Professional Documents

Culture Documents

Platts APAG Report 01.09.2015

Uploaded by

Sharifpour CommerceCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Platts APAG Report 01.09.2015

Uploaded by

Sharifpour CommerceCopyright:

Available Formats

[OIL ]

ASIA-PACIFIC/ARAB GULF MARKETSCAN

www.platts.com

Volume 34 / Issue 165 / September 1, 2015

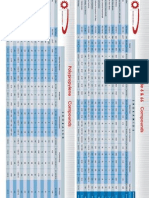

Asia products

Code Mid

Change Code Mid

Change

Code Mid

Change

Singapore

(PGA page 2002)

FOB Singapore ($/barrel) MOPS strip

NEW

Premium/Discount

Naphtha

PAAAP00 47.7447.78 47.760 +2.610

AAPKA00 47.5947.63 47.610 +2.660

Spot naphtha

AAOVE00 47.6447.68 47.660 +2.660

PAADC00 0.00/0.10 0.050

0.000

Gasoline 97 unleaded

PGAMS00 69.4369.47 69.450 +3.340

AAPKE00* 21.82/21.86 21.840

+0.680

Gasoline 95 unleaded

PGAEZ00 66.7266.76 66.740 +3.360

AAPKF00* 19.11/19.15 19.130

+0.700

Gasoline 92 unleaded

PGAEY00 62.6162.65 62.630 +3.460

AAPKG00* 15.00/15.04 15.020

+0.800

Gasoline 92 unleaded

AAXEQ00 61.5461.58 61.560 +3.420 AAXER00 1.05/1.09 1.070

+0.040

CFR Naphtha

AAOVF00

48.110 NANA

AAOVG00

0.500 NANA

Kerosene

PJABF00 60.8060.84 60.820 +2.640

AAPJZ00 62.1662.20 62.180 +2.830

PJACU00 -1.38/-1.34 -1.360

-0.190

Gasoil 10 ppm

AAOVC00 64.4864.52 64.500 +3.100

AAOVD00** 2.35/2.39 2.370

-0.050

Gasoil 50 ppm

AAPPF00 63.9764.01 63.990 +3.100

AAPPH00** 1.84/1.88 1.860

-0.050

Gasoil 0.05% sulfur

AAFEX00 61.6361.67 61.650 +3.110

AAFFB00** -0.50/-0.46 -0.480 -0.040

Gasoil 0.25% sulfur

AACUE00 61.1661.20 61.180 +3.120

AACQI00** -0.97/-0.93 -0.950 -0.030

Gasoil POABC00 61.6361.67 61.650 +3.110 AAPJY00 62.1162.15 62.130 +3.150

POAIC00** -0.50/-0.46 -0.480 -0.040

FO 180 CST 2% ($/mt)

PUAXS00 267.33267.37 267.350 +18.510

HSFO 180 CST ($/mt) PUADV00 261.45261.49 261.470 +18.110

AAPJX00 266.82266.86 266.840 +19.310

AAGZF00 -5.39/-5.35 -5.370

-1.200

HSFO 380 CST ($/mt) PPXDK00 257.49257.53 257.510 +19.920

AAPJW00 262.04262.08 262.060 +19.280

PPXDL00 -4.57/-4.53 -4.550

+0.640

Ex-Wharf 180 CST ($/mt)

AAFET00 264.00265.00 264.500 +20.000

Ex-Wharf 380 CST ($/mt)

AAFER00 259.00260.00 259.500 +20.000

Ex-Wharf 500 CST ($/mt)

AAVUP00 254.00255.00 254.500 +22.000

*Differential to FOB Singapore naphtha. **Differential to FOB Singapore gasoil. The Gasoil Reg 0.5% assessment was renamed Gasoil on January 3, 2012. The renamed

Gasoil assessment continued to reflect the same underlying methodology and quality specifications, including a sulfur content of 0.5% sulfur, through calendar year 2012.

The specification changed to 500 ppm sulfur on January 2, 2013.

Middle East physical oil assessments

FOB Arab Gulf ($/barrel)

Premium/Discount

Naphtha ($/mt)

PAAAA00 417.96418.46 418.210 +24.035

AAPKH00 6.75/7.25

Naphtha LR2 ($/mt)

AAIDA00 419.61420.11 419.860 +24.025

Gasoline 95 unleaded

AAICY00 63.5463.58 63.560 +3.360

AAWUJ00 3.88/3.92

Gasoline 95 unleaded CFR

AAWUK00 5.26/5.30

Kerosene

PJAAA00 58.1758.21 58.190 +2.650

PJACV00 1.28/1.32

Kerosene LR2

AAKNZ00 58.1758.21 58.190 +2.650

Gasoil 10 ppm

AAIDT00 60.2960.33 60.310 +3.120

AAIDU00* 2.83/2.87

Gasoil 0.005% sulfur

AASGJ00 60.2460.28 60.260 +3.120

AASGK00* 2.78/2.82

Gasoil 0.05% sulfur

AAFEZ00 58.8458.88 58.860 +3.120

AAFFD00* 1.38/1.42

Gasoil 0.25% sulfur

AACUA00 57.8457.88 57.860 +3.120

AACUC00* 0.38/0.42

Gasoil

POAAT00 58.8458.88 58.860 +3.120

POAID00* 1.38/1.42

Gasoil LR2

AAKBT00 58.8458.88 58.860 +3.120

HSFO 180 CST ($/mt)

PUABE00 245.99246.03 246.010 +18.110

AAXJA00 0.75/1.25

HSFO 380 CST ($/mt)

AAIDC00 242.03242.07 242.050 +19.920

AAXJB00 0.75/1.25

HSFO 180/380 spread ($/mt) PPXDM00 -3.98/-3.94 -3.960 +1.810

*premium to MOPAG Gasoil during loading.

Singapore paper

(PGA page 2004)

7.000 0.000

3.900 -0.080

5.280

1.300 0.000

2.850

2.800

1.400

0.400

1.400

0.000

0.000

0.000

0.000

0.000

1.000 -1.000

1.000 -1.000

Subscriber notes

(PGA page 1500)

Due to a change in Singapores gazetted public

holidays for 2015 following the announcement of a

general election, Platts Singapore office will no longer

be open Friday, September 11, 2015, as had been

previously announced. No oil or shipping publications

or assessments from Singapore will be carried out on

that date. Normal publishing schedules will resume

Monday, September 14, 2015. For full details of Platts

publishing schedule and services affected, refer to

http://www.platts.com/holiday Platts is proposing to

reflect deliveries from the Pulau Seraya Power Station

Terminal in Singapore in its benchmark FOB Singapore

assessments for gasoil. Under Platts methodology, certain

approved alternative locations may be used for offers

of oil published during the Market on Close assessment

(Subscriber notes continue on page 13)

Asia-Pacific/Arab Gulf Marketscan

September 1, 2015

Asia products

Code Mid

Change Code Mid

Change

Code Mid

Change

(PGA page 2655)

Balance September* ($/barrel) October ($/barrel) November ($/barrel)

Naphtha Japan ($/mt)

Naphtha

AAPLD00 47.5347.57

47.550

+0.250

Gasoline 92 unleaded

AAXEK00 61.7861.82

61.800

-2.850

Reforming Spread

AAXEN00 14.23/14.27

14.250

-3.100

Kerosene

AAPLE00 61.7661.80

61.780

+3.310

Gasoil

AAPLF00 61.8861.92

61.900

+3.520

HSFO 180 CST ($/mt)

AAPML00 265.43265.47 265.450

+3.950

HSFO 380 CST ($/mt)

AAPKB00 260.73260.77 260.750

+5.450

Gasoil EFS ($/mt)

AAQTX00

-33.100

+2.610

AAXFE00 454.25454.75 454.500

+24.000

AAXFF00 455.50456.00 455.750

+23.500

PAAAQ00 47.7347.77

PAAAR00 47.8847.92 47.900

+2.800

AAXEL00 60.9360.97

AAXEO00 13.18/13.22

PJABS00 63.2163.25

POAFC00 62.7062.74

PUAXZ00 270.43270.47

AAPKC00 265.43265.47

AAQTY00

47.750

+2.850

60.950

+2.600

13.200

-0.250

63.230

+4.150

62.720

+3.920

270.450

+24.200

265.450

+23.900

-32.240

-2.050

AAXEM00 60.0360.07 60.050

+2.550

AAXEP00 12.13/12.17 12.150

-0.250

PJABT00 64.1864.22 64.200

+4.040

POAFG00 63.3363.37 63.350

+3.820

PUAYF00 275.23275.27 275.250

+23.800

AAPKD00 269.68269.72 269.700

+23.150

AAQTZ00 -29.290

+0.710

*Balance month swaps are assessed from the 1st to the 15th of the month, and to the 14th of February; **Interim Gasoil swaps published ahead of the change in specification of FOB Singapore Gasoil January 2, 2013.

Gasoline components

(PBF page 2410)

FOB Singapore ($/mt)

MTBE

PHALF00 686.00688.00

Gasoline

687.000

+38.000

Singapore demurrage

(PGT pages 2910 & 2960)

$/day

Demurrage Clean

Demurrage Dirty

AALPY00 22000.000

-500.000

AALQA00 27000.000

+500.000

Indonesia physical oil assessments

(PGA page 2516)

FOB Indonesia ($/barrel)

Premium/Discount

LSWR Mixed/Cracked

LSWR

PPAPU00 47.0047.04

AAUGR00 44.8044.84

47.020

+2.920

44.820

+2.920

AAHXR00 7.76/7.80

AAWTX00 4.37/4.41

Japan physical oil assessments

7.780

+0.080

4.390

0.000

(PGA page 2006)

C+F Japan ($/mt)

Premium/Discount

Naphtha

Nph 2nd 1/2 Oct

Nph 1st 1/2 Nov

Nph 2nd 1/2 Nov

Naphtha MOPJ Strip

PAAAD00 454.25454.75

PAAAE00 454.25454.75

PAAAF00 454.25454.75

PAAAG00 454.25454.75

AAXFH00 455.50456.00

454.500

+23.875

454.500

+23.500

454.500

+23.750

454.500

+24.000

455.750

+22.750

PAADI00 -1.75/-1.25

-1.500

0.000

AAXFI00 -1.50/-1.00

-1.250

+1.130

C+F Japan ($/barrel)

Premium/Discount

Gasoline 91-92 unleaded

Gasoline 95 unleaded

Kerosene

Gasoil

HSFO 180 CST ($/mt)

PGACW00 65.4665.50

PGAQQ00 69.5769.61

PJAAN00 62.5162.55

POABF00 67.1167.15

PUACJ00 275.98276.02

65.480

+3.460

69.590

+3.360

62.530

+2.830

67.130

+3.050

276.000

+18.180

PAADK00 0.33/0.37

AAWVG00 2.61/2.65

0.350

0.000

2.630

-0.050

FOB Okinawa ($/barrel)

Premium/Discount

Gasoil

POAIW00 60.9160.95

60.930

+3.150

POAIY00 -1.22/-1.18

South Korea physical oil assessments

-1.200

0.000

(PGA page 2008)

C+F Korea ($/mt)

Premium/Discount

Naphtha

PAADE00 450.75451.25

451.000

+23.870

PAADG00 -3.75/-3.25

-3.500

0.000

Copyright 2015, McGraw Hill Financial

Market analysis: (PGA page 2396) Surging US RBOB

futures values and stable regional demand provided

support to the Asian gasoline market Tuesday, although

participants were not optimistic about the demand

outlook for the rest of the year. Retail gasoline demand

tails off after the peak summer demand season and

refineries with turnarounds planned for September and

October have largely secured the stocks they need,

making it increasingly difficult for supply in the region

to find outlets, trade sources said. One ray of hope is

Indonesia, where state-owned Pertamina is expected

to import around 10.44 million barrels of gasoline in

September, up from 10.11 million barrels in August, trade

sources said. The September estimate includes about 9.4

million barrels of 88 RON gasoline, up from 8.47 million

barrels in August, which could be due to the Eid al-Adha

holiday on September 24, when demand typically rises.

September imports of 92 RON finished grade gasoline

and high octane mogas component 92 RON gasoline

were estimated at 600,000 barrels and 400,000 barrels

respectively, down from 800,000 barrels for each grade

in August. Indonesia is expected to import slightly less

88 RON gasoline after it starts up a new gasoline-making

residue fluid catalytic cracker with 62,000 b/d throughput

at the 348,000 b/d Cilacap refinery in the fourth quarter.

In China, Guangxi Petrochemical, a unit of state-controlled

Asia-Pacific/Arab Gulf Marketscan

Asia products

Code

Mid Change

Code

South Korea physical oil assessments

Mid Change

(PGA page 2008)

FOB Korea ($/barrel) Premium/Discount

PGAQO00 66.5766.61 66.590

+3.410

Gasoline 95 unleaded

Jet

PJADG00 60.6160.65 60.630

+2.830

PJADI00 -1.57/-1.53

Gasoil

POAIE00 60.8660.90 60.880

+3.150

POAIG00 -1.27/-1.23

HSFO 180 CST 3.5% ($/mt)

PUBDP00 268.82268.86 268.840

+18.810

PUBDR00 1.75/2.25

HSFO 380 CST 3.5% sulfur ($/mt) PUBDY00 264.86264.90 264.880

+20.620

PUBEA00 1.75/2.25

Mean of Platts West India netbacks

-1.550

0.000

-1.250

0.000

2.000

-0.500

2.000

-0.500

(PGA page 2012)

FOB India ($/mt) FOB India ($/barrel)

AAQWK00 424.880

+23.870

AAQWJ00 47.210

+2.650

Naphtha

Gasoline (92 RON)

AARBQ00 515.120

+29.410

AARBP00 60.600

+3.460

Gasoline (95 RON)

AAQWI00 543.380

+28.230

AAQWH00 64.690

+3.360

Jet kero

AAQWM00 463.240

+20.860

AAQWL00 58.640

+2.640

Gasoil (10ppm)

AAQWO00 474.250

+23.620

AAQWN00 62.240

+3.100

Gasoil (500ppm)

AAQWQ00 442.050

+23.170

AAQWP00 59.340

+3.110

Gasoil (2500ppm)

AAQWS00 438.550

+23.240

AAQWR00

58.870

+3.120

Australia (PGA page 2014)

C+F Australia ($/barrel)

AACZF00 68.2068.24

Gasoline 92

Gasoline 95

AACZH00 72.3172.35

Jet

AAFIY00 66.8166.85

Gasoil 10ppm

AAQUD00 70.8670.90

Freight netbacks

68.220

+3.460

72.330

+3.360

66.830

+2.640

70.880

+3.100

(PGA pages PGT2910 & PGT2960)

AG-Spore

Spore-Japan AG-Japan

Spore-Australia

AAPOF00 24.20

AAPOG00 36.29*

Naphtha

AAPOH00 34.64*

Naphtha-LR2

AAPOC00 3.18 AAPOD00 2.85

AAPOE00 5.59

Gasoline

AAPOI00 2.63 AAPOJ00 6.01

Kerosene

AAPOK00 2.63

Kerosene-LR2

AAPOL00 2.79 AAPOM00 6.38

Gasoil

AAPON00 2.79

Gasoil-LR-2

AAPOO00 15.46* AAPOP00 14.53*

HSFO 180 CST

AAPOQ00 15.46*

HSFO 380 CST

All values in $/barrel, except * values in $/mt

South China/Hong Kong physical oil assessments

(PGA page 2010)

South China ($/mt) Premium/Discount to MOPS ($/barrel)

AAICU00 529.50533.50 531.500

+29.500

Gasoline 90 unleaded

Gasoline 93 unleaded

AAICW00 541.50545.50 543.500

+29.500

Jet/kero

PJABQ00 493.25497.25 495.250

+22.250

AAWTW00 0.50/0.54

0.520 0.000

Gasoil

POAFA00 463.75467.75 465.750

+23.500

AABJZ00 0.37/0.41

0.390 0.000

Gasoil 0.2%

AALEK00 460.75464.75 462.750

+23.500

Hong Kong bunker grades ($/mt)

PUACC00 275.00276.00 275.500

+22.500

HSFO 180 CST

HSFO 380 CST

PUAER00 269.50270.50 270.000

+22.500

*C+F Hong Kong, $/barrel premium/discount to Mean of Platts Singapore.

Copyright 2015, McGraw Hill Financial

September 1, 2015

PetroChina, will make its first gasoline direct export to

Australia in September, a 36,000 mt cargo that largely

conforms to Euro 5 standards, sources said. Guangxi

received a 370,000 mt gasoline export quota in the

latest round of allocations that covers Q4. China exported

136,826 mt of gasoline to Australia over January-July,

comprising 4.3% of Australias total import for the period.

This is expected to rise as China steps up export efforts

amid slowing domestic demand. The Singapore Platts

Market on Close assessment process saw 1.55 million

barrels, or 31 cargoes, of 95 RON gasoline traded in

August, the highest volume on record. Sietco, the trading

arm of oil major Shell, was the biggest buyer in August

at 1.35 million barrels, while BP, PetroChina, Unipec and

Petronas each bought one cargo of 50,000 barrels.

Thailands PTT was the biggest seller at 12 of the 31

cargoes traded, followed by PetroChina with seven.

Gasoline Unl 92 FOB Spore Cargo assessment

rationale: (PGA page 2392) FOB Singapore 92 RON

gasoline was assessed at $62.63/barrel Tuesday. The

assessment took into consideration PTTs offer of a

September 27-October 1 loading cargo at $62.40/b, as

well as the trades of September 16-20 loading cargoes

from PTT and Socar to PetroChina, both at $62.60/b.

The above commentary applies to the following market data

code: PGAEY00

Gasoline Unl 95 FOB Spore Cargo assessment

rationale: (PGA page 2392) FOB Singapore 95 RON

gasoline was assessed at $66.74/barrel Tuesday to

reflect a narrowed 95-92 inter-RON spread.

The above commentary applies to the following market data

code: PGAEZ00

Gasoline Unl 97 FOB Spore Cargo assessment

rationale: (PGA page 2392) FOB Singapore 97 RON

gasoline was assessed at $69.45/barrel Tuesday, taking

into account the inter-octane spreads in the absence of

bids or offers for 97 RON gasoline.

The above commentary applies to the following market data

code: PGAMS00

Asia-Pacific/Arab Gulf Marketscan

Singapore Gasoline bids/offers/trades: (PGA page 2393)

PLATTS ASIA MOGAS CARGO MOC: OUTSTANDING

INTEREST: BIDS: 92 RON: FOB Straits: Sep 16-20:

PetroChina no longer bids on at $62.60/b after trade

with PTT at $62.60/b and with Socar at $62.60/B for

50kb; 92 RON: FOB Straits: Sep 16-20: SK bids at

$62.10/b for 50kb; 92 RON: FOB Straits: Sep 22-26:

Total bids at $62.10/b for 50kb; 95 RON: FOB Straits:

Sep 16-20: Vitol no longer bids at $66.58/b or MOPS

95 plus $0.68/b after trade with P66 for 50kb; 95

RON: FOB Straits: Sep 16-20: Socar bids at MOPS 95

plus $1.10/b for 50kb

PLATTS ASIA MOGAS CARGO MOC: OUTSTANDING

INTEREST: OFFERS: 92 RON: FOB Straits: Sep 22-26:

Sietco offers at $63.10/b for 50kb; 92 RON: FOB

Straits: Sep 24-28: Unipec offers at $63.30/b or

MOPS 92 plus $1.80/b, or Sep 27-Oct 1 at $63.30/b

or MOPS 92 plus $1.80/b for 50kb; 92 RON: FOB

Straits: Sep 27-Oct 1: PTT offers at $62.40/b for

50kb

PLATTS ASIA MOGAS CARGO MOC: DEAL SUMMARY:

THREE TRADES: 95 RON: FOB Straits: Sep 16-20:

P66 sells to Vitol at $66.58/b for 50kb (4:24:10); 92

RON: FOB Straits: Sep 16-20: PTT sells to PetroChina

at $62.60/b for 50kb (4:24:29); 92 RON: FOB Straits:

Sep 16-20: Socar sells to PetroChina at $62.60/b for

50kb (4:28.29)

Singapore Gasoline exclusions: (PGA page 2393)

No market data was excluded from the gasoline

assessment process on September 1, 2015.

Foreign exchange rates

USD/Yen

Eur/USD

GBP/USD

USD/SGD

USD/MYR

USD/HK

AUD/USD

USD/CNY

(PGA page 2160)

AAWFX00 119.7400

-1.4400

AAWFU00 1.1287

+0.0074

AAWFV00 1.5324

-0.0080

AAWFZ00 1.4085

-0.0048

AAWGA00 4.1595

-0.0355

AAWFY00 7.7500

-0.0006

AAWFT00 0.7077

-0.0063

AAWFW00 6.3752

-0.0141

Source: Development Bank of Singapore

Naphtha

Market analysis: (PGA page 2398) The recent burst of

positive sentiment in global crude oil markets was still

filtering through to the Asian naphtha market Tuesday

despite signs it was fading in early day trade. The mood

is better now, a trader said, noting crude oil futures had

risen more than 20% week on week on expectations of

supply cuts. October ICE Brent futures stood at $52.74/

mt at 0653 GMT Tuesday, compared with $43.45/mt at

the 0830 GMT Asia close last Tuesday, Platts data showed.

Regional naphtha traders said demand for naphtha remain

stable. Prompt demand for naphtha in China and South

Korea is good, one trader said. South Koreas LG Chem

is seeking 22,500-27,500 mt cargoes of naphtha with a

minimum paraffin content of 70% for delivery to Daesan

over October 1-15 or October 8-15. The total volume

was not specified; LG Chem typically acquires one or

two cargoes in its tenders. The tender closes Tuesday

and has a pricing basis of Mean of Platts Japan naphtha

assessments 30 days prior to delivery, trade sources said.

LG Chem last sought 25,000 mt cargoes of open-spec

naphtha with a minimum paraffin content of 70% for H1

October delivery into Yeosu or Daesan, which trade sources

said it bought at a discount of $4/mt to MOPJ naphtha

assessments. Seller details could not be confirmed.

Naphtha C+F Japan Cargo assessment rationale:

(PGA page 2388) The CFR Japan naphtha marker was

assessed at $454.50/mt Tuesday. H2 October was

assessed at $454.50/mt, H1 November at $454.50/

mt and H2 November at $454.50/mt. The assessment

reflected offers for H2 October, H1 November and H2

November at $455/mt each, equivalent to a crack

spread of $89.75/mt versus October ICE Brent futures,

demonstrating value.

The above commentary applies to the following market data

code: PAAAD00

Naphtha FOB Spore Cargo assessment rationale:

(PGA page 2388) FOB Singapore naphtha was assessed

at $47.76/barrel Tuesday, based on an assessed

Copyright 2015, McGraw Hill Financial

September 1, 2015

freight rate of $24.2/mt for the Singapore-Japan route

for 30,000-mt cargoes. CFR Japan H2 October was

assessed at $454.50/mt, or $50.50/b.

The above commentary applies to the following market data

code: PAAAP00

Naphtha FOB Arab Gulf Cargo assessment rationale:

(PGA page 2388) FOB Arab Gulf naphtha was assessed

at $418.21/mt Tuesday, based on an assessed freight

rate of $36.29/mt for the Persian Gulf-Japan route for

55,000-mt cargoes. The CFR Japan naphtha marker was

assessed at $454.50/mt.

The above commentary applies to the following market data

code: PAAAA00

Naphtha Cargo bids/offers/trades: (PGA page 2389)

JAPAN NAPHTHA CARGO: DEAL SUMMARY: No Trades.

JAPAN NAPHTHA CARGO: OUTSTANDING INTEREST:

BIDS: Naphtha: CFR Japan: 25kt: Socar bid H1 Nov

452.00 or H2 Nov 451.00; WD Naphtha: CFR Japan:

25kt: Itochu withdraws bids H2 Oct 452.00 or H1 Nov

450.00 (4:28:55); WD Naphtha: CFR Japan: 25kt:

Vitol withdraws bid H1 Nov 451.00 or H2 Nov 451.00

(4:27:04).

JAPAN NAPHTHA CARGO: OUTSTANDING INTEREST:

OFFERS: Naphtha: CFR Japan: 25kt: BP offers H2 Oct

455.00; Naphtha: CFR Japan: 25kt: Idemitsu offers

H2 Oct 457.00; Naphtha: CFR Japan: 25kt: Shell

offers H1 Nov 455.00 or H2 Nov 455.00; Naphtha:

CFR Japan: 25kt: Lukoil offers H1 Nov 457.00 or H2

Nov 457.00; Naphtha: CFR Japan: 25kt: BP offers H1

Nov 467.00; Naphtha: CFR Japan: 25kt: Vitol offers

H1 Nov 461.00 or H2 Nov 461.00.

JAPAN NAPHTHA CARGO SPREADS: OUTSTANDING

PLATTS OIL IS ON TWITTER

FOR UP-TO-THE-MINUTE OIL NEWS

AND INFORMATION FROM PLATTS

Follow us on twitter.com/PlattsOil

Asia-Pacific/Arab Gulf Marketscan

INTEREST: BIDS: Naphtha: CFR Japan: 25kt: Trafigura

bid H2 Oct/H2 Nov -1.50 or H2 Oct/H2 Dec -2.50 or

H2 Nov/H2 Jan -2.50.

JAPAN NAPHTHA CARGO SPREADS: OUTSTANDING

INTEREST: OFFERS: No Offers.

Naphtha Cargo exclusions: (PGA page 2389) No market

data was excluded from the September 1, 2015 Asian

Naphtha assessment

Jet

Market analysis: (PGA page 2499) While some seasonal

uptick is expected in the fourth quarter, demand for

aviation fuel currently remains bearish. When compared

to last year, demand is not as aggressive. We need

some fresh news, stimulus, said a North Asian refiner

Tuesday. The heavy supply situation in the region was

also bearish news for the market. Asia and the Middle

East has been flooded with cargoes as a number of new

refineries had come online in the Middle East, and the

Chinese have been increasing their jet exports. Chinas

Ministry of Commerce last week issued the fourth batch

of export quotas for 2015 totaling 9.9 million mt of oil

products -- triple the volume approved in the third batch

and taking the total volume allocated so far for 2015 to

28.65 million mt, up 47% year on year, industry sources

said. The products covered under the export quota

include gasoil, gasoline, jet/kerosene and naphtha. The

quota for jet fuel for 2015 is 13,320,000 mt. So far,

6,287,000 mt was exported between January and July,

leaving 7,033,000 mt of potential exports still to come.

And while, Chinas apparent demand for jet/kerosene

jumped 20% year on year in July to 753,000 b/d, and

was up 13.4% from June when demand fell 1.9% year

on year, there was a 6.1% year-on-year stock build to

2.23 million mt as of end-July, Platts calculations based

on recently released official government data showed.

In tender news, Sri Lankas Ceypetco bought 800,000

barrels of jet A-1 fuel at a premium of $1.62/b to MOPS

jet fuel/kerosene assessments, DES, for delivery over

September to April.

September 1, 2015

European products ($/mt)

Code

Mid Change

Code

Mid Change

Mediterranean

FOB (Italy)

Prem Unl 10ppm

Naphtha

Jet aviation fuel

Gasoil 0.1%

10ppm ULSD

1%

3.5%

AAWZA00 521.25521.75

PAAAI00 385.50386.00

AAIDL00 482.00482.50

AAVJI00 460.50461.00

AAWYY00 482.50483.00

PUAAK00 244.00244.50

PUAAZ00 234.50235.00

521.500

+3.000

385.750

-3.250

482.250

+5.000

460.750

+5.250

482.750

+4.750

244.250

+8.500

234.750

+6.250

(PGA page 1114)

CIF (Genova/Lavera)

AAWZB00 531.00531.50 531.250

+3.000

PAAAH00 398.00398.50 398.250

-3.250

AAVJJ00 474.75475.25 475.000

+5.250

AAWYZ00 494.25494.75 494.500

+4.750

PUAAJ00 254.75255.25 255.000

+8.500

PUAAY00 245.25245.75 245.500

+6.250

Northwest Europe cargoes

(PGA page 1110)

CIF (Basis ARA)

AAXFQ00 530.75531.25 531.000

-14.000

Gasoline 10ppm

Naphtha Swap

PAAAJ00 413.75414.25 414.000

+1.500

Naphtha Phy

PAAAL00 408.25408.75 408.500

-3.250

Jet

PJAAU00 502.00502.50 502.250

+5.000

Ultra low sulfur diesel 10ppm AAVBG00 487.75488.25 488.000

+1.750

Gasoil 0.1%

AAYWS00 476.25476.75 476.500

+4.500

Diesel 10ppm NWE

AAWZC00 490.50491.00 490.750

+1.750

Diesel 10 PPM UK

AAVBH00 492.00492.50 492.250

+1.750

1%

PUAAL00 246.50247.00 246.750

+8.000

3.5%

PUABA00 235.25235.75 235.500

+12.250

0.5-0.7% straight run

Low sulfur VGO

AAHMZ00 349.00350.00 349.500

+4.000

High sulfur VGO

AAHND00 343.50344.50 344.000

+4.000

Northwest Europe barges

FOB NWE

PJAAV00 491.00491.50 491.250

+5.000

AAVBF00 473.50474.00 473.750

+1.750

AAYWR00 460.50461.00 460.750

+4.500

AAWZD00 475.75476.25 476.000

+1.750

PUAAM00 236.75237.25 237.000

+8.000

PUABB00 223.50224.00 223.750

+12.000

PKABA00 304.00305.00 304.500

+4.500

AAHMX00 345.50346.50 346.000

+4.000

AAHNB00 340.00341.00 340.500

+4.000

(PGA pages 1112 & 1380)

FOB Rotterdam

Eurobob

Unleaded 98

Premium Unleaded

Reformate

MTBE*

Naphtha Phy

Jet

Gasoil 50 ppm

Gasoil 0.1%*

10 ppm*

1%

3.5%

Fuel Oil 3.5% 500 CST

Low sulfur VGO

High sulfur VGO

AAQZV00 515.25515.75

AAKOD00 600.25600.75

PGABM00 534.75535.25

AAXPM00

PHALA00 670.75671.25

PAAAM00 404.25404.75

PJABA00 500.50501.00

AAUQC00 473.50474.00

AAYWT00 466.25466.75

AAJUS00 477.25477.75

PUAAP00 242.25242.75

PUABC00 242.25242.75

PUAGN00 234.25234.75

AAHNF00 346.00347.00

AAHNI00 340.50341.50

515.500

-14.000

600.500

-14.000

535.000

-15.500

555.500

-14.000

671.000

+3.250

404.500

-3.250

500.750

+7.000

473.750

+3.000

466.500

+5.000

477.500

+3.750

242.500

+12.250

242.500

+12.250

234.500

+12.250

346.500

+4.500

341.000

+4.500

*FOB Amsterdam-Rotterdam-Antwerp

ICE LS gasoil GWAVE (Previous days values)

Sep

Oct

(PGA page 702)

PXAAJ00 482.750 31-Aug-15

PXAAK00 491.750 31-Aug-15

Rotterdam bunker

380 CST

PUAFN00 245.00246.00

(PGA page 1112)

245.500

+13.000

Copyright 2015, McGraw Hill Financial

Asia-Pacific/Arab Gulf Marketscan

Jet Kero FOB Spore Cargo assessment rationale:

(PGA page 2494) The FOB Singapore jet fuel/kerosene

cash differential was assessed at minus $1.36/

barrel Tuesday, down 19 cents/b day on day, based

on structure in the absence of bids and offers proving

value. The September/October swap spread was down

37 cents/b over the period at minus $1.45/b. The cash

differential for the front-loading period of September

16-20, middle-loading period of September 21-25 and

back-loading period of September 26-October 1 were

assessed at minus $1.41/b, minus $1.34/b and minus

$1.33/b, respectively. With MOPS strip at $62.18/b and

the cash differential at minus $1.36/b, the outright price

of jet fuel was $60.82/b.

The above commentary applies to the following market data

code: PJABF00

Singapore Jet bids/offers/trades: (PGA page 2495)

ASIA JET CARGO MOC: DEAL SUMMARY: No trades

reported

ASIA JET CARGO MOC: OUTSTANDING INTEREST:

BUDS: No bids reported

ASIA JET CARGO MOC: OUTSTANDING INTEREST:

OFFERS: Jet: FOB Straits: Vitol offers MOPS -0.50 Sep

16-20 100kb (Deemed pricing Sep 16-22) INCO; Jet:

FOB Straits: Hin Leong offers MOPS -0.30 Sep 16-20

100kb INCO; Jet: FOB Straits: BP offers MOPS -0.50

Sep 16-20 100kb (Deemed pricing Sep 15-21) BP

GTC; Jet: FOB Straits: Sietco offers MOPS -0.30 Sep

16-20 100kb (Deemed pricing Sep 16-22); Jet: FOB

Straits: Winson offers MOPS -0.50 Sep 21-25 100kb

INCO; Jet: FOB Straits: Hin Leong offers MOPS -0.30

Sep 21-25 100kb INCO; Jet: FOB Straits: BP offers

MOPS -0.50 Sep 21-25 100kb (Deemed pricing Sep

21-28) BP GTC; Jet: FOB Straits: Petrochina offers

MOPS -0.50 Sep 24-28 100kb INCO; Jet: FOB Straits:

BP offers MOPS -0.30 Sep 26-30 100kb (Deemed

pricing Sep 25 - Oct 1) BP GTC; Jet: FOB Straits: Hin

Leong offers MOPS -0.30 Sep 26-30 100kb INCO; Jet:

FOB Straits: Noble offers MOPS -0.40 Sep 27-Oct 1

100kb (Deemed pricing Sep 25 - Oct 1)

(continued on page 8)

September 1, 2015

US products (/gal)

US West Coast pipeline

(PGA page 158)

Code Mid

Change

Code Mid

Change

Los Angeles San Francisco

AAUHA00 176.32176.42 176.370 -9.180

Unleaded 84

Unleaded 84

PGADG00 176.52176.62 176.570 -9.180

Premium 88.5

PGABG00 196.32196.42 196.370 -9.180

PGABO00 196.52196.62 196.570 -9.180

CARBOB

AAKYJ00 192.32192.42 192.370 -3.180

AAKYN00 176.57176.67 176.620 -9.180

CARBOB PREM

AAKYL00 202.32202.42 202.370 -3.180

AAKYP00 196.57196.67 196.620 -9.180

Jet

PJAAP00 149.20149.30 149.250 -12.390

PJABC00 149.20149.30 149.250 -12.390

ULS (EPA) Diesel

POAET00 152.20152.30 152.250 -11.140

POAEY00 153.20153.30 153.250 -11.640

CARB diesel

POAAK00 153.45153.55 153.500 -11.140

POAAL00 154.45154.55 154.500 -11.640

Seattle

Portland

AAXJE00 162.17162.27 162.220 -9.180

AAXJC00 163.32163.42 163.370 -9.180

Unleaded 84

Premium 90

AAXJF00 192.17192.27 192.220 -9.180

AAXJD00 193.32193.42 193.370 -9.180

Jet

PJABB00 149.20149.30 149.250 -12.390

ULS (EPA) Diesel

AAUEX00 156.30156.40 156.350 -9.390

AAUEY00 157.45157.55 157.500 -9.390

180 CST

PUAWT00 352.95353.05 353.000 -1.000

PUAWV00 387.95388.05 388.000 -7.000

380 CST

PUAWZ00 302.95303.05 303.000 -1.000

PUAXB00 352.95353.05 353.000 -7.000

Phoenix

AADDP00 187.32187.42 187.370 -3.180

RBOB unleaded 84

RBOB premium 89.5

PPXDJ00 197.32197.42 197.370 -3.180

Differential to NYMEX

CARBOB

CARBOB paper 1st month*

CARBOB paper 2nd month*

Jet Fuel

ULS (EPA) Diesel

CARB Diesel

AANVX00 52.95/53.05 53.000

+6.000

AAKYR00 25.95/26.05 26.000

-19.000

AAKYS00 18.45/18.55 18.500 -6.500

AANVY00 -8.30/-8.20 -8.250

-1.250

AANVZ00 -5.30/-5.20 -5.250

0.000

AANWA00 -4.05/-3.95 -4.000

0.000

* Premium to NYMEX gasoline settlement

US West Coast waterborne

Los Angeles San Francisco

Unleaded 87

PGADI00 176.32176.42 176.370 -9.180

Jet

PJABI00 148.20148.30 148.250 -12.390

0.5% S

PUAGD00 40.3940.41 40.400 -2.440

1.0% S

PUAAQ00 39.8939.91 39.900 -2.440

2.0% S

AABGP00 37.3937.41 37.400 -2.440

180 CST

PUAWR00 287.45287.55 287.500 -15.500

PUBDA00 300.95301.05 301.000 -7.000

380 CST

PUAWX00 237.45237.55 237.500 -15.500

PUBCY00 260.95261.05 261.000 -7.000

ASIA-PACIFIC/ARAB GULF

MARKETSCAN

Volume 34 / Issue 165 / September 1, 2015

Editorial: Dave Ernsberger, Tel +44 20 7176 6116, Global Oil Director; Jonty Rushforth, Tel +65-6530-6581, Editorial Director, Asia & Middle East Oil Markets.

Client services information: North America: 800-PLATTS8 (800-752-8878); direct: +1 212-904-3070 Europe & Middle East: +44-20-7176-6111 Asian Pacific:

+65-6530-6430 Latin America: +54-11-4121-4810, E-mail: support@platts.com

Copyright 2015 McGraw Hill Financial. All rights reserved. No portion of this publication may be photocopied, reproduced, retransmitted, put into a computer

system or otherwise redistributed without prior written authorization from Platts. Platts is a trademark of McGraw Hill Financial. Information has been obtained

from sources believed reliable. However, because of the possibility of human or mechanical error by sources, McGraw Hill Financial or others, McGraw Hill Financial

does not guarantee the accuracy, adequacy or completeness of any such information and is not responsible for any errors or omissions or for results obtained

from use of such information. See back of publication invoice for complete terms and conditions.

Copyright 2015, McGraw Hill Financial

Asia-Pacific/Arab Gulf Marketscan

September 1, 2015

Asia Pacific and Middle East crude assessments ($/barrel)

(Asia MOC)

API

Gravity Code

Mid Change

(Asia MOC) (Asia close)

Code

Mid Change

Code

Condensate

Mid Change

Diff to Dubai Diff to Asian Dated Brent

NW Shelf

61.9 PCAGX00 49.7849.82 49.800

+3.140 AAPAI00 -2.05

-0.050

Ras Gas

57.0 AAPET00 52.0352.07 52.050

+3.530

AAPEU00

0.65/0.75

0.700

-0.050

AARAZ00 -0.560

-0.420

DFC 56.82

ADFCA00 52.0352.07 52.050

+3.530

ADFCB00

0.65/0.75

0.700

-0.050

ADFCC00 -0.560

-0.420

Qatar LSC

56.9 AARBB00 51.1851.22 51.200

+3.530

AARBD00 -0.20/-0.10 -0.150 -0.050

AARBC00 -1.410

-0.420

South Pars

57.4 AARAV00 49.0349.07 49.050

+3.530

AARAX00 -2.35/-2.25 -2.300 -0.050

AARAW00 -3.560

-0.420

Diff to ICP

Senipah

54.4 AAEOE00 50.8350.87 50.850

+3.140

AAEOK00 -3.10/-3.00 -3.050 -0.050

AAPBE00 -1.000

-0.050

Light crude

Heavy crude

Copyright 2015, McGraw Hill Financial

AAPBD00 49.250 +0.680

(PGA page 2215)

AAPAB00 48.750 +0.780

AAPAT00 47.450 +0.780

AAOZV00 50.850 +0.730

AAPBP00 46.060 +0.790

AAPAD00 48.850 +0.780

AAPBH00 47.510 +0.840

AAPBB00 45.860 +0.790

AAPBF00 43.560 +0.990

AARAM00 51.950 +0.530

AAREN00 51.950 +0.530

AARWD00 49.370 +0.300

AAPAN00 52.710 +0.490

AAOZX00 52.250 +0.730

AAPAR00 53.000 +0.730

AAPAP00 52.950 +0.730

(PGA page 2217)

AARAQ00 50.500 +0.780

AAPAJ00 51.000 +0.780

AAPAF00 45.950 +0.930

AAPAZ00 44.360 +0.840

AAPAL00 43.510 +0.840

AAPBN00 42.610 +0.840

AAPAV00 41.630 +0.840

AAPBJ00 42.410 +0.840

(PGA page 2218)

Diff to ICP Diff to Asian Dated Brent

Dar Blend

25.0 AARAB00

43.8343.87

43.850 + 3.190 AARAC00 -8.000

0.000

Shengli

24.2 PCABY00

43.5943.63

43.610 + 3.190 AAPAY00 -8.240

0.000

Duri

20.8 PCABA00

43.6943.73

43.710 + 3.190

PCABB00

-0.05/0.05

0.000

0.000

AAPBM00 -8.140

0.000

Stybarrow 22.8

AARAH00 50.350

+ 3.290 AARAI00 -1.500

+ 0.100

Enfield

22.0 AARAE00 51.350

+ 3.240 AARAF00 -0.500

+ 0.050

Vincent

18.3 AARAK00 49.050

+ 3.290 AARAL00 -2.800

+ 0.100

Change

AAPAH00 48.200 +0.680

AARAY00 50.400 +0.430

ADFCD00 50.400 +0.430

AARBA00 49.550 +0.430

AARAU00 47.400 +0.430

(PGA page 2216)

Diff to OSP Diff to Asian Dated Brent

Su Tu Den

36.8 AARAR00 52.0852.12 52.100

+3.190

AARAT00 -1.80/-1.70 -1.750 0.000

AARAS00 0.250

0.000

Bach Ho

40.7 PCAHY00 52.5852.62 52.600

+3.190 AAPAK00 0.750

0.000

Nanhai

40.0 PCAFR00 47.5347.57 47.550

+3.290 AAPAG00 -4.300

+0.100

Diff to ICP

Minas

35.3 PCABO00 45.9445.98 45.960

+3.190

PCABP00 -0.20/-0.10 -0.150 0.000

AAPBA00 -5.890

0.000

Nile Blend

33.9 AAPLC00 45.0945.13 45.110

+3.190

AAPEX00 -1.05/-0.95 -1.000 0.000

AAPAM00 -6.740

0.000

Widuri

33.2 PCAFE00 44.1944.23 44.210

+3.190

PCAFF00 -0.75/-0.65 -0.700 0.000

AAPBO00 -7.640

0.000

Daqing

32.2 PCAAZ00 43.2243.26 43.240

+3.190

AAPAW00 -8.620

0.000

Cinta

31.1 PCAAX00 43.9944.03 44.010

+3.190

PCAAY00 -0.75/-0.65 -0.700 0.000

AAPBK00 -7.840

0.000

Mid

(PGA page 2213)

(PGA page 2214)

Diff to ICP Diff to Asian Dated Brent

Cossack

47.7 PCAGZ00 50.3350.37 50.350

+3.190 AAPAC00 -1.500

0.000

Gippsland 48.7

PCACP00 49.0349.07 49.050

+3.190 AAPAU00 -2.800

0.000

Tapis

45.2 PCACB00 52.4352.47 52.450

+3.190 AAOZW00 0.600

0.000

Belida

45.1 PCAFL00 47.6447.68 47.660

+3.190

PCAFM00 -0.15/-0.05 -0.100 0.000

AAPBQ00 -4.190

0.000

Kutubu

44.3 PCAFJ00 50.4350.47 50.450

+3.190 AAPAE00 -1.400

0.000

Handil Mix

43.9 PCABE00 49.0949.13 49.110

+3.190

PCABF00

0.75/0.85

0.800

0.000

AAPBI00 -2.740

0.000

Attaka

42.3 PCAAJ00 47.4447.48 47.460

+3.190

PCAAK00 -0.35/-0.25 -0.300 0.000

AAPBC00 -4.390

0.000

Ardjuna

38.0 PCACQ00 45.1445.18 45.160

+3.290

PCACR00 -0.10/0.00 -0.050 0.000

AAPBG00 -6.690

+0.100

Diff to Dubai

+3.580

AARAP00

2.20/2.30

2.250

0.000

AARAO00 0.990

-0.370

Vityaz

41.6 AARAN00 53.5853.62 53.600

Sakhalin Blend 45.5 AARBN00 53.5853.62 53.600

+3.580

AARCN00

2.20/2.30

2.250

0.000

AARDN00 0.990

-0.370

ESPO M1

34.8 AARWF00 51.0051.04 51.020

+3.310

AASEU00

0.40/0.50

0.450

0.000

AARWE00 -0.330

-0.400

ESPO M2

34.8 AAWFE00 52.0852.12 52.100

+3.580

AAWFG00

0.70/0.80

0.750

0.000

Diff to Oman/Dubai

Sokol

39.7 AASCJ00 54.3454.38 54.360

+3.590

AASCK00

2.95/3.05

3.000

0.000

AAPAO00 1.750

-0.360

Kikeh

34.9 AAWUH00 53.8353.87 53.850

+3.190 AAOZY00 2.000

0.000

Miri Light

32.3 PCABQ00 54.5854.62 54.600

+3.190 AAPAS00 2.750

0.000

Labuan

32.0 PCABL00 54.5354.57 54.550

+3.190 AAPAQ00 2.700

0.000

Medium crude

Code

(PGA page 2212)

(London close)

(PGA page 2219)

AARAA00 42.250

+ 0.780

AAPAX00 42.010

+ 0.840

AAPBL00 42.110

+ 0.840

AARAG00 48.750

+ 0.930

AARAD00 49.750

+ 0.830

AARAJ00 47.450

+ 0.930

Asia-Pacific/Arab Gulf Marketscan

Singapore Jet exclusions: (PGA page 2495) No market

data was excluded from the September 1, 2015

assessment process

Jet Index

(PGA page 115)

Index

$/barrel

PJASO00 175.63 PJASO08 61.47

Asia & Oceania

Mid East & Africa PJMEA00 178.26 PJMEA08 59.69

PJGLO00 169.52 PJGLO08 62.01

Global

September 1, 2015

Platts assessment of futures markets at MOC close

(PGA page 703)

Singapore 16:30

ICE gasoil futures ($/mt)

Balance Sep *

AAQYM01

494.25

Oct

Oct

AAQYM02

499.50

Nov

Nov

AAQYM03

501.25

Dec

NYMEX RBOB (/gal)

XNRBA01

144.36

XNRBA02

141.81

XNRBA03

140.30

Oct

Nov

Dec

NYMEX NY ULSD (/gal)

XNHOA01 164.11

XNHOA02 165.72

XNHOA03 167.34

NYMEX RBOB (/gal)

NYRBM01 139.37

NYRBM02 136.79

NYRBM03 134.82

Oct

Nov

Dec

NYMEX NY ULSD (/gal)

NYHOM01 157.50

NYHOM02 159.37

NYHOM03 161.20

New York 15:15

Oct

Nov

Dec

NYMEX light sweet crude ($/barrel)

NYCRM01 45.25

Oct

NYCRM02 45.89

Nov

NYCRM03 46.55

Dec

*Balance month swaps are assessed from the 1st to the 15th of the month, and to the 14th of February.

Gasoil

Market analysis: (PGA page 2498) The Asian gasoil

market remained in the doldrums Tuesday, as supply

continued to flow into the market from North Asia, while

demand from Southeast Asia and regional importers

languished, traders said. Demand from West Africa was

said to be robust, providing a pillar of support to the

500 ppm sulfur grade. The gasoil Exchange of Futures

for Swaps for balance September fell slightly, to minus

$31/mt Tuesday afternoon, from minus $30.19/mt at

the Asian close Monday. At this level, the arbitrage to

send cargoes from the Persian Gulf and India to Europe

was workable for refiners and producers, but may not

be workable for traders. China could potentially export

more gasoil for the rest of the year, as the country has

only exported 2.516 million mt of gasoil over January to

July. Chinas gasoil export quota awarded so far this year

is 8.83 million mt, leaving 6.314 million mt of unused

export quota. In the spot market, Taiwans Formosa

Petrochemical issued a tender offering 720,000 barrels

of 500 ppm sulfur gasoil for October 1-5 loading

from Mailiao in a tender closing September 2, market

sources said. For September loading, Formosa sold

a total of eight cargoes of 500 ppm sulfur gasoil on

a spot basis, three to PetroChina and five to Winson

Oil, at a discount of $1.20/b and $1.68-$1.70/b to

Mean of Platts Singapore Gasoil assessment on a

FOB basis. In Sri Lanka, Ceypetco has signed a term

contract to buy 743,000 barrels of 500 ppm sulfur

gasoil in combination with 800,000 barrels of jet A-1

fuel for delivery into Dolphin Tanker berth in Colombo

China tanker fixtures

Vessel

Volume

Grade

Route

Arrival date

Bitumen

Bitumen

Crude

Bitumen

M100

Bitumen

Bitumen

SR380

Bitumen

Bitumen

M100

M100

Crude

Bitumen

Bitumen

Crude

Bitumen

Bitumen

Bitumen

Malaysia-Qingdao

Malaysia-Longkou

Venezuela-Rizhao

Malaysia-Qingdao

Russia-Tianjin

Malaysia-Qingdao

Malaysia-Qingdao

Venezuela-Qingdao

Malaysia-Qingdao

Malaysia-Rizhao

Russia-Longkou

Russia-Laizhou

Australia-Rizhao

Malaysia-Qingdao

Malaysia-Longkou

Oman-Rizhao

Malaysia-Rizhao

Malaysia-Longkou

Malaysia-Longkou Se

Importer

East China

TBA

TBA

Mulan

Fuwei

TBA

TBA

TBA

TBA

TBA

TBA

Daqing 453

Daqing 454

TBA

TBA

TBA

TBA

TBA

TBA

TBA

100kt

93kt

260kt

150kt

40kt

150kt

146kt

126kt

150kt

98kt

40kt

42kt

90kt

150kt

97kt

260kt

100kt

98kt

100kt

August 1

August 3

August 3

August 4

August 4

August 5

August 5

August 6

August 7

August 10

August 8

August 12

August 14

August 15

August 22

August 25

August 26

September

ptember 7

Jingbo

Qirun

Dongming

Yijia

Hengyuan

Yijia

Qirun

Chinaoil

Yijia

Yuhuang

ChemChina

Changyi

Dongming

Yijia

Hualong

Dongming

Yuhuang

2 Qirun

Tianhong

International tanker fixtures

(PGA pages PGT2904 and PGT2950)

Ship name

Size

Rate

New Solution

Silver Glory

Desh Ujaala o/o

Montestena

Jag Lyall

Teekay tbn

Aries Sun

Jag Laxmi

Yang Mei Hu

Brightoil League

265

CR

265

CR

242

CR

140 CR

100

CR

100

CR

100

CR

80

CR

80

FO

80

CR

Type

Date

Route

12-Sep

8-Sep

20-Sep

17-Sep

10-Sep

18-Sep

11-Sep

9-Sep

9-Sep

11-Sep

PG-China

PG-China

Ras Tanura-Paradip

Basrah-UKC

Kozmino-Yingkou

Kozmino-Sriracha

Kozmino-NChina

Senipah-Thailand

Spore-NAsia

Su Tu Den-SChina

Copyright 2015, McGraw Hill Financial

coa

coa

w33

w37.5

rnr

coa

$750k

rnr

w97.5

w102.5

Charterer

Unipec

Unipec

IOC

Petco

NPI

ExxonMob

Glasford

PTT

Cargill

Unipec

Asia-Pacific/Arab Gulf Marketscan

over September 1, 2015 to April 30, 2016. PetroChina

is the supplier at a premium of $1.72/b to the Mean of

Platts Singapore Gasoil assessments, DES basis, and

a premium of $1.62/b to the MOPS jet fuel/kerosene

assessments, DES basis. Ceypetco is taking delivery of

five combination cargoes over the eight-month period.

Each cargo will comprise 148,600 barrels of gasoil and

160,000 barrels of jet A-1 fuel.

Gasoil .001%S (10ppm) FOB Spore Cargo assessment

rationale: (PGA page 2490) The 10 ppm sulfur gasoil

cash differential was assessed at plus $2.37/b

Tuesday, down 5 cents/b, based on structure. The

balance September/October Singapore gasoil swap

fell 9 cents/b to be assessed at minus 82 cents/b.

The cash differential on the front-loading period of

September 16-20 was assessed at plus $2.21/b, midloading period of September 21-25 at plus $2.36/b and

back-loading period of September 26-October 1 at plus

$2.51/b. With the MOPS strip at $62.13/b and the

cash differential at plus $2.37/b, the outright price of

10 ppm sulfur gasoil was $64.50/b.

The above commentary applies to the following market data

code: AAOVC00

Gasoil .05%S (500ppm) FOB Spore Cargo assessment

rationale: (PGA page 2490) The 500 ppm sulfur gasoil

cash differential was assessed at minus 48 cents/b

Tuesday. The cash differential for the front-loading

period of September 16-20 was assessed at minus 55

cents/b, down 8 cents/b, reflecting Winsons offer for

a cargo loading over September 16-20 at MOPS Gasoil

minus 50 cents/b after deemed pricing. The mid-loading

period of September 21-25 and back-loading period of

September 26-October 1 were assessed at minus 46

cents/b and minus 44 cents/b respectively, reflecting

losses on the front-loading period. With the MOPS strip

at $62.13/b and the cash differential at minus 48

cents/b, the outright price of 500 ppm sulfur gasoil was

$61.65/b.

The above commentary applies to the following market data

code: AAFEX00

September 1, 2015

International tanker fixtures (cont.)

(PGA pages PGT2904 and PGT2950)

Ship name

Size

Rate

Trident Star

Olympic Spirit II

Northern Pearl

Torm Anne

Yiangos

New Dream

New Courage

Nordic Saturn

Al Mahfoza

Pacific Sunrise

Shah Deniz

Iblea

Teekay tbn

Brightoil tbn

Ratna Puja

Vermillion Energy

Densa Orca

Minerva Vera

Glorycrown

Patroclus

Istanbul

Ithaki

Archangel

Pelagos

Sovcomflot tbn

Stena Arctica

Solviken

Cardiff tbn

Mastera

Olympic Light

Cap Victor

Sea Falcon

Stena Superior

Leni P

Stealth Skyros

Krasnodar

Minerva Zenia

Minerva Libra

Commander

Jill Jacob

Maersk Penguin

SCF Plymouth

Gulf Pearl

Oriental Emerald

Tbn

Dai Nam

Tbn

Pro Alliance

80

COND

76

CR

50

FO

30

DY

265 CR

265

CR

265

CR

130

DY

80

CR

80

FO

80

FO

75 DY

100

CR

80

CR

80

FO

80

CR

130

CR

130

CR

130 CR

130 CR

130 CR

260 CR

140 CR

100 CR

100

CR

100

CR

100

CR

100

CR

100

CR

260

DY

130

CR

70

CR

130

HC

130

DY

70

CR

70 DY

70

CR

70

DY

50 DY

50

DY

80

GO

65

JT

55

NA

40

JT

35 NA

35

NA

90 JT

75

NA

Type

Date

Route

14-Sep

4-Sep

30-Sep

14-Sep

11-Sep

11-Sep

9-Sep

18-Sep

12-Sep

4-Sep

9-Sep

8-Sep

11-Sep

10-Sep

mSep

4-Sep

17-Sep

18-Sep

20-Sep

21-Sep

24-Sep

30-Sep

14-Sep

10-Sep

11-Sep

11-Sep

11-Sep

12-Sep

9-Sep

27-Sep

10-Sep

1-Sep

19-Sep

10-Sep

3-Sep

6-Sep

5-Sep

7-Sep

eSep

eSep

16-Sep

12-Sep

9-Sep

2-Sep

17-Sep

4-Sep

13-Sep

5-Sep

Dampier-Malacca

Seria-Chennai

Spore-Ulsan

Balikpapan-Spore

PG-China

Basrah-China

PG-China

Bashayer-China

Ras Gharib-Sikka

Ruwais-opts

PG-Red Sea

Vadinar-USGC

Kozmino-Japan

Su Tu Den-China

Spore-Far East

Vietnam-Spore

WAF-UKCM

WAF-UKCM

WAF-UKCM

Akpo-UKCM

WAF-UKCM

WAF-WCIndia

Novo-UKCM

Primorsk-UKC

Primorsk-UKC

Primorsk-UKC

Ust Luga-UKC

Ust Luga-UKC

Ust Luga-UKC

Brazil-China

Brazil-opts

USGC Lighter

Bullen Bay-Kemaman

Brazil-USGC

ECMexico-USGC

Caribs-USGC

ECMexico-USGC

USGC-ECCanada

USGC-WCMexico

USGC-Med

Sikka-EAfrica

PG-Mombasa

Rabigh-Japan

Sikka-USWC

Mumbai-Japan

PG-Japan

PG-West

PG-S Korea

Copyright 2015, McGraw Hill Financial

rnr

rnr

o/p

$485k

coa

coa

coa

rnr

w80

rnr

$820k

$2.45m

$750k

rnr

w100

$400k

w55

w55

w55

w55

w56.75

$3.3m

w62.5

w75

rnr

w75

o/p

w75

coa

w41

w60

$16k/d

$3.6m

w52

w90

w95

w100

w80

rnr

rnr

w135

o/p

w117.5

$2.1m

rnr

w135

rnr

rnr

Charterer

Petco

IOC

Mercuria

JX

Unipec

Unipec

Unipec

Unipec

Reliance

Vitol

ATC

Chevron

NGT

cnr

Mitsui

Shell

Valero

Valero

Shell

Shell

ExxonMob

BPCL

Unipec

Litasco

Shell

Clearlake

Total

ST

Shell

Petrobras

Shell

AET

Tipco

Petrobras

Marathon

Chevron

Hou Ref

BP

cnr

BBNaft

Sahara

CSSA

Marubeni

Reliance

BP

Marubeni

Shell

cnr

Asia-Pacific/Arab Gulf Marketscan

Gasoil FOB Spore Cargo assessment rationale: (PGA

page 2490) The 500 ppm sulfur gasoil cash differential

was assessed at minus 48 cents/b Tuesday. The cash

differential for the front-loading period of September

16-20 was assessed at minus 55 cents/b, down 8

cents/b, reflecting Winsons offer for a cargo loading

over September 16-20 at MOPS Gasoil minus 50

cents/b after deemed pricing. The mid-loading period of

September 21-25 and back-loading period of September

26-October 1 were assessed at minus 46 cents/b and

minus 44 cents/b respectively, reflecting losses on the

front-loading period. With the MOPS strip at $62.13/b

and the cash differential at minus 48 cents/b, the

outright price of 500 ppm sulfur gasoil was $61.65/b.

The above commentary applies to the following market data

code: POABC00

Gasoil .25%S (2500ppm) FOB Spore Cargo assessment

rationale: (PGA page 2489) The 2,500 ppm sulfur gasoil

cash differential was assessed at minus 95 cents/b

Tuesday, down 3 cents/b, as the 500 ppm sulfur gasoil

cash differential fell 4 cents/b. With the MOPS strip at

$62.13/b and the cash differential at minus 95 cents/b,

the outright price of 2,500 ppm sulfur gasoil was

$61.18/b.

The above commentary applies to the following market data

code: AACUE00

Gasoil .05% (500ppm) FOB Arab Gulf Cargo assessment

rationale: (PGA page 2489) FOB Arab Gulf 500 ppm sulfur

gasoil was assessed at $58.86/b Tuesday, based on an

assessed freight rate of $2.79/b for the Persian GulfSingapore route for 55,000-mt cargoes. Singapore 500

ppm sulfur gasoil was assessed at $61.65/b.

The above commentary applies to the following market data

code: AAFEZ00

Gasoil FOB Arab Gulf Cargo assessment rationale: (PGA

page 2489) FOB Arab Gulf 500 ppm sulfur gasoil was

assessed at $58.86/b Tuesday, based on an assessed

freight rate of $2.79/b for the Persian Gulf-Singapore

route for 55,000-mt cargoes. Singapore 500 ppm sulfur

September 1, 2015

International tanker fixtures (cont.)

(PGA pages PGT2904 and PGT2950)

Ship name

Rate

Pro Triumph

Maersk Progress

Hong Ze Hu

Bow Pioneer

Spruce 2

Red Eagle

Front Panther

Seriana

Tbn

BW Merlin

Torm Cecilie

Chang Hang Bi Yu

M/R tbn

Challenge Point

Front Arrow o/o

Ami

Histria Crown

Aldebaran

Yukon Star

STI Onyx

BW Puma

Cartagena

Kouros

Atlantic Aquarius

Torm Lotte

Seapride

High Saturn

FSL Spore

New Century

Torm Alexandra

Elka Angelique

Atlantic Leo

Teesta Sirit

Super Star

BLS Liwa

BW Zambesi

Torm Ragnhild

Ardmore Seaventure

Ardmore Seatrader

Vendome Street

STI Bronx

Vukovar

Maersk Murotsu

Silver Houston

STI Garnet

Resolve

Ridgebury Cindy A

Valle Azzurra

Size

Type

75

NA

60

GO

60

UN

60

GO

60

UN

55

NA

90

GO

80

GO

35

UN

35

CL

35

NA

35

GO

35

CL

35

UN

37

UN

30 NA

30

CL

30 CL

30

CL

37

UN

37

UN

37 UN

37 UN

37

UN

37

UN

37 UN

40

ULSD

37

CL

60

CL

38

CL

38

CL

38

NA

38

CL

38

UN

38

CL

60

CL

38

CL

38

CL

38

CL

38

CL

38

CL

38 UN

38

UN

38

CL

38

CL

38 CL

38

CL

38

CL

Date

Route

8-Sep

9-Sep

7-Sep

19-Sep

10-Sep

17-Sep

eSep

10-Sep

18-Sep

10-Sep

9-Sep

5-Sep

mSep

11-Sep

9-Sep

3-Sep

9-Sep

3-Sep

8-Sep

dnr

5-Sep

7-Sep

8-Sep

8-Sep

9-Sep

7-Sep

7-Sep

dnr

1-Sep

6-Sep

10-Sep

4-Sep

5-Sep

3-Sep

eSep

5-Sep

5-Sep

6-Sep

6-Sep

5-Sep

5-Sep

1-Sep

6-Sep

9-Sep

2-Sep

5-Sep

5-Sep

1-Sep

PG-Japan

Cross PG

Yasref-PG

Sikka-UKC

PG-EAfrica

PG-Japan

Nakhodka-WAfrica

S Korea-WAfrica

S Korea-Philippines

S Korea-Spore

Onsan-Japan

Dalian-Spore

Dalian-Spore

Mailiao-Subic Bay

Sarroch-Chile

Milazzo-Med

Black Sea-Med

Tarragona-Med

Algeciras-Med

ARA-WAF

Mongstad-USAC

Pembroke-USAC

Fawley-USAC

UKC-ECMexico

Porvoo-UKC

ARA-TA

Primorsk-UKC

UKC-opts

USGC-UKCM

USGC-opts

USGC-opts

Pisco-USGC

USGC-Brazil

USGC-opts

USGC-TA

USGC-UKCM

USGC-UKCM

USGC-UKCM

USGC-TA

Caribs-USAC

USGC-UKCM

USGC-ECMex

USGC-ECMex

USWC-Chile

USGC-opts

USGC-opts

USGC-Caribs

USGC-UKCM

Copyright 2015, McGraw Hill Financial

10

rnr

$390k

rnr

$2.2m

w140

Platts

$3.5m

o/p

rnr

$575k

$450k

rnr

$600k

$390k

w150

rnr

w135

w130

w130

rnr

rnr

w125

w122.5

rnr

w140

w125

w125

rnr

w60

rnr

rnr

$475k

w130

o/p

w67.5

w60

w67.5

w65

w70

w115

w70

$230k

$240k

$975k

rnr

rnr

rnr

w70

Charterer

Marubeni

cnr

ATC

Reliance

CSSA

Chevron

Lukoil

Trafigura

cnr

cnr

ATC

Lukoil

Vitol

CSSA

Valero

Clearlake

cnr

Repsol

Total

Mercuria

Statoil

Valero

ExxonMob

PMI

Neste

Total

Vitol

cnr

cnr

cnr

cnr

Repsol

Petrobras

Cargill

BP

ATMI

ST

ATMI

ATMI

Trafigura

Shell

PMI

PMI

Repsol

cnr

cnr

Ecopet

P66

Asia-Pacific/Arab Gulf Marketscan

gasoil was assessed at $61.65/b.

The above commentary applies to the following market data

code: POAAT00

Asia & Middle East Gasoil bids/offers/trades: (PGA page 2491)

ASIA GO CARGO MOC: DEAL SUMMARY: No trades

reported

ASIA GO CARGO MOC: OUTSTANDING INTEREST:

BIDS: Gasoil 10ppm: FOB Straits: Vitol bids MOPS

+1.50 Sep 16-20 150kb (Deemed pricing Sep 15-21)

INCO; Gasoil 10ppm: FOB Straits: BP bids MOPS

+1.40 Sep 20-24 250kb (Deemed pricing Sep 18-25);

Gasoil 500ppm: FOB Straits: Sietco bids MOPS -0.30

Sep 16-20 250kb (Deemed pricing Sep 1-7); Gasoil

500ppm: FOB Straits: Trafigura bids MOPS -0.70

Sep 22-26 250kb (Deemed pricing Sep 21-28) INCO;

Gasoil 500ppm: FOB Straits: Trafigura bids MOPS

-0.80 Sep 23-27 250kb INCO; Gasoil 500ppm: FOB

Straits: Total bids MOPS -0.80 Sep 27-Oct 1 250kb

(Deemed pricing Sep 1-11)

ASIA GO CARGO MOC: OUTSTANDING INTEREST:

OFFERS: Gasoil 500ppm: FOB Straits: Winson offers

MOPS -0.50 Sep 16-20 150kb (Deemed pricing Sep

15-21) INCO; Gasoil 500ppm: FOB Straits: Unipec

offers MOPS -0.40 Sep 16-20 150kb (Deemed pricing

Sep 15-21) INCO; Gasoil 500ppm: FOB Straits: Lukoil

offers MOPS -0.28 Sep 16-20 150kb (Deemed pricing

Sep 16-22); Gasoil 500ppm: FOB Straits: Glencore

offers MOPS -0.20 Sep 16-20 150kb (Deemed pricing

Sep 14-18) INCO;

5) Gasoil 500ppm: FOB Straits: Winson offers MOPS

-0.30 Sep 21-25 150kb (Deemed pricing Sep 18-25)

INCO; Gasoil 500ppm: FOB Straits: BP offers MOPS

-0.10 Sep 21-25 150kb (Deemed pricing Sep 21-28) BP

GTC; Gasoil 500ppm: FOB Straits: Noble offers MOPS

-0.20 Sep 27-Oct 1 150kb (Deemed pricing Sep 25 Oct 1); Gasoil 500ppm: FOB Straits: BP offers MOPS

-0.10 Sep 27-Oct 1 150kb (Deemed pricing Sep 25 Oct 1) BP GTC

Asia & Middle East Gasoil exclusions: (PGA page 2491)

No market data was excluded from the September

September 1, 2015

International tanker fixtures (cont.)

(PGA pages PGT2904 and PGT2950)

Ship name

Rate

Sea Helios

Ainazi

Mount Everest

Astir Lady

Pomer

Rbury Rosemary Z

Ardmore Seamaster

Dong-A Krios

Size

Type

38

CL

38 NA

38

NA

38

CL

38 UN

38

CL

38

UN

38

GO

Date

Route

5-Sep

4-Sep

4-Sep

2-Sep

3-Sep

9-Sep

5-Sep

10-Sep

Come by Chance-UKCM

Peru-USGC

Caribs-USAC

USGC-ECMex

USGC-ECMex

USGC-Caribs

Bahamas-USGC

Anacortes-opts

w60

$475k

w115

rnr

$230k

$450k

rnr

rnr

Charterer

BP

Repsol

AOT

PMI

PMI

Ecopet

Noble

ST

CL: Clean, F: Failed, UL: Unleaded, NA: Naphtha, GO: Gasoil, DY: Dirty, CR: Crude, FO: Fuel Oil, CO: Condensate, +:Update, pt: prompt, cnr: charterer not reported, rnr: rate

not reported

Deals summaries

(PGA page 190)

Naphtha paper

REPORTED DURING AND OUTSIDE WINDOW:

Platts Naphtha Japan swap: Oct heard done 457

Platts Naphtha Japan swap: Oct heard done 454.50 x2

Platts Naphtha Japan swap: Sep/Oct heard done -1.75 x2

REPORTED AFTER CLOSE:

Platts Naphtha Japan swap: Oct heard done 456.00

Jet paper

Platts Asia deals summary: Jet paper Sep 01, 2015: Jet: Bal

September done 61.8 Hartree buys from Vitol (08:29:36); Jet:

Bal September done 61.8 Hartree buys from Shell (08:29:45);

Jet: Bal September done 61.8 Oak Futures buys from Noble

(08:29:58); Jet: Bal September done 61.8 MCE buys from BP

(08:30:04); Jet: Bal September done 61.8 Oak Futures buys

from Shell (08:30:08)

Platts Asia deals summary: Regrade paper Sep 01, 2015: No

trades reported

Gasoil paper

Platts Asia deals summary: Gasoil paper Sep 01, 2015

Gasoil: Bal September done 61.9 Litasco buys from Chevron

(08:29:52)

Gasoil: Bal September done 61.9 MCE buys from Glencore

(08:30:01)

Fuel oil paper

Platts Asia deals summary: 180 CST paper Sep 01,2015

180 CST: Bal September/October done -5 Mercuria sells to

Vitol (08:14:59)

Platts Asia deals summary: 380 CST paper Sep 01, 2015

380 CST: Bal September/October done -4.5 Vitol buys from BP

(08:19:14)

Copyright 2015, McGraw Hill Financial

380 CST: Bal September/October done -4.75 Oak Futures

sells to Mercuria (08:28:27)

380 CST: Bal September/October done -4.75 Oak Futures

sells to Vitol (08:28:28)

380 CST: Bal September done 261 Oak Futures buys from BP

(08:29:14)

380 CST: Bal September done 261 Oak Futures buys from BP

(08:29:20)

380 CST: Bal September done 260.75 Gunvor sells to Litasco

(08:29:21)

380 CST: Bal September done 261 Glencore buys from BP

(08:29:28)

380 CST: Bal September done 260.5 Hin Leong sells to

Mercuria (08:29:29)

380 CST: Bal September done 260.75 Gunvor sells to Litasco

(08:29:31)

380 CST: Bal September done 261 Oak Futures buys from BP

(08:29:33)

380 CST: Bal September done 260.75 Gunvor sells to

Glencore (08:29:35)

380 CST: Bal September/October done -4.75 Oak Futures

sells to Vitol (08:29:36)

380 CST: Bal September done 261 Oak Futures buys from

Vitol (08:29:37)

380 CST: Bal September done 261 Oak Futures buys from BP

(08:29:40)

380 CST: Bal September/October done -4.75 Oak Futures

sells to Mercuria (08:29:43)x2

380 CST: Bal September done 260.75 Gunvor sells to MCE

(08:29:43)

380 CST: Oct15 done 265.5 Oak Futures buys from Unipec

11

Asia-Pacific/Arab Gulf Marketscan

1, 2015 Asian gasoil market on close assessment

process.

Fuel Oil

Market analysis: (PGA page 2599) The Singapore high

sulfur fuel oil market early on Tuesday saw market

sentiment on the paper market improve a touch, as

balance September/October spreads for 180 CST

and 380 CST swaps gained traction from stronger

buying interest seen on the Rotterdam barge market.

The higher day-on-day value for crude, after sharply

higher settlements the previous day, was also boosting

sentiment, according to a Singapore-based broker. On

the bunker fuel front, sellers were relieved that they had

gone long on supplies, with crude prices up so much day

on day, and also being able to sell on their supplies at a

higher value. In tenders, Indias HPCL sold to PetroChina

up to 60,000 mt of 180 CST HSFO, with maximum 3.5%

sulfur content, for loading from Visakhapatnam over

September 1-3 and/or September 3-10, at a discount

of around $30/mt to the Mean of Platts Singapore 180

CST high sulfur fuel oil assessments, FOB.

FO 180 CST 3.5%S FOB Spore Cargo assessment

rationale: (PGA page 2593) FOB Singapore 180 CST high

sulfur fuel oil was assessed at $261.47/mt Tuesday.

The cash differential was assessed at minus $5.37/

mt. The assessment reflected two trades: Gunvor

bought from Mercuria a September 25-29 loading

cargo at $262.00/mt and Vitol bought from Mercuria a

September 18-22 loading cargo at $260.00/mt.

The above commentary applies to the following market data

code: PUADV00

FO 380 CST 3.5%S FOB Spore Cargo assessment

rationale: (PGA page 2593) FOB Singapore 380 CST

HSFO was assessed at $257.51/mt Tuesday, with the

cash differential at minus $4.55/mt. The assessment

reflected two bids from Vitol at MOPS minus $4.50/

mt for a September 27-October 1 loading cargo and a

September 22-26 loading cargo.

September 1, 2015

Deals summaries (cont.)

(08:29:49)

380 CST: Bal September done 260.75 BP sells to MCE

(08:29:49)

380 CST: Bal September done 260.5 BP sells to Mercuria

(08:29:49)

380 CST: Bal September done 260.75 BP sells to Litasco

(08:29:49)

380 CST: Bal September done 260.5 BP sells to MCE

(08:29:51)

380 CST: Bal September done 260.5 BP sells to Glencore

(08:29:51)

380 CST: Oct15 done 265.5 Oak Futures buys from Unipec

(08:29:54)

380 CST: Bal September done 260.75 BP sells to Litasco

(08:29:54)

380 CST: Bal September done 260.5 Hin Leong sells to

Mercuria (08:29:57)

The above commentary applies to the following market data

code: PPXDK00

FO 180 CST FOB Arab Gulf Cargo assessment

rationale: (PGA page 2593) FOB Arab Gulf 180 CST high

sulfur fuel oil was assessed at $246.01/mt Tuesday

based on an assessed freight rate of $15.46/mt for the

Persian Gulf-East route for 80,000-mt cargoes.

The above commentary applies to the following market data

code: PUABE00

FO 380 CST 3.5% FOB Arab Gulf Cargo assessment

rationale: (PGA page 2593) FOB Arab Gulf 380 CST high

sulfur fuel oil was assessed at $242.05/mt Tuesday

based on an assessed freight rate of $15.46/mt for the

Persian Gulf-East route for 80,000-mt cargoes.

The above commentary applies to the following market data

code: AAIDC00

Singapore Fuel Oil bids/offers/trades: (PGA page 2594)

ASIA 180 CST HSFO CARGO: DEAL SUMMARY:

1) Platts HSFO 180CST: FOB Straits: 20kt: Sep

25-29: Gunvor buys from Mercuria at $262.00/mt

INCO (4:25:19.374); 2) Platts HSFO 180CST: FOB

Copyright 2015, McGraw Hill Financial

(PGA page 190)

380 CST: Bal September done 261 Mercuria buys from Vitol

(08:29:57)x2

380 CST: Oct15 done 265.5 Itochu buys from Unipec

(08:29:58)

380 CST: Bal September done 260.75 MCE buys from BP

(08:29:59)

380 CST: Bal September done 260.75 Oak Futures buys from

BP (08:30:02)

380 CST: Bal September done 261 Litasco buys from Vitol

(08:30:05)

380 CST: Bal September done 261 Litasco buys from Vitol

(08:30:10)

Platts Asia deals summary: Viscosity paper Sep 01, 2015

No trades reported.

Mogas paper

ASIA MOGAS SWAPS MOC: DEAL SUMMARY: NO TRADE

Straits: 20kt: Sep 18-22: Vitol buys from Mercuria at

$260.00/mt INCO (4:25:32.468).

ASIA 180 CST HSFO CARGO: OUTSTANDING INTEREST:

Platts HSFO 180CST: FOB Straits: Vitol bids MOPS

-6.00 Sep 22-26 40kt INCO OR; Platts HSFO 180CST:

FOB Straits: Vitol bids MOPS -6.00 Sep 27-Oct 1

40kt INCO; Platts HSFO 180CST: FOB Straits: Unipec

bids Bal Sep -7.00 Sep 27-Oct 1 20kt INCO; Platts

HSFO 180CST: FOB Straits: CCMA offers MOPS -2.00

Sep 17-21 20kt INCOTERMS; Platts HSFO 180CST:

FOB Straits: P66 offers MOPS -3.50 Sep 17-21 20kt

INCOTERMS; Platts HSFO 180CST: FOB Straits:

Mercuria no longer offers on 260.00 Sep 18-22 20kt,

after trade with Vitol OR; WD Platts HSFO 180CST:

FOB Straits: Mercuria no longer offers MOPS -4.00

Sep 18-22 20kt; WD Platts HSFO 180CST: FOB

Straits: Mercuria no longer offers MOPS -4.00 Sep

25-29 20kt OR; Platts HSFO 180CST: FOB Straits:

Mercuria no longer offers on 262.00 Sep 25-29 20kt,

after trade with Gunvor; Platts HSFO 180CST: FOB

Straits: BP offers MOPS -2.00 Sep 16-20 20kt.

ASIA 380 CST HSFO CARGO: DEAL SUMMARY: No

trades.

12

Asia-Pacific/Arab Gulf Marketscan

ASIA 380 CST HSFO CARGO: OUTSTANDING INTEREST:

Platts HSFO 380CST: FOB Straits: BP bids MOPS

-8.00 Sep 22-26 40kt INCO; Platts HSFO 380CST:

FOB Straits: Lukoil bids MOPS -8.00 Sep 27-Oct 1

20kt INCO; Platts HSFO 380CST: FOB Straits: Vitol

bids MOPS -4.50 Sep 22-26 40kt INCO OR; Platts

HSFO 380CST: FOB Straits: Vitol bids MOPS -4.50

Sep 27-Oct 1 40kt INCO; Platts HSFO 380CST: FOB

Straits: Unipec bids Bal Sep -7.50 Sep 27-Oct 1 20kt;

Platts HSFO 380CST: FOB Straits: Cargill bids Bal Sep

-6.00 Sep 27-Oct 1 40kt INCO 2000; Platts HSFO

380CST: FOB Straits: Cargill bids Bal Sep -6.00 Sep

25-29 40kt INCO 2000; Platts HSFO 380CST: FOB

Straits: SK bids Bal Sep -6.00 Sep 27-Oct 1 40kt;

Platts HSFO 380CST: FOB Straits: SK bids Bal Sep

-6.00 Sep 16-20 40kt; Platts HSFO 380CST: FOB

Straits: Mercuria bids MOPS -5.00 Sep 27-Oct 1 20kt

OR; Platts HSFO 380CST: FOB Straits: Mercuria bids

MOPS -5.00 Sep 22-26 20kt; Platts HSFO 380CST:

FOB Straits: HL bids MOPS -5.00 Sep 27-Oct 1 20kt

INCOTERMS2000; Platts HSFO 380CST: FOB Straits:

Glencore bids Bal Sep -3.50 Sep 27-Oct 1 40kt INCO

OR; Platts HSFO 380CST: FOB Straits: Glencore bids

Bal Sep -3.50 Sep 25-29 40kt INCO; Platts HSFO

380CST: FOB Straits: KIB bids MOPS -9.00 Sep 16-20

40kt INCO; Platts HSFO 380CST: FOB Straits: Brightoil

bids Bal Sep -5.00 Sep 21-25 40kt INCO; Platts HSFO

380CST: FOB Straits: Coastal bids 256.00 Sep 22-26

20kt OR; Platts HSFO 380CST: FOB Straits: Coastal

bids MOPS -6.50 Sep 22-26 20kt; WD Platts HSFO

380CST: FOB Straits: P66 no longer offers MOPS

-3.00 Sep 27-Oct 1 20kt INCOTERMS; Platts HSFO

380CST: FOB Straits: Unipec offers MOPS -1.00 Sep

21-25 20kt INCO; Platts HSFO 380CST: FOB Straits:

CCMA offers Oct Avg -5.00 Sep 27-Oct 1 20kt INCO;

Platts HSFO 380CST: FOB Straits: PetroChina offers

MOPS +1.00 Sep 20-24 20kt INCO; Platts HSFO

380CST: FOB Straits: PetroChina offers MOPS +1.00

Sep 23-27 20kt INCO; Platts HSFO 380CST: FOB

Straits: PetroChina offers MOPS +1.00 Sep 27-Oct

1 20kt INCO; Platts HSFO 380CST: FOB Straits: HL

offers 257.00 Sep 16-20 20kt INCOTERMS 2000;

Platts HSFO 380CST: FOB Straits: CAO offers H2 Sep

+2.00 Sep 21-25 40kt INCO; Platts HSFO 380CST:

FOB Straits: CAO offers H2 Sep +3.00 Sep 27-Oct

1 40kt INCO; Platts HSFO 380CST: FOB Straits: BP

offers MOPS -2.00 Sep 16-20 20kt INCO

ASIA 380 CST HSFO CARGO: WITHDRAWN: Platts

HSFO 180CST: FOB Straits: Mercuria no longer offers

on 260.00 Sep 18-22 20kt, after trade with Vitol

OR; WD Platts HSFO 180CST: FOB Straits: Mercuria

no longer offers MOPS -4.00 Sep 18-22 20kt; WD

Platts HSFO 180CST: FOB Straits: Mercuria no longer

offers MOPS -4.00 Sep 25-29 20kt OR; Platts HSFO

180CST: FOB Straits: Mercuria no longer offers on

262.00 Sep 25-29 20kt, after trade with Gunvor;

WD Platts HSFO 380CST: FOB Straits: P66 no longer

offers MOPS -3.00 Sep 27-Oct 1 20kt INCOTERMS.

Singapore Fuel Oil exclusions: (PGA page 2594) No

market data was excluded from the September 1, 2015,

assessment process.

US West Coast Gasoline

(PGA page 397)

West Coast gasoline differentials were mostly unchanged

Tuesday, though the benchmark grade in Los Angeles

climbed on a stronger deal. Los Angeles CARBOB jumped

6 cents/gal to NYMEX October RBOB plus 53 cents/

gal, based on a deal at that level. The spot price for

San Francisco CARBOB remained flat at NYMEX October

RBOB plus 37.25 cents/gal. A public meeting to discuss

increasing processing rates at ExxonMobils Torrance,

California, refinery scheduled for Wednesday was canceled,

further delaying the restart of its gasoline-making FCC unit,

a spokeswoman for a California regulatory agency said

Tuesday. The South Coast Air Quality Management District

spokeswoman said she had no further information about

when the meeting would be held or why it was canceled.

ExxonMobil is looking to use refurbished parts on the FCC

to replace the electrostatic precipitators damaged by a fire

on February 18. The company needs the environmental

regulators approval because the older parts do not meet

current environmental air pollution standards.

Copyright 2015, McGraw Hill Financial

September 1, 2015

Subscriber notes (cont.)

(PGApage 1500)

process. The terminal has four berths and an overall total

storage capacity of 835,000 cu m, of which 180,000 cu

m is dedicated to clean product storage. At 1.0 m tide,

the approach draft is approximately 12.6 m and able

to accommodate Aframax and partially laden Suezmax

size vessels. The largest of the four berths, berth 1, is

able to accommodate a partially laden Suezmax vessel,

while berth 2 is able to accommodate Aframax size

vessels. Please send initial comments or questions by

7 September 2015 to asia_oilproducts@platts.com and

pricegroup@platts.com. For written comments, please

provide a clear indication if comments are not intended

for publication by Platts for public viewing. Platts will

consider all comments received and will make comments

not marked as confidential available upon request.

Sour Crude

Market analysis: (PGA page 2298) Sentiment in the Asian