Professional Documents

Culture Documents

CONN Stock Summary

Uploaded by

Old School ValueCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CONN Stock Summary

Uploaded by

Old School ValueCopyright:

Available Formats

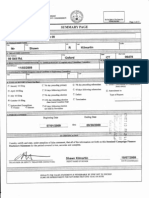

Conn's Inc

(CONN) February 10, 2010

Figures in Millions except per share values

Company Overview

Conn�s Inc. is a specialty retailer of home appliances and consumer electronics. The Company sells home appliances including refrigerators, freezers, washers, dryers,

dishwashers and ranges, and a variety of consumer electronics including liquid crystal display (LCD), plasma and digital light processing (DLP) televisions, camcorders,

digital cameras, computers and computer accessories, Blu-ray and digital versatile disc (DVD) players, video game equipment, portable audio, Moving Picture Expert

Group layer-three (MP3 players), global positioning system (GPS) devices and home theater products. The Company currently operate 75 retail and clearance stores

located in Texas, Louisiana and Oklahoma.

Valuation

Current Price 5 Year Historical Price vs Intrinsic Value

$ 4.61 Margin of Safety 50

NCAV $ 6.94 51%

45

Total Net Reprod. Cost $ 26.01 464%

40

Earnings Power Value (EPV) $ 18.32 297%

35

Discounted Cash Flow (DCF) $ 18.49 301%

30

Ben Graham Formula $ 13.07 184%

25

20

Key Statistics Valuation Ratios 15

Market Cap (millions) $ 103.55 P/E (TTM) 7.3

10

52-Week High $ 17.67 P/S (TTM) 0.1

5

52-Week Low $ 4.42 P/B (MRQ) 0.3

% off 52-Week Low 4% P/Tang. BV (MRQ) 0.3 0

FCF/EV (TTM) 10.8% 2/8/2010

1/20/2009

12/31/2007

12/11/2006

11/21/2005

11/1/2004

Cash Flows P/FCF (TTM) 0.0 Historical Price Intrinsic Value Buy Price

Owner Earnings FCF EV/Sales (TTM) 0.2

Owner Earnings FCF Avg Grwth 13.0% EV/FCF (TTM) 9.3

FCF

FCF Avg Grwth 0.0% Margins & Profitability Balance Sheet

Gross Cash and Equiv $ 10.60

Effectiveness Gross Margin Short-Term Investments $ 149.40

CROIC Operating Accts Rec $ 156.20

CROIC Avg 7.0% Operating Margin Inventory $ 71.70

FCF/S Net Profit Total Current Assets $ 271.10

FCF/S Avg 4.2% Net Margin Net PP&E $ 61.60

ROA Intangibles $ -

ROA Avg 11.0% Financial Strength (MRQ) Total Assets $ 419.80

ROE Quick Ratio 3.5

ROE Avg 15.7% Current Ratio 4.2 Total Current Liabilities $ 84.50

LT Debt to Equity 37.3 Long-Term Debt $ 125.30

Efficiency Total Debt to Equity 37.3 Total Liabilities $ 231.95

Receivable Turnover (TTM) 7.5

Inventory Turnover (TTM) 6.7

Asset Turnover (TTM) 1.7

You might also like

- MYGN Fundamental Analysis Report With The OSV Stock AnalyzerDocument1 pageMYGN Fundamental Analysis Report With The OSV Stock AnalyzerOld School ValueNo ratings yet

- Where To Find Value in 2014Document19 pagesWhere To Find Value in 2014Old School ValueNo ratings yet

- Financial Ratio Analysis Dec 2013 PDFDocument13 pagesFinancial Ratio Analysis Dec 2013 PDFHạng VũNo ratings yet

- The Value of DELL and A Free EBIT Multiples CalculatorDocument4 pagesThe Value of DELL and A Free EBIT Multiples CalculatorOld School ValueNo ratings yet

- The Ultimate Guide To Stock Valuation - Sample ChaptersDocument11 pagesThe Ultimate Guide To Stock Valuation - Sample ChaptersOld School ValueNo ratings yet

- Balance Sheet Financial Statement AnalysisDocument5 pagesBalance Sheet Financial Statement AnalysisOld School Value100% (4)

- Infusystems INFU Value Investors ClubDocument4 pagesInfusystems INFU Value Investors ClubOld School ValueNo ratings yet

- InterDigital IDCC Stock Analyzer Report 0820 - Old School ValueDocument9 pagesInterDigital IDCC Stock Analyzer Report 0820 - Old School ValueOld School ValueNo ratings yet

- Marvell (MRVL) Stock Analyzer ReportDocument12 pagesMarvell (MRVL) Stock Analyzer ReportOld School Value0% (1)

- INFU Stock PresentationDocument16 pagesINFU Stock PresentationOld School ValueNo ratings yet

- Magic Formula White PaperDocument5 pagesMagic Formula White PaperOld School Value100% (3)

- Apple Target Price of $600Document45 pagesApple Target Price of $600Old School ValueNo ratings yet

- 16 Financial Ratios To Determine A Company's Strength and WeaknessesDocument5 pages16 Financial Ratios To Determine A Company's Strength and WeaknessesOld School Value88% (8)

- AAPL Reverse Valuation With Old School ValueDocument14 pagesAAPL Reverse Valuation With Old School ValueOld School ValueNo ratings yet

- Financial Statement Analysis For Cash Flow StatementDocument5 pagesFinancial Statement Analysis For Cash Flow StatementOld School Value100% (3)

- Four Basic Steps For Gauging The Firm's True Financial PositionDocument3 pagesFour Basic Steps For Gauging The Firm's True Financial PositionOld School Value100% (2)

- AEY Report Graham Net Nets Dec 2011Document7 pagesAEY Report Graham Net Nets Dec 2011Old School ValueNo ratings yet

- Income Statement Financial Statement AnalysisDocument5 pagesIncome Statement Financial Statement AnalysisOld School Value100% (1)

- Chap 3 FCFHelenDocument66 pagesChap 3 FCFHelenarslanj123No ratings yet

- Stock Valuation Spreadsheet RadioShack RSHDocument10 pagesStock Valuation Spreadsheet RadioShack RSHOld School ValueNo ratings yet

- Adrian Day Portfolio Review 4Q 2011Document8 pagesAdrian Day Portfolio Review 4Q 2011Old School ValueNo ratings yet

- Creating Stock Screens AAIIDocument68 pagesCreating Stock Screens AAIIOld School Value100% (2)

- Dacha Strategiv Metals Aug 2011 PresentationDocument26 pagesDacha Strategiv Metals Aug 2011 PresentationOld School ValueNo ratings yet

- Pet Stores in The US Industry ReportDocument33 pagesPet Stores in The US Industry ReportzizilolNo ratings yet

- Adrian Day Portfolio Review 3Q 2011Document8 pagesAdrian Day Portfolio Review 3Q 2011Old School ValueNo ratings yet

- Adrian Day Portfolio Review 2Q11Document8 pagesAdrian Day Portfolio Review 2Q11Old School ValueNo ratings yet

- GRVY Compustat ReportDocument15 pagesGRVY Compustat ReportOld School ValueNo ratings yet

- Revisiting The 2009 Forbes 200 Best Small CompaniesDocument6 pagesRevisiting The 2009 Forbes 200 Best Small CompaniesOld School ValueNo ratings yet

- Rare Earth Elements: The Global Supply IssueDocument18 pagesRare Earth Elements: The Global Supply IssueOld School ValueNo ratings yet

- Graham & Doddsville Spring 2011 NewsletterDocument27 pagesGraham & Doddsville Spring 2011 NewsletterOld School ValueNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Flow of Accounting Entries in Oracle AppDocument19 pagesFlow of Accounting Entries in Oracle AppSrinivas AzureNo ratings yet

- Market Research and Product Development: Citi Global Consumer BankDocument4 pagesMarket Research and Product Development: Citi Global Consumer BankAnil Kumar ShahNo ratings yet

- Substantive Procedures For InvestmentsDocument2 pagesSubstantive Procedures For InvestmentsChristian PerezNo ratings yet

- Infosys 2019-2023Document14 pagesInfosys 2019-2023Deepak GuptaNo ratings yet

- Sharpe's ModelDocument58 pagesSharpe's ModelTausif R Maredia100% (1)

- Tranzact Insurance 7-06Document1 pageTranzact Insurance 7-06julissaNo ratings yet

- Account Activity SummaryDocument141 pagesAccount Activity SummaryMOHAMAD IKSAN ABIDINNo ratings yet

- Amendment To Real Estate MortgageDocument2 pagesAmendment To Real Estate MortgageRaihanah Sarah Tucaben Macarimpas100% (1)

- CARSONDocument2 pagesCARSONShubhangi AgrawalNo ratings yet

- Merger Arbitrage Case StudyDocument5 pagesMerger Arbitrage Case Studychuff6675100% (1)

- Seec F'orm 20Document23 pagesSeec F'orm 20The Valley IndyNo ratings yet

- Valuation 1Document22 pagesValuation 1Nisa AnnNo ratings yet

- Advanced Accounting 7e Hoyle - Chapter 1Document47 pagesAdvanced Accounting 7e Hoyle - Chapter 1Leni Rosiyani100% (8)

- Vellekoop Nieuwenhuis DividendsDocument20 pagesVellekoop Nieuwenhuis DividendsshuuchuuNo ratings yet

- OBYC Different Transaction Like BSX, GBBDocument3 pagesOBYC Different Transaction Like BSX, GBBIgnacio Luzardo AlvezNo ratings yet

- 3-ABC Design-PeriodicDocument2 pages3-ABC Design-PeriodicFroilan RolaNo ratings yet

- Request For Electronic Policy Payout: Policy Number Name of Policy Holder Aadhaar Number PAN Mobile NumberDocument1 pageRequest For Electronic Policy Payout: Policy Number Name of Policy Holder Aadhaar Number PAN Mobile Numberrovensingh007No ratings yet

- What is Bitcoin? The Beginner's Guide to Understanding BitcoinDocument4 pagesWhat is Bitcoin? The Beginner's Guide to Understanding BitcoinDevonNo ratings yet

- Working Capital Management of Reliance Infra LTDDocument76 pagesWorking Capital Management of Reliance Infra LTDniceprachiNo ratings yet

- Financing Hospital ExpansionDocument6 pagesFinancing Hospital ExpansionJabu MpolokengNo ratings yet

- Struktur Modal Optimal Dan Kecepatan Penyesuaian Studi Empiris Di Bursa Efek IndonesiaDocument20 pagesStruktur Modal Optimal Dan Kecepatan Penyesuaian Studi Empiris Di Bursa Efek IndonesiaChandra Bagas AlfianNo ratings yet

- Significance of Payback Analysis in Decision-MakingDocument9 pagesSignificance of Payback Analysis in Decision-MakingdutrafaissalNo ratings yet

- Chapter 5 Time Value of MoneyDocument39 pagesChapter 5 Time Value of MoneyAU Sharma100% (2)

- Internal Control Manual SummaryDocument14 pagesInternal Control Manual SummaryMarina OleynichenkoNo ratings yet

- ANALE - Stiinte Economice - Vol 2 - 2014 - FinalDocument250 pagesANALE - Stiinte Economice - Vol 2 - 2014 - FinalmhldcnNo ratings yet

- Disclosure No. 140 2021 Annual Report For Fiscal Year Ended September 30 2020 SEC Form 17 ADocument153 pagesDisclosure No. 140 2021 Annual Report For Fiscal Year Ended September 30 2020 SEC Form 17 AJan Nicklaus S. BunagNo ratings yet

- Form No. 3825 Discharge of Matured PolicyDocument3 pagesForm No. 3825 Discharge of Matured Policymails4vips100% (1)

- Chapter 1 5Document100 pagesChapter 1 5Bijaya DhakalNo ratings yet

- NRI Document Checklist - Merchant NavyDocument2 pagesNRI Document Checklist - Merchant NavyAvinash ChaurasiaNo ratings yet