Professional Documents

Culture Documents

QS14 - Class Exercises Solution

Uploaded by

lyk0texCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QS14 - Class Exercises Solution

Uploaded by

lyk0texCopyright:

Available Formats

Accounting 225 Quiz Section #14

Chapter 12-1 Class Exercises Solution

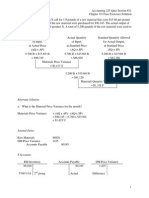

1. Curly Inc. is considering whether to continue to make a component or to buy it from an

outside supplier. The company uses 16,000 of the components each year. The unit product cost

of the component according to the company's cost accounting system is given as follows:

Assume that direct labor is a variable cost. Of the fixed manufacturing overhead, 30% is

avoidable if the component were bought from the outside supplier. In addition, making the

component uses 1 minute on the machine that is the company's current constraint. If the

component were bought, this machine time would be freed up for use on another product that

requires 2 minutes on the constraining machine and that has a contribution margin of $8.10 per

unit.

a) When deciding whether to make or buy the component, what cost of making the component

should be compared to the price of buying the component?

b) How much will Curly Inc. save or lose by buying the component instead of making it?

Unit Cost Make: $21.57

Unit Cost Buy: $21

Curly Inc. will save 57c per unit if it buys the component.

Or $9120 for 16000 units

Accounting 225 Quiz Section #14

Chapter 12-1 Class Exercises Solution

2. Green Company produces 1,000 parts per year, which are used in the assembly of one of its

products. The unit product cost of these parts is:

The part can be purchased from an outside supplier at $20 per unit. If the part is purchased from

the outside supplier, two thirds of the fixed manufacturing costs can be eliminated. The annual

impact on the company's net operating income as a result of buying the part from the outside

supplier would be:

Accounting 225 Quiz Section #14

Chapter 12-1 Class Exercises Solution

3. Part J88 is used in one of Quinney Corporation's products. The company makes 3,000 units of

this part each year. The company's Accounting Department reports the following costs of

producing the part at this level of activity:

An outside supplier has offered to produce this part and sell it to the company for $32.10 each. If

this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor,

can be avoided. The special equipment used to make the part was purchased many years ago and

has no salvage value or other use. The allocated general overhead represents fixed costs of the

entire company. If the outside supplier's offer were accepted, only $3,000 of these allocated

general overhead costs would be avoided.

If management decides to buy part J88 from the outside supplier rather than to continue making

the part, what would be the annual impact on the company's overall net operating income?

Accounting 225 Quiz Section #14

Chapter 12-1 Class Exercises Solution

4. The Clemson Company reported the following results last year for the manufacture and sale of

one of its products known as a Tam.

Clemson Company is trying to determine whether or not to discontinue the manufacture and sale

of Tams. The operating results reported above for last year are expected to continue in the

foreseeable future if the product is not dropped. The fixed manufacturing overhead represents the

costs of production facilities and equipment that the Tam product shares with other products

produced by Clemson. If the Tax product were dropped, there would be no change in the fixed

manufacturing costs of the company.

a) Assume that discontinuing the manufacture and sale of Tams will have no effect on the sale of

other product lines. If the company discontinues the Tam product line, the change in annual

operating income (or loss) should be:

b) Assume that discontinuing the Tam product would result in a $120,000 increase in the

contribution margin of other product lines. How many Tams would have to be sold next year for

the company to be as well off as if it just dropped the line and enjoyed the increase in

contribution margin from other products?

Contribution margin per Tam: $390,000 6,500 = $60

Sales of Tams to be as well off as if it dropped Tams: $30,000

units

$60 = 500 + 6,500 = 7,000

You might also like

- Docx 1Document10 pagesDocx 1Anna Marie AlferezNo ratings yet

- 2009-09-06 125024 MmmmekaDocument24 pages2009-09-06 125024 MmmmekathenikkitrNo ratings yet

- MS02 Relevant Costs Special Order and Sell or Process FurtherDocument5 pagesMS02 Relevant Costs Special Order and Sell or Process FurtherIohc NedmiNo ratings yet

- Quiz 18: Use The Following Information For Questions 3 To 5Document4 pagesQuiz 18: Use The Following Information For Questions 3 To 5CrisNo ratings yet

- CPA Firm MAS Purpose & Collection Cost Savings for Accounts ReceivableDocument30 pagesCPA Firm MAS Purpose & Collection Cost Savings for Accounts ReceivableMarc Allen Anthony GanNo ratings yet

- ACR 107 Management Advisory Services ReviewDocument102 pagesACR 107 Management Advisory Services ReviewPatrick Kyle AgraviadorNo ratings yet

- KsadsadsDocument3 pagesKsadsadsKenneth Bryan Tegerero Tegio0% (1)

- MCQ Rel CostsRespAcctgTransferPricing PDFDocument6 pagesMCQ Rel CostsRespAcctgTransferPricing PDF수지No ratings yet

- Managerial Accounting QuizDocument13 pagesManagerial Accounting QuizDip PerNo ratings yet

- (At) 01 - Preface, Framework, EtcDocument8 pages(At) 01 - Preface, Framework, EtcCykee Hanna Quizo LumongsodNo ratings yet

- Managerial AccountingDocument9 pagesManagerial AccountingChristopher Price100% (1)

- Multiple Choice Questions on Ethics, Risk, and Internal AuditingDocument9 pagesMultiple Choice Questions on Ethics, Risk, and Internal AuditingMontenegroNo ratings yet

- Ans For Decision MakingDocument5 pagesAns For Decision MakingSellKcNo ratings yet

- Ch28 Test Bank 4-5-10Document9 pagesCh28 Test Bank 4-5-10bluephoe100% (1)

- Chapter 08 5eDocument41 pagesChapter 08 5eChrissa Marie Viente100% (1)

- Learn key differences between variable and absorption costingDocument32 pagesLearn key differences between variable and absorption costingJellai JollyNo ratings yet

- MAS - Group 5Document7 pagesMAS - Group 5beleky watersNo ratings yet

- Short-Run Alternative Choice Decisions AnalysisDocument4 pagesShort-Run Alternative Choice Decisions AnalysisStefPerNo ratings yet

- Chapter 13 - Tor F and MCDocument13 pagesChapter 13 - Tor F and MCAnika100% (1)

- Set ADocument9 pagesSet AGladys Mae CorpuzNo ratings yet

- Assignment 4 - CVPDocument12 pagesAssignment 4 - CVPAlyssa BasilioNo ratings yet

- Chapter 9--The Use of Budgets in Planning and Decision MakingDocument71 pagesChapter 9--The Use of Budgets in Planning and Decision MakingGray JavierNo ratings yet

- MASDocument2 pagesMASClarisse AlimotNo ratings yet

- Desired Income (Step Costs)Document2 pagesDesired Income (Step Costs)Ann louNo ratings yet

- ICPA PH - Substatantive Testing & Audit EvidenceDocument7 pagesICPA PH - Substatantive Testing & Audit EvidenceErika delos SantosNo ratings yet

- MAS Handout CH4 DiffCostAnaDocument2 pagesMAS Handout CH4 DiffCostAnaAbigail TumabaoNo ratings yet

- QuzziesDocument2 pagesQuzziesKionna TamaraNo ratings yet

- Shenista Inc. Product Profit AnalysisDocument3 pagesShenista Inc. Product Profit Analysismohitgaba19No ratings yet

- Mas 2 Final ExamDocument3 pagesMas 2 Final ExamMax50% (2)

- Calculate break-even sales, operating income for companiesDocument6 pagesCalculate break-even sales, operating income for companiesAsdfghjkl LkjhgfdsaNo ratings yet

- Translation of Foreign Currency StatementDocument5 pagesTranslation of Foreign Currency StatementPea Del Monte AñanaNo ratings yet

- Cost Accounting SeatworkDocument2 pagesCost Accounting SeatworkLorena TuazonNo ratings yet

- Managerial AccountingMid Term Examination (1) - CONSULTADocument7 pagesManagerial AccountingMid Term Examination (1) - CONSULTAMay Ramos100% (1)

- B. 39,000 Stethoscopes: Results For Item 2Document20 pagesB. 39,000 Stethoscopes: Results For Item 2Kath LeynesNo ratings yet

- Management Advisory Services Second Pre-Board Examinations Multiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetDocument15 pagesManagement Advisory Services Second Pre-Board Examinations Multiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetRhad EstoqueNo ratings yet

- Capital Budgeting ReviewerDocument50 pagesCapital Budgeting ReviewerPines MacapagalNo ratings yet

- Dr. Lee's patient service revenue calculation under accrual basisDocument6 pagesDr. Lee's patient service revenue calculation under accrual basisAndrea Lyn Salonga CacayNo ratings yet

- MAS 2PB Oct 2014Document12 pagesMAS 2PB Oct 2014Rhad Estoque100% (1)

- Acctba3 - Comprehensive ReviewerDocument10 pagesAcctba3 - Comprehensive ReviewerDarwyn MendozaNo ratings yet

- CAD ROI and Residual IncomeDocument7 pagesCAD ROI and Residual IncomeRen100% (1)

- Sample Final 11BDocument11 pagesSample Final 11Bjosephmelkonian1741100% (1)

- GP Variance AnalysisDocument2 pagesGP Variance AnalysisRodison de GuiaNo ratings yet

- 5a Relevant Revenue Cost and Decision MakingDocument6 pages5a Relevant Revenue Cost and Decision MakingGina TingdayNo ratings yet

- Calculating variable and fixed costs for units producedDocument12 pagesCalculating variable and fixed costs for units producedashibhallau100% (1)

- 148-M-S-M-C (34) 5847Document2 pages148-M-S-M-C (34) 5847Ahmed AwaisNo ratings yet

- Afar 5Document4 pagesAfar 5Tk KimNo ratings yet

- Finals Quiz 1 CostDocument6 pagesFinals Quiz 1 CostChloe Oberlin100% (1)

- AP Equity 1Document3 pagesAP Equity 1Mark Michael Legaspi100% (1)

- Buscom Quiz 2 MidtermDocument2 pagesBuscom Quiz 2 MidtermRafael Capunpon VallejosNo ratings yet

- Quiz 17: Flexible Budget Variances for Alloway's FencingDocument2 pagesQuiz 17: Flexible Budget Variances for Alloway's Fencingwarning urgentNo ratings yet

- I Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouDocument9 pagesI Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouJeric TorionNo ratings yet

- Franchise AccountingDocument2 pagesFranchise AccountingChristopher NogotNo ratings yet

- Essay on Activity-Based Costing for Ingersol DraperiesDocument13 pagesEssay on Activity-Based Costing for Ingersol DraperiesLhorene Hope DueñasNo ratings yet

- Auditing Problem 2Document1 pageAuditing Problem 2jhobs100% (1)

- Department of Accountancy: Page - 1Document16 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- Diagnostic Afar 2018Document45 pagesDiagnostic Afar 2018jaysonNo ratings yet

- Ac102 ch11Document19 pagesAc102 ch11Yenny Torro100% (1)

- Differential Analysis: The Key To Decision MakingDocument25 pagesDifferential Analysis: The Key To Decision MakingJhinglee Sacupayo Gocela100% (1)

- ACCT505 Quiz #2 SolutionsDocument9 pagesACCT505 Quiz #2 SolutionsMilton MightyNo ratings yet

- Chap14 Relevant Costing Problem ExercisesDocument5 pagesChap14 Relevant Costing Problem ExercisesNiccoloNo ratings yet

- QS16 - Class ExercisesDocument5 pagesQS16 - Class Exerciseslyk0texNo ratings yet

- QS17 - Class Exercises SolutionDocument4 pagesQS17 - Class Exercises Solutionlyk0texNo ratings yet

- QS17 - Class ExercisesDocument4 pagesQS17 - Class Exerciseslyk0texNo ratings yet

- QS13 - Class Exercises SolutionDocument2 pagesQS13 - Class Exercises Solutionlyk0texNo ratings yet

- QS15 - Class Exercises SolutionDocument5 pagesQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS15 - Class ExercisesDocument4 pagesQS15 - Class Exerciseslyk0texNo ratings yet

- QS16 - Class Exercises SolutionDocument5 pagesQS16 - Class Exercises Solutionlyk0texNo ratings yet

- QS14 - Class ExercisesDocument4 pagesQS14 - Class Exerciseslyk0texNo ratings yet

- QS12 - Class Exercises SolutionDocument2 pagesQS12 - Class Exercises Solutionlyk0tex100% (1)

- QS11 - Class ExercisesDocument5 pagesQS11 - Class Exerciseslyk0texNo ratings yet

- QS12 - Midterm 2 Review SolutionDocument7 pagesQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS12 - Class ExercisesDocument2 pagesQS12 - Class Exerciseslyk0texNo ratings yet

- QS10 - Class ExercisesDocument1 pageQS10 - Class Exerciseslyk0texNo ratings yet

- QS13 - Class ExercisesDocument2 pagesQS13 - Class Exerciseslyk0texNo ratings yet

- QS12 - Midterm 2 ReviewDocument5 pagesQS12 - Midterm 2 Reviewlyk0texNo ratings yet

- QS11 - Class Exercises SolutionDocument8 pagesQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS06 - Class ExercisesDocument3 pagesQS06 - Class Exerciseslyk0texNo ratings yet

- QS05 - Class ExercisesDocument2 pagesQS05 - Class Exerciseslyk0texNo ratings yet

- QS10 - Class Exercises SolutionDocument2 pagesQS10 - Class Exercises Solutionlyk0texNo ratings yet

- QS09 - Class Exercises SolutionDocument4 pagesQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS04 - Class Exercises SolutionDocument3 pagesQS04 - Class Exercises Solutionlyk0texNo ratings yet

- QS08 - Class Exercises SolutionDocument5 pagesQS08 - Class Exercises Solutionlyk0texNo ratings yet

- QS07 - Class ExercisesDocument8 pagesQS07 - Class Exerciseslyk0texNo ratings yet

- QS09 - Class ExercisesDocument4 pagesQS09 - Class Exerciseslyk0texNo ratings yet

- QS08 - Class ExercisesDocument4 pagesQS08 - Class Exerciseslyk0texNo ratings yet

- QS07 - Class Exercises SolutionDocument8 pagesQS07 - Class Exercises Solutionlyk0texNo ratings yet

- QS04 - Class ExercisesDocument3 pagesQS04 - Class Exerciseslyk0texNo ratings yet

- QS05 - Class Exercises SolutionDocument3 pagesQS05 - Class Exercises Solutionlyk0texNo ratings yet

- QS06 - Class Exercises SolutionDocument2 pagesQS06 - Class Exercises Solutionlyk0texNo ratings yet

- Parle vs. Britannia Brand Architecture AnalysisDocument3 pagesParle vs. Britannia Brand Architecture AnalysisSangeeta RoyNo ratings yet

- ZoomX EV Market Entry Strategy for IndiaDocument3 pagesZoomX EV Market Entry Strategy for Indiaaditya khandelwalNo ratings yet

- Establishing Objectives and Budgeting For The Promotional ProgramDocument31 pagesEstablishing Objectives and Budgeting For The Promotional ProgramannNo ratings yet

- BASL Ratio Analysis Highlights Strong Financial PositionDocument18 pagesBASL Ratio Analysis Highlights Strong Financial PositionSreeram Anand IrugintiNo ratings yet

- Chapter 4 EIADocument25 pagesChapter 4 EIAkentbiibibibiNo ratings yet

- Natalie Jaeger Resume 1Document1 pageNatalie Jaeger Resume 1api-384851446No ratings yet

- China's Online Gaming - Group Presentation - 09!05!2011 - Strategy Creators - BangaloreDocument22 pagesChina's Online Gaming - Group Presentation - 09!05!2011 - Strategy Creators - Bangaloreupalr100% (1)

- Tutorial 6 THEORY OF FIRMDocument2 pagesTutorial 6 THEORY OF FIRMCHZE CHZI CHUAH0% (1)

- Simplifyy - A Business Plan For A NewDocument41 pagesSimplifyy - A Business Plan For A NewSamyak Doshi100% (1)

- India's Tea Industry: A Historical Overview and Current ScenarioDocument32 pagesIndia's Tea Industry: A Historical Overview and Current ScenarioSathish JuliusNo ratings yet

- Engineering Cost Estimation and Life Cycle Cost AnalysisDocument33 pagesEngineering Cost Estimation and Life Cycle Cost AnalysiscamableNo ratings yet

- Chapter 7, Lesson 1: Place: Distribution DesignDocument22 pagesChapter 7, Lesson 1: Place: Distribution DesignSophie Kesche ScheniderNo ratings yet

- 3-Strategies Spreads Guy BowerDocument15 pages3-Strategies Spreads Guy BowerNicoLazaNo ratings yet

- B2B Cheat Sheet HDDocument10 pagesB2B Cheat Sheet HDwilliam.lautamaNo ratings yet

- Income Taxation Chapter 13: Principles of Deductions Multiple Choice QuestionsDocument14 pagesIncome Taxation Chapter 13: Principles of Deductions Multiple Choice QuestionsMichael Brian TorresNo ratings yet

- Practice For Chapter 5 SolutionsDocument6 pagesPractice For Chapter 5 SolutionsAndrew WhitfieldNo ratings yet

- Brand Analysis Into ActionDocument2 pagesBrand Analysis Into Actionashish_phadNo ratings yet

- Equity in Victorian Education and Deficit ThinkingDocument24 pagesEquity in Victorian Education and Deficit ThinkingRussell HodgesNo ratings yet

- Airtel Bill PaymentDocument1 pageAirtel Bill PaymentVipin SinghNo ratings yet

- BICDocument18 pagesBICLita IonutNo ratings yet

- Sternberg Press - January 2021Document5 pagesSternberg Press - January 2021ArtdataNo ratings yet

- Yamaha Corporation (13035676)Document13 pagesYamaha Corporation (13035676)NguyenZumNo ratings yet

- JP Morgan BacheletDocument4 pagesJP Morgan BacheletDiario ElMostrador.clNo ratings yet

- Ch. 3 PracticeDocument12 pagesCh. 3 PracticeM KNo ratings yet

- Chapter 15Document91 pagesChapter 15raiNo ratings yet

- Psycle Marketing Strategy - f3033Document4 pagesPsycle Marketing Strategy - f3033Umesh Gade100% (1)

- SDMDocument19 pagesSDMNakul PatelNo ratings yet

- The 5 Most Powerful Candlestick Patterns (NUAN, GMCR) - InvestopediaDocument6 pagesThe 5 Most Powerful Candlestick Patterns (NUAN, GMCR) - InvestopediaMax Rene Velazquez GarciaNo ratings yet

- Equity Investments 2019 RecapDocument10 pagesEquity Investments 2019 RecapAlmirah's iCPA ReviewNo ratings yet

- Gavin's VSA Trading Plan - Extended Edition (Tom Williams Additional Comments)Document10 pagesGavin's VSA Trading Plan - Extended Edition (Tom Williams Additional Comments)Govind SinghNo ratings yet