Professional Documents

Culture Documents

Annual Tax Filing Test Rules

Uploaded by

Charles DavidsonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Tax Filing Test Rules

Uploaded by

Charles DavidsonCopyright:

Available Formats

Annual Filing Season Program

Category

Annual Federal Tax Refresher (AFTR) Course

Comprehension Test Parameters

1. Integrity

The comprehension test must be handled with the upmost integrity by the return preparer, which includes avoiding use of

unauthorized materials during the test, and misuse or unauthorized distribution of test materials

2. Questions

Each AFTR test will include at least 100 questions that assess a return preparers comprehension of course content

Each AFTR test will consist of all multiple choice questions OR a combination of multiple choice and true/false questions

3. Length

A maximum of three continuous hours will be allowed to complete the minimum standard of 100 test questions

4. Content

All topics across the three domains highlighted in Annual Federal Tax Refresher Course Outline document will be tested;

however, each CE providers comprehension test will be unique

5. Passing Score

Return preparers must answer a minimum of 70% of the test questions correctly to pass an AFTR comprehension test

Return preparers are permitted to attempt the test an unlimited number of times; however, a return preparer may only

6. Attempts

rd

attempt a specific version of the test twice (i.e., a different version of the test will be given at least every 3 test attempt by

a return preparer)

Rev. 6/25/14

You might also like

- Godspell PacketDocument9 pagesGodspell Packettommyjranieri80% (10)

- Adler - On Broadway - Art and Commerce On The Great White WayDocument269 pagesAdler - On Broadway - Art and Commerce On The Great White WayCharles Davidson100% (2)

- Types of test items and assessing reliabilityDocument16 pagesTypes of test items and assessing reliabilitygeetkumar1867% (6)

- Automated Software Testing Interview Questions You'll Most Likely Be AskedFrom EverandAutomated Software Testing Interview Questions You'll Most Likely Be AskedNo ratings yet

- MSA Work InstructionDocument2 pagesMSA Work Instructionazadsingh192% (13)

- Quality Control ManagementDocument19 pagesQuality Control ManagementArluky Novandy0% (1)

- Air Instructor Manual March 14Document128 pagesAir Instructor Manual March 14jamesbeaudoin100% (1)

- Aerial ApplicationDocument242 pagesAerial ApplicationshadrekNo ratings yet

- Final Assessment Guide Forklift v1 PDFDocument20 pagesFinal Assessment Guide Forklift v1 PDFjegadish1No ratings yet

- SERIES 9 EXAM REVIEW 2022+ TEST BANKFrom EverandSERIES 9 EXAM REVIEW 2022+ TEST BANKRating: 5 out of 5 stars5/5 (1)

- Stage ManagementDocument25 pagesStage ManagementCharles Davidson100% (2)

- QC Management for Lab TestingDocument4 pagesQC Management for Lab Testingkriss WongNo ratings yet

- SERIES 3 FUTURES LICENSING EXAM REVIEW 2021+ TEST BANKFrom EverandSERIES 3 FUTURES LICENSING EXAM REVIEW 2021+ TEST BANKNo ratings yet

- Godspell Synopsis Details Original NY ProductionDocument4 pagesGodspell Synopsis Details Original NY ProductionCharles DavidsonNo ratings yet

- CFSP Membership - WWW - CfseDocument3 pagesCFSP Membership - WWW - CfseSARFRAZ ALINo ratings yet

- OrationDocument1 pageOrationNoel Krish ZacalNo ratings yet

- Protocol For Reporting WorkloadDocument3 pagesProtocol For Reporting WorkloadCarla Puno100% (7)

- Prepare Evidence Gathering ToolsDocument43 pagesPrepare Evidence Gathering Toolsjonellambayan100% (1)

- Test ConstructionDocument18 pagesTest Constructionsameer goyalNo ratings yet

- SERIES 3 FUTURES LICENSING EXAM REVIEW 2022+ TEST BANKFrom EverandSERIES 3 FUTURES LICENSING EXAM REVIEW 2022+ TEST BANKNo ratings yet

- ALCPT HandbookDocument17 pagesALCPT HandbookMetodi Hadji Janev33% (3)

- Guidelines for Constructing Effective Classroom TestsDocument25 pagesGuidelines for Constructing Effective Classroom Testsketian15No ratings yet

- ALCPT HandbookDocument16 pagesALCPT HandbookAleksandar Sashe Dodevski100% (3)

- Mark Scheme (Results) June 2011: GCE Biology (6BI08) Paper 01 Practical Biology and Research (WA)Document13 pagesMark Scheme (Results) June 2011: GCE Biology (6BI08) Paper 01 Practical Biology and Research (WA)areyouthere92No ratings yet

- Textile Quality Management: MR Dale CarrollDocument16 pagesTextile Quality Management: MR Dale CarrollShoukhin TalukdarNo ratings yet

- Qualities of a Good Measuring InstrumentDocument9 pagesQualities of a Good Measuring InstrumentNova Rhea GarciaNo ratings yet

- Kesulitan Makan Pada AnakDocument6 pagesKesulitan Makan Pada AnakDewi Rahma PutriNo ratings yet

- ALCPT HandbookDocument15 pagesALCPT Handbookkibi2009No ratings yet

- STP 304-3 Interlab Testing ProgramsDocument31 pagesSTP 304-3 Interlab Testing ProgramsChong NeoyeahNo ratings yet

- Mark Scheme (Results) January 2013: GCE Biology (6BI08) Paper 01 Practical Biology and Investigative SkillsDocument12 pagesMark Scheme (Results) January 2013: GCE Biology (6BI08) Paper 01 Practical Biology and Investigative Skillsafoo1234No ratings yet

- Course Syllabus SampleDocument10 pagesCourse Syllabus Samplececil josef liganNo ratings yet

- Abraham Tilahun GSE 6950 15Document13 pagesAbraham Tilahun GSE 6950 15Abraham tilahun100% (1)

- The Medical College Admission Test2016 - b-1Document3 pagesThe Medical College Admission Test2016 - b-1Angel Itachi MinjarezNo ratings yet

- Tri-Coll M Paed Dent - Guide To CandidatesDocument8 pagesTri-Coll M Paed Dent - Guide To CandidatesGujapaneni Ravi KumarNo ratings yet

- Quality Assurance Fit and Seal Supplier GuidelinesDocument3 pagesQuality Assurance Fit and Seal Supplier GuidelinesBalaNo ratings yet

- CLIA-Verification-Performance Specs-BookletDocument6 pagesCLIA-Verification-Performance Specs-BookletZaraith Sanchez-Oviol PeareNo ratings yet

- Off Test Taking TipsDocument2 pagesOff Test Taking TipsVikram AdityaNo ratings yet

- How To Respond To Extended Response Questions Global Strategy and Leadership - S1 2019Document11 pagesHow To Respond To Extended Response Questions Global Strategy and Leadership - S1 2019kennyeffectNo ratings yet

- Laboratory Monitors: Standard Guide ForDocument4 pagesLaboratory Monitors: Standard Guide ForMorched TounsiNo ratings yet

- Phases of Polygraph ExamDocument14 pagesPhases of Polygraph ExamZainor MaslaNo ratings yet

- Quality Management Guidelines for Proficiency TestingDocument5 pagesQuality Management Guidelines for Proficiency TestingRoyal BimhahNo ratings yet

- GRR Method for Ensuring Measurement QualityDocument7 pagesGRR Method for Ensuring Measurement QualityINNOBUNo7No ratings yet

- FEM ATPL Easa - Fem - Module - 2.4 - Atpla - v2021 - RGB - v5Document6 pagesFEM ATPL Easa - Fem - Module - 2.4 - Atpla - v2021 - RGB - v5simoneNo ratings yet

- QAHE English Language Testing PolicyDocument5 pagesQAHE English Language Testing PolicyHakimullah RashidiNo ratings yet

- Stages of Test DevelopmentDocument3 pagesStages of Test DevelopmentalexesssmazeNo ratings yet

- Three Year LL.B Syllabus-Regulations 2016-17 PDFDocument102 pagesThree Year LL.B Syllabus-Regulations 2016-17 PDFMichael RajaNo ratings yet

- GAT Guide: Test OverviewDocument6 pagesGAT Guide: Test OverviewMujeeb RehmanNo ratings yet

- CHEM 101 General Chemistry I Fall 2015Document8 pagesCHEM 101 General Chemistry I Fall 2015Promise AdewaleNo ratings yet

- FEM AoC A TRI Y SFI Easa - Fem - Module - 7.1 - Aoc - Sfi - Tria - v2021 - RGB - v5Document16 pagesFEM AoC A TRI Y SFI Easa - Fem - Module - 7.1 - Aoc - Sfi - Tria - v2021 - RGB - v5simoneNo ratings yet

- What To Say To Candidates in An ExamDocument12 pagesWhat To Say To Candidates in An ExamBaird KingNo ratings yet

- Supplement To Chapter 9Document2 pagesSupplement To Chapter 9hello_khayNo ratings yet

- AaaaDocument7 pagesAaaapaulinavasquez051No ratings yet

- Chapter Three: Characteristics of AssessmentDocument9 pagesChapter Three: Characteristics of AssessmentHussam ObiNo ratings yet

- Pearson BTEC Level 3 Award For Working As A Close Protection Operative Within The Private Security Industry QCFDocument4 pagesPearson BTEC Level 3 Award For Working As A Close Protection Operative Within The Private Security Industry QCFRaymon Kennedy OrtizNo ratings yet

- Size and Structure of The Pilot PlantDocument20 pagesSize and Structure of The Pilot PlantDhaniar PurwitasariNo ratings yet

- Note To ProfDocument1 pageNote To ProfBob SagettNo ratings yet

- SUPPLIER PARTNERSHIPDocument34 pagesSUPPLIER PARTNERSHIPnive20318.ecNo ratings yet

- Bpharm KuhsDocument67 pagesBpharm KuhsMuhammed HabeebullaNo ratings yet

- Physical Chem Lab ManualDocument88 pagesPhysical Chem Lab ManualAura Paige Montecastro-RevillaNo ratings yet

- Csir Net Lifescience Exam PatternDocument1 pageCsir Net Lifescience Exam PatternSantosh KarimiNo ratings yet

- LL.B SyllabusDocument67 pagesLL.B SyllabusPraveen Kumar KokkantiNo ratings yet

- Confined Space Entry (CSE) Certification Training Standard: Workplace Health, Safety and Compensation ActDocument5 pagesConfined Space Entry (CSE) Certification Training Standard: Workplace Health, Safety and Compensation ActUdha Pengen SuksesNo ratings yet

- CIPS MER Assessment Candidate Guide Incl AppendicesDocument10 pagesCIPS MER Assessment Candidate Guide Incl Appendicestsmith.tas12No ratings yet

- Analyzing Script StructureDocument34 pagesAnalyzing Script StructureCharles DavidsonNo ratings yet

- The Visual Collaboration: Working With DesignersDocument35 pagesThe Visual Collaboration: Working With DesignersCharles DavidsonNo ratings yet

- MGN 477 SeaDocument26 pagesMGN 477 SeaCharles DavidsonNo ratings yet

- Infant Feeding EmergencyDocument3 pagesInfant Feeding EmergencyCharles DavidsonNo ratings yet

- MGN 477 MLC Outer Cover MSF 4156Document2 pagesMGN 477 MLC Outer Cover MSF 4156Charles DavidsonNo ratings yet

- MGN 477 MLC List of Young Persons MSF 4158Document2 pagesMGN 477 MLC List of Young Persons MSF 4158Charles DavidsonNo ratings yet

- EeoDocument14 pagesEeoCharles DavidsonNo ratings yet

- Application To Direct at The Washington Community TheaterDocument4 pagesApplication To Direct at The Washington Community TheaterCharles DavidsonNo ratings yet

- Fabian Truth MakingDocument21 pagesFabian Truth MakingCharles DavidsonNo ratings yet

- MGN 477 MLC List of Crew MSF 4157Document1 pageMGN 477 MLC List of Crew MSF 4157Charles DavidsonNo ratings yet

- Call Me Dave PrefaceDocument4 pagesCall Me Dave PrefaceCharles DavidsonNo ratings yet

- MT 201503Document48 pagesMT 201503Charles DavidsonNo ratings yet

- NISO Milestone Timeline FromISQDocument6 pagesNISO Milestone Timeline FromISQKartheek RajaNo ratings yet

- Emer Prep GuideDocument11 pagesEmer Prep GuideCan CanNo ratings yet

- I Ms Global 2014 Annual ReportDocument16 pagesI Ms Global 2014 Annual ReportCharles DavidsonNo ratings yet

- Uc2.ark 13960 t5t72cg70Document563 pagesUc2.ark 13960 t5t72cg70Charles DavidsonNo ratings yet

- PMP - Project Phase TasksDocument20 pagesPMP - Project Phase TaskscaapiitooNo ratings yet

- FrontpageDocument1 pageFrontpageCharles DavidsonNo ratings yet

- Law Enf CommDocument2 pagesLaw Enf CommguidelliNo ratings yet

- Student Achievement Record HRBDocument1 pageStudent Achievement Record HRBCharles DavidsonNo ratings yet

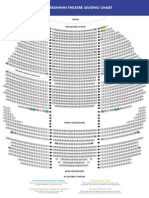

- The Gershwin Theatre Seating Chart: StageDocument1 pageThe Gershwin Theatre Seating Chart: StageCharles DavidsonNo ratings yet

- The ABCs of ApostillesDocument0 pagesThe ABCs of ApostillesjheanNo ratings yet

- Tax Professional DesignationsDocument12 pagesTax Professional DesignationsCharles DavidsonNo ratings yet