Professional Documents

Culture Documents

HKICPA QP Exam (Module A) Sep2008 Question Paper

Uploaded by

cynthia tsuiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HKICPA QP Exam (Module A) Sep2008 Question Paper

Uploaded by

cynthia tsuiCopyright:

Available Formats

SECTION A – CASE QUESTIONS (Total: 50 marks)

Answer ALL of the following questions. Marks will be awarded for logical argumentation

and appropriate presentation of the answers.

CASE

Assume that you are Mr. David Li, the accounting manager of City Limited (“City”). City is a

company incorporated and listed in Hong Kong and is principally engaged in the

manufacturing of electronic products. The draft consolidated financial statements for the

year ended 31 March 2008 are shown as follows:

Consolidated Statement of Comprehensive Income for the year ended 31 March 2008

NOTES HK$’000

Revenue 2,348,314

Cost of sales (2,044,510)

Gross profit 303,804

Interest income 5,306

Selling and distribution costs (44,868)

Administrative expenses (136,085)

Loss on disposal of an associate (e) (7,888)

Finance costs (4,974)

Profit before tax (a) 115,295

Income tax expense (14,758)

PROFIT FOR THE YEAR 100,537

Other comprehensive income:

Exchange differences on translating foreign operations (g) 310

TOTAL COMPREHENSIVE INCOME FOR THE YEAR 100,847

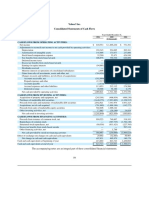

Consolidated Statement of Financial Position as at 31 March 2008

2008 2007

NOTES HK$’000 HK$’000

Non-current Assets

Property, plant and equipment (b) 115,568 114,170

Investment in an associate (e) -- 11,748

Club membership (d) 1,956 1,956

Pledged bank deposits (f) 6,582 6,232

124,106 134,106

Current Assets

Inventories 270,726 346,984

Trade receivables, deposits and prepayments 719,128 670,522

Pledged bank deposits (f) 2,322 13,522

Bank balances and cash 234,026 143,472

1,226,202 1,174,500

Module A (September 2008 Session) Page 1 of 9

Current Liabilities

Trade payables and accrued charges 675,602 708,524

Amount due to a related party 48,634 37,862

Tax liabilities 7,898 10,580

Obligations under finance leases – due within one year 220 2,690

Bank borrowings – due within one year 76,482 83,006

808,836 842,662

Net Current Assets 417,366 331,838

Total Assets less Current Liabilities 541,472 465,944

Equity

Share capital (c) 6,068 6,000

Reserves 518,706 443,618

Total Equity 524,774 449,618

Non-current Liabilities

Obligations under finance leases – due after one year -- 216

Bank borrowings – due after one year 10,412 8,908

Deferred tax liabilities 6,286 7,202

16,698 16,326

541,472 465,944

Consolidated Statement of Changes in Equity for the year ended 31 March 2008

Share Share Retained Translation Share Total

capital premium profits of foreign option equity

operations reserve

$’000 $’000 $’000 $’000 $’000 $’000

At 31 March 2007 6,000 154,490 284,821 590 3,717 449,618

Total comprehensive income

for the year -- -- 100,537 310 -- 100,847

Exercise of share options 68 4,050 -- -- (4,050) 68

Recognition of equity-settled

share-based payment -- -- -- -- 333 333

Final dividend paid

in respect of 2007 -- -- (16,990) -- -- (16,990)

Interim dividend declared

in respect of 2008 -- -- (9,102) -- -- (9,102)

At 31 March 2008 6,068 158,540 359,266 900 -- 524,774

Module A (September 2008 Session) Page 2 of 9

Additional information:

(a) PROFIT BEFORE TAX

2008 2007

HK$’000 HK$’000

Profit before tax has been arrived at after charging:

Depreciation 32,036 26,748

Equity-settled share-based payment 333 3,717

Loss on disposal of property, plant and equipment 802 436

Impairment loss recognised on trade receivables 210 --

(b) PROPERTY, PLANT AND EQUIPMENT

HK$’000

COST

At 31 March 2007 219,792

Additions 34,240

Disposals (2,898)

At 31 March 2008 251,134

DEPRECIATION

At 31 March 2007 105,622

Charge for the year 32,036

Eliminated on disposals (2,092)

At 31 March 2008 135,566

CARRYING AMOUNTS

At 31 March 2008 115,568

At 31 March 2007 114,170

(c) Pursuant to the service agreement between City and a director of City dated 1 May

2006, an option to subscribe for 6,800,000 shares in the Company at an exercise price

equal to the par value of HK$0.01 per share (the “Pre-IPO Share Option”) was granted

to the director. The Pre-IPO Share Option, which serves as an incentive for the

director, shall be exercised during the period from 1 May 2007 to 31 December 2008

and the option holder has to be in employment with City when he exercises the options.

The estimated fair value of the Pre-IPO Share Option at the date of grant is

HK$4,050,000.

(d) The club membership represents entrance fees paid to golf clubs held on a long-term

basis. It is considered by the management of City as having an indefinite useful life.

(e) On 1 April 2007, City disposed of its entire 20% interest in an associate for a cash

consideration of HK$3,860,000, resulting in a loss on disposal of HK$7,888,000.

(f) As at 31 March 2008, bank deposits of HK$8,904,000 had been pledged to secure

City’s banking facilities in terms of short-term bank borrowings and long-term

borrowings.

Module A (September 2008 Session) Page 3 of 9

(g) Exchange differences arising on translation of foreign operations recognised directly in

equity for the year ended 31 March 2008 were made on the translation of the financial

statements of the 100% owned foreign subsidiaries. The exchange gains/(losses)

were found to be made up as follows:

HK$’000

Inventories 120

Trade receivables 140

Trade payables (40)

Cash 90

After you sent these draft consolidated financial statements to City’s directors for review, a

new director who has just joined the board sent you an e-mail as follows:

To : David LI, Accounting Manager

From : Janice CHEUNG (Director)

c.c. : Michelle CHOW, Julian LIN, Fiona MERRILL (Directors)

Date : 18 May 2008

Consolidated financial statements of City as at 31 March 2008

Could you please clarify the following points relating to City’s draft consolidated financial

statements which I have just reviewed?

(A) So far as I understand, cash is cash. Why is there a total of three items showing our

bank deposits and cash in the consolidated statement of financial position? Also, I

cannot find the consolidated statement of cash flows. Please send it to me again.

(B) I note that the amount of the item “Club membership” has remained the same

throughout the two years in the consolidated statement of financial position. I believe

that non-current assets should be subject to depreciation and amortisation. Why does

the amount of this item remain the same?

(C) I have also found an item “Equity-settled share-based payment expense” in the note to

profit before tax. As we are only issuing equity to the employees, how would it affect

the profit before tax? Why is HK$333,000 recognised as an expense in 2008 while

the total estimated fair value is HK$4,050,000?

I would appreciate your clarification in time for the upcoming board meeting.

Best regards,

Janice

Module A (September 2008 Session) Page 4 of 9

Required:

Question 1 (50 marks – approximately 90 minutes)

(a) Prepare a memorandum in response to the issues raised by Ms. Janice CHEUNG.

In your memorandum, you should:

(i) discuss the reasons for the classification of bank deposits and cash into

three items as shown in the consolidated statement of financial position;

(8 marks)

(ii) discuss the accounting treatment of the “Club membership”; and

(7 marks)

(iii) discuss, with appropriate calculations, the accounting treatment of the

“Equity-settled share-based payment expense”.

(8 marks)

(b) Prepare an annex to your memorandum showing the consolidated statement of

cash flows for the year ended 31 March 2008.

(27 marks)

* * * * * * * *

Module A (September 2008 Session) Page 5 of 9

End of Section A

Module A (September 2008 Session) Page 6 of 9

SECTION B – ESSAY / SHORT QUESTIONS (Total: 50 marks)

Answer ALL of the following questions. Marks will be awarded for logical argumentation

and appropriate presentation of the answers.

Question 2 (10 marks – approximately 18 minutes)

Discuss the following statements:

(a) "In the preparation of the financial statements, we should update all accounting

estimates based on the latest available, reliable information at the date when the

financial statements are authorised for issue."

(5 marks)

(b) "It is an option for an entity with an investment in a subsidiary not to prepare

consolidated financial statements."

(5 marks)

Module A (September 2008 Session) Page 7 of 9

Question 3 (15 marks – approximately 27 minutes)

On 1 January 2007, Thompson Manufacturing Inc. (“TMI”), the lessor, entered into a

non-cancellable lease agreement for equipment with Silver Rod Company (“SRC”), the

lessee. The following information pertains to the lease:

Annual lease payment due at the beginning of each year, beginning on HK$53,069

1 January 2007

Option to purchase at the end of lease term HK$10,000

Lease term 5 years

Economic useful life of leased equipment 8 years

Lessor's manufacturing cost HK$200,000

Fair value of leased equipment at 1 January 2007 HK$227,500

Estimated unguaranteed residual value of leased equipment at the end HK$30,000

of lease term

Lessor's implicit rate 12.93%

Lessee's incremental borrowing rate 10%

Required:

(a) Discuss how the purchase option at the end of the lease term offered by TMI to

SRC will affect the classification of this lease by SRC.

(3 marks)

(b) Prepare an amortisation schedule that would be suitable for TMI for the lease

term.

(5 marks)

(c) Prepare all the journal entries that TMI should make for each of the years ended

31 December 2007 and 2008.

(7 marks)

Module A (September 2008 Session) Page 8 of 9

Question 4 (13 marks – approximately 23 minutes)

On 25 September 2007, Good Drink Limited (“GDL”) had a highly probable forecast sale of

1,000 tons of sugar expected to occur on or about 30 April 2008. GDL designated the cash

flows of the forecast sales as a hedged item and entered a futures contract to sell 1,000 tons

of sugar at $3,000 per ton on 30 April 2008.

Fair value of the sugar futures contract

At inception of the hedge Nil

On 31 December 2007 $80,000

On 30 April 2008 $50,000

GDL closed out the futures contract with a receipt of $50,000 on 30 April 2008 and sold the

inventory for $2,950,000. The cost of the inventory sold is $2,500,000.

Required:

(a) Prepare the journal entries that GDL should make during the year ended

31 December 2007 assuming hedge accounting is adopted and the hedge is

considered an effective hedge.

(2 marks)

(b) Prepare the journal entries that GDL should make on 30 April 2008.

(6 marks)

(c) Explain the differences in accounting treatment and entries on the futures

contract assuming GDL does not opt for the use of hedge accounting.

(5 marks)

Question 5 (12 marks – approximately 22 minutes)

(a) Explain the differences in calculation of diluted earnings per share between

contingently issuable shares and a convertible bond.

(8 marks)

(b) "In a business combination, if the fair value of the identifiable assets and

liabilities and contingent liabilities at the acquisition date can only be

determined provisionally, the acquirer shall adjust such provisional value upon

the finalisation of the fair value determination." Discuss.

(4 marks)

* * * END OF EXAMINATION PAPER * * *

Module A (September 2008 Session) Page 9 of 9

You might also like

- Trabajo de Contabilidad en InglesDocument5 pagesTrabajo de Contabilidad en Inglescarmen viquezNo ratings yet

- United Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Document2 pagesUnited Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Fuaad DodooNo ratings yet

- Hong Fok Corporation Limited: Revenue (Note 1)Document10 pagesHong Fok Corporation Limited: Revenue (Note 1)Theng RogerNo ratings yet

- Standard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Document1 pageStandard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Fuaad DodooNo ratings yet

- Unaudited Consolidated Financial Statements: For The Nine Months Ended 30 September 2021Document10 pagesUnaudited Consolidated Financial Statements: For The Nine Months Ended 30 September 2021Fuaad DodooNo ratings yet

- Receipts and Payments AccountDocument2 pagesReceipts and Payments AccountUmapathi MNo ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- CH 1 Exhibit 1 Q 1-5Document6 pagesCH 1 Exhibit 1 Q 1-5ЭниЭ.No ratings yet

- Q3 Financial Statement q3 For Period 30 September 2021Document2 pagesQ3 Financial Statement q3 For Period 30 September 2021Fuaad DodooNo ratings yet

- Fusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司Document22 pagesFusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司in resNo ratings yet

- Byte Back, Inc. FS June 30, 2009Document17 pagesByte Back, Inc. FS June 30, 2009byteback2No ratings yet

- MR D.I.Y. Group's Q3 2020 financial reportDocument15 pagesMR D.I.Y. Group's Q3 2020 financial reportMzm Zahir MzmNo ratings yet

- Access BankDocument1 pageAccess BankFuaad DodooNo ratings yet

- Trident, Inc. Consolidated Balance Sheets: Execonline - Mastering Finance FundamentalsDocument3 pagesTrident, Inc. Consolidated Balance Sheets: Execonline - Mastering Finance Fundamentalschemicalchouhan9303No ratings yet

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012No ratings yet

- WTB 2016 Tec, Inc. Interim Fs 2016Document32 pagesWTB 2016 Tec, Inc. Interim Fs 2016KarlayaanNo ratings yet

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- 11 Excelfiles Student Text Assignments 2010Document6 pages11 Excelfiles Student Text Assignments 2010leuleuNo ratings yet

- Capital Structure and Reserves of Public CompaniesDocument6 pagesCapital Structure and Reserves of Public CompaniesleuleuNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- CHAPTER 6-FA Questions - BAsicDocument3 pagesCHAPTER 6-FA Questions - BAsicHussna Al-Habsi حُسنى الحبسيNo ratings yet

- Yahoo! and Kodenko financial statement analysisDocument7 pagesYahoo! and Kodenko financial statement analysisPriyah RathakrishnahNo ratings yet

- Yahoo Annual Report 2006Document2 pagesYahoo Annual Report 2006domini809No ratings yet

- Q4 2022 Bursa Announcement - 2Document13 pagesQ4 2022 Bursa Announcement - 2Quint WongNo ratings yet

- FAUJI MEAT LIMITED CONDENSED INTERIM FINANCIAL STATEMENTSDocument66 pagesFAUJI MEAT LIMITED CONDENSED INTERIM FINANCIAL STATEMENTSAbdurrehman ShaheenNo ratings yet

- FS Annual 2009 English STCDocument25 pagesFS Annual 2009 English STCarkmaxNo ratings yet

- FS Gogold 2023 Q3Document17 pagesFS Gogold 2023 Q3Jasdeep ToorNo ratings yet

- Financial Accounting and Reporting: IFRS - 2021 December AKDocument15 pagesFinancial Accounting and Reporting: IFRS - 2021 December AKMarchella LukitoNo ratings yet

- ChinaNet 2012 Investor PresentationDocument74 pagesChinaNet 2012 Investor PresentationJosé ivan LópezNo ratings yet

- Summary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Document1 pageSummary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Fuaad DodooNo ratings yet

- 1-800-FLOWERS Balance Sheet and Income Statement AnalysisDocument28 pages1-800-FLOWERS Balance Sheet and Income Statement AnalysisPuMuK03No ratings yet

- Kuwait Privatization Projects Holding Co.: Financial Statement - 2006Document21 pagesKuwait Privatization Projects Holding Co.: Financial Statement - 2006phckuwaitNo ratings yet

- Balance Sheet As of December 31, 2019 in Rupiah: Pt. Daisen Wood FrameDocument6 pagesBalance Sheet As of December 31, 2019 in Rupiah: Pt. Daisen Wood FrameDwiputra SetiabudhiNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- Consolidated Financial Statements Mar 11Document17 pagesConsolidated Financial Statements Mar 11praynamazNo ratings yet

- Balance SheetDocument6 pagesBalance SheetayeshnaveedNo ratings yet

- Running Finance ExerciseDocument11 pagesRunning Finance Exercisew_fibNo ratings yet

- H1 Consolidated FS 2023 FinalDocument21 pagesH1 Consolidated FS 2023 FinalHussein BoffuNo ratings yet

- UBA FS-31Dec2021Document2 pagesUBA FS-31Dec2021Fuaad DodooNo ratings yet

- CAL BankDocument2 pagesCAL BankFuaad DodooNo ratings yet

- ENX - URD2022 - Financial Statements and Auditors ReportDocument99 pagesENX - URD2022 - Financial Statements and Auditors ReportRaghunathNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Quarterly Report 20200930Document18 pagesQuarterly Report 20200930Ang SHNo ratings yet

- MicrosoftDocument11 pagesMicrosoftJannah Victoria AmoraNo ratings yet

- Practice Problems, CH 12Document6 pagesPractice Problems, CH 12scridNo ratings yet

- Sales Revenue: 5 Finance CostDocument2 pagesSales Revenue: 5 Finance Costbalqis izaziNo ratings yet

- Annual-Report-FML-30-June-2020 Vol 1Document1 pageAnnual-Report-FML-30-June-2020 Vol 1Bluish FlameNo ratings yet

- GREAT BEAR RESOURCES LTD. Financial Statements 20211110 SE000000002967812994Document14 pagesGREAT BEAR RESOURCES LTD. Financial Statements 20211110 SE000000002967812994Leon GribanovNo ratings yet

- The WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2020Document4 pagesThe WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2020Mohammad Abram MaulanaNo ratings yet

- Bangladesh Lamps 3rd Q 2010Document3 pagesBangladesh Lamps 3rd Q 2010Sopne Vasa PurushNo ratings yet

- Globus Bank 2021 ABRIDGED FSDocument1 pageGlobus Bank 2021 ABRIDGED FSAwojuyigbeNo ratings yet

- Final Financial Reporting AssessmentDocument23 pagesFinal Financial Reporting Assessmentapi-413236814No ratings yet

- ACCT 302 Financial Reporting II Tutorial Set 4-1Document8 pagesACCT 302 Financial Reporting II Tutorial Set 4-1Ohenewaa AppiahNo ratings yet

- IHC Financial Statments For Period Ended 30 September 2020 - English PDFDocument40 pagesIHC Financial Statments For Period Ended 30 September 2020 - English PDFHafisMohammedSahibNo ratings yet

- Final 2021 CBG Summary Fs 2021 SignedDocument2 pagesFinal 2021 CBG Summary Fs 2021 SignedFuaad DodooNo ratings yet

- CR-July-Aug-2022Document6 pagesCR-July-Aug-2022banglauserNo ratings yet

- Consolidated Statements of Operations - USD ($) Shares in Millions, $ in MillionsDocument20 pagesConsolidated Statements of Operations - USD ($) Shares in Millions, $ in MillionsLuka KhmaladzeNo ratings yet

- Andy's Cannabis Financial StatementsDocument3 pagesAndy's Cannabis Financial Statementsnickstevens24No ratings yet

- HKICPA QP Exam (Module A) Sep2008 AnswerDocument12 pagesHKICPA QP Exam (Module A) Sep2008 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Sep2006 AnswerDocument15 pagesHKICPA QP Exam (Module A) Sep2006 Answercynthia tsui100% (2)

- HKICPA QP Exam (Module A) Sep2004 AnswerDocument14 pagesHKICPA QP Exam (Module A) Sep2004 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) May2005 AnswerDocument12 pagesHKICPA QP Exam (Module A) May2005 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Feb2006 AnswerDocument12 pagesHKICPA QP Exam (Module A) Feb2006 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) May2007 AnswerDocument13 pagesHKICPA QP Exam (Module A) May2007 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) May2007 AnswerDocument13 pagesHKICPA QP Exam (Module A) May2007 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Sep2006 Question PaperDocument7 pagesHKICPA QP Exam (Module A) Sep2006 Question Papercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Feb2008 AnswerDocument10 pagesHKICPA QP Exam (Module A) Feb2008 Answercynthia tsui100% (1)

- HKICPA QP Exam (Module A) Sep2004 Question PaperDocument7 pagesHKICPA QP Exam (Module A) Sep2004 Question Papercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) May2007 Question PaperDocument7 pagesHKICPA QP Exam (Module A) May2007 Question Papercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) May2005 Question PaperDocument6 pagesHKICPA QP Exam (Module A) May2005 Question Papercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Feb2006 Question PaperDocument7 pagesHKICPA QP Exam (Module A) Feb2006 Question Papercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Feb2008 Question PaperDocument8 pagesHKICPA QP Exam (Module A) Feb2008 Question Papercynthia tsuiNo ratings yet

- Doucmentation Manual of Bank PDFDocument518 pagesDoucmentation Manual of Bank PDFSamsul ArfinNo ratings yet

- NMB Bhawan, Babarmahal G.P.O. Box: 11543, Kathmandu, Nepal Phone: +977-1-4246160 Fax: +977-1-4246156Document53 pagesNMB Bhawan, Babarmahal G.P.O. Box: 11543, Kathmandu, Nepal Phone: +977-1-4246160 Fax: +977-1-4246156Sujan TumbapoNo ratings yet

- CBSE Exam PWDDocument155 pagesCBSE Exam PWDDisability Rights AllianceNo ratings yet

- About IDBI Federal Life Insurance joint venture of IDBI Bank, Federal Bank and AgeasDocument10 pagesAbout IDBI Federal Life Insurance joint venture of IDBI Bank, Federal Bank and AgeasArun ElanghoNo ratings yet

- La Casa Interiors Deposits All Cash Receipts Each Wednesday andDocument1 pageLa Casa Interiors Deposits All Cash Receipts Each Wednesday andAmit PandeyNo ratings yet

- FinaltenderDocument85 pagesFinaltenderRiyaz ShaikhNo ratings yet

- Mindful Money - Canna CampbellDocument301 pagesMindful Money - Canna CampbellAaliyah Csmrt100% (6)

- Business Plan Soma Bookstore P.O BOX 1910 Kisii.: Machakos UniversityDocument19 pagesBusiness Plan Soma Bookstore P.O BOX 1910 Kisii.: Machakos UniversityBosire keNo ratings yet

- Sheils Title Company, Inc. v. Commonwealth Land Title Insurance Co., 184 F.3d 10, 1st Cir. (1999)Document14 pagesSheils Title Company, Inc. v. Commonwealth Land Title Insurance Co., 184 F.3d 10, 1st Cir. (1999)Scribd Government DocsNo ratings yet

- Bank Of Punjab Internship ReportDocument49 pagesBank Of Punjab Internship ReportHussain HadiNo ratings yet

- Tamar Frankel - Trust and HonestyDocument264 pagesTamar Frankel - Trust and HonestyNgurah Berna AdienegaraNo ratings yet

- Banks: Its Role in The Financial Life of A NationDocument13 pagesBanks: Its Role in The Financial Life of A NationEhsan Karim100% (1)

- Banking ProductsDocument45 pagesBanking ProductsRAJAN SINGHNo ratings yet

- Chapter 4 CashDocument9 pagesChapter 4 CashTsegaye BelayNo ratings yet

- Analyzing Financial StatementsDocument15 pagesAnalyzing Financial StatementsTin PortuzuelaNo ratings yet

- (Emerson) Lead Magnet - CompressedDocument4 pages(Emerson) Lead Magnet - CompressedJohn BuenviajeNo ratings yet

- NBL Internship ReportDocument129 pagesNBL Internship ReportMohammad Anamul HoqueNo ratings yet

- Special Power of Attorney Know All Men by These PresentsDocument1 pageSpecial Power of Attorney Know All Men by These PresentsRochelle VelezNo ratings yet

- Uttra ProjectDocument76 pagesUttra Project9415697349100% (1)

- Social Science Class 10 QuestionDocument20 pagesSocial Science Class 10 Questionradhe thakurNo ratings yet

- HSBCnet Payments User GuideDocument120 pagesHSBCnet Payments User GuideelmenshawymarwaNo ratings yet

- Account and Auditing Some NotesDocument13 pagesAccount and Auditing Some NotesBasilDarlongDiengdohNo ratings yet

- 01-Apr-2021Document1 page01-Apr-2021Abu Bkr JanjuaNo ratings yet

- Additional Illustration-9Document12 pagesAdditional Illustration-9alokpandeygenxNo ratings yet

- Rural DevelopmentDocument17 pagesRural DevelopmentBhavya SharmaNo ratings yet

- Effect of Merger and Acquisition on Nigeria's Banking SectorDocument60 pagesEffect of Merger and Acquisition on Nigeria's Banking SectorDavis D'SaNo ratings yet

- Notes On The Overview of Money Market SecuritiesDocument2 pagesNotes On The Overview of Money Market SecuritiesjeanneNo ratings yet

- CV9Document3 pagesCV9Ali Zafrullah BinudinNo ratings yet

- 38. Đề thi thử TN THPT 2021 Môn Tiếng anh Chuyên Hoàng Văn Thụ Hòa Bình Lần 2 File word có lời giảiDocument20 pages38. Đề thi thử TN THPT 2021 Môn Tiếng anh Chuyên Hoàng Văn Thụ Hòa Bình Lần 2 File word có lời giảihai anh HoangNo ratings yet

- Understanding Financial Markets and IntermediariesDocument8 pagesUnderstanding Financial Markets and IntermediariesSebastian LimNo ratings yet