Professional Documents

Culture Documents

TDS Challan

Uploaded by

Jainsanjaykumar0 ratings0% found this document useful (0 votes)

900 views1 pageT.D.S. / TCS TAX CHALLAN CHALLAN No. / ITNS 281 Tax Applicable (Tick One) Assessment Year Tax Deduction Account No. (T.A.N.) Full Name Complete Address with City and State Tel. No. Pin Type of Payment Code TDS/TCS Payable by Taxpayer (200) TDS / TCS Regular Assessment (Raised by I.T. Deptt.) (400)

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentT.D.S. / TCS TAX CHALLAN CHALLAN No. / ITNS 281 Tax Applicable (Tick One) Assessment Year Tax Deduction Account No. (T.A.N.) Full Name Complete Address with City and State Tel. No. Pin Type of Payment Code TDS/TCS Payable by Taxpayer (200) TDS / TCS Regular Assessment (Raised by I.T. Deptt.) (400)

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

900 views1 pageTDS Challan

Uploaded by

JainsanjaykumarT.D.S. / TCS TAX CHALLAN CHALLAN No. / ITNS 281 Tax Applicable (Tick One) Assessment Year Tax Deduction Account No. (T.A.N.) Full Name Complete Address with City and State Tel. No. Pin Type of Payment Code TDS/TCS Payable by Taxpayer (200) TDS / TCS Regular Assessment (Raised by I.T. Deptt.) (400)

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You are on page 1of 1

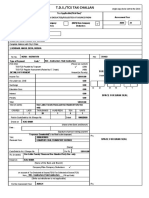

Single Copy (to be sent to the ZAO)

T.D.S./TCS TAX CHALLAN

CHALLAN Tax Applicable (Tick One)*

No./ TAX DEDUCTED/COLLECTED AT SOURCE FROM Assessment Year

(0020) COMPANY (0021) NON-COMPANY 2 0 1 0 - 1 1

ITNS 281 DEDUCTEES DEDUCTEES √

Tax Deduction Account No. (T.A.N.)

Full Name

Complete Address with City & State

Tel. No. Pin

Type of Payment Code *

TDS/TCS Payable By Taxpayer (200)

TDS/TCS Regular Assessment (Raised by I.T. Deptt.) (400)

DETAILS OF PAYMENT Amount (in Rs. Only) For Use in Receiving Bank

Income Tax Debit to A/c / Cheque creditted on

Surcharge - -

Education Cess D D M M Y Y Y Y

Interest

SPACE FOR BANK SEAL

Penalty

Others

Total

Total (In Words)

CRORES LACS THOUSANDS HUNDREDS TENS UNITS

Paid in Cash/Debit to A/c/ Cheque No. Dated

Drawn on

(Name of the Bank & Branch)

Date: Rs. :

(Signature of the person making payment)

Taxpayers Counterfoil (to be filled up by tax payer) SPACE FOR BANK SEAL

TAN

Received From

(Name)

Cash/Debit to A/c/ Cheque No. For Rs.

Rs. (in Words)

Drawn on

(Name of the Bank & Branch)

on account of

Code

For the Assessment Year - Rs. :

You might also like

- TDS TCS Tax ChallanDocument1 pageTDS TCS Tax Challanjagdish412301No ratings yet

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- Itns-281 TDS ChallanDocument1 pageItns-281 TDS Challanvirendra36999100% (2)

- For Payment From July 2005 OnwardsDocument1 pageFor Payment From July 2005 Onwardsvijay123*75% (4)

- Zentds KDK SoftwareDocument1 pageZentds KDK Softwarear8ku9sh0aNo ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Challan No. ITNS 280Document2 pagesChallan No. ITNS 280RAHUL AGARWALNo ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaNo ratings yet

- ImportantDocument1 pageImportantWilliam SureshNo ratings yet

- Challan No./ ITNS 282: Tax Applicable (Tick One)Document2 pagesChallan No./ ITNS 282: Tax Applicable (Tick One)satishkumar.mandora.smNo ratings yet

- TDS TCS Tax Challan PaymentDocument5 pagesTDS TCS Tax Challan PaymentSachin KumarNo ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- (0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanDocument3 pages(0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanRambabuNo ratings yet

- PrintTDSChallan (281) 2020-2021 PDFDocument1 pagePrintTDSChallan (281) 2020-2021 PDFAmeyNo ratings yet

- TDS Challan for Shree Raghuvanshi Lohana MahajanDocument2 pagesTDS Challan for Shree Raghuvanshi Lohana Mahajannilesh vithalaniNo ratings yet

- T.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseDocument10 pagesT.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseHARDEEPTHAPARNo ratings yet

- Form 281 Candeur Constructions - 92bDocument1 pageForm 281 Candeur Constructions - 92bReddeppa Reddy BisaigariNo ratings yet

- TCS TenduDocument1 pageTCS TenduSwetha KarthickNo ratings yet

- ITNS 281 TDS/TCS ChallanDocument3 pagesITNS 281 TDS/TCS ChallanC.A. Ankit JainNo ratings yet

- Ganraj ConstructionDocument2 pagesGanraj ConstructionSUNIL GAIKWADNo ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- TDS-ChallanFormatDocument1 pageTDS-ChallanFormatAnand_Gupta_6499No ratings yet

- Itns 285Document2 pagesItns 285Anurag SharmaNo ratings yet

- Ashima Kalra 194 CDocument1 pageAshima Kalra 194 CSudhanshu JaiswalNo ratings yet

- Draft Challan IchhaDocument1 pageDraft Challan IchhaSneha SharmaNo ratings yet

- Zero Zero Three Zero Two Zero: DD MM YyDocument1 pageZero Zero Three Zero Two Zero: DD MM YyShubham Pandey WatsonNo ratings yet

- TDS Challan FormDocument1 pageTDS Challan FormVipin Kumar ChandelNo ratings yet

- Tds Challan 281 Nov'2021Document6 pagesTds Challan 281 Nov'2021tojendra laltenNo ratings yet

- (0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FDocument1 page(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FAngad MundraNo ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- Challan - 281Document1 pageChallan - 281Kelly WilliamsNo ratings yet

- Form 16B TDS CertificateDocument1 pageForm 16B TDS CertificateSurendra Kumar BaaniyaNo ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Document3 pagesD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarNo ratings yet

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDocument1 pageAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNo ratings yet

- GST FormatDocument3 pagesGST FormatAnmol GoyalNo ratings yet

- TDS Challan2009-2010Document18 pagesTDS Challan2009-2010ANJAIAHCHARYNo ratings yet

- Challan No. ITNS 280: Tax Applicable Assessment YearDocument1 pageChallan No. ITNS 280: Tax Applicable Assessment YearNalini SenthilkumarNo ratings yet

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Document1 pageAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanNo ratings yet

- Challan Advance TaxDocument1 pageChallan Advance Taxamit22505No ratings yet

- Ganapati TDS ChalanDocument3 pagesGanapati TDS ChalanPruthiv RajNo ratings yet

- ChallanFormDocument1 pageChallanFormrmzmuhammedNo ratings yet

- ChallanFormDocument1 pageChallanFormbghosh00112233No ratings yet

- Challan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDocument2 pagesChallan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDharmeshNo ratings yet

- Challan PDFDocument1 pageChallan PDFShilesh GargNo ratings yet

- Single Copy Tax Challan for Self Assessment TaxDocument1 pageSingle Copy Tax Challan for Self Assessment TaxShilesh GargNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Saravana KumarNo ratings yet

- ChallanDocument1 pageChallanabhi7991No ratings yet

- ChallanDocument1 pageChallanYash KavteNo ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- How To Set Up Intercompany Balancing Rules For Bank Account TransfersDocument9 pagesHow To Set Up Intercompany Balancing Rules For Bank Account TransfersflavioNo ratings yet

- Internship ReportDocument75 pagesInternship ReportAsma AzamNo ratings yet

- Mcqs For Chapter 5 Islamic Bonds and DerivativesDocument3 pagesMcqs For Chapter 5 Islamic Bonds and DerivativesalaaNo ratings yet

- How money laundering risks affect countries and financial institutionsDocument42 pagesHow money laundering risks affect countries and financial institutionsAbidRazaca88% (16)

- Understanding Real, Personal and Nominal AccountsDocument3 pagesUnderstanding Real, Personal and Nominal Accountsarsalan ShahzadNo ratings yet

- A Study On E-Banking Service Quality and Customer SatisfactionDocument9 pagesA Study On E-Banking Service Quality and Customer Satisfactionmohak bettercalmemonuNo ratings yet

- Acca Afm Interest Rate RiskDocument25 pagesAcca Afm Interest Rate RiskBijay AgrawalNo ratings yet

- Final SynthesisDocument6 pagesFinal Synthesisapi-256072244No ratings yet

- UCT Handbook 12 2019 StudentFees PDFDocument132 pagesUCT Handbook 12 2019 StudentFees PDFNjabulo DlaminiNo ratings yet

- Finacle Menu OptionsDocument7 pagesFinacle Menu OptionsNiki Lohani100% (2)

- CPM Pre Calculus Chapter 12 SolutionsDocument43 pagesCPM Pre Calculus Chapter 12 SolutionsSean KadkhodayanNo ratings yet

- CXC It Sba 2015Document6 pagesCXC It Sba 2015Wayne WrightNo ratings yet

- Vault Career Guide To Investment Management European Edition 2014 FinalDocument127 pagesVault Career Guide To Investment Management European Edition 2014 FinalJohn Chawner100% (1)

- PMCM Company Deck June 2018Document32 pagesPMCM Company Deck June 2018Hannes Sternbeck FryxellNo ratings yet

- International BankingDocument55 pagesInternational BankingNipathBelaniNo ratings yet

- Company OverviewDocument9 pagesCompany OverviewMj Nazario100% (1)

- Past Year Exam Paper Bank Discount & Promissory NotesDocument5 pagesPast Year Exam Paper Bank Discount & Promissory Notesatiqahcantik100% (1)

- The Concept of Free MarketDocument6 pagesThe Concept of Free MarketDavidNo ratings yet

- Capital MarketsDocument8 pagesCapital Marketsrupeshmore145No ratings yet

- Tire City IncDocument12 pagesTire City Incdownloadsking100% (1)

- Bisnis Gratis Dapat DollarDocument5 pagesBisnis Gratis Dapat Dollarerna1990No ratings yet

- Indian Financial MarketDocument114 pagesIndian Financial MarketmilindpreetiNo ratings yet

- UTI - Systematic Investment Plan (SIP) New Editable Application FormDocument4 pagesUTI - Systematic Investment Plan (SIP) New Editable Application FormAnilmohan SreedharanNo ratings yet

- CFG Accounting and Finance Considerations PWC Winter 2014Document39 pagesCFG Accounting and Finance Considerations PWC Winter 2014timevalueNo ratings yet

- GFR FormsDocument2 pagesGFR FormsSaurav GhoshNo ratings yet

- SWOT of BFSIDocument3 pagesSWOT of BFSIsumit athwani100% (1)

- Company Law Tutorial Questions Semester 1-2014-2016Document3 pagesCompany Law Tutorial Questions Semester 1-2014-2016Latanya BridgemohanNo ratings yet

- Berry Creek Ranch Horse SaleDocument23 pagesBerry Creek Ranch Horse SalesurfnewmediaNo ratings yet

- E-Payment in India PDFDocument6 pagesE-Payment in India PDFM GouthamNo ratings yet

- Nippon Life Insurance Co., Inc. v. CIR, CTA Case No. 6142, February 4, 2002Document21 pagesNippon Life Insurance Co., Inc. v. CIR, CTA Case No. 6142, February 4, 2002EnzoGarcia100% (1)