Professional Documents

Culture Documents

Gul Ahmed

Uploaded by

DanialRizviCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gul Ahmed

Uploaded by

DanialRizviCopyright:

Available Formats

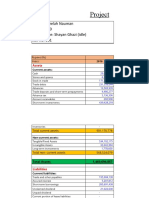

Financial Highlights

Amount in PKR. millions

Profit & Loss

2014

2013

2012

2011

2010

2009

Sales

33,013

30,243

24,945

25,464

19,689

13,906

Gross profit

5,976

4,751

3,512

4,655

3,173

2,359

Operating profit

2,659

2,120

1,400

2,664

1,653

1,209

Profit / (loss)

before tax

1,496

852

(1)

1,537

708

170

Profit / (loss)

after tax

1,235

711

(240)

1,196

478

80

Cash dividend

*81

79

Bonus share

457

305

635

8,210

7,132

6,829

6,654

6,140

6,106

Intangible

20

23

27

39

16

29

Long term

investment,

loans, advances

and deposits

151

112

109

96

93

90

Net current

assets

890

666

(98)

422

(224)

(390)

Total assets

employed

9,271

7,933

6,867

7,211

6,025

5,835

Share capital

1,828

1,523

1,270

635

635

635

Reserves

4,832

3,905

3,203

4,078

2,961

2,483

Shareholders'

equity

6,660

5,428

4,473

4,713

3,596

3,118

Balance Sheet

Property, plant

and equipment

Represented by

:

Long term loans

2,239

2,155

2,096

2,199

2,223

2,567

372

350

298

299

207

149

9,271

7,933

6,867

7,211

6,025

5,835

Operating

activities

2,090

(161)

3,497

(2,617)

454

442

Investing

activities

(1,833)

(1,068)

(920)

(1,250)

(711)

(931)

Financing

activities

217

210

(70)

(148)

(170)

398

(7,715)

(8,188)

(7,169)

(9,676)

(5,660)

(5,233)

Deferred

liabilities

Total capital

employed

Cash Flow

Statement

Cash and cash

equivalents at

the end of the

year

*Represents actual dividend amount excluding amount payable to Holding Company and an

Associated Company who have foregone their right to the dividend.

Financial Ratios

Profitability ratios

Gross profit ratio( %)

18.10 15.71

14.08

18.28

16.12 16.96

Operating leverage

ratio(Times)

2.77 2.56

23.48

2.03

0.88 1.57

EBITDA margin to sales(%)

10.66 9.59

8.53

13.19

11.92 13.37

Net profit to sales(%)

3.74 2.35

(0.96)

4.70

2.43 0.58

Return on equity(%)

20.43 14.36

(5.23)

28.80

14.22 2.73

Return on capital

employed(%)

30.91 28.65

19.90

40.25

27.87 21.82

Liquidity ratios

Current ratio

1.06 1.05

0.99

1.03

0.97 0.95

Quick/acid test ratio

0.20 0.27

0.24

0.19

0.34 0.39

Cash to current liabilities

0.01 0.01

0.01

0.01

0.01 0.01

0.14

(0.10)

0.02 0.03

Cash flow from operations to

0.06 (0.01)

sales

Capital structure ratios

Financial leverage ratio

1.62 2.03

2.25

2.67

2.40 2.69

Weighted average cost of

debt

0.10 0.11

0.11

0.10

0.11 0.12

Debt to equity ratio

0.34 0.40

0.47

0.47

0.62 0.82

Interest cover ratio

2.29 1.67

0.98

2.34

1.75 1.16

Inventory turnover (Days)

145

121

151

134

Inventory turnover ratio

2.52 3.00

2.41

2.72

30

31

12.15

11.60

86

82

Turnover ratios

Debtor turnover (Days)

Debtor turnover ratio

22

28

16.76 13.01

107

3.74 3.40

45

66

8.05 5.54

Creditor turnover (Days)

126

Creditor turnover ratio

2.91 3.64

4.23

4.43

4.98 4.77

Fixed assets turnover ratio

4.02 4.24

3.65

3.83

3.21 2.27

Total assets turnover ratio

1.36 1.43

1.41

1.25

1.35 1.02

95

83

Operating cycle (Days)

41

100

98

49

73

70

76

97

Investor information

Earnings per share (Rupees)

6.75 4.09

(1.73)

9.42

3.76 0.73

Price earning ratio

9.48 5.81

(12.18)

5.49

4.93 53.21

Price to book ratio

0.48 0.17

0.15

0.16

0.08 0.18

Dividend yield ratio

*0.02

0.07

Cash dividend per

share(Rupees)

*1.50

1.25

25

20

100

*22.21

16.60

Dividend cover ratio (Times) *4.50

6.02

36.43 35.63

35.23

37.12

28.32 24.56

at the end of the year

(Rupees)

high during the year

(Rupees)

low during the year

(Rupees)

64.01 23.74

72.35 27.64

20.50 19.16

21.11

64.29

16.05

51.73

53.65

18.53

18.53 38.84

38.84 49.00

17.40 28.60

EBITDA (Million)

3,519 2,900

2,129

3,359

2,347 1,860

Bonus shares issued (%)

Dividend payout ratio (%)

Break-up value per

share(Rupees)

Market value per share

You might also like

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Management Management Management ManagementDocument94 pagesManagement Management Management Managementalizah khadarooNo ratings yet

- Fundamentals of Accounting and AuditingDocument458 pagesFundamentals of Accounting and Auditingrajeev sharma100% (1)

- Financial Ratio Annalysis Dharwad Milk Project Report MbaDocument97 pagesFinancial Ratio Annalysis Dharwad Milk Project Report MbaBabasab Patil (Karrisatte)100% (4)

- Accomplishment Report For The City AddressDocument4 pagesAccomplishment Report For The City AddressBplo Caloocan100% (1)

- Lecture 11 PPT - PPT Business ModelDocument30 pagesLecture 11 PPT - PPT Business Modelmohammadaliae71100% (1)

- Understanding Corporate FinanceDocument98 pagesUnderstanding Corporate FinanceJosh KrishaNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Business Plan ForDocument14 pagesBusiness Plan ForAbenezer Yohannes100% (2)

- Full Download Managing Business Process Flows 3rd Edition Anupindi Solutions ManualDocument35 pagesFull Download Managing Business Process Flows 3rd Edition Anupindi Solutions Manualmarchellemckethanuk100% (40)

- Week 1Document34 pagesWeek 1Mitchie Faustino100% (1)

- SAP FICO Financial AccountingDocument4 pagesSAP FICO Financial AccountingNeelesh KumarNo ratings yet

- Six Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceDocument5 pagesSix Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceraviaxgNo ratings yet

- Group 2 RSRMDocument13 pagesGroup 2 RSRMAbid Hasan RomanNo ratings yet

- D.G Khan Cement Company Limited Income StatementDocument25 pagesD.G Khan Cement Company Limited Income StatementadnanjeeNo ratings yet

- Kuantan Flour Mills SolverDocument20 pagesKuantan Flour Mills SolverSharmila DeviNo ratings yet

- My Project Yunzelah Nauman (060) (BBA)Document42 pagesMy Project Yunzelah Nauman (060) (BBA)Ayman ayNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Project Company Subject Group Group Members: GC University FaisalabadDocument23 pagesProject Company Subject Group Group Members: GC University FaisalabadMuhammad Tayyab RazaNo ratings yet

- Balance Sheet: AssetsDocument19 pagesBalance Sheet: Assetssumeer shafiqNo ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- Horizontal Vertical AnalysisDocument4 pagesHorizontal Vertical AnalysisAhmedNo ratings yet

- Oil & Gas Development Company Limited: Equity and LiabilitiesDocument56 pagesOil & Gas Development Company Limited: Equity and LiabilitiesFariaFaryNo ratings yet

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- Restaurant BusinessDocument14 pagesRestaurant BusinessSAKIBNo ratings yet

- Sir Sarwar AFSDocument41 pagesSir Sarwar AFSawaischeemaNo ratings yet

- Financial Modelling ISBSCF MarchDocument13 pagesFinancial Modelling ISBSCF MarchMohd Najib Bin Abd MajidNo ratings yet

- Dandot CementDocument154 pagesDandot CementKamran ShabbirNo ratings yet

- MCB Financial AnalysisDocument30 pagesMCB Financial AnalysisMuhammad Nasir Khan100% (4)

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadNo ratings yet

- GSK Financial FiguresDocument35 pagesGSK Financial FiguresKalenga CyrilleNo ratings yet

- Financial Highlights: Hinopak Motors LimitedDocument6 pagesFinancial Highlights: Hinopak Motors LimitedAli ButtNo ratings yet

- 17-Horizontal & Vertical AnalysisDocument2 pages17-Horizontal & Vertical AnalysisRebecca HarrisonNo ratings yet

- Atlas Honda: Analysis of Financial Statements Balance SheetDocument4 pagesAtlas Honda: Analysis of Financial Statements Balance Sheetrouf786No ratings yet

- Ratio CalculationsDocument59 pagesRatio CalculationsMayesha MehnazNo ratings yet

- Universe 18Document70 pagesUniverse 18fereNo ratings yet

- Non Current Liabilities: Rupees in ThousandsDocument28 pagesNon Current Liabilities: Rupees in ThousandstanzeilNo ratings yet

- Confidence Cement LTD: Income StatementDocument20 pagesConfidence Cement LTD: Income StatementIftekar Hasan SajibNo ratings yet

- Associated Cement Company LTD: Profit & Loss Account Balance SheetDocument3 pagesAssociated Cement Company LTD: Profit & Loss Account Balance SheetZulfiqar HaiderNo ratings yet

- Case 14 ExcelDocument8 pagesCase 14 ExcelRabeya AktarNo ratings yet

- Assets: Balance SheetDocument4 pagesAssets: Balance SheetAsadvirkNo ratings yet

- 5 EstadosDocument15 pages5 EstadosHenryRuizNo ratings yet

- Goldson CompanyDocument10 pagesGoldson CompanyRabeyaNo ratings yet

- W18826 XLS EngDocument11 pagesW18826 XLS EngNini HuanachinNo ratings yet

- Financial HighlightsDocument1 pageFinancial HighlightsAhmed SiddNo ratings yet

- Account Aset Aset LancarDocument7 pagesAccount Aset Aset LancarLeffrand NouvalNo ratings yet

- Puma Energy Results Report q3 2016 v3Document8 pagesPuma Energy Results Report q3 2016 v3KA-11 Єфіменко ІванNo ratings yet

- Term Paper Excel Calculations-Premier Cement Mills Ltd.Document40 pagesTerm Paper Excel Calculations-Premier Cement Mills Ltd.Jannatul TrishiNo ratings yet

- Reports 6Document18 pagesReports 6Asad ZamanNo ratings yet

- FIN440 Phase 2 ExcelDocument27 pagesFIN440 Phase 2 ExcelRiddo BadhonNo ratings yet

- Horizental Analysis On Income StatementDocument21 pagesHorizental Analysis On Income StatementMuhib NoharioNo ratings yet

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- 16 FIN 065 FinalDocument28 pages16 FIN 065 Finalযুবরাজ মহিউদ্দিনNo ratings yet

- Fin 254 Group Project ExcelDocument12 pagesFin 254 Group Project Excelapi-422062723No ratings yet

- Horivontal Analysis of Engro Foods Annual Report 2011Document2 pagesHorivontal Analysis of Engro Foods Annual Report 2011Arshad Baig MughalNo ratings yet

- Excel File SuzukiDocument18 pagesExcel File SuzukiMahnoor AfzalNo ratings yet

- Income Statement: Assets Non-Current AssetsDocument213 pagesIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahNo ratings yet

- Accounting ProjectDocument16 pagesAccounting Projectnawal jamshaidNo ratings yet

- Annual Financial Statements 2007Document0 pagesAnnual Financial Statements 2007hyjulioNo ratings yet

- Berger Paints: Statement of Financial PositionDocument6 pagesBerger Paints: Statement of Financial PositionMuhammad Hamza ZahidNo ratings yet

- Redco Textiles LimitedDocument18 pagesRedco Textiles LimitedUmer FarooqNo ratings yet

- Financial Statements Analysis: Arsalan FarooqueDocument31 pagesFinancial Statements Analysis: Arsalan FarooqueMuhib NoharioNo ratings yet

- BDlampDocument59 pagesBDlampSohel RanaNo ratings yet

- Faysal Bank Spread Accounts 2012Document133 pagesFaysal Bank Spread Accounts 2012waqas_haider_1No ratings yet

- Case Ahold SolutionDocument18 pagesCase Ahold Solutiondeepanshu guptaNo ratings yet

- KPJ Financial Comparison 1Document15 pagesKPJ Financial Comparison 1MaryamKhalilahNo ratings yet

- Atlas Honda (2019 22)Document6 pagesAtlas Honda (2019 22)husnainbutt2025No ratings yet

- Ratio Analysis of Fuel Company-3Document21 pagesRatio Analysis of Fuel Company-3Zakaria ShuvoNo ratings yet

- Complete Financial Model & Valuation of ARCCDocument46 pagesComplete Financial Model & Valuation of ARCCgr5yjjbmjsNo ratings yet

- FIN 440 Group Task 1Document104 pagesFIN 440 Group Task 1দিপ্ত বসুNo ratings yet

- Accounting For ManagersDocument289 pagesAccounting For ManagersEliecer Campos Cárdenas100% (2)

- 4 5886424778507552732Document46 pages4 5886424778507552732Agidew Shewalemi100% (1)

- Anytime Fitness - Financials - Sec 83 MR Malik PDFDocument6 pagesAnytime Fitness - Financials - Sec 83 MR Malik PDFJasbir SehwagNo ratings yet

- 2019 Unit 3 Outcome 2 Solution BookDocument10 pages2019 Unit 3 Outcome 2 Solution BookLachlan McFarlandNo ratings yet

- It Entrepreneurship: Feasibility AnalysisDocument41 pagesIt Entrepreneurship: Feasibility AnalysisNurZul HealMeNo ratings yet

- AF314 RevisionDocument7 pagesAF314 RevisionShiv AchariNo ratings yet

- An IFRS-based Taxonomy of Financial RatiosDocument16 pagesAn IFRS-based Taxonomy of Financial RatiosWihelmina DeaNo ratings yet

- 2015-16 - California YMCA Youth & Government Annual ReportDocument16 pages2015-16 - California YMCA Youth & Government Annual ReportRichard HsuNo ratings yet

- Industrial Arts - 6 - PowerpointDocument21 pagesIndustrial Arts - 6 - PowerpointGerard Adrian C. CastilloNo ratings yet

- Lecture 6 Accruals and PrepaymentsDocument21 pagesLecture 6 Accruals and PrepaymentsazizbektokhirbekovNo ratings yet

- Efisiensi Dan Efektivitas Penggunaan Mod PDFDocument12 pagesEfisiensi Dan Efektivitas Penggunaan Mod PDFameliajamirusNo ratings yet

- Comfy Home Financials For Students 1Document5 pagesComfy Home Financials For Students 1Sunil SharmaNo ratings yet

- QuestionDocument2 pagesQuestionyaniNo ratings yet

- Trading Is Hazardous To Your Wealth - The Common Stock Investment Performance of Individual InvestorsDocument34 pagesTrading Is Hazardous To Your Wealth - The Common Stock Investment Performance of Individual InvestorsmrmiscNo ratings yet

- Five Below, Inc. ProfileDocument27 pagesFive Below, Inc. ProfileReese PathakNo ratings yet

- Subramanyam FSA Chapter 01 - ETJDocument44 pagesSubramanyam FSA Chapter 01 - ETJMaya AngrianiNo ratings yet

- Poa 01 - 1.2223Document3 pagesPoa 01 - 1.2223Phương Anh HàNo ratings yet

- The Revenue Cycle: Sales and Cash CollectionsDocument46 pagesThe Revenue Cycle: Sales and Cash CollectionsgoeswidsNo ratings yet

- McDonalds Financial AnalysisDocument11 pagesMcDonalds Financial AnalysisHooksA01No ratings yet

- Zica t1 Financial AccountingDocument363 pagesZica t1 Financial Accountinglord100% (2)