Professional Documents

Culture Documents

Acknowledgement Final

Uploaded by

Mohan Naidu0 ratings0% found this document useful (0 votes)

221 views2 pagesGovernment of India received a return of income and / or return of fringe benefits in Form No. ITR year 2009-10, having the following particulars.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGovernment of India received a return of income and / or return of fringe benefits in Form No. ITR year 2009-10, having the following particulars.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

221 views2 pagesAcknowledgement Final

Uploaded by

Mohan NaiduGovernment of India received a return of income and / or return of fringe benefits in Form No. ITR year 2009-10, having the following particulars.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

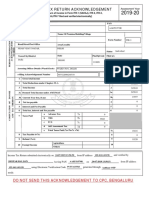

Government of India

INCOME-TAX DEPARTMENT

ACKNOWLEDGEMENT

Received with thanks from _______________________________________________________________ a

return of income and/or return of fringe benefits in Form No. ITR … for assessment

year 2009-10, having the following particulars.

Name PAN

AND TAX THEREONCOMPUTATION OF INCOME PERSONALINFORMATION

Flat/Door/Block No Name Of Premises/Building/Village

Road/Street/Post Office Area/Locality

Town/City/District State Status

(fill the

code)

Designation of Assessing Officer (Ward/ Circle) Original or Revised

1 Gross total income 1

2 Deductions under Chapter-VI-A 2

3 Total Income 3

3aCurrent Year loss (if any) 3a

4 Net tax payable 4

5 Interest payable 5

6 Total tax and interest payable 6

7 Taxes Paid

a Advance Tax 7a

b TDS 7b

c TCS 7c

d Self Assessment Tax 7d

e Total Taxes Paid (7a+7b+7c +7d) 7e

8 Tax Payable (6-7e) 8

9 Refund (7e-6) 9

COMPUTATION OF

10 Value of Fringe Benefits 10

FRINGE BENEFITS

11 Total fringe benefit tax liability 11

12 Total interest payable 12

13 Total tax and interest payable 13

14 Taxes Paid

a Advance Tax 14a

b Self Assessment Tax 14b

14

c Total Taxes Paid (14a+14b)

c

15 Tax Payable (13-14c) 15

AND TAX TEREON

16 Refund (14c – 13) 16

Receipt No Seal and Signature of receiving official

Date

You might also like

- Indian Government Income Tax AcknowledgementDocument1 pageIndian Government Income Tax AcknowledgementPramod Reddy RNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Acknowledgement 1Document1 pageAcknowledgement 1kumar1309No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument3 pagesItr-V: Indian Income Tax Return Verification FormBalaji NaikNo ratings yet

- ITR Ack 2010 11Document1 pageITR Ack 2010 11Kiran Avinash Priti MhatreNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument4 pagesItr-V: Indian Income Tax Return Verification FormVivekanandNo ratings yet

- Ack. 2010-11Document1 pageAck. 2010-11Kiran GajjarNo ratings yet

- Form ITR-V and Acknowledgement FinalDocument4 pagesForm ITR-V and Acknowledgement FinalHarish100% (1)

- Itr 2 in Excel Format With Formula For A.Y. 2010 11Document12 pagesItr 2 in Excel Format With Formula For A.Y. 2010 11Shakeel sheoranNo ratings yet

- Itr-V 2 0 0 9 - 1 0: Indian Income Tax Return Verification Form Assessment YearDocument10 pagesItr-V 2 0 0 9 - 1 0: Indian Income Tax Return Verification Form Assessment YearranaonlineNo ratings yet

- Itr-V: Income Tax Return Verification Form IndianDocument1 pageItr-V: Income Tax Return Verification Form Indianapi-25886395No ratings yet

- Itr-V Axlpa8901a 2019-20 958819430290819Document1 pageItr-V Axlpa8901a 2019-20 958819430290819sduttacob114No ratings yet

- Indian Income Tax Return Verification FormDocument28 pagesIndian Income Tax Return Verification FormPobitro DasNo ratings yet

- Income Tax Return Ay 2019-20Document1 pageIncome Tax Return Ay 2019-20ramanNo ratings yet

- 2019 07 19 20 32 28 808 - 1563548548808 - XXXPS0222X - Acknowledgement PDFDocument1 page2019 07 19 20 32 28 808 - 1563548548808 - XXXPS0222X - Acknowledgement PDFsampreethpNo ratings yet

- PDF 776005010080819Document1 pagePDF 776005010080819Hasan KhanNo ratings yet

- Indian Income Tax Return Acknowledgement DetailsDocument1 pageIndian Income Tax Return Acknowledgement DetailsMaheshNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMaheshNo ratings yet

- 2019 06 24 15 21 22 990 - 1561369882990 - XXXPA6889X - Acknowledgement PDFDocument1 page2019 06 24 15 21 22 990 - 1561369882990 - XXXPA6889X - Acknowledgement PDFSiva KumariNo ratings yet

- Indian Income Tax Return Acknowledgement SummaryDocument1 pageIndian Income Tax Return Acknowledgement SummaryShankar SagarNo ratings yet

- Balwinder Singh ITR 2Document1 pageBalwinder Singh ITR 2Pawan KumarNo ratings yet

- Indian Income Tax Return Acknowledgement DetailsDocument1 pageIndian Income Tax Return Acknowledgement DetailsAnimesh JainNo ratings yet

- Kajal Devi Itr 19-20 PDFDocument1 pageKajal Devi Itr 19-20 PDFShakeeb HashmiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusurajit halderNo ratings yet

- A.Y. 2019-20 ItrvunlDocument1 pageA.Y. 2019-20 Itrvunlkishan bhalodiyaNo ratings yet

- PDF 265963700280222Document1 pagePDF 265963700280222Nemaram PatelNo ratings yet

- 2019 07 08 17 57 37 774 - 1562588857774 - XXXPD5098X - ItrvDocument1 page2019 07 08 17 57 37 774 - 1562588857774 - XXXPD5098X - ItrvAaditya PatelNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return Acknowledgementvikash dwibediNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementSagar Kumar GuptaNo ratings yet

- Indian Income Tax Return Verification FormDocument1 pageIndian Income Tax Return Verification FormSahana SkNo ratings yet

- Indian Income Tax Return Acknowledgement SummaryDocument1 pageIndian Income Tax Return Acknowledgement SummaryPradeep NegiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruvishnu ksNo ratings yet

- 2019-08-28-20-01-51-446_1567002711446_XXXPP5379X_AcknowledgementDocument1 page2019-08-28-20-01-51-446_1567002711446_XXXPP5379X_AcknowledgementParvatareddy TriveniNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurudibyan dasNo ratings yet

- Ay 2019-20Document3 pagesAy 2019-20mushtaqkhan8750No ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)ANSHU KAPOORNo ratings yet

- VERIFY INDIAN INCOME TAX RETURNDocument1 pageVERIFY INDIAN INCOME TAX RETURNRajesh KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurujasvir singhNo ratings yet

- Itr 19-20Document1 pageItr 19-20Ashwani KumarNo ratings yet

- Itr 19-20Document1 pageItr 19-20Ruloans VaishaliNo ratings yet

- Indian Income Tax Return Acknowledgement for Kapil Dilip WasuleDocument1 pageIndian Income Tax Return Acknowledgement for Kapil Dilip WasuleMohit JainNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSujan SamantaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearHarjot SinghNo ratings yet

- ACKDocument1 pageACKSAITEJA SOLVENT PURCHASENo ratings yet

- Indian Income Tax Return Acknowledgement for FY 2019-20Document1 pageIndian Income Tax Return Acknowledgement for FY 2019-20Subhendu NathNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNadeemNo ratings yet

- Itr-V Avapn7956m 2019-20 370567540270620Document1 pageItr-V Avapn7956m 2019-20 370567540270620kaysenterprises636No ratings yet

- Indian Income Tax Return Acknowledgement: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement: Assessment Yearbhaseen photostateNo ratings yet

- Itr Acknowledgement FormatDocument1 pageItr Acknowledgement FormatDinesh RajputNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Pravin MasalgeNo ratings yet

- Itr-V GMCPS4166R 2019-20 480205390220519Document1 pageItr-V GMCPS4166R 2019-20 480205390220519kumarhealthcare2000No ratings yet

- Itr Ack Fin Yr 2018-19 (2019-20) PDFDocument1 pageItr Ack Fin Yr 2018-19 (2019-20) PDFgunda satishkumarNo ratings yet

- 2019 09 27 06 24 49 469 - 1569545689469 - XXXPS6429X - Itrv PDFDocument1 page2019 09 27 06 24 49 469 - 1569545689469 - XXXPS6429X - Itrv PDFSse ikolaha SubstationNo ratings yet

- 2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFDocument1 page2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFAnil AnnajiNo ratings yet

- ITR Acknowledgement for Individual with Rs. 9340 RefundDocument1 pageITR Acknowledgement for Individual with Rs. 9340 RefundDeepak KumarNo ratings yet

- 2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvDocument1 page2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvAbhiraj dodNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument14 pagesITR-3 Indian Income Tax Return: Part A-GENHarishNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument13 pagesITR-2 Indian Income Tax Return: Part A-GENHarish100% (1)

- Form ITR-1-2009-10Document7 pagesForm ITR-1-2009-10vikram_enercon3941No ratings yet

- Form283 (1) FBT&BCTT ChallanDocument2 pagesForm283 (1) FBT&BCTT Challanapi-3705645100% (4)

- Form 49 B (TAN)Document4 pagesForm 49 B (TAN)Mohan NaiduNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Wollo University Assigmt - TaxationDocument11 pagesWollo University Assigmt - TaxationkasimNo ratings yet

- Tax Digest (Siao Tiao Hong V Cir)Document2 pagesTax Digest (Siao Tiao Hong V Cir)Alex CustodioNo ratings yet

- Chhatrapati Shahu Ji Maharaj University, Kanpur PDFDocument1 pageChhatrapati Shahu Ji Maharaj University, Kanpur PDFNicunj guptaNo ratings yet

- Finman ReviewerDocument5 pagesFinman ReviewerCecilia TanNo ratings yet

- Zakat Vs TaxesDocument4 pagesZakat Vs TaxesNeilson LuNo ratings yet

- Omkar Black Book PDFDocument99 pagesOmkar Black Book PDFsam torresNo ratings yet

- Intermediate Accounting III ReviewerDocument3 pagesIntermediate Accounting III ReviewerRenalyn PascuaNo ratings yet

- ExercisesDocument9 pagesExercisesvirginia sheraNo ratings yet

- Ghana Company Categories and FormsDocument9 pagesGhana Company Categories and Formsben atNo ratings yet

- ScrapDocument106 pagesScrapElliot HofmanNo ratings yet

- Microeconomics 5th Edition Krugman Solutions ManualDocument15 pagesMicroeconomics 5th Edition Krugman Solutions Manualtheclamarrowlkro21100% (18)

- Master Services Agreement: Appen Butler Hill Pty, LTDDocument14 pagesMaster Services Agreement: Appen Butler Hill Pty, LTDHappy manansalaNo ratings yet

- By The Way: SANTOS V. NLRC 287 SCRA 117 (1998)Document4 pagesBy The Way: SANTOS V. NLRC 287 SCRA 117 (1998)Dan Andrei Salmo SadorraNo ratings yet

- BasicchartofaccountsDocument6 pagesBasicchartofaccountsPanith MeasNo ratings yet

- Tanzania Revenue Authority's Direct Tax Laws on Determining Year of IncomeDocument64 pagesTanzania Revenue Authority's Direct Tax Laws on Determining Year of IncomeBISEKONo ratings yet

- Ease of Paying TaxesDocument2 pagesEase of Paying TaxesLET ReviewerNo ratings yet

- Rose Gelb, Victor Edwin Gelb, Manufacturers Trust Company, Executors, of The Estate of Harry Gelb v. Commissioner of Internal Revenue, 298 F.2d 544, 2d Cir. (1962)Document11 pagesRose Gelb, Victor Edwin Gelb, Manufacturers Trust Company, Executors, of The Estate of Harry Gelb v. Commissioner of Internal Revenue, 298 F.2d 544, 2d Cir. (1962)Scribd Government DocsNo ratings yet

- Demand AnalysisDocument25 pagesDemand AnalysisSharanya RameshNo ratings yet

- Module 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Document10 pagesModule 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Jann Exequiel FranciscoNo ratings yet

- En Bookcore Your-Booking Cb7d3krbg1 Print Lang enDocument2 pagesEn Bookcore Your-Booking Cb7d3krbg1 Print Lang enneethu1995georgeNo ratings yet

- Bir Form 2316Document2 pagesBir Form 2316Benjie T Madayag100% (1)

- Deposit Interest Certificate 40903908Document2 pagesDeposit Interest Certificate 40903908adityaNo ratings yet

- Zonal Values Notice for Cebu City North PropertiesDocument199 pagesZonal Values Notice for Cebu City North PropertiesSeth Raven100% (1)

- Donors TaxDocument16 pagesDonors TaxNikkolae LibreaNo ratings yet

- FIN 300 Chapter 3 Analysis of Financial StatementsDocument9 pagesFIN 300 Chapter 3 Analysis of Financial StatementsJean EliaNo ratings yet

- Stag Notes 2021 Capuno TopicsDocument22 pagesStag Notes 2021 Capuno TopicsBrigette Domingo100% (2)

- Major AssumptionsDocument3 pagesMajor AssumptionsChristian VillaNo ratings yet

- Deloitte Support Services India Private Limited: My TransactionsDocument1 pageDeloitte Support Services India Private Limited: My TransactionsAzure DevOpsNo ratings yet

- Tax Tribunal Upholds Deduction u/s 54 for Property SaleDocument7 pagesTax Tribunal Upholds Deduction u/s 54 for Property SaleSuyash BarmechaNo ratings yet

- Soriano vs. Secretary of Finance, 815 SCRA 316, January 24, 2017Document2 pagesSoriano vs. Secretary of Finance, 815 SCRA 316, January 24, 2017Jane BandojaNo ratings yet