Professional Documents

Culture Documents

Liquid Chemical

Uploaded by

Henil Dudhia0 ratings0% found this document useful (0 votes)

556 views5 pagessolution for liquid chemical case

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsolution for liquid chemical case

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

556 views5 pagesLiquid Chemical

Uploaded by

Henil Dudhiasolution for liquid chemical case

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

Liquid Chemical

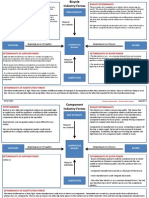

In the given case Liquid Chemical Company manufactures and sells a

range of high-grade products. Many of these products require careful

packaging. The company has a special patented lining made that it uses

in specially designed packing containers. Mr. Walsh the general

manager was carefully looking at the problem and as a matter of solution

he came up with the four alternatives:

* Alternative A: It is the status quo. (i.e., Liquid Chemical Co. will

continue making the containers and performing maintenance.)

* Alternative B: Liquid Chemical Co. will continue making the containers,

but it will outsource the maintenance to Packages, Inc.

* Alternative C: Liquid Chemical Co. will buy containers from Packages,

Inc., but it will perform the maintenance.

* Alternative D: It is completely outsourced. Packages, Inc. will make the

containers and provide the necessary maintenance.

The analysis of each of the four alternatives is given below in terms of

the NPV:

Option A |

Year | 1 | 2 | 3 | 4 | 5 |

Cost of GHL net of tax savings | | | | | -144000 |

Purchase of other materials | -500000 | -500000 | -500000 | -500000 |

-500000 |

Supervisor | -50000 | -50000 | -50000 | -50000 | -50000 |

Worker | -450000 | -450000 | -450000 | -450000 | -450000 |

Rent of warehouse | -85000 | -85000 | -85000 | -85000 | -85000 |

Maintenance | -36000 | -36000 | -36000 | -36000 | -36000 |

Other Expense | -157500 | -157500 | -157500 | -157500 | -157500 |

managers Salaries | -80000 | -80000 | -80000 | -80000 | -80000 |

Total Costs | -1358500 | -1358500 | -1358500 | -1358500 | -1358500 |

Tax Savings | 543400 | 543400 | 543400 | 543400 | 543400 |

Cash Flow Due to Costs | -815100 | -815100 | -815100 | -815100 |

-815100 |

Tax Effects of Depreciation | 60000 | 60000 | 60000 | 60000 | |

Tax Effect of GHL | 80000 | 80000 | 80000 | 80000 | |

Total Cash Flow | -675100 | -675100 | -675100 | -675100 | -959100 |

PVIF @ 10% | 0.909091 | 0.826446 | 0.751315 | 0.683013 | 0.620921 |

Present Value | -613727 | -557934 | -507213 | -461102 | -595526 |

Total Cash Outlay | -2735502 |

Option B |

Year | 1 | 2 | 3 | 4 | 5 |

Cost of GHL net of tax savings | | | | | -72000 |

Purchase of other materials | -450000 | -450000 | -450000 | -450000 |

-450000 |

Supervisor | -50000 | -50000 | -50000 | -50000 | -50000 |

Worker | -360000 | -360000 | -360000 | -360000 | -360000 |

Rent of warehouse | -85000 | -85000 | -85000 | -85000 | -85000 |

Maintenance | -36000 | -36000 | -36000 | -36000 | -36000 |

Other Expense | -92500 | -92500 | -92500 | -92500 | -92500 |

managers Salaries | -80000 | -80000 | -80000 | -80000 | -80000 |

Maintenance Contract | -375000 | -375000 | -375000 | -375000 | -375000

|

Total Costs | -1528500 | -1528500 | -1528500 | -1528500 | -1528500 |

Tax Savings | 611400 | 611400 | 611400 | 611400 | 611400 |

Cash Flow Due to Costs | -917100 | -917100 | -917100 | -917100 |

-917100 |

Tax Effects of Depreciation | 32000 | 60000 | 60000 | 60000 | |

Tax Effect of GHL | 80000 | 80000 | 80000 | 80000 | |

Total Cash Flow | -805100 | -777100 | -777100 | -777100 | -989100 |

PVIF @ 10% | 0.909091 | 0.826446 | 0.751315 | 0.683013 | 0.620921 |

Present Value | -731909 | -642231 | -583847 | -530770 | -614153 |

Total Cash Outlay | -3102910 |

Option C |

Year | 1 | 2 | 3 | 4 | 5 |

Cost of GHL net of tax savings | | | | | |

Purchase of other materials | -450000 | -450000 | -450000 | -450000 |

-450000 |

Supervisor | -50000 | -50000 | -50000 | -50000 | -50000 |

Worker | -30000 | -30000 | -30000 | -30000 | -30000 |

Rent of warehouse | 0 | 0 | 0 | 0 | 0 |

Maintenance | -36000 | -36000 | -36000 | -36000 | -36000 |

Other Expense | -65000 | -65000 | -65000 | -65000 | -65000 |

managers Salaries | 0 | 0 | 0 | 0 | 0 |

Sub contracting Fees | -1250000 | -1250000 | -1250000 | -1250000 |

-1250000 |

Total Costs | -1881000 | -631000 | -631000 | -631000 | -631000 |

Tax Savings | 752400 | 252400 | 252400 | 252400 | 252400 |

Cash Flow Due to Costs | -1128600 | -378600 | -378600 | -378600 |

-378600 |

Total Cash Flow | -1128600 | -378600 | -378600 | -378600 | -378600 |

PVIF @ 10% | 0.909091 | 0.826446 | 0.751315 | 0.683013 | 0.620921 |

Present Value | -1026000 | -312893 | -284448 | -258589 | -235081 |

Total Cash Outlay | -2117010 |

Less: Initial Inflow | 28000 |

Net Cash Outlay | -2089010 |

Option D |

Year | 1 | 2 | 3 | 4 | 5 |

Cost of GHL net of tax savings | | | | | |

Purchase of other materials | 0 | 0 | 0 | 0 | 0 |

Supervisor | -50000 | -50000 | -50000 | -50000 | -50000 |

Worker | -30000 | -30000 | -30000 | -30000 | -30000 |

Rent of warehouse | 0 | 0 | 0 | 0 | 0 |

Maintenance | 0 | 0 | 0 | 0 | 0 |

Other Expense | 0 | 0 | 0 | 0 | 0 |

managers Salaries | 0 | 0 | 0 | 0 | 0 |

Maintenance Contract | -375000 | -375000 | -375000 | -375000 | -375000

|

Sub contracting Fees | -1250000 | -1250000 | -1250000 | -1250000 |

-1250000 |

Total Costs | -1705000 | -80000 | -80000 | -80000 | -80000 |

Tax Savings | 682000 | 32000 | 32000 | 32000 | 32000 |

Cash Flow Due to Costs | -1023000 | -48000 | -48000 | -48000 | -48000 |

Total Cash Flow | -1023000 | -48000 | -48000 | -48000 | -48000 |

PVIF @ 10% | 0.909091 | 0.826446 | 0.751315 | 0.683013 | 0.620921 |

Present Value | -930000 | -39669.4 | -36063.1 | -32784.6 | -29804.2 |

Total Cash Outlay | -1068321 |

Less: Initial Inflow | 0 |

Net Cash Outlay | -1068321 |

Based on the above analysis following summary can be drawn:

Option | NPV |

Option A | $ (2,735,501.80) |

Option B | $ (3,102,910.26) |

Option C | $ (2,089,010.05) |

Option D | $ (1,068,321.40) |

So the lowest NPV is of option D. So the company should go ahead with

option d and as a result it should completely outsource. Packages, Inc.

will make the containers and provide the necessary maintenance.

You might also like

- Sample Quiz 2 Fin 819Document8 pagesSample Quiz 2 Fin 819mehdiNo ratings yet

- Liquid Chemical Company-CaseDocument3 pagesLiquid Chemical Company-Casesunil50% (2)

- Consolidated Income StatementsDocument34 pagesConsolidated Income StatementsJuBin DeliwalaNo ratings yet

- Riskman SectionD Group3 Case2Document8 pagesRiskman SectionD Group3 Case2subhrajyoti_mandal100% (1)

- Topic 5 Deferred TaxDocument45 pagesTopic 5 Deferred TaxFuchoin Reiko100% (1)

- Butler CaseDocument12 pagesButler CaseJosh BenjaminNo ratings yet

- Asset Conversion CycleDocument12 pagesAsset Conversion Cyclessimi137No ratings yet

- Problem Set 2 SolutionDocument10 pagesProblem Set 2 SolutionLawly GinNo ratings yet

- IIMC Business Valuation Course Covers Models Growth Rates (FI-257Document5 pagesIIMC Business Valuation Course Covers Models Growth Rates (FI-257agrawalrishiNo ratings yet

- Problemset5 AnswersDocument11 pagesProblemset5 AnswersHowo4DieNo ratings yet

- Adjusted Present Value AnalysisDocument30 pagesAdjusted Present Value AnalysisBhuvnesh PrakashNo ratings yet

- Solutions BD3 SM24 GEDocument4 pagesSolutions BD3 SM24 GEAgnes ChewNo ratings yet

- Capital Budgeting Methods and Cash Flow AnalysisDocument42 pagesCapital Budgeting Methods and Cash Flow AnalysiskornelusNo ratings yet

- PGPM FLEX MIDTERM Danforth - Donnalley Laundry Products CompanyDocument3 pagesPGPM FLEX MIDTERM Danforth - Donnalley Laundry Products Companyhayagreevan vNo ratings yet

- Agro Chem, Inc.Document32 pagesAgro Chem, Inc.Camryn Bintz50% (2)

- Income Statement SimDocument5 pagesIncome Statement Simjustwon100% (1)

- Chap 12 SolutionDocument15 pagesChap 12 SolutionMarium Raza0% (1)

- Vikram Rathi - Taxing SituationsDocument2 pagesVikram Rathi - Taxing SituationsVikram RathiNo ratings yet

- Dipifr Int 2010 Dec A PDFDocument11 pagesDipifr Int 2010 Dec A PDFPiyal HossainNo ratings yet

- CH 6 Model 14 Free Cash Flow CalculationDocument12 pagesCH 6 Model 14 Free Cash Flow CalculationrealitNo ratings yet

- Chapter 02 - Basic Financial StatementsDocument139 pagesChapter 02 - Basic Financial StatementsElio BazNo ratings yet

- Philips Corporate Valuation Project PDFDocument13 pagesPhilips Corporate Valuation Project PDFNariman MamadoffNo ratings yet

- Learn deferred tax and accounting for timing differencesDocument10 pagesLearn deferred tax and accounting for timing differencesteddy matendawafaNo ratings yet

- Discounted Cash Flow (DCF) Definition - InvestopediaDocument2 pagesDiscounted Cash Flow (DCF) Definition - Investopedianaviprasadthebond9532No ratings yet

- Consolidated Statement of Profit or Loss and Other Comprehensive IncomeDocument40 pagesConsolidated Statement of Profit or Loss and Other Comprehensive IncomeSing YeeNo ratings yet

- Earnings Per ShareDocument30 pagesEarnings Per ShareTanka P Chettri100% (1)

- Corporate Finance PDFDocument185 pagesCorporate Finance PDFrodgington duneNo ratings yet

- Lecture 7 Adjusted Present ValueDocument19 pagesLecture 7 Adjusted Present ValuePraneet Singavarapu100% (1)

- Mergers & Acquisitions ValuationDocument5 pagesMergers & Acquisitions ValuationAparna KalaskarNo ratings yet

- Reliance IndustriesDocument32 pagesReliance IndustriesZia AhmadNo ratings yet

- 20 Marks 2019 Adjustments To Net Income: Consolidated Income Statement 2019Document4 pages20 Marks 2019 Adjustments To Net Income: Consolidated Income Statement 2019Jax TellerNo ratings yet

- The Application of Ifrs Oil and Gas PDFDocument18 pagesThe Application of Ifrs Oil and Gas PDFSahilJainNo ratings yet

- Problem 9Document1 pageProblem 9reemy13No ratings yet

- IFRS Functional Currency CaseDocument23 pagesIFRS Functional Currency CaseDan SimpsonNo ratings yet

- Revised Paradip Refinery ReportDocument22 pagesRevised Paradip Refinery ReportioeuserNo ratings yet

- Kinder Morgan Presentation To Investors at Credit Suisse June 2014Document36 pagesKinder Morgan Presentation To Investors at Credit Suisse June 2014dracutcivicwatchNo ratings yet

- ReportDocument8 pagesReportZain AliNo ratings yet

- Ethanol ManufactureDocument3 pagesEthanol Manufacturechemical78No ratings yet

- Petron Corporation Vertical Analysis of Balance Sheet RatiosDocument2 pagesPetron Corporation Vertical Analysis of Balance Sheet RatiosMeyNo ratings yet

- MS Brothers Super Rice MillDocument9 pagesMS Brothers Super Rice MillMasud Ahmed khan100% (1)

- Ratio Analysis Mapple Leaf & BestWay CementDocument46 pagesRatio Analysis Mapple Leaf & BestWay CementUmer RashidNo ratings yet

- Cash Flow Statement-2015Document43 pagesCash Flow Statement-2015Sudipta Chatterjee100% (1)

- Solutions BD3 SM15 GEDocument9 pagesSolutions BD3 SM15 GEAgnes Chew100% (1)

- Singapore Institute of Management: University of London Preliminary Exam 2020Document20 pagesSingapore Institute of Management: University of London Preliminary Exam 2020Kəmalə AslanzadəNo ratings yet

- NPV ProfileDocument3 pagesNPV ProfileKhan Ahsan HabibNo ratings yet

- Topic 7 - Financial Leverage - ExtraDocument57 pagesTopic 7 - Financial Leverage - ExtraBaby KhorNo ratings yet

- Understanding Financial Statements Chapter 1 ExercisesDocument83 pagesUnderstanding Financial Statements Chapter 1 Exerciseskbrooks323No ratings yet

- Financial Analysis of PEPSICODocument8 pagesFinancial Analysis of PEPSICOUsmanNo ratings yet

- Ias 12Document38 pagesIas 12lindsay boncodinNo ratings yet

- Adjusted Present Value Method of Project AppraisalDocument7 pagesAdjusted Present Value Method of Project AppraisalAhmed RazaNo ratings yet

- Chapter 8.6Document3 pagesChapter 8.6CarlosnyNo ratings yet

- BD3 SM17Document3 pagesBD3 SM17Nguyễn Bành100% (1)

- Stevens Textiles S 2013 Financial Statements Are Shown Here Balance Sheet AsDocument2 pagesStevens Textiles S 2013 Financial Statements Are Shown Here Balance Sheet AsAmit PandeyNo ratings yet

- Case 68 Sweet DreamsDocument12 pagesCase 68 Sweet Dreams3happy3No ratings yet

- 2.4 Earnings Per ShareDocument40 pages2.4 Earnings Per ShareMinal Bihani100% (1)

- Term LoanDocument18 pagesTerm LoanDhani Devonne BieberNo ratings yet

- DSCR Excel Template Calculate Loan QualificationDocument3 pagesDSCR Excel Template Calculate Loan QualificationAntonNo ratings yet

- EVA As A Value Based Management Tool A Case Study of Selected Indian It CompaniesDocument6 pagesEVA As A Value Based Management Tool A Case Study of Selected Indian It CompaniesarcherselevatorsNo ratings yet

- Accrual Accounting ProcessDocument52 pagesAccrual Accounting Processaamritaa100% (1)

- Case study solution: Water company financial projectionsDocument15 pagesCase study solution: Water company financial projectionsRahul Tiwari100% (2)

- Carbon Footprint - Activity Data Collection FormDocument6 pagesCarbon Footprint - Activity Data Collection FormHenil Dudhia100% (1)

- Business History: To Cite This Article: Sydney Finkelstein (2006) Why Smart Executives Fail: Four Case HistoriesDocument19 pagesBusiness History: To Cite This Article: Sydney Finkelstein (2006) Why Smart Executives Fail: Four Case HistoriesChirayu ShahNo ratings yet

- GST On MalaysiaDocument2 pagesGST On MalaysiaHenil DudhiaNo ratings yet

- Consolidated Coordinator TeamDocument1 pageConsolidated Coordinator TeamHenil DudhiaNo ratings yet

- Inorganic Growth Strategies: Mergers, Acquisitions, RestructuringDocument15 pagesInorganic Growth Strategies: Mergers, Acquisitions, RestructuringHenil DudhiaNo ratings yet

- Culture and Strategic Management-Remaining SlidesDocument15 pagesCulture and Strategic Management-Remaining SlidesHenil DudhiaNo ratings yet

- Leadership and EntrepreneurshipDocument10 pagesLeadership and EntrepreneurshipHenil DudhiaNo ratings yet

- Strategic Change ManagementDocument20 pagesStrategic Change ManagementHenil DudhiaNo ratings yet

- Calculation of Coal DemandDocument9 pagesCalculation of Coal DemandHenil DudhiaNo ratings yet

- Corporate GovernanceDocument19 pagesCorporate GovernanceHenil DudhiaNo ratings yet

- Akash ShahDocument2 pagesAkash ShahHenil DudhiaNo ratings yet

- Inorganic Growth Strategies: Mergers, Acquisitions, RestructuringDocument15 pagesInorganic Growth Strategies: Mergers, Acquisitions, RestructuringHenil DudhiaNo ratings yet

- Company List 1-195Document20 pagesCompany List 1-195Henil DudhiaNo ratings yet

- Cooperative StrategiesDocument26 pagesCooperative StrategiesHenil Dudhia100% (2)

- Supply Chain of FedExDocument43 pagesSupply Chain of FedExdebendu nag100% (5)

- Engineering Procurement and ConstructionDocument84 pagesEngineering Procurement and ConstructionAayushi Arora75% (4)

- Culture and Strategic ManagementDocument23 pagesCulture and Strategic ManagementHenil DudhiaNo ratings yet

- EPC Opportunities in Indian Power Oil Gas and Mining SectorDocument5 pagesEPC Opportunities in Indian Power Oil Gas and Mining SectorHenil DudhiaNo ratings yet

- Cultural Influence in TCSDocument5 pagesCultural Influence in TCSHenil DudhiaNo ratings yet

- Case Study Presentation Two Tough Calls A Harvard Business SchoolDocument10 pagesCase Study Presentation Two Tough Calls A Harvard Business SchoolHenil DudhiaNo ratings yet

- Revised PPT Press Conference INDC v5Document28 pagesRevised PPT Press Conference INDC v5Henil DudhiaNo ratings yet

- Addresses For Placement Brochure Dispatch 1Document93 pagesAddresses For Placement Brochure Dispatch 1Henil DudhiaNo ratings yet

- Political Environment: DHL Has Access To Several Threats and Opportunities Available in TheDocument3 pagesPolitical Environment: DHL Has Access To Several Threats and Opportunities Available in TheHenil Dudhia50% (2)

- Roll No. First Name Last Name Percent Aptitude Test Score (60) GD ScoreDocument2 pagesRoll No. First Name Last Name Percent Aptitude Test Score (60) GD ScoreHenil DudhiaNo ratings yet

- BLOODDocument3 pagesBLOODHenil DudhiaNo ratings yet

- S CurveDocument10 pagesS CurveHenil DudhiaNo ratings yet

- Long Packaging: Fragrance CR Response No Gas InnovationDocument30 pagesLong Packaging: Fragrance CR Response No Gas InnovationHenil DudhiaNo ratings yet

- Chi TestDocument3 pagesChi TestHenil DudhiaNo ratings yet

- Name of The Company: Package: Name of The Contractor: Sunny Constructions Pvt. LTDDocument12 pagesName of The Company: Package: Name of The Contractor: Sunny Constructions Pvt. LTDHenil DudhiaNo ratings yet

- CS CMDocument20 pagesCS CMHenil DudhiaNo ratings yet

- Financial ModelDocument30 pagesFinancial ModelrecasmarkNo ratings yet

- The Best Way to Start an Ecommerce Business with SellviaTITLEDocument27 pagesThe Best Way to Start an Ecommerce Business with SellviaTITLECesar FloresNo ratings yet

- Amundi Etf Euro InflationDocument3 pagesAmundi Etf Euro InflationRoberto PerezNo ratings yet

- Unit 35 - A and B BTECDocument25 pagesUnit 35 - A and B BTECgamingkrrish7No ratings yet

- Logistics Concept Evolution Objectives ADocument11 pagesLogistics Concept Evolution Objectives ASiyabonga MthombeniNo ratings yet

- Marketing Week 15Document2 pagesMarketing Week 15Lillian KobusingyeNo ratings yet

- Financial Accounting Assignment 1 (Chapter 1&2) Prepared by Abraam Fahmy & Amany FayekDocument6 pagesFinancial Accounting Assignment 1 (Chapter 1&2) Prepared by Abraam Fahmy & Amany FayekabraamNo ratings yet

- CPT Accounts ThoeryDocument6 pagesCPT Accounts ThoeryanandvkakuNo ratings yet

- Final Report - Vietnam Consumer Finance Report 1H2022 - Home CreditDocument58 pagesFinal Report - Vietnam Consumer Finance Report 1H2022 - Home CreditTuấn Tú Võ100% (1)

- Cost Question BankDocument3 pagesCost Question BankAtul ShivaNo ratings yet

- Marginal Costing vs Absorption Costing: Key DifferencesDocument23 pagesMarginal Costing vs Absorption Costing: Key DifferencesPei IngNo ratings yet

- Assignment Solution - Yield Curve and HedgingDocument12 pagesAssignment Solution - Yield Curve and HedgingAkashNo ratings yet

- Strategic Management Midterm ReviewerDocument15 pagesStrategic Management Midterm ReviewerAlthea SantillanNo ratings yet

- SMS PlusDocument7 pagesSMS PlusAnabia RahmanNo ratings yet

- Independent Auditors ReportDocument6 pagesIndependent Auditors Reportdaleep sharmaNo ratings yet

- 5fdbb98b29d37cc26751e750 - Ecommerce Business Plan Example - BlueCartDocument10 pages5fdbb98b29d37cc26751e750 - Ecommerce Business Plan Example - BlueCartella diazNo ratings yet

- Entrepreneurial ProcessDocument15 pagesEntrepreneurial ProcessMardy DahuyagNo ratings yet

- Indian Garment Industry Supply ChainDocument10 pagesIndian Garment Industry Supply ChainManpreet Singh KhuranaNo ratings yet

- Capital Structure DecisionsDocument20 pagesCapital Structure Decisionsmuluken walelgnNo ratings yet

- Bharti Airtel Case Write UpDocument3 pagesBharti Airtel Case Write UpSeth40% (5)

- Shimano 2Document10 pagesShimano 2Tigist AlemayehuNo ratings yet

- Accrual EngineDocument6 pagesAccrual EngineSatya Prasad0% (1)

- Chapter 01 - AnswerDocument18 pagesChapter 01 - AnswerJoy Angelique JavierNo ratings yet

- A181 Tutorial 2Document9 pagesA181 Tutorial 2Fatin Nur Aina Mohd Radzi33% (3)

- Mergers and AcquisitionsDocument25 pagesMergers and AcquisitionsDanesh AjayNo ratings yet

- BBA 1st - 8th Semester Syllabus - 1546787544 PDFDocument84 pagesBBA 1st - 8th Semester Syllabus - 1546787544 PDFMausam GhimireNo ratings yet

- Ifa 1&2 Afa 1&2Document254 pagesIfa 1&2 Afa 1&2Gena AlisuuNo ratings yet

- How A Robust IT Architecture Improves Value Chain Activities?Document4 pagesHow A Robust IT Architecture Improves Value Chain Activities?malathyNo ratings yet

- Axis Bank Corporate Strategy AnalysisDocument34 pagesAxis Bank Corporate Strategy AnalysisDeep Ghose DastidarNo ratings yet

- ZDHC Gateway Pricing Guide Formulators - ENG 2023Document5 pagesZDHC Gateway Pricing Guide Formulators - ENG 2023DidarNo ratings yet