Letter From Education Deputy MinisterDocument2 pagesLetter From Education Deputy MinisterAnonymous QRCBjQd5I7No ratings yet

- Edmonton Catholic School Board Governance Oversight Observer's Report - DraftDocument16 pagesEdmonton Catholic School Board Governance Oversight Observer's Report - DraftAnonymous QRCBjQd5I7No ratings yet

- Alberta Map of 2016-2019 ProjectsDocument1 pageAlberta Map of 2016-2019 ProjectsAnonymous QRCBjQd5I7No ratings yet

- College of Naturopathic Doctors of Alberta LetterDocument3 pagesCollege of Naturopathic Doctors of Alberta LetterAnonymous QRCBjQd5I70% (1)

- Fatality Report - CardinalDocument6 pagesFatality Report - CardinalAnonymous QRCBjQd5I7No ratings yet

- Estimated Wildfire Perimeter Based On Aerial AssessmentDocument1 pageEstimated Wildfire Perimeter Based On Aerial AssessmentAnonymous QRCBjQd5I7No ratings yet

- MD of Greenview Fire Evac ZoneDocument1 pageMD of Greenview Fire Evac ZoneAnonymous QRCBjQd5I7No ratings yet

- DR Michelle Cohen Receipt of ComplaintDocument1 pageDR Michelle Cohen Receipt of ComplaintAnonymous QRCBjQd5I7No ratings yet

- Alberta Highway and Flood Projects 2016-2019Document37 pagesAlberta Highway and Flood Projects 2016-2019Anonymous QRCBjQd5I7No ratings yet

- Hockey Edmonton Body-Checking DecisionDocument5 pagesHockey Edmonton Body-Checking DecisionAnonymous QRCBjQd5I7No ratings yet

- Red Deer Community Standards BylawDocument16 pagesRed Deer Community Standards BylawAnonymous QRCBjQd5I7No ratings yet

- Instant Download Smith and Robersons Business Law 15th Edition Mann Solutions Manual PDF Full ChapterDocument32 pagesInstant Download Smith and Robersons Business Law 15th Edition Mann Solutions Manual PDF Full Chapterrappelpotherueo100% (7)

- Gramsci Hegemony Separation PowersDocument2 pagesGramsci Hegemony Separation PowersPrem VijayanNo ratings yet

- Laws and Found: Phil Refining V, NG Sam DigestDocument3 pagesLaws and Found: Phil Refining V, NG Sam DigestSilver Anthony Juarez PatocNo ratings yet

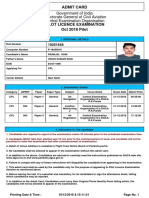

- Government of India Directorate General of Civil Aviation Central Examination OrganisationDocument1 pageGovernment of India Directorate General of Civil Aviation Central Examination OrganisationsubharansuNo ratings yet

- ULAB Midterm Exam Business Communication CourseDocument5 pagesULAB Midterm Exam Business Communication CourseKh SwononNo ratings yet

- International Instruments Relating To Intellectual Property RightsDocument11 pagesInternational Instruments Relating To Intellectual Property Rightsशैल अनुकृति100% (4)

- CH08 PDFDocument25 pagesCH08 PDFpestaNo ratings yet

- Heirs of Malabanan Vs RepublicDocument9 pagesHeirs of Malabanan Vs RepublicAnisah AquilaNo ratings yet

- Awe SampleDocument12 pagesAwe SamplerichmondNo ratings yet

- Investment Declaration Format FY 2022-23Document3 pagesInvestment Declaration Format FY 2022-23Divya WaghmareNo ratings yet

- OpenSAP Signavio1 Week 1 Unit 1 Intro PresentationDocument8 pagesOpenSAP Signavio1 Week 1 Unit 1 Intro PresentationMoyin OluwaNo ratings yet

- Chinese in The PHDocument15 pagesChinese in The PHMandalihan GepersonNo ratings yet

- Forticlient Ems 7.2.0 Release NotesDocument25 pagesForticlient Ems 7.2.0 Release NotesHalil DemirNo ratings yet

- Affordable CountriesDocument16 pagesAffordable CountriesjemalNo ratings yet

- E-Ticket: Travel InformationDocument2 pagesE-Ticket: Travel InformationAli BajwaNo ratings yet

- Human Rights Victim's Claim Application Form and FAQsDocument23 pagesHuman Rights Victim's Claim Application Form and FAQsTon RiveraNo ratings yet

- Politics by Other Means, Conflicting Interests in Libya's Security SectorDocument102 pagesPolitics by Other Means, Conflicting Interests in Libya's Security SectorNaeem GherianyNo ratings yet

- Court Martial of Capt Poonam KaurDocument4 pagesCourt Martial of Capt Poonam Kaurguardianfoundation100% (2)

- Newton's Second Law - RevisitedDocument18 pagesNewton's Second Law - RevisitedRob DicksonNo ratings yet

- TDS-466 Chembetaine CGFDocument1 pageTDS-466 Chembetaine CGFFabianoNo ratings yet

- Cdi 2Document3 pagesCdi 2Mark Joseph Berbanio PacaritNo ratings yet

- Disclosure To Promote The Right To Information: IS 5290 (1993) : Specification For Landing Valves (CED 22: Fire Fighting)Document20 pagesDisclosure To Promote The Right To Information: IS 5290 (1993) : Specification For Landing Valves (CED 22: Fire Fighting)Tanmoy Dutta100% (1)

- Purisima Vs Phil TobaccoDocument4 pagesPurisima Vs Phil TobaccoJohnde Martinez100% (1)

- Design and Implementation of Linux Firewall PoliciesDocument11 pagesDesign and Implementation of Linux Firewall PoliciesUjjwal pandeyNo ratings yet

- Machined Components: S E C T I O N 4Document10 pagesMachined Components: S E C T I O N 4solquihaNo ratings yet

- FINANCIAL - MANAGEMENT Solution BookDocument170 pagesFINANCIAL - MANAGEMENT Solution BookWajahat SadiqNo ratings yet