Professional Documents

Culture Documents

SRD Legal - TAX Update Issue 1 - 20150901

Uploaded by

Sanjay Dwivedi0 ratings0% found this document useful (0 votes)

10 views10 pagesFortnightly newsletter on Indirect Taxes

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFortnightly newsletter on Indirect Taxes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views10 pagesSRD Legal - TAX Update Issue 1 - 20150901

Uploaded by

Sanjay DwivediFortnightly newsletter on Indirect Taxes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

SFD CCGatL

TAX ag

Newsletter on In:

September, 2015

Tssue 1

GST Central Excise

Service Tax Customs

Foreign Trade

TAX Update

Dear Readers,

Greetings from Team SRD Legal.

It gives us immense pleasure to launch this

fortnightly newsletter, “TAX Update” on

Indirect Taxation. Typically it would cover

updates on GST, Central Excise, Service Tax,

Customs, SEZ, EUs, Foreign Trade etc.

‘The world of taxation has routinely remained

in flux. Changes in law occur at fast pace and

the industry is expected to implement a new

legislation, the moment it is signed in New

Delhi. One has to cope-up with the deluge of

notifications/ circulars/ public notices etc, At

the same time, the Tribunals, High Courts &

Supreme Court keep on updating the

interpretations. What was right yesterday or

even today may prove to be wrong tomorrow.

Ignorance proves costly and comes bundled

‘with harassment.

With efforts of the government in

implementing GST becoming stronger and

realistic, the time to understand the concept &

intricacies of GST too has arrived, In coming

days, the situation will demand more frequent

and elaborate communication between us.

channel of communication. Starting this

month, this newsletter would reach you on the

O1 and the 16% day of every month with the

latest news on Indirect Taxes.

However, it will not be exhaustive. We don't

intend to bombard you with stream of

irrelevant information. We will be very

selective and would include only that

information which, in our judgment, would be

essential and useful to our clients

We have no doubt in our minds that every

piece of information included in this newsletter

would be informative and useful. We are

confident that you all will appreciate and give

your patronage to this new initiative by SRD

LEGAL.

Thanking you,

‘Manoj Kasale

Advocate

Q| SRD Legal, Advocates & Consultants

TAX Update

Central Excise

7

of Edue

ations 12/2015-CE (NT), dt.

30/04/2015]

When in this year’s budget the

b,

government granted complete exemption

from payment of Education Cess and the

Secondary & Higher Ed. Cess, everyone

Credits of

expected that the Cenvi

these cesses would be allowed to be

f the

vice tax.

availed and used for paym

basie excise duty and the

After two month’s wait, the government

came out with amendment to the Cenvat

Credit Rules, 2004 allowing utilizations

Credit of cesses paid on inputs or

capital goods received in our

factory on or after 01% March,

2015 can be utilized for payment

of Basic Excise Duty.

Tn respect of capital goods

received in 2014-15 the balance

50% of these cesses can be utilized

to pay BED (we would avail this

50% credit in 2

5-16)

Credit of the cesses paid on input

es received on or after O1*

March, 2015 can be utili

payment of BED.

‘SRD Legal, Advocates & Consultants

TAX Update

However, the amendment does not

provide for utilisation of the credit of the

cesses lying in balance as on 28

February, 2015. Thus, a major part of

the problem remains unresolved

‘The said balance can still be utilized for

the following purpos

i, For payments of Cesses on

removal of input/ capital goods as

such under rule 3 (6) of Cenvat

Credit Rules, 2004.

ii, For payment of Cesses on goods to

be cleared under rule 16 of C.

Excise Rules, 2002.

iii, For reversal of wrong credits of

Cesses.

Amount payable under rule 6 of

Cenvat Credit Rules, 2004:

[Notification 14/2015-CE (NT), dt.

19/05/2015]

You would recall that one of the options

under rule 6 was to pay an amount of 6%

of the value of exempted goods cleared or

the services provided. This payment is

treated as equivalent of reversal of the

credit.

When the rate of service tax was

enhanced to 14% (w-e.f. 01/06/2015), the

rate of above amount was also revised.

‘The amount payable now is as under:

- On exempted goods: 6%

- On exempted services: 7%

Refund of unuti

under Rule 5B:

ized Cenvat Credit

[Notification no.

dated 19/05/2015]

15/2015-CE (NT),

Cenvat Credit gets accumulated with

those providing services covered under

partial reverse charge because a part of

the tax is payable by the service

receiver. Therefore, the government has

made provision for grant of refund of

such unutilized credit [under Rule 5B

read with notification 12/2014-CE (NT).

The following two services were covered

under partial reverse charge till 31¢

March 2015 (25% tax was payable by the

service provider and the balance by the

service receiver). However, with effect

from 01% April, 2015 the entire tax

became payable by the service receiver:

- Supply of Manpower; and

+ Security Services

Now, with effect from 19/05/2015 the

government has withdrawn the facility

of refund of unutilised credit in respect

of these two services.

Issuance of digitally signed invoices

and_preservation of records in_e-

for)

[Notification No.8/2015-CE (NT) dated

06/07/2015]

Rules permit maintenance of Daily Stock

Account (RG-1) and Service Tax records

in electronic form (.e. on computer). It

also provides for issuance of digitally

4] SRD Legal, Advocates & Consultants

TAX Update

signed C. Excise Invoices and the Service

Tax invoices! —_bills/-_—_challans/

consignment notes.

The notification prescribes the

conditions, safeguards & procedures to

be adhered to. Some of the requirements

under:

* Class 2 or Class 3 Digital

Signature Certificate issued by

Certifying Authority in India is

must.

* The assessee is required to

intimate certain details to the

Deputy/ Assistant Commissioner

before he starts using the Digital

Signature. Those who are already

using Digital Signature should file

the intimation within 15 days of

issuance of the notification,

© Appropriate back up of the

e-records has to be maintained

and preserved for five years.

Supply of goods into SEZ: Rebate

and Refund of accumulated Cenvat

Credit available:

[Circular 1001/8/2015-CX.8, dated

28/04/2015]

Rebate on exports is available under

Rule 18 of C, Excise Rules, 2002.

refund of Cenvat Credit

accumulated due to exports is available

under rule 5 of Cenvat Credit Rules,

2004

Similar!

Both the rules were amended in this

year's budget, so as to define ‘export’ and

‘export goods’. From the definitions it

appeared that SEZ supplies would not be

treated as export and consequently the

benefits under the two rules would not

be available.

CBEC has now clarified that:

“any licit clearances of goods to an

SEZ from the DTA will continue to

be export and therefore be entitled

[licit = legal or proper]

All indenting agents & traders need

not be registered as a dealer with C.

Excise: Credit available against

manufacturer’s invoice itself

[Circular 1003/10/2015-CX.8, dated

05/05/2015]

Rule 11 of C. Excise Rules, 2002 was

amended vide notification no. 08/2015-

CE (NT) dated 01/03/2015,

invoices to be issued on instructions of

registered dealers. This had given rise to

a widespread confusion. The C. Excise

officers started insisting that if we

receive goods through some agent or a

trader then we cannot avail credit unless

the agent/ trader is registered as an

excise ‘dealer’

regarding

CBEC has now clarified that.

+ A registered dealer need not bring

the goods to his premises. The

goods can be supplied directly

from the premises of the

manufacturer! importer to the

5 | SRD Legal, Advocates & Consultants

TAX Update

consignee. The dealer can issue

Cenvatable invoice.

* A manufacturer can avail

CENVAT Credit on the basis of

the invoices issued by

manufacturer's invoice when the

goods are directly sent to him on

the direction of a dealer. The

dealer may or may not be

registered, and he does not need

to issue C. Excise Invoice.

CASE LAWS

Refund - Unjust Enrichment - (High

Court Madras) - In case any amount is

deposited during the pendency of

adjudication proceedings or

investigation, the said amount would be

in the nature of deposit under protest

and, therefore, the principles of unjust

enrichment would not apply.

CCE, Coimbatore vs, Pricol Ltd. [2015

(039) STR 0190 (Mad.)]

EOU - Rebate of duty paid on

Export Goods — (High Court

Rajasthan)

EOU does not have option to pay duty on

export goods. Hence it cannot claim

rebate of duty paid on final products

Notification No. 24/2003-C.E., dated 13-

3-2003 provides absolute exemption to

the goods manufactured by EOU.

Vanasthali ‘Textile Industries Ltd. vs.

U.O.L 2015 (321) ELT 0089 (Raj.)

Related Person — A manufacturer and

his customer cannot be treated as

‘related person’ merely because the

manufacturer decides to sell his entire

production to the said customer, instead

of incurring expenses. — on

marketing/advertising.

(2015-TIOL-1748-CESTAT-DEL)

6 | SRD Legal, Advocates & Consultants

| 14x update

SERVICE TAX

Rate of S.

6% to 14

‘The new rate of tax came into force with

fe

ne 2015. [Notification

14/2019 19/05/ 201

Service Tax on Job-work in respect

of alcoholic liquor:

109(2) of Finance Act, 2015

read with notification 14/2015-ST, dt.

19/05/2015).

Th processes

n are ke

[Entry 66D (] and

service tax on anyone

in the negative list

hence there is no

arrying out such

processes. However, the entry has been

amended so as to exclude the processes

for production or manufacture of

alcoholic liquor for human consumption.

Thus, Service Tax shall be levied or

contract manufacturing/job work for

production of potable liquor for a

consideration.

Detailed manual scrutiny of Service

Tax Returns

has directed

carry out detailed scrutiny of the service

7 | SRD Legal, Advocates & Consultants

TAX Update

tax returns. Quite detailed guidelines

have been issued. Following are the

highlights:

+ A Return Scrutiny Cell is being

created in each Commissionerate.

+ The focus would be on those

assessees who are not being

audited, (Paying tax below Rs. 50

lakh per annum)

* The department has developed

certain risk parameters. ‘The

Directorate General of Systems &

Data Management (DGS&DM)

will provide the Risk Data to the

Commissionerate, on the basis of

which assesses would be selected.

* A detailed checklist has been

provided.

+ The department will also compare

the date with 26AS statement,

Income Tax Return ete.

CASE LAWS ON SERVICE TAX

No levy of Service Tax on Works

Contract prior to 01.06.07

The Hon'ble Supreme Court has set to

rest the long standing controversy on

applicability of service tax under Works

Contract Service prior to 01.06.07. In its

landmark judgement, the Hon'ble

Supreme Court held that Finance Act,

1994 did not lay down any charge or

machinery to levy and assess service tax

on indivisible works contracts.

[CCE & C, Kerala Vs. Larsen & Toubro

Ltd.- 2015-TIOL-187-SC-ST]

Ground of Appeal - In relation to

appeal against order for pre-deposit, the

Hon'ble High Court of Allahabad held

that a new ground cannot be raised for

the first time in appeal, when it was not

raised before the adjudicating authority

Bharat Sanchar Nigam Ltd. vs. CCE.

2015 (820) ELT 0544 (All)

Penalty - Benefit of section 80 -

Reasonable Cause for failure to pay

tax - Once it is held that the assessee

was eligible for benefit of Section 80 then

not only the penalty under Section 78,

but the penalties under Sections 76 and

77 too stand waived.

[Akbar Travels of India (P) Ltd. vs. CCE

& ST, Thiruvananthapuram - 2015 (038)

STR 0957 (Ker.)]

8] SRD Legal, Advocates & Consultants

| 14x update

CUSTOMS

Payment of customs duty in case of

bonafide default _in export

obligation.

CBEC has permitted suo-

motu payment of customs duty during

the pendency of applications with DGFT

for regularizing bonafide default in

export obligation under Advance

Authorization/EPCG Scheme. This

would save interest cost for such

exporters.

(Circular No.11/2015-Cus dated

01.04.15)

Refund of 4% SAD

Importers are allowed to file refund of

4% SAD at the Customs Stations where

imports are made, Number of refund

claim at such customs station is limited

to one per month.

Earlier, importers were permitted to file

only one refund claim per month in a

Commissionerate

(Circular No.12/2015-Cus dated

09.04.15)

SDF Form dispenses: A declaration

included in the Shipping Bill:

Where exports are taking place through

EDI ports, the RBI dispenses with SDF

form. Instead on its desire the CBEC has

added a declaration in the Shipping Bill

to the effect that the exporter

undertakes to abide by the provisions of

FEMA, 1999

(Circular No.15/2015-Cus

dated 18.05.15)

Clearance Facilitation

CBEC has set up Customs Clearance

Facilitation Committee at every major

customs seaport and airport. This

committee comprises of senior-most

functionaries of various de

Plant/Animal Quarantine Department,

Drug Controller of India, Textile

Committee, Port Trust, Airport

Authority of India, Custodians, Wildlife

Authorities, Railways/

CONCOR/Pollution Control Board ete

tments viz,

It is s

fated that this Committee will

ensure expeditious clearance of

import/export of goods,

(Circular —_No.13/2015-Cus dated

13.04.15)

9| SRD Legal, Advocates & Consultants

| tax update

About SRD LEGAL:

SRD LEGAL was established in 2007 by Sanjay Dwivedi, Advocate and has grown

into a team headed by four Advocates. The firm handles litigations on C. Excise,

Service Tax & Customs matters up to High Court. It also renders legal advisory

services.

Contact:

‘Del, : +91-22-25 6565 47/ 48

512, Business Park, Citi of Joy, +91- 9004825702/ 8767661950

J. 8. D, Road, Mulund (West), Pax : +91-22-25 6565 49

‘Mumbai - 400 080.

e-mail: mail@srdlegal.in

Team SRD Legal

Mr. Sanjay Dwivedi, Advocate - 9320 456 555

‘Mr. Manoj Kasale, Advocate - 96 190 290 95

‘Mr. Raymond George, Advocate - 98204 80597

‘Mrs, Savita Dwivedi, Advocate - 998 737 0673

For private circulation only.

© SRD Legal

Disclaimer

The information contained in this publication is intended for informational purposes

only and does not constitute legal opinion or advice. The views & information

contained herein are of general nature and are not intended to address the

circumstances of any particular person or entity. The contents are not comprehensive

or sufficient for taking decisions. Please do not act on the information/ views

provided in this newsletter without obtaining professional advice after a thorough

examination of the facts and circumstances of a particular situation. There can be no

assurance that the judicial/quasi judicial authorities may not take a position

contrary to the views mentioned herein. Although we endeavour to provide accurate

and timely information, there is no assurance or guarantee in this regard.

SRD LEGAL neither accepts nor assumes any responsibility or liability arising from

any decision or action taken or to be taken or refrained to be taken, by anyone on the

basis of this publication.

10 | SRD Legal, Advocates & Consultants

You might also like

- A Practical Guide To GST - Adv. Sanjay Dwivedi (2017 Edition)Document435 pagesA Practical Guide To GST - Adv. Sanjay Dwivedi (2017 Edition)Sanjay DwivediNo ratings yet

- Drafting Effective Notices & Orders-1Document46 pagesDrafting Effective Notices & Orders-1Sanjay DwivediNo ratings yet

- Drafting Effective Notices & Orders-1Document46 pagesDrafting Effective Notices & Orders-1Sanjay DwivediNo ratings yet

- GST On Second Hand CarsDocument2 pagesGST On Second Hand CarsSanjay DwivediNo ratings yet

- Apportionment of ITC On Capital GoodsDocument5 pagesApportionment of ITC On Capital GoodsSanjay DwivediNo ratings yet

- Law Update - October 2021Document13 pagesLaw Update - October 2021Sanjay DwivediNo ratings yet

- A Practical Guide To GST (Chapter 15 - Transition To GST)Document43 pagesA Practical Guide To GST (Chapter 15 - Transition To GST)Sanjay DwivediNo ratings yet

- Sanjay Dwivedi Advocate Credit RulesDocument22 pagesSanjay Dwivedi Advocate Credit RulesSanjay DwivediNo ratings yet

- Sabka Vishwas (LDR) Scheme 2019 - As Per The Finance BillDocument15 pagesSabka Vishwas (LDR) Scheme 2019 - As Per The Finance BillSanjay DwivediNo ratings yet

- GST - Documents & Records-May 18Document29 pagesGST - Documents & Records-May 18Sanjay DwivediNo ratings yet

- Ten Things To Know About E-Way BillDocument2 pagesTen Things To Know About E-Way BillSanjay DwivediNo ratings yet

- Classification of Goods & ServicesDocument4 pagesClassification of Goods & ServicesSanjay DwivediNo ratings yet

- SRD Legal - TAX Update Issue 2 - 20150916Document14 pagesSRD Legal - TAX Update Issue 2 - 20150916Sanjay DwivediNo ratings yet

- Works Contract Under GST (Bare Framework)Document6 pagesWorks Contract Under GST (Bare Framework)Sanjay DwivediNo ratings yet

- Apportionment of ITCDocument5 pagesApportionment of ITCSanjay DwivediNo ratings yet

- Implementation of Rule 6 (3A) of CCR 2004Document8 pagesImplementation of Rule 6 (3A) of CCR 2004Sanjay DwivediNo ratings yet

- Apportionment of ITCDocument5 pagesApportionment of ITCSanjay DwivediNo ratings yet

- SRD Legal - TAX Update Issue 7 - 20151201Document14 pagesSRD Legal - TAX Update Issue 7 - 20151201Sanjay DwivediNo ratings yet

- Power Projects - C. Excise Exemption - Check ListDocument7 pagesPower Projects - C. Excise Exemption - Check ListSanjay DwivediNo ratings yet

- SRD Legal - TAX Update Issue 4 - 20151016Document12 pagesSRD Legal - TAX Update Issue 4 - 20151016Sanjay DwivediNo ratings yet

- Budget 2015Document25 pagesBudget 2015Sanjay DwivediNo ratings yet

- SRD Legal - TAX Update Issue 3 - 20151001Document10 pagesSRD Legal - TAX Update Issue 3 - 20151001Sanjay DwivediNo ratings yet

- Budgetary Changes C. Excise - 28th Feb 2015 PDFDocument7 pagesBudgetary Changes C. Excise - 28th Feb 2015 PDFSanjay DwivediNo ratings yet

- Job-Work Declaration Under 214-86Document2 pagesJob-Work Declaration Under 214-86Sanjay Dwivedi50% (2)

- Invoice - Use & Cancellation PDFDocument14 pagesInvoice - Use & Cancellation PDFSanjay DwivediNo ratings yet

- Rule 6 (3A) of CCR'04Document5 pagesRule 6 (3A) of CCR'04Sanjay DwivediNo ratings yet

- Import For Jobbing PDFDocument6 pagesImport For Jobbing PDFSanjay Dwivedi100% (1)

- Export Procedure for Merchant ExporterDocument9 pagesExport Procedure for Merchant ExporterSanjay DwivediNo ratings yet

- Point of TaxationDocument12 pagesPoint of TaxationSanjay DwivediNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

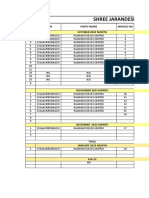

- Shree Jarandeshwar FPC - Sales: SR - No Gstin Party Name Invoice No October 2022 MonthDocument9 pagesShree Jarandeshwar FPC - Sales: SR - No Gstin Party Name Invoice No October 2022 MonthEKNATH PHALKENo ratings yet

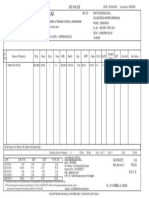

- Roseville Edunut education workshop invoiceDocument4 pagesRoseville Edunut education workshop invoiceAshish KadyanNo ratings yet

- Flipkart Labels 19 Jan 2024 07 20Document4 pagesFlipkart Labels 19 Jan 2024 07 20Nikhil BisuiNo ratings yet

- Flipkart Labels 01 Dec 2020 04 37Document1 pageFlipkart Labels 01 Dec 2020 04 37pgpm20 SANCHIT GARGNo ratings yet

- The India Cements Limited: OrginalDocument3 pagesThe India Cements Limited: OrginalVadde Anil KumarNo ratings yet

- Boat White Headphone BillDocument1 pageBoat White Headphone BillAvanish JaiswalNo ratings yet

- HPCL Price List Eff-16th Jan 2021Document1 pageHPCL Price List Eff-16th Jan 2021aee lweNo ratings yet

- Tax Invoice / Bill of SupplyDocument1 pageTax Invoice / Bill of SupplySanvi KalraNo ratings yet

- Levy & Chrage of Tax - 221122 - 192035Document17 pagesLevy & Chrage of Tax - 221122 - 192035Tushar MadanNo ratings yet

- InvoiceDocument1 pageInvoicelakhan jethaniNo ratings yet

- Sahyog MedicalDocument1 pageSahyog MedicalK D HERBAL & UNANINo ratings yet

- Chapter 20 Purchase Entry of Interstate Exempted ItemsDocument3 pagesChapter 20 Purchase Entry of Interstate Exempted ItemsTEJA SINGH100% (2)

- E-Way Bill: Mode Vehicle / Trans Doc No & Dt. From Entered Date Entered by Cewb No. (If Any) Multi Veh - Info (If Any)Document1 pageE-Way Bill: Mode Vehicle / Trans Doc No & Dt. From Entered Date Entered by Cewb No. (If Any) Multi Veh - Info (If Any)South PointNo ratings yet

- Certificate NACIN Jan-2024 72ndbatch (Revised)Document2 pagesCertificate NACIN Jan-2024 72ndbatch (Revised)IAS MeenaNo ratings yet

- Statement 21959461Document1 pageStatement 21959461budi manNo ratings yet

- Flipkart Labels 31 Aug 2023-11-33Document26 pagesFlipkart Labels 31 Aug 2023-11-33Rohan ChawlaNo ratings yet

- Al Malik Life Sciences Price List (Zoic) - 23Document10 pagesAl Malik Life Sciences Price List (Zoic) - 23Faiz ArchitectsNo ratings yet

- Criticare Airoli Hospital Inv .1.12.21Document1 pageCriticare Airoli Hospital Inv .1.12.21RavindraNo ratings yet

- Pravesh Kumar DT 09.04.2019Document29 pagesPravesh Kumar DT 09.04.2019vikrant naikNo ratings yet

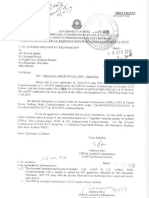

- Sir/ Madam,: Directorate General of GST IntelligenceDocument2 pagesSir/ Madam,: Directorate General of GST IntelligenceSudhit SethiNo ratings yet

- Europe VATContactsDocument2 pagesEurope VATContactsEriwaNo ratings yet

- Rapido Auto - Railway STN To OfcDocument3 pagesRapido Auto - Railway STN To OfcShaik MastanvaliNo ratings yet

- Flipkart Labels 23 Feb 2024-12-13Document9 pagesFlipkart Labels 23 Feb 2024-12-13chhavientzNo ratings yet

- Tax Invoice for Smartwatch PurchaseDocument1 pageTax Invoice for Smartwatch PurchaseIndrajit RanaNo ratings yet

- Tax Invoice Order SummaryDocument1 pageTax Invoice Order SummaryShubham NamdevNo ratings yet

- E-Way BillDocument1 pageE-Way BillPEDAPUDI SIVANo ratings yet

- Tax Invoices for Textile ProductsDocument24 pagesTax Invoices for Textile ProductsMahendra RijalNo ratings yet

- Series 1: Table 3.1 Gender Wise Classification of Respondents Gender No of Respondents Percentage (%)Document21 pagesSeries 1: Table 3.1 Gender Wise Classification of Respondents Gender No of Respondents Percentage (%)BOBBY THOMASNo ratings yet

- E-Way MH Challan-14Document1 pageE-Way MH Challan-14Sunil GuptaNo ratings yet

- Digital Order: Feb. 26 2022: Details For Order # D01-7940294-2662636Document1 pageDigital Order: Feb. 26 2022: Details For Order # D01-7940294-2662636AssignmentHelp OnlineNo ratings yet